Professional Documents

Culture Documents

Calculation

Calculation

Uploaded by

Desmond Grasie Zumankyere0 ratings0% found this document useful (0 votes)

56 views48 pagesPSAF

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPSAF

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

56 views48 pagesCalculation

Calculation

Uploaded by

Desmond Grasie ZumankyerePSAF

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 48

we Me EN ae ER lo da’

Tr aN . a! -

\r hi on at ae ESSAY Va gdute 2

. a Bo ea Coe Ene eek, th

Yor ae" Yer ae ei Fee 1

INTERVENTION

G\ cal Oreo,

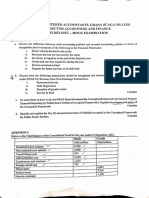

PUBLIC SECTOR ACCOUNTING

5™ MARCH, 2023

Time allowed

elexxNow

Reading and planning: 15 minutes

Writing: 3 hour

ATTEMPT ALL QUESTIONS

Do NOT open this paper until instructed by the supervisor.

During reading and planning time only the question paper

may be annotated. You must NOT write in your answer

booklet until instructed by the supervisor,

Elexxon Business Consultancy and Financial Training

Bleaxon Consultancy and Financial Training: ww.elexxon.com; 0547884068/0201484726

LOCAL GOVERNMENT FINANCIAL STATEMENTS.

QUESTION ONE

The following details relates to Aboso Municipal Assembly for the year 2022.

GHE'000

Dividend Received |G 93,250

Central Government Salaries Je Comet) ers cm 12,000,000.

BasicRates A St 370,900

Districts Development Facility ecan kwon =) hers le. 15,000,600

Rent from Land and Building [Gc 6,120,800

Established Posts aw. 1,140,700

Other Expenditure _ £600,000

Non- Established Posts Sir 580,000

‘Allowances a carne 390,470

Court Fees a See 240,000

Inventory and Consumables — <_< 800,000

Sanitation Fees &G. 370,000

General Cleaning iS 350,000

Common Fund — SS = 2,930,000

Social Benefit — 840300

Equity Investment Acquired — W\O® 420,000

Infrastructure, Plant and Equipment — —\c @ 980,000

WorkInProgress 490,000

LomsReceived Rew Tiana Taps 2,330,000

Interest Expense Eh 200,000

Advances to Staff 7 yf 660,000

Royalties a (Ge 430,000

Consultanciescot SG 470,000

‘Training and Workshop cost S 275,000

‘Transport and Travelling cost cs 620,000

‘Consumption of Fixed Assets 960,000

Special Services = eas 820,000

Utilities =a. £630,000

Page 1 of a5

Market Tolls 870,000

Permit Fees 990,000

Fines and Penalties 330,000

Development Bonds Issued 1,300,000

Hostel License (630,920

Business Income 2,300,600

Chop Bar License 300,400

Proceeds from Sale of Equity 990,320

‘Accumulated Fund (1/1/2022) 370,600

Herbalist License 530,370

‘Cash and Cash Equivalent @ (1/1/2022) 12,300,240

Stool Land Revenue 600,000

Lony Park Fees 720,400

‘Market Store Rent 300,750

Recoveries 194,000

‘Loan Repayment 143,000

Property Rate 820,900

Additional Information:

i) Aboso Municipal Assembly adopts accrual basis of accounting in the preparation of its

financial statements.

ii) Established Post salaries outstanding as at 31/12/2022 was GH¢180,000,000.

iii) Inventory at 31/12/2022 was GH¢170,000,000.

Required:

Prepare for Aboso Municipal Assembly:

a) Statement of financial performance for the year ended 31/12/2022.

b) Statement of cash flow for the year ended 31/12/2022.

uv

Page 2 of 45

QUESTION TWO.

Below is the extract from the records of Sepe District Assembly.

Trial Balance as at 31 December 2022 _

C GHE000 | GH000

“Travel and transport - 10,000)

Seminar and conference - 8,700

Independence Day celebration 5,600

Office consumables 4,100

Inventory of office consumables 1,200

Local Consultancy 300

Limited engagement 1,300.

Non-established post salaries 4,400

Allowances for staff. 2,100

‘Assembly members allowances 950

Foreign travels per diems 500

Foreign travels 1,800

Share of District Assembly Common Fund | 68,000

Share of stool land revenues, 13,000

(Ceded revenues from GRA. 11,250

Basic rates 10,000

Property rates 26,000

Market tolls _ 6,800

Market store fees 9,100

Lorry parks 600

“Advertisements and promotions 7,400

Vehicle licenses 560

Hawkers’ licenses 120

Entertainment licenses 700

Fixed deposit interest 800

Fixed deposit investment 10,000

Motor vehicles 25,000 | _5,000

Furniture and fittings 15,000 [3,000

Premises 36,000 [5,600

Equipment 34,000 | _3,600

Cash and cash equivalent - 5,400

Loans and advances _ 6,200

Revenue receivable 300

Page 3 of a5

‘Other expenses 1,700

‘Accumulated surpluses 47,020

District development facility

224,550 | 224.550

Additional Information:

i) The Central Government has a Constitutional responsibility to pay all Established Post Salaries

of the Assembly from the Consolidated Fund. The Established Post Salaries paid by the Central

Government on behalf of the Assembly for 2022 amounted to GH¢64,000,000. This payment has

not reflected in the books of Sepe District Assembly,

ii) Office consumables in respect of Stationery and other items bought for GH¢ 1,800,000 remained

unused during the year, The Current Replacement cost of the Inventories is GHe1,050,000.

Meanwhile, the Net Realisable value of the inventories is estimated at GH¢1,400,000.

iii) Consumption of fixed capital is to be changed as follows:

‘Assets Estimated useful life

Motor vehicles S years,

Furniture and fittings years

Premises 50 years

Equipment Si years

iv) During the year, the Private Broadcasters Association have given free air to the

information service department to promote civic education on election 2022. The estimated cost

of the air time was GHC12, 000,000.

v)_ Sepe District Assembly could not pay the Blectricity Bill for the last quarter of 2022. This was

brought to its attention by the Electricity Company Ltd. of Ghana. The amount involved is

GH¢4,000,000.

vi) The Government has assigned some young graduates to Sepe District Assembly as part of the

Nation Builders Corp programme to support the Assembly in Revenue Mobilisation. The

allowances amounting to GH¢2,000,000 due them from Sepe District Assembly for the last

month of the year was outstanding, Sepe District Assembly promises to pay them by the end of

the Third quarter of 2022.

Page 4 of 45,

vii) Fixed Deposit attracts interest of 25% per annum and some interest is due as at 31 December

2022,

viii) The Assembly took a Loan to purchased equipment at a cost of GHe200,000,000 on 1 January,

2022 and a new equipment valuing GHc100, 000,000 was donated to the Assembly during the

‘year 2022. These pieces of Equipment were assessed to have usefil life of ten years. This has not

been accounted for in the trial balance.

ix) Extract of the 2022 Budget of the Sepe District Assembly is as follows:

Main Budget Revised Budget

GH¢"000 GH¢"000

Decentralised transfer 177,000 185,000

Compensation of employees 35,600 74,300

Goods and Services 45,780 35,600

Other expenses, 1,870 1,700

Internally Generated Funds 187,400 102,000

Donations and grants 1,000 1,000

Required:

Prepare in accordance with the ZPSAS and the Public Financial Management Act, 2016 (Act

921):

a) Statement of Financial Performance for the year ended 31 December 2022.

»)_ Statement of Financial Position as at 31 December 2022.

©) Statement of Budget Information in Comparison with Actuals for the year ended 31

December 2022,

4) Notes to the Financial Statements,

Pages of 45

QUESTION THREE

The following balances was extracted from the books of Eduase Municipal Assembly for the year

ended 31% December, 2022

DEBIT | — CREDT

GHS GHS

[Basic Rate _ 9,121,95

Royalties 61,7653

[Employees Compensation 5,000,6

iReat 7813.4

ines and Fees 4,467.80

[Licenses 10,016,420,

Property Rate 57,456,331

ther Levies 224,567

District Development Facility 338,721

Common Fund 171,202

Stool land Revenue 43.33

roceeds from Disposal of Assets 41,500]

Investment Income 5.550

unicipal Bond Issued 790,250)

[Loans from Prudential Bank 833,524

Prudential Bank Loan repayments 244,150

jond Repayments 287,320

salaries & Wages “Established Positions 2878S

Salaries & Wages- Non-Established Posts 718,820)

Salary Related Allowances 133,760)

jon-Salary Related allowances 228,54

[Gratuities 144,37

[End of Service Benefit (ESB) 100.10)

Page 6 of 45

Employer's Pension Contributions 467,650)

Materials and Office Consumables 4,169,340}

(Utilities. aoe 472,040]

{General Cleaning 183,970}

entals 150,766

Travel and Transport 1,937,910|

‘epairs and Maintenance 150,817]

[Training, Seminar and Conferences 4,425,869 |

[Consultancy Expenses 4,001,540}

{special Services | ___ 292,280]

ther Charges and Fees 3,570,460]

[Emergency Services 36,625

[Additions to Infrastructure, Plant & Bquipment 136,239,510)

fork In Progress - Constructions and Buildings 20,796,200]

Consumption of Fixed assets for the year 5,600,046|

rest paid on loans 1,875,781

|Employer social benefits in Cash 1,370,600)

[Equity Investments in Companies 3,450,

[Cash and cash equivalents (1/1/2022) 39,450,1

Additional Information

i, Property Rate outstanding as 31/12/2022 was GHC40,000,000

i, Work in Progress amount of GHC35, 000,000 has been incurred during the period. However,

because of liquidity challenges faced by Assembly only GHC28,000,000 has since been paid

iii, During the year, the Chiefs and People of the Assembly donated a New Vehicle valued at

‘GH¢400,000 to the Assembly. No record was made in the books

Page 7 of a5

Required:

a) Prepare a Statement of Financial Performance for Eduase Municipal Assembly for year

ended December 31, 2022.

b) Prepare a Statement of Cash Flow for Eduase Municipal Assembly for the year ended

December 31, 2022.

©) Prepare the Relevant Notes and Schedules to the Financial Statement

Page 8 of 45

MINISTRIES DEPARTMENTS AND AGENCIES

QUESTION ONE

‘The following Trial Balance relates to Danke State University, a public tertiary educational

institution in Ghana, a8 at 31 December, 2022

GH¢'000 GH¢'000

‘Cash and Bank 264,810]

Program Accreditation Cost 508,950

Examination Invigilation Cost 450,000]

‘Sponsorship 7,290 4217510

Proceeds from Sale of Textbooks 98,290]

Stationery Inventory (1/1/2022) 98,290

Textbooks Inventory (1/1/2022) 35,550

Purchases of Stationery -261,000[

Purchases of Textbooks 152,740

Mature Entrance Examination Fees 190,280

Graduation Cost/Fees_ 15,580 450,000

Fees Income 3,600,000

61,950

Sale of Admission Vouchers 450,110}

Books and Research Allowance 135,600

Established Post Salaries i) 4,452,150]

Meeting Sitting Allowance 71,000)

Employer's Contribution to Provident Fund 22,550]

Non-Established Post Salaries 1,128,240,

‘Exams Seript Marking Cost 78,050)

‘Transcript Fees 24,700]

‘Academic Facility User Fees 7,040,580

Other Facility User Fees (v) 816,010

Property, Plant and Equipment (vil) 13,770,000] 1,105,400

Investment Property (vii) 2,254,500] 716,800]

Software (vii) 895,950

Feos Receivables (iv) 421,230]

Loans and Advances (iii) 187,200 |

Internet Broad Band Cost 5,338,270 |

Other Expenses 63,900)

Page 9 of a5

‘Bad debt provision 4,500

Bank Loans 685,000

GoG Subvention 8,646,740)

Salary Related Allowances 180,560

Examinations Moderation Cost 226,670

Project Work Supervision Allowance 43,650

Staff Training and Development 2,093,600

Ulty Bis (i) 504,040

Casual labour 250,650

“Applied Research Conference 300,000

Tnterest on Loans 200,000

13% SSF (Employer's contribution) 32,550

Withholding Tax 31,450

Payables 164,550

‘Accumulated Fund 11,084,700

Basa 570 3addd.570

Additional Information:

4) Itis the policy of the University to prepare Financial Statements on accrual basis in compliance

with Public Financial Management Act,2016 (Act 921), Public Financial Management Regulation

2019 (L.12378) and the International Public Sector Accounting Standards (IPSAS),

ii) Usility Bills outstanding during the year amounted to GH¢15,500,000 whilst that of Established

Post Salaries amounted to GH¢120,000,000. These have been omitted from the trial balance

iii) Loans and Advances represent Salary Loan given to some Staff of the University. These loans

were granted at a concessionary interest rate of 2%, Provision isto be made for interest on Loans

and Advances,

iv) The Fees Receivables represents outstanding school fees for 870 students. Out ofthis, 90 students,

were expelled from the school for poor academic performance. As a result, it is very unlikely the

University would recover the amount of School Fees owed itby the expelled students, This amount

constitutes 5% of Fees Receivables.

‘The University from experience also consider that itis very unlikely to recover al the

outstanding fees and they intend to set a provision of unrecoverable debt against the remaining

school fees at the rate of 7%

V) Included in the Other Facility User Fees is hostel fees amounting to GH¢1,050,000 paid in respect

‘of 2022/2023 Academic year.

vi) Inventory of Text books as at 31 December 202! amounted to GH¢ 142,500,000 at cost and having

4 Net Realisable value of GHE165,000,000, but its Replacement cost is GH¢78, 000,000. In

addition, stationery inventory as at 31 December, 2022 amounted to GH¢17,000,000 and having

a Replacement cost of GHE18,000,000 with an estimated Net Realisable Value of

GH¢25,000,000.

