Professional Documents

Culture Documents

GEC124

Uploaded by

Norsaibah MANIRICopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GEC124

Uploaded by

Norsaibah MANIRICopyright:

Available Formats

VI.

FINANCIAL PLAN

4.1 Project Cost

The total capital requirement of the business is presented in Table 5.1.

Table 5.1 Total Project Cost

Cost

Fixed Investment 5,000

Pre-operating Expenses 2,000

Working Capital 4,000

TOTAL PROJECT COST Php 10,000

5.2 Projected Income Statement

The projected income statement of the business for the first month of operation is shown

in Table 5.2 below.

Table 5.2 Projected Income Statement

Month 1

Total Sales

15,000

Less: Cost of Goods Sold 1,770

Gross Profit 10,000

Less: Administrative and Operating Expenses 7,822

NET PROFIT* Php 10,561

*The business assumed to earn the same net profit in the next months of operation.

5.3 Projected Cash Flow Statement

The cash flow statement of the business during the pre-operating period and first month

of operation is presented below.

Table 5.3 Projected Cash Flow Statement

Cash Inflow Pre-operating Month 1

Owner’s Equity 12,000 0

Cash Sales 0 15,000

Collection from Receivables 0 0

TOTAL CASH INFLOW 12,000 15,000

Cash Outflows 2,000 0

Pre-operating

Fixed Expenses

Investments 5,000 0

Material/Merchandise/Supply Purchases 4,000 0

Direct Labor 0 0

Administrative & Operating Expenses 0 7,822

(minus amortization

TOTAL of pre-operating Exp.)

CASH OUTFLOW 11,000 7,822

NET CASH FLOW 1,000 9,020

Add: Beginning Cash Balance 700 950

ENDING CASH BALANCE* Php 1,700 Php 9,970

*The business assumed to have the same ending cash balance in the next months of operation.

5.3 Projected Balance Sheet

The projected balance sheet of the business for the pre-operating period and first month

of operation is displayed in Table 5.4.

Table 5.4 Projected Balance Sheet

Assets Pre-operating Month 1

Cash 1,000 5,000

Accounts Receivable 0 0

Raw Materials Inventory 500 1,000

Finished Goods Inventory 0 0

Merchandise Inventory 0 0

Supplies 500 500

Pre-operating Expenses 2,000 3,000

Equipment 1,000 1,000

TOTAL ASSETS 5,000 10,500

Liabilities

Accounts Payable 0 0

Loans 0 0

Total Liabilities 0 0

Owner’s Equity 12,000 12,000

Retained Earnings 0 15,000

Total Owner’s Equity 12,000 27,000

TOTAL LIABILITIES & OWNER’S EQUITY Php 12,000 Php 27,000

4.5 Financial Analysis

4.5.1 Break-even Point Sales

The break-even point sales are derived through the computation below:

BEP Sales = Monthly Sales x Monthly Operating Expenses

Monthly Sales – Monthly Cost of Goods Sold

BEP Sales = 15,000 x 7,822

15,000 – 6,500

BEP Sales = Php 13,803.52

4.5.2 Return on Investment

Return on investment is determined using the formula below.

Return on Investment (ROI) = Net Income

Long-term Liabilities + Owner’s Equity

Return on Investment = 19,561 = 1.53%

12,000

4.5.3 Payback period

To determine the period when could the capital invested be recovered, payback is

computed using the formula below.

Payback Period = Total Project Cost

Annual Net Income

Payback Period = 10,000 = 0.13 year or 1.2** months

72,531

You might also like

- Comprehensive SOCF ProblemDocument1 pageComprehensive SOCF ProblemAbdullah alhamaadNo ratings yet

- Sample Illustration Financial StatementDocument3 pagesSample Illustration Financial StatementJuvy Jane DuarteNo ratings yet

- Written Assignment Unit 1 BUS 5110Document7 pagesWritten Assignment Unit 1 BUS 5110Joseph KamaraNo ratings yet

- BUS 5110 - Assignment 1Document6 pagesBUS 5110 - Assignment 1michelle100% (1)

- Statement of AffairsDocument4 pagesStatement of AffairsCaliNo ratings yet

- Written Assignment Unit01Document6 pagesWritten Assignment Unit01Michael Aboelkhair100% (1)

- M2Document2 pagesM2sejal aroraNo ratings yet

- Performance Task BUSINESS-and-ACCOUNTINGDocument3 pagesPerformance Task BUSINESS-and-ACCOUNTINGSallyContiBolorNo ratings yet

- Chapter 1 - A Framework For Financial Accounting: Click On LinksDocument14 pagesChapter 1 - A Framework For Financial Accounting: Click On LinksABDULLAH ALSHEHRINo ratings yet

- Preparation of Financial StatementsDocument5 pagesPreparation of Financial StatementsOji ArashibaNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Financial Sttement PreparationDocument3 pagesFinancial Sttement PreparationMIEL CAÑETENo ratings yet

- PC 2 QuestionnaireDocument3 pagesPC 2 QuestionnaireLuWiz DiazNo ratings yet

- Diagnostic Quiz On Accounting 2Document9 pagesDiagnostic Quiz On Accounting 2Anne Ford67% (3)

- ASSIGNMENT 411 - Audit of FS PresentationDocument4 pagesASSIGNMENT 411 - Audit of FS PresentationWam OwnNo ratings yet

- Fabm 2. Final ExamDocument3 pagesFabm 2. Final ExamSHIERY MAE FALCONITINNo ratings yet

- SolotionsDocument34 pagesSolotionsabdulrahman Abdullah100% (1)

- AssignmentDocument5 pagesAssignmentOur Beatiful Waziristan OfficialNo ratings yet

- Fundamentals of Accounting 1 BDocument6 pagesFundamentals of Accounting 1 BAle EalNo ratings yet

- Quiz Finma 0920Document5 pagesQuiz Finma 0920Danica RamosNo ratings yet

- Capital Budgeting - 2021Document7 pagesCapital Budgeting - 2021Mohamed ZaitoonNo ratings yet

- Bus. Finance W3-4 - C5 (Answer)Document5 pagesBus. Finance W3-4 - C5 (Answer)Rory GdLNo ratings yet

- Cash Flow Statement Cash AnalysisDocument21 pagesCash Flow Statement Cash Analysisshrestha.aryxnNo ratings yet

- Jankyle EdiongDocument10 pagesJankyle EdiongPasa YanNo ratings yet

- 1 Accounting Equation UniqueDocument3 pages1 Accounting Equation UniqueSohan AgrawalNo ratings yet

- Property, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetDocument4 pagesProperty, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetAstri KaruniaNo ratings yet

- Financial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesDocument7 pagesFinancial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesAndy MoralesNo ratings yet

- MR BALIKDocument7 pagesMR BALIKGAMES EMPIRENo ratings yet

- Financial Accounting & AnalysisDocument2 pagesFinancial Accounting & AnalysisTangerine Ila TomarNo ratings yet

- Advanced AccountingDocument12 pagesAdvanced AccountingmayuriNo ratings yet

- HW GPFS Answer PDFDocument4 pagesHW GPFS Answer PDFalyssaNo ratings yet

- BusFin PT 4Document2 pagesBusFin PT 4Nadjmeah AbdillahNo ratings yet

- TASK-10: Submitted by Sincy Mathew Institute of Management and Technology, PunnapraDocument4 pagesTASK-10: Submitted by Sincy Mathew Institute of Management and Technology, PunnapraSincy MathewNo ratings yet

- Class 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIDocument70 pagesClass 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIPathan KausarNo ratings yet

- Fina 470 Project Two - Check PointDocument9 pagesFina 470 Project Two - Check PointMitchell ParrottNo ratings yet

- Management Development Institute, GurgaonDocument7 pagesManagement Development Institute, Gurgaonrishav jhaNo ratings yet

- TEML10ACTIVITY 38 2nd CDocument3 pagesTEML10ACTIVITY 38 2nd CJennilyn SolimanNo ratings yet

- The Accounting Equation: Assets Liabilities + EquityDocument4 pagesThe Accounting Equation: Assets Liabilities + EquityRegine CariñoNo ratings yet

- Mittens Kittens CompanyDocument5 pagesMittens Kittens CompanyDianna EsmerayNo ratings yet

- Learning Activity 1 - Analysis of Financial StatementsDocument3 pagesLearning Activity 1 - Analysis of Financial StatementsAra Joyce PermalinoNo ratings yet

- Financial PlanDocument3 pagesFinancial PlanAyesha Jamil 5099-FMS/BBA/F17No ratings yet

- Learning Activity 5 - Financial PlanDocument6 pagesLearning Activity 5 - Financial PlanGeryca CarranzaNo ratings yet

- APC Ch11sol.2014Document5 pagesAPC Ch11sol.2014Anonymous LusWvyNo ratings yet

- Gross Working CapitalDocument14 pagesGross Working Capitalfizza amjadNo ratings yet

- DBA401 - CS221051: Balance Sheet AssetsDocument10 pagesDBA401 - CS221051: Balance Sheet AssetsAian Kit Jasper SanchezNo ratings yet

- Ce Quiz II (A+b+c)Document3 pagesCe Quiz II (A+b+c)Mohaiminur ArponNo ratings yet

- Techniques of Financial Analysis by ERICH A HELFERTDocument62 pagesTechniques of Financial Analysis by ERICH A HELFERTRupee Rudolf Lucy Ha100% (3)

- Accounting II FinalDocument6 pagesAccounting II FinalPak KhNo ratings yet

- Facc 099 Content SheetDocument14 pagesFacc 099 Content SheetUfuoma OkwuraiweNo ratings yet

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- Answer Exercise 1Document2 pagesAnswer Exercise 1Puteri Noor SyahiraNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- ASC SolutionDocument15 pagesASC SolutionanswerNo ratings yet

- As 22.deffered - TaxDocument7 pagesAs 22.deffered - TaxabrastogiNo ratings yet

- Abigail ContemploDocument10 pagesAbigail ContemploKeziah ChristineNo ratings yet

- Projected Financial Statement: Slash CompanyDocument7 pagesProjected Financial Statement: Slash CompanyKevin T. OnaroNo ratings yet

- Financial Statement Analysis ExerciseDocument5 pagesFinancial Statement Analysis ExerciseMelanie SamsonaNo ratings yet

- St. Haniel C.A Exercise 6Document11 pagesSt. Haniel C.A Exercise 6ArthurLeonard MalijanNo ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- Mandatory IFRS Adoption and The Effects On SMES in Nigeria: A Study of Selected SMEsDocument5 pagesMandatory IFRS Adoption and The Effects On SMES in Nigeria: A Study of Selected SMEsInternational Journal of Business Marketing and ManagementNo ratings yet

- Career Research Paper PDFDocument29 pagesCareer Research Paper PDFLeonor MendezNo ratings yet

- 2018 Annual Inspections Report enDocument12 pages2018 Annual Inspections Report ensekar raniNo ratings yet

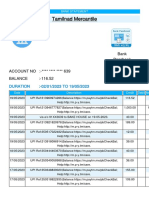

- Tamilnad Mercantile1684550531048Document25 pagesTamilnad Mercantile1684550531048Miracle KhordsNo ratings yet

- Managerial Accounting PPDocument42 pagesManagerial Accounting PPSaurav KumarNo ratings yet

- Ija Jun 2019Document140 pagesIja Jun 2019Bitopan DasNo ratings yet

- Mas Final PreboardDocument12 pagesMas Final Preboardpaulodantes099No ratings yet

- Ethics, Fraud, and Internal Control: Accounting Information Systems, 7eDocument44 pagesEthics, Fraud, and Internal Control: Accounting Information Systems, 7eZac VanessaNo ratings yet

- Ethics and Governance Module 5 QuizDocument7 pagesEthics and Governance Module 5 QuizGoraksha KhoseNo ratings yet

- Reviewer in Management Advisory Services RoqueDocument500 pagesReviewer in Management Advisory Services RoqueEuphoria89% (71)

- Conceptual Framework For Financial Reporting 2010Document6 pagesConceptual Framework For Financial Reporting 2010Vikash HurrydossNo ratings yet

- Accouting, Tax Management & Audit Vouchering UNDER CA ReportDocument95 pagesAccouting, Tax Management & Audit Vouchering UNDER CA ReportsalmanNo ratings yet

- Role To T-Code MappingDocument1,331 pagesRole To T-Code MappingAbdelhamid HarakatNo ratings yet

- Book1 Group Act5110Document9 pagesBook1 Group Act5110SAMNo ratings yet

- ch15 EquityDocument80 pagesch15 EquityAnggrainiNo ratings yet

- Seminar Week 6 (Lecture Slides Chapter 11)Document22 pagesSeminar Week 6 (Lecture Slides Chapter 11)palekingyeNo ratings yet

- Sop of Torrent UniversityDocument5 pagesSop of Torrent UniversitySumit ThapaNo ratings yet

- Bafinmax CM7Document22 pagesBafinmax CM7Marvin AndresNo ratings yet

- Auditing and Assurance I - Autiting Ethical Case Ann Walker Dan SuzetteDocument9 pagesAuditing and Assurance I - Autiting Ethical Case Ann Walker Dan SuzetteErfita ApriliaNo ratings yet

- AUDITING 1 Tuanakotta Chapter 15-30Document33 pagesAUDITING 1 Tuanakotta Chapter 15-30daniel marselinusNo ratings yet

- Reading 23 - Long-Lived AssetsDocument7 pagesReading 23 - Long-Lived AssetsLuis Henrique N. SpínolaNo ratings yet

- Far Eastern University: Institute of Accounts, Business and FinanceDocument7 pagesFar Eastern University: Institute of Accounts, Business and FinanceAnn Lorraine MamalesNo ratings yet

- ExtracionDocument84 pagesExtracionTatiana Lozada RodriguezNo ratings yet

- Terminal Sample 1 SolvedDocument14 pagesTerminal Sample 1 SolvedFami FamzNo ratings yet

- Indoco Annual Report FY16Document160 pagesIndoco Annual Report FY16Ishaan MittalNo ratings yet

- Everything About HedgingDocument114 pagesEverything About HedgingFlorentinnaNo ratings yet

- What Are The Pros and Cons of Joining in JPIA?: JPIA's Contributory Factors ACC C610-302A Group 2Document6 pagesWhat Are The Pros and Cons of Joining in JPIA?: JPIA's Contributory Factors ACC C610-302A Group 2kmarisseeNo ratings yet

- Master BudgetDocument6 pagesMaster BudgetPia LustreNo ratings yet

- FIN658 Degree Session 1 2012Document8 pagesFIN658 Degree Session 1 2012Amirah RahmanNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document7 pagesFundamentals of Accountancy, Business and Management 1Yannah LongalongNo ratings yet