Professional Documents

Culture Documents

Fault Lines A Summary PDF

Fault Lines A Summary PDF

Uploaded by

Inma Vidal GrimaltosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fault Lines A Summary PDF

Fault Lines A Summary PDF

Uploaded by

Inma Vidal GrimaltosCopyright:

Available Formats

Fault lines How hidden fractures still threaten the world economy In 2005, a man was roundly scoffed

d at by a group of luminaries who had gathered to celebrate Alan Greenspans legacy. His crime? In those heydays of financial prosperity, he claimed that the world was headed for financial disaster. As it turned out two years later, he was right. This man was none other than Raghuram Rajan, the current economic advisor to the Prime Minister of India. Through his latest book Fault Lines, Raghuram Rajan argues that the roots of the calamity can be traced back to three sets of fault lines. The first set of fault lines stems from domestic political pressures, especially in the United States. Under this, the author talks about the rising income inequality in the United States. The rising inequality combined with poor safety net creates pressures on politicians. However, instead of improving the competitiveness of labor force, the government has chosen the easier option of enabling credit to sub-prime borrowers. So, the first set of fault lines leads to easy credit to fuel consumption. The second set of fault lines emanates from trade imbalances between countries. Here the author focuses on trade surplus countries, such as Germany, Japan and China. These countries rely on exports for growth and so are excessively dependent on the foreign consumer. Now this excess supply is absorbed by the borrowers in US, UK and Greece which results in a bubble. The indebtedness grows to the point where these countries cannot afford any further spending and the bubble bursts. The third and final set of fault lines develops when different types of financial systems come into contact to finance these trade imbalances. In this case the foreign investors into US implicitly assumed that the US government would back the mortgage agencies like Fannie Mae and Freddie Mac. Consequently, the funds from the foreign private sector flowed into the highly rated mortgage-backed securities. Finally, you bring these three dots together and this is how the story goes - United States is politically predisposed towards stimulating consumption, the surplus countries depend on foreign consumption for growth and finally, investors from developing countries finance sub-prime mortgages. So, consumption in US increases till it is no longer affordable. The bubble bursts and crisis precipitates. To summarize, the book traces the crisis to three sets of fault lines domestic political pressures, trade imbalances and incompatible financial systems. At the end of it all, you might not agree with every single point that the book makes but the book will definitely make you think and question your biases against particular countries.

You might also like

- Modern Advanced Accounting in Canada Chapter 10 Solution ManualDocument54 pagesModern Advanced Accounting in Canada Chapter 10 Solution ManualJay-P100% (1)

- Coursera Course02Module03AssignmentDocument7 pagesCoursera Course02Module03AssignmentZain Ul Haq0% (2)

- Our Government Has Run Out of MoneyDocument10 pagesOur Government Has Run Out of MoneykakeroteNo ratings yet

- America CLDocument11 pagesAmerica CLkakeroteNo ratings yet

- Summary On Bloomberg Business Week MagazineDocument5 pagesSummary On Bloomberg Business Week MagazineAbhishek RaneNo ratings yet

- Martin Wolf ColumnDocument6 pagesMartin Wolf Columnpriyam_22No ratings yet

- America AlDocument12 pagesAmerica AlkakeroteNo ratings yet

- The Debt Bomb: Arron S OverDocument7 pagesThe Debt Bomb: Arron S Overrtibbits1234No ratings yet

- Government Austerity Measures Next StepDocument10 pagesGovernment Austerity Measures Next StepkakeroteNo ratings yet

- America in PerilDocument12 pagesAmerica in PerilkakeroteNo ratings yet

- US Debt Ceiling Battle - 1Document4 pagesUS Debt Ceiling Battle - 1Spencer1234556789No ratings yet

- Our Government Has Run Out of MoneyDocument10 pagesOur Government Has Run Out of MoneykakeroteNo ratings yet

- Government Austerity Measures Next StepDocument9 pagesGovernment Austerity Measures Next StepkakeroteNo ratings yet

- The U.S. Economic Crisis: Causes and Solutions: by Fred MoseleyDocument3 pagesThe U.S. Economic Crisis: Causes and Solutions: by Fred MoseleySirbu CatalinNo ratings yet

- The Economist - Finacial CrisisDocument4 pagesThe Economist - Finacial CrisisEnzo PitonNo ratings yet

- Robert Nemy International 5Document3 pagesRobert Nemy International 5Robert NemyNo ratings yet

- CFR Insiders Confirm That An Alarming Economic Crisis in The US Is ImminentDocument12 pagesCFR Insiders Confirm That An Alarming Economic Crisis in The US Is ImminentJeremy JamesNo ratings yet

- Government Austerity Measures Next StepDocument10 pagesGovernment Austerity Measures Next StepkakeroteNo ratings yet

- Another Financial Meltdown Is Closer Than It Appears.: Source: FREDDocument14 pagesAnother Financial Meltdown Is Closer Than It Appears.: Source: FREDVidit HarsulkarNo ratings yet

- Running on Empty: How the Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About ItFrom EverandRunning on Empty: How the Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About ItRating: 3.5 out of 5 stars3.5/5 (22)

- CLA2 - $20 Trillion An Indebted StoryDocument8 pagesCLA2 - $20 Trillion An Indebted StoryRobertRaisbeckNo ratings yet

- The Truth About Trade: What Critics Get Wrong About The Global EconomyDocument8 pagesThe Truth About Trade: What Critics Get Wrong About The Global EconomyMirjamNo ratings yet

- Fault Lines SummaryDocument6 pagesFault Lines SummaryEdward Essau FyittaNo ratings yet

- Textos Desafios InglesDocument20 pagesTextos Desafios InglesVanderson Souza PinhoNo ratings yet

- MARKETS CRISIS EURO US Will The U.S. and Europe Rise Again - or Sink Together - Wharton Oct 2011 2866Document3 pagesMARKETS CRISIS EURO US Will The U.S. and Europe Rise Again - or Sink Together - Wharton Oct 2011 2866Julie OneillNo ratings yet

- International Finance: Trade Deficits: Bad or Good?Document12 pagesInternational Finance: Trade Deficits: Bad or Good?Yuri Walter AkiateNo ratings yet

- CA Newsletter July 28 To 03 AugDocument15 pagesCA Newsletter July 28 To 03 AugAshish DeshpandeNo ratings yet

- Who Owns The Pbublic DebtDocument4 pagesWho Owns The Pbublic DebtEhud No-bloombergNo ratings yet

- History in The Making: Lessons and Legacies of The Financial CrisisDocument11 pagesHistory in The Making: Lessons and Legacies of The Financial Crisissouravkiller4uNo ratings yet

- Aydin Free Market Madness and Human Nature FINAL June 25Document25 pagesAydin Free Market Madness and Human Nature FINAL June 25Kind MidoNo ratings yet

- Never Accept Economic Truths Merely Because Somebody Said SoDocument3 pagesNever Accept Economic Truths Merely Because Somebody Said SoARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanNo ratings yet

- Keynesian Economics Doesn't WorkDocument9 pagesKeynesian Economics Doesn't WorkkakeroteNo ratings yet

- Trinity 2012Document23 pagesTrinity 2012Ling JiaNo ratings yet

- United States Debt CrisisDocument2 pagesUnited States Debt CrisisSatish SonawaleNo ratings yet

- ME Repot RahulDocument13 pagesME Repot RahulAshfak ShaikhNo ratings yet

- 01-15-09 Nation-The Crisis Is Global by William GreiderDocument2 pages01-15-09 Nation-The Crisis Is Global by William GreiderMark WelkieNo ratings yet

- A Baffling Global EconomyDocument8 pagesA Baffling Global EconomyEdgar Cherubini LecunaNo ratings yet

- Crisis Financiera UsaDocument10 pagesCrisis Financiera UsaRox BenaducciNo ratings yet

- Daily Tel ObamaDocument4 pagesDaily Tel ObamaDonato PaglionicoNo ratings yet

- A Spectre Is Rising. To Bury It Again, Barack Obama Needs To Take The LeadDocument5 pagesA Spectre Is Rising. To Bury It Again, Barack Obama Needs To Take The Leadirfan shafiqueNo ratings yet

- Spill-Over Effects of Mortgage Credit Crisis in USA On EuropeDocument15 pagesSpill-Over Effects of Mortgage Credit Crisis in USA On EuropeUsman SansiNo ratings yet

- Economics ProjectDocument34 pagesEconomics ProjectNagin RajNo ratings yet

- The Future of The US DollarDocument10 pagesThe Future of The US Dollar11duongso9No ratings yet

- Donald's DefaultDocument12 pagesDonald's DefaultCenter for American ProgressNo ratings yet

- National Debt ThesisDocument6 pagesNational Debt Thesisbrandygranttallahassee100% (2)

- Rising Inequality As A Cause of The Present CrisisDocument24 pagesRising Inequality As A Cause of The Present CrisisRobert McKeeNo ratings yet

- SubmittedeconpaperDocument7 pagesSubmittedeconpaperapi-207294683No ratings yet

- Red Flag. 2001.06. 2Document2 pagesRed Flag. 2001.06. 2Hazar YükselNo ratings yet

- Final ExamDocument4 pagesFinal ExamLeticia ScheinkmanNo ratings yet

- No Tranquility - Iturbe, MassaDocument3 pagesNo Tranquility - Iturbe, MassaooofireballoooNo ratings yet

- Keynesian Economics Doesn't WorkDocument8 pagesKeynesian Economics Doesn't WorkkakeroteNo ratings yet

- Capitalism After The Crisis: Luigi ZingalesDocument14 pagesCapitalism After The Crisis: Luigi ZingalesrzbassoNo ratings yet

- Four Nations Four LessonsDocument3 pagesFour Nations Four Lessonsnaveen261084No ratings yet

- Why Rigged Capitalism Is Damaging Liberal DemocracyDocument11 pagesWhy Rigged Capitalism Is Damaging Liberal DemocracyLuanaBessaNo ratings yet

