Professional Documents

Culture Documents

Group Relief Form For Claimant Company For Year of Assessment Form GR-B

Uploaded by

iese027Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Group Relief Form For Claimant Company For Year of Assessment Form GR-B

Uploaded by

iese027Copyright:

Available Formats

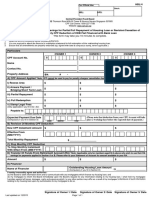

Form GR-B Group Relief Form for Claimant Company for Year of Assessment

Important: - Group relief is available to Singapore incorporated companies belonging to the same group and which have the same accounting year end. - This Form must be submitted together with the Form C. - Please read IRAS e-Tax Guide "Group Relief System" before completing this Form. - Please refer to "Items that do not qualify for transfer under the GR system" on IRAS' website (www.iras.gov.sg). - Please use separate Forms if you have more than 7 transferor companies. - This Form may take you 10 minutes to fill in. - Please get ready the following information to fill in the Form: Details of the claimant company (see Part 1) Details of the transferor companies (see Part 3) Details of claimant company

Note:

Part 1 Name:

Tax ref. no.: Part 2 Declaration

I declare that the ordinary shareholding levels of the relevant holding company are maintained at or above 75% during the continuous period1 stated in Part 3 and all information given in this Form is true and complete. I understand that I need to retain my computation on the ordinary shareholding levels of the relevant holding company as the Comptroller of Income Tax may request for it.

Full name and signature of person completing the Form Part 3 Order

Capacity of person completing the Form

Contact no.

Date

Details of transferor companies in order of priority Name Tax ref. no. From

Continuous period1 To

dd/mm/yyyy dd/mm/yyyy

From

dd/mm/yyyy

To

dd/mm/yyyy

From

dd/mm/yyyy

To

dd/mm/yyyy

From

dd/mm/yyyy

To

dd/mm/yyyy

From

dd/mm/yyyy

To

dd/mm/yyyy

From

dd/mm/yyyy

To

dd/mm/yyyy

From

dd/mm/yyyy

1

To

dd/mm/yyyy

Continuous period refers to the period ending on the last day of the basis period during which the ordinary shareholding levels of the relevant holding company is maintained at or above 75%. Under the Singapore Income Tax 55 Act, thereRoad, are penalties for making a false or incorrect declaration. Newton Revenue House, Singapore 307987

Telephone: 1800-356 8622 Facsimile: 6351 4360 http://www.iras.gov.sg

You might also like

- Explanatory Notes Formct1Document15 pagesExplanatory Notes Formct1lockon31No ratings yet

- Election To Be Treated As An Interest Charge DISC: H I Identifying NumberDocument2 pagesElection To Be Treated As An Interest Charge DISC: H I Identifying NumberInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- Irs - 2553 FormDocument4 pagesIrs - 2553 FormmeikaizenNo ratings yet

- Service Tax Registration ProcedureDocument3 pagesService Tax Registration ProcedurerockyrrNo ratings yet

- Local Body Tax in Pune Municipal Corporation (LBT in PMC) - 0Document20 pagesLocal Body Tax in Pune Municipal Corporation (LBT in PMC) - 0nikhilpasariNo ratings yet

- Application Format For Non Individual Applicants Oct 2010Document8 pagesApplication Format For Non Individual Applicants Oct 2010Tarun ChaudharyNo ratings yet

- Purpose of It ReturnDocument4 pagesPurpose of It ReturnJithu Jose ParackalNo ratings yet

- What Is Incorporation of A CompanyDocument4 pagesWhat Is Incorporation of A CompanyAnshika GuptaNo ratings yet

- Limited Liability Partnership (LLP) Registration in IndiaDocument6 pagesLimited Liability Partnership (LLP) Registration in IndiaSOURABH JAINNo ratings yet

- Statutory Audit ProceduresDocument11 pagesStatutory Audit ProceduresDiwaker MadanNo ratings yet

