Professional Documents

Culture Documents

Insurance Claim Loss Assessor Homeowner5

Uploaded by

rosanajonesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance Claim Loss Assessor Homeowner5

Uploaded by

rosanajonesCopyright:

Available Formats

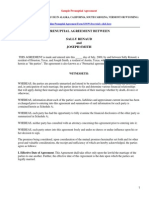

YOUR GUIDE TO THE INSURANCE CLAIM PROCESS

Insurance company receives claim from insured owner.

BUILDING SERVICES AUTHORITY

Time frames will be dependant upon: location extent of damage

STAGE 1

Insurer appoints loss adjuster or loss assessor.

Loss adjuster or loss assessor contacts insured owner. Inspection and/or emergency repairs arranged.

This guide is a general overview of the insurance process in relation to natural disasters. Please note that particular insurance companies may operate in slightly different ways. December 2009

Assessment inspection complete.

Engineer appointed if necessary Demolish Rebuild / Repair Builders provide quotation based on engineers site instructions. Insurance company provide approval. Decision made by insurer and insured owner which way to proceed. Design and documentation of repair completed. Builder contracts with insured owner. Contract signed and home warranty insurance premium paid for work over $3,300. Obtain development approval from certifier. Builder / contractor commences work. Inspections carried out by certifier.

STAGE 2

STAGE 2

Builders/contractors inspect and make safe as required. Provide quotation. Insurance company provides approval. Design and documentation of repair completed. Builder contracts with insured owner. Contract signed and home warranty insurance premium paid for work over $3,300. If necessary obtain development approval from certifier. Builder/contractor commences work. Inspections carried out by certifier.

Report to insurance company.

STAGE 3

STAGE 3

You might also like

- Probate Information ListDocument6 pagesProbate Information ListrosanajonesNo ratings yet

- Medical Power of Attorney EXAMPLEDocument6 pagesMedical Power of Attorney EXAMPLErosanajones0% (1)

- Financial Planning QuestionnaireDocument7 pagesFinancial Planning QuestionnairerosanajonesNo ratings yet

- Medical Power of Attorney EXAMPLEDocument6 pagesMedical Power of Attorney EXAMPLErosanajones0% (1)

- Blank Currency SpreadsheetDocument1 pageBlank Currency SpreadsheetrosanajonesNo ratings yet

- Wrongful Death InterrogatoriesDocument32 pagesWrongful Death InterrogatoriesrosanajonesNo ratings yet

- Power Tips Preview Edition 1.0Document27 pagesPower Tips Preview Edition 1.0SHRIYANo ratings yet

- Lady Bird Deed FormDocument2 pagesLady Bird Deed Formrosanajones50% (18)

- DNR FormDocument2 pagesDNR FormrosanajonesNo ratings yet

- DNR FormDocument2 pagesDNR FormrosanajonesNo ratings yet

- DNR FormDocument2 pagesDNR FormrosanajonesNo ratings yet

- Living Trust Form GuideDocument9 pagesLiving Trust Form GuiderosanajonesNo ratings yet

- How To Write A Patent ApplicationDocument53 pagesHow To Write A Patent ApplicationrichardinvicNo ratings yet

- Property Damage Insurance Claim Loss Assessor Homeowner4Document45 pagesProperty Damage Insurance Claim Loss Assessor Homeowner4rosanajonesNo ratings yet

- Sample Prenuptial Agreement FormDocument10 pagesSample Prenuptial Agreement FormrosanajonesNo ratings yet

- A9RB800 Expunction of Records in TexasDocument12 pagesA9RB800 Expunction of Records in TexasrosanajonesNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)