Professional Documents

Culture Documents

Questions On Stock Markets 170712

Uploaded by

Chetan KurdiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questions On Stock Markets 170712

Uploaded by

Chetan KurdiaCopyright:

Available Formats

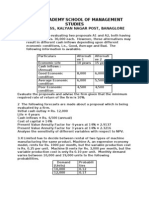

Stock Markets: Ques for practice Q.1) An investor has decided to invest Rs.

1, 00,000 in the stocks of two companies, i.e. ABC Company and XYZ Company. The projections of returns from the stocks of these two companies along with their probabilities are as follows: Probability 0.20 0.25 0.25 0.30 ABC Company 12% 14% -7% 28% XYZ Company 16% 10% 28% -2%

You are required to a. Comment on the return and risk of investment in individual stocks b. Compare the risk and return of these two stocks with a portfolio of these stocks in equal proportions

Q2) The current price of stock A & stock B are Rs. 80 and Rs. 60 respectively. At the end of the year, the price of stocks A & B and their associated probabilities are given below. Stock A (Rs.) 74 80 85 Stock B (Rs.) 55 60 66 Probability 0.30 0.40 0.30

Given this data, which stock should an investor choose?

Q.3 On request of an investor who holds two stocks A & B, an analyst prepared ex ante probability distribution for the possible economic scenarios and the conditional returns for two stocks and the market index as shown below. Economic Scenario Growth Stagnation Recession Probability 0.40 0.30 0.30 Conditional Returns (%) A B Market 25 20 18 10 15 13 -5 -8 -3

Risk free rate during the next year is expected to be around 11 %. Determine whether the investor should liquidate his holdings in stocks A & B or on the contrary make fresh investments in them? The assumptions of CAPM hold true. Q. 4 The data given below relates to companies Alpha and Beta. Expected Dividend Current market price Expected market price after 1 year under 2 scenarios Optimistic scenario 100 Pessimistic scenario 50 Alpha (Rs.) 5 60 Beta (Rs.) 8 120

175 100

If an investors holding period is one year, which stock should he buy?

2

You might also like

- Financial Soundness Indicators for Financial Sector Stability in BangladeshFrom EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability: A Tale of Three Asian CountriesFrom EverandFinancial Soundness Indicators for Financial Sector Stability: A Tale of Three Asian CountriesNo ratings yet

- Stock Markets and Portfolio Theory SimsrDocument4 pagesStock Markets and Portfolio Theory SimsrRasesh Shah0% (1)

- Return and Risk Portfolio AnalysisDocument24 pagesReturn and Risk Portfolio AnalysisAditi SharmaNo ratings yet

- Portfolio Analysis PDFDocument4 pagesPortfolio Analysis PDFFitness JourneyNo ratings yet

- Module 3 and 4 Only QuestionsDocument169 pagesModule 3 and 4 Only QuestionslovishNo ratings yet

- Risk N ReturnDocument6 pagesRisk N ReturnRakesh Kr RouniyarNo ratings yet

- Portfolio Management Handout 1 - Questions PDFDocument6 pagesPortfolio Management Handout 1 - Questions PDFPriyankaNo ratings yet

- EDBAS 202 Portfolio Theory ProblemsDocument3 pagesEDBAS 202 Portfolio Theory ProblemsHambeca PHNo ratings yet

- ExercisesDocument3 pagesExercisesrhumblineNo ratings yet

- Dec 2009 IcwaDocument8 pagesDec 2009 Icwamknatoo1963No ratings yet

- CAPM Expected Returns for PortfoliosDocument10 pagesCAPM Expected Returns for Portfoliosadisontakke_31792263No ratings yet

- Assignment 1Document2 pagesAssignment 1chanus19No ratings yet

- DTU406 - Mock ExamDocument8 pagesDTU406 - Mock ExamXuân MaiNo ratings yet

- Financial Modeling AssignmentDocument3 pagesFinancial Modeling Assignmentsanchit001No ratings yet

- Rate of Return and Risk Analysis for Multiple InvestmentsDocument10 pagesRate of Return and Risk Analysis for Multiple InvestmentsAzrul KechikNo ratings yet

- Probability ConceptsDocument5 pagesProbability ConceptsAslam HossainNo ratings yet

- Risk Return Sharpe QsDocument2 pagesRisk Return Sharpe QsKshitij TyagiNo ratings yet

- SFM - 1Document3 pagesSFM - 1ketulNo ratings yet

- Practical QuestionsDocument6 pagesPractical Questionsshantanu_malviya_1100% (1)

- DTU406 - Practice Exam PDFDocument8 pagesDTU406 - Practice Exam PDFLý Minh TânNo ratings yet

- Cash Flow Probability Cash Flow Probability Proj A Proj B Proj A Year Project A Project B Expected Value Discount Rate PV (Encf)Document10 pagesCash Flow Probability Cash Flow Probability Proj A Proj B Proj A Year Project A Project B Expected Value Discount Rate PV (Encf)hardik100No ratings yet

- Portfolio Management and SAPM Book Tybms and TybfmDocument40 pagesPortfolio Management and SAPM Book Tybms and TybfmRahul VengurlekarNo ratings yet

- 2830203-Security Analysis and Portfolio ManagementDocument2 pages2830203-Security Analysis and Portfolio ManagementbhumikajasaniNo ratings yet

- Mqp1 10mba Mbafm02 AmDocument4 pagesMqp1 10mba Mbafm02 AmDipesh JainNo ratings yet

- Portfolio Management Tutorial 3Document3 pagesPortfolio Management Tutorial 3andy033003No ratings yet

- Sums On Project AnalysisDocument26 pagesSums On Project AnalysisAlbert Thomas80% (5)

- Understanding the Efficient Market HypothesesDocument23 pagesUnderstanding the Efficient Market HypothesesAdi SadiNo ratings yet

- Mock Exam 2023 #2 - First Session (Ethical and Professional Standards, Quantitative Methods, Economics Financial Statement Analysis) - QuestionDocument30 pagesMock Exam 2023 #2 - First Session (Ethical and Professional Standards, Quantitative Methods, Economics Financial Statement Analysis) - QuestionCyrine JemaaNo ratings yet

- Icfai P. A. Test Iii (2008)Document2 pagesIcfai P. A. Test Iii (2008)api-3757629No ratings yet

- MBA 4 Sem I M Unit IV Probs On Portfolio TheoryDocument5 pagesMBA 4 Sem I M Unit IV Probs On Portfolio TheoryMoheed UddinNo ratings yet

- Chapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BDocument4 pagesChapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BAnsleyNo ratings yet

- SAPM ProblemsDocument7 pagesSAPM ProblemsNavleen KaurNo ratings yet

- Practice Problems CorpFinDocument2 pagesPractice Problems CorpFinSrestha ChatterjeeNo ratings yet

- Unit 4 QuestionsDocument2 pagesUnit 4 Questionslinka fasterNo ratings yet

- MBA Investment Portfolio Management AssignmentDocument4 pagesMBA Investment Portfolio Management AssignmentDeepanshu Arora100% (1)

- Portfolio Management SumsDocument4 pagesPortfolio Management SumsPratik Rambhia0% (1)

- Chap 5-Pages-45-46,63-119Document59 pagesChap 5-Pages-45-46,63-119RITZ BROWNNo ratings yet

- CH 18Document7 pagesCH 18Amit ChaturvediNo ratings yet

- MBA 4th Sem IM Unit I Probs On Risk and ReturnDocument5 pagesMBA 4th Sem IM Unit I Probs On Risk and ReturnMoheed UddinNo ratings yet

- 435 Problem Set 1Document3 pages435 Problem Set 1Md. Mehedi Hasan100% (1)

- BUS 365: Investments Practice Problems Risk and ReturnDocument4 pagesBUS 365: Investments Practice Problems Risk and ReturnAmeya RanadiveNo ratings yet

- Gujarat Technological University: InstructionsDocument3 pagesGujarat Technological University: Instructionssiddharth devnaniNo ratings yet

- Risk and ReturnDocument2 pagesRisk and ReturnKhondaker RafsanjaniNo ratings yet

- FRM Test 07 QSDocument24 pagesFRM Test 07 QSKamal BhatiaNo ratings yet

- Cfa L 1 Mock Paper - Solution - 2024Document10 pagesCfa L 1 Mock Paper - Solution - 2024guayrestudioNo ratings yet

- Indvi Assignment 1 Investment and Port MGTDocument2 pagesIndvi Assignment 1 Investment and Port MGTaddisie temesgenNo ratings yet

- Risk and ReturnsDocument3 pagesRisk and ReturnsDivakara ReddyNo ratings yet

- Statistics Solved Papers 2015Document38 pagesStatistics Solved Papers 2015AsadZahidNo ratings yet

- R09 Probability Concepts Q BankDocument20 pagesR09 Probability Concepts Q Bankakshay mouryaNo ratings yet

- Quiz Quantitative MethodsDocument4 pagesQuiz Quantitative MethodsJorge RojasNo ratings yet

- Investment & Portfolio MGT AssignmentDocument2 pagesInvestment & Portfolio MGT AssignmentAgidew ShewalemiNo ratings yet

- Calculations OnlyDocument10 pagesCalculations OnlyPatience AkpanNo ratings yet

- Finance Pq1Document33 pagesFinance Pq1pakhok3No ratings yet

- Portfolio Management PDFDocument27 pagesPortfolio Management PDFdwkr giriNo ratings yet

- IPM Practice Question BankDocument3 pagesIPM Practice Question Bankbhaveshs81No ratings yet

- Financial Economics HEC, Paris: Problem Set 3Document2 pagesFinancial Economics HEC, Paris: Problem Set 3DuporteauNo ratings yet

- Business Finance II: Exercise 1Document7 pagesBusiness Finance II: Exercise 1faisalNo ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)No ratings yet

- Child LabourDocument6 pagesChild LabourChetan KurdiaNo ratings yet

- Chanda KochharDocument4 pagesChanda KochharChetan KurdiaNo ratings yet

- Sort Cut Key For ExelknmkDocument1 pageSort Cut Key For ExelknmkChetan KurdiaNo ratings yet

- Relationship between Indian stock market and other developing Asian marketsDocument1 pageRelationship between Indian stock market and other developing Asian marketsChetan KurdiaNo ratings yet

- India's Constitution Drafted by Constituent AssemblyDocument4 pagesIndia's Constitution Drafted by Constituent AssemblyChetan KurdiaNo ratings yet

- Intervew Globe OpDocument18 pagesIntervew Globe OpChetan KurdiaNo ratings yet

- Name: Mobile No:09167660784: Education QualificationDocument2 pagesName: Mobile No:09167660784: Education QualificationChetan KurdiaNo ratings yet

- Name: Mobile No:09167314561: Education QualificationDocument2 pagesName: Mobile No:09167314561: Education QualificationChetan KurdiaNo ratings yet

- Green Roof Living Wall Factory Warehouse Hotel VideosDocument4 pagesGreen Roof Living Wall Factory Warehouse Hotel VideosChetan KurdiaNo ratings yet

- Name: Mobile No:09167660784 E-Mail:: Ashwani KumarDocument2 pagesName: Mobile No:09167660784 E-Mail:: Ashwani KumarChetan KurdiaNo ratings yet

- 112528902Document3 pages112528902Chetan KurdiaNo ratings yet

- A Study On Price Fluctuations in Commodity MarketDocument1 pageA Study On Price Fluctuations in Commodity MarketChetan KurdiaNo ratings yet

- Financial Markets and Institutions Course OverviewDocument3 pagesFinancial Markets and Institutions Course OverviewChetan KurdiaNo ratings yet

- 12 JniDocument1 page12 JniChetan KurdiaNo ratings yet

- Society, Individuals and Ethics - Handout For VESIMSR - 2013Document3 pagesSociety, Individuals and Ethics - Handout For VESIMSR - 2013Chetan KurdiaNo ratings yet

- SFA guide covers benefits, tools, emerging technologies like SaaSDocument32 pagesSFA guide covers benefits, tools, emerging technologies like SaaSChetan KurdiaNo ratings yet

- Merger ND AcqDocument4 pagesMerger ND AcqChetan KurdiaNo ratings yet

- VESIMSR - Dec 2012 - PGDBM - Session Plan - Ethics in BusinessDocument3 pagesVESIMSR - Dec 2012 - PGDBM - Session Plan - Ethics in BusinessChetan KurdiaNo ratings yet

- Brics ReportDocument204 pagesBrics ReportUdaya VikkurthiNo ratings yet

- Damodaran DCFDocument15 pagesDamodaran DCFpraveen_356100% (2)

- Capital Market in India - PPT SummersDocument10 pagesCapital Market in India - PPT SummersKunal TikooNo ratings yet

- AMFI Model Test PaperDocument26 pagesAMFI Model Test PaperChetan KurdiaNo ratings yet

- Chapter Twelve: Arbitrage Pricing TheoryDocument7 pagesChapter Twelve: Arbitrage Pricing TheoryI.sathya NarayanaNo ratings yet

- Relation between Indian and US stock marketsDocument19 pagesRelation between Indian and US stock marketsChetan KurdiaNo ratings yet

- TapDocument20 pagesTapChetan KurdiaNo ratings yet

- Impact of geoengineering techniques on biodiversityDocument4 pagesImpact of geoengineering techniques on biodiversityChetan KurdiaNo ratings yet

- Trade&FDIDocument21 pagesTrade&FDIankush srNo ratings yet

- Modified CV Pratap SinghDocument3 pagesModified CV Pratap SinghChetan KurdiaNo ratings yet

- Banking & Insurance ManagementDocument1 pageBanking & Insurance ManagementChetan KurdiaNo ratings yet