Professional Documents

Culture Documents

Matters of Size

Matters of Size

Uploaded by

sushant_shaantCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Matters of Size

Matters of Size

Uploaded by

sushant_shaantCopyright:

Available Formats

Archives

Dec '04 Aug '04 Nov '04 Jul '04 Mar '04 Oct '04 Jun '04 Feb '04 Sep '04 May '04 Jan '04

January ' 04

Apr '04

2007 2006 2005 2003 2002

Articles Case Analysis

Matters of Size -CSV Ratna MD, 1/9th the size of the chip goliath Intel, has always tried to outsmart it. Every now and then, it comes out with products that are better than Intel's offerings, but yet are priced lower. Since 1999, when AMD unveiled its Athlon series of chips (independently proven to offer better performance), it has been increasing its global market share for PC processors at Intel's expense. During 1999-2001 for instance, AMD increased its market share from 13% to 21%, even as Intel's share shrunk from 84% to 79%.

A

AMD's popularity was built on the three planks of performance, design and price. All of its chips were priced almost 15-20% less than Intel's competing chips. But pricing its chips higher gave Intel higher margins as well; it also enjoyed economies of scale and a hugely bankable brand name (the tagline `Intel inside,' happens to be one of the most recalled ones ever). The reason why AMD still languishes behind Intel is that the former has more weaknesses than the latter has strengths. Though AMD is very good at designing better performing chips, it is weak in marketing and manufacturing. It is also weak in the server chip market and gets most of its revenues from the slumping PC market. As mentioned in the case, AMD was unable to cash in on popularity of K6 as it could not keep up with the demand due to lack of adequate manufacturing facilities. It faced similar problems with K6III, which was launched against P3. On top of that, AMD has been losing money for quite some time now and its estimates were quite bleak for the year 2003, mostly because the PC market has been flat. During 2002-03, the company's financial health has suffered due to losses from existing products while its debt burden has been rising. According to the company's filings, it has around $2.31 bn in debt (half of which is long-term). And with PC sales still sluggish in early-2004, the financial obligations are likely to augment further than decrease. Whatever a company does should boost its bottom line. If a strategy of aggression directed against a much bigger rival is adversely affecting one's bottom line, it is an indication that there is something wrong. To be able to win against a larger rival is not just about being smart, but about pooling in the right resources that complement's one's smartness and let one stay alive. Size does matter in the business arena since with size comes many advantages. Just consider how well Intel is faring even in a slump! Though Intel is also affected by the PC slowdown, unlike AMD, it is profitable and has $11.6 bn in cash and equivalents. It has put money in new production processes in the past year. That coupled with greater economies of scale, would make its products cheaper to make. Intel's strategy has always been to keep up its high margins by frequently introducing new, costlier chips while slashing the prices of older products to reduce their inventory. Also, its brand name enables it

to command a 30-40% premium over AMD's chips. So, if at all there were a price war, Intel would but naturally emerge the winner. AMD would not be able to sustain price cuts with its weak financial position. Already there is a lot of pressure on its bottom line. Intel's margins are around 47%, while AMD's gross margins dropped from 35% in the first quarter of 2003 to an all-time low of 7% in the second quarter. Intel is well entrenched in the market. It has been rolling out new products aggressively and with its size to back it up, it can afford to play the price game. though AMD products were cheaper than comparable Intel products, it had to resort to price cuts to retain its share of the market. But all is not sour on AMD's side. It has successfully eroded Intel's market share. It now has a 20% slice of the global computer microprocessor business pie. More importantly, Microsoft is supporting AMD. For Microsoft, Intel's dominance is a threatit would any day prefer to keep the rivalry between the chip players alive, so that PC processor prices are lower. This is because higher processor sales would in turn augment Microsoft's revenues. With Linux on its tail, Microsoft cannot afford to increase licensing fee and has to depend on the processor prices being low. In fact, one can expect Microsoft to associate itself equally well with both the companies to prevent a monopoly situation and to continue the price war. And as we know, price wars are harmful for all the players involved. If, instead of competing with AMD, Intel had conceded some market share to it, margins of both the players would have been good and AMD would not have become so aggressive. Who knows, it might even have worked with Intel on some turf. This way, the market would have moved into a well-functioning duopoly, with both the players being on a strong footing. But Intel was not ready to give away its `monopoly' and in the process, (much to its own detriment and the delight of the customers), permanently reduced the prices of the processors. As a result, third parties like Microsoft, OEMs and even those who have found niches like Sun and IBM have been benefiting. AMD, on its part, should not be carried away either by the popularity of its better performing chips or by the backing of Microsoft. It should, instead, focus on getting its manufacturing right, broadening its product lines, moving away from the volatile PC market and preventing the prices in the processor market from eroding further. The author is Faculty Associate at The ICFAI University Press and Consulting Editor for The Icfai Journal of Services Marketing. Reference # 14-04-01-

You might also like

- Archives: Case AnalysisDocument4 pagesArchives: Case Analysissushant_shaantNo ratings yet

- Archives: Case AnalysisDocument2 pagesArchives: Case Analysissushant_shaantNo ratings yet

- Reviving IridiumDocument13 pagesReviving Iridiumsushant_shaantNo ratings yet

- Reinventing CadburyDocument3 pagesReinventing Cadburysushant_shaantNo ratings yet

- Reorganizing HPDocument11 pagesReorganizing HPsushant_shaant100% (1)

- Archives: Case AnalysisDocument5 pagesArchives: Case Analysissushant_shaantNo ratings yet

- Regular Features: View Demo Editorial To Our Readers Data Bank Book SummaryDocument3 pagesRegular Features: View Demo Editorial To Our Readers Data Bank Book Summarysushant_shaantNo ratings yet

- Regular Features: View Demo Editorial To Our Readers Data Bank Book SummaryDocument3 pagesRegular Features: View Demo Editorial To Our Readers Data Bank Book Summarysushant_shaantNo ratings yet

- VolatilityDocument8 pagesVolatilitysushant_shaantNo ratings yet

- Operational RestructuringDocument3 pagesOperational Restructuringsushant_shaantNo ratings yet

- Why MBA After BEDocument1 pageWhy MBA After BEsushant_shaantNo ratings yet

- Essar SteelDocument3 pagesEssar Steelsushant_shaantNo ratings yet

- Modi Rubbers Vs Financial InstitutionsDocument14 pagesModi Rubbers Vs Financial Institutionssushant_shaantNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Module 3 - Computer SoftwareDocument3 pagesModule 3 - Computer SoftwareErichelle EspineliNo ratings yet

- PH Meter SI400 Rev 02Document2 pagesPH Meter SI400 Rev 02kazokinoNo ratings yet

- Baknor Cold Plates Liquid and BrazedDocument2 pagesBaknor Cold Plates Liquid and Brazedthemike03No ratings yet

- HP 430 - 431 - 435 - 630 Cq43 Foxconn Chicago Montevina Uma Tpn-f101tpn-f102 Rev 0.1 SchematicsDocument46 pagesHP 430 - 431 - 435 - 630 Cq43 Foxconn Chicago Montevina Uma Tpn-f101tpn-f102 Rev 0.1 SchematicsMalith UdayangaNo ratings yet

- Kappa 60-1cs OmDocument4 pagesKappa 60-1cs Omtfieldho7131No ratings yet

- Mission I: The CyberteriansDocument3 pagesMission I: The CyberteriansSteven MooreNo ratings yet

- Informatica Bottlenecks OverviewDocument7 pagesInformatica Bottlenecks OverviewDhananjay ReddyNo ratings yet

- Introduction of MTK Tools V2 PDFDocument81 pagesIntroduction of MTK Tools V2 PDFmmlipu.iosNo ratings yet

- Yellow Black White Modern Doodle UI Computer Pitch Deck Marketing PresentationDocument13 pagesYellow Black White Modern Doodle UI Computer Pitch Deck Marketing PresentationJestia Lyn EngracialNo ratings yet

- OUI DocumentDocument216 pagesOUI Documentkfactor83No ratings yet

- TL 7660Document23 pagesTL 7660yustinus yondyNo ratings yet

- Instrucoes Power Stack OtsDocument3 pagesInstrucoes Power Stack OtsArturo PachecoNo ratings yet

- 715g7312 p01 000 0020 - Philips - PsuDocument6 pages715g7312 p01 000 0020 - Philips - PsuAlberto CamarenaNo ratings yet

- Setari Bune Pentru PerformanteDocument4 pagesSetari Bune Pentru PerformanteArmagedonNo ratings yet

- Cpu OrganizationDocument5 pagesCpu OrganizationNavis Nayagam100% (2)

- TCC-CBG 25 (30) 30 (28) LitDocument360 pagesTCC-CBG 25 (30) 30 (28) Lithuuthao100% (2)

- Instrumentation SpecsDocument1 pageInstrumentation SpecskapsarcNo ratings yet

- Taller Ley Ohm Resistores y KirchoffDocument19 pagesTaller Ley Ohm Resistores y KirchoffgrinllowNo ratings yet

- Vodafone Webbox User Manual (Kenya - EN) 20110504Document42 pagesVodafone Webbox User Manual (Kenya - EN) 20110504Johnny DoeNo ratings yet

- Abbriviations SiemensDocument12 pagesAbbriviations SiemensmahmoudidworkNo ratings yet

- 22 05 16-Expansion Fittings and Loops For Plumbing PipingDocument8 pages22 05 16-Expansion Fittings and Loops For Plumbing PipingMahmoud GwailyNo ratings yet

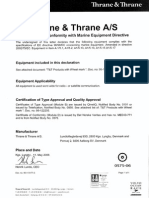

- System 4000 500W Declaration of ConformityDocument8 pagesSystem 4000 500W Declaration of ConformityPalaKhartikeyanNo ratings yet

- Brian Madden and Ron Oglesby - Terminal Server 2003Document511 pagesBrian Madden and Ron Oglesby - Terminal Server 2003api-3847330100% (2)

- Ece III Logic Design (10es33) NotesDocument193 pagesEce III Logic Design (10es33) NotesAditya HegadeNo ratings yet

- Bosch Me7.4.5 1033Document2 pagesBosch Me7.4.5 1033Rafael FávaroNo ratings yet

- Manual Raytek MI3Document145 pagesManual Raytek MI3Robson Gomes da SilvaNo ratings yet

- Tyros To Loops Import InstructionsDocument10 pagesTyros To Loops Import InstructionsAli DkaliNo ratings yet

- ITEC3116-SNAL-Lecture 05 - Linux Installation by VMWplayer & Virtual BoxDocument21 pagesITEC3116-SNAL-Lecture 05 - Linux Installation by VMWplayer & Virtual BoxHassnain IjazNo ratings yet

- University of Essex: School of Computer Science andDocument6 pagesUniversity of Essex: School of Computer Science andVlad SimizeanuNo ratings yet

- Manual Craftman 10inch SawDocument44 pagesManual Craftman 10inch SawGabriel DobrinoiuNo ratings yet