Professional Documents

Culture Documents

Ce Quiz II (A+b+c)

Uploaded by

Mohaiminur ArponOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ce Quiz II (A+b+c)

Uploaded by

Mohaiminur ArponCopyright:

Available Formats

Ahsanullah University of Science & Technology

Civil Engineering

Quiz-II (HUM 201) [A+B+C]

Time: 50 Minutes (Additional 10 Minutes for Submission)

Question 01: Briefly Explain Assets, Liabilities and Equity. (Not More than 10 lines).

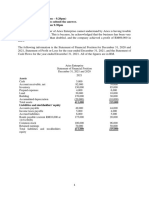

Question 02: This is the Income Statement of Starship Company. Do Vertical Analysis and

comment on the business.

Particulars 2020 2019

Sales Revenue 25,74,000 21,06,000

Less: Sales Returns 2,21,130 1,64,970

Less: Sales Discounts 12,870 10,530

Net Sales 23,40,000 19,30,500

Less: Cost of Goods Sold 9,36,000 7,60,500

Gross Profit 14,04,000 11,70,000

Less: Operating Expenses 7,02,000 5,85,000

Income from Operations/Operating Income 7,02,000 5,85,000

Add: Non-Operating Income 11,700 11,700

Income before Interest Expenses & Taxes 7,13,700 5,96,700

Less: Non-Operating Expenses 23,400 23,400

Income Before Taxes 6,90,300 5,73,300

Less: Income Tax (@40%) 2,76,120 2,29,320

Net Income 4,14,180 3,43,980

Question 03:

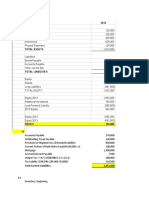

PWC Company

Balance Sheet

December 31, 2020

Particulars Amount (Taka)

Assets:

Current Asset;

Cash 10,000

Accounts Receivables 1,50,000

Notes Receivables 1,20,000

Inventories 1,20,000

Total Current Assets 4,00,000

Fixed Assets:

Lands & Buildings 1,50,000

Furniture 1,10,000

Equipment 1,15,000

Intangible Assets 15,000

Total Fixed Assets 3,55,000

Total Assets

7,55,000

Liabilities & Shareholders’ Equity;

Liabilities;

Current Liabilities;

Accounts Payable 1,50,000

Notes Payable 90,000

Interest Payable 15,000

Total Current Liabilities 2,55,000

Long Term Liabilities 2,00,000

Total Labilities 4,55,000

Shareholders’ Equity:

Common Stock 2,80,000

Retained Earnings

Total Shareholders’ Equity

20,000

3,00,000

Total Liabilities & Shareholders’ Equity 7,55,000

Total Number of Shares outstanding 1,00,000

PWC Company

Income Statement

As on December 31, 2020

Particulars Amount (TK)

Sales (Credit Sales) 14,00,000

Less: Cost of Goods Sold (Credit Purchase) 7,00,000

Gross Profit 7,00,000

Less: Operating Expenses 4,50,000

Income from Operations 2,50,000

Add: Other Income 1,00,000

Net Income 3,50,000

Required; Based on the above financial statements, compute the following ratios for the year

2020;

1. Current Ratio

2. Quick Ratio

3. Profit Margin Ratio

4. Earnings Per Share (EPS)

5. Accounts Receivables Turnover Ratio & Average Collection Period

6. Accounts Payables Turnover Ratio & Average Payment Period

7. Debt to Asset Ratio

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Valvula Contrabalance CBV1 10 S O A 30Document21 pagesValvula Contrabalance CBV1 10 S O A 30Judith Daza SilvaNo ratings yet

- How to Skim Texts EffectivelyDocument3 pagesHow to Skim Texts EffectivelyMohaiminur ArponNo ratings yet

- CIH EXAM Equations 2020 Explained by Expert Dr. Daniel FarcasDocument36 pagesCIH EXAM Equations 2020 Explained by Expert Dr. Daniel FarcasDaniel FarcasNo ratings yet

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehNo ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Final Account, Income Statement and Financial Analysis Practice QuestionsDocument36 pagesFinal Account, Income Statement and Financial Analysis Practice QuestionsMansi GoelNo ratings yet

- Cash Flow Statement-ExampleDocument18 pagesCash Flow Statement-ExampleAnakha RadhakrishnanNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- UntitledDocument13 pagesUntitledTejasree SaiNo ratings yet

- De Jesus, Zephaniah - (Finals)Document4 pagesDe Jesus, Zephaniah - (Finals)Zephaniah De JesusNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- MBA Accounts2Document5 pagesMBA Accounts2Yojan PonnettiNo ratings yet

- Financial Ratios and Analysis of XYZ CompanyDocument4 pagesFinancial Ratios and Analysis of XYZ CompanyMa Theresa MaguadNo ratings yet

- Accounts DDocument13 pagesAccounts DRahit MitraNo ratings yet

- Advanced Costing and Auditing ProblemsDocument5 pagesAdvanced Costing and Auditing ProblemsOur Beatiful Waziristan OfficialNo ratings yet

- CF Statement Solutions 1Document4 pagesCF Statement Solutions 1Joy MukhiNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Entity ADocument4 pagesEntity Ataeyung kimNo ratings yet

- Preparation of Financial Statements - QBDocument26 pagesPreparation of Financial Statements - QBHindutav arya100% (1)

- Cash Flow Statement Cash AnalysisDocument21 pagesCash Flow Statement Cash Analysisshrestha.aryxnNo ratings yet

- B2 2021 Nov AnsDocument13 pagesB2 2021 Nov AnsRashid AbeidNo ratings yet

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision QuestionskelvinmunashenyamutumbaNo ratings yet

- Proposed DividebdDocument34 pagesProposed DividebdPiyush SrivastavaNo ratings yet

- National Law Institute University: BhopalDocument3 pagesNational Law Institute University: BhopalMranal MeshramNo ratings yet

- SME Financial StatementsDocument15 pagesSME Financial StatementsJatha JamolodNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- Financial Management July 18, 2021Document7 pagesFinancial Management July 18, 2021Bhie JaneeNo ratings yet

- CH 4 and 5 Sanjay Ind Sol Finacman 6th EdDocument8 pagesCH 4 and 5 Sanjay Ind Sol Finacman 6th EdAnshika100% (2)

- St. Haniel C.A Exercise 6Document11 pagesSt. Haniel C.A Exercise 6ArthurLeonard MalijanNo ratings yet

- Mahusay-Bsa416 Module 3Document9 pagesMahusay-Bsa416 Module 3Jeth MahusayNo ratings yet

- Financial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesDocument7 pagesFinancial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesAndy MoralesNo ratings yet

- (Nikolay TSD) LCBB4001 Accounting Fundamentals-A1Document24 pages(Nikolay TSD) LCBB4001 Accounting Fundamentals-A1munnaNo ratings yet

- Quiz 1Document2 pagesQuiz 1jevieconsultaaquino2003No ratings yet

- Perfect Practice SolutionDocument41 pagesPerfect Practice Solutionnarutevarsha5No ratings yet

- Cash Flow StatementDocument9 pagesCash Flow StatementPiyush MalaniNo ratings yet

- Welspun Company Cashflow ProblemDocument2 pagesWelspun Company Cashflow ProblemSai DeshpandeNo ratings yet

- Cash Flow Statement QuestionDocument5 pagesCash Flow Statement QuestionsatyaNo ratings yet

- Quiz IntAccDocument12 pagesQuiz IntAccTrixie HicaldeNo ratings yet

- Section A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesDocument7 pagesSection A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesgeofreyNo ratings yet

- Week 1 621 notesDocument6 pagesWeek 1 621 notesSameera VithanaNo ratings yet

- CashFlowStatement AssignmentDocument15 pagesCashFlowStatement AssignmentAnanta Vishain0% (1)

- China Tea CompanyDocument4 pagesChina Tea CompanyLeika Gay Soriano OlarteNo ratings yet

- Line ItemDocument295 pagesLine ItemEve Rose Tacadao IINo ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument9 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- Act 1 Simple Company (SFP)Document3 pagesAct 1 Simple Company (SFP)Reginald MundoNo ratings yet

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- Mid term examDocument6 pagesMid term examWaizin KyawNo ratings yet

- Dilemma Company Financial Statement 2020Document1 pageDilemma Company Financial Statement 2020Tish ViennaNo ratings yet

- Capital Budgeting - 2021Document7 pagesCapital Budgeting - 2021Mohamed ZaitoonNo ratings yet

- 1Document20 pages1Denver AcenasNo ratings yet

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- Case StudyDocument22 pagesCase StudyM Zain Ul AbedeenNo ratings yet

- Non-Current Asset: Balance Sheet 31-Dec-20Document4 pagesNon-Current Asset: Balance Sheet 31-Dec-20Shehzadi Mahum (F-Name :Sohail Ahmed)No ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Management Accounting Final ExamDocument4 pagesManagement Accounting Final Examacctg2012No ratings yet

- Balance Sheet and Cash Flow Statement AnalysisDocument3 pagesBalance Sheet and Cash Flow Statement AnalysisAmit GodaraNo ratings yet

- Longitudinal Profile of A Stream MathDocument4 pagesLongitudinal Profile of A Stream MathMohaiminur ArponNo ratings yet

- UNIT LOAD METHOD TITLEDocument53 pagesUNIT LOAD METHOD TITLEkennypennyNo ratings yet

- 4) Stair DesignDocument11 pages4) Stair DesignMohaiminur ArponNo ratings yet

- 5) Sunshade DesignDocument5 pages5) Sunshade DesignMohaiminur ArponNo ratings yet

- Road-Construction ADocument2 pagesRoad-Construction AMohaiminur ArponNo ratings yet

- Road Construction ADocument2 pagesRoad Construction AMohaiminur ArponNo ratings yet

- CT 01 Math 233 - 31 7 2021Document1 pageCT 01 Math 233 - 31 7 2021Mohaiminur ArponNo ratings yet

- Ryans Computers - Best Online Computer Shop in BangladeshDocument3 pagesRyans Computers - Best Online Computer Shop in BangladeshMohaiminur ArponNo ratings yet

- Frequency Dist. TableDocument1 pageFrequency Dist. TableMohaiminur ArponNo ratings yet

- Pile Foundation DesignDocument17 pagesPile Foundation Designsunil khandelwalNo ratings yet

- CT 01 Math 233 - 31 7 2021Document1 pageCT 01 Math 233 - 31 7 2021Mohaiminur ArponNo ratings yet

- Bar Diagram, (2) Pie Chart, (3) Histogram, (4) Frequency Polygon, (5) Cumulative Frequency Polygon (Ogive) - ExampleDocument2 pagesBar Diagram, (2) Pie Chart, (3) Histogram, (4) Frequency Polygon, (5) Cumulative Frequency Polygon (Ogive) - ExampleMohaiminur ArponNo ratings yet

- Ahsanullah University of Science and Technology: ND NDDocument1 pageAhsanullah University of Science and Technology: ND NDMohaiminur ArponNo ratings yet

- V.3 21195 Sinopharm Vaccine Explainer 24Document6 pagesV.3 21195 Sinopharm Vaccine Explainer 24Mohammad Hisham BhawpalNo ratings yet

- Determination of Shear Center: Course Number: CE 211 Course Title: Mechanics of Solids IDocument21 pagesDetermination of Shear Center: Course Number: CE 211 Course Title: Mechanics of Solids IMohaiminur ArponNo ratings yet

- Determination of specific gravity and water absorption of coarse aggregateDocument2 pagesDetermination of specific gravity and water absorption of coarse aggregateMohaiminur ArponNo ratings yet

- Analytic Mechanics SolutionDocument176 pagesAnalytic Mechanics SolutionMohaiminur ArponNo ratings yet

- Hemant Kumar Bhaskar Roll No:-0610421Document32 pagesHemant Kumar Bhaskar Roll No:-0610421akshay kothiyalNo ratings yet

- Recommended ValueDocument1 pageRecommended ValueMohaiminur ArponNo ratings yet

- Ahsanullah University of Science and Technology: Engineering Materials SessionalDocument8 pagesAhsanullah University of Science and Technology: Engineering Materials SessionalMohaiminur ArponNo ratings yet

- Determination of Shear Center: Course Number: CE 211 Course Title: Mechanics of Solids IDocument21 pagesDetermination of Shear Center: Course Number: CE 211 Course Title: Mechanics of Solids IMohaiminur ArponNo ratings yet

- CE 101 1st Year 2nd Semester Fall 2019 FinalDocument7 pagesCE 101 1st Year 2nd Semester Fall 2019 FinalMohaiminur ArponNo ratings yet

- Figures and Tables For British Method and ACI Method of Mix DesignDocument4 pagesFigures and Tables For British Method and ACI Method of Mix DesignMohaiminur ArponNo ratings yet

- CSE 2154 Numerical Methods and Computer Programming Lab Online 3 Marks: 30Document1 pageCSE 2154 Numerical Methods and Computer Programming Lab Online 3 Marks: 30Mohaiminur ArponNo ratings yet

