Professional Documents

Culture Documents

Biz Tutorial

Biz Tutorial

Uploaded by

tanalvis0 ratings0% found this document useful (0 votes)

5 views4 pagesanswer

Original Title

biz tutorial

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentanswer

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views4 pagesBiz Tutorial

Biz Tutorial

Uploaded by

tanalvisanswer

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

1a

liquidity ratio

= current asset/ current liabilities

= 1,999,606 /1,562,625

1.279645468

1b

quick/ acid-test

ratio

= (current assets - inventories)/current liabilities

= (1,999,606-13,858)/1,562,625

1.270777058

2a

average collection

period

= account receivable /sales per day

= 762,482/(1,886,999/365)

147.4859976

2b

inventory turnover

= cost of good sold/ inventories

= 460550/13858

33.23351133

2c

total asset turnover

= sales/total assets

= 1,886,999/8,759,103

0.215432904

3a

debt ratio

= total debt/total assets

= 1,562,625/8,759,103

0.178400117

3b

Times interest

earned ratio

= EBIT/total interest

= 661,582/(349126+85436)

1.522411071

4a

Operating profit

margin

= operating profits/ sales

= 661,582/1,886,999

0.35060008

4b

nett profit margin

= earnings available for common stockholders/ sales

= 142,321/1,886,999

0.075421874

4c

EPS

= earnings available for common stockholders/ number of shares of common stock outstan

= 142,321/411,142

0.346160207

4d

return on total

assets

= earning available for common stockholders/ total assets

= 142,321/1,999,606

0.071174521

4e

return on equity

= earnings available for common stockholders/ common stocks equity

= 142,321/1,473,800

0.096567377

interest=financing cost+ minority interest

5a

P/E ratio

= market price per share of common stock/ earnings per shares

= 3/0.3462

8.665511265

5b

M/B ratio

= common stock equity/number of shares of common stock outstanding

= 1,473,800/411,142

3.584649586

t+ minority interest

hares of common stock outstanding

= 661582/349126

1.894966

outstanding

You might also like

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- conversion/tmp/activity - Task - Scratch/541632757.docx Last Saved: 0/0/0000 0:00:00 AMDocument147 pagesconversion/tmp/activity - Task - Scratch/541632757.docx Last Saved: 0/0/0000 0:00:00 AMAndrew FergusonNo ratings yet

- Six Sigma Overview For Green Belt: Prof. B. MajumdarDocument31 pagesSix Sigma Overview For Green Belt: Prof. B. MajumdarAnkitNo ratings yet

- Mulugeta Beza-Im Assignment-IDocument11 pagesMulugeta Beza-Im Assignment-IMulugeta BezaNo ratings yet

- Dry RunDocument5 pagesDry RunMarc MagbalonNo ratings yet

- Joint VentureDocument133 pagesJoint VentureArindom MukherjeeNo ratings yet

- Oracle Process MFG User GuideDocument386 pagesOracle Process MFG User GuideThomas FitzgeraldNo ratings yet

- CH 12 Global Marketing ManagementDocument9 pagesCH 12 Global Marketing ManagementAslamMhdNo ratings yet

- HR Practices at Raymond India LimitedDocument9 pagesHR Practices at Raymond India LimitedRowdy HbkNo ratings yet

- Ijrar Issue 20542895Document5 pagesIjrar Issue 20542895Ashutosh sonkarNo ratings yet

- Business Development Sales Manager in Cleveland OH Resume Jeffrey ScottDocument2 pagesBusiness Development Sales Manager in Cleveland OH Resume Jeffrey ScottJeffreyScott2No ratings yet

- Kenya - Renew Sugar Miller RegistrationDocument5 pagesKenya - Renew Sugar Miller RegistrationIan Ochieng'No ratings yet

- Registering A Foreign Company in BangladeshDocument3 pagesRegistering A Foreign Company in Bangladeshshabin16No ratings yet

- Habtom 1-3Document3 pagesHabtom 1-3Kokob YosiefNo ratings yet

- Business ActivityDocument9 pagesBusiness Activityattackdfg2002No ratings yet

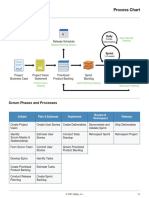

- Scrum Flow: Process ChartDocument2 pagesScrum Flow: Process ChartJean BazanNo ratings yet

- Causal Relationship Between CSR and FB in Banks: SciencedirectDocument6 pagesCausal Relationship Between CSR and FB in Banks: SciencedirectAji PurboNo ratings yet

- InvoiceDocument1 pageInvoiceciocbromheadNo ratings yet

- Ipam Offer 19439 - PDF - Fee - Tuition PaymentsDocument1 pageIpam Offer 19439 - PDF - Fee - Tuition PaymentskamaraalphaadamNo ratings yet

- GTU MBA 2018 1 Summer 3519208 Management Information System (Mis)Document3 pagesGTU MBA 2018 1 Summer 3519208 Management Information System (Mis)Sagar ShettiNo ratings yet

- Qust - Ans - Operational and Integrated Risk ManagementDocument348 pagesQust - Ans - Operational and Integrated Risk ManagementBlack MambaNo ratings yet

- Sap Ps TutorialDocument20 pagesSap Ps TutorialAnusha Reddy100% (1)

- Bulletin 68 PDFDocument3 pagesBulletin 68 PDFviktor_gligorovNo ratings yet

- Business Plan: Stairway To HeavenDocument33 pagesBusiness Plan: Stairway To HeavenlallupalluprincessNo ratings yet

- Request Jud Not W Motion Joinder 4-29-13 0Document518 pagesRequest Jud Not W Motion Joinder 4-29-13 0Nancy Duffy McCarronNo ratings yet

- Piercing The Corporate Veil or Lifting The Corporate Veil Is A Legal Decision To Treat TheDocument5 pagesPiercing The Corporate Veil or Lifting The Corporate Veil Is A Legal Decision To Treat TheRhenne-Ann OrayanNo ratings yet

- Annual Report 2005 06Document70 pagesAnnual Report 2005 06mrkeralaNo ratings yet

- Business Expressions 1 StudentDocument26 pagesBusiness Expressions 1 StudentThuanDinhNo ratings yet

- Report of Strategic Marketing Management Afroze Towels (PVT) LTDDocument21 pagesReport of Strategic Marketing Management Afroze Towels (PVT) LTDMuqaddas IsrarNo ratings yet

- Introduction To Warehouse Management: High ImpactDocument25 pagesIntroduction To Warehouse Management: High ImpactJesus Mata FacendaNo ratings yet

- PSBA AT Quizzer 1 - Fundamentals of Auditing and Assurance Services 2SAY2021Document12 pagesPSBA AT Quizzer 1 - Fundamentals of Auditing and Assurance Services 2SAY2021Abdulmajed Unda MimbantasNo ratings yet