Professional Documents

Culture Documents

Quiz - Horizontal Analysis

Uploaded by

Quenie De la CruzCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz - Horizontal Analysis

Uploaded by

Quenie De la CruzCopyright:

Available Formats

ROMBLON STATE UNIVERSITY

Odiongan, Romblon

COLLEGE OF BUSINESS AND ACCOUNTANCY

Financial Analysis & Reporting

Name Date Rating

Course Year Time Score

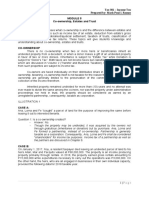

I. HORIZONTAL ANALYSIS OF COMPARATIVE STATEMENTS

Concept Application:

SHARP Corporation

Comparative Statements of Financial Position

December 31, 2016

(in Thousand pesos)

Increase (decrease)

2016 2015 AMOUNT PERCENT

Assets

Current Assets

Cash & Cash Equivalent P 24,890 P 2,120

Held for Trading 10,000

Trade & Other Receivables 16,000 6,000

Inventory 8,960 10,600

Total Current Assets P 59,850 P 18,720

Non-Current Asset

Property, Plant & Equipment P 150,000 P 161,280

Intangibles 16,000 20,000

Total Non-current Asset 166,000 181,280

TOTAL ASSETS P 225,850 P 200,000

Liabilities and Shareholders’ Equity

Current Liabilities

Trade & Other Payables P 8,400 P 3,350

Unearned Revenues 10,600 11,650

Notes payable – current 900 600

Total current liabilities P19,900 P15,600

Non-Current Liabilities

Notes Payable-non-current 73,550 100,000

TOTAL LIABILITIES P 93,450 P 115,600

Shareholders’ Equity

Ordinary Shares, P100 par 80,000 60,000

Premium on Ordinary Shares 16,000 10,000

Total paid-in-capital 96,000 70,000

Retained Earnings 36,400 14,400

TOTAL SHAREHOLDERS’ 132,400 84,400

EQUITY

TOTAL LIABILITIES &

SHAREHOLDERS’ EQUITY P 225,850 P 200,000

SHARP Corporation

Comparative Income Statements

For the years ended December 31, 2016 & 2015

Increase (decrease)

2016 2015 AMOUNT PERCENT

Sales P 480,000 P 400,000

Less: Cost of good sold 364,000 280,000

Gross Income 116,000 120,000

Add: Other Income 15,000 9,600

Total Income 131,000 129,600

Less: Other Expenses 12,400

Finance Costs (Interest) 14,400 19,000

Total Expenses 26,800 19,000

Net Income before taxes 104,200 110,600

Less: Income Tax 32,334 35,392

Net income after taxes 71,866 75,208

In your Analysis you will use the following format:

1. On Horizontal Analysis:

1.1 Horizontal Analysis Computation

1.2 Analysis and interpretation of your findings

*Liquidity & Solvency

*Stability or Long-term Financial Position

*Operating Efficiency and Profitability

1.3 Conclusion

1.5 State your recommendations

You might also like

- MUDIM ZAKARIA EntDocument25 pagesMUDIM ZAKARIA EntFarid Alias50% (2)

- Carbex Inc sales mix problemDocument3 pagesCarbex Inc sales mix problemAyhuNo ratings yet

- Financial Management in Different Forms of Organizations: Harshita Milind Chaudhari HPGD/JA21G2/5255Document20 pagesFinancial Management in Different Forms of Organizations: Harshita Milind Chaudhari HPGD/JA21G2/5255harshita chaudhari100% (1)

- Mathematical Literacy P1 GR 12 Exemplar 2021 EngDocument15 pagesMathematical Literacy P1 GR 12 Exemplar 2021 EngJeketera Shadreck67% (21)

- BDO Unibank 2020 Annual Report Financial SupplementsDocument236 pagesBDO Unibank 2020 Annual Report Financial SupplementsDanNo ratings yet

- Fundamentals of Strategic ManagementDocument52 pagesFundamentals of Strategic ManagementGennelyn Grace PenaredondoNo ratings yet

- CH1 HbotbDocument7 pagesCH1 HbotbJela OasinNo ratings yet

- Cover Letter - Johnson & JohnsonDocument1 pageCover Letter - Johnson & JohnsonrezaseptiadiNo ratings yet

- Installment Sales & Long-Term ConsDocument6 pagesInstallment Sales & Long-Term ConsSirr JeyNo ratings yet

- Mr. Nam's Dilemma: Choosing the Right Financing StrategyDocument8 pagesMr. Nam's Dilemma: Choosing the Right Financing StrategyCleofe Mae Piñero AseñasNo ratings yet

- RSU Thesis Format & Style ManualDocument56 pagesRSU Thesis Format & Style ManualQuenie De la CruzNo ratings yet

- Module 2 - Functions of BSPDocument14 pagesModule 2 - Functions of BSPQuenie De la CruzNo ratings yet

- Liability of Accommodation Party in Negotiable InstrumentsDocument7 pagesLiability of Accommodation Party in Negotiable InstrumentsRonalyn Orpiano0% (1)

- Amazon Invoice Books 6Document2 pagesAmazon Invoice Books 6raghuveer9303No ratings yet

- Real Freedom-For-All (What-if-Anything-Can-Justify-Capitalism) by Philippe Van Parijs (1995)Document340 pagesReal Freedom-For-All (What-if-Anything-Can-Justify-Capitalism) by Philippe Van Parijs (1995)nemo nulaNo ratings yet

- STRATEGIC MANAGEMENT GUIDEDocument21 pagesSTRATEGIC MANAGEMENT GUIDEnadineNo ratings yet

- ESTIMATING DOUBTFUL ACCOUNTSDocument15 pagesESTIMATING DOUBTFUL ACCOUNTSMARY GRACE VARGASNo ratings yet

- Horizontal and Vertical AnalysisDocument5 pagesHorizontal and Vertical AnalysisWaleed KhalidNo ratings yet

- (Final) Quiz Statement of Changes in Equity and Cash Flows Word FileDocument3 pages(Final) Quiz Statement of Changes in Equity and Cash Flows Word FileAyanna CameroNo ratings yet

- Balanced ScorecardDocument14 pagesBalanced ScorecardLand DoranNo ratings yet

- Horizontal AnalysisDocument6 pagesHorizontal AnalysisJames Torniado AgboNo ratings yet

- What Is A Marketing Budget?: Strategic Marketing Analysis and BudgetingDocument8 pagesWhat Is A Marketing Budget?: Strategic Marketing Analysis and BudgetingJohn Michael SomorostroNo ratings yet

- Notes For Civil Code Article 1177 and Article 1178Document5 pagesNotes For Civil Code Article 1177 and Article 1178Chasz CarandangNo ratings yet

- Exam in Accounting-FinalsDocument5 pagesExam in Accounting-FinalsIyarna YasraNo ratings yet

- Financial Management BSATDocument9 pagesFinancial Management BSATEma Dupilas GuianalanNo ratings yet

- Ast Millan CH1Document2 pagesAst Millan CH1Maxine OngNo ratings yet

- Accounting For Partnership and Corporation (3 Trimester - CY 2016-2017)Document56 pagesAccounting For Partnership and Corporation (3 Trimester - CY 2016-2017)Gumafelix, Jose Eduardo S.No ratings yet

- Cash & Cash Equivalents Composition & Other Topics CashDocument5 pagesCash & Cash Equivalents Composition & Other Topics CashEurich Gibarr Gavina EstradaNo ratings yet

- 1.3 Introduction To Money and Interest RatesDocument2 pages1.3 Introduction To Money and Interest RatesJessa Lyn Gao LapinigNo ratings yet

- AE 18 Financial Market Prelim ExamDocument3 pagesAE 18 Financial Market Prelim ExamWenjunNo ratings yet

- Time Value of MoneyDocument8 pagesTime Value of MoneyLj SzeNo ratings yet

- Rice Company Was Incorporated On January 1Document6 pagesRice Company Was Incorporated On January 1Marjorie PalmaNo ratings yet

- Chapter 9 Financial Forecasting For Strategic GrowthDocument18 pagesChapter 9 Financial Forecasting For Strategic GrowthMa. Jhoan DailyNo ratings yet

- Borrowing Cost DrillDocument2 pagesBorrowing Cost DrillJasmin Rabon0% (1)

- Chapter 4 Sec Code of Corporate Governance, ContinuedDocument12 pagesChapter 4 Sec Code of Corporate Governance, ContinuedRenato AbalosNo ratings yet

- Taxation of Estates, Trusts and Co-OwnershipDocument10 pagesTaxation of Estates, Trusts and Co-OwnershipChryshelle Anne Marie LontokNo ratings yet

- MB0045 Financial Management Answer KeyDocument21 pagesMB0045 Financial Management Answer Keysureshganji06No ratings yet

- Financial Statements Analysis - ComprehensiveDocument60 pagesFinancial Statements Analysis - ComprehensiveGonzalo Jr. RualesNo ratings yet

- Pfrs 1: First Time Adoption of PfrsDocument12 pagesPfrs 1: First Time Adoption of PfrsZeo AlcantaraNo ratings yet

- Pride and Prosper, Inc.: Case AnalysisDocument5 pagesPride and Prosper, Inc.: Case AnalysisErica Dizon100% (1)

- FINANCIAL FORECAST GUIDEDocument16 pagesFINANCIAL FORECAST GUIDEMariann Jane GanNo ratings yet

- 2020 Dec. MIDTERM EXAM BSA 3A Financial MGMT FinalDocument6 pages2020 Dec. MIDTERM EXAM BSA 3A Financial MGMT FinalVernnNo ratings yet

- Caltech Ventures Performance AgreementDocument3 pagesCaltech Ventures Performance AgreementAnita WilliamsNo ratings yet

- Intermediate Accounting 1 - Practice QuizDocument12 pagesIntermediate Accounting 1 - Practice QuizJesaiah PalmaNo ratings yet

- BDO's Financial Projections Reflect Strategic GoalsDocument4 pagesBDO's Financial Projections Reflect Strategic GoalsCamille PerenaNo ratings yet

- Chapter 3 - TheoriesDocument10 pagesChapter 3 - TheoriesXynith Nicole RamosNo ratings yet

- Accounting for Investment in AssociatesDocument2 pagesAccounting for Investment in AssociatesRanee DeeNo ratings yet

- Module 9 - Commercial Bank Management PDFDocument16 pagesModule 9 - Commercial Bank Management PDFRodel Novesteras ClausNo ratings yet

- Financial Statement Analysis Drill TheoryDocument3 pagesFinancial Statement Analysis Drill TheoryJoy Dhemple LambacoNo ratings yet

- What Are The Basic Benefits and Purposes of DeveloDocument7 pagesWhat Are The Basic Benefits and Purposes of DeveloHenry L BanaagNo ratings yet

- Acctg 15 - Midterm ExamDocument6 pagesAcctg 15 - Midterm ExamAngelo LabiosNo ratings yet

- Chart of Accounts General Ledger General Ledger Page No. Page No. Assets IncomeDocument44 pagesChart of Accounts General Ledger General Ledger Page No. Page No. Assets IncomeJireh RiveraNo ratings yet

- Nacua CAC Unit2 ActivityDocument13 pagesNacua CAC Unit2 ActivityJasper John NacuaNo ratings yet

- Background of The StudyDocument47 pagesBackground of The Studykeith tambaNo ratings yet

- Chapter 5Document7 pagesChapter 5intelragadio100% (1)

- Chapter 2 - Premium LiabilityDocument2 pagesChapter 2 - Premium LiabilityXienaNo ratings yet

- Unit VIII Accounting For Long Term Construction ContractsDocument8 pagesUnit VIII Accounting For Long Term Construction ContractsNovylyn AldaveNo ratings yet

- Problem 14-5: Kayla Cruz & Gabriel TekikoDocument7 pagesProblem 14-5: Kayla Cruz & Gabriel TekikoNURHAM SUMLAYNo ratings yet

- Decision Tree - JDDDocument3 pagesDecision Tree - JDDJed DilloNo ratings yet

- Which Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in AssociatesDocument1 pageWhich Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in Associatesjahnhannalei marticio0% (1)

- Investagrams Virtual Trading RIVERADocument3 pagesInvestagrams Virtual Trading RIVERACarlo RiveraNo ratings yet

- Chapter 5 Statement of Changes in EquityDocument6 pagesChapter 5 Statement of Changes in EquitylcNo ratings yet

- Balance SheetDocument18 pagesBalance SheetAndriaNo ratings yet

- Project ManagementDocument2 pagesProject ManagementRocel DomingoNo ratings yet

- Discussion 2 CHAPDocument4 pagesDiscussion 2 CHAPHannah LegaspiNo ratings yet

- Management Science - Final ExamDocument5 pagesManagement Science - Final ExamRHEA VANESSA FIGUEROA ARDIENTENo ratings yet

- Q2 2023-EndDocument77 pagesQ2 2023-EndQuenie De la CruzNo ratings yet

- Monitoring List of Potential ClientsDocument1 pageMonitoring List of Potential ClientsQuenie De la CruzNo ratings yet

- Cultural Heritage Sites for DialogueDocument18 pagesCultural Heritage Sites for DialogueQuenie De la CruzNo ratings yet

- Thesis Template EIDocument22 pagesThesis Template EIQuenie De la CruzNo ratings yet

- Importance of Technology in Facilitating Learning - Jasper M. VillanuevaDocument2 pagesImportance of Technology in Facilitating Learning - Jasper M. VillanuevaQuenie De la CruzNo ratings yet

- Letter For SurveyDocument1 pageLetter For SurveyQuenie De la CruzNo ratings yet

- Survey Form QuestionnairesDocument3 pagesSurvey Form QuestionnairesQuenie De la CruzNo ratings yet

- EI Questionnaires For ValidationDocument4 pagesEI Questionnaires For ValidationQuenie De la CruzNo ratings yet

- EI THESIS Need To CritiqueDocument72 pagesEI THESIS Need To CritiqueQuenie De la CruzNo ratings yet

- Chapter VDocument3 pagesChapter VQuenie De la CruzNo ratings yet

- Chapter VDocument3 pagesChapter VQuenie De la CruzNo ratings yet

- Excuse LetterDocument1 pageExcuse LetterQuenie De la CruzNo ratings yet

- Validation Letter (Edited)Document1 pageValidation Letter (Edited)Quenie De la CruzNo ratings yet

- Thesis Group-30Document41 pagesThesis Group-30Quenie De la CruzNo ratings yet

- Art Appreciation - Module 2 - Week 2Document7 pagesArt Appreciation - Module 2 - Week 2Quenie De la CruzNo ratings yet

- My Story: Born in 2003, Aspiring CriminologistDocument2 pagesMy Story: Born in 2003, Aspiring CriminologistQuenie De la CruzNo ratings yet

- Compilation of TheoriesDocument15 pagesCompilation of TheoriesQuenie De la Cruz100% (1)

- List of Gov. Universities in Western Visayas With PresidentsDocument2 pagesList of Gov. Universities in Western Visayas With PresidentsQuenie De la CruzNo ratings yet

- BAA 222 SyllabusDocument7 pagesBAA 222 SyllabusQuenie De la CruzNo ratings yet

- Chapter 8-Zero Rated SalesDocument8 pagesChapter 8-Zero Rated SalesQuenie De la CruzNo ratings yet

- Exercise 5 VATDocument3 pagesExercise 5 VATQuenie De la CruzNo ratings yet

- Art Appreciation - Module 1 - Week 1Document15 pagesArt Appreciation - Module 1 - Week 1Quenie De la CruzNo ratings yet

- MKTG 1 - Q1 - 2022 - 8-9 (Responses)Document2 pagesMKTG 1 - Q1 - 2022 - 8-9 (Responses)Quenie De la CruzNo ratings yet

- Chapter 7-Regular Output VATDocument9 pagesChapter 7-Regular Output VATQuenie De la CruzNo ratings yet

- Tax 2 - Transfer and Business Tax: Second Semester A.Y. 2020-2021Document2 pagesTax 2 - Transfer and Business Tax: Second Semester A.Y. 2020-2021Quenie De la CruzNo ratings yet

- Chapter 4-Reviewing The LiteratureDocument11 pagesChapter 4-Reviewing The LiteratureQuenie De la CruzNo ratings yet

- Economic Chapters 1-5 Questions Page 303-306Document8 pagesEconomic Chapters 1-5 Questions Page 303-306api-19964497No ratings yet

- YogSandesh October Eng2011Document66 pagesYogSandesh October Eng2011Manmohan Gupta100% (1)

- Aloha TableService - Essentials - WorkbookDocument93 pagesAloha TableService - Essentials - WorkbookIgnatius Reilly50% (2)

- 1800 SynonymsDocument430 pages1800 SynonymsLK English ClassesNo ratings yet

- Niches (TG@MoneyBashers)Document64 pagesNiches (TG@MoneyBashers)kosanoc504No ratings yet

- Research 1 QuestionDocument7 pagesResearch 1 Questiondoom zy100% (1)

- Public AdministrationDocument8 pagesPublic AdministrationHezekia KiruiNo ratings yet

- Laiba Tahir 2025-11-0172 Izzah Atif Dar 2025-11-0184 Ahmad Jawaid 2025-11-0024Document8 pagesLaiba Tahir 2025-11-0172 Izzah Atif Dar 2025-11-0184 Ahmad Jawaid 2025-11-0024laibaNo ratings yet

- InTax - Items - of - Gross - Income TAMAYAO - GARCIA RESADocument5 pagesInTax - Items - of - Gross - Income TAMAYAO - GARCIA RESAAbby NavarroNo ratings yet

- Deductions From Gross EstateDocument20 pagesDeductions From Gross EstateJamaica David100% (1)

- Ilovepdf - Merged - 2023-07-14T193418.587Document3 pagesIlovepdf - Merged - 2023-07-14T193418.587SRINIVASREDDY PIRAMALNo ratings yet

- Tax Reduction Case Studies v2Document12 pagesTax Reduction Case Studies v2Arkel KingNo ratings yet

- Donor Tax GuideDocument13 pagesDonor Tax GuideRovi Anne IgoyNo ratings yet

- Operating Costing Questions (FINAL)Document4 pagesOperating Costing Questions (FINAL)Tejas YeoleNo ratings yet

- BD SM01 Final SN GeDocument3 pagesBD SM01 Final SN GeSharon Huang ZihangNo ratings yet

- FinolexDocument171 pagesFinolexAkash Nil ChatterjeeNo ratings yet

- Attitude of People Towards Green ProductsDocument52 pagesAttitude of People Towards Green ProductsMessiNo ratings yet

- IAS 2 Inventory ValuationDocument4 pagesIAS 2 Inventory ValuationSultanNo ratings yet

- Approaches To Public Utility PricingDocument17 pagesApproaches To Public Utility PricingPrasad DsaNo ratings yet

- CHAPTER 5. Types of StrategiesDocument23 pagesCHAPTER 5. Types of StrategiesAiralyn RosNo ratings yet

- Citi Corporate SolutionsDocument9 pagesCiti Corporate Solutionsapi-26094277No ratings yet

- CIR v. BPI, G.R. No. 147375, 2006Document12 pagesCIR v. BPI, G.R. No. 147375, 2006BREL GOSIMATNo ratings yet

- Report H12016 Eng FinalDocument29 pagesReport H12016 Eng FinalTy BorjaNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceKuldeep Krishan Trivedi Sr.No ratings yet

- For Corporate Social Responsibility - Cs P SriramDocument45 pagesFor Corporate Social Responsibility - Cs P SriramThe First AlertNo ratings yet

- Test 2 HomeworkDocument12 pagesTest 2 HomeworkMiguel CortezNo ratings yet