Professional Documents

Culture Documents

Computation of Total Income of Dr. Chowdhury For The Assesment Year 2008-2009

Uploaded by

Nazim ChowdhuryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Computation of Total Income of Dr. Chowdhury For The Assesment Year 2008-2009

Uploaded by

Nazim ChowdhuryCopyright:

Available Formats

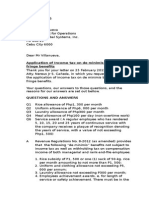

Computation of Total Income of Dr.

chowdhury for the assesment year 2008-2009

Particulars

Basic salary tk. 100000 per month House rent 60% of basic Less: Exempted 15000 pm or 50% of basic (whicever is less) Medical Allowance 10% of Basic Entertainment Allowance 15% of basic Bonus Equivalent 2 months pay (100000*2) Conveyance facilites (7.5% of basic) overhead allowance Setting question and evaluating the answer scripts Employers contribution to RPF 5% of basic Interest from securities Interest from Debentures Total Income Amount in BDT Details Total 100000*12 720000 180000 1200000 540000 120000 180000 200000 90000 50000 30000 60000 4000 16000 2490000

Computation of Investment Allowance Employer's & Employees contribution to RPF (60000*2) Saving certificates Contributed to Aga khan establishments Total investment allowance claimed

Amount(BDT) 120000 50000 80000 250000

Investment allowance comes to 25% of total income = (2490000-60000)*25%=607500) or actual investment 250000 or maximum 500000 whichever is less. So allowable investment allowance is Tk. 250000

Tax Calculation

Particulars

On the 1st Tk. 165000 of total income On next Tk. 275000 of total income On next Tk. 325000 of total income On next Tk. 375000 of total income Balance Tk. 1350000 Tax on total income Less: Investment rebate (10% of 250000) Net tax payable Less: Tax deducted at source Tk. 2500 per month Balance Payable Made By

Tax Rate

0 10% 15% 20% 25%

Amount (BDT)

Nil 27500 48750 75000 337500 488750 25000 463750 30000 433750

Name: M Rakibul Alam

You might also like

- Omputation of Total Income From Salary & Tax LiabilityDocument7 pagesOmputation of Total Income From Salary & Tax LiabilityRyhanul IslamNo ratings yet

- Tax UpdateDocument149 pagesTax UpdateJamz LopezNo ratings yet

- Income From Salary: Ca Arpit RajawatDocument46 pagesIncome From Salary: Ca Arpit RajawatVardhini VadegharNo ratings yet

- Case 3 SalaryDocument3 pagesCase 3 SalaryKritika ChoudharyNo ratings yet

- VRS NotesDocument82 pagesVRS NotesrisingiocmNo ratings yet

- Question Income From Salary Solved in ClassDocument4 pagesQuestion Income From Salary Solved in ClassFozle Rabby 182-11-5893No ratings yet

- Arindam Das Salary For The Month of July 2008Document4 pagesArindam Das Salary For The Month of July 2008Bala MuruNo ratings yet

- IT Declaration Form Revised SalaryDocument1 pageIT Declaration Form Revised SalaryMANUBHOPALNo ratings yet

- CH 2.TaxSalary IncomeDocument13 pagesCH 2.TaxSalary IncomeSajid AhmedNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- Taxation Law CIA 3Document3 pagesTaxation Law CIA 3Deepa GowdaNo ratings yet

- Basic Income Tax StructureDocument69 pagesBasic Income Tax StructureAditya AnandNo ratings yet

- Assignment TAX (21 AIS 039)Document18 pagesAssignment TAX (21 AIS 039)Amran OviNo ratings yet

- DO IT Salary Income With SolutionDocument3 pagesDO IT Salary Income With SolutionAnsary LabibNo ratings yet

- Tax SavingsDocument32 pagesTax Savingsh946073000850% (2)

- Personal Income Tax IssuesDocument6 pagesPersonal Income Tax Issuesraf1413No ratings yet

- Capital Budegeting Class ProblemsDocument19 pagesCapital Budegeting Class ProblemsVishnupriya PremkumarNo ratings yet

- Taxation of Employment IncomeDocument7 pagesTaxation of Employment IncomeJamvy Jose FernandezNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarNo ratings yet

- Capii Income Tax and Vat July2015Document15 pagesCapii Income Tax and Vat July2015casarokarNo ratings yet

- Deductions To Be Made in Computing Total IncomeDocument15 pagesDeductions To Be Made in Computing Total IncomeAbey FrancisNo ratings yet

- Hussainkhawaja 1177 3641 2 LECTURE-10Document51 pagesHussainkhawaja 1177 3641 2 LECTURE-10Hasnain BhuttoNo ratings yet

- Provident FundDocument5 pagesProvident FundG MadhuriNo ratings yet

- Annexure C ExamplesDocument21 pagesAnnexure C ExamplesLee Ka FaiNo ratings yet

- Employment Income TaxDocument20 pagesEmployment Income TaxBizu AtnafuNo ratings yet

- Fifth PartDocument17 pagesFifth PartMahsinur RahmanNo ratings yet

- Income Tax Law & PracticeDocument29 pagesIncome Tax Law & PracticeMohanNo ratings yet

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument1 pageSalary Calculation Yearly & Monthly Break Up of Gross SalaryANKIT_JAIN84No ratings yet

- ATax - 03Document29 pagesATax - 03Haseeb Ahmed ShaikhNo ratings yet

- Tax AssignmentDocument11 pagesTax AssignmentAM NerdyNo ratings yet

- Gols E-Learning Portal Live Virtual Classroom (LVC)Document24 pagesGols E-Learning Portal Live Virtual Classroom (LVC)Lokesh manglaNo ratings yet