Vii) The University uses Straight Line method of depreciation for Non-Current Assets. Details of Non-

Current Assets and their respective useful lives are stated below:

‘Non-Current Assets Useful Life

Property, Plant and Machinery 20 years

Tnvestment Property 10 years

Page 10 of 45

Sivan — Tyan]

Required:

) Prepare a Statement of Financial Performance for Danke State University for the year ended

31 December 2022,

b) Prepare a Statement of Financial Position for Danke State University as at 31 December,

2022

©) State FOUR (4) accounting policies applied in preparing the financial statement

QUESTION TWO

‘Agogo Municipal Hospital is a Public Hospital established in the Ashanti Region,

which serves several communities. Its Trial Balance for the year ended 31 December

2022 is provided below.

DR R

GHE000 GHE O00

‘Cash and Cash Equivalent 504,000

Withholding Taxes 180,000

Outpatients 917,000

Tapatients 365,000

Drugs and Medications 657,000

Drugs Purchase 340,000

Inventory of Drags 110,000]

Other Service Income 215,790

‘Ultra Sound Revenue s 232,000

Taboratory Service Fees 458,200

“Travel and Transport 9,000

Seminar and Conferences 80,000

General Cleaning 62,400

Consulting Specialist 25,000

Clinical Consumables 12,000

Contracted Service Expense 15,000

[Established Post Salaries 1,406,400,

fasual Labour 102,750

[Extra Duty Allowances 438,500

[Other Allowances 81,000

Stationery Stock 18,000

Purchases of Stationery (63,500

(GoG Subvention 1,503,000)

Repairs and Maintenance 70,000

jurgical Fees 120,000]

Page 11 of a5

Eye Care Fees 180,000

Rent 664,160

Provision for Undertakings (1/1/2022) 2,700)

[Laboratory Equipment 350,000 55,000

Building 1,215,000) 60,750

(tor Vehicles 800,000] 720,000)

oftware 10,000 4,000

ixed Deposits 100,000

NHIS Claims Receivables 900,000]

[loans and Advances 17,000

Sundry Creditors 144,000

[Ambulance Service Fees 152,000

ental Fees 112,000)

‘Mortuary Fees - 25,000

Bank Loans 150,000 |

interest 3,500

linvestment Income (Fixed Deposit) 10,000

ther Expenses Tf 35,800

[Accumulated Surplus 668,250

(Undertaking (Receivables) 30,000

7,198,850) 198,850

Additional information

{The hospital's policy is to apply the Accrual Bases of Accounting in preparing its

Financial Statements in compliance with the Public Financial Management Act,2016(Act

921), Public Financial Management Regulation 2019 L.1 2378 and the International Public

Sector Accounting Standards (IPSAS).

ii) The hospital purchased equipment at the cost of GH¢200,000 on 1 April 2022

iii) A new equipment valuing GH¢100,000 was donated to the hospital on 1 July 2022. The

equipment was assessed to have a usefil life of ten (10) years. This has not yet been

accounted for in the Trial Balance.

iv) The Fixed Deposit attracts an interest of 10% per annum.

v) Inventory of drugs as at 31 December 2022 amounted to GH¢95,000,000 at cost and had

‘a net realizable value of GH¢1 10,000,000 but its replacement cost is GH¢78,000,000.

In addition, stationery stock as at 31 December 2022 cost GH¢28,000,000 and have a

replacement cost of GH¢25,000,000 with an estimated net realizable value of

(GHE35,000,000.

vi) Redundancy pays outstanding as at the end of the year amounted to GH¢25,950,000.

vii) Provision for undertaking is estimated at 8%.

viii) The hospital currently owes Healer Pharmaceuticals for Drugs amounting to

GHE1, 950,000 supplied to the hospital during the years 2022 and 2023 in respect of

the following months,

Page 12 of aS

‘Months/ years ‘Amount Outstanding GH)

November 2022 820,000

December 2022 610,000

January 2023 520,000

Totals 1,250.00)

ix) Consumption of Fixed Asset is charged on straight line basis with time apportionment

in the year of acquisition

‘Asset Useful life

Laboratory Equipment 20 years

Building SOyears

Motor Vehicles - 10 years

Software i Syears

Required:

Prepare in compliance with the IPSAS and relevant legislations.

a) Statement of Financial Performance for the year ended 31 December 2022.

b)_ Statement of Financial Position as at 31 December 2022.

©) Notes to the Accotints.

QUESTION THREE

‘The following Trial Balance relates to Atonsu State University, a Public Tertiary Educational

Institution in Ghana, as at 31/12/2022.

Fees Income

Resit Registration Fees

‘Admission Forms

Establish Post

Allowance

Consultancy Fees

Legal Cost

GOG grant

‘Transcript Fees

Academic facility user Fees

Residential facility user Fees

Consultancy Cost

Non- Establish Post

DR cR

GH¢'000 GH¢'000

4,000,000

78,500

300,122

5,312,430

856,670

655,600

25,059

1,540,000

1,360,024

2,266,707

906,683

565,500,

1,253,600

Page 13 of 45

Seminars cost

Sponsorship

Receivables

Payables

22% loan

Books and Research Allowance

Property, Plant and Equipment

Investment Property

Software

Other Incomes

Project Work Supervisory Allowance

Cash and Bank

Training and Workshop cost

Bad debt provision (student fees)

Goods and Service

Other Expenses

Withholding Tax

Accumulated Fund

Utilities Bills

Salaries Subvention,

Superannuation

End of Service Benefits

Stationery Stock

Additional information:

300,000

8,100

468,050

150,765

15,300,000

2,505,000

995,500

48,500

294,233

104,000

8,251,735

71,000

360,053

278,500

298,040

399,165,

38,245,900

4,533,414

182,840

8,600

1,006,000

352,000

150,000

211,430

4,940

90,500

11,205,270

9,196,270

38,245,900

i) The University has adopted the Accrual Basis International Public Sector Accounting

Standards (IPSAS) as the Basis for the preparation of its financial statements,

ii) An NGO has donated a vehicle to the University. The records of the NGO show that the

vehicle donated cost GHC80, 000,000, however the fair value of the vehicle is GHCS2,

000,000, with estimated useful life of five years. No records were made in the books of the

University.

Page 14 of 45

iii) Inventories included in the use of goods and services available at the end of the year were

‘Text books which are held for sale and stationery for consumables.

Inventories for use Inventories for sale

GHC GHC

Historical cost 200,500,000 22,000,000

Replacement coat 157,880,000 15,000,000

Net realisable value 50,000,000 155,254,000

iv) Consultancy cost amounting to GH¢234,500,000 was incurred but not yet paid.

¥) Books and Research Allowance was received from Government during the period

amounting to GH¢337,530,000 for disbursement to qualified Lecturers and Administrative

staff.

vi) Provision is to be made for interest on loans.

vii) 65% of the receivables represent an amount of students’ fees outstanding as at

31/12/2022.

viii) Provision for doubtful debt is estimated to be 7% of outstanding school fees.

ix) Some staffs have sued the University for unlawful dismissal on 15th July, 2022 seeking

damages amounting to GHC80,000,000, as at the year end, the case has been heard awaiting

judgment. Unfortunately, the judgement shall be given in the favor of the plaintiffs on 20th

February, 2023

x) The university uses straight line basis of depreciation for Capital Assets. Capital Assets

and their useful lives are detailed out below:

Assets Useful Life

Plant and Machinery oyears

Investment Property 9 years

Software 5 years

Page 15 of 45

Required:

4) Prepare a Statement of Financial Performance for Atonsu State University for the year ended

31/12/2022.

ii) Prepare a Statement of Financial Position as at 31/12/2022,

QUESTION FOUR

Emem Government Hospital, is « Public Hospital in the Bono Region, which serves several Municipalities,

in the Region. Its Trial Balance for the year ended 31* December 2022 is provided below.

