Professional Documents

Culture Documents

07 Notes Example

Uploaded by

Pratheep GsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

07 Notes Example

Uploaded by

Pratheep GsCopyright:

Available Formats

1 of 2

100127

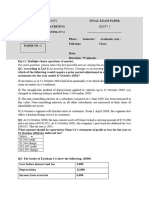

Chapter 7: Pages 230, corrections and explanations

New asset cost

Revenue per asset per year

June 30

V

Buy

30

20

10

Revenue

Depreciation

Income

Book value of asset

Example for LL Assets Revised

120

60

Dec 31

Other Asset Base

Other Income

Dec 31

1,000

150

Dec 31

60

40

20

June 30

V

Retire

30

20

10

60

40

20

100

60

20

CAPitalize

EXPense

CAP: Income

CAP: ROA

EXP: CFO=Income

EXP: ROA

Bigger Income?

Bigger ROA ?

4

2

5

CFI

100

240

200

540

CAP: CFO

20

60

100

Book Value, End

x

x

x

Total Depcn Expense

5

4

2

1,000

1,500

1,700

1,540 100

1,700 80

1,740 40

1,540 100

1,700 80

1,740 40

1st year asset

Total Revenue

300

570

750

810

810

810

810

810

810

2nd year asset

Revenue from assets

150

420

600

660

660

660

660

660

660

Exp

3rd year asset

# of operating Assets

2.5

7.0

10.0

11.0

11.0

11.0

11.0

11.0

11.0

4rd year asset

Purchase

5

4

2

5

4

2

5

4

2

5

4

2

5

4

2

5

4

2

Beginning Assets

Replace

1

2

3

4

5

6

7

8

9

Growth

Year

Depreciation

200

160

80

200

160

80

200

200

160

80

200

160

80

200

160

100

80

40

100

80

40

100

80

40

100

280

400

440

440

440

440

440

440

1,500

1,700

1,540

1,700

1,740

1,540

1,700

1,740

1,540

300

570

750

810

810

810

810

810

810

(600)

(480)

(240)

(600)

(480)

(240)

(600)

(480)

(240)

200

290

350

370

370

370

370

370

370

18.1%

21.6%

22.8%

21.5%

22.6%

22.8%

21.5%

22.6%

(300)

90

510

210

330

570

210

330

570

9%

51%

21%

33%

57%

21%

33%

57%

Cap

Exp

Cap

Cap

Exp

Cap

Cap

Exp

Cap

Exp

Cap

Exp

Exp

Cap

Exp

Exp

x

x

x

20

60

100

80

120

500

700

2 of 2

Example for LL Assets Revised

1,000

800

600

400

200

0

CAP: Income

(200)

EXP: CFO=Income

(400)

CAP: CFO

60.0%

CAP: ROA

EXP: ROA

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

1

You might also like

- Mon Sour Calaunan PROBLEM 16-7Document2 pagesMon Sour Calaunan PROBLEM 16-7monsour28No ratings yet

- Statement of CI: Total Revenue 319,000 150,000 450,000Document2 pagesStatement of CI: Total Revenue 319,000 150,000 450,000Kristine Astorga-NgNo ratings yet

- Solman EquityDocument12 pagesSolman EquityBrunxAlabastroNo ratings yet

- Jawaban Soal Lat. Bu Iin+Soal (Visit ComDocument11 pagesJawaban Soal Lat. Bu Iin+Soal (Visit ComYhogan JayaNo ratings yet

- BAO6504 Lecture 2, 2014Document20 pagesBAO6504 Lecture 2, 2014LindaLindyNo ratings yet

- ACCT 1005 Worksheet 5 Suggested Solutions 2012Document10 pagesACCT 1005 Worksheet 5 Suggested Solutions 2012ChakShaniqueNo ratings yet

- JKhoggesDocument6 pagesJKhoggesDegrace NsNo ratings yet

- Chapter 13Document11 pagesChapter 13Christine GorospeNo ratings yet

- Eco Frame LTDDocument7 pagesEco Frame LTDewinzeNo ratings yet

- Cash FlowDocument25 pagesCash Flowshaheen_khan6787No ratings yet

- Department AccountsDocument14 pagesDepartment Accountsjashveer rekhiNo ratings yet

- FSA - Intro PDFDocument10 pagesFSA - Intro PDFsingh somyadeepNo ratings yet

- Financial Statements: BAO6504 Accounting For ManagementDocument20 pagesFinancial Statements: BAO6504 Accounting For ManagementDaud SulaimanNo ratings yet

- Cash Flow Statements IIDocument7 pagesCash Flow Statements IIChris RessoNo ratings yet

- Class Activity 1 Cash Flow StatementDocument2 pagesClass Activity 1 Cash Flow StatementHacker SKNo ratings yet

- Tools of Financial Analysis & PlanningDocument68 pagesTools of Financial Analysis & Planninganon_672065362100% (1)

- Fa 2 - Vertical Financial StatementsDocument7 pagesFa 2 - Vertical Financial StatementsEduwiz Mänagemënt EdücatîonNo ratings yet

- Accy 517 HW PB Set 1Document30 pagesAccy 517 HW PB Set 1YonghoChoNo ratings yet

- Chapter 4 AnswersDocument4 pagesChapter 4 Answerscialee100% (2)

- Chapter 4 Acctg 1 LessonDocument14 pagesChapter 4 Acctg 1 Lessonizai vitorNo ratings yet

- 13 4Document1 page13 4paresareb100% (1)

- 4th Assessment STUDENTDocument5 pages4th Assessment STUDENTJOHANNA TORRESNo ratings yet

- Supershop Fianal For Balance SheetDocument21 pagesSupershop Fianal For Balance SheetMohammad Osman GoniNo ratings yet

- Trabajo Zarate FinishDocument17 pagesTrabajo Zarate FinishDavidFloresNo ratings yet

- CHP 2AnalysisInterpretationofAccountsDocument5 pagesCHP 2AnalysisInterpretationofAccountsalpeshmahto2004No ratings yet

- ACCT5101Pretest PDFDocument18 pagesACCT5101Pretest PDFArah OpalecNo ratings yet

- UntitledDocument13 pagesUntitledAnne GuamosNo ratings yet

- 1 PhototecDocument3 pages1 PhototecKaishe RamosNo ratings yet

- 400 - 805 ChangesInOwnershipIntrst51cDocument5 pages400 - 805 ChangesInOwnershipIntrst51cZenni T XinNo ratings yet

- Statement of CIDocument4 pagesStatement of CIMarvin CaliwaganNo ratings yet

- 5 Year Financial PlanDocument36 pages5 Year Financial PlanVenance EdsonNo ratings yet

- CH 01Document5 pagesCH 01deelol99No ratings yet

- Topic:-Evaluate The Financial Performance of Marks &spencer PLCDocument27 pagesTopic:-Evaluate The Financial Performance of Marks &spencer PLCAnonymous ohYFoO4No ratings yet

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.No ratings yet

- Kunci Jawaban Modul AKL Bu Iin - OlivethewennoDocument17 pagesKunci Jawaban Modul AKL Bu Iin - OlivethewennoOliviane Theodora WennoNo ratings yet

- Income Statements 2010Document10 pagesIncome Statements 2010Shivam GoelNo ratings yet

- Hanson Ski Products Tables AnswerDocument12 pagesHanson Ski Products Tables AnswerPranjal Kumar33% (3)

- Taxable Income and Income Tax - Foreign Tax Credit - AdministrDocument52 pagesTaxable Income and Income Tax - Foreign Tax Credit - AdministrCharlotte MalgapoNo ratings yet

- Lesson 6 - Cash Flows PDFDocument40 pagesLesson 6 - Cash Flows PDFChy B80% (5)

- Review Test FarDocument10 pagesReview Test FarEli PinesNo ratings yet

- Statement of Changes in Equity ReviewerDocument3 pagesStatement of Changes in Equity ReviewerSean Arvy SamsonNo ratings yet

- Cash Flow StatementDocument9 pagesCash Flow StatementPiyush MalaniNo ratings yet

- Comments Based On FPIsDocument2 pagesComments Based On FPIsEjaz KhanNo ratings yet

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402No ratings yet

- Section A - CASE QUESTIONS (Total: 50 Marks) : Module A (December 2010 Session)Document13 pagesSection A - CASE QUESTIONS (Total: 50 Marks) : Module A (December 2010 Session)Vong Yu Kwan EdwinNo ratings yet

- Financial Accounting by ValixDocument5 pagesFinancial Accounting by Valixblahblahblue0% (1)

- Chapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document25 pagesChapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- C02 Financial StatementsDocument31 pagesC02 Financial StatementsJeya De GuzmanNo ratings yet

- Seatwork On Business Combination Stock AcquisitionDocument2 pagesSeatwork On Business Combination Stock AcquisitionceistNo ratings yet

- Ratio ProblemsDocument11 pagesRatio ProblemsShihad Panoor N KNo ratings yet

- AccountingDocument22 pagesAccountingTia1977No ratings yet

- Instructor's Manual: Financial Accounting & ReportingDocument337 pagesInstructor's Manual: Financial Accounting & ReportingradioheadddddNo ratings yet

- Excercise Sheet Lecture 3Document30 pagesExcercise Sheet Lecture 3Mohamed ZaitoonNo ratings yet

- Working CapitalDocument24 pagesWorking CapitalTushar SharmaNo ratings yet

- Introduction To Management AccountingDocument5 pagesIntroduction To Management AccountingDechen WangmoNo ratings yet

- ExcelDocument10 pagesExcelWaseem TajNo ratings yet

- Assignment 1Document7 pagesAssignment 1Dat DoanNo ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Helloe Worlg: Gooogg WorkDocument4 pagesHelloe Worlg: Gooogg WorkPratheep GsNo ratings yet

- Employment - 12 18 Oct 2019Document40 pagesEmployment - 12 18 Oct 2019Pratheep GsNo ratings yet

- Helloe Wor1234lg: Gooogg WorkDocument4 pagesHelloe Wor1234lg: Gooogg WorkPratheep GsNo ratings yet

- Helloe Worlg: Gooogg WorkDocument4 pagesHelloe Worlg: Gooogg WorkPratheep GsNo ratings yet

- Vitamin and Mineral Requirements in Human NutritionDocument362 pagesVitamin and Mineral Requirements in Human NutritionriemannNo ratings yet

- Helloe Worlg: Gooogg WorkDocument4 pagesHelloe Worlg: Gooogg WorkPratheep GsNo ratings yet

- Helloe Worlg: Gooogg WorkDocument3 pagesHelloe Worlg: Gooogg WorkPratheep GsNo ratings yet

- Helloe Worlg: Gooogg WorkDocument4 pagesHelloe Worlg: Gooogg WorkPratheep GsNo ratings yet

- Helloe Worlg: Gooogg WorkDocument4 pagesHelloe Worlg: Gooogg WorkPratheep GsNo ratings yet

- Helloe Worlg: Gooogg WorkDocument4 pagesHelloe Worlg: Gooogg WorkPratheep GsNo ratings yet

- Helloe Worlg: Gooogg WorkDocument4 pagesHelloe Worlg: Gooogg WorkPratheep GsNo ratings yet

- The Guide To The Business Analysis Body of Knowledge™ Version 2.0 FrameworkDocument16 pagesThe Guide To The Business Analysis Body of Knowledge™ Version 2.0 FrameworksaurabhthoratNo ratings yet

- Rare Yantras PDFDocument4 pagesRare Yantras PDFPratheep GsNo ratings yet

- Helloe Worlg: Gooogg WorkDocument4 pagesHelloe Worlg: Gooogg WorkPratheep GsNo ratings yet

- Helloe Worlg: Gooogg WorkDocument4 pagesHelloe Worlg: Gooogg WorkPratheep GsNo ratings yet

- Yantra JupiterDocument1 pageYantra JupiterPratheep GsNo ratings yet

- SL No. Publisher Place Board Core Titles: List of Important Publishers We Deal WithDocument9 pagesSL No. Publisher Place Board Core Titles: List of Important Publishers We Deal WithPratheep GsNo ratings yet

- Entitlement Details - Pratheep Chakravarthy Gnana MoorthyDocument2 pagesEntitlement Details - Pratheep Chakravarthy Gnana MoorthyPratheep GsNo ratings yet

- Helloe Worlg: Gooogg WorkDocument2 pagesHelloe Worlg: Gooogg WorkPratheep GsNo ratings yet

- Bazaar of India Chy-Wan-Prash Contents: Contains No Artifical Preservatives, Flavors, or ColorsDocument1 pageBazaar of India Chy-Wan-Prash Contents: Contains No Artifical Preservatives, Flavors, or ColorsPratheep GsNo ratings yet

- Sun Mantras BsyDocument3 pagesSun Mantras BsyHarshad PatilNo ratings yet

- Yantra SunDocument1 pageYantra SunPratheep GsNo ratings yet

- Yoga For Human ExcellenceDocument2 pagesYoga For Human ExcellencePratheep GsNo ratings yet

- Madonna CenterDocument2 pagesMadonna CenterPratheep GsNo ratings yet

- Affidavit AyushDocument5 pagesAffidavit AyushPratheep GsNo ratings yet

- 010 Practical WisdomDocument3 pages010 Practical WisdomPratheep GsNo ratings yet