0% found this document useful (0 votes)

378 views9 pagesPublic Sector Financial Analysis Report

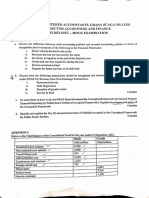

The financial statements show Country X had a net loss of 14.5 billion while Country Y had a net gain of 7.56 billion. Country X has a larger population and GDP but also much higher debt levels and a negative accumulated fund. A ratio analysis should be conducted to further analyze the financial performance and position of the two countries. Key ratios to examine include debt to GDP, revenue to GDP, and accumulated fund to total assets.

Uploaded by

Desmond Grasie ZumankyereCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

378 views9 pagesPublic Sector Financial Analysis Report

The financial statements show Country X had a net loss of 14.5 billion while Country Y had a net gain of 7.56 billion. Country X has a larger population and GDP but also much higher debt levels and a negative accumulated fund. A ratio analysis should be conducted to further analyze the financial performance and position of the two countries. Key ratios to examine include debt to GDP, revenue to GDP, and accumulated fund to total assets.

Uploaded by

Desmond Grasie ZumankyereCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd