Professional Documents

Culture Documents

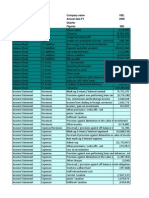

Marathon SDN BHD Statement of Cash Flow For The Year Ended 31 December 20X8 RM'000 RM'000 Cash Flow From Operating Activities

Uploaded by

Arissa LaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marathon SDN BHD Statement of Cash Flow For The Year Ended 31 December 20X8 RM'000 RM'000 Cash Flow From Operating Activities

Uploaded by

Arissa LaiCopyright:

Available Formats

Marathon Sdn Bhd Statement of Cash Flow for the year ended 31 December 20X8 RM'000 Cash flow

from operating activities Profit before tax Adjustments: Interest income Interest expense Depreciation Gain on disposal Operating profit before working capital charges Decrease in inventories (26,350 - 29,365) Decrease in trade receivables (13,412 - 16,446) Decrease in trade payables (23,534 - 23,804) Cash generated from operation Tax paid (W1) Interest paid Net cash generated from operating activities (A) RM'000 17,414 (101) 1,749 6,784 (1,806) 3,015 3,034 (270) (2,395) (1,749)

6,626 24,040

5,779 29,819 (4,144) 25,675

Cash flow from investing activities Purchase of non-current asset (W2) Proceeds from disposal of non-current asset (W2) Interest income received Net cash used in investing activities (B) Cash flow from financing activities Dividend paid Procceds from share issued (23,576 - 21,082) Procceds from share issued at premium (11,982 - 10,245) Repayment of long term loan ( 5,743 - 22,632) Net cash used in financing activities (C) Net increase in cash and cash equivalents (A + B + C) Cash and cash equivalents at the beginning of the year * Cash and cash equivalents at the end of the year*

(14,196) 5,667 101 (8,428)

(3,697) 2,494 1,737 (16,889) (16,355) 892 (4,806) (3,914)

*Notes to cash and cash equivalents* Cash at bank Bank overdraft 20X8 2,955 (6,869) (3,914) 20X7 3,036 (7,842) (4,806)

W1 Tax paid Tax payable RM 2,395 Balance b/d 2,101 SCI 4,496 RM 1,926 2,570 4,496

Bank Balance c/d

W2

Non-current asset - Cost RM Balance b/d 124,252 Disposal a/c Bank (additional purchase) 14,196 Balance c/d 138,448 Accumulated depreciation RM 1,435 Balance b/d 30,978 Depreciation 32,413 Disposal a/c RM 1,806 Bank 5,296 Accumulated depreciation 7,102

RM 5,296 133,152 138,448

Disposal a/c Balance c/d

RM 25,629 6,784 32,413

Gain on disposal Non-current asset - Cost

RM 5,667 1,435 7,102

You might also like

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Working Capital of Hindalco Industries LTD For THE YEARS 2009-2013Document30 pagesWorking Capital of Hindalco Industries LTD For THE YEARS 2009-2013VaibhavSonawaneNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- A. Net IncomeDocument8 pagesA. Net IncomeAeron Paul AntonioNo ratings yet

- GP MIS ReportDocument16 pagesGP MIS ReportFarah MarjanNo ratings yet

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.No ratings yet

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document26 pagesChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- AB Bank Limited Consolidated FinancialsDocument26 pagesAB Bank Limited Consolidated FinancialsSourav KarmakarNo ratings yet

- Financial StatementsDocument20 pagesFinancial Statementswilsonkoh1989No ratings yet

- Year-to-Date Revenues and Income Analysis for Period Ending Dec 2010Document35 pagesYear-to-Date Revenues and Income Analysis for Period Ending Dec 2010Kalenga CyrilleNo ratings yet

- Tiso Blackstar Annoucement (CL)Document2 pagesTiso Blackstar Annoucement (CL)Anonymous J5yEGEOcVrNo ratings yet

- Cash Flow of PureshitDocument2 pagesCash Flow of PureshitJhess BayaNo ratings yet

- Example SDN BHDDocument9 pagesExample SDN BHDputery_perakNo ratings yet

- SSS 2017 Financial Report: Members' Contributions Hit P158 Billion, Benefit Payments Up 28Document16 pagesSSS 2017 Financial Report: Members' Contributions Hit P158 Billion, Benefit Payments Up 28Ariel DimalantaNo ratings yet

- Nigeria German Chemicals Final Results 2012Document4 pagesNigeria German Chemicals Final Results 2012vatimetro2012No ratings yet

- Example of Financial TemplateDocument2 pagesExample of Financial Templatezeus33No ratings yet

- United Bank Limited: Consolidated Condensed Interim Financial StatementsDocument19 pagesUnited Bank Limited: Consolidated Condensed Interim Financial StatementsMuhammad HassanNo ratings yet

- DemonstraDocument75 pagesDemonstraFibriaRINo ratings yet

- Gel Cash FlowDocument3 pagesGel Cash Flowravibhartia1978No ratings yet

- Votorantim Financial ReportDocument0 pagesVotorantim Financial ReporthyjulioNo ratings yet

- FAtDocument6 pagesFAtCassandra AnneNo ratings yet

- Consolidated Financial StatementsDocument78 pagesConsolidated Financial StatementsAbid HussainNo ratings yet

- Wipro Financial StatementsDocument37 pagesWipro Financial StatementssumitpankajNo ratings yet

- Business & Finance Homework HelpDocument9 pagesBusiness & Finance Homework HelpAustine OtienoNo ratings yet

- Cash Flow Statement HighlightsDocument2 pagesCash Flow Statement HighlightsAbhishek AgarwalNo ratings yet

- IFRS For SME's Financial Statements TemplateDocument27 pagesIFRS For SME's Financial Statements TemplatemrlskzNo ratings yet

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- Changes in Equity StatementDocument1 pageChanges in Equity StatementAnonymous f7wV1lQKRNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Aftab Automobiles Limited and Its SubsidiariesDocument4 pagesAftab Automobiles Limited and Its SubsidiariesNur Md Al HossainNo ratings yet

- Hls Fy2010 Fy Results 20110222Document14 pagesHls Fy2010 Fy Results 20110222Chin Siong GohNo ratings yet

- National Foods by Saqib LiaqatDocument14 pagesNational Foods by Saqib LiaqatAhmad SafiNo ratings yet

- Analysis of Financial Statements: Bs-Ba 6Document13 pagesAnalysis of Financial Statements: Bs-Ba 6Saqib LiaqatNo ratings yet

- Beng Kuang Marine Limited: Page 1 of 10Document10 pagesBeng Kuang Marine Limited: Page 1 of 10pathanfor786No ratings yet

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulNo ratings yet

- Income Statement and Balance Sheet AnalysisDocument5 pagesIncome Statement and Balance Sheet Analysisthe master magicNo ratings yet

- Consolidated Income Statement: All Amounts in US Dollars Thousands Unless Otherwises StatedDocument6 pagesConsolidated Income Statement: All Amounts in US Dollars Thousands Unless Otherwises StatedMbanga PennNo ratings yet

- MCB Bank Limited 2007 Financial Statements ReviewDocument83 pagesMCB Bank Limited 2007 Financial Statements Reviewusmankhan9No ratings yet

- S H D I: Untrust OME Evelopers, NCDocument25 pagesS H D I: Untrust OME Evelopers, NCfjl300No ratings yet

- Statement of Cash Flows AnalysisDocument4 pagesStatement of Cash Flows Analysislehan2447No ratings yet

- Ar 2005 Financial Statements p55 eDocument3 pagesAr 2005 Financial Statements p55 esalehin1969No ratings yet

- Financial Statements Year Ended Dec 2010Document24 pagesFinancial Statements Year Ended Dec 2010Eric FongNo ratings yet

- Standalone Accounts 2008Document87 pagesStandalone Accounts 2008Noore NayabNo ratings yet

- Standalone Cash Flow Statement 11Document2 pagesStandalone Cash Flow Statement 11Suhaib RaisNo ratings yet

- Balance SheetDocument6 pagesBalance SheetMohammad Abid MiahNo ratings yet

- IDB Financial Statements 2009Document68 pagesIDB Financial Statements 2009tjl84No ratings yet

- INDIGO Cash FlowsDocument9 pagesINDIGO Cash FlowsAyush SarawagiNo ratings yet

- Strabag 2010Document174 pagesStrabag 2010MarkoNo ratings yet

- Company Name HBL Annual Data FY 2009 Quarter Figures 000: Mark-Up / Return / Interest EarnedDocument6 pagesCompany Name HBL Annual Data FY 2009 Quarter Figures 000: Mark-Up / Return / Interest EarnedCherry SprinkleNo ratings yet

- MCB Bank Limited Consolidated Financial Statements SummaryDocument93 pagesMCB Bank Limited Consolidated Financial Statements SummaryUmair NasirNo ratings yet

- Kuantan Flour Mills SolverDocument20 pagesKuantan Flour Mills SolverSharmila DeviNo ratings yet

- Consolidated Financial Statements Dec 312012Document60 pagesConsolidated Financial Statements Dec 312012Inamullah KhanNo ratings yet

- Comman Size Analysis of Income StatementDocument11 pagesComman Size Analysis of Income Statement4 7No ratings yet

- Financial Accounting 3a Assignment 2 2022Document9 pagesFinancial Accounting 3a Assignment 2 2022sartynaftalNo ratings yet

- Donam Corporate FinanceDocument9 pagesDonam Corporate FinanceMAGOMU DAN DAVIDNo ratings yet

- UBL Financial Statement AnalysisDocument17 pagesUBL Financial Statement AnalysisJamal GillNo ratings yet

- Income Statement: Assets Non-Current AssetsDocument213 pagesIncome Statement: Assets Non-Current AssetsAhmed_Raza_ShahNo ratings yet

- Weida 2011's 4th QTR Return - 31032011Document23 pagesWeida 2011's 4th QTR Return - 31032011Kai Sheng RooraNo ratings yet

- Work StressDocument28 pagesWork StressArissa LaiNo ratings yet

- Financial Job Guide For NewbiesDocument27 pagesFinancial Job Guide For NewbiesArissa Lai100% (1)

- Financial Job Guide For NewbiesDocument27 pagesFinancial Job Guide For NewbiesArissa Lai100% (1)

- ManagementDocument2 pagesManagementArissa LaiNo ratings yet