Professional Documents

Culture Documents

IAS Changes2

Uploaded by

johnny458Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS Changes2

Uploaded by

johnny458Copyright:

Available Formats

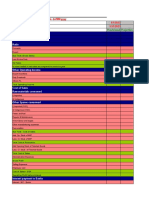

Income Statement Turnover Cost of sales Gross profit Other Income Distribution costs Administrative expenses Other expenses

Financial cost Profit on ordinary activities before tax Corporation tax Profit on ordinary activities after tax

Statement of Financial Position ASSETS Non-current assets Property, Plant & Equipment Goodwill Other Intangible Assets Current Assets Inventories Trade and Other Receivables Cash and Cash Equivalents Total Assets EQUITY AND LIABILITIES Equity Share Capital Other Reserves Retained Earnings Non-Current Liabilities Long Term Borrowings Current Liabilities Trade and other Payables Short Term Borrowings Current Tax Payable Total Equity and Liabilities Statement of Change in Equity Opening Balance Dividends Comprehensive Income for the Year Balance at Dec 31

Statement of Cash Flow Cash Flows from operating activities Profit from operations Add Depreciation Add Loss on Sale of Fixed Asset Operating cash flow before working capital changes Decrease in inventories Increase in trade receivables Increase in trade payables Cash generated from operations Less Interest Paid:Bank overdraft Bank Loan Less Tax Paid Net Cash from Operating Activities Cash Flow from Investing Activities Payments to acquire tangible fixed assets Proceeds from sale of tangible fixed assets Net Cash Used in Investing Activities Cash Flow from Financing Activities Redemption of Ordinary shares Repayment of Bank Loan Dividends Paid : Final 2010 Interim Preference Net Cash Used in Financing Activities Net decrease in cash and cash equivalents Cash and cash equivalents at the beginning of the year Cash and cash equivalents at the end of the year Net decrease in cash and cash equivalents

Profit form operations = Operating Profit + Overdraft interest + Loan interest

You might also like

- Appropriations Dividend To Shareholders of Parent CompanyDocument30 pagesAppropriations Dividend To Shareholders of Parent Companyavinashtiwari201745No ratings yet

- Study Unit 1 FAC1601Document18 pagesStudy Unit 1 FAC1601andreqwNo ratings yet

- Vertical Analysis For Att and VerizonDocument4 pagesVertical Analysis For Att and Verizonapi-299644289No ratings yet

- Ruchi Soya Cash Flow Statement AnalysisDocument2 pagesRuchi Soya Cash Flow Statement AnalysisShreyansh Sanat JoshiNo ratings yet

- Itc - ImibDocument20 pagesItc - ImibYash RoxsNo ratings yet

- Ratio Analysis of Colgate-Palmolive Company Financial Statements (2007-2015Document18 pagesRatio Analysis of Colgate-Palmolive Company Financial Statements (2007-2015Zohaib AhmedNo ratings yet

- Format of Cash Flow StatementDocument5 pagesFormat of Cash Flow Statementilyas2sapNo ratings yet

- Cashflow FormatDocument2 pagesCashflow FormatShubham BawkarNo ratings yet

- Financial Ratios and Formulas GuideDocument9 pagesFinancial Ratios and Formulas GuideAsad HamidNo ratings yet

- Statement of Profit or Loss 2014Document8 pagesStatement of Profit or Loss 2014LouiseNo ratings yet

- Statement of Financial Position AssetsDocument5 pagesStatement of Financial Position AssetsNindasurnilaPramestiCahyaniNo ratings yet

- Cash Flow Statement AnalysisDocument2 pagesCash Flow Statement Analysispadmanabha1979No ratings yet

- Classification of Accounts PDFDocument3 pagesClassification of Accounts PDFLuzz Landicho100% (1)

- Categories: Net Property and EquipmentDocument4 pagesCategories: Net Property and EquipmentthrowawayyyNo ratings yet

- Format of Financial StatementsDocument2 pagesFormat of Financial StatementsnellyNo ratings yet

- Bank Balance Sheet and Income Statement AnalysisDocument40 pagesBank Balance Sheet and Income Statement AnalysisAAM26No ratings yet

- Cash Flow Cheat SheetsDocument2 pagesCash Flow Cheat SheetsSarah SafiraNo ratings yet

- Synergy Computer Solutions Intl Limited: Cash Flow StatementDocument2 pagesSynergy Computer Solutions Intl Limited: Cash Flow StatementNaresh KumarNo ratings yet

- Cash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business ManagementDocument20 pagesCash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business Managementaftabkhan21No ratings yet

- Cash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareDocument135 pagesCash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareMariel de Lara100% (2)

- Fiscal Year Is January-December. All Values ZAR MillionsDocument14 pagesFiscal Year Is January-December. All Values ZAR MillionsRavi JainNo ratings yet

- Equity ValuationDocument2,424 pagesEquity ValuationMuteeb Raina0% (1)

- Cash FlowDocument1 pageCash Flowbunso2012No ratings yet

- Class of AccountsDocument5 pagesClass of AccountssalynnaNo ratings yet

- Sales: Pro Forma Income Statement Year 1 Year 2Document3 pagesSales: Pro Forma Income Statement Year 1 Year 2Abdul Ahad SheikhNo ratings yet

- Cma Format - 29.08.2022 - 12.13PMDocument12 pagesCma Format - 29.08.2022 - 12.13PMShreeRang ConsultancyNo ratings yet

- Opening Balance Sheet Format ConversionDocument8 pagesOpening Balance Sheet Format ConversionNilesh JanghuNo ratings yet

- Apple 10QDocument57 pagesApple 10QadsadasMNo ratings yet

- Birla 3M Limited balance sheet and income statement analysis for 2000Document4 pagesBirla 3M Limited balance sheet and income statement analysis for 2000anushageminiNo ratings yet

- Basic Accounting Concepts: Financial AccountingDocument16 pagesBasic Accounting Concepts: Financial AccountinggusneriNo ratings yet

- Assets Current AssetsDocument10 pagesAssets Current AssetsSharmine TejanoNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Classification of AccountsDocument3 pagesClassification of AccountsSaurav Aradhana100% (1)

- From Account To Account Revenue 41110 41290 Gross ProfitDocument4 pagesFrom Account To Account Revenue 41110 41290 Gross ProfitAravind AllamNo ratings yet

- Unit V: Financial AccountingDocument31 pagesUnit V: Financial AccountingAbhishek Bose100% (2)

- Colgate Fin Model DraftDocument5 pagesColgate Fin Model Draftmayor78No ratings yet

- Nestle SA operating cash flow analysis 2010-2013Document4 pagesNestle SA operating cash flow analysis 2010-2013CfhunSaatNo ratings yet

- Vardhman Textiles Balance Sheet AnalysisDocument11 pagesVardhman Textiles Balance Sheet AnalysisRNo ratings yet

- Ratio AnalysisDocument27 pagesRatio AnalysisPratik Thorat100% (1)

- State Bank of India: Total IncomeDocument2 pagesState Bank of India: Total IncomeRahul ReinNo ratings yet

- Alphabet Inc., Consolidated Statement of Cash FlowsDocument4 pagesAlphabet Inc., Consolidated Statement of Cash FlowsWenly PranataNo ratings yet

- Horizintal and Vertical Analysis of Jollibee Foods CorpDocument9 pagesHorizintal and Vertical Analysis of Jollibee Foods CorpAlfraim Sheine Sandulan Gomez100% (1)

- Income Statement: Quarterly Financials For Toyota Motor Corporation ADSDocument7 pagesIncome Statement: Quarterly Financials For Toyota Motor Corporation ADSneenakm22No ratings yet

- ACC1002X Cheat Sheet 2Document1 pageACC1002X Cheat Sheet 2jieboNo ratings yet

- Standardized Financial Statements: Accounting Analysis GuideDocument3 pagesStandardized Financial Statements: Accounting Analysis GuideJonathanChanNo ratings yet

- Statement of Cash FlowsDocument7 pagesStatement of Cash FlowsratihNo ratings yet

- Data DictionaryDocument6 pagesData DictionarySecret PsychologyNo ratings yet

- Funds From Operation Net Sales - Cost of Goods Sold - Operating ExpensesDocument1 pageFunds From Operation Net Sales - Cost of Goods Sold - Operating ExpensesChris RessoNo ratings yet

- Exhibit 6.3 Margin Money For Working CapitalDocument12 pagesExhibit 6.3 Margin Money For Working Capitalanon_285857320No ratings yet

- Common Account TitlesDocument4 pagesCommon Account TitlesJaydie CruzNo ratings yet

- AC550 Course ProjectDocument2 pagesAC550 Course ProjectPhuong Dang0% (2)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Understanding Business Accounting For DummiesFrom EverandUnderstanding Business Accounting For DummiesRating: 3.5 out of 5 stars3.5/5 (8)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- EdexcelASBio 02550Document4 pagesEdexcelASBio 02550johnny458No ratings yet

- EdexcelASBio 00020Document2 pagesEdexcelASBio 00020johnny458No ratings yet

- Edexcel International Accounting 8011 9011 GCE Syllabus Revised IAS and A2Document21 pagesEdexcel International Accounting 8011 9011 GCE Syllabus Revised IAS and A2Malika Navaratna0% (1)

- GCE Accounting (6001) Paper 1 Mark SchemeDocument18 pagesGCE Accounting (6001) Paper 1 Mark SchemeStephanie UCmanNo ratings yet

- Specimen Papers Web VersionDocument49 pagesSpecimen Papers Web Versionfrieda20093835No ratings yet

- Accounting A LevelDocument16 pagesAccounting A LevelNipuni PereraNo ratings yet

- Accounting 8011 9011 GCE Syllabus IAS SyllabusDocument19 pagesAccounting 8011 9011 GCE Syllabus IAS Syllabusjohnny458No ratings yet

- Içåççå BÑ Ãáå Íáçåë Çî Ååéç Iéîéä D'B Áå Ååçìåíáåö Evmnnf: J Êâ Påüéãé Ïáíü BÑ Ãáåéêëû OééçêíDocument28 pagesIçåççå BÑ Ãáå Íáçåë Çî Ååéç Iéîéä D'B Áå Ååçìåíáåö Evmnnf: J Êâ Påüéãé Ïáíü BÑ Ãáåéêëû Oééçêísanjoy90No ratings yet

- June 2003Document29 pagesJune 2003johnny458No ratings yet

- GCE Accounting Reading ListDocument1 pageGCE Accounting Reading Listjohnny458No ratings yet

- Answers 2012-2013 PDFDocument13 pagesAnswers 2012-2013 PDFMichelle Nugget UyNo ratings yet