DEBIT CREDIT

GHS"000 ‘GHS"000

‘Outpatients 196,000

Inpatients 545,000

Drugs and medications 770,000.

Drugs purchase 600,000

Inventory of drug 120,000,

Other service income 30,000

Ultra Sound 70,000

Laboratory service Fees 120,000

Travel and transport 90,000

Purchases of Stationery 30,000

Seminar and conferences 160,000,

General cleaning 20,000

Consulting specialist 100,000,

Clinical consumables 320,000

‘Operational expense 860,000

Established Post Salaries 1,670,000,

‘Casual Labor: 140,000,

Extra Duty Allowances 500,000

Other Allowances 200,000

GoG subvention 2,400,000

‘Surgical Fees 18,000

‘OPD_ 9,000

Eye care Fees 45,000

Rent 117,000

‘Accumulated depreciation 1,400,000

PPE at cost 7,000,000

Fixed deposits 60,000

Receivables 50,000

Loans and advances 180.000

Sundry creditors 200,000,

‘Ambulance 44,000

Dental fees 38,000

Page 16 of a5

Mortuary 115,000

Bank and cash 24,000

‘Bank loans 400,000

Interest ; 40,000

Investment income 7 30

Cither Expenses 30,000

‘Accumulated surplus 5.65400

120,194,000 120,194,000

‘Additional information

a)

»)

d)

‘The hospital currently owes Emest Chemist for drugs supplied to the hospital during the

year for an amount of GHS 84,000,000 for drugs bought for the year. Arrangement has

been made to settle the bills in the third quarter of 2022.

Most of the patients are on National Health Insurance Scheme. The hospital made

Insurance claim of GHS 70,000,000 for the'Iast quarter of 2032 which has not been

received as at 31" December

The PPE are Depreciated over 10 years

Volunteer specialist from USA was hosted to conduct special operations for the under-

privilege patients for free. Their 6 months stay cost the Donor an amount of GHS

240,000,000 which was fully paid. Sixty percent of the cost represents per diems paid to

the specialist and the remaining was for goods and services.

A Bank Loan of GHS 50,000,000 contracted form CAL Bank in 2021 was recognized as

revenue in 2021 Financial Statement. This Loan still remain outstanding as at 31%

December, 2022.

Inventory of drugs as at 31" December 2022 amounted to GHs 80,000,000 at cost and

having a net realizable value of GHc5S0, 000,000, but its replacement cost is Ghe78,

000,000. In addition, stationery stock as at 31° December,2022 cost GHs28,000,000 and

having a Replacement cost of GHs25,000,000 with an estimated Net Realisable value of

GHe35,000,000.

‘The approved budget extract for 2022 both main budget and supplementary is as follows

Page 17 of 45

Internally generated fund

Donation

GoG subvention

Compensation of employees

Goods and services

Interest

Other expenses

Required,

Main Budget for 2022

GHS, 0000

1,500,000

180,000

3,700,000

2,000,000,

1,200,000

44,000

15,000

‘Supplementary Budget for 2022

Prepare in compliance with the IPSAS and relevant legislations

GHS, 000

500,000

20,000

300,000

500,000

200,000

5,000

a) Statement of Financial Performance for the year ended 31" December 2022

b) Statement of Financial Position as at 31" December 2022

©) Statement of Budget information in comparison with the actual for the year ended 31"

December 2022.

4) Notes to the accounts.

CENTRAL GOVERNMENT FINANCIAL STATEMENT.

QUESTION ONE

Stated below are the balances extracted from the Consolidated Fund of the

Republic of Ghana for the year ended 31 December, 2022,

Dr, cr

GH¢'million | __GH¢'million

Cash and Cash Equivalent 10,538

Domestic Debis 15,539

Public Debt Interest 3,459

Taxes paid by Corporations 3,600

Taxes paid by Individuals 4272

Page 18 of 45

Repairs and Maintenance 930

Rentals 9,608

Dividends 1,396

Fertilizer Subsidy 18

Established Position 7,000

Contract Appointment 13

‘Transfer to School Feeding 554

Counterpart Fund from Development Partners 320

Non-Established Position 727

Subsidies on Petroleum products 21

Emergency Service 135

Materials and Office Consumables 1,437

General Tax on Goods and Services 3,200

Tax on Exports 2,440

Infrastructure 9,960 760

Property, Plant, and Equipment 40,160 840

Investment Propert 9,840 600

Work in Progress 839

Equity and other Investments 2,327

Property Income 476

Petroleum Related Fund 7,010

General Cleaning 1,479

Social Assistance Benefits 773

Other Expenditure 240)

‘Advane: 252

Short Term-Loan 331

Grant 270

Training and Capacity Building 300

Consultaney Expenses 316

Salaries to Secondment staff 84

Receivables 80

Extemal Debt 51,974

Other Payables 6,340

| Supplier Payables 77

‘Accumulated fund a 10,189

i 102,722 102.722

Page 19 of a5,

Additional informatioi

i, Itis the policy of the Controller and Accountant General to adopt Accrual Basis

in preparing the Public Accounts of the Consolidated Fund in compliance with

Public Financial Management Act, 2016(Act 921), Public Financial Management

Regulation 2019 (LI 2378) and the Intemational Public Sector Accounting

Standards (IPSAS).

ii, During the year, staff of Controller and Accountant General benefited from an

IPSAS centfication training programme fully funded by the Swiss govemment. The

fair value of these services amounted to GH¢18 million. This transaction has not

been recorded in the Trial Balance.

iii) Some multilateral partners have extended Debt Forgiveness Policy to the

Government which has resulted in external debt amounting to GH¢3 billion being

written off during the year. However, this transaction has not been reflected in the

books of aecounts.

iv) The Grant shown in the trial balance as revenue relates to Project Grant which

Government has applied from African Development Bank amounting to $56

million but the grant received in the Trial Balance represents part of the expected

grant, The Minister of Finance and Controller and Accountant General have

provided enough evidence indicating that Government will fulfil all the conditions

that merit the full release of the Grant to the State and it is highly probable that the

remaining Grant will be released. The exchange rate as at the balance sheet date

‘was GH¢6 to $1

¥) Consumption of Non-Current Assets is charged on Straight

reat as follows:

Basis for the

‘Asset Useful life

Property, Plant, and Equipment 20 years

Tnvestment Property 40 years

Infrastructure 30 years

vi) On 1 September, 2021, GH¢S billion was spent in acquiring Motor Vehicle to

boost Government project, However, these transactions were included in the

accounts as Goods and Service in the year 2021. This error has since not been

rectified

Require

Prepare in a form suitable for publication:

a) Statement of Financial Performance for the year ended 31 December 2022.

) Statement of Financial Position as at 31 December, 2022,

©) Notes to the accounts.