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDocument9 pagesTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNo ratings yet

- RTP NOV 2022 Important PointsDocument4 pagesRTP NOV 2022 Important PointsDaniel TerstegenNo ratings yet

- Taxation of Salary Income 2017 IndiaDocument19 pagesTaxation of Salary Income 2017 Indiarpiyer72No ratings yet

- Preparation of Legal OpinionDocument5 pagesPreparation of Legal OpinionNereus Sanaani CAñeda Jr.No ratings yet

- Individual Portfolio of Mr. X: ScenarioDocument5 pagesIndividual Portfolio of Mr. X: ScenarioBhavesh BajajNo ratings yet

- Month Basic DA Convey CCA HRA Bonus Medical LTA OtherDocument6 pagesMonth Basic DA Convey CCA HRA Bonus Medical LTA Othersmartb0yNo ratings yet

- Ias 19 NotesDocument41 pagesIas 19 NotesTanyahl MatumbikeNo ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- Unit 5, 6 & 7 Capital Budgeting 1Document14 pagesUnit 5, 6 & 7 Capital Budgeting 1ankit mehtaNo ratings yet

- Problems On Taxable Salary Income-AdditionalDocument24 pagesProblems On Taxable Salary Income-AdditionalBasappaSarkar81% (48)

- Deduction ProvisionsDocument11 pagesDeduction ProvisionsdevasrisaivNo ratings yet

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument2 pagesSalary Calculation Yearly & Monthly Break Up of Gross Salarymoh300No ratings yet

- Salaries PresentationDocument21 pagesSalaries PresentationDipika PandaNo ratings yet

- IT Calculator 14 15 Taxguru - inDocument16 pagesIT Calculator 14 15 Taxguru - inanirbanpwd76No ratings yet

- SMART Compendium Notes ACCA P6 (40 Pages)Document42 pagesSMART Compendium Notes ACCA P6 (40 Pages)m0r0n100% (2)

- 3.1 Employment Income Tax Edited March 2021Document22 pages3.1 Employment Income Tax Edited March 2021Bimmer MemerNo ratings yet

- Chapter 12 TaxdeductionsDocument16 pagesChapter 12 TaxdeductionsRiya SharmaNo ratings yet

- Scanner Ipcc Paper 4Document34 pagesScanner Ipcc Paper 4Meet GargNo ratings yet

- Computation of Income Under The Head "Profits and Gains of Business or Profession"Document14 pagesComputation of Income Under The Head "Profits and Gains of Business or Profession"Shubham KumarNo ratings yet

- Chapter-6 (Salary)Document53 pagesChapter-6 (Salary)BoRO TriAngLENo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- Income Tax Statement Financial Year 2014-2015: Designation NameDocument1 pageIncome Tax Statement Financial Year 2014-2015: Designation NameAnandraojs JsNo ratings yet

- Tax Planning For Salaried Employees - Taxguru - inDocument5 pagesTax Planning For Salaried Employees - Taxguru - invthreefriendsNo ratings yet

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument2 pagesSalary Calculation Yearly & Monthly Break Up of Gross SalaryDeyzan HusainNo ratings yet

- ASSESSMENT YEAR 2014 Tax Rates and DetailsDocument6 pagesASSESSMENT YEAR 2014 Tax Rates and Detailsamit2201No ratings yet

- Income Tax Exemptions For The Year 2010Document4 pagesIncome Tax Exemptions For The Year 2010Homework PingNo ratings yet

- 1 .Income Tax On Salaries - (01.06.2015)Document57 pages1 .Income Tax On Salaries - (01.06.2015)yvNo ratings yet

- Employee Welfare and Benefits (Raul C. Cruz)Document16 pagesEmployee Welfare and Benefits (Raul C. Cruz)Bhenjhan AbbilaniNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- CDCS ExamDocument24 pagesCDCS ExamPangoea Pangoea100% (1)

- CH 04Document29 pagesCH 04Hohes OpoilNo ratings yet

- CDCS Self-Study Guide 2011Document21 pagesCDCS Self-Study Guide 2011armamut100% (2)

- Good NightDocument1 pageGood NightNazim ChowdhuryNo ratings yet

- Definition of BenefitDocument7 pagesDefinition of BenefitRokon Uddin AhmedNo ratings yet

- DefinitionDocument1 pageDefinitionNazim ChowdhuryNo ratings yet

- Global WarmingDocument2 pagesGlobal WarmingPallavi PadamNo ratings yet

- The Disney CompanyDocument11 pagesThe Disney CompanyNazim ChowdhuryNo ratings yet

- Who Are The Main PlayersDocument2 pagesWho Are The Main PlayersNazim ChowdhuryNo ratings yet

- HelDocument60 pagesHelNazim ChowdhuryNo ratings yet

- ENG - 102 Group Project: Submitted To: Ziaul Karim Faculty of Independent University Bangladesh Submitted byDocument1 pageENG - 102 Group Project: Submitted To: Ziaul Karim Faculty of Independent University Bangladesh Submitted byNazim ChowdhuryNo ratings yet

- North South UniversityDocument1 pageNorth South UniversityNazim ChowdhuryNo ratings yet

- North South UniversityDocument1 pageNorth South UniversityNazim ChowdhuryNo ratings yet

- North South UniversityDocument1 pageNorth South UniversityNazim ChowdhuryNo ratings yet