Professional Documents

Culture Documents

Åå Éìêå P Äíw Mìääáå Eé Äíü Åç Mêáî Íé Båíéêéêáëé Fççáåé Aéñáåáéååó Aáëçêçéê Efaaf Áë Íüé Ïçêäçûë Äé Çáåö Å Ìëé ÇÑ

Åå Éìêå P Äíw Mìääáå Eé Äíü Åç Mêáî Íé Båíéêéêáëé Fççáåé Aéñáåáéååó Aáëçêçéê Efaaf Áë Íüé Ïçêäçûë Äé Çáåö Å Ìëé ÇÑ

Uploaded by

Siddhant PuthranOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Åå Éìêå P Äíw Mìääáå Eé Äíü Åç Mêáî Íé Båíéêéêáëé Fççáåé Aéñáåáéååó Aáëçêçéê Efaaf Áë Íüé Ïçêäçûë Äé Çáåö Å Ìëé ÇÑ

Åå Éìêå P Äíw Mìääáå Eé Äíü Åç Mêáî Íé Båíéêéêáëé Fççáåé Aéñáåáéååó Aáëçêçéê Efaaf Áë Íüé Ïçêäçûë Äé Çáåö Å Ìëé ÇÑ

Uploaded by

Siddhant PuthranCopyright:

Available Formats

From the Department of

LEADI NG I N THOUGHT AND ACTI ON

Pr oduct Number 000

Rel eased August 31, 2003

CASE STUDY SERI ES

`lomlo^qb=pqo^qbdv=^ka=fkqbok^qflk^i=_rpfkbpp=

[=

1his report was written by Anu;a Ra;endra and

1e; Shah under the supervision o Proessor C.K.

Prahalad. 1he reports are intended to be catalysts

or discussion and are not intended to illustrate

eective or ineective strategies.

Copyright 1he University o Michigan

Business School, !00!.

^~~=p~W=

m=e~=~=m~=b=

=

= Iodine Deiciency Disorder (IDD) is the world`s leading cause o

mental disorders, including retardation and lowered IQ. Research

indicates that !0/ o the world`s population is at risk o IDD. Well-

balanced diets provide the required amount o iodine, making the poor

particularly susceptible to IDD. In India, almost 0/ o the population

earns less than 3!,000 per year

J

; over 0 million are already inlicted

with IDD and another !00 million are at risk.

!

Since even the poorest

eat salt, it is globally recogni.ed as the best vehicle or supplementing

diets with iodine.

However, many still do not receive the required amount o iodine rom

salt because:

Only about !/ o edible salt in India is iodi.ed.

Many consumers are not educated on the human body`s

requirements or iodine despite the availability o iodi.ed salt in

the marketplace.

Fven those who understand the importance o iodine may be

reluctant to pay the premium or iodi.ed salt over the cost o

non-iodi.ed salt.

1raditionally iodi.ed salt loses a signiicant amount o iodine in

storage, transportation and Indian cooking. Fven consumers

who purchase iodi.ed salt or its health beneits may not

actually receive the recommended daily allowance o iodine.

Rel eased December 12, 2003

qeb=fkkls^qflkK=K=K=

1he parado o the Iodine Deiciency Disorder, the leading

cause o mental disorder among the poor, is that the solution is

known and is inepensive. 1he issues are how to reach and

educate the poor while, at the same time, getting salt producers to

innovate inepensive methods to guarantee a minimum level o

iodine concentration in salt. In developing countries, such as

India, traditional methods o iodi.ing salt are no guarantee that

the salt will retain its iodine content as it reaches the consumer.

2003 Uni ver si t y of Mi chi gan Regent s

2 of 30

Released December J!, !00!

Non-governmental organi.ations (NGO) and governmental organi.ations are traditionally called upon to

solve problems pertaining to the poor and public health crises such as IDD. Nonproit organi.ations oten

beneit rom grassroots links, long-term commitment toward a single cause, cost-eectiveness and political

inluence.

!

According to Dr. C. S. Pandav, India`s Regional Coordinator or the International Council or the

Control o Iodine Deiciency (ICCIDD), NGOs have critical strengths:

NGOs serve as an interace between people, especially those who are poor and needy, and the private

sector/governments. In other words, they orm a link between those who have and those who do not

have. 1he strength o an NGO such as ours is competence, commitment, credibility, collaboration and

advocacy.

!

Conversely, multi-national corporations (MNC) typically limit their involvement with the poor to corporate

social responsibility. Although many MNCs have tapped into India`s wealthy, urban populations, ew have

attempted to reach the poor. Multi-national corporations have key capabilities, such as technological know-

how, distribution networks, marketing eperience and inancial backing that enable them to combat public

health problems such as IDD at a proit. 1hough nonproit organi.ations are competent in dealing with such

issues, it is rare or any one to have the same breadth as an MNC. 1he key to tackling epidemics such as IDD is

the collaboration between nonproits and MNCs.

Hindustan Lever Ltd.`s (HLL) technological innovation, Annapurna salt with stable iodine, demonstrates how

nonproits and a large, or-proit corporation, together, can bridge the gap between:

IDD and a more healthy population

1he poor as a problem and the poor as a source o innovation and proits

As Rehka Balu o IastCompany Maga.ine describes:

Poor people, HLL`s{ eecutives believe, can become ;ust as discerning about brands as rich consumers.

And i brands eist as a store o value - a promise about a product`s distinctive qualities and eatures -

then oering poor consumers a real choice o brands means oering them a slightly better quality o lie.

Marketing well-made products to the poor isn`t ;ust a business opportunity; it is a sign o commercial

respect or people whose needs are usually overlooked.

q=m=e~=`W=f=~=f=a=a==

Iodine is a chemical element that is most prevalent as iodide (I-), iodate (IO

!

-) and elemental iodine (I

!

). I1a-

(Greek or violet) was named or violet vapor that was isolated during gunpowder production. Iodine has been

known to have medicinal purposes since the ourth century AD when a Chinese physician, Ko Hung,

prescribed an alcoholic etract rom iodine-rich seaweed to patients suering rom goiters. In J8J, Jean-

Baptiste Dumas, a prominent Irench chemist, proved iodine was present in natural sponge, a standard

treatment or goiters at that time.

2003 Uni ver si t y of Mi chi gan Regent s

3 of 30

Released December J!, !00!

Iodine, produced in the thyroid gland at the base o the neck, is critical or the production o two thyroid

hormones, thyroine (1!) and triiodothyronine (1!), which optimi.e physical and mental development, aid

with cellular metabolism and allow cells to manuacture proteins. When the body does not have suicient

iodine, this results in IDD (Iodine Deiciency Disorder).

6

Research has been done to estimate the proper dosage

o iodine required and common ways o consuming the essential nutrient. (1echnical Appendi J)

f=a=

=

Iodine Deiciency Disorder (IDD) is the world`s leading cause o mental deects, including severe retardation,

dea-mutism and partial paralysis, and can adversely aect the entire human body, including its muscles, heart,

liver, kidneys and the developing brain. IDD also can cause growth retardation, reproductive ailure,

childhood mortality, physical sluggishness and other deects in the development o the nervous system.

One o the most visible signs o IDD is a goiter. 1his painul growth occurs when the thyroid enlarges in an

attempt to compensate or inadequate hormone production.=In a healthy body, the pituitary gland sends the

proper amount o 1SH (thyroid stimulating hormone) to the thyroid to stimulate the production o 1! and

1!, both o which require a certain level o iodine in the body. When the thyroid does not receive enough

Iodine, the 1! and 1! hormones are not produced in adequate quantities. 1he pituitary gland reacts to the low

levels o 1! and 1! hormones in the body by sending more 1SH to the thyroid, causing the thyroid to enlarge.

1his enlargement leads to goiter. Approimately 0 million people in the world were diagnosed with this

painul growth during the J0s.

Children living in iodine-deicient areas have an average Intelligent Quotient (IQ) J! points less than that o

children in iodine suicient areas. 1he most severe orm o IDD is hypothyroidism and is prevalent among

young children in remote areas where the daily iodine intake is less than ! micrograms (mcg).

Hypothyroidism causes cretinism, gross mental retardation and short stature.

In most parts o Asia, IDD is less prevalent in coastal regions, but continues to be problematic in interior

mountainous provinces. Japanese, who not only eat a great deal o ish and seaweed but also ertili.e crops with

seaweed, are not aected by IDD as much. Poor populations, or whom consistent, well-balanced diets are not

available, must obtain iodine rom another source. Incidences o IDD around the globe illustrate the parity

between rich and poor countries (Fhibit J). Along with Vitamin A and iron deiciency, IDD can decrease the

economic wealth o a nation by up to /.

1he International Council or the Control o Iodine Deiciency Disorder (ICCIDD) is a nonproit, non-

governmental organi.ation ormed in J8 with support rom UNICFI and the World Health Organi.ation

to apply knowledge about IDD to help eradicate the disease worldwide. 1he ICCIDD has become the most

signiicant nonproit organi.ation dedicated to iodine deiciency in India.

=

2003 Uni ver si t y of Mi chi gan Regent s

4 of 30

Released December J!, !00!

b=f=

Fcess iodine also can cause health alictions including thyroid underactivity, where large amounts o iodine

block the thyroid's ability to produce 1! and 1!. Individuals` tolerances or iodine vary; those with a tendency

toward autoimmune thyroid diseases (e.g., Graves' disease or Hashimoto's thyroiditis) and those with a amily

history may be more sensitive. Some research has indicated that ecess iodine also can lead to papillary thyroid

cancer, although this has not been proven. (Papillary thyroid cancer is usually mild and rarely causes death.

8

)

Although ecess and deicient iodine are both undesirable, the latter is worse because it can cause permanent

brain damage.

=

f=p~=

1he prevention, control and elimination o IDD depend upon increasing iodine intake. Intervention measures

designed to cover entire populations include iodi.ing salt, water, bread and oil. Iodi.ed salt is the best vehicle

since salt is one o the ew commodities that is universally consumed across socioeconomic and geographic

segments. Iurther, iodi.ing salt is inepensive, costing approimately J0 U.S. cents per person per year (1able

!).

J0

Other supporting actors include salt`s wide production and distribution network, and the act that adding

iodine to salt does not alter salt`s color, taste or odor. Properly iodi.ed salt will rarely add more than about !00

mcg o iodine daily to the diet. 1hereore, concern about iodine ecess is not a reason to stop or avoid

consumption o iodi.ed salt.

q~=NK=m=`==f=p~=E^=f~=m~==N=_F

a= b~=

Desired level o iodine in Salt !0 ppm (parts per million) !0 mg/kg

1otal requirement o iodi.ed salt 6,000,000 tons

1otal requirement o iodine J80 tons

Cost o iodine per ton Rs.60,000

1otal cost o iodine per year Rs.J0.8 crores

JJ

Cost o iodine per person per year Rs.0.J08

1otal lietime cost or a person (0 yrs) Rs..6 (30.J6)

Needless to say, the total cost o getting iodi.ed salt to the consumer and convincing her to consume it, adds to

the cost.

=

=

2003 Uni ver si t y of Mi chi gan Regent s

5 of 30

Released December J!, !00!

p~=j~==

=

India`s salt market is dominated by more than !00 local players producing unbranded products o varying

quality. A ew branded manuacturers produce 00,000 to 600,000 tons per year, while most local producers sell

less than J,000 tons (Diagram !).

J!

a~~=NW=b=p~=s~=^~~==f~==

Unlike other parts o the world, mineral salt only composes / o the Indian salt market because India`s

topography does not lend itsel to salt mines. Ninety-ive percent o Indian salt is obtained by salt arming,` a

lengthy evaporation process whereby seawater is pumped and stored in man-made inland pans. High

temperatures along these coastal pans evaporate the water, leaving behind unreined salt. In India alone, about

J0 million tons o natural evaporated salt are armed yearly, o which !0/-!/ are or industrial use and /

or edible consumption. O the edible salt, !/ is reined and / is consumed unreined, unbranded and

unpackaged. Fight hundred thousand tons o salt are iodi.ed and packaged or consumption.

1he salt market attracts a large number o producers, despite its being a low unit price business. Salt margins

can be quite high and although the absolute values o revenues and proits are not as high as some consumer

products, such as soaps and detergents, the return on capital employed make or an attractive business.

Because it is virtually impossible to dierentiate reined salt on the basis o taste, smell or color and because

honest packaging laws are inadequately enorced, Indian consumers ace unique challenges:

Imitation brands such as Captain Hook` in place o Captain Cook` or 1ota` or 1ata` lead conused

consumers to purchase the wrong product.

Many manuacturers print iodi.ed salt on packs when, in act, the salt is not iodi.ed.

Crystal/Loose

(Unrefined)

Branded Unbranded

Packaged

Refined Unrefined

Branded Unbranded Branded Unbranded

Iodized Non-iodized Iodized Non-iodized

Iodized

Iodized Non-iodized Iodized Non-iodized

Iodized Non-iodized

2003 Uni ver si t y of Mi chi gan Regent s

6 of 30

Released December J!, !00!

a=j~=

=

Diverse tastes and cultural variations urther complicate the demand or salt in India. Ior eample, South

Indians tend to preer crystal salt, especially in the salt-producing state o 1amil Nadu Andhra Pradesh and

Karnataka. Many Gu;arati consumers purchase loose salt and use a large iron to pound it into smaller crystals

themselves, making it more diicult to sell them already reined salt. Small packs o reined salt are popular in

the west while in the north and east, where salt is not readily available, Jkg packages drive penetration.

J!

f=p~==f~=

=

Under pressure rom the world health community, China (J) and India (J) banned the sale o non-

iodi.ed salt. India`s Universal Salt Iodi.ation law mandated that all salt manuacturers add at least J ppm o

iodine to edible salt.

J!

1he law was hailed by the health community. However, it was vehemently protested by

independent salt producers who accounted or nearly one-third o India's salt production that was consumed

by !00 million people. 1hese producers argued they could not aord the additional cost o purchasing iodine,

machinery and packaging to iodi.e salt.

J

Salt industry employees continued to consume non-iodi.ed salt. (1his

population is now alicted with some o the highest incidences o IDD.) Succumbing to intense lobbying by

the producers, many o whom operated manual J0-acre coastal plots that were leased rom the government, the

government o India repealed the Universal Salt Iodi.ation law in July !000.

Although a ew manuacturers voluntary added iodine, most uneducated consumers continued to purchase the

lower-priced un-iodi.ed salts, perpetuating IDD. Since !000, a ew individual states, including Gu;arat, have

reversed the ederal government`s repeal and orced manuacturers to iodi.e salt.

f=`~~=~=hNR=q=

=

Iodine is added to salt by spraying a solution o KIO

!

(Potassium iodate is the most common iodi.ing agent in

India and other tropical regions) or o KI (Potassium iodine is an iodi.ing agent used in most western countries

and is less stable than potassium iodate). Net, the salt-iodine miture is dried and orms a homogeneous

coating on the salt`s crystal surace.

f=i==f~=p~=

Potassium iodate is very stable on its own and the iodine is retained even in varying ambient conditions;

however, this compound becomes unstable when it interacts with salt. Research indicates that environmental

actors such as air moisture, high temperatures, poor quality o raw salt, impurities in salt, low environmental

pH and time beore consumption can all eaggerate the instability o salt iodi.ed with potassium iodate,

resulting in ecess iodine loss. Most Indian salt is armed in desert areas near India`s coastline and must be

transported long distances to reach consumers, adding storage time and eposure to eternal conditions.

According to the National Institute o Nutrition (NIN) in Hyderabad, India: Under Indian climate and

2003 Uni ver si t y of Mi chi gan Regent s

7 of 30

Released December J!, !00!

storage conditions, iodine loss in ortiied salt has been observed to be !/ to !/ in the irst three months and

!0/ to 0/ by one year.`

!8

Indians` unique cooking style leads to urther iodine loss. 1raditional Indian cooking calls or salt to be added

beore ood is heated, boiled, ried or cooked in any way; this contrasts with most western cooking where salt is

added or taste ater ood has been completely cooked. In addition, the varying pH levels o Indian spices

interact with salt and result in urther iodine loss. 1he loss o iodine in Indian culinary practices ranges rom

!0/ to 0/.`

!

=

A J study at the All India Institute o Medical Sciences (AIIMS) estimated the iodine lost in cooking 0

common Indian recipes that called or steaming, pressure-cooking, roasting, deep rying, or boiling (Fhibit

!a). 1he mean losses o iodine are displayed in 1able !.

0

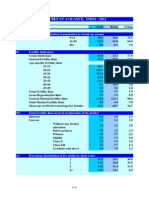

q~=OK=f=i==p~=a==f~=`==

1ype o cooking

procedure

Mean I

!

content o

uncooked sample

Mean I

!

content o

cooked sample

M-.a / / / I

2

Pressure Cooking 6.68 mcg/J00g .!J mcg/J00g /2I2;

Boiling 6.J !. /cco;

Shallow rying .! !.8 /2c71;

Deep rying 8.J 6.8 /I;

Roasting J!.8 J!.! /1;

Steaming 6.8 . /2oc2;

1he study concluded that the cumulative eect o heat, storage and cooking can result in an almost complete

loss o iodine by the time the consumer eats salt. Since salt is the primary carrier o iodine and a typical adult

consumes J0g o salt per day, iodi.ed salt must be able to deliver J parts per million (ppm) o iodine upon

consumption to achieve the recommended daily allowance o J0mg o iodine per day. Acknowledging that

iodine is lost during storage and transport, the Indian Prevention o Iood Adulteration law o September !000

mandated that manuacturers o iodi.ed salt add at least !0 ppm o iodine to ensure that J ppm are delivered

to the consumer at retail. 1his law, however, did not take into account the iodine lost during Indian cooking.

=

q=_==p~==f~=

A ew national players dominate the market with numerous local players. Although many brands o salt are

also iodi.ed, only Annapurna (marketed by Hindustan Lever Ltd (HLL) is marketed on the Idodi.ed and

health platorm.

=

=

=

2003 Uni ver si t y of Mi chi gan Regent s

8 of 30

Released December J!, !00!

q~~=p~=

1ata Sons Ltd. is a 3J0 billion dollar conglomerate with 80 companies serving its seven business sectors. With

unmatched breadth rom automobile engineering to inormation technology communications to hotel services,

1ata is the most recogni.able brand in Indian business.

1ata has been the dominant player in the salt market or over !0 years with a ocus on the Jkg package in the

urban market. 1ata markets its salt as pure and as D-/ (. a..( (the country`s salt) to upper-income

segments.

1ata salt is a by-product o sodium bicarbonate, or soda ash. 1he company produces nearly 0/ o India`s total

capacity or soda ash. Consumers are comortable with 1ata`s household name and the quality o the salt, but

the company has not eerted a strong branding campaign, relying instead on the strength o its name.

=

a~=

=

In !00J, Kunvar A;ay Ioods Private Ltd. introduced Dandi Salt as high quality, triple reined and reasonably

priced.

J6

Leveraging the historical importance o Mahatma Gandhi`s J!J Salt March to Dandi Beach, Dandi

salt was purposely named as such to evoke patriotic and emotional attachment to the brand. Dandi`s aggressive

advertising resulted in high irst purchases; however, consumer complaints about its poor taste and appearance

adversely aected repeat purchases.

l=`=

ca.. entered the market with Healthy World salt.

c./ entered the branded staples market with wheat lour and subsequently introduced Nature Iresh`

iodi.ed salt.

N. L/1 introduced Nirma Salt with severe discounting and caused disruption and losses or

Annapurna in the wholesale channel. Promotions included giving salt or ree with the purchase o Nirma

Washing Powder, its popular line o detergents.

I///a; entered branded staples with Pillsbury Atta` and may be a uture entrant into the salt market.

I1c, which was originally limited to the tobacco business, entered the atta and salt markets with its

Aashirvad` brand.

Na-a .aa/./a- o unreined, unwashed salt that has iodine added right at the salt pan areas sells

or Rs.! per kg.

Haa1-1 / /./ /.;- vie or market share in various pockets o the country. Irom a cost perspective,

local producers save on transport by selling only in areas close to salt arms.

=

2003 Uni ver si t y of Mi chi gan Regent s

9 of 30

Released December J!, !00!

eii=`~=m=

=

Unilever is a Iortune 00 multinational corporation, selling ood and home and personal care brands through !00

subsidiary companies in more than J00 countries. Unilever products are available or purchase in 0 additional

countries. In J!J, Unilever created its irst Indian subsidiary, Hindustan Vanaspati Manuacturing Company,

ollowed by Lever Brothers India Limited (J!!) and United 1raders Limited (J!). 1hese three companies

merged to orm Hindustan Lever Ltd. in November J6. 1oday, HLL is one o Unilever`s largest subsidiaries

with the parent company holding !/ equity.

HLL is India's leading ast-moving consumer goods company with !!,!00 employees (!0,000 including group

employees) in both the Home Personal Care Products and Ioods Beverages segments and is India's largest

eporter o branded consumer products. 1his industry giant continues to win accolades or its innovative

business strategies and uncanny ability to adapt to diverse markets in India and around the world. Iorbes

Global has rated HLL the best consumer households company u/1u1-`

J

HLL`s corporate vision is

engrained in its employees rom the onset o their careers:

1o meet everyday needs o people everywhere - to anticipate the aspirations o our consumers and

customers and to respond creatively and competitively with branded products and services which raise

the quality o lie.

-HLL Vision Statemen

eii=b==_~=p~=

= =

O India`s Rs.!. trillion oods market, 8/ is unprocessed (Iigure J). O the unprocessed, !8/ was ood grains

and staples (Iigure !). 1he Popular Ioods division recogni.ed this potential and entered branded staples in the

mid-J0s.

J8

Iigure J. Iood market structure in India

78%

16%

6%

Processed (ready or consumption)

Semi - Processed

(require urther processing/cooking)

Unprocessed (raw/resh)

2003 Uni ver si t y of Mi chi gan Regent s

10 of 30

Released December J!, !00!

c=OK=r==~==f~

NV

=

Oils & Oil Seeds,

8%

Sugar, 6%

Coffee/Tea/Others

, 3%

Foodgrains &

Staples, 38%

Milk & Milk

Products, 21%

Fruits & Veg, 15%

Meat/Egg/Fish,

9%

According to Dhawan, HLL made the decision to enter the branded staples business with salt and atta (milled

wheat lour) by assessing their branding potential:

Which products have the best potential or branding How can we develop the undeveloped ood

staples market People want the assurance o a high-quality, hygienic ood product, which is oten

diicult to dierentiate in something like salt. Consumers are looking or a brand to provide them

with that trust. We decided we could provide that with salt and atta.`

!0

HLL created the +aa.aa. brand or its new line o salt and atta. +aa.aa. (.a means ood or grain; aa.

means to prepare) is the name o the Hindu goddess o abundance.

q=b==^~~=p~=

=

1he timeline below details the product evolution o Annapurna salt over its eight-year history.

!6

NVVRW Annapurna salt was launched in the southern state o Andhra Pradesh in a test market and positioned as

a a- salt. 1his entry had limited success because all salts looked pure, and 1ata salt was already established

under this platorm.

2003 Uni ver si t y of Mi chi gan Regent s

11 of 30

Released December J!, !00!

NVVTW As the government o India and the ICCIDD increased attention upon the problems o iodine deiciency

and the role salt could play to combat IDD, HLL sei.ed the opportunity to become the irst to market salt on

an 1.-1 platorm. 1hough other branded salts were iodi.ed, none were advertised as such. HLL became the

irst corporation to address IDD-related health concerns such as mental retardation and goiters and earned the

ICCIDD. Meanwhile, additional reports by non-governmental organi.ations such as the World Health

Organi.ation revealed that unacceptable amounts o iodine leave salt during manuacturing, storage and

transport, and during the Indian` cooking process.

OMMMW Annapurna`s new line o iodi.ed ;/./ salt was launched in South India as the cleanest, whitest, most

evenly si.ed on the market. 1he launch was successul and inventories were quickly depleted.

OMMNW Annapurna was re-launched with HLL`s proprietary stable iodine (KJ) technology, which limits iodine

lost during storage, transportation and Indian` cooking. By now, the granularity and other eatures o

Annapurna salt were much better as well, although advertising did not relect these improvements. Marketing

or the new product included the hiring o a public relations company to educate consumers on how KJ could

help diminish the prevalence o IDD in India. Soon thereater, Annapurna overtook Captain Cook and

became a close second to 1ata salt in market share.

g~~=OMMPW Annapurna Platinum salt was launched on a mineral balance` platorm. Platinum contains the

same level o stable iodine as Annapurna; however, it has less sodium than most salts to appeal to consumers

with high blood pressure.

^=OMMPW 1he Annapurna brand merged with Knorr to become Knorr-Annapurna. Knorr-Annapurna

ocused on authentic Indian cuisine in three segments: soupy snacks, cooking aids (pastas, spices, etc.) and

branded staples, which were headed by Dhawan`s team. 1he new Knorr-Annapurna salt packaging had the

key message o stable iodine printed on the ront more prominently than the old Kissan-Annapurna package

(Fhibit !).

Dhawan ;ustiied the Annapurna evolution as necessary:

Annapurna needs to give reasons or the market to epand and that has happened. 1he number o re-

launches is not too requent in this market. 1he lie o a product is usually J8 months. Because the

name has remained the same throughout, each launch has had us going back with the strongest, most

relevant perspective. We have gained market share each time. Who knows what beneits may be ahead

with salt

=================================================

e~=i=o~=p~W=

Unilever operates ive research acilities worldwide: one in the United Kingdom, one each in Holland and

Fdgewater, New Jersey, and two HLL laboratories with scientists between them in Bangalore and Andheri

(a suburb o Mumbai). HLRC in Andheri opened in J8 to anticipate and meet the demands o Indian

2003 Uni ver si t y of Mi chi gan Regent s

12 of 30

Released December J!, !00!

consumers. HLRC`s innovation is recogni.ed globally and has evolved to service other subsidiaries within

Unilever as well.

HLL scientists work closely with their business counterparts to anticipate and understand market demands.

Dr. A.S.=Abhiraman, a ormer chemical engineering proessor at Georgia 1ech University, is HLL`s Director

o Research and actively recruits researchers rom the top technical schools around the world who aim to set

standards in marketable science:

1he diiculty in research is what to innovate, not how to innovate. Research must be business relevant.

Business occasionally only sees the reality o today but sometimes society does not articulate need or a

product beore it is created.

!

eio`=~=^~~=p~=

=

1he J launch o Annapurna salt orced HLL to compete at the lowest price point o any product in the

history o HLL; the brand team reali.ed the need to dierentiate the commodity in the increasingly

competitive salt market. In J, Dr. Amitava Pramanik, an HLRC research scientist, developed the

composition or the irst Annapurna, which would be marketed as the most pure` salt. Ater the launch, sales

and market research indicated consumers were more interested in the appearance and taste o salt than its

chemical properties. Praminik`s team continued to search or a dierentiator or Annapurna salt:

I remember reading an article by the Central Salt and Marine Chemicals Research Institute that

mentioned the stability o iodine in salt is poor and can be lost in storage. 1hat article, published in late

J!, was ollowed by a variety o publications that claimed that up to 0/ o iodine can be lost during

Indian cooking. 1his publicity gave us the idea we could dierentiate Annapurna on the iodi.ed salt

platorm - a recogni.ed deiciency in other branded salts.

Dr. Amitava Pramanik

As the public health community, including the World Health Organi.ation, ICCIDD and the government o

India called Iodine Deiciency Disorder the leading preventable ailment in India, Praminik and his team

narrowed ocus to developing a technology that could guarantee that substantial iodine would not be lost

during storage, transport and cooking, and J ppm were actually delivered to customers. 1heir reasons were

twoold:

J. 1o provide the brand team with a dierentiator no competitor could match.

!. 1o help combat IDD in India.

eii=p~=q~=j~=

=

HLL deines its various customer segments based on amily income, with A being the richest and D being the

poorest. 1he Knorr-Annapurna salt 1arget Group (1G) is young mothers in socioeconomic segments C and D

between ! and !0 years o age, who are responsible or their household cooking and purchasing decisions.

2003 Uni ver si t y of Mi chi gan Regent s

13 of 30

Released December J!, !00!

HLL believes these mothers` priorities include keeping their amilies healthy and ensuring their children grow

up bright in an increasingly competitive society. In a recent HLL poll o women in the 1G, 6/ indicated they

had seen a message about stable iodine at least our times in the last one and a hal years. 1he administrators o

the survey did not inquire about the percentage that retained the message.

Knorr-Annapurna Platinum is targeted to=the A and B socioeconomic segmentsK Although Platinum is a low-

sodium salt solution or consumers with high blood pressure, its positioning is mineral balanced` to convey an

image o an established liestyle. 1he marketing team believes the communication around Platinum must be

updated. 1he larger cities have the greatest churn in the market, so the greatest ocus or Platinum has been on

urban markets.=

=

eii=m=i=~=m=

=

Indian law mandates retail products must be sold at a Maimum Retail Price (MRP), which is printed on the

packaging. 1he price is printed on the packaging and some retailers charge less than this amount to draw

customers. Annapurna salt packaging is printed in numerous vernacular languages; even i a consumer is

literate, she may speak one o India`s J! oicial languages or 00 dialects Annapurna`s best-selling SKU to

date is priced at Rs..0 or a Jkg pack, the same as that o 1ata salt (1able ).

Annapurna also introduced !00g and 00g Low Unit Price (LUP) packs to appeal to consumers in the bottom

o the pyramid. Although the proportionate cost o manuacturing LUPs is currently higher than that o the

Jkg bag, HLRC is researching technologies that would drive the cost down. 1o this, Narayan adds:

1able !. SKUs o Branded Salts

_~= p= m=EoKF= q~=j~=

Knorr-Annapurna !00g J.0 Bottom o the Pyramid

Knorr-Annapurna 00g !. Bottom o the Pyramid; Middle class

Knorr-Annapurna Jkg .0 Middle class

Knorr-Annapurna

Crystal

!00g N/A

Bottom o the Pyramid; Regional

Knorr-Annapurna

Crystal

00g N/A Regional

Knorr-Annapurna

Platinum

Jkg J0.0 Urban upper income

Captain Cook Jkg .0 Urban upper income

Dandi Salt Jkg . Middle and upper income

1ata Salt Jkg . Urban upper income

1ata Salt 00g !.0 Urban middle class

2003 Uni ver si t y of Mi chi gan Regent s

14 of 30

Released December J!, !00!

Annapurna retails at the same unit price, regardless o the package si.e purchased. As Annapurna targets

bottom o the pyramid consumers more aggressively, this strategy could be an advantage against competitors

who charge premiums or small packs. LUPs have been slow to penetrate mass markets; however, they have

been successul in surprise niche markets such as college students living in hostels.

eii=j~=p~=

In determining which part o the salt market to enter, HLL considered which segments oered the greatest

potential. In J, ater considering input rom brand managers and eecutives, Kapur led his team to enter

the reined salt market with the primary goal o upgrading the / unreined market (bottom o the pyramid

consumers) to Annapurna and the secondary goal o converting branded consumers to Annapurna. Dhawan

stands by the decision and this continues to be the order o ocus or the HLL salt team:

^~~=j~=

=

Annapurna salt is being marketed in two phases; the irst message is that iodi.ed salt, in general, helps prevent

IDD and goiters. 1o urban and upper income markets that are more aware o the importance o iodi.ed salt,

Annapurna`s message is that KJ speciically helps increase mental agility and IQ. Our campaigns continue to

emphasi.e that Annapurna`s iodine is dierent, that it does not get lost.

^=

1he salt team believes all mothers are motivated by the same dreams o bright, healthy children. All o

Annapurna`s advertisements convey this message. 1his strategy is similar to that o most HLL products ecept

ice cream, which is a luury purchase in India and is marketed only to urban top-income groups.

During the !00J launch o Annapurna with KJ, HLL aired a puppet show about IDD on Doordharshan, an

Indian government-run television network, sharing costs equally with the network. 1he inomercial was

etremely successul, winning awards rom Unilever or its eectiveness o delivering a retainable message.

According to HLL market analysis, the target group viewed Annapurna advertisements an average o our

times. Although the long-term retention is unknown, the immediate recollection o the advertisements`

message was about 0/. In the uture, Annapurna`s advertising will be tracked more careully. Advanced

1racking Process (A1P) is typically used our times per year on established brands and will be or the irst time

on Knorr-Annapurna salt ater the !00! launch.

h=_~==p=

j~=c~~=

=

Annapurna team members all share valuable insights into the challenges the salt market presents to the brand.

Z.a M./- a Regional Sales Manager or HLL: Fveryone must consume some orm o salt (thereore salt

itsel has J00/ penetration); however, this makes the channels even more comple. Ior eample, Annapurna

has !0,000-!0,000 outlets in Mumbai alone. So we need to put our products where the inrastructure supports

2003 Uni ver si t y of Mi chi gan Regent s

15 of 30

Released December J!, !00!

them; we also need to look at culinary, seasonings, snacks, etc. in the oods business; basically manage

categories well and make sure we have the inrastructure in place to support them.`

!!

=

D/.u.a: We must make the value proposition very clear to consumers. At an average o !00gm/month o

consumption, even i the consumers pay Rs.!/kg premium, it translates into ;ust !-! paise per day or a ma;or

health beneit`

!!

N..;.a: Salt is consumed at !kg per month in a household o our people. Annapurna costs Rs..0 while the

local product they can buy is Rs.! to Rs.!. Annapurna oers ull iodine without loss. 1he impact is not only on

goiters but also on mental development. Our challenge is to communicate the larger picture so consumers

connect that Annapurna can help them reali.e their aspirations and dreams.`

!

j~=p~=

=

1hough unbranded local manuacturers still dominate the salt market, branded salts are slowly increasing

shares (Fhibit ). 1ata salt remains the leader with J/ market share in an Rs.J!0-J!0 crore business. HLL is

a close second with J!/ market share and an Rs.J00 crore business o which Annapurna is JJ/ and Captain

Cook is !/. Other players with J./ to !/ market share each are Nirma, Shudh, Dandi, Nature Iresh,

Sprinkle and 1ota. In South India, where HLL has a strong presence, Annapurna is also the dominant salt.

North India also has mined salt available (Kala Namak`), which takes some o the branded salt business.

Narayan believes the slowdown in sales the prior year is not indicative o Annapurna salt`s uture:

Neither the overall salt market nor Annapurna grew in !00! because discounters such as Nirmas and

Dandi waged price wars. 1hey seem to have wiped themselves out o the market now. Nirma was

riding on the back o its eisting distribution network; the company tried to sell salt with detergent so

traders got higher margins. But they did not have enough advertising Rupees behind it; and, o course,

Nirma is known or detergents and toilet soaps and not oods. 1hey did not reali.e that ood is a

dierent business. Dandi had ta evasion issues.

!6

Ram Narayan, HLL

In its irst phase, advertising or Annapurna salt ocused primarily on iodine education. In act, in the

Doordarshan inomercial, the Annapurna name was only mentioned in the last ew seconds. 1he brand team

believed i the consumers were irst educated on the importance o iodine, they

m=

=

In natural evaporation salt arming, seawater is pumped into lat man-made salt pans. Conditions or salt

arms are very particular and include lat land between water and mountains, a coastline and plenty o resh air

2003 Uni ver si t y of Mi chi gan Regent s

16 of 30

Released December J!, !00!

and wind so the water can evaporate naturally, leaving behind unreined sea salt. Land that has been used or

salt arming becomes barren and cannot be used or other purposes.

eii=p~=m=

=

HLL procures raw salt rom privately owned salt arms and contracts with our third-party reineries to take

advantage o under-utili.ation in the reining industry and to minimi.e investment in manuacturing acilities.

1hese reineries are strategically located near salt arms to minimi.e inbound transport (1able ). At least one

HLL employee works with each reinery to ensure that the salt is manuactured per Unilever guidelines.

q~=QK=eii=qJm~=p~=o==

c~= i~= B==m=

==

p=~==

Gandhidam Near Bhu;, Gu;arat !/ Northern, Fastern,

Western

Jambusur Near Baroda, Gu;arat !/ Northern, Fastern,

Western

Chennai 1amil Nadu !/ Southern

1uticorin 1amil Nadu J!/ Southern

=

d~~=c~==

1he Gandhidam reinery, located in a vast desert close to the Arabian Sea, is the largest o the our. 1his

region, where wind and sun are plenty and rainall is rare, was the site o the !000 Oscar-nominated ilm

L...a. Its numerous salt pans are renowned or ecellent quality raw salt, which is pure, white and abundant,

drawing many manuacturers to the region. 1he purer the raw salt is the less washing it needs, resulting in cost

savings.

Western India Ltd. is one o the largest manuacturers o raw salt rom sea brine, owning 8,000 acres o land

near Gandhidam and producing si million tons o raw salt per year. 1he company was ormed in J! and

produced three tons o salt in its inaugural year. In J, HLL approached Western India with a proposition to

procure and manuacture salt or the Annapurna brand. Production began in J. While HLL contracts with

other salt manuacturers to produce Annapurna at the three other reineries, Western India may only produce

salt or HLL. HLL orecasts sales at the start o each month and inorms J.G. Natta, Managing Director o

Western India Ltd. (he goes by Javeri), o the required amounts.

n~=`=

= =

Birin Mehta is Western India`s Quality Control Manger at Gandhidam and is responsible or ensuring raw salt

and brine quality. Mehta has J chemists under him who work as Inspectors to ensure that HLL standards are

being met or salt quality and ingredients, weight and packaging. 1his team conducts tests every hour and has

the authority to re;ect non-conorming batches. Most batches do conorm, though, since re;ects are typically

2003 Uni ver si t y of Mi chi gan Regent s

17 of 30

Released December J!, !00!

discovered during processing. HLL has its own quality control group in Mumbai that tests random samples

obtained rom all our reineries.

m=`=~=t=f~=o==a~=q=

=

Industry costs or reined salt production include materials (!0/), transport rom arms to actories (!0-!/)

and materials and packaging (J-!0/). Western India has taken cost-cutting measures to decrease labor

requirements at Gandhidam. Since uel costs are determined by oil companies and the Indian government, the

company is ocusing on reducing uel requirements.

q~=

=

1ransport times can be very long due to India`s poor road inrastructure. Because the shel lie o salt is only

one year, minimi.ing storage time in the 1ua, decreasing transport distances and increasing the number o

consumer purchase points are vital. 1he Annapurna salt supply chain varies signiicantly rom region to region

and takes between J. and 6 months (rom natural evaporation o sea salt to a consumer`s purchase), the bulk o

which is during the salt arming stage. 1able shows post manuacture times in the supply chain or south and

west India.

q~=VK=b~==q==^~~=p~=p=`~==p=~=t=f~=

^= q=

1ransport rom Gandidham or Chennaii reinery to

stockist on J0-ton truck

! - days in transit

Held in stockist inventory ! - ! weeks

1ransport rom stockist to retailer ! - ! hours

Held in retailer inventory J - J. weeks

Unlike Annapurna, which is cleaned and packed prior to transport, 1ata salt (produced in bulk rom vacuum

evaporation) is transported to depots where it is cleaned and packed. Although 1ata loses economies o scale

with higher packaging costs (each depot must have packaging capabilities), consumers beneit with a resher

product. Mishra strives to optimi.e distribution:

I am always looking or ways to minimi.e the cost and width o distribution. Salt is not a high-value

product so distribution costs are almost equal to production costs. We must minimi.e salt handling.

60

=

= = = = Gopal Mishra, HLL

f~==q~=

1hrough !000, most salt was distributed on trucks, a method that was not optimal in north and east India or

the ollowing reasons:

2003 Uni ver si t y of Mi chi gan Regent s

18 of 30

Released December J!, !00!

Salt is produced in Gu;arat (west) and 1amil Nadu (south) and must be transported over long distances to

reach north and east India, resulting in high transit costs.

High reight cost due to the large number o trucks required.

Poor Indian road conditions, especially near hilly regions, causing long transit times.

Danger rom political etremists who control many roads in the northeast.

In response to these concerns, HLL successully eecuted a salt supply chain innovation in the beginning o

!00J. HLL began to use rail, mitigating some o the problems with trucking and earning an edge on

competitors. With this system, salt is transported on .(--si.ed rail carriages (J! carriages carrying up to !,!00

tons), vastly increasing the amount o salt that can be transported in one shipment. Rail transport adds a Salt

Buer Depot` step to the process, in which salt is loaded onto trucks or delivery to the stockist or retail outlet

(Iigure 8).

Iigure !. Rail Distribution

Rail has signiicantly improved eiciencies and decreased costs or salt distribution to locations ar rom HLL

reineries and has replaced trucks as the primary mode o distribution or the north and east (1able ).

6J

q~=RK=a=m~==o~=~=q=E^~F=

o= q==q~= B==^~~=p~=

North Rail J

Fast Rail J

South 1ruck !0

West 1ruck !0

Although rail was an improvement, HLL`s distribution team still ound it diicult to service customers

and believed that costs could be urther decreased.

Gopal Mishra, HLL

=

=

=

=

Factory Rail Transport Salt Buffer

Depot

Stockist Retail

2003 Uni ver si t y of Mi chi gan Regent s

19 of 30

Released December J!, !00!

o~=m=p=

=

One way HLL aims to increase consumer demand or Annapurna salt is by aggressively increasing volumes in

retail outlets. Although stockists educate retailers on HLL brand dierentiation, most retail outlets are driven

primarily by margins and schemes (promotions). Most dealers sell brands rom a variety o companies, many o

which oer competitive schemes (Fhibit 8).

Annapurna salt successully penetrated many retail chains and converted shopkeepers with superior

promotion. 1hese schemes have spawned price wars among manuacturers and resulted in even less brand

loyalty rom store owners.

==

a=a==o~=o~=f~=

One o the greatest challenges with rural India is that the media only reaches 0/ o the population. 1his

leaves over 00 million people that don`t see your message. 1he population lives in 600,000 villages and

over hal don`t have motorable roads, so we needed unique means to communicate to them. 1his

challenge is the same in other emerging markets.

-Vindi Banga, Chairman and CFO, HLL

m=p~=_~=

=

A J pro;ect identiied si new growth opportunities or HLL:

Conectionaries and sweets (Since its launch, candy marketed to the BOP has become HLL`s astest-

growing product.)

Consumer healthcare (1his resulted in the creation o HLL`s Ayush` brand.)

SANGAM, an e-tailing program or daily ordering and delivery. A pilot is being tested in Navi (New)

Bombay (Fhibit 6).

Addressing the needs o top-end consumers (Forts in this area have been met with limited success so ar.)

Water

3/.(/ (meaning strength in Sanskrit), a direct-to-consumer initiative targeted at individuals in the bottom

o the economic pyramid in rural India

Pro;ect Shakti was launched under the umbrella o New Ventures, a department created as a result o the

work. Shakti utili.es women`s Sel-Help Groups or Fntrepreneur Development 1raining to operate as a

Rural Direct to Home` sales orce, educating consumers on the health and hygiene beneits o HLL brands

and nurturing relationships to reinorce the HLL message. New Ventures contends this direct-to-consumer

initiative not only will stimulate demand and consumption to earn huge proits or HLL, but also change the

lives o people in rural India, something that mass-marketing alone cannot accomplish. Sharat Dhall leads

Pro;ect Shakti (Fhibit ):

We have our goals or Pro;ect Shakti. Iirst, we plan to increase our reach to the rural market. 1hen

we will attempt to increase awareness and change attitudes regarding usage o the various product

2003 Uni ver si t y of Mi chi gan Regent s

20 of 30

Released December J!, !00!

categories. Iinally, and most important, cataly.e rural aluence and hence drive growth o the

market.

6!

Sharat Dhall, HLL

In a typical SHG, J women invest Rs.J each daily into a ;oint account`. 1hese monies are loaned internally to

group members at interest rates between !/ and !/. Peer pressure oten inluences SHG members to have

higher repayment than more credit-worthy` lendees in urban and aluent areas, encouraging banks to loan

money to them. 1his enables the members to start new business ventures and gain economic empowerment.

1hey also can receive lending using cows, sheep and other property as collateral.

SHGs started ive years ago in Andhra Pradesh and two years ago in Karnataka with the support o the

governments. HLL uses SHGs as a medium to transmit HLL brand awareness and sales and to empower the

citi.ens o rural India.

Dhall continues:

Sel-help groups present an enormous Rural Direct to Home` opportunity or us. We are oering an

opportunity to create meaningul incomes or the people at the bottom o the pyramid. It also can be

very proitable or HLL. In December !000, a pilot in one district resulted in a signiicant increase in

household consumption ependiture on HLL brands and an overall increase in market share. In

addition, the women were creating stable, sustainable, risk-ree earnings. As a result o these promising

igures, the corporate oice approved the oicial launch o Pro;ect Shakti. Fven now, the venture is

low risk or HLL, and the potential increase in demand and consumption is astounding.

6!

Sharat Dhall, HLL

p~=_=d~=

=

Pro;ect Shakti has caught the attention o many within HLL who have recogni.ed the venture as an eciting

opportunity to penetrate the rural bottom o the pyramid, while inding double-digit savings in costs as

compared to using rural agencies.

HLL eecutives also believe Shakti oers intangible beneits, including increasing brand awareness,

developing new channels and social impact. 1hey assert that HLL`s role in the empowerment o rural women

is more important than sales alone.

=

f~=^~=

=

Regions where HLL distribution networks are already established (such as Kerala and 1amil Nadu) and

where the roads are already in good condition may not be as successul or Shakti, since they are within easy

reach o traditional distribution. A viable village or Shakti is a unction o many demographical actors,

including current purchase patterns, population and per capita income.=

2003 Uni ver si t y of Mi chi gan Regent s

21 of 30

Released December J!, !00!

p=p=

=

RSPs go door to door to obtain demographic inormation about a potential village and enter it into Shakti

Century, a tracking database. Promising villages have minimum populations o !,000 (600 homes with an

average o ive per household). 1he population is divided into our economic segments with potential villages

having at least J0/ in Segment A and J/ in Segment B:

Segment A: f.a1. (land owners) and other wealthy people earning over Rs.!,000 per month.

Segment B: Middle-class citi.ens whose employers pay them weekly. Monthly salaries are between Rs.J,000

and Rs.!,000.

Segments C and D: C may be viable but the D segment is not viewed as a potential market. 1hese

individuals earn less than Rs.J,000 per month and hardly purchase one bar o soap per month.

1he Shakti team also identiies satellite villages, typically within 8km o the dealer with populations between

J,000 and !,000. Satellite villages are not large enough to ;ustiy a separate dealer.

6!

i~=d=o~==p=p=

=

Mr. Pradeep Kashyap, known as the I.//- / Ra./ Ia1., is head o the Marketing and Research 1eam

(MAR1) consulting irm and was retained by HLL to help build strong government relations or Pro;ect

Shakti. HLL and MAR1 partner with state and local government departments such as Rural Development

and Women`s Fmpowerment to learn where SHGs eist and to obtain inormation about optimal locations

and dealers.

6

In Andhra Pradesh, up to 0/ o women belong to SHGs. Nationwide, about one million groups already

eist. HLL Sales Managers and MAR1 communicate the potential beneits to local oicials and are usually

successul in obtaining support and inormation Andhra Pradesh`s Women`s Fmpowerment Commissioner,

Ramalaami, was so impressed with Pro;ect Shakti that she requests monthly updates. Going orward,

Balasubramanian teaches his subordinates to communicate the ollowing message:

We are oering economic opportunities or your community. It will be easier or you to convince them

now since we have a proven track record. Andhra Pradesh typically had a !/ success rate with sel-

help groups. With Pro;ect Shakti, they have a success rate over 0/.

Ater agreeing upon a plausible location or a Shakti Dealership, local government oicials invite enterprising

women rom SHGs to an initial meeting. HLL conducts the meeting and invites women who epress an

interest in Pro;ect Shakti to learn more about the opportunities. Convincing the women and their amilies

usually takes signiicant eort on the part o the HLL team.

=

=

2003 Uni ver si t y of Mi chi gan Regent s

22 of 30

Released December J!, !00!

d=`~=

=

At the onset o the program, the Pro;ect Shakti team discussed and eperimented with the optimal proile o a

Shakti Dealer and Shakti Communicator. Although the Indian population has a larger number o men and

young boys or whom these positions could be an opportune career path and or whom the training and

liestyle required might be an easier it, the team determined that women were the best pulpits o education

and inluence. Conversely, the management team is currently comprised o men only with less than a handul

o women having held these positions.

Many local retailers, mostly men, have asked to become Shakti Dealers. However, HLL re;ected their requests,

eplaining that retailers can still beneit rom Shakti Dealers who can supply them more regularly, saving shop

owners long trips to obtain new inventory.

m=p~=i~=l~~=~=m=

=

Because most rural distributors own only one delivery vehicle, HLL limits the number o Shakti Dealers to !0

per district so distributors are not overburdened. As Shakti grows, so will distributors` guaranteed income

rom each Dealer, at which time HLL will increase the density o Dealers. ==

=

p~=a~=

=

A Shakti Dealer or Shakti +. (mother) works as an HLL direct-to-consumer distributor, selling primarily

to individuals rom an SHG. She also relies on smaller distributors, retailers and consumers in si to J0 satellite

villages to supplement her business. She must invest between Rs.J,000 and Rs.!0,000 at the onset or inventory

and training, oten borrowing to do so.

1he Shakti Amma works toward having 00 customers on her roster and grossing between Rs.J,000 and

Rs.!0,000 per month. Most Dealers gross between Rs.J0,000 and Rs.J!,000 and net about / (approimately

Rs.00 to Rs.J,000 per month), oten doubling her household income.

