0% found this document useful (0 votes)

153 views6 pagesFeasibility Analysis for PT. Layak Alih

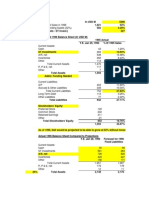

This document contains financial projections for PT. Layak Alih Segera from 2001 to 2005 including sales, costs of goods sold, gross profit, overhead, depreciation, earnings before interest and taxes, interest expense, earnings before taxes, taxes, and net after tax income. It also includes an analysis of the appropriate weighted average cost of capital of 12% and a capital budgeting analysis table projecting cash flows, discount factors, discounted cash flows, and cumulative discounted cash flows. The capital budgeting analysis shows the project has a payback period of 3 years, positive net present value of Rp. 2,172.11 million, return on investment of 46%, return on equity of 60%, and internal rate of return

Uploaded by

Anandita Ade PutriCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

153 views6 pagesFeasibility Analysis for PT. Layak Alih

This document contains financial projections for PT. Layak Alih Segera from 2001 to 2005 including sales, costs of goods sold, gross profit, overhead, depreciation, earnings before interest and taxes, interest expense, earnings before taxes, taxes, and net after tax income. It also includes an analysis of the appropriate weighted average cost of capital of 12% and a capital budgeting analysis table projecting cash flows, discount factors, discounted cash flows, and cumulative discounted cash flows. The capital budgeting analysis shows the project has a payback period of 3 years, positive net present value of Rp. 2,172.11 million, return on investment of 46%, return on equity of 60%, and internal rate of return

Uploaded by

Anandita Ade PutriCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd