Professional Documents

Culture Documents

Valuing Acquirer and Target Firm - Business Analysis

Uploaded by

Yi Lin Lim0 ratings0% found this document useful (0 votes)

5 views2 pagesLearning how to value a merger and acquisition firms

how to value synergies

put a number to the merged entity

Original Title

Valuing Acquirer and Target Firm_Business Analysis

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLearning how to value a merger and acquisition firms

how to value synergies

put a number to the merged entity

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesValuing Acquirer and Target Firm - Business Analysis

Uploaded by

Yi Lin LimLearning how to value a merger and acquisition firms

how to value synergies

put a number to the merged entity

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

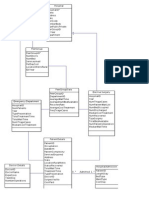

Acquisi'on

Calcula'ons:

1) 2) 3) 4) Value

of

Firm

Acquirer

(INDEPENDENTLY)

Value

of

Firm

Target

(INDEPENDENTLY)

Value

of

combined

rm

(without

synergies)

Value

of

combined

rm

(with

synergies)

Things to note: Growth rates in dierent circumstances.

First

10

years

Growth:

25%

Beta:

1.45

Terminal

Value

Growth:

6%

Beta:

1.10

FCFn

WACC

-

g

Ainsworth run a gamble

B. Refer two lecture examples + workshop 1) Trend in share price 2) InformaIon provided (i.e., high, Low, 1 year return: +150.4%) 4) RecommendaIon: Majority HOLD 5) Reasons for recommendaIon? 6) PEG calculaIon vs. current trading price Other theories knowledge: If the analysts do not think its the growth is conInuing, why is that a hold NOT sell recommendaIon? Are analysts forecast accurate? What are the other poten)al models to determine whether it is under or over priced. Present Value models Residual earnings? (arIcles on Bradshaw (2004))

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- BAV Tutorial 1Document8 pagesBAV Tutorial 1Yi Lin LimNo ratings yet

- (FINA2207: Business Analysis and Valuation) Solution To Workshop 1 QuestionsDocument5 pages(FINA2207: Business Analysis and Valuation) Solution To Workshop 1 QuestionsYi Lin LimNo ratings yet

- Definitions - Discrete StructuresDocument5 pagesDefinitions - Discrete StructuresYi Lin LimNo ratings yet

- $70,000 Bill After Bali Accident: ELLE FARCIC The West AustralianDocument2 pages$70,000 Bill After Bali Accident: ELLE FARCIC The West AustralianYi Lin LimNo ratings yet

- My Weekly Use of Mobile DevicesDocument9 pagesMy Weekly Use of Mobile DevicesYi Lin LimNo ratings yet

- Project Descriptions - My DatabaseDocument4 pagesProject Descriptions - My DatabaseYi Lin LimNo ratings yet

- UML DiagramDocument1 pageUML DiagramYi Lin LimNo ratings yet

- Pumping LemmaDocument1 pagePumping LemmaYi Lin LimNo ratings yet

- Brief Summary of Insertion SortDocument5 pagesBrief Summary of Insertion SortYi Lin LimNo ratings yet

- Essay Questions: 0 of 300 WordsDocument1 pageEssay Questions: 0 of 300 WordsYi Lin LimNo ratings yet

- Comp Science QN: Stair Climbing ProblemDocument2 pagesComp Science QN: Stair Climbing ProblemYi Lin LimNo ratings yet

- MatLab - Own GrayscaleDocument1 pageMatLab - Own GrayscaleYi Lin LimNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)