Professional Documents

Culture Documents

Quiz 1

Uploaded by

jevieconsultaaquino2003Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 1

Uploaded by

jevieconsultaaquino2003Copyright:

Available Formats

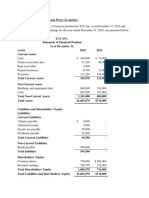

Ariel Corporation

Comparative Statement of Financial Position

December 31, 2020

(in Thousand Pesos)

2020 2019

ASSETS

Current Assets

Cash and Cash Equivalents 24,890 2,120

Held for Trading Securities 10,000

Trade & Other Receivables 16,000 6,000

Inventory 8,960 10,600

Total Current Assets 59,850 18,720

Non Current Assets

Property, Plant and Equipment 150,000 161,280

Investment in Equity Securities 16,000 20,000

Total Non-Current Asset 166,000 181,280

TOTAL ASSETS 225,850 200,000

LIABILITIES & SHAREHOLDERS’ EQUITY

Current liabilities

Trade and Other Payables 8,400 3,350

Unearned Revenues 10,600 11,650

Notes Payable-current 900 600

Total current liabilities 19,900 15,600

Non Current Liabilities

Notes Payable – Non current 73,550 100,000

Total Liabilities 93,450 115,640

SHAREHOLDERS’ EQUITY

Ordinary Shares, P100 par 80,000 60,000

Premium on Ordinary Shares 16,000 10,000

Total Paid-in-capital 96,000 70,000

Retained Earnings 36,400 14,400

Total shareholders’ equity 132,400 84,400

TOTAL LIABILITIES & SHAREHOLDERS’ EQUITY 225,850 200,000

Ariel Corporation

Comparative Income Statement

For the Years Ended December 31, 2020 & 2019

(in Thousand Pesos)

2020 2019

Sales 480,000

400,000

Less: Cost of goods sold 364,000

280,000

Gross Income 116,000

120,000

Add: Other Income 15,000

9,600

Total Income 131,000

129,600

Less: Other expenses 12,400

Finance Cost (Interest) 14,400 19,000

Total Expenses 26,800 19,000

Net income before taxes 104,200 110,600

Less: Income tax 32,334 35,392

Net Income after Taxes 71,866 75,208

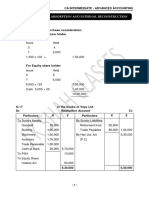

Compute the following ratios:

1. Current Ratio

2. Quick Ratio

3. Inventory turn over

4. Receivable turnover

5. Debt-to-equity ratio

6. Debt Ratio

7. Equity Ratio

8. Profit Margin

9. Return on Asset

10. Return on Equity

You might also like

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision QuestionskelvinmunashenyamutumbaNo ratings yet

- FM1 ActivityDocument4 pagesFM1 ActivityChieMae Benson Quinto100% (1)

- Colleagues CoDocument7 pagesColleagues CoKeahlyn BoticarioNo ratings yet

- Entity ADocument4 pagesEntity Ataeyung kimNo ratings yet

- Comparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Document2 pagesComparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Rose BaynaNo ratings yet

- Chapter 7Document4 pagesChapter 7Aisha AlarimiNo ratings yet

- Bhieee Company Statement of Financial Position 31-Dec-19Document6 pagesBhieee Company Statement of Financial Position 31-Dec-19Ace ClarkNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisRoel AsduloNo ratings yet

- Line ItemDocument295 pagesLine ItemEve Rose Tacadao IINo ratings yet

- Colleagues Co. Statement of Financial Statements December 31, 20X1Document6 pagesColleagues Co. Statement of Financial Statements December 31, 20X1Keahlyn BoticarioNo ratings yet

- 01 - Exercises Session 1 - EmptyDocument4 pages01 - Exercises Session 1 - EmptyAgustín RosalesNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Financial Ratio QuizDocument1 pageFinancial Ratio QuizMylene SantiagoNo ratings yet

- CAPE U1 Ratio QuestionDocument12 pagesCAPE U1 Ratio QuestionNadine DavidsonNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- Ce Quiz II (A+b+c)Document3 pagesCe Quiz II (A+b+c)Mohaiminur ArponNo ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsAsad RehmanNo ratings yet

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- The Financial Statements of CF LTDDocument4 pagesThe Financial Statements of CF LTDKIMBERLY MUKAMBANo ratings yet

