Professional Documents

Culture Documents

Form No. 15G: I/We Son/daughter/wife of at Do Hereby Declare - Resident of

Uploaded by

rakeshsharma5790Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 15G: I/We Son/daughter/wife of at Do Hereby Declare - Resident of

Uploaded by

rakeshsharma5790Copyright:

Available Formats

form compiled by http://www.finance.pushpi.

com

For convenience in filling the form, please use 'Tab' or 'Forward Cursor ( -->)' key to move from one cell to another.

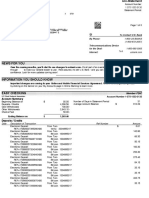

FORM NO. 15G

[ See rule 29C]

Declaration under sub-sections (1) and (1A) of section 197A of the Income-tax Act, 1961, to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax

I/We* *son/daughter/wife of resident of @ do hereby declare

(name and address 1 *that I am a shareholder in of the company) and the shares in the said company, particulars of which are given in Schedule I below, stand in my name and are beneficially owned by me, and the dividends therefrom are not includible in the total income of any other person under sections 60 to 64 of the Income-tax Act, 1961; Or *#that the securities or sums, particulars of which are given in Schedule II or Schedule III or Schedule IV below, stand in *my/our name and beneficially belong to *me/us, and the *interest in respect of such securities or sums and/or income in respect of units is/are not includible in the total income of any other person under sections 60 to 64 of the Income-tax Act, 1961; Or *that the particulars of my account under the National Savings Scheme and the amount of withdrawal are as per the Schedule V below; 2 that *my/our present occupation is; 3 that the tax on *my/our estimated total income, including *the dividends from shares referred to in Schedule I below; and/or *#interest on securities, interest other than interest on securities and/or income in respect of units, referred to in Schedule II, Schedule III and/or Schedule IV below; and/or *the amount referred to in clause (a ) of sub-section (2) of section 80CCA, mentioned in Schedule V below, computed in accordance with the provisions of the Income-tax Act, 1961, for the previous year ending on relevant to the assessment year will be nil; 4 that *my/our income from *dividend/interest on securities/interest other than "interest on other than interest on securities/units/amounts referred to in clause (a) of sub-section (2) of section 80CCA or the aggregate of such incomes, computed in accordance with the provisions of the Income-tax Act, 1961, for the previous year ending on relevant to the assessment year will not exceed the maximum amount which is not chargeable to income-tax; 5 that *I/we have not been assessed to income-tax at any time in the past but I fall within the jurisdiction of the Chief Commissioner or Commissioner of Income-tax Or relevant to the that *I was/we were last assessed to income-tax for the assessment year assessment year 20 - 20 will not exceed the maximum amount which is not chargeable to incometax; 6 that I *am/am not resident in India within the meaning of section 6 of the Income Tax Act, 1961; 7 Particulars of the *shares of the company/securities/sums/account under the National Savings Scheme and the amount of withdrawal referred to in paragraph 1 above, in respect of which the declaration is being made, are as under: SCHEDULE I

No. of shares

Class of shares and face value of each share

Total face value of shares

Distinctive numbers of the shares

Date(s) on which the shares were acquired by the declarant

SCHEDULE II Description of securities Number of securities Date(s) of securities Amount of securities Date(s) on which the securities were acquired by the declarant

SCHEDULE III Name and address of the person to whom the sums are given on interest Amount of such sums Date on which sums were given on interest Period for which such sums were given on interest Rate of interest

SCHEDULE IV Name and address of the Mutual Fund Number of units Class of units and face value of each unit Distinctive number of units Income in respect of units

SCHEDULE V Particulars of the Post Office where the account under the National Savings Scheme is maintained and the account number Date on which the account was opened The amount of withdrawal from the account

**Signature of the declarant Verification *I/We do hereby declare that to the best of *my/our knowledge and belief what is stated above is correct, complete and is truly stated. Verified today, the Place Signature of the declarant Notes: 1 @ Give complete postal address. 2 The declaration should be furnished in duplicate. 3 *Delete whichever is not applicable 4 #Declaration in respect of these payments can be furnished by a person (Not being a company or a firm). 5 **Indicate the capacity in which the declaration is furnished on behalf of a Hindu Undevided family, association of persons, etc. 6 Before signing the verification, the declarant should satisfy himself that the information furnished in the declaration is true, correct and complete in all respects. Any person making a false statement in the declaration shall be liable to prosecution under section 277 of the Income-tax Act, 1961, and on conviction be punishable (i ) in a case where tax sought to be evaded exceeds one lakh rupees, with rigorous imprisonment which shall not be less than six months but which may extend to seven years and with fine; day of

(i ) in a case where tax sought to be evaded exceeds one lakh rupees, with rigorous imprisonment which shall not be less than six months but which may extend to seven years and with fine; (ii ) in any other case, with rigorous imprisonment which shall not be less than three months but which may extend to three years and with fine.

PART II [FOR USE BY THE PERSON TO WHOM THE DECLARATION IS FURNISHED] 1 Name

2 3

and address of the person responsible for paying the income, mentioned in paragraph 1 of the declaration Date on which the declaration was furnished by the declarant Date of *declaration, distribution or payment of dividend / withdrawal from account number under the National Savings Scheme Period in respect of which *dividend has been declared / interest is being credited or paid / income in respect of units is being credited or paid Amount of *dividend / interest or income in respect of units / withdrawal from National Savings Scheme Account *Rate at which interest or income in respect of units, as the case may be, is credited/paid

Forwarded to the Chief Commissioner or Commissioner of Income-tax

Place Date

Signature of the person responsible for paying the income referred to in Paragraph

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Us Bank Statement PDFDocument4 pagesUs Bank Statement PDFlubia86% (7)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Corporate Income TaxDocument12 pagesCorporate Income TaxShiela Marie Sta Ana100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Proposal AgregatorDocument20 pagesProposal Agregatorvier emNo ratings yet

- Stetment 10 PDFDocument4 pagesStetment 10 PDFvaraprasadNo ratings yet

- CC-3189 Dec'22Document2 pagesCC-3189 Dec'22Asif AhmedNo ratings yet

- Letter of Intent: V5 Global Services Private LimitedDocument3 pagesLetter of Intent: V5 Global Services Private LimitedRamesh ReddyNo ratings yet

- Ug Special TermDocument40 pagesUg Special TermRegina SamsonNo ratings yet

- Policy No. Plan Name Frequency Installment Premium: A Reliance Capital CompanyDocument1 pagePolicy No. Plan Name Frequency Installment Premium: A Reliance Capital CompanyAstro Bhushan RatnakarNo ratings yet

- Of GST PMT 04: Habit Lobjective Zype QuestionsDocument11 pagesOf GST PMT 04: Habit Lobjective Zype QuestionsPraveen JoeNo ratings yet

- Project On Incometax ActDocument27 pagesProject On Incometax ActRahul sawadiaNo ratings yet

- Lesson 3 TAXATIONDocument14 pagesLesson 3 TAXATIONMarked BrassNo ratings yet

- Mini Master FormDocument6 pagesMini Master FormLUINo ratings yet

- Sro 11030950 081122Document2 pagesSro 11030950 081122Nicco MarantsonNo ratings yet

- Addendum: TO Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForDocument19 pagesAddendum: TO Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForKhoo Kah JinNo ratings yet

- Expression CoralDocument1 pageExpression CoralvbookumarNo ratings yet

- 12Document1 page12Magsaysay SouthNo ratings yet

- Digital Payments Driving Financial InclusionDocument73 pagesDigital Payments Driving Financial InclusionAyush NahakNo ratings yet

- Refund Rules Wef 12-Nov-15Document11 pagesRefund Rules Wef 12-Nov-15jamesNo ratings yet

- Bir Ruling No. Ot-007-202Document4 pagesBir Ruling No. Ot-007-202Ren Mar CruzNo ratings yet

- Coral ServiceDocument25 pagesCoral ServiceNicolas ErnestoNo ratings yet

- SolutionsDocument2 pagesSolutionsJan Aldrin AfosNo ratings yet

- TermsDocument3 pagesTermsAmy GarrettNo ratings yet

- Medical BillDocument1 pageMedical BillAbubarkat LaskarNo ratings yet

- Account Statement From 1 Mar 2020 To 28 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Mar 2020 To 28 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceNILESHNo ratings yet

- Rajeev Sharma: Account StatementDocument7 pagesRajeev Sharma: Account StatementRajSharmaNo ratings yet

- Tax Deduction at SourceDocument10 pagesTax Deduction at Sourceshivani singhNo ratings yet

- LTA Declaration Form Form 12BBDocument3 pagesLTA Declaration Form Form 12BBAmitomSudarshanNo ratings yet

- Cardholder Dispute Form: I Hereby Dispute The Above Mentioned Transaction(s) (Please Tick Relevant Box (Es) )Document1 pageCardholder Dispute Form: I Hereby Dispute The Above Mentioned Transaction(s) (Please Tick Relevant Box (Es) )Kirubakaran RamasundaramoorthyNo ratings yet

- 183 OracleDocument1 page183 OracleSomu RoyalNo ratings yet