- Recommended ValueDocument1 pageRecommended ValueMohaiminur ArponNo ratings yet

- Personal SWOT AnalysisDocument8 pagesPersonal SWOT AnalysisNamNo ratings yet

- PhotosynthesisDocument30 pagesPhotosynthesisAngela CanlasNo ratings yet

- Touch-Tone Recognition: EE301 Final Project April 26, 2010 MHP 101Document20 pagesTouch-Tone Recognition: EE301 Final Project April 26, 2010 MHP 101Sheelaj BabuNo ratings yet

- Organic Compounds ExplainedDocument37 pagesOrganic Compounds ExplainedAlejandro VillanuevaNo ratings yet

- Rogers Lacaze Case InfoDocument1 pageRogers Lacaze Case InfomakeawishNo ratings yet

- Monitoring Rock and Soil Mass Performance: To The ConferenceDocument1 pageMonitoring Rock and Soil Mass Performance: To The ConferenceÉrica GuedesNo ratings yet

- Samantha Serpas ResumeDocument1 pageSamantha Serpas Resumeapi-247085580No ratings yet

- 202-Nido 2024Document27 pages202-Nido 2024tabhonor69No ratings yet

- Itm Guia Rapida Tds 600 Tipo4 Ed1 EspDocument148 pagesItm Guia Rapida Tds 600 Tipo4 Ed1 Espcamel2003No ratings yet

- Lucky TextileDocument5 pagesLucky TextileSaim Bin RashidNo ratings yet

- Understanding Heavy Lifting Operations and Vessel StabilityDocument15 pagesUnderstanding Heavy Lifting Operations and Vessel StabilitygeorgesagunaNo ratings yet

- BIG-IP Access Policy Manager CustomizationDocument118 pagesBIG-IP Access Policy Manager CustomizationDhananjai SinghNo ratings yet

- Patrick Meyer Reliability Understanding Statistics 2010Document160 pagesPatrick Meyer Reliability Understanding Statistics 2010jcgueinj100% (1)

- Rocha Et Al 2020 Fostering Inter - and Transdisciplinarity in Discipline-Oriented Universities To Improve Sustainability Science and PracticeDocument12 pagesRocha Et Al 2020 Fostering Inter - and Transdisciplinarity in Discipline-Oriented Universities To Improve Sustainability Science and PracticeAna CarolinaNo ratings yet

- Mechanics of Solids by Sadhu Singhpdf Ebook and Ma PDFDocument1 pageMechanics of Solids by Sadhu Singhpdf Ebook and Ma PDFNeeraj Janghu0% (2)

- A Review of Air Filter TestDocument14 pagesA Review of Air Filter Testhussain mominNo ratings yet

- Downfall of Ayub Khan and Rise of Zulfikar Ali BhuttoDocument9 pagesDownfall of Ayub Khan and Rise of Zulfikar Ali Bhuttoabdullah sheikhNo ratings yet

- Zero-Force Members: Hapter Tructural NalysisDocument3 pagesZero-Force Members: Hapter Tructural NalysistifaNo ratings yet

- JuliadatascienceDocument214 pagesJuliadatascienceFulvio JoséNo ratings yet

- Boundary WorkDocument36 pagesBoundary WorkSebastiaan van der LubbenNo ratings yet

- Bonny Norton Peirce - Social Identity and InvestmentDocument24 pagesBonny Norton Peirce - Social Identity and InvestmentAllie SANo ratings yet

- History All Pictures QuestionsDocument7 pagesHistory All Pictures QuestionsDivyansh RajoriaNo ratings yet

- Case StudiesDocument19 pagesCase StudiesSorin MarkovNo ratings yet

- COLORMATCHING GUIDELINES FOR DEMI-PERMANENT HAIR COLORDocument1 pageCOLORMATCHING GUIDELINES FOR DEMI-PERMANENT HAIR COLORss bbNo ratings yet

- Literature Review On OscilloscopeDocument5 pagesLiterature Review On Oscilloscopedhjiiorif100% (1)

- Standard Top Up Vouchers: Prices:: Internet Blocked Internet BlockedDocument15 pagesStandard Top Up Vouchers: Prices:: Internet Blocked Internet BlockedJeet SinghNo ratings yet

- Pharmaco-pornographic Politics and the New Gender EcologyDocument14 pagesPharmaco-pornographic Politics and the New Gender EcologyMgalo MgaloNo ratings yet

- Inventions Crossword PuzzleDocument2 pagesInventions Crossword PuzzleAimri910% (1)