- Guideline - For - Sef - Matrade GrantDocument32 pagesGuideline - For - Sef - Matrade GrantSutharthanMariyappanNo ratings yet

- GST and It Ppt. GRP.6Document32 pagesGST and It Ppt. GRP.6BANANI DASNo ratings yet

- Various Initial Registrations and LicensesDocument34 pagesVarious Initial Registrations and LicensesshrividhulaaNo ratings yet

- Form DPT-3 - Reporting Outstanding Loans & Borrowings - Companies Act 2013 - Taxguru - inDocument3 pagesForm DPT-3 - Reporting Outstanding Loans & Borrowings - Companies Act 2013 - Taxguru - inRahulBoseNo ratings yet

- LPGApplication PDFDocument17 pagesLPGApplication PDFAnkur MongaNo ratings yet

- State Claim Form Solar 2006Document2 pagesState Claim Form Solar 2006sandyolkowskiNo ratings yet

- Manual Registration Application Normal Taxpayer/ Composition/ Casual Taxable Person/ Input Service Distributor (ISD) / SEZ Developer/ SEZ UnitDocument29 pagesManual Registration Application Normal Taxpayer/ Composition/ Casual Taxable Person/ Input Service Distributor (ISD) / SEZ Developer/ SEZ UnitshaouluNo ratings yet

- Professional Tax Flow - 24072017Document6 pagesProfessional Tax Flow - 24072017ajithNo ratings yet

- Application For Change in PolicyDocument6 pagesApplication For Change in PolicyklerinetNo ratings yet

- Checklist For TakeoverDocument17 pagesChecklist For Takeoverpreeti211100% (1)

- Application Form For Enlistment Vendors - NALCO PDFDocument3 pagesApplication Form For Enlistment Vendors - NALCO PDFAnonymous LowTJuvm7zNo ratings yet

- PDABJ674Document24 pagesPDABJ674yadisahassenaNo ratings yet

- TATA PV-Dealer-Application-form PDFDocument19 pagesTATA PV-Dealer-Application-form PDFC00LE0No ratings yet

- Empanelment of ContractorsDocument8 pagesEmpanelment of ContractorsSumit SinghalNo ratings yet

- Generic Ic Disc PresentationDocument55 pagesGeneric Ic Disc PresentationInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- Steps To Claim Dividend Shares IepfDocument4 pagesSteps To Claim Dividend Shares IepfBiswambhar GhoshNo ratings yet

- Sip & Micro Sip PDC Form - 29.04.2013Document4 pagesSip & Micro Sip PDC Form - 29.04.2013Aayush ShahNo ratings yet

- Notes: Mandatory Electronic Filing and Payment of Income TaxDocument8 pagesNotes: Mandatory Electronic Filing and Payment of Income TaxJose AlexanderNo ratings yet

- Gebiz SUPPLY HeadsDocument14 pagesGebiz SUPPLY HeadsYam BalaoingNo ratings yet

- Pac Rep RRF 2004Document4 pagesPac Rep RRF 2004L. A. PatersonNo ratings yet

- How To Claim GST Refund If No Specific Refund Application Available in Refunds Section - Taxguru - inDocument11 pagesHow To Claim GST Refund If No Specific Refund Application Available in Refunds Section - Taxguru - inKaushal DidwaniaNo ratings yet

- Limited Liability PartnershipDocument12 pagesLimited Liability PartnershipananthkalviNo ratings yet

- Filling Instructions 03Document1 pageFilling Instructions 03Abdurrehman ShaheenNo ratings yet

- Bir60 EguideDocument15 pagesBir60 Eguidekumar.arasu8717No ratings yet

- ct600 Guide 2011Document24 pagesct600 Guide 2011Deepak SaldanhaNo ratings yet

- Fatca Crs Self Certification FormDocument6 pagesFatca Crs Self Certification FormMohammed FaisalNo ratings yet

- BIR Form 0614-EVAP Payment Form Guidelines and Instructions: Who Shall Use This FormDocument1 pageBIR Form 0614-EVAP Payment Form Guidelines and Instructions: Who Shall Use This FormMhel GollenaNo ratings yet

- Check List For The AuditDocument14 pagesCheck List For The AuditushaNo ratings yet

- Company EstablishmentDocument13 pagesCompany EstablishmentKrishna Singh RajputNo ratings yet

- Steps To Be Taken To Incorporate A New CompanyDocument4 pagesSteps To Be Taken To Incorporate A New Companyharry_1981No ratings yet

- By Sriram Parthasarathy, Director Prowis Corporate Services Private LTD.Document41 pagesBy Sriram Parthasarathy, Director Prowis Corporate Services Private LTD.riteshsharda767No ratings yet

- Form HBL4Document3 pagesForm HBL4klerinetNo ratings yet

- Professional Training ReportDocument10 pagesProfessional Training Reportjaya sreeNo ratings yet

- Provident Fund Balance Through RTIDocument7 pagesProvident Fund Balance Through RTIgvkkishoreNo ratings yet

- IEPF Claim Instruction KitDocument10 pagesIEPF Claim Instruction KitAmit ZalaNo ratings yet

- Bir60 EguideDocument12 pagesBir60 EguideRay Li Shing KitNo ratings yet

- Complete Guide On Revocation of Cancellation of GST Registration (As Per Latest Notification) - Taxguru - inDocument3 pagesComplete Guide On Revocation of Cancellation of GST Registration (As Per Latest Notification) - Taxguru - insuraj shekhawatNo ratings yet

- WT IT - Declarations - Guidelines - FY - 2019-20 PDFDocument11 pagesWT IT - Declarations - Guidelines - FY - 2019-20 PDFGautham ReddyNo ratings yet

- User Manuadfgl Application PDFDocument15 pagesUser Manuadfgl Application PDFVengat VenkitasamyNo ratings yet

- Form 2: Instructions For Filling of Eform - 2 (Return of Allotment)Document4 pagesForm 2: Instructions For Filling of Eform - 2 (Return of Allotment)Om PrakashNo ratings yet

- Consent To Extend The Time To Assess Tax Under Section 332 (B)Document1 pageConsent To Extend The Time To Assess Tax Under Section 332 (B)Francis Wolfgang UrbanNo ratings yet

- FPF060 Member'sContributionRemittance V01Document3 pagesFPF060 Member'sContributionRemittance V01christine_balanagNo ratings yet

- Pag IbigDocument3 pagesPag IbigSharon Rillo Ofalda100% (1)

- Startup Presentation On 25th Nov. 2020Document24 pagesStartup Presentation On 25th Nov. 2020Prashant PanickerNo ratings yet

- 14/06/1976 Krishna Satyanarayana V POL/156089 Emp Id:0507657Document2 pages14/06/1976 Krishna Satyanarayana V POL/156089 Emp Id:0507657Satya NarayanaNo ratings yet

- Employment Pass / S Pass Appeal FormDocument6 pagesEmployment Pass / S Pass Appeal FormHso Hwa KyaingNo ratings yet

- STPI RegistrationDocument3 pagesSTPI RegistrationAmitNo ratings yet

- The Numbers Refer To Section A-B Sheet, Section A DetailDocument41 pagesThe Numbers Refer To Section A-B Sheet, Section A DetailenyonyoziNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Instructions For AuthorsDocument25 pagesInstructions For Authorsiese027No ratings yet

- Paris MOU Calculator - LDocument4 pagesParis MOU Calculator - Liese027No ratings yet

- Memo of UnderstandingDocument1 pageMemo of Understandingiese027No ratings yet

- OR-FY07 Allocations: KEY CNSRT Sta Name CDBG FY2007 HOME FY2007 ADDI FY2007Document2 pagesOR-FY07 Allocations: KEY CNSRT Sta Name CDBG FY2007 HOME FY2007 ADDI FY2007iese027No ratings yet

