Professional Documents

Culture Documents

AC16B Introduction (Cost Accounting)

AC16B Introduction (Cost Accounting)

Uploaded by

rouvennlCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AC16B Introduction (Cost Accounting)

AC16B Introduction (Cost Accounting)

Uploaded by

rouvennlCopyright:

Available Formats

AC16B Introduction to Cost Accounting: Cost Classifications and Terms

Cost Accounting A method of accounting in which all costs incurred in carrying out an activity or accomplishing a purpose are collected, classified, and recorded. This data is then summarized and analyzed to arrive at a selling price, or to determine where savings are possible. This cost is determined by direct measurement, arbitrary assignment, or systematic and rational allocation. The appropriate method of determining cost depends on the circumstances that generate the need for information. Various costing methods are illustrated throughout the text. Cost is defined as an exchange price, a forgoing, a sacrifice made to secure benefit. Oftentimes, the term cost is used synonymously with expense. Expense however is a cost that has expired and deductible from revenues. Expenses are measured by the amount of the decrease in assets or the increase in liabilities related to the production and delivery of goods and the rendering of services. Loss is a cost that expired without producing any revenue benefit. COST TERMS TO REMEMBER: A cost management system (CMS) consists of a set of formal methods developed for planning and controlling an organizations cost-generating activities relative to its short-term objectives and long-term strategies. A cost object is anything of interest or useful informational value, such as a product, service, department, division, or territory. Cost drivers are activities that have direct cause-and-effect relationships with costs. CLASSIFICATIONS OF COST 1. According to Time Period for which the cost is computed Historical cost costs incurred in the past Budgeted cost costs expected to be incurred in the future 2. According to Management Function Manufacturing costs also called production cost or factory cost - is usually defined as the sum of the three cost elements: direct materials, direct labor, and factory overhead.

Direct Materials are all materials that form an integral part of the finished product and that are included explicitly in calculating the cost of the product. Example: the leather to make bags and shoes, crude oil to make gasoline. Direct Labor is labor that converts the raw materials into the finished product and be assigned feasibly to a specific product. Factory Overhead---also called production overhead, indirect production costs, manufacturing expenses, or factory burden---consists of all manufacturing costs not traced directly to specific output. Commercial Expenses Marketing Expenses begin at the point at which the manufacturing has been completed and the product is in salable condition. Administrative Expenses are those expenses that are incurred in directing the course of the organizations activities.

3. According to Generally Accepted Accounting Treatment Product costs are inventoriable cost identified as part of inventory on hand. These are related to making or acquiring the products or providing the services that directly generate the revenues of an entity; Period costs are costs that are expensed in the period they are incurred. A period cost is identified with a time period. The time period in which the benefit is received is the period in which the cost is to be recognized as expense and thus deducted from revenue. 4. According to Ease of Traceability Costs can be identified as direct or indirect depending upon the ease with which the cost can be traced to a particular costing object. Direct Costs costs that are directly traceable to a product. Indirect Costs costs that are difficult to directly trace to a specific product or its costs are so trivial that it would be impractical to allocate them directly to a product or costing object. >Avoidable cost cost that will not be incurred if an activity is suspended or stopped or when a department or segment is closed.

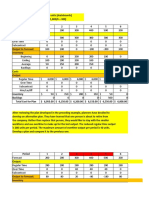

5. According to the Way a Cost responds to a change in Activity Cost Classification Fixed Cost Variable Cost Total Change Constant Vary Per Unit Change Vary Constant

Mixed Cost cost that vary with changes in volume but they do not vary in direct proportion. Step Variable Cost - Step-variable costs include characteristic of both variable and fixed costs in a way that (a) step-variable costs do change as production level changes, and (b) step-variable costs change only when a production level (range of activity) is overcome. 6. According to Importance in Decision Making Relevant or Differential Costs are expected future cash flows that result from a specific decision. Relevant costs are important for managerial decision-making. These costs differ across alternatives. It is also called incremental cost because of the way it is being used, wherein an incremental difference is being computed and analyzed if such difference is beneficial or not. Irrelevant costs are those that do not relate to any of the decision alternatives and are either historical in nature or are the same under all decision alternatives. 7. According to Control of Management Controllable costs are costs which are considered controlled or under the influence of its department head or manager. Non-controllable costs are costs for which the department head has no control over the incurrence or behavior of the cost.

8. According to Commitment to Cost Expenditures Out-of-Pocket Costs are costs involving cash outlay. Imputed cost is an invisible cost that is not incurred directly and for which there is no cash outlay. Committed costs relate to investments in facilities, equipment, and factory buildings. Committed costs are long term in nature, and they can't be reduced significantly without impacting the entity's ability to operate normally. Examples of committed costs include depreciation, insurance, rent, and taxes. Discretionary costs are costs that management can change easily. Examples of discretionary costs include advertising, research and development, and repairs. Sunk cost is a cost that has already been incurred and will not be changed or avoided in the future. Sunk costs are not relevant in making decisions about replacement of items associated with such costs. For example, the cost of equipment purchased in the past is a sunk cost. 9. Other Cost Classifications Standard cost is the predetermined cost of producing a product or service. It is the cost that the management aims to achieve. Opportunity cost is the lost benefit of one course of action that a company encounters because another course of action was chosen. Engineered costs are costs that have been found to bear observable and known relationships to a quantifiable activity base. Postponable cost, in cost accounting, is the cost that can be shifted to the future with little or no effect on current operations. Examples of postponable costs include routine repairs and maintenance expenses and certain personnel expenses. Information costs are the costs of obtaining information. Capitalized costs are treated as assets and become expenses in future periods as the asset is depreciated or amortized.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SAP Product Costing 101 - Product Costing OverviewDocument40 pagesSAP Product Costing 101 - Product Costing Overviewsanty406380% (5)

- AFAR Preweek Lecture Part 2Document18 pagesAFAR Preweek Lecture Part 2Joris YapNo ratings yet

- Management Accounting: A Business Partner: Lecture # 1Document15 pagesManagement Accounting: A Business Partner: Lecture # 1Amna NasserNo ratings yet

- Manufacturing Accounts (Study Guide)Document17 pagesManufacturing Accounts (Study Guide)PetrinaNo ratings yet

- CAF 8 CMA Autumn 2019 PDFDocument4 pagesCAF 8 CMA Autumn 2019 PDFbinuNo ratings yet

- SAP CO-PC Product Costing in SAP ERP6.0 OneDocument34 pagesSAP CO-PC Product Costing in SAP ERP6.0 OneAyub KhanNo ratings yet

- Ch06 Harrison 8e GE SMDocument87 pagesCh06 Harrison 8e GE SMMuh BilalNo ratings yet

- COM670 Chapter 4Document28 pagesCOM670 Chapter 4aakapsNo ratings yet

- Standard Costing and The Balance ScorecardDocument76 pagesStandard Costing and The Balance ScorecardSaifurKomolNo ratings yet

- Fabm2: Quarter 1 Week 4 Module 4Document13 pagesFabm2: Quarter 1 Week 4 Module 4Micah GNo ratings yet

- T or F M A X e T S o CDocument31 pagesT or F M A X e T S o CShai RaNo ratings yet

- Budget and Budgetary ControlDocument16 pagesBudget and Budgetary Controlnousheen rehmanNo ratings yet

- Management Accounting 2 SummaryDocument47 pagesManagement Accounting 2 SummaryDanny FranklinNo ratings yet

- Cost of Goods Sold CogsDocument29 pagesCost of Goods Sold CogsArzan Ali0% (1)

- Aggregate Planning Example SolvedDocument16 pagesAggregate Planning Example SolvedAbdullah ShahidNo ratings yet

- Case Memo InstructionsDocument6 pagesCase Memo Instructionsneelpatel34150% (1)

- Periodic VS Perpetual Inventory SystemDocument3 pagesPeriodic VS Perpetual Inventory SystemBea chuaNo ratings yet

- Financial Analysis of Hòa Phát Group Joint Stock CompanyDocument36 pagesFinancial Analysis of Hòa Phát Group Joint Stock CompanySang NguyễnNo ratings yet

- Full AssignmentDocument9 pagesFull AssignmentMumit AhmedNo ratings yet

- Guna Fibre Financial AnalysisDocument5 pagesGuna Fibre Financial AnalysissumeetkantkaulNo ratings yet

- Should Freight-Out Be Considered COGS or Selling ExpenseDocument2 pagesShould Freight-Out Be Considered COGS or Selling ExpenseArunabh SaxenaNo ratings yet

- Investment Analysis and Portfolio Management: Prof - Rajiv@cms - Ac.inDocument41 pagesInvestment Analysis and Portfolio Management: Prof - Rajiv@cms - Ac.inAshish kumar NairNo ratings yet

- Assignment MBA 1003Document34 pagesAssignment MBA 1003KAWongCy100% (1)

- ACC2B Assignment 1 2023Document3 pagesACC2B Assignment 1 2023Mushaisano MudauNo ratings yet

- Quiz 2 - 09.10.18 Set A BDocument4 pagesQuiz 2 - 09.10.18 Set A BRey Joyce AbuelNo ratings yet

- Chapter 9Document12 pagesChapter 9Ruthchell CiriacoNo ratings yet

- Business Plan Template v3-4-5Document9 pagesBusiness Plan Template v3-4-5tk_mzansiNo ratings yet

- Chapter 3 Key Points On Process CostingDocument4 pagesChapter 3 Key Points On Process CostingKyeienNo ratings yet

- F2 ACCA Financial Accounting - Inventory by MOCDocument10 pagesF2 ACCA Financial Accounting - Inventory by MOCMunyaradzi Onismas Chinyukwi100% (1)

- Apple IpodDocument10 pagesApple IpodHeru KocoNo ratings yet