Page 20 of a5

QUESTION TWO

Below is the Trial Balance of the Consolidated Fund of Ghana for the year ended 31

December, 2022.

DR cR

Gii¢ million | GH million

Cash and Bank 61,350,

Established Post Salaries ae 13,524

Non-Established Post Salaries 4,016

Communications Service Tax 5,144

PAYE 6,940

Non-Tax Revenues 2,312

Travel and Transport 468

Administration Cost 6,704

Conferences and Seminars 2,510

Foreign Travel Cost_ 1,490

Stationery Inventories 20

Stationery Purchased 20

Vehicles Income Tax 2,316

‘Corporate Tax 4,626

Grants. 1,150 2,516

Customs and Excise, Duties 1,286

‘Subsidies for Consumption 1,282 | |

Subsidies for Production 722

Value Added Tax 7.716

Social Benefits 760

State Protocol 100

Allowance 300

Domestic Debt Interest 2,906

Extemal Debt Interest 3,482

Motor Vehicle 4,800 | 1,920

Equipment 8,400 1,680

Computers 18,400 5,240

Building 5,000

‘Work in Progress 400

‘Equity and Security Investment 1,960

Loans and Advances 1,120

Gold and Other Reserves 1,620

Judgement Debt 280

Page 21 of 45

Treasury Bills 22,240

Domestic Debt 26,924

Payables 34,844

External Debt 45,726

‘Trust Fund and Deposits 4,470

(Other Expenditure 1,800

Rent Receivable 1,600

‘Accumulated Fund 29,516

175.900 175,900

Additional information:

i) It is the policy of Controller and Accountant General to use Accrual Basis of Accounting in

preparing the Public Accounts of the Consolidated Fund financial statements in compliance

with Public Financial Management Act, 2016 (Act 921), Public Financial Management

Regulation 2019 L.1 2378 and the International Public Sector Accounting Standards (IPSAS).

ii) Inventory in respect of stationery outstanding as at 31 December, 2022 cost GH¢18 million

and has a current Replacement Cost of GH¢12 million. Meanwhile, the Net Realisable value

of the Inventories is estimated at GH¢14 million. No market exists for unused inventories.

iii) An Established Post Salary in arrears as a result of salary increment in the fourth

quarter of 2022 was GH¢56 million and Public Debt Interest outstanding as at 31

December, 2022 amounts to GH¢ 14 million.

iv) Consumption of Fixed Capital is charged on Straight Line Basis for the year as follows:

Asset Useful life

Motor vehicle S years

Equipment 10 years

Computers 5 years

Building 50 years

v) The Multilateral Partners have extended their Debt Forgiveness policy to the Government

which has resulted in the Extemal Debt write off amounting to GH¢4 billion in the year.

However, this transaction has not been accounted for in the books.

vi) In the year 2021, GH¢8 billion was spent in acquiring Equipment to boast Government

project, however, these transactions were recognised in the accounts as Goods and Services

Expenditure in the year 2021. This error has since not been rectified.

Page 22 of 45

Required:

Prepare in a form suitable for publication and in accordance with the relevant Financial

Laws and IPSAS:

a) Statement of Financial Performance for the year ended 31 December 2022.

) Statement of Financial Position as at 31 December, 2022.

QUESTION THREE

Stated below are the balances extracted from Consolidated Fund of the Republic of Ghana for the

year ended 31st December, 2022.

Dr or

‘Gug 000 | GHE ‘000

Cash and Cash Equivalent 16,600,250.

15% Loan Note (Domestic Debt) — 3,474 430

Extemal Debt [nterest 324,300

“Taxes paid by Corporations 16,085,530.

“Taxes paid by Individuals 16,926,230

Repairs and Maintenance 7,163,200,

Rentals 12,010,500 |

Public Debt Interest Arrears 1,745,600,

‘Subsidies, on utilities 23,530

Established Position 8,766,800

Staff Compensation Acerued 4,189,040

“Transfer to Schoo! Feeding 3,561

‘Other Income. 11,985,330

‘Non-Established Position 908,752

Subsidies on Petroleum products 26,400

Cost of Purchases for use 2,694,606,

‘Cost of Purchases for sale 1,796,404

General Tax on Goods and Services 15,586,130

“Tax on Exports - 3,050,000

Tnfrastructure 12,450,000 950,000

Plant and Equipment ‘50,200,500 | 1,050,000

[Tnyestment Property 12,300,000. "750,550

‘Work in Progress — 1,048,950,

| Bquity and other investments _ 2,909,870

Property income. 12,180,290,

Accumulated fund 12,681,300,

‘Revenue from fines, penalties and forfeits 1,263,500

General Cleaning 1,849,600,

LEAP Program Cost 966,250,

‘Other Expenditure 714,900

Advances 3,161,877

Project Grant 377,200

“Training, Seminar and Conference Cost 1,000,970,

Page 23 of aS

Consultancy Expenses 3145500

‘Probation. 105,250.

Receivables 100,170

Extemal Debt 2,468,000

Domestic Debis Interest 706.100

Deposits and Other Trust Monies 5581820

Withholding Tax, 2,812,030

Suppliers 96.260 |

1a7.6s8240 | 127. ask-240

Additional Information:

i, It is the policy of Controller and Accountant General to Adopt Accrual Basis of

preparing the Public Accounts of the Consolidated Fund in compliance with Public

Financial Management Act,2016(Act 921), Public Financial Management Regulation

2019 L.12378 and the International Public Sector Accounting Standards (IPSAS).

ii, During the year, Trade Union Congress successfully negotiated with the Goverament

for wages and salaries increment. Government determined to respond positively to

them. This resulted in accumulated amears of GH¢2,140,000,000 to be settled in

31/10/2022.

iii, Inventories included in use of goods and services available at the end of the year were

as follows:

Inventories for use | Inventories for sale

‘GH¢°000 GH¢"000

Cost 257,800 300,350

Replacement Cost. 350,880 288,500

Net Realisable Value. 250,770 305,200

iv.

vi

During the year, Government received relief in a form of Ambulance from UN to

combat the Covid-19 pandemic. These Ambulances have a total fair value of

GH 550,250,000 and an estimated useful life of 10 years.

In 2021 fiscal year, the Government of Ghana contracted a loan from World Bank

amounting to GH¢6 million. This amount was wrongly recognized as revenue in 2021

financial statement. However, this loan is still outstanding.

Consumption of fixed capital is charged on straight line basis for the year as follows:

Asset Useful life

Plant and Equipment 0 years

Investment Property 15 years

Infrastructure 30 years

Page 24 of 45

(All figures to the nearest whole number)

Required:

Prepare in a form suitable for publication:

a) Statement of Financial Performance for the year ended 31 December 2022.

b) Statement of Financial Position as at 31st December, 2022.

©) Notes to the accounts.

QUESTION FOUR

Below are the balances of the Consolidated Fund for the year ended 31° December, 2022

DEBIT | CREDIT

GS Gas)

[Tax paid by Individuals 57,456,330

[Tax Paid by Other Businesses 61,765,3

iscellaneous Taxes for individuals and Other Businesses 5,000,

General Taxes on Goods and Services 7,813,401

Excises 4,467.80

{Customs and Other Import Duties 756,42

[raxes on Exports, 9,121,951

Levies ___ 224,561]

Programme & Project Grants 338,729

roperty Income Taxes 171,207

jevenue from Sale of Goods and Services 43.33

ines, Penalties and Forfeiture 41,500]

Miscellaneous Non-Tax Revenue 5.550]

[Bilateral Loans Received __ | 360,000]

[Multilateral Loans Received 430.250]

Loans from External Commercial Institutions 789,520

lLoan from Domestic Commercial Institutions 44,000]

[Proceeds from sale of shares in Private Companies 9,260,0

[Bilateral Loan repayments 133,000

[Multitateral Loan repayments 111,150

ixtemnal Commercial Institutional loan repayments, 167,520

jomestic Commercial Institutional loan repavments 117,800

salaries & Wages -Established Positions 2,878,500

Salaries & Wages- Non-Established Posts 718,820

Salary related allowances 133,760

Page 25 of a5

jon-Salary related allowances 228.540}

[Gratuities 144,371

[End of Service Benefit (BSB) 100,11

[Employer's Pension Contributions 467,654

aterils end Office Consumables 4,169,340,

Utilities 472,04

[General Cleaning 183,97

ventals 150,71

[Travel and Transport 1,937,91

Repairs and Maintenance 150,817}

[fraining, Seminar and Conferences 4,425,869,

(Consultancy Expenses 4,001,549

Bpecial Services. 292,280,

[ther Changes and Fees 3,570,460)

[Emergency Services 36,625]

\Additions to Infrastructure, Plant & Equipment 136,239,511

|Work In Progress - Constructions and Buildings 20,796,201

(Consumption of Fixed assets for the year 3,500,04

[interest paid on domestic loans $88,555,

Interest paid on extemal loans 987,226

Subsidies on Utility. 1,438,200,

Bubsidies on Petroleum Products 922,44

Employer ‘social benefits in Cash_ 1,370.6

Equity Investments in. ‘Companies & Public 3,450,

ish and cash equivalents (1/1/2022) 37,089.48

Page 26 of a5

Additional Information

i) Direct Taxes Outstanding as 31/12/2022 was GHC40,000,000.

ii) Corporation Tax amounting to GHC400,000 was paid in advance as at 31/12/2022.

iii) Work in Progress amount of GHC35, 000,000 has been incurred during the period.

However, because of liquidity challenges faced by Government only GHC28,000,000

has since been paid.

iv) T-VET, a multinational company with branches in several countries including Ghana

paid a Property Income taxes for two (2) years at an amount of GHC30,000. This

amount is included in the Trial Balance.

¥) Government Received Donation from USA Government in the form of Motor vehicle

which value GHC358,000 with a useful life 1Oyears. This has not been accounted for

in the Trial Balance.

Required:

a) Prepare a Statement of Financial Performance of the Consolidated Fund for the year ended

December 31, 2022

b) Prepare a Statement of Cash Flow of the Consolidated Fund for the year ended December

31, 2022.

©) Prepare the relevant Notes and Schedules to the financial statement,

Page 27 of 45

BUDGET AND PEFA QUESTIONS

QUESTION ONE

‘Below is the Revenue and Expenditure Extract of the Consolidated Fund for the

year ended 31 December 2022,

Consolidated Fund of Ghana

Statement of Financial Performance for the year ended 31 December, 2022

Actual Original Budget

GHg'000 GH¢'000

Revenues

Tax revenues 270,000 312,000

‘Non tax revenues 26,700 39,000

Grants and Donations —1.200 10,800.

Total revenue 303,900 361,800

Expenditures

Compensation of employees 121,500 124,800

Goods and Services 54,000 120,700

Consumption of fixed capital 1,950 -

Interest 81,000 82,100

Social benefit cost 1,500 1,800

Subsidies 1,080 1,170

Grants 2,700 2,910

Other expenditure 34,020 32,000

Total expenditure 297.750, 365.480

Net Operating result 6.150 680)

Page 28 of 45

Additional information:

The Minister for Finance, has presented a mid-year budget review to

Parliament that included a supplementary (additional) budget for 2022. The

Minister has cited several local and international reasons for the budget,

adjustments. The approved supplementary budget is as follows:

GHg"000

Compensation of employees 11,500

Goods and services 17,000

Interest 2,500

Social benefit cost 1,500

Subsidies 180

Total expenditure

Required:

Prepare a Budget Performance Report showing relevant variances and

explanation for the possible causes.

Page 29 of 45

QUESTION TWO

One important pillar in Public Financial Management is accounting and financial

reporting, according to the Public Expenditure and Financial Accountability (PEFA)

Framework of 2016, The pillar has three indicators with ten dimensions scored using the

‘Weakest Link Method (M1) and Average Method (M2).

‘The information below relates to the scoring of accounting and reporting pillar for

Ghana in the 2019-2020 PEFA Report.

Pillar (PI-07) Accounting and Financial Reporting

Indicators/dimensions | Descriptions ‘Score

Indicator 1 (P1-07.1)_| Financial data integrity To be determined

Dimensions (M2) ‘Bank account reconciliation D

Suspense accounts D

‘Advance accounts A

Financial data integrity process c

Indicator 2 In-year budget reports To be determined

Dimensions (MI) Coverage and comparability of reports B

Timing of in-year budget reports c

‘Accuracy of in-budget reports B |

Indicator 3 ‘Annual financial reports To be determined

Dimensions (MI) Completeness of annual financial report c

Submission of reports for extemal audit B

‘Accounting standards D

Required:

‘i)Distinguish between the weakest link method and average method of scoring the

performance indicators,

ii) Compute the score for each of the three indicators using the appropriate method

of scoring and interpret your result.

iii) Suggest TWO (2) ways the government can improve its performance in

indicator 3: Annual financial reports.

Page 30 of a5

QUESTION THREE

Since the ereation of Atuum District Assembly (ADA) in 2014, inadequate revenue mobilisation

has been its major challenge making the Assembly unpopular. The newly appointed District

Chief Executive (DCE) is coticemed about the effectiveness of the revenue budget system of

the Assembly.

Below is the extract of the Reventie Budget of the Assembly for the 2022 financial year.

Revenue ‘Annual Budget] Actual to March

be GHE Gug

Licenses 880,000 244,000

Fees and Miscellaneous charges 3,400,000 890,000

Investment income 600,400, 178,000

Property rate 5,400,000 | 1,310,000

Basic Rate 750,000 120,000

Grants and donations, 7,000,000 320,000

The budget allocation over the various items over the quarters is in the ratio of 3:3:2:2.

The DCE indicates that the budget reliability measures of Public Expenditure and

Financial Accountability (PEFA) are ideal for assessing the budget performance of the

‘Assembly. In the framework, the following interpretation is given to budget outruns:

+ Outtum/variance not greater than 5% is scored as A, indicating very good budget reliability

+ Outtum higher than 5% but not exceeding 10% is scored B, indicating good budget

reliability.

+ Outtum higher than 10% but not exceeding 15% is scored C, indicating average budget

reliability.

