Professional Documents

Culture Documents

Dec-2006 Foreign Exchange Management FM-302

Uploaded by

Mayank GoyalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dec-2006 Foreign Exchange Management FM-302

Uploaded by

Mayank GoyalCopyright:

Available Formats

Dec-2006 Foreign Exchange Management FM-302 Time: Three Hours MM: 70 Note: - Attempt FIVE questions in all.

Question No 1 is compulsory. All questions carry equal marks. 1. a. What is spread in foreign exchange market? b. Explain the term arbitrage and its types. c. What is mark to market? d. What is foreign exchange risk? e. Distinguish between call and put option. f. What is netting in foreign exchange market. g. Explain foreign exchange fundamental forecasting. 2. Explain the foreign exchange markets. What are its major functions? Also explain the structure of foreign exchange market with suitable examples. 3. Explain the currency forward markets and its features. What mechanism of quoting the forward rates, explain with suitable examples. 4. Distinguish between foreign exchange risk and foreign exchange exposure. How will you measure risk and exposure? Explain with suitable examples. 5. Explains currency swap market. What are its important features? What different types of currency swap contracts? Explain the trading mechanism of this market in brief. 6. Distinguish between currency translation exposure and operating exposure. How will you manage the operating exposure? Explain with examples. 7. What do you mean by forecasting of foreign exchange rate? What is its significance? Explain various technical techniques used in this respect with examples. 8. Write notes on the following: i. Measurement of foreign exchange gains. ii. Tax treatment of foreign exchange gains. iii. Tax treatment of foreign exchange losses

You might also like

- Dec-2008 Foreign Exchange Management FM-302Document1 pageDec-2008 Foreign Exchange Management FM-302Mayank GoyalNo ratings yet

- Dec-2007 Foreign Exchange Management FM-302Document1 pageDec-2007 Foreign Exchange Management FM-302Mayank GoyalNo ratings yet

- Important QuestionsDocument2 pagesImportant QuestionsSajal AggarwalNo ratings yet

- Assignments For Financial Derivatives (RMB FM 05) Assignment-1Document2 pagesAssignments For Financial Derivatives (RMB FM 05) Assignment-1HOD MBANo ratings yet

- Foreign ExchangeDocument3 pagesForeign ExchangeManpreet SinghNo ratings yet

- Investment Management - MBA 4th SemDocument6 pagesInvestment Management - MBA 4th SemManasu Shiva Mysuru0% (1)

- CDM QuestionsDocument3 pagesCDM QuestionsAkshayNo ratings yet

- FD Question BankDocument5 pagesFD Question Bankruchi agrawalNo ratings yet

- Specialization: International Business: Masters Program in Business Administration (MBA)Document2 pagesSpecialization: International Business: Masters Program in Business Administration (MBA)Meena NaveinNo ratings yet

- Section-A Answer The Following Ten Marks QuestionsDocument1 pageSection-A Answer The Following Ten Marks QuestionsSangeeta SharmaNo ratings yet

- Short Answer QuestionsDocument5 pagesShort Answer QuestionsMuthu KrishnaNo ratings yet

- International Finance 23Document1 pageInternational Finance 23Mohammed RafiNo ratings yet

- 7 KoDocument1 page7 Koclaim ssfNo ratings yet

- International Business EnvironmentDocument3 pagesInternational Business EnvironmentNeelabh KumarNo ratings yet

- Vinayaka Missions University, Salem. MBA - 2008 Regulation - IV Semester Elective: International Finance Question Bank Unit 1 PART - A (2 Marks)Document8 pagesVinayaka Missions University, Salem. MBA - 2008 Regulation - IV Semester Elective: International Finance Question Bank Unit 1 PART - A (2 Marks)Tarun Kumar ThakurNo ratings yet

- TY-BFM Question BankDocument17 pagesTY-BFM Question BankManish SolankiNo ratings yet

- ME QuestionsDocument2 pagesME QuestionskajuNo ratings yet

- Subject - Monetary Economics: MoneyDocument4 pagesSubject - Monetary Economics: MoneyRajat LonareNo ratings yet

- International Finance Chapterwise QuestionssDocument2 pagesInternational Finance Chapterwise QuestionssAkshayNo ratings yet

- Test 4Document1 pageTest 4Pao KhangNo ratings yet

- Section-A Answer The Following One Mark QuestionsDocument1 pageSection-A Answer The Following One Mark QuestionsSangeeta SharmaNo ratings yet

- Important Questions Economics For ManagersDocument2 pagesImportant Questions Economics For ManagersAbhijit PaulNo ratings yet

- International Marketing QBDocument2 pagesInternational Marketing QBAbdallah El Jeddawi AsaNo ratings yet

- QB Innovative Financial ServicesDocument5 pagesQB Innovative Financial ServicesHousedealNo ratings yet

- International Finance ManagementDocument6 pagesInternational Finance ManagementSailpoint CourseNo ratings yet

- Engineering Economics and Financial AccountingDocument5 pagesEngineering Economics and Financial AccountingAkvijayNo ratings yet

- Chartered Market Technician (CMT) Program - Level I: Exam Time Length: 2 Hours, 15 Minutes Exam Format: Multiple ChoiceDocument10 pagesChartered Market Technician (CMT) Program - Level I: Exam Time Length: 2 Hours, 15 Minutes Exam Format: Multiple ChoicesankarjvNo ratings yet

- CMTDocument9 pagesCMTAndres Ortuño0% (1)

- Short Answer QuestionsDocument7 pagesShort Answer QuestionsSai Srinivas Murthy .GNo ratings yet

- Question Bank Sem IIIDocument3 pagesQuestion Bank Sem IIIRahul NishadNo ratings yet

- Model Question Paper On Commodity MarketsDocument2 pagesModel Question Paper On Commodity MarketsKrishnamohan VaddadiNo ratings yet

- IBM Questions From Previous VTU Question PapersDocument8 pagesIBM Questions From Previous VTU Question PapersBhushanarNo ratings yet

- Bba - 8 International Finance: Q. No. 1. McqsDocument1 pageBba - 8 International Finance: Q. No. 1. McqsKainat TanveerNo ratings yet

- Model Question Pape1Document5 pagesModel Question Pape1Vijay SinghNo ratings yet

- P.G. Diploma in International Business (P.G.D.I.B) Examination, 2010 101: International Marketing and Management (2008 Pattern)Document7 pagesP.G. Diploma in International Business (P.G.D.I.B) Examination, 2010 101: International Marketing and Management (2008 Pattern)ADitya PatwardhanNo ratings yet

- 1836/PMBAB1: Global Financial Markets and International Banking Time: Three Hours Maximum: 100 MarksDocument2 pages1836/PMBAB1: Global Financial Markets and International Banking Time: Three Hours Maximum: 100 Markshixibav222No ratings yet

- Fin 401 PDFDocument2 pagesFin 401 PDFSimanta KalitaNo ratings yet

- Security Analysis and Portfolio Management FaqDocument5 pagesSecurity Analysis and Portfolio Management Faqshanthini_srmNo ratings yet

- Practice Fin Man Exam Advanced Wiley 2013 Test Bank Multiple Answer Chapter 13 - 14Document8 pagesPractice Fin Man Exam Advanced Wiley 2013 Test Bank Multiple Answer Chapter 13 - 14rgarbuz155No ratings yet

- Imp Ques - Managerial EconomicsDocument6 pagesImp Ques - Managerial EconomicsPavan Kumar NNo ratings yet

- Tutorial Sheet For Engineering and Managerial EconomicsDocument3 pagesTutorial Sheet For Engineering and Managerial Economicssaxena_sumit1985No ratings yet

- Question Bank - EABDDocument6 pagesQuestion Bank - EABDShubham PurohitNo ratings yet

- Lesson Plan FM406Document4 pagesLesson Plan FM406Keshav ThadaniNo ratings yet

- Managerial EconomicsDocument4 pagesManagerial Economicsyogeetha saiNo ratings yet

- Tyfm Derivative Markets Question BankDocument4 pagesTyfm Derivative Markets Question BankSmith ShettyNo ratings yet

- Business EconomicsDocument2 pagesBusiness EconomicsXyz ZyzNo ratings yet

- RM Gtu TheoryDocument4 pagesRM Gtu TheoryAtibAhmedNo ratings yet

- Assignment Drive SPRING 2015 Program: Approximately of 400 Words. Each Question Is Followed by Evaluation SchemeDocument2 pagesAssignment Drive SPRING 2015 Program: Approximately of 400 Words. Each Question Is Followed by Evaluation SchemeTusharr AhujaNo ratings yet

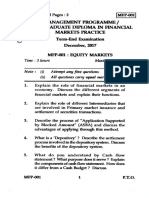

- 2 Management Programme / T. Post Graduate Diploma in Financial 0-Markets Practice 00 Term-End Examination December, 2017 Mfp-001: Equity MarketsDocument2 pages2 Management Programme / T. Post Graduate Diploma in Financial 0-Markets Practice 00 Term-End Examination December, 2017 Mfp-001: Equity MarketsRohit GhuseNo ratings yet

- Question BankDocument7 pagesQuestion Bankdanushgowda600No ratings yet

- Case Study Currency SwapsDocument2 pagesCase Study Currency SwapsSourav Maity100% (2)

- Individual Assignment of Financial and Managerial AccountingDocument1 pageIndividual Assignment of Financial and Managerial AccountingAbebe Getnet LoginNo ratings yet

- Befa Important QuestionsDocument5 pagesBefa Important Questionskruthi reddyNo ratings yet

- Lesson Plan Financial Derivatives MbaiiiDocument5 pagesLesson Plan Financial Derivatives MbaiiiSheg AonNo ratings yet

- Global Business Management - AssignmentDocument2 pagesGlobal Business Management - AssignmentNizamudeen SaNo ratings yet

- Worksheet Chapter-Foreign Exchange Rate Class - XIIDocument3 pagesWorksheet Chapter-Foreign Exchange Rate Class - XIIhargun kaur gabaNo ratings yet

- B.S.A Crescent Engineering College MG 2452 Engineering Economics and Financial Accounting Unit-1 Introduction Part-ADocument2 pagesB.S.A Crescent Engineering College MG 2452 Engineering Economics and Financial Accounting Unit-1 Introduction Part-AGautham LogarajNo ratings yet

- Question Bank MamDocument3 pagesQuestion Bank MamSushantChheniyaNo ratings yet

- P.Kalyanasundaram: ObjectiveDocument3 pagesP.Kalyanasundaram: ObjectiveMayank GoyalNo ratings yet

- Risk & Return RelationshipDocument26 pagesRisk & Return RelationshipMayank GoyalNo ratings yet

- WTO Framework and International MarketingDocument7 pagesWTO Framework and International MarketingMayank GoyalNo ratings yet

- Price Rate-Of-ChangeDocument2 pagesPrice Rate-Of-ChangeMayank GoyalNo ratings yet

- RiskDocument3 pagesRiskMayank GoyalNo ratings yet

- MB0040 Assignment Spring 2013Document2 pagesMB0040 Assignment Spring 2013Pradeep SNo ratings yet

- Smoothing Constant 2/ (10 + 1) 10-Day EMADocument1 pageSmoothing Constant 2/ (10 + 1) 10-Day EMAMayank GoyalNo ratings yet

- Sl. No. Name Gender D.O.B. Age (Yrs) Phone No 1: 1 Sahil Berwal Male 5/17/1990 23 8950115518Document3 pagesSl. No. Name Gender D.O.B. Age (Yrs) Phone No 1: 1 Sahil Berwal Male 5/17/1990 23 8950115518Mayank GoyalNo ratings yet

- Customer Service: MAR 3231 Fall 2008Document10 pagesCustomer Service: MAR 3231 Fall 2008Mayank GoyalNo ratings yet