- Series 6 Part 2Document8 pagesSeries 6 Part 2iese027No ratings yet

- Tier-2 MoU ResourcesDocument2 pagesTier-2 MoU Resourcesiese027No ratings yet

- Updates in Win7 and WS08R2 SP1Document80 pagesUpdates in Win7 and WS08R2 SP1Lee GalligNo ratings yet

- Imm5669e PDFDocument4 pagesImm5669e PDFSampathNo ratings yet

- MOUrev 072011Document1 pageMOUrev 072011iese027No ratings yet

- VA MOU Template Rev.2013!3!21Document2 pagesVA MOU Template Rev.2013!3!21iese027No ratings yet

- Checklist For Club Qualification For 2013 2014Document1 pageChecklist For Club Qualification For 2013 2014iese027No ratings yet

- BIBIndexesACCdev18 Details.6 1Document7 pagesBIBIndexesACCdev18 Details.6 1iese027No ratings yet

- Manpower 2010Document7 pagesManpower 2010iese027No ratings yet

- BPE Pricing Structures Shared 2-20 Lines - VOICE ONLYDocument2 pagesBPE Pricing Structures Shared 2-20 Lines - VOICE ONLYiese027No ratings yet

- ARTF Key DocumentsDocument2 pagesARTF Key Documentsiese027No ratings yet

- BPE Pricing Structures Shared 2-20 Lines - VOICE ONLYDocument2 pagesBPE Pricing Structures Shared 2-20 Lines - VOICE ONLYiese027No ratings yet

- Singapore ISCED MappingDocument1 pageSingapore ISCED Mappingiese027No ratings yet

- Student or General Public Injury and Property Damage Report: University of MissouriDocument2 pagesStudent or General Public Injury and Property Damage Report: University of Missouriiese027No ratings yet

- Use of Quitting Advice or Products Maori and NonmaoriDocument4 pagesUse of Quitting Advice or Products Maori and Nonmaoriiese027No ratings yet

- Series 6 Part 2Document8 pagesSeries 6 Part 2iese027No ratings yet

- Quarterly Report20 GenericlinksDocument1 pageQuarterly Report20 Genericlinksiese027No ratings yet

- TT22 - Lease Versus Buy AnalysisDocument5 pagesTT22 - Lease Versus Buy Analysisiese027No ratings yet

- Singapore ISCED MappingDocument1 pageSingapore ISCED Mappingiese027No ratings yet

- Wait or Buy CondoDocument5 pagesWait or Buy CondoNeedster100% (3)

- OR-FY07 Allocations: KEY CNSRT Sta Name CDBG FY2007 HOME FY2007 ADDI FY2007Document2 pagesOR-FY07 Allocations: KEY CNSRT Sta Name CDBG FY2007 HOME FY2007 ADDI FY2007iese027No ratings yet

- Friday DB JHI SER BH: JHI Repaid On 1st Dec SER Extra Repaid 23rd SeptDocument5 pagesFriday DB JHI SER BH: JHI Repaid On 1st Dec SER Extra Repaid 23rd Septiese027No ratings yet

- Uploads Resources 2112 Capital Lease Determination Revised July 09Document11 pagesUploads Resources 2112 Capital Lease Determination Revised July 09iese027No ratings yet

- Uploads Resources 2112 Capital Lease Determination Revised July 09Document11 pagesUploads Resources 2112 Capital Lease Determination Revised July 09iese027No ratings yet

- People Aged From 16 To 24 Not in Education, Employment or Training ('NEET')Document6 pagesPeople Aged From 16 To 24 Not in Education, Employment or Training ('NEET')iese027No ratings yet

- TT22 - Lease Versus Buy AnalysisDocument5 pagesTT22 - Lease Versus Buy Analysisiese027No ratings yet