In irst ew months, a Rural Sales Promoter (RSP) visits !0 homes in a new Dealer`s village with her. A

Dealer`s learning curve is usually three months beore she begins to perorm like other HLL distributors.

According to Dhall, the three most important actors or a Shakti Dealer`s success are:

66

Dealer`s entrepreneurial skills to seek out business instead o passively waiting or customers.

Incentives and loyalty programs she oers to generate new and repeat business (e.g., I a customer

purchases Rs.0 o product, then she receives a ree sachet o another product).

Dealer`s willingness to service the retail trade in addition to her direct-to-consumer channel.

=

=

=

=

2003 Uni ver si t y of Mi chi gan Regent s

23 of 30

Released December J!, !00!

a~=b~~=

1he 1otal 1ransactions (11) or number o times a Dealer is supplied during one JC is usually one per month,

with stronger Dealers having up to three 11. HLL awards motivational pri.es such as Best Perormer to

Dealers as a part o state run Women`s Day and other similar activities.

While perormance varies among Dealers, over 60/ are currently generating over Rs.J!,000 per JC.

6

1he

disparity in Dealer perormance and income can lead to tensions in the villages. As one Dealer in Ra;apoor

who grosses Rs.!!,000 per JC described, there is some ;ealousy between other dealers and customers in her

village, but it is still not enough to aect the success o her business.

q~=SK=d=o==g=`=

d=o=E=oF= B==p~=a~=

J,000+ !0/

J!,000 - J,000 !0/

8,000 - J!,000 !0/

Sporadic or none in ! months (inactive) J0/

Most training is in a market setting (versus a classroom) with Dealers learning selling, business and record-

keeping skills. Dealers also are educated about HLL brands through communication with RSPs. Although

sharing success stories with other Dealers in a classroom could be beneicial, HLL has ound the logistics

diicult to manage. Not only is it diicult or the Dealers to leave their villages, but it also is a logistic burden

or RSPs to make the arrangements.

68

p~=m~~~=

=

1he Shakti Pracharani or Communicator is a person hired on a ied monthly sum basis and typically earns

less than a Shakti Dealer. An ideal Pracharani is conident and outspoken, with ecellent communication

skills. Unlike the Dealer, whose travel is limited to her village and a ew satellite villages, the Pracharani must

travel throughout the district. She is paid bonuses o about Rs.!0 or attending more than her required number

o group meetings. At such meetings, she acilitates games and tests SHG members` knowledge with questions

such as how to identiy Annapurna salt rom an imitation product. 1he Pracharani is required to call the area

Coordinator at the end o every day to update him on her progress.

1he travel requirements or Pracharanis have proved to be a challenge. Most o the women have amily

responsibilities, which make it diicult or them to be out o their homes or long periods o time. Also, local

culture ears a woman`s saety when she travels alone rom village to village. Ior these reasons, HLL is also

eperimenting with a model where two Communicators represent each district to minimi.e travel and, as

necessary, travel together.

6

2003 Uni ver si t y of Mi chi gan Regent s

24 of 30

Released December J!, !00!

j~=p~=

=

Similar to the Annapurna salt team`s strategy, New Ventures aims to increase the range o HLL products in

rural markets by taking market share rom local players and establishing brands that are not currently present

in the market. Although New Ventures does not yet receive pressure rom other HLL business units to push a

particular unit`s products, Dhall epects and hopes this will happen once Pro;ect Shakti proves itsel.

Pro;ect Shakti was initially launched with Personal Products only; Soaps and Detergents and Popular Ioods

(including Annapurna Salt) were added to the product oering in !00!. Personal Products currently comprise

J6/ o sales (Fhibit J!). Beverages will be added in !00!. HLL already has a strong presence in the rural

markets with soaps, talc and shampoos and is now ocusing on dental products (Colgate Palmolive`s Colgate is

the leader), abric cleaners and oods. 1he Shakti team is instructed to delicately balance the push between

brands generating higher margins with those the market dictates.

j~=^~~==m=p~=

=

1rue to HLL`s vision o eventually converting Captain Cook customers to Annapurna, Captain Cook is not

sold through Shakti.

A picture o a laughing sun (i.e., the universal symbol or iodine) is printed on all Annapurna salt

packaging so that those speaking other languages or even the illiterate may recogni.e the symbol and

identiy Annapurna salt.

1he Pracharani distributes pamphlets and other educational material on IDD during SHGs.

Other educational marketing initiatives such as a two-week Annapurna salt drive and Iodine Day (as a

part o World Health Day) urther the stable iodine message in rural markets.

=

p~=a~==i~=

Dhall believes that Shakti`s long-term success will be dependent upon Dealers` ability to sell enough volume to

earn substantial revenues. 1o this end, the team is eploring linkage` or reerral relationships with non-

competitive partners selling complementary products including insurance (crop insurance or arm

communities) and inancial services (loans rom lenders such as ICICI Bank). Partnerships with battery, bulb

and other commodity manuacturers were considered; however, relationships where investment and inventory

are not required look the most promising since it is diicult to share synergies without having common

distributors.

Dealers stimulate business in their shops by selling products such as saris, bangals and rice. HLL is supportive

o Shakti Dealers` selling non-competitive products to encourage one-stop shopping or village customers; a

ormal linkage pilot is underway in the Nangonda district.

p~=a~==b~==

==

1he Shakti team sponsors estivals and value-added events to promote HLL brands.

+;. /H-.///; D.;: HLL brings a physician to villages to discuss health issues and answer patient questions.

2003 Uni ver si t y of Mi chi gan Regent s

25 of 30

Released December J!, !00!

3/.(/ I./; I.(: 1he Shakti Dealer creates a basket o health and hygiene products or the betterment o a

amily. She discounts the basket by leveraging her margins on various brands to create perceived value or her

customers. Speciic products depend upon her particular market and oten include soap (Liebuoy, Bree.e);

detergent powder or bars (Wheel, Super); coconut oil (Nihar); salt (Annapurna); talc (Ponds); cream sachet

(Iair and Lovely); shampoo (Clinic Plus). Most amily packs retail or Rs.J00 with the purchaser receiving a /

toJ0/ discount.

3/.(/ D.; An artiicial estival with product giveaways, songs and opportunities to purchase HLL brands at

discounted prices. 1he primary purpose o the day is to promote the Dealer and accounts or approimately

!0/ o a dealer`s average monthly sales (Fhibit J).

N-u/-//- Monthly updates written by Balasubramanian including success stories, schemes and motivations

are sent to Dealers and Communicators.

I-/ I1a- Fducates children, parents and schoolteachers on the importance o iodine through direct

contact

I/a./ I1- A amous Mumbai ilmmaker, Adi Poacha, was commissioned to create a video to showcase

Pro;ect Shakti to the media, government and other organi.ations

-3/.(/ An inormation technology-based initiative aimed at providing solutions to rural inormation needs. A

si-month pilot was rolled out in J! villages in May !00!.

I successul, each Shakti Dealer eventually will have a computer at her home with Internet and e-mail access.

Villagers will be able to use the computer to learn about crops, health and hygiene solutions that HLL brands

and its partner companies oer.

p~=p~=~=j~=

=

1he Shakti Dealer earns dierent margins based upon who her customer is. On average, she earns -8/

margin on her sales, higher than the / average margin gained by most HLL distributors. She visits retailers

twice monthly to pitch products and drop o inventory.

0

q~=TW==p~=a~=j~=

p~=cW= a~=j~==jom=

Dealer`s home-store JJ/

Home to home JJ/

Group meetings 6/

Village shopkeepers !/ (Dealer`s regular competitive rate)

=

=

2003 Uni ver si t y of Mi chi gan Regent s

26 of 30

Released December J!, !00!

q~=UW=p~=a~=j~I=OMM=^~~=p~=b~=

m=m~==`= a~=j~=

3/.(/ D-./- .; oo / a/; / HLL

Sold at Home Rs.J.0 Rs.0.60

Sold at Group Mtg Rs.J.!0 Rs.0.!0

Sold to Shopkeepers Rs.J.!0 Rs.0.!0

=

`=

=

Most competitors have been ollowing watch and wait policy; however, new entrants such as Procter and

Gamble and Brittania are epected by !00!. Local players have already started to eel a pinch in sales and have

begun to ight back with consumer promotions and product giveaways.

