Professional Documents

Culture Documents

EECO

Uploaded by

abegaelbautistaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EECO

Uploaded by

abegaelbautistaCopyright:

Available Formats

6-1 While in college Ellen received $10,000 in student loans at 5% interest.

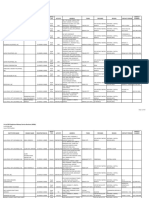

She will graduate in June and is expected to begin repaying the loans in either 5 or 10 equal annual payments. Compute her yearly payments for both repayment plans. Solution 5 YEARS 10 YEARS A = P(A/P, i, n) A = P(A/P, i, n) = 10,000(A/P, 5%, 5) = 10,000(A/P, 5%, 10) = $2,310.00 = $1,295.00 6-2 Suppose you wanted to buy a $100,000 house. You have $20,000 cash to use as the down payment. The bank offers to loan you the remainder at 6% nominal interest. The term of the loan is 20 years. Compute your monthly loan payment assuming the payment is the same for all months. Solution Amount of loan: $100,000 - $20,000 = $80,000 i = 6%/12 = % per month n = 20 x 12 = 240 periods A = 80,000(A/P, %, 240) = $572.80 per month 6-3 Lester Peabody decides to install a fuel storage system for his farm that will save him an estimated 6.5 cents/gallon on his fuel cost. He uses an estimated 20,000 gallons/year on his farm. Initial cost of the system is $10,000 and the annual maintenance is a uniform gradient amount of $25. After a period of 10 years the estimated salvage is $3,000. If money is worth 12%, is it a wise

investment? Solution EAC =(10,000 - 3,000)(A/P, 12%, 10) + 3,000(.12) + 25(A/G, 12%, 10) = $1,688.63 EAB = 20,000(.065) = $1,300 EAW = -$388.63 not a wise investment 6-4 The returns for a business for five years are as follows: $8,250, $12,600, $9,750, $11,400, and $14,500. If the value of money is 12%, what is the equivalent annual benefit for the five-year period? Solution PW = 8,250(P/F, 12%, 1) + 12,600(P/F, 12%, 2) + 9,750(P/F, 12%, 3) + 11,400(P/F, 12%, 4) + 14,500(P/F, 12%, 5) = $39,823 EAB = 39,823(A/P, 12%, 5) = $11,047 6-5 The local loan shark has loaned you $1000. The interest rate you must pay is 20%, compounded monthly. The loan will be repaid by making 24 equal monthly payments. What is the amount of each monthly payment? Solution A = 1,000(A/P, 20%/12, 24) There is no 1-2/3% compound interest table readily available. Therefore the capital recovery factor must be calculated. (A/P, 1.666%, 24) = [0.01666(1.01666)24] / [(1.01666)24 - 1] = 0.050892 A = 1,000(0.050892) = $50.90

You might also like

- Chap 9Document34 pagesChap 9Sarah Hunt83% (6)

- Week 2 Quiz SolutionsDocument11 pagesWeek 2 Quiz SolutionsMehwish PervaizNo ratings yet

- Case 37 Space-Age Materials DirectedDocument0 pagesCase 37 Space-Age Materials Directed1t4No ratings yet

- PW Cost Chapter05Document14 pagesPW Cost Chapter05abd_hafidz_1100% (1)

- Solutions - Practice Questions by Chapter (1-4)Document23 pagesSolutions - Practice Questions by Chapter (1-4)Kelly BaoNo ratings yet

- Cash Receipt Template 03Document1 pageCash Receipt Template 03B. GundayaoNo ratings yet

- 04 Understanding Balance Sheets - Cash Flow StatementsDocument58 pages04 Understanding Balance Sheets - Cash Flow StatementsRoy GSNo ratings yet

- Assignment - Chapter 4 - SolutionDocument9 pagesAssignment - Chapter 4 - SolutionQuỳnh Nguyễn0% (1)

- Fin CH-9Document36 pagesFin CH-9TheAgents10788% (16)

- Financial ManagementDocument17 pagesFinancial ManagementTehniat Zafar100% (7)

- Dividend Growth Rate CalculationDocument6 pagesDividend Growth Rate CalculationCrew's GamingNo ratings yet

- Master program admission letter from Ocean University China professorDocument1 pageMaster program admission letter from Ocean University China professorAdnan Khurshid TanoliNo ratings yet

- SPA - Business RegistrationDocument2 pagesSPA - Business RegistrationGlenn Lapitan CarpenaNo ratings yet

- Cash Receipt VoucherDocument1 pageCash Receipt VoucherRoha CbcNo ratings yet

- MSBsDocument435 pagesMSBsSophieNo ratings yet

- Letter of Intent To BIR Apply For EfpsDocument1 pageLetter of Intent To BIR Apply For EfpsMadel TomasNo ratings yet

- Securities and Exchange Commission: Republic of The PhilippinesDocument1 pageSecurities and Exchange Commission: Republic of The PhilippinesRobert Paul A Moreno100% (1)

- Job CostingDocument18 pagesJob CostingPaula ChicoNo ratings yet

- Payroll TemplateDocument15 pagesPayroll TemplatebarcelonnaNo ratings yet

- Tanduay Trend AnalysisDocument17 pagesTanduay Trend AnalysisDiane Isogon LorenzoNo ratings yet

- Capital Budgeting: Year Cash FlowDocument5 pagesCapital Budgeting: Year Cash FlowNaeem Uddin100% (3)

- SRC Rule 68 As AmendedDocument51 pagesSRC Rule 68 As AmendedGilYah MoralesNo ratings yet

- Ifrs 13 CPD PPT 12 2013Document79 pagesIfrs 13 CPD PPT 12 2013Nicolaus CopernicusNo ratings yet

- What is an External AuditDocument5 pagesWhat is an External AuditRohit BajpaiNo ratings yet

- PROG 2023 66845 CPD Learning Session 1Document12 pagesPROG 2023 66845 CPD Learning Session 1prc.zamboanga.regulationcpdNo ratings yet

- Case Presentation Managerial AccountingDocument16 pagesCase Presentation Managerial Accountinggelly studiesNo ratings yet

- Adjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingDocument9 pagesAdjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingHassan AliNo ratings yet

- Qualification DocumentDocument89 pagesQualification DocumentMichael NcubeNo ratings yet

- Engineering EconomyDocument15 pagesEngineering Economyjm1310% (1)

- Chapter 06Document16 pagesChapter 06coriactrNo ratings yet

- Chapter6E2010 PDFDocument12 pagesChapter6E2010 PDFutcm77No ratings yet

- Chapter3E2010 PDFDocument20 pagesChapter3E2010 PDFsubash1111@gmail.comNo ratings yet

- Chapter5E2010 PDFDocument12 pagesChapter5E2010 PDFRahani HyugaNo ratings yet

- HW Solution Chapter 4 5Document15 pagesHW Solution Chapter 4 5Trần Thị Ngọc BíchNo ratings yet

- PhamAnh Assignment 4Document4 pagesPhamAnh Assignment 4Phạm Ngọc Anh0% (1)

- Bab 6 Ekonomi TeknikDocument3 pagesBab 6 Ekonomi TeknikMuammar TeukuNo ratings yet

- Midterm Exam II Solution KeyDocument4 pagesMidterm Exam II Solution KeyyarenNo ratings yet

- 2324EE HW1 G (Group#2)Document5 pages2324EE HW1 G (Group#2)mytinhszNo ratings yet

- Mathematics of Finance: Simple and Compound Interest FormulasDocument11 pagesMathematics of Finance: Simple and Compound Interest FormulasAshekin MahadiNo ratings yet

- Easy Problem Chapter 5Document5 pagesEasy Problem Chapter 5Natally LangfeldtNo ratings yet

- Annuities 101Document6 pagesAnnuities 101Chrystal Jasmine J. RoqueNo ratings yet

- Engineering Economy - Individual AssignmentDocument3 pagesEngineering Economy - Individual AssignmentNguyễn QuỳnhNo ratings yet

- T01 - Sekar Nadiyah - 2106781230Document11 pagesT01 - Sekar Nadiyah - 2106781230Sekar NadiyahNo ratings yet

- Tugas Manajemen Keuangan (Maulana Ikhsan Tarigan) 197007091Document5 pagesTugas Manajemen Keuangan (Maulana Ikhsan Tarigan) 197007091Maulana IkhsanNo ratings yet

- Time Value of Money - MathDocument12 pagesTime Value of Money - MathNahidul Islam IUNo ratings yet

- Engineering Econ Lab - Week 1Document2 pagesEngineering Econ Lab - Week 1Zac QuezonNo ratings yet

- Time ValueDocument10 pagesTime ValueBhaskar VishalNo ratings yet

- What Is The Present Value ofDocument27 pagesWhat Is The Present Value ofJade Ballado-TanNo ratings yet

- EECO - Problem Set - Annuities and PerpetuitiesDocument10 pagesEECO - Problem Set - Annuities and PerpetuitiesWebb PalangNo ratings yet

- Engineering EconomyDocument37 pagesEngineering EconomyxxkooonxxNo ratings yet

- Other Annuity TypesDocument7 pagesOther Annuity TypesLevi John Corpin AmadorNo ratings yet

- 5 - Capital Investment Appraisal (Part-2)Document10 pages5 - Capital Investment Appraisal (Part-2)Fahim HussainNo ratings yet

- Problem SetDocument8 pagesProblem SetЭниЭ.No ratings yet

- SBE211-Regular ExamDocument4 pagesSBE211-Regular ExamThanh Hoa TrầnNo ratings yet

- FRMTest 01Document18 pagesFRMTest 01Kamal BhatiaNo ratings yet

- Compound and Simple Interest QuestionsDocument15 pagesCompound and Simple Interest QuestionsPramod PuthurNo ratings yet

- Partnership ProblemsDocument23 pagesPartnership ProblemsTheanmozhi SNo ratings yet

- Review Material BSDocument55 pagesReview Material BSRoan Eam TanNo ratings yet

- TVM ChallengingDocument5 pagesTVM Challengingnabeelarao100% (1)

- Bonds Yields and Prices, Ni Kadek WahyuniDocument5 pagesBonds Yields and Prices, Ni Kadek WahyuniWahyuni MertasariNo ratings yet