- Zach Industries Financial Ratio AnalysisDocument2 pagesZach Industries Financial Ratio AnalysisCarla RománNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- China Tea CompanyDocument4 pagesChina Tea CompanyLeika Gay Soriano OlarteNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Sesi 13 & 14Document10 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- De Jesus, Zephaniah - (Finals)Document4 pagesDe Jesus, Zephaniah - (Finals)Zephaniah De JesusNo ratings yet

- Solve accounting problems and prepare financial statementsDocument5 pagesSolve accounting problems and prepare financial statementsUmer NawazNo ratings yet

- Fm2quizb4 QoDocument10 pagesFm2quizb4 QoYe YongshiNo ratings yet

- Part F - Additional QuestionsDocument9 pagesPart F - Additional QuestionsDesmond Grasie ZumankyereNo ratings yet

- FRS 1 Ig (2016)Document15 pagesFRS 1 Ig (2016)David LeeNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- FS Preparation 1Document4 pagesFS Preparation 1Bae Tashnimah Farina BaltNo ratings yet

- Cash Flow Statement for Passaic CompanyDocument7 pagesCash Flow Statement for Passaic CompanyShane TabunggaoNo ratings yet

- ACCT 3061 Asignación Cap 4 y 5Document4 pagesACCT 3061 Asignación Cap 4 y 5gpm-81No ratings yet

- Home Depot Final DCFDocument120 pagesHome Depot Final DCFapi-515120297No ratings yet

- Quiz - Horizontal AnalysisDocument2 pagesQuiz - Horizontal AnalysisQuenie De la CruzNo ratings yet

- ARM Corp Statement of Cash FlowsDocument2 pagesARM Corp Statement of Cash FlowsJeasmine Andrea Diane PayumoNo ratings yet

- Support Material Financial Statement PDFDocument6 pagesSupport Material Financial Statement PDFsanele dlaminiNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisMelanie SamsonaNo ratings yet

- The Deluxe Store Income Statement For The Year Ended November 30, 2020Document2 pagesThe Deluxe Store Income Statement For The Year Ended November 30, 2020Charisa BenjaminNo ratings yet

- Tutorial Chapter: Analysis of Financial Statement: 2018 2019 Current Ratio 1.79 1.55Document14 pagesTutorial Chapter: Analysis of Financial Statement: 2018 2019 Current Ratio 1.79 1.55FISH JELLYNo ratings yet

- Business Finance SamplesDocument2 pagesBusiness Finance SamplesjoeromesantosNo ratings yet

- Financial Ratio Analysis TutorialDocument6 pagesFinancial Ratio Analysis TutorialWEI QUAN LEENo ratings yet

- Annual Income Statement (Values in 000's $) : Current AssetsDocument6 pagesAnnual Income Statement (Values in 000's $) : Current AssetsVikash ChauhanNo ratings yet

- Pad Corporation Consolidation WorksheetDocument2 pagesPad Corporation Consolidation WorksheetTiffany WijayaNo ratings yet

- Exercise Lecture 2 Cash FlowDocument2 pagesExercise Lecture 2 Cash Flowdebbie intanNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Buku Financial Distress Tanpa ContohDocument6 pagesBuku Financial Distress Tanpa ContohPutri RenalitaNo ratings yet

- ST - 21-Fin 1a - N-Fin Man. (Midterm Quiz 2)Document3 pagesST - 21-Fin 1a - N-Fin Man. (Midterm Quiz 2)irish romanNo ratings yet

- Financial Statement Analysis Questions ExplainedDocument4 pagesFinancial Statement Analysis Questions ExplainedRisha OsfordNo ratings yet

- Capital Budgeting - 2021Document7 pagesCapital Budgeting - 2021Mohamed ZaitoonNo ratings yet

- Mas M 1404 Financial Statements AnalysisDocument22 pagesMas M 1404 Financial Statements Analysisxxx101xxxNo ratings yet

- Sessions 8 - 9 - BS - SentDocument11 pagesSessions 8 - 9 - BS - SentAjay DesaleNo ratings yet

- Additional Cash Flow Problems QuestionsDocument3 pagesAdditional Cash Flow Problems QuestionsChelle HullezaNo ratings yet

- Financial StatmentDocument2 pagesFinancial StatmentMohammed ademNo ratings yet

- Q3 NNF LimitedDocument2 pagesQ3 NNF Limitedamosmalusi5No ratings yet

- Notice of AGM 23Document5 pagesNotice of AGM 23Ekta rohraNo ratings yet

- Advanced Accounting 11th Edition Hoyle Schaefer Doupnik 0078025400 9780078025402 Solution ManualDocument36 pagesAdvanced Accounting 11th Edition Hoyle Schaefer Doupnik 0078025400 9780078025402 Solution Manualfrednunezqatpikzxen100% (22)

- Cost of Capital (Practice Questions)Document2 pagesCost of Capital (Practice Questions)Wais Deen NazariNo ratings yet

- NPV EgDocument4 pagesNPV EgSanjay MehrotraNo ratings yet

- Chapter 23 Current Cost AccountingDocument24 pagesChapter 23 Current Cost AccountingElaine Fiona VillafuerteNo ratings yet

- Relevant Research ArticleDocument26 pagesRelevant Research ArticleVedant MaskeNo ratings yet

- FA RatiosDocument3 pagesFA Ratiosnath.sandipNo ratings yet

- Bodie Investments 12e IM CH18Document4 pagesBodie Investments 12e IM CH18lexon_kbNo ratings yet

- Previous Questions and Answers Plus Two AccountancyDocument47 pagesPrevious Questions and Answers Plus Two AccountancyPushppa KumaryNo ratings yet

- Company Law Course Outline - 1Document3 pagesCompany Law Course Outline - 1TemwaniNo ratings yet

- Bussiness Case Project Rehab Asrama AtletDocument50 pagesBussiness Case Project Rehab Asrama AtletBangun SaranaNo ratings yet

- Revision XiiDocument7 pagesRevision Xiinightstarlucifer804No ratings yet

- 5 Amalgamation, Absorption and External Reconstruction - HomeworkDocument21 pages5 Amalgamation, Absorption and External Reconstruction - HomeworkYash ShewaleNo ratings yet

- FMGTDocument40 pagesFMGTbindrapalak1905No ratings yet

- Secondary MarketDocument23 pagesSecondary MarketDorji DelmaNo ratings yet

- CH 3 AFADocument64 pagesCH 3 AFANigussie BerhanuNo ratings yet

- Class 11 Accountancy Worksheet - 2023-24Document17 pagesClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNo ratings yet

- BNBR - Final Report Billingual December 31 2022 PDFDocument135 pagesBNBR - Final Report Billingual December 31 2022 PDFVal IntanNo ratings yet

- Taxation of Individuals and Business Entities 2018 Edition 9Th Edition Spilker Test Bank Full Chapter PDFDocument36 pagesTaxation of Individuals and Business Entities 2018 Edition 9Th Edition Spilker Test Bank Full Chapter PDFbertha.fowler930100% (10)

- ACCOUNTING FOR SPECIAL TRANSACTIONS - Installment SalesDocument25 pagesACCOUNTING FOR SPECIAL TRANSACTIONS - Installment SalesDewdrop Mae RafananNo ratings yet

- Conceptual Framework and Financial ReportingDocument50 pagesConceptual Framework and Financial ReportingFirelight ZyNo ratings yet

- GR 9 Teachers GuideDocument107 pagesGR 9 Teachers GuideAmogelang Katlego MakhalemeleNo ratings yet

- LU2 Lecturer NotesDocument23 pagesLU2 Lecturer NotesShweta SinghNo ratings yet

- Lap - Keuangan Tangaya KonveksiDocument30 pagesLap - Keuangan Tangaya KonveksiSecret PeopleNo ratings yet

- Trial BalanceDocument1 pageTrial BalancePUSPA Ghalda ShafaNo ratings yet

- Soal Dan Jawaban Latihan Lab 3 - Stock InvestmentDocument8 pagesSoal Dan Jawaban Latihan Lab 3 - Stock InvestmentPUTRI YANINo ratings yet

- Kumpulan Soal UTS AKL IIDocument19 pagesKumpulan Soal UTS AKL IIAlessandro SitopuNo ratings yet

- INTERCOMPANY TRANSACTIONsDocument3 pagesINTERCOMPANY TRANSACTIONsChelle CastuloNo ratings yet

- 07 Fundamentals of Capital BudgetingDocument18 pages07 Fundamentals of Capital BudgetingWesNo ratings yet

- IPO Performance and Pricing Factors on Indian Stock ExchangesDocument15 pagesIPO Performance and Pricing Factors on Indian Stock ExchangesSunil KumarNo ratings yet