Professional Documents

Culture Documents

Time Value of Money Problem #7: Mortgage Amortization

Time Value of Money Problem #7: Mortgage Amortization

Uploaded by

Malathi Meenakshi SundaramOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Time Value of Money Problem #7: Mortgage Amortization

Time Value of Money Problem #7: Mortgage Amortization

Uploaded by

Malathi Meenakshi SundaramCopyright:

Available Formats

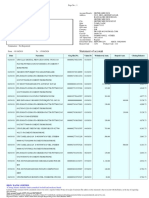

TIME VALUE OF MONEY PROBLEM #7: MORTGAGE AMORTIZATION Professor Peter Harris Mathematics by Sharon Petrushka Introduction This

problem will focus on calculating mortgage payments. Knowledge of Time Value of Money Problem #4: Present Value is a prerequisite towards proceeding with this problem. A mortgage is simply a loan collateralized by property which is payable over a number of years or on a monthly basis. The lender, usually a bank charges the borrower an interest charge for the privilege of borrowing money.

Mathematics: A mortgage is simply a stream of payments made by the borrower to the lender. This is an annuity as we discussed in Problem 4 . Mortgages and other loan arrangements, such as an automobile loan, which require monthly payments over a period of time simply involve the use of the Present Value of Annuity concept. The loan amount is the Present Value of the Annuity, the monthly payment is the payment per period, and the cost of borrowing money is the interest rate. Thus, PVA = where PVA ' N Payment Payment ! " # $ %# & '($N ) ' = = = = Present Value of the loan interest rate number of periods Payment per period [7]

In the case of a mortgage, we frequently must find the Payment. We will solve algebraically for Payment in formula [7] . Recall from lesson 2 that we can multiply or divide both sides of an equation by the same non-zero quantity. Thus multiplying both sides of formula [7] by ' yields Payment ! " # $ %# & '($N ) !' * Payment ! " # $ %# & '($N ] ' PVA ! ' = Payment [(1 $ %# & '($N ] Example 1: If you borrow $200,000 over a five year period at an annual interest rate of 11%, find your yearly payment on the loan? Payment = PVA ! ' [(1 $ %# & '($N ] 200,000 !+## * ,-. ##-+/0 [# $ %# & +##($, )

PVA ! ' *

and dividing both sides of this expression by [1 $ %# & '($N ] yields [7]

Payment =

A payment of $54,114.06 will be required yearly for five years to pay this loan off. Note that the payments will be due at the end of each year.

Let us examine what will happen if the interest rate is increased to 15%. Logically, it seems that your payment should also increase. Example 2: If you borrow $200,000 over a five year period at an annual interest rate of 15%, find your yearly payment on the loan. 200,000 !+#5 * 59,663.11 [# $ %# & +#5($, )

Payment =

We see then that if the interest rate goes up to 15%, your yearly payment will rise to $59,663.11 . What will happen if we extend the length of the loan to a seven year period? Example 3: If you borrow $200,000 over a seven year period at an annual interest rate of 11%, find your yearly payment on the loan. 200,000 !+## * 42,443.05 [# $ %# & +##($7 )

Payment =

Clearly, extending the length of the loan will result in a decrease in the yearly payment to $42,443.05.

Using the TI-83:

If you took out a twenty-five year mortgage in the amount of $260,000 at an interest rate of 11%, what is your required monthly mortgage payment, assuming that payments are made at the end of the month.

Solution: Since the payments are required to be made monthly, the number of payments is 25 years * 12 payments years = 300 payments. The interest rate is quoted on an annual basis, but c the market convention is that this rate is compounded monthly, and therefore p y and y are both 12. We enter the following: N = 300 there are 300 payments I% = 11 PV = 260000 PMT = 0 This is the value for which we are solving. FV = 0 P/Y = 12. Monthly payments. C/Y = 12 Monthly compounded interest rate. PMT: END BEGIN. Next, place the cursor at the PMT variable, and we then press [ALPHA] [ Solve ] .

The answer computed for PMT is -2548.29. The required monthly mortgage payment for a twenty-five year, $260,000 at 11% interest is $2,548.29.

Business Problem: You recently purchased a car for $4,500 and are going to finance the car by obtaining a car loan from the bank. The terms of the loan are $4,500 payable at the end of each month for 4 years (48 months) at an annual interest rate of 14.90%. Find your required monthly payments on the loan? We enter the following: N = 48 there are 48 payments. I% = 14.9 PV = 4500 PMT = 0 This is the value for which we are solving. FV = 0 P/Y = 12. Monthly payments. C/Y = 12 Monthly compounded interest rate. PMT: END BEGIN. Next, put the cursor on the 0 next to PMT, and press [ALPHA] [SOLVE].

The answer computed for PMT is $125.01. The required car payment over a 48 month period (4 years) at 14.90% annual interest is $125.01.

Additional Problems: 1. You want to borrow $10,000 to buy a car. The loan is at 10% per year and is to be paid over forty eight months. What is the monthly loan payment? A $100,000, ten year mortgage with an 11% interest rate will require monthly payments in what amount? Research Problem: If you were to take out a student loan in the amount of $10,000 what will be the monthly payments given prevailing interest rate of loans and the time period of the loan? (Call your Financial Aid Office).

2.

3.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Simple Strategies To Boost Your Profits - Trading With RSI Power Zones - Hima ReddyDocument34 pagesSimple Strategies To Boost Your Profits - Trading With RSI Power Zones - Hima ReddyPhu Anh Nguyen100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Motion For Leave To File An Amended AnswerDocument12 pagesMotion For Leave To File An Amended AnswerColorblind JusticeNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Spend AnalyticsDocument14 pagesSpend AnalyticsijjiNo ratings yet

- Bausch N LombDocument3 pagesBausch N LombRahul SharanNo ratings yet

- Summary Candle Patterns PDFDocument6 pagesSummary Candle Patterns PDFmejiasidNo ratings yet

- Multiple Choice QuestionsDocument3 pagesMultiple Choice QuestionsRaja Ghufran Arif100% (1)

- Spinning Mills DatabaseDocument32 pagesSpinning Mills DatabaseRomi Vairagibava50% (2)

- Kanji Dictionary For Foreigners Learning Japanese 2500 Kanjis Isbn9784816366970pdfDocument4 pagesKanji Dictionary For Foreigners Learning Japanese 2500 Kanjis Isbn9784816366970pdfAbe TarucNo ratings yet

- Case DigestDocument2 pagesCase DigestHoneylyne PlazaNo ratings yet

- Short Sale Approval LettersDocument24 pagesShort Sale Approval LettersBryant TutasNo ratings yet

- Grauwe, Paul The Limits of The MarketDocument182 pagesGrauwe, Paul The Limits of The MarketNathalie BareñoNo ratings yet

- State of Art in Body Tracking: Publication Interne N° 06 - 2005Document7 pagesState of Art in Body Tracking: Publication Interne N° 06 - 2005Abe TarucNo ratings yet

- Westmead International SchoolDocument1 pageWestmead International SchoolAbe TarucNo ratings yet

- iiki: The Radio Number SeptemberDocument6 pagesiiki: The Radio Number SeptemberAbe TarucNo ratings yet

- The Budget LineDocument7 pagesThe Budget LineJohannes Kevin FortunaNo ratings yet

- Award of New Project (Company Update)Document2 pagesAward of New Project (Company Update)Shyam SunderNo ratings yet

- Affidavits (Vtpossj) Venue Title Person Oath Statement Signature JuratDocument8 pagesAffidavits (Vtpossj) Venue Title Person Oath Statement Signature JuratRen ConchaNo ratings yet

- SWOT Analysis of BSRMDocument2 pagesSWOT Analysis of BSRMHaider RahiNo ratings yet

- BetasDocument4 pagesBetasRICARDO ANDRES ROJAS ALARCONNo ratings yet

- 16.maths Revision Mind Map by Aman KediaDocument9 pages16.maths Revision Mind Map by Aman KediaSushant TaleNo ratings yet

- Pishnu... Contract CostingDocument7 pagesPishnu... Contract CostingSiddharth MishraNo ratings yet

- Buchanan Musgrave CH 1Document30 pagesBuchanan Musgrave CH 1Manuelbeltran96No ratings yet

- NCR NegoSale Batch 15015 012120Document20 pagesNCR NegoSale Batch 15015 012120Kyth Ria Jherusalem SanchezNo ratings yet

- MIDA Guidelines On Principal HubDocument5 pagesMIDA Guidelines On Principal HubPikyinFooNo ratings yet

- Concept Paper Saving Behavior and PreferencesDocument8 pagesConcept Paper Saving Behavior and PreferencesepraNo ratings yet

- Ibr Arra SolazymeDocument1 pageIbr Arra SolazymeRamakrishnan TamilvaananNo ratings yet

- Commuting Tipid TipsDocument3 pagesCommuting Tipid TipsRoseballToledoNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePraveen KumarNo ratings yet

- Forecasts - The TestDocument3 pagesForecasts - The TestPatrykNo ratings yet

- Dialog BingDocument14 pagesDialog BingFajar Wiramas PrabowoNo ratings yet

- Lucena Schedule of Registration LET Passers August 2014Document2 pagesLucena Schedule of Registration LET Passers August 2014TheSummitExpressNo ratings yet

- Professional Services: Business PlanDocument6 pagesProfessional Services: Business PlanDiego ChávezNo ratings yet

- D.1 UM vs. BSPDocument1 pageD.1 UM vs. BSPNLainie OmarNo ratings yet

- DÍAZ, Junot - Apocalypse - Boston ReviewDocument10 pagesDÍAZ, Junot - Apocalypse - Boston ReviewAnonymous OeCloZYzNo ratings yet