Professional Documents

Culture Documents

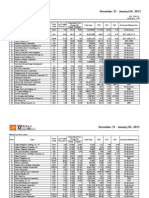

The Philippine Stock Exchange, Inc Daily Quotations Report January 24, 2013

Uploaded by

srichardequipOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Philippine Stock Exchange, Inc Daily Quotations Report January 24, 2013

Uploaded by

srichardequipCopyright:

Available Formats

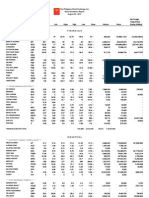

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 24 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

FINANCIALS

**** BANKS ****

ASIATRUST

BDO UNIBANK

ASIA

BDO

76.1

76.15

75.75

76.8

75.75

BPI

BPI

99.9

100.1

98.7

100.2

CHINABANK

CHIB

55.3

55.45

55.4

55.4

CITYSTATE BANK

CSB

EW

20

30.8

27

30.85

30.7

EIBA

EIBB

MBT

104.3

104.4

PBC

PNB

72

96.3

RCBC

PTC

PSB

RCB

SECURITY BANK

SECB

UNION BANK

UBP

EW

EXPORT BANK

EXPORT BANK B

METROBANK

PBCOM

PHIL. NATL BANK

PHILTRUST

PSBANK

76.15

2,969,880

226,198,010.5

(33,275,545.5)

98.55

100

860,300

85,720,256.5

26,150,892.5

55.3

55.3

177,070

9,800,512

(3,978,033)

31

30.7

30.85

2,884,300

88,949,465

(38,379,445)

103.5

105

103.5

104.4

2,938,880

306,628,330

(6,898,379)

77

97

95.15

98.7

95.15

97

1,242,350

120,198,867.5

6,896,277

65.5

102

69

103

69.45

102

69.7

103

69.9

101.5

69

103

69

390

57,750

39,755

4,005,384.5

2,494,088

170.5

170.6

168

173

168

170.5

943,150

160,748,637

119,306,707

117

117.4

117.5

118.3

116.2

117.5

195,720

22,978,050

11,166,475

**** OTHER FINANCIAL INSTITUTION ****

BANKARD

BKD

0.77

0.8

0.75

0.81

0.73

0.81

291,000

227,460

BDO LEASING

COL FINANCIAL

BLFI

COL

1.95

18.6

2.05

18.8

18.6

19

18.6

18.8

430,400

8,071,896

1,174,460

FILIPINO FUND

FFI

10.9

11.14

10.9

10.9

10.9

10.9

100

1,090

FIRST ABACUS

MANULIFE

FAF

I

MFC

0.76

2.81

540

0.81

2.86

555

0.76

2.85

555

0.76

2.86

555

0.76

2.85

555

0.76

2.86

555

60,000

9,000

20

45,600

25,670

11,100

MAYBANK ATR KE

MAKE

24.15

24.25

24.25

24.25

24.15

24.15

24,600

595,440

MEDCO HLDG.

PSE

MED

NRCP

PSE

1.74

417

1.75

417.2

1.74

416.6

1.75

417

1.74

415.4

1.75

417

535,000

10,120

935,900

4,216,572

(840,000)

(703,302)

SUN LIFE

SLF

1,080

1,085

1,110

1,110

1,085

1,085

160

176,200

VANTAGE

2.44

2.46

2.44

2.44

2.44

2.44

11,000

26,840

VOLUME :

13,641,190

IREMIT

PHILNARE

FINANCIALS SECTOR TOTAL

VALUE :

1,039,601,036

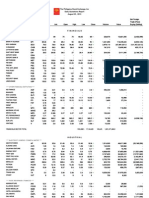

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ABOITIZ POWER

AP

38.4

38.45

38

38.65

37.95

38.4

2,407,800

92,173,960

19,978,215

ALSONS CONS

ACR

1.25

1.26

1.31

1.31

1.26

1.26

3,676,000

4,693,590

182,140

CALAPAN VENTURE

ENERGY DEVT.

H2O

EDC

4.1

6.73

4.3

6.74

4.3

6.73

4.3

6.79

4.3

6.72

4.3

6.74

30,000

13,668,000

129,000

92,257,047

(19,766,670)

FIRST GEN

FGEN

23.6

23.65

23.35

23.75

23.35

23.6

824,200

19,375,825

(5,670)

FIRST PHIL HLDG

FPH

99.3

99.35

99.5

99.5

98.5

99.35

320,160

31,771,070

3,655,711

MANILA WATER

MWC

33.65

33.7

33.8

33.8

33.5

33.65

1,141,200

38,403,910

18,826,330

MERALCO A

MER

280.2

280.4

279.6

280.8

278.8

280.4

534,980

149,952,168

29,856,818

PETRON

PCOR

PNX

10.4

9.38

10.42

9.45

10.4

9.55

10.4

9.55

10.36

9.4

10.4

9.45

5,471,600

25,700

56,831,644

242,654

554,636

-

SPC

TA

VVT

4.52

1.4

9.01

4.9

1.41

9.48

1.41

-

1.43

-

1.4

-

1.4

-

17,913,000

-

25,337,500

-

(286,000)

-

PHOENIX

SALCON POWER

TRANS-ASIA

VIVANT

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

ANI

8.07

8.19

8.1

8.14

8.06

8.07

134,900

1,093,228

ALLIANCE SELECT

FOOD

1.9

1.92

1.92

1.93

1.9

1.9

287,000

549,250

19,000

BOGO MEDELLIN

BMM

CBC

DNL

53.2

5.47

63

5.48

5.29

5.54

5.28

5.48

17,953,400

97,534,384

44,212,122

GSMI

JFC

16.7

106.7

17

107.9

17.1

106.4

17.1

108

17

106.3

17

107.9

2,700

262,370

45,934

28,035,826

(6,985,378)

46

13

52.5

13.1

13.3

13.5

13.1

13.1

1,284,200

17,080,874

(5,684,286)

7.8

6.11

7.94

6.15

7.94

6.3

7.94

6.35

7.94

6.08

7.94

6.11

500

11,666,100

3,970

71,740,024

(7,064,652)

PF

RFM

241.8

4.75

242

4.8

242.2

4.73

242.2

4.85

242

4.73

242

4.75

3,370

2,670,000

815,548

12,750,540

(791,348)

(9,059,680)

RCI

ROX

2.25

2.93

2.6

3

2.95

2.95

40,000

118,500

SMB

SMC

SFI

0.14

0.141

0.142

0.142

0.141

0.141

4,610,000

651,120

204,900

CAT

URC

85.7

85.9

84.2

86.15

84.2

85.9

2,387,010

205,043,717

(23,406,653)

COSMOS

DNL INDUS

GINEBRA

JOLLIBEE

LIBERTY FLOUR

LT GROUP

PANCAKE

PEPSI-COLA

PUREFOODS A

RFM CORP

ROXAS AND CO.

ROXAS HLDG.

SAN MIGUEL

SAN MIGUEL CORP.

SWIFT

TARLAC

UNIV ROBINA

LFM

LTG

PCKH

PIP

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 24 , 2013

Name

VICTORIAS

VITARICH

Symbol

Bid

VMC

VITA

1.49

0.92

Ask

1.51

0.94

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

1.51

0.93

1.51

0.94

1.5

0.92

1.5

0.94

1,025,000

246,000

1,540,970

229,260

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

ASIABEST GROUP

ABG

18.66

18.88

19.04

19.04

18.66

18.88

2,300

43,068

CONCRETE A

EEI CORP.

CA

CAB

EEI

55

15

10.98

65

11

10.92

11.08

10.92

11

430,500

4,735,158

(378,022)

FED. CHEMICALS

FED

10.02

11.8

10.52

11.9

10.52

11.9

7,200

77,124

HOLCIM

HLCM

LRI

12.98

11.04

13

11.06

12.98

11.14

13

11.14

12.98

11.04

13

11.06

448,000

1,123,300

5,822,944

12,479,702

(4,325,100)

625,526

MMI

MWIDE

PHN

5.15

17.8

11.94

5.6

18

12.06

5.4

18.18

12.08

5.8

18.18

12.08

5.15

18

12

5.6

18

12.06

21,000

39,900

21,400

110,080

718,254

258,260

(225,856)

TKC STEEL

PNC

CMT

SRDC

T

1.2

1.71

1.75

1.73

1.76

1.72

1.75

41,000

70,710

VULCAN IND`L

VUL

1.53

1.54

1.58

1.58

1.53

1.53

814,000

1,259,990

CIP

COAT

EURO

LMG

73.1

3

1.8

2.79

104.8

3.01

1.85

2.81

3.02

1.8

2.95

3.02

1.8

3.1

3

1.8

2.78

3

1.8

2.8

300,000

15,000

4,954,000

902,600

27,000

14,520,190

(23,980)

MVC

MIH

1.61

13.16

1.95

13.2

13.8

13.98

13

13.16

97,200

1,276,794

MIHB

MAH

MAHB

PPC

13.08

-

14.5

-

CONCRETE B

LAFARGE_REP

MARIWASA

MEGAWIDE

PHINMA

PNCC

SEACEM

SUPERCITY

**** CHEMICALS ****

CHEMPHIL

CHEMREZ

EUROMED

LMG CHEMICALS

MABUHAY VINYL

MANCHESTER A

MANCHESTER B

METROALLIANCE A

METROALLIANCE B

PRYCE CORP.

**** ELECTRICAL COMPONENTS & EQUIPMENT ****

CHIPS

CHIPS

26.25

26.75

27

27.3

26

26.75

111,500

2,960,610

(1,070,230)

GREENERGY

GREEN

IMI

ION

PMPC

0.019

3.97

0.63

4.55

0.02

4

0.66

6

0.02

3.95

-

0.021

3.95

-

0.02

3.95

-

0.02

3.95

-

52,700,000

2,000

-

1,054,100

7,900

-

(10,000)

-

SPLASH CORP.

ALPHA

FYN

FYNB

PCP

SPH

1.72

1.8

1.74

1.74

1.72

1.72

515,000

889,680

STENIEL

STN

INTEGRATED MICRO

IONICS

PANASONIC

**** OTHER INDUSTRIALS ****

ALPHALAND

FILSYN A

FILSYN B

PICOP RES.

INDUSTRIALS SECTOR TOTAL

VOLUME :

151,049,175

VALUE :

1,059,116,871

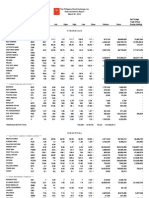

HOLDING FIRMS

**** HOLDING FIRMS ****

ABACUS A

ABOITIZ

ABA

AEV

0.66

55.6

0.67

55.65

0.68

56.5

0.68

56.5

0.66

55.5

0.68

55.65

927,000

1,321,530

619,300

73,538,971.5

(1,123,538)

ALCORN GOLD

APM

0.153

0.154

0.157

0.161

0.154

0.154

667,510,000

104,748,570

(13,729,240)

ALLIANCE GLOBAL

AGI

17.46

17.48

17.5

17.66

17.28

17.46

7,883,600

137,750,658

25,944,700

ANGLO-PHIL HLDG

APO

2.34

2.35

2.34

2.35

2.34

2.35

1,013,000

2,375,170

ANSCOR

ANS

5.6

5.62

5.58

5.62

5.58

5.62

10,100

56,576

ASIA AMALGAMATED

AAA

4.8

4.85

4.75

4.95

4.7

4.8

232,000

1,111,870

ATN HOLDINGS A

ATN

ATNB

AC

0.9

0.9

542

0.91

0.94

543

0.9

535

0.9

548

0.9

535

0.9

542

4,000

1,069,290

3,600

579,677,895

146,440,465

BH

DMC

336

53.2

645

53.25

53.15

53.4

53.05

53.2

1,566,400

83,236,257.5

2,460,593

FILINVEST DEV.

FJP

FJPB

FC

FDC

2.91

2.75

4.71

2.93

3.1

4.74

4.71

4.93

4.71

4.71

805,000

3,811,190

(460,830)

FORUM PACIFIC

FPI

0.217

0.229

0.232

0.232

0.232

0.232

10,000

2,320

GT CAPITAL

GTCAP

678

678.5

669.5

681

669.5

678

310,710

210,732,805

32,571,320

HOUSE OF INV

HI

6.37

6.49

6.4

6.4

6.38

6.38

45,000

287,200

JG SUMMIT

JGS

38.8

38.85

39.25

39.25

38.8

38.85

812,800

31,624,740

6,773,070

JOLLIVILLE HLDG

JOH

6.02

7.3

7.37

7.42

6.98

7.3

54,500

402,171

KEPPEL HLDG. A

KPH

5.1

5.7

5.7

5.7

5.1

5.1

5,900

30,270

KEPPEL HLDG. B

KPHB

5.01

5.77

5.01

5.01

5.01

5.01

9,500

47,595

LODESTAR

LIHC

0.97

0.98

0.97

0.97

1,067,000

1,037,130

LOPEZ HLDGS.

LPZ

6.84

6.85

6.9

6.9

6.83

6.85

2,103,000

14,407,569

1,168,719

MABUHAY HLDG.

MHC

0.47

0.5

0.48

0.48

0.48

0.48

870,000

417,600

ATN HOLDINGS B

AYALA CORP

BHI HOLDINGS

DMCI HOLDINGS

F&J PRINCE A

F&J PRINCE B

FIL-ESTATE CORP

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 24 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

MARCVENTURES

MARC

1.98

1.99

1.98

2.04

1.97

1.99

293,000

589,360

METRO PAC INV

MPI

4.85

4.86

4.8

4.93

4.79

4.86

115,260,000

560,602,290

(250,324,530)

MINERALES IND

MIC

6.93

6.95

6.8

6.95

334,900

2,306,477

MJC INVESTMENTS

6.5

0.05

1.2

7

0.051

1.25

0.05

1.3

0.051

1.32

0.05

1.2

0.05

1.25

4,530,000

228,500

PRIME MEDIA

MJIC

PA

PRIM

699,000

850,780

PRIME ORION

POPI

0.68

0.69

0.62

0.69

0.62

0.68

26,881,000

17,734,940

(483,830)

REPUBLIC GLASS

SEAFRONT RES.

REG

SPM

2.51

2.25

2.7

2.35

2.4

2.59

2.24

2.35

564,000

1,360,220

SINOPHIL

SINO

0.315

0.325

0.325

0.325

0.31

0.31

900,000

283,300

(32,500)

SM INVESTMENTS

SM

944.5

947.5

950

950

940

944.5

120,470

113,777,480

22,457,385

SOLID GROUP

SGI

SOC

2.3

1.15

2.32

1.19

2.32

1.15

2.34

1.15

2.25

1.14

2.32

1.15

1,059,000

122,000

2,434,440

139,570

(116,000)

-

380

0.26

0.29

470

0.285

0.295

0.29

0.3

0.29

0.295

WELLEX INDUS

SGP

UNI

WIN

460,000

135,650

ZEUS HOLDINGS

ZHI

0.54

0.55

0.57

0.6

0.54

0.54

10,430,000

6,050,340

(521,840)

PACIFICA A

SOUTH CHINA

TRANSGRID

UNIOIL HLDG.

HOLDING FIRMS SECTOR TOTAL

VOLUME :

849,285,310

VALUE :

1,953,274,495

PROPERTY

**** PROPERTY ****

A. BROWN

BRN

2.9

2.94

2.9

2.96

2.9

2.91

157,000

458,590

(75,400)

ALCO

ALCO

0.2

0.202

0.195

0.2

0.195

0.2

1,810,000

356,700

ANCHOR LAND

ARANETA PROP

ALHI

ARA

16.8

1.01

17.5

1.03

1.04

1.04

1.01

1.02

1,266,000

1,296,070

AYALA LAND

ALI

27.3

27.65

27.35

27.65

27.25

27.65

7,178,000

196,350,870

11,270,310

BELLE CORP.

BEL

5.1

5.11

5.13

5.13

5.07

5.11

3,465,500

17,674,613

2,801,187

CEBU HLDG.

CHI

4.27

4.39

3.95

4.5

3.95

4.27

770,000

3,208,150

(315,000)

CEBU PROPERTY A

CENTURY PROP

CPV

CPVB

CPG

4.81

4.81

1.8

5.1

5.1

1.82

1.78

1.85

1.78

1.8

11,703,000

21,235,240

8,746,650

CITY & LAND

LAND

2.25

2.3

2.38

2.38

2.3

2.3

19,000

43,980

CITYLAND DEVT.

CDC

CEI

CYBR

1.13

0.065

0.81

1.16

0.068

0.82

1.14

0.81

1.14

0.83

1.14

0.81

1.14

0.81

58,000

4,007,000

66,120

3,278,130

122,500

FILINVEST LAND

ELI

EVER

FLI

0.99

0.38

1.63

1.01

0.39

1.64

0.98

0.395

1.65

1.01

0.395

1.65

0.98

0.385

1.63

0.99

0.39

1.63

4,647,000

310,000

7,231,000

4,646,410

119,650

11,808,700

(1,795,640)

(3,872,300)

GLOBAL-ESTATE

GERI

2.04

2.06

2.04

2.11

2.04

2.04

13,243,000

27,465,820

(926,220)

GOTESCO LAND A

GO

GOB

HP

IRC

1.76

1.09

1.99

1.1

1.2

1.2

1.1

1.1

7,282,000

8,168,410

10,800

MEGAWORLD

KEP

MC

MCB

MEG

2.85

3.11

3.27

3.12

3.1

3.16

3.1

3.11

24,312,000

76,088,070

(38,436,000)

MRC ALLIED

MRC

0.11

0.111

0.111

0.111

0.11

0.111

12,150,000

1,346,880

PHIL ESTATES

PHES

0.64

0.65

0.66

0.66

0.64

0.65

1,449,000

930,150

PHIL. TOBACCO

TFC

RLT

18.02

0.5

25

0.52

0.5

0.5

0.5

0.5

190,000

95,000

ROBINSONS LAND

PMT

PRMX

RLC

2.77

21.4

3.4

21.5

21.15

21.8

21.15

21.5

934,300

20,183,420

13,099,560

ROCKWELL

ROCK

3.02

3.04

3.03

3.08

3.02

1,832,000

5,552,750

1,081,420

SAN MIGUEL PROP

SM DEVT

SMP

SHNG

SMDC

3.1

5.96

3.11

5.97

3.1

6

3.12

6

3.1

5.96

3.11

5.97

359,000

586,100

1,113,000

3,505,689

(710,846)

SM PRIME HLDG.

SMPH

17.32

17.36

17.04

17.4

17

17.36

7,902,000

136,935,526

2,366,046

STA.LUCIA LAND

SLI

0.74

0.75

0.74

0.77

0.74

0.74

447,000

335,160

(15,730)

STARMALLS

STR

SUN

UW

VLL

3.68

0.57

5.09

3.9

0.59

5.14

3.9

0.58

5.14

3.9

0.58

5.17

3.9

0.57

5.05

3.9

0.57

5.14

2,000

70,000

7,834,000

7,800

40,530

40,046,773

9,280

19,497,256

CEBU PROPERTY B

CROWN EQUITIES

CYBER BAY

EMPIRE EAST

EVER-GOTESCO

GOTESCO LAND B

HIGHLANDS PRIME

IRCPROPERTIES

KEPPEL PROP

MARSTEEL A

MARSTEEL B

PHILREALTY

PRIMETOWN PROP.

PRIMEX CORP.

SHNG PROPERTIES

SUNTRUST HOME

UNIWIDE HLDG.

VISTA LAND

PROPERTY SECTOR TOTAL

VOLUME :

121,251,900

VALUE :

582,437,621

SERVICES

**** MEDIA ****

ABS-CBN

ABS

39.6

39.9

39.9

40

39.6

39.6

14,200

563,160

GMA NETWORK

GMA7

9.54

9.6

9.61

9.61

9.53

9.54

73,100

699,692

MANILA BULLETIN

MB

0.76

0.77

0.76

0.76

0.76

0.76

152,000

115,520

MLABROADCASTING

MBC

3.32

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 24 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

**** TELCOMMUNICATION ****

GLOBE TELECOM

GLO

LIBERTY TELECOM

LIB

PLDT

PTT CORP

1,154

1,158

1,160

1,165

1,154

1,158

75,510

87,390,630

2.4

2.45

2.4

2.44

2.4

2.44

18,000

43,480

5,049,995

-

TEL

2,792

2,796

2,780

2,816

2,780

2,792

130,005

363,660,970

(13,032,860)

PTT

**** INFORMATION TECHNOLOGY ****

DIVERSIFIED

DFNN

4.71

4.8

4.7

4.8

4.7

4.8

515,000

2,429,200

IMPERIAL A

IPVG CORP.

IMP

IMPB

CLOUD

IP

5.13

3.75

0.65

6.5

48.8

3.77

0.66

3.75

0.66

3.76

0.68

3.75

0.65

3.76

0.66

327,000

2,218,000

1,229,030

1,465,120

ISLAND INFO

IS

0.051

0.053

0.051

0.053

0.051

0.051

230,000

11,830

ISM COMM.

PHILWEB

ISM

NXT

WEB

2.2

13.8

2.25

14.2

2.19

14.2

2.2

14.2

2.19

13.9

2.2

14.2

223,000

2,738,200

490,400

38,537,534

(220,000)

(8,543,760)

TOUCH SOLUTIONS

TSI

8.9

8.4

9.06

8.4

345,100

3,074,869

(12,770)

TRANSPACIFIC BR

TBGI

YEHEY

2.19

1.29

2.29

1.31

1.29

1.31

1.29

1.31

33,000

42,700

IMPERIAL B

IP CONVERGE

NEXTSTAGE

YEHEY

**** TRANSPORTATION SERVICES ****

2GO GROUP

2GO

1.8

1.81

1.8

1.8

1.8

1.8

36,000

64,800

ASIAN TERMINALS

ATI

12

12.48

13.7

16.04

12

12

36,600

484,022

61,750

CEBU AIR, INC.

CEB

61.9

61.95

61.5

61.9

61.5

61.9

105,360

6,499,085

(2,950,416)

INTL CONTAINER

ICT

75.5

76.5

76.9

76.9

75.5

76.5

268,670

20,538,333

2,896,818

LORENZOSHIPPING

LSC

MAC

PAL

1.4

2.55

-

1.6

2.64

-

ACE

BHI

GPH

WPI

1.27

0.133

33.1

0.405

1.3

0.134

45

0.415

1.31

0.132

0.415

1.32

0.134

0.415

1.28

0.132

0.41

1.32

0.133

0.415

54,000

17,440,000

190,000

69,280

2,304,620

78,500

39,800

-

FAR EASTERN U

CEU

FEU

11

1,066

11.92

1,069

1,060

1,069

1,060

1,069

1,390

1,474,110

(31,950)

IPEOPLE

IPO

8.7

9.2

9.2

9.2

9.2

9.2

80,700

742,440

(6,440)

BCOR

BLOOM

26.05

13

28

13.02

13.06

13.1

13

13

2,526,800

33,012,578

(18,979,400)

LEISURE

EG

LR

0.024

8.7

0.025

8.71

0.024

8.73

0.025

8.77

0.024

8.7

0.024

8.71

81,600,000

1,235,500

1,958,600

10,780,193

(1,279,200)

(1,539,285)

MANILA JOCKEY

MJC

2.87

2.88

2.87

2.94

2.87

2.88

842,000

2,424,540

PACIFIC ONLINE

PHIL. RACING

LOTO

PRC

14

10.3

14.02

10.4

14

10.2

14

10.38

14

10.2

14

10.3

10,000

87,500

140,000

898,718

PREMIEREHORIZON

PHA

0.335

0.35

0.335

0.335

0.335

0.335

420,000

140,700

9,570

MACROASIA

PAL HOLDINGS

**** HOTEL & LEISURE ****

ACESITE HOTEL

BOULEVARD HLDG.

GRAND PLAZA

WATERFRONT

**** EDUCATION ****

CENTRO ESCOLAR

**** CASINOS & GAMING ****

BERJAYA

BLOOMBERRY

IP E-GAME

**** RETAIL ****

7-11

SEVN

87

88

87

87

87

87

110

9,570

CALATA CORP.

CAL

3.72

3.74

3.68

3.81

3.65

3.75

548,000

2,016,080

PUREGOLD

PGOLD

32.4

32.5

32.25

33.05

32.25

32.5

4,328,300

142,227,255

(9,383,190)

APC GROUP

APC

0.82

0.83

0.82

0.83

0.82

0.83

692,000

570,390

(203,350)

EASYCALL

ICTVI

ECP

PORT

ICTV

2.71

0.42

2.8

20

0.45

2.75

0.43

2.75

0.43

2.75

0.42

2.75

0.42

8,000

70,000

22,000

29,600

8,600

PAXYS

PAX

2.9

2.91

2.9

2.92

2.89

2.9

262,000

760,120

14,500

PHILCOMSAT

PHC

STI

1.01

1.01

1.01

6,115,000

6,124,600

(595,200)

**** OTHER SERVICES ****

GLOBALPORTS

STI_HOLDINGS

SERVICES SECTOR TOTAL

VOLUME :

124,189,345

VALUE :

735,055,239

MINING & OIL

**** MINING ****

ABRA MINING

APEX MINING A

APEX MINING B

AR

APX

0.0057

4.55

0.0058

4.8

0.0058

4.55

0.0058

4.55

0.0057

4.55

0.0058

4.55

9,000,000

188,000

51,700

855,400

4.79

21.85

22

22.05

21.7

21.8

712,100

15,550,805

(472,310)

ATLAS MINING

APXB

AT

4.5

21.8

ATOK

AB

19.6

22

21

21

21

21

2,000

42,000

42,000

BENGUET A

BC

18.5

18.8

18.8

18.8

18.8

18.8

4,100

77,080

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 24 , 2013

Name

Symbol

BENGUET B

Bid

Ask

Open

High

18.9

1.02

1.03

0.99

1.01

15

15.1

15

0.52

1.15

0.53

1.17

0.53

1.16

Low

Close

CENTURY PEAK

BCB

CPM

18.32

1.01

COAL ASIA

COAL

DIZON MINES

DIZ

GEOGRACE

LEPANTO A

GEO

LC

LEPANTO B

LCB

1.2

1.21

1.24

1.24

1.2

MANILA MINING A

MA

0.063

0.064

0.065

0.065

0.064

MANILA MINING B

MAB

0.066

0.068

0.068

0.068

0.067

NICKELASIA

NIKL

19.68

19.7

19.58

20

NIHAO

NI

4.19

4.2

4.39

4.39

OMICO CORP.

OM

0.58

0.59

0.59

ORIENTAL P

PHILEX

ORE

PX

3.44

17.88

3.47

17.92

3.54

18.08

SEMIRARA MINING

SCC

240.6

240.8

UNITED PARAGON

UPM

0.017

0.018

BSC

OPM

0.275

0.02

PETROENERGY

OPMB

PERC

0.021

6.16

PHILEXPETROLEUM

PXP

31.05

31.5

32

32.8

31

PHILODRILL A

OV

0.043

0.044

0.044

0.044

0.043

PNOC A

PEC

PECB

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

1.02

465,000

471,410

20,600

1.01

0.99

0.99

18,301,000

18,216,040

(1,669,780)

15.1

14.78

15

48,700

729,068

(52,500)

0.53

1.18

0.52

1.14

0.53

1.17

388,000

9,643,000

201,840

11,174,150

1.2

6,653,000

8,044,140

795,780

0.064

105,810,000

6,772,210

0.068

67,550,000

4,575,900

167,500

19.48

19.68

880,200

17,380,586

(5,520,348)

4.15

4.19

840,000

3,552,080

(193,350)

0.59

0.59

0.59

2,000

1,180

3.54

18.22

3.44

17.84

3.45

17.92

305,000

8,743,000

1,053,660

157,024,456

77,893,792

240.4

241

240.2

240.6

62,380

15,016,956

(696,284)

0.018

0.019

0.018

0.018

86,800,000

1,572,400

0.28

0.021

0.28

0.021

0.28

0.021

0.28

0.02

0.28

0.02

380,000

15,300,000

106,400

306,100

0.022

6.3

0.021

6.16

0.021

6.17

0.021

6.16

0.021

6.16

1,000,000

31,700

21,000

195,402

(61,600)

31.5

264,000

8,300,345

(695,605)

0.043

51,800,000

2,269,800

(284,000)

**** OIL ****

BASIC PETROLEUM

ORIENTAL A

ORIENTAL B

PNOC B

MINING AND OIL SECTOR TOTAL

VOLUME :

385,173,180

VALUE :

273,562,108

PREFERRED

ALLIEDBANK PREF

12.5

-

535

539

535

539

1,610

861,690

(10,780)

FIRST PHIL HOLD

ACPR

DMCP

FGENF

FGENG

FPHP

102

103.8

101.2

105.6

104

101.3

103.8

101.2

103.8

101.5

103.8

101.2

103.8

101.5

30

110

3,114

11,156

(8,120)

PETRON PREF

PPREF

108.9

109

108.9

109.2

108.9

108.9

45,500

4,955,010

54,450

SMC PREF 1

SMCP1

SMC2A

SMC2B

SMC2C

74.95

75

75.65

75

76

75.7

75

75.7

75

75.7

74.95

75.65

75

75.65

712,420

62,250

53,431,489

4,712,300

(34,873,511)

(37,825)

ABS-CBN PDR

PFP

SFIP

BCP

ABSP

1,030

1.3

11.68

41.25

1,035

1.46

41.5

1,035

41.5

1,035

41.5

1,035

41.25

1,035

41.25

375

17,600

388,125

728,650

(227,120)

GMA HOLDINGS

GMAP

9.6

9.92

9.96

9.96

9.6

9.92

121,700

1,202,320

9,600

GLOBE PREF A

GLOPA

TLHH

10

79,420

-

PBCP PREFERRED

AYALA PREF. A

AYALA PREF. B

DMCI PREFERRED

FIRST GEN F

FIRST GEN G

SMCPREFS2A

SMCPREFS2B

SMCPREFS2C

SMPFC PREFS

SWIFT PREF

BENGUET PREF. A

PLDT HH

ABC

PBCP

ACPA

PREFERRED TOTAL

VOLUME :

961,595

VALUE :

66,293,854

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC.

IRCPROPERTIES W

MEG-WARRANTS

MEG-WARRANTS2

PLDT-USD

IRW

MEGW1

MEGW2

DTEL

0.05

2.09

2.06

-

2.12

2.2

-

2.09

-

2.09

-

2.09

-

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC. TOTAL

2.09

-

VOLUME :

38,000

-

38,000

VALUE :

79,420

SMALL AND MEDIUM ENTERPRISES

IRIPPLE

RPL

7.7

8.1

7.19

8.19

7.19

8.08

1,600

12,265

MAKATI FINANCE

MFIN

2.3

SMALL AND MEDIUM ENTERPRISES TOTAL

TOTAL REGULAR

VOLUME :

VOLUME :

1,600

1,644,591,700

VALUE :

VALUE :

12,265

5,643,059,635

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 24 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

NO. OF ADVANCES:

77

NO. OF DECLINES:

74

NO. OF UNCHANGED:

51

NO. OF TRADED ISSUES: 202

NO. OF TRADES:

22032

BLOCK SALES

SECURITY

PRICE

CHI

3.7

CHI

3.7

TEL

2,787.2793

ODDLOT VOLUME:

ODDLOT VALUE:

:

:

VOLUME

10,000,000

73,000,000

7,500

VALUE

37,000,000

270,100,000

20,904,594

269,562

201,225.27

MAIN BOARD CROSS VOLUME: :

MAIN BOARD CROSS VALUE:

:

128,922,320

1,447,520,952.5

NON-SECTORAL VOLUME:

0

NON-SECTORAL VALUE:

0

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining and Oil

PSEi

All Shares

SME

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

1,586.85

9,092.44

5,422.62

2,406.36

1,848.83

21,797.27

6,092.25

3,850.08

1,605.7

9,147.39

5,438.87

2,430.3

1,861.99

21,867.69

6,124.9

3,865.8

1,586.85

9,091.61

5,394.37

2,404.27

1,846.13

21,481.75

6,092.25

3,850.08

1,600.91

9,140.73

5,398.97

2,430.3

1,851.26

21,597.23

6,117.27

3,858.02

0.91

0.32

-0.01

0.97

0.12

-0.92

0.41

0.2

14.48

28.95

-0.47

23.3

2.29

-200.04

24.74

7.76

13,642,875

151,055,527

849,292,915

204,260,169

124,201,010

385,414,666

1,039,618,206.25

1,059,158,483.45

1,953,320,972.6

889,579,253.75

755,996,133.45

273,580,139.77

1,600

12,265

1,727,868,762

Php 5,971,265,454.27

GRAND TOTAL

FOREIGN BUYING

FOREIGN SELLING

Php 3,089,576,859.63

Php 2,940,180,689.25

Companies Under Suspension by the Exchange as of 01/24/2013

ACPR

ALPHA

ASIA

CAT

CBC

CMT

EIBA

EIBB

FC

FYN

FYNB

GO

GOB

MAH

MAHB

MC

MCB

NXT

PAL

PEC

PECB

PHC

PNC

SMB

SMC

SMP

MED

PCP

PMT

PPC

PTT

STN

UW

- AYALA PREF. B

- ALPHALAND

- ASIATRUST

- TARLAC

- COSMOS

- SEACEM

- EXPORT BANK

- EXPORT BANK B

- FIL-ESTATE CORP

- FILSYN A

- FILSYN B

- GOTESCO LAND A

- GOTESCO LAND B

- METROALLIANCE A

- METROALLIANCE B

- MARSTEEL A

- MARSTEEL B

- NEXTSTAGE

- PAL HOLDINGS

- PNOC A

- PNOC B

- PHILCOMSAT

- PNCC

- SAN MIGUEL

- SAN MIGUEL CORP.

- SAN MIGUEL PROP

- MEDCO HLDG.

- PICOP RES.

- PRIMETOWN PROP.

- PRYCE CORP.

- PTT CORP

- STENIEL

- UNIWIDE HLDG.

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 24 , 2013

Name

Symbol

Bid

ABC

- ALLIEDBANK PREF

SMCP1

- SMC PREF 1

* Sectoral totals includes main transactions

** Total Regular includes main transactions

*** Grand total includes main,oddlot and block sale transactions

Ask

Open

High

Low

Close

Volume

Value

Net Foreign

Trade (Peso)

Buying (Selling)

You might also like

- The Philippine Stock Exchange, Inc Daily Quotations Report January 23, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 23, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 18, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 22, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 22, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 25, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 25, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 03, 2012Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 03, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013srichardequipNo ratings yet

- Stockquotes 08222013Document7 pagesStockquotes 08222013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 29, 2013Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 29, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 19, 2012Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 19, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 31, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 31, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report October 05, 2012Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report October 05, 2012Rufino Gerard MorenoNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 20, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 20, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 28, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 28, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 13, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 13, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 26, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 26, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Ryan Samuel C. CervasNo ratings yet

- Stockquotes 08232013Document7 pagesStockquotes 08232013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 12, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 12, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 08, 2013Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 08, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 17, 2012Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 17, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 22, 2013Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 22, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 02, 2011Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 02, 2011Richard SzeNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 11, 2012Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 11, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 18, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 18, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 29, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 29, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 22, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 22, 2013srichardequipNo ratings yet

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsFrom EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNo ratings yet

- The Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility CourseFrom EverandThe Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility CourseNo ratings yet

- Kase on Technical Analysis Workbook: Trading and ForecastingFrom EverandKase on Technical Analysis Workbook: Trading and ForecastingNo ratings yet

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKFrom EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKNo ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- Timing the Market: How to Profit in the Stock Market Using the Yield Curve, Technical Analysis, and Cultural IndicatorsFrom EverandTiming the Market: How to Profit in the Stock Market Using the Yield Curve, Technical Analysis, and Cultural IndicatorsNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNo ratings yet

- Stockquotes 02062015Document8 pagesStockquotes 02062015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNo ratings yet

- Stockquotes 02042015 PDFDocument8 pagesStockquotes 02042015 PDFsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNo ratings yet

- Stockquotes 02112015 PDFDocument8 pagesStockquotes 02112015 PDFsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNo ratings yet

- ECCODocument3 pagesECCOsrichardequipNo ratings yet

- wk02 Jan2013mktwatchDocument3 pageswk02 Jan2013mktwatchsrichardequipNo ratings yet

- Stockquotes 02112015 PDFDocument8 pagesStockquotes 02112015 PDFsrichardequipNo ratings yet

- wk03 Jan2013mktwatchDocument3 pageswk03 Jan2013mktwatchsrichardequipNo ratings yet

- October 2015: Sun Mon Tue Wed Thu Fri SatDocument1 pageOctober 2015: Sun Mon Tue Wed Thu Fri SatjNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013srichardequipNo ratings yet

- wk01 Jan2013mktwatchDocument3 pageswk01 Jan2013mktwatchsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013srichardequipNo ratings yet

- Stockquotes 04022013Document7 pagesStockquotes 04022013srichardequipNo ratings yet

- Table 1 Marriage 2011Document1 pageTable 1 Marriage 2011srichardequipNo ratings yet

- Extreme Networks AVB Enabled Switch Deployment GuideDocument7 pagesExtreme Networks AVB Enabled Switch Deployment GuideHoanghung TranNo ratings yet

- Building Management System (BMS) Basic Trunkline Schematic Diagram 2Document3 pagesBuilding Management System (BMS) Basic Trunkline Schematic Diagram 2Anonymous NcB95G6XwNo ratings yet

- 6310 Installation Manual (ENG) PDFDocument1 page6310 Installation Manual (ENG) PDFipas191266No ratings yet

- Superfans 2Document10 pagesSuperfans 2rebeca ross100% (1)

- Pruebas y ProcedimientoDocument5 pagesPruebas y ProcedimientoAnonymous OYLvnCxNo ratings yet

- Maria Alvarez Gomez CV - TranslationDocument3 pagesMaria Alvarez Gomez CV - Translationapi-283766010No ratings yet

- Deir Ó GrádaighDocument2 pagesDeir Ó GrádaighDonal Ó ScannlainNo ratings yet

- Proyectos Pictóricos: Lazar Stankovic 2018Document18 pagesProyectos Pictóricos: Lazar Stankovic 2018Lazar StankovicNo ratings yet

- Laser b1 Word ListDocument10 pagesLaser b1 Word ListBeatriz Perez LunaNo ratings yet

- MS2420 / MS2430: Installation and User's GuideDocument81 pagesMS2420 / MS2430: Installation and User's GuideMauricio MatuteNo ratings yet

- Shop ItemsDocument31 pagesShop ItemsAmol ChoreNo ratings yet

- Video ConferencingDocument2 pagesVideo ConferencingJeoNo ratings yet

- Lista de JogosDocument2 pagesLista de JogosDinho de MarccoNo ratings yet

- Sang Bleu BPDocument11 pagesSang Bleu BPdream_theater3100% (1)

- Assignment Group Report PMKDocument16 pagesAssignment Group Report PMKMUSHI ABDULLAH BIN MUHAMAD JEHKA (KB)No ratings yet

- Bibliografia InventariDocument39 pagesBibliografia InventariDani100% (1)

- PS 1 Suit Techpack FinalDocument22 pagesPS 1 Suit Techpack FinalyeraNo ratings yet

- Today Forecast: Mature Young Cumulative 80 1000 1250Document4 pagesToday Forecast: Mature Young Cumulative 80 1000 1250Bruno NunesNo ratings yet

- Binoria Menu 18-12-2022Document20 pagesBinoria Menu 18-12-2022Asif MaqboolNo ratings yet

- 011 DYLAN THE DRAGON Free Childrens Book by Monkey PenDocument24 pages011 DYLAN THE DRAGON Free Childrens Book by Monkey PenAmanda HuiNo ratings yet

- NIPL T20 2018 Playerlist 1Document301 pagesNIPL T20 2018 Playerlist 1Nikhil B MNo ratings yet

- NFS2-3030 - NCA-2 - LCM - Upgrade Instructions October 2016Document2 pagesNFS2-3030 - NCA-2 - LCM - Upgrade Instructions October 2016João CustódioNo ratings yet

- ApplicationDocument30 pagesApplicationAshat HaqNo ratings yet

- Osram HBO Super Pressure Mercury Lamps Catalog 1977Document8 pagesOsram HBO Super Pressure Mercury Lamps Catalog 1977Alan MastersNo ratings yet

- Keyboard Shortcut For MacDocument1 pageKeyboard Shortcut For MacDinh Ngoc Lam DienNo ratings yet

- Abhiash Badgujar CVDocument3 pagesAbhiash Badgujar CVapi-432815856No ratings yet

- Final Fantasy: Tactics CheatsDocument8 pagesFinal Fantasy: Tactics CheatsMohammad Yusril Iqbal HabibanaNo ratings yet

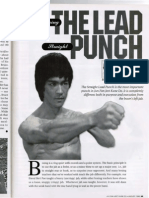

- The Lead Punch ArticleDocument11 pagesThe Lead Punch ArticleSteven Resell100% (12)

- Confessions... Second ConditionalDocument2 pagesConfessions... Second ConditionalBianca Apostolache33% (3)

- Food Cart Work Immersion Group 1mDocument19 pagesFood Cart Work Immersion Group 1mEurica LimNo ratings yet