Whereas HLL must pursue Shakti to grow, Dhall asserts that the other MNCs will irst try to take business

rom the top o the economic bucket. Dhall asserts that HLL holds a competitive edge and others ace ierce

barriers to entry:

1hey must irst build a portolio o brands that will generate enough sales so it will be worthwhile or

dealers since the turnover is too low in any one product line. HLL is unique in its ability to generate such

large rural turnover. Other companies may oer a higher margin to potential Dealers, but HLL is

shielded with brand depth ollowed by our amilial spirit. Also, HLL can leverage its distribution system

across India better than any o our competition.

J

Vishal Dhawan, HLL

=

OMMO=o=

=

1he !00! goal or Pro;ect Shakti set by HLL eecutives was to have 00 dealers in its operating states with sales

o Rs.!. crore. 1his goal was surpassed with sales o Rs.!.! crore.

Shakti was rolled out across !J districts in Andhra Pradesh and Karnataka each, with ! and !!! dealers,

respectively, covered !,6 markets where regular distribution had not yet reached. 1his resulted in a !8/

increase in the rural population covered by HLL.

OMMP=m~=

=

Pro;ect Shakti has generated Rs.!! lakhs through the irst our Journey Cycles (JC) o !00!, and the company

is targeting a year-end goal o Rs.J6 crore in sales. Sales oicers compile district-wide sales reports every JC,

which is about !8 days.

=

2003 Uni ver si t y of Mi chi gan Regent s

27 of 30

Released December J!, !00!

q~=VK=m=p~=p~=Ei~=oKF==g=`=NJQ==OMMP=

p~= g`N= g`O= g`P= g`Q=

Andhra Pradesh !! !J ! 6

Karnataka ! ! ! !!

1he company`s sales growth in Andhra Pradesh and Karnataka was J0/, higher than that o non-Shakti areas.

O the almost Rs.!00 lakh generated, nearly hal was earned rom customers who switched rom local,

unbranded products. 1he team has not determined whether sales are incremental or ;ust replacing other

channels because some districts can grow more quickly than others or many unrelated reasons.

Pro;ect Shakti plans to have J,000 Dealers by May !J, !00!. Management hopes that by the end o the year,

every Dealer will have at least J00 houses in each village purchasing Rs.J00 o HLL products each month.

In addition to sales revenues, Dhall is proud o Shakti`s impact on the standard o living o people in rural

markets through:

Business consultancy to SHGs

Agricultural intermediation (i.e., castor seeds procurement in Mahboobnagar, AP)

Fntrepreneurship training or more than J0,00 women in AP

=

`~=

=

Irom the corporate perspective, Shakti`s greatest challenge is distribution with India`s underdeveloped

inrastructure. Ior the sales managers on the ront line, training rural women to work on their own or the

irst time poses the biggest hurdle. Ior Dealers and Pracharanis, educating rural consumers about the quality

o HLL products continues to prove diicult since most villagers are accustomed to less-epensive, unbranded,

local products. Fven i they are convinced o HLL`s marketing message, many imitation products cloud the

market and conuse consumers. =

iJq=s==

In !00!, New Ventures plans to etend into 8 additional districts in Andhra Pradesh, Karnataka, Uttar

Pradesh, Madhya Pradesh and Gu;arat. 1he team plans to drive sales o lead brands by leveraging health and

hygiene ventures with non-governmental organi.ations. In the long term, Dhall hopes:

Shakti will broaden the scale o economic aluence via inormation. Ior eample, i-Shakti could help

increase crop yield. 1his creation o rural wealth can be an enabler to drive economic growth on a large

scale in India. 1he vision or Shakti is that we will have J0,000 Shakti Dealers covering J00,000

villages, selling to J00 million consumers. 1his is a vision we epect to achieve over the net three years.

In my mind, it can become the biggest rural operation in the history o Indian business and change the

way companies look at reaching the consumers at the bottom o the pyramid.

Sharat Dhall, HLL

=

2003 Uni ver si t y of Mi chi gan Regent s

28 of 30

Released December J!, !00!

i~=hJe=d~=

=

Annapurna salt already has started to bridge the gap between the health needs o the !0/ o the u/1'

a/./a that is at risk o IDD and Unilever`s needs or sustained growth and proitability. Ater initial

success with Annapurna salt in India, Unilever divisions sought to scale HLRC`s patented technology to other

markets. Research was conducted to determine which markets would be the best to eplore. 1he team decided

to ocus on countries that were most similar to India in terms o climate, overall health o the population,

cooking habits and potential o branded staples. Based upon these actors, Annapurna salt was launched in

Ghana in December !00J and, along with other products in the Annapurna line, is now marketed, sold and

distributed as an international brand.

Arica presents an untapped market o 00 million people, the ma;ority o whom live on less than two dollars a

day. 1he Annapurna team has proven that, despite the perceived limited buying power o these people, the

Arican market is still attractive. In some countries, Annapurna salt was proitable in hal the epected time

and met its gross margin target in ;ust J8 months - nearly three years ahead o schedule.

Unilever established a Popular Ioods Division in Ghana, under which Annapurna salt captured a !/ market

share only two years ater entering the market. In Ghana, a !0g bag o Annapurna salt sells or 600 cedis,

equivalent to about seven cents (compared with the !00g Annapurna pack in India which sells or Rs.J., or

;ust over ! cents). 1his pricing is advantageous in the Ghanaian market because at 600 cedis, the price o

Annapurna salt is about the same price as raw salt and /.// the price o other reined salts on the market, which

are typically marketed to a small number o upper-income Ghanaians.

Unilever also has launched Annapurna in Kenya and the Ivory Coast, where the brand provides the poor with

needed nutrients such as vitamin A, iron and iodine. 1he success o Annapurna is mostly attributed to low-cost

production and a pricing strategy geared toward low-income consumers. Annapurna`s Arican epansion

continues. In !00!, Annapurna salt was launched in Nigeria, Arica`s largest salt market that consumes nearly

hal a million tons per year. Under the umbrella o a new company, West Arican Popular Ioods Nigeria,

resulting rom a ;oint venture agreement between Unilever and the Dangote group, Annapurna eventually

will launch other basic ood products. Ater Nigeria, Unilever plans to bring the Annapurna salt solution to

West Arica`s 3J0 million salt market, including Mali and Niger.

In Arica, Annapurna has become proitable by attracting and retaining consumers rom the bottom o the

economic pyramid. Annapurna`s successul entry into Arica demonstrates that signiicant epansion is still

possible; HLL can sell a product with breakthrough technology that promotes improved public health at

competitive prices. 1his model can be applied to other Unilever brands to achieve similar results.=

=

`=

HLL is demonstrating that or multi-national corporations, the bottom o the pyramid can serve as a //.//-

impetus o innovative technology and marketing savvy, and that corporations, together with NGOs, can

address social problems at aordable costs. Annapurna salt`s KJ (stable iodine) technology is uniquely

positioned to combat IDD, a worldwide health problem while delivering substantial proits to HLL. Similarly,

Pro;ect Shakti is proving to be a repeatable model that can empower the BOP to enhance their quality o lie

2003 Uni ver si t y of Mi chi gan Regent s

29 of 30

Released December J!, !00!

and help pave a road rom the bottom o the neglected social strata to a sought ater market. Although these

accomplishments are admirable, several questions still remain. It is unclear whether Annapurna consumers

truly appreciate the breakthrough technology embedded within the salt and purchase it /-.a- / KJ, or i

most sales are a result o margin-driven shopkeepers who push Annapurna over other brands. HLL has not yet

determined whether consumers are willing to pay a price premium or Annapurna based upon the technology

alone. Only time will tell; until then, HLRC is working to decrease costs, which in turn can lead to a price

decrease o Annapurna i the market demands it.

Should HLL keep the KJ technology proprietary I KJ (stable iodine) alone is not a dierentiator in the

sale o the product, would HLL earn higher proits by licensing the technology to other salt manuacturers

and, at the same time, battle the IDD endemic on a larger scale

HLL acknowledges that in order or Pro;ect Shakti to be a signiicant part o the company`s rural penetration,

Dealers and Communicators must be well trained. It is unclear how Dealers will perorm in an epanded

inrastructure. Also, HLL will need to determine whether the Pro;ect Shakti model is repeatable in other

countries. Indian amily structure and village interaction provide a unique diusion mechanism that is an

eective vehicle or Shakti. Whether this model will be successul in Arica, South America or other parts o

Asia due to cultural dierences in village structures must be urther eplored.

Fven though these questions remain unanswered, HLL has developed an innovative model that other

corporations can eamine to determine how they may utili.e the BOP to enhance their bottom line.

=

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)