- 3qep1 PDFDocument7 pages3qep1 PDFAadi AnandNo ratings yet

- Bad History, Worse Policy: How a False Narrative about the Financial Crisis led to the Dodd-Frank ActFrom EverandBad History, Worse Policy: How a False Narrative about the Financial Crisis led to the Dodd-Frank ActNo ratings yet

- 21st Century Global EconomicsDocument9 pages21st Century Global EconomicsMary M HuberNo ratings yet

- NazewegukasubedeDocument2 pagesNazewegukasubedeshaft181No ratings yet

- Programmable Controllers: Ifm Electronic GMBHDocument6 pagesProgrammable Controllers: Ifm Electronic GMBHisaacsavioNo ratings yet

- AEW Global Focused Real Estate Fund: Fund Highlights Morningstar RatingDocument2 pagesAEW Global Focused Real Estate Fund: Fund Highlights Morningstar RatingBob MilisNo ratings yet

- Preliminary Design of Tunnel Env.Document84 pagesPreliminary Design of Tunnel Env.John WT'FankNo ratings yet

- Poushali Guha-MM304Document2 pagesPoushali Guha-MM304Poushali GuhaNo ratings yet

- Financial Statements Certified Public Accountant (CPA) : External AuditsDocument51 pagesFinancial Statements Certified Public Accountant (CPA) : External AuditsMs. Parul AkhterNo ratings yet

- ManacDocument3 pagesManacMark Anthony ManarangNo ratings yet

- GS What Lies Beneath PresentationDocument112 pagesGS What Lies Beneath PresentationBob MoncrieffNo ratings yet

- Unemployment Problem in JakartaDocument3 pagesUnemployment Problem in JakartabudimagNo ratings yet

- (Gary Burn) The Re-Emergence of Global Finance (BookFi)Document244 pages(Gary Burn) The Re-Emergence of Global Finance (BookFi)ВадимNo ratings yet

- Case 9 - Much Ado About NothingDocument6 pagesCase 9 - Much Ado About NothingMariaAngelicaMargenApe100% (1)

- Ads Practice TestDocument13 pagesAds Practice TestLan AnhNo ratings yet

- Organic Skin Care Products Business Plan by SlidesgoDocument60 pagesOrganic Skin Care Products Business Plan by SlidesgoSrinath NalluriNo ratings yet

- IAS 21: Accounting Foreign Currency Transaction & Financial Statement TranslationDocument38 pagesIAS 21: Accounting Foreign Currency Transaction & Financial Statement Translationmesfin yemer100% (1)

- Fire Insurance: An Insight - .Document31 pagesFire Insurance: An Insight - .neelusoni29No ratings yet

- Assessment 2 LOG2603 (Group) Session 2 2021 - 2022 (COMPLETED)Document3 pagesAssessment 2 LOG2603 (Group) Session 2 2021 - 2022 (COMPLETED)Muhammad Zarif IshakNo ratings yet

- CV Valeri Mdivani PDFDocument1 pageCV Valeri Mdivani PDFMato VikNo ratings yet

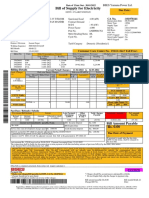

- Bill of Supply For Electricity: Due DateDocument1 pageBill of Supply For Electricity: Due DateSaurav BansalNo ratings yet

- MS Univ - Port Logistics - Supply Chain Executive - Assessment QuestionsDocument4 pagesMS Univ - Port Logistics - Supply Chain Executive - Assessment QuestionsEsakki iyyappan2003No ratings yet

- Supplier Assessment Report-Guangzhou ZPH Technology Co., Ltd.Document17 pagesSupplier Assessment Report-Guangzhou ZPH Technology Co., Ltd.juanNo ratings yet

- SOC Islamic July Dec 2021 1Document57 pagesSOC Islamic July Dec 2021 1ZohaibNo ratings yet

- Distribution and Logistics in Parle-GDocument6 pagesDistribution and Logistics in Parle-GShriyansh Asati100% (1)

- GRR - APRR - 2021 (Singapore 84-99)Document120 pagesGRR - APRR - 2021 (Singapore 84-99)chloeNo ratings yet

- الشباتر العاشر مترجم مبادئ إدارةDocument15 pagesالشباتر العاشر مترجم مبادئ إدارةjtgo765No ratings yet

- Tutorial Letter 001/3/2021: Semester 1 and 2Document49 pagesTutorial Letter 001/3/2021: Semester 1 and 2Lerato MnguniNo ratings yet

- Connor Leonard IMC 2016 LetterDocument8 pagesConnor Leonard IMC 2016 Lettermarketfolly.com75% (4)

- Chap 028Document33 pagesChap 028Danny FarmerNo ratings yet

- Captain Jack On FF Predict Price Movement Hi - Res PDFDocument60 pagesCaptain Jack On FF Predict Price Movement Hi - Res PDFMushfiq FaysalNo ratings yet