+ Outtum higher than 15% is scored as D, indicating poor budget reliability.

Note that each revenue item is treated as an indicator under the PEPA framework,

Required:

i) As the Budget Officer, prepare the statement of budget performance for the first quarter

of the 2022 financial year, indicating clearly the outturn percentage and the respective

scores.

ii) Write a report to the DCE on the budget performance of the Assembly and suggest ways of

improving the budget reliability of the Assembly.

Page 31 of 45

QUESTION THREE

‘The following details represent statements of Financial Performance for the Consolidated Fund

for the year ended 2019 and its Budget.

Direct tx

Indirect tax.

‘Non tax rev.

Less exp,

Compensation of employees

Goods and services

Social benefit

Interest,

Subsidises

Grants

‘Total exp,

Surplus

You are required to:

Actual

50,000

70,000

7,000

15,000

442,000

35,000

18,000

5,300

4,300

2,000

4,000

$8,600

(73,400)

Budget

92,300

46,000

10,000

11,000

32,000

19,000

8,200

6,000

9,000

3,000

81,800)

Prepare budget out-turn statement for 2019 fiscal year in both absolute amount and in relative

terms.

Page 32 of 45

INTERPRETATION OF PUBLIC FINANCIAL STATEMEMT ANALYSIS

QUESTION ONE

Presented below is the Statement of Financial Performance of Bekwai Municipal

Assenibly for the year ended 31 December 2022.

GH¢'million —GHmillion GH" million

2022 2021 2022

Actual Actual Budget

Revenues

Decentralized Transfer 16,450 12,400 20,200

IGF 22,200 25,600 34,100

Donation and Grants 1,300 1,900 2,000

‘Total revenue 39,950 39,900 56,300

Expenditure

Compensation for employees 29,800 24,300 25,900

Use of goods and services 10,300 9,860 18,000

Consumption of fixed Asset 240 220 -

Interest 19,660 14,550 16,780

Grants 510 430 1,920

‘Other expenses 1,600 1,430 2.450

Total Expenditure 62.110 30,790 65,050

Net Operation Result (22.160) 10,890) (8.750)

Required:

4) Prepare Common Size Statement of Financial Performance for the year ended 31

December 2022.

ii) Based on the Common Size Statement of Financial Performance prepared in i) above,

write a report analysing the financial performance of Bekwai Municipal Assembly in line

with the Recommended Practice Guide 2, Financial Statement Discussion and Analysis.

Page 33 of a5

QUESTION TWO

a) The financial information below relates to the Consolidated Fund of Ghana.

Statement of Financial Position of the Consolidated Fund as at December 31, 2022

Non-Current Assets

Property Plant and Equipment

Equity investment

Total Non-current assets

Current Assets

‘Work in progress

Receivables

Cash and cash equivalent

Other assets

Total current assets

Total assets

Funds and Liabilities

Accumulated Fund

Current Liabilities

Payables

‘Trust monies

Domestic loans

Total Current Liabilities

Non-Current Liabilities

Domestic loans

External loans

Total Non-Current Liabilities

Total Funds and Liabilities

2021

GH¢'million

(111,280)

1,600

2,540

240

15,380,

2022

GH¢’million

5,600

12,000

12.600

2,000

900

2,980

600,

6.480

(111,620)

19,000

2,300

12.500

33.800

43,000

58,900

01,900

24,030

Page 34 of 45

Additional Informatio,

i) The total market value of all final goods and services produced domestically in Ghana for

2022 and 2021 fiscal year amounted to GH¢205,100,940,000 and GH¢185,600,400,000

respectively.

ii) According to the Statistical Service data, the population of the country is estimated as

25,000,000 in 2022 and 23,900,000 in 2021.

Required:

4) From the information above, compute for the two financial years, the following ratios: 0

Gross Debt

+ Net Debt percentage

+ Debt per Capita

+ Debt to Gross Domestic Product ratio

+ Total Asset to debt

+ Capital Asset per Capita

ii)Based on the ratios computed, write a report discussing and analysing the financial

Position of the Consolidated Fund to the Head of a “think tank” of a Civil Society

Organisation for Financial Accountability.

Page 35 of 45

QUESTION THREE

Country X and Country Y are West African Countries that attained independence around the

same period, Presented below are the financial statements of the two countries,

Statement of Financial Performance for the year ended 31 December 2022

Country X Country Y

GH¢ million GH¢ million

Revenues

Domestic tax 39,675 25,500

International trade tax 27,300 31,995

Non-tax revenue 11,250 19,200

Grants 1,950 1.650

Total revenue 80,175 78.345

Expenditure

‘Compensation for employees 44,700 30,450

Use of goods and services 15,450 21,000

Consumption of fixed capital 360 420

Exchange difference 1,485 900

Interest 29,490 15,690

Subsidies 765 180

Other expenses 2.400 2145

‘Total Expenditure 94,650 70.785

Net Operation Result (14,475) 1560

Other information:

Population 30,000,000 22,500,000

Gross Domestic Product (GH) 217,500,000,000 165,000,000,000

Page 36 of 45

Statement of Financial Position as at 31 December 2022

Country X

GH¢ million

Non-Current Assets

Property, plant and equipment 3,675

Equity investment 12,000

15,625

Current Assets

Receivables 10,050

Cash and cash equivalent 2.050

12100

Total Assets 22215

Funds and Liabilities

Accumulated Fund (120,300)

Current Liabilities

Payables 9,300

Trust monies 2,100

Domestic debt 24,000

35.400

Non-current Liabilities

Domestic debt 54,000

External debt 63.675,

112.675

7,200

6,150

1,350

4,250

27,000

E

000

Page 37 of a5

‘Total Fund and Liabilities

Required:

32,715

’) From the information provided, compute for the two countries respectively:

+ Grant to Total Revenue ratio

+ Wage Bill to Tax Revenue ratio

+ Interest to Revenue ratio

+ Debt to GDP ratio

* Capital expenditure per Capita

+ Wages bill to Total Expenditure ratio

81,450

ii) Based on the result in question, write a report discussing and analysing the Financial

Performance and Financial Position of the two countries. Include in your report the

limitations of the analysis of the two countries.

QUESTION FOUR

[The following information is given about two countries in West Africa for 2021 financial year |

Statement of Financial Performance for the year ended 31st December 2021

Ghana ‘Nigeria

“Annual [Annual

Actual Budget Actual Budget

$000 $1000 $000 $004

Revenues

Tax revenues 7,010,000, 7,350,400 45,000,000 52,000,001

(on tax revenues 800,000 1,200,600, 4,450,000 6,500,001

Grants and Donations 300,200 20,000 1,200,000 1,800,009

otal revenue 8,110,200 $971,000 30,650,000 60,300,000)

[expenditures

Compensation of employees | 3,855,500 3,307,680, 20,250,000 20,800,000]

joods and services 801,700 2,310,600 9,000,000 20,800,000)

(Consumption of fixed capital 67,500 zi 325,000

interest 2,939,000 7,940,500 13,500,000 13,000,000

Social benefit cost 45,600 67,000 250,000 300,00

Subsidies 86,000 95,000 180,000 195,00

Page 38 of 45

[Grants 38,000 80,000 450,000 485,00

Dthier expenditure 980,000 1,890,000 3,670,000 62,000,0(

[Total expenditure 8,830,300 | 10,690,780 49,625,000 117,580,0

jet Operating result = 720,100__| = _ 1,719,780 1,025,000 = 57,280,004

Page 39 of 45

Statement of Financial Position as at 31st December 2021

Country G Country N

Actual Actual

Assets $000 1000

Non-Current Assets

Property Plant and equipment 100,000,000 550,120,000

Capital work in Progress 2,000,000 7,600,000

Equity investment 50,000,000 120,000,000

‘Loans receivable o 2,000,000

152,000,000 684,720,000

Current Assets

Loan receivable and loans 1,250,000 5,670,000

Tnventory 2,400,500 8,700,000

Cash and Cash equivalent 2,560,000 1,360,000

1,090,500 15,730,000

Total Assets 153,090,500 200,450,000

Fund and Liabilities

Accumulated Fund 670,000 800,000

Operating Surplus (720100) 1.025.000

(50,100) 1,825,000

Current Liability

Payables 4,340,600 6,225,000

Long term liabilities

Domestic Debt 666,000,000 320,700,000

Extemal debt 82,800,000 371,700,000

Total liabilities 153,140,600 698,625,000

‘Total funds and liabilities 153,090,500 700,450,000

Page 40 of a5

Additional Information

i) The Statistical and economic data of the two countries for 2021 is given below:

Ghana Nigeria

Population 29 million 106 million

Gross Domestic Product ($000) 238,000,000 1,890,000,000

ii) All figures of the two countries were originally presented in their respective reporting

currencies and have been converted into US Dollar to facilitate analysis.

ii) Non tax revenue reported include dividend received from the Goverament Business

Enterprises of respective Governments. Dividend income constitutes 50% of the non- tax

revenues of country Ghana and 80% of the non-tax revenues of country Nigeria,

iii) Include in the Non-Tax Revenue is Annual Budgeting Funding Amount of $160 million

and $110 million for country Ghana and country Nigeria respectively

iii) The Property, Plant and Equipment balances of Ghana and Nigeria at carrying amount at

the beginning of year 2021 were $92, 200,000,000 and $541,600,000,000 respectively.

Req

a) Compute the following accounting ratios of the two countries respe:

i, Percent Tax Outtum,

ii, Total Revenue to Gross Domestic Debt

iii, Fiscal balance to Gross Domestic product (actual and budget)

iv, Interest to Tax Revenue

v. Return on equity investment

vi, Debt to Gross Domestic Product

vii. Primary Fiscal Balance to Gross Domestic Product

Page 41 of 4S

QUESTION FIVE

‘The following Financial Statement relates to Amansie Central District Assembly.

STATEMENT OF FINANCIAL PERFORMANCE FOR THE YEAR ENDED 31°*

DECEMBER, 2022.

2022 2021

Revenue GHC’000 GHC’000

Decentralised Transfer 95,000 80,000

IGF 150,000 145,000

Donations and Grants 50,000 48,000

295,000, 273,000

Expenditure

Compensation 20,000 18,000

Goods and Services 25,000 23,500

Social Benefit 10,000 73,800

Interest 5,000 5,500

Consumption of Fixed Assets 2,550 1,755

Other Expenses 72,000 80.000

141,550 128,755

SURPLUS 153.450 144.245

Page 42 of a5

STATEMENT OF FINANCIAL POSITION AS AT 315" DECEMBER, 2022.

2022

GHC'000

NON-CURRENT ASSET

Property, Plant and Equipment 395,000

Investment Property 200,000

Financial Asset . 160,000

Intangible Asset 180,500

CURRENT ASSET

Inventory, 30,000,

Receivables 140,000

TOTAL ASSET 1,476,450

LIABILITIES AND FUND

CURRENT LIABILITIES

Payables 700,450

Deposit 500,500

NON-CURRENT LIABILITIES

20% Loan note 200,000

Accumulated Fund 15,500.

TOTAL LIABILITIES AND FUND 1,476,450.

Required:

Prepare Common Size Report on

2021

GHC'000

365,880

250,000

165,000

165,900

45,000

150,000

1,492,230

800,230

300,000

i) Statement of Financial Position of Amansie Central District Assembly.

ii) Statement of Financial Performance of Amansie Central District Assembly.

Page 43 of a5

QUESTION SIX

Consolidated Fund of Ghana

‘Statement of Financial Position as at 31 December,

2022 2021

ASSETS GH¢'million GHg'million | GH¢’million — GHg’million

Non-Current Asset

Property, Plant and 88,191 78,220

Equipment

Financial Assets 2.124 27.289

Total Non-Current Assets 115,315 105,509

Current Asset

Inventory 3,207 1,903,

Cash and Cash Equivalents 16,106 4,007

9.313 5.910

(Current liabilities

Payables 12,154 4,581

Deposits and Trust Monies 1054 10,909.

Total Current Liabilities 23.208 3,895) | 15.490 420

Net Asset 111.420 105.929

FINANCED BY:

‘Accumulated Fund 20,481 19,312

Non-Current Liabilities

Domestic Debt 45,924 44,791

Extemal Debt 45.015 41,826

111.420, 105.929,

Required:

’) Prepare Common Size Statement of Financial Position for the year ended 31 December

2022 and 2021

ii) Based on the Common Size Statement of Financial Position prepared in i) above, write a report

analysing the financial position in line with the Recommended Practice Guide 2, Financial Statement

Discussion and Analysis.

Page 44 of 45

QUESTION SIX

Presented below is the Statement of Financial Performance of the Consolidated Fund of

Ghana,

Revenue and Expenditure Statement of the Consolidated Fund for

the year ended 31 December, 2022

GH¢' million GH¢’million_ GH¢’million

2022 2021

Actual Actual 2022 Budget

Revenues

Direct tax 16,450 12,400 20,200

Indirect tax 22,200 25,600 34,100

Non-tax revenue 7,500 5,800 7,000

Grants 1,300 1,900 2,000

Total revenue 47.450 45.200 63,300

Expenditure

Compensation for employees 29,800 24,300 25,900

Use of goods and services 10,300 9,860 18,000

Consumption of fixed Asset, 240 220 =

Interest 19,660 14,550 16,780

Subsidies 510 430 1,920

Other expenses 1,600 1,430 2,450

Exchange difference 620 400 -

‘Total Expenditure 62,730 51,190 65,050

Net Operation Result 45,280) (5.490) (4.750)

Required:

Based on a Common Size Statement of Financial Performance, write a report discussing

and analysing the financial performance of the Consolidated Fund in line with the

Recommended Practice Guide 2, Financial Statement Discussion and Analysis.

Page 45 of a5

Golthor ra,

D> alendes on erhh [Gry 3, J

Ls oe

SEN nem ee

2

loss

> re WO Gk AE oF TW coee che

> Cc Use S

5) SC Ww eget se, Zora

helys

> Wm Rew dupe ecre he - isetie

Penk gesr ete? a Hae a Se

af

ase Wve

Ran SAS OF Ashtom

Bvt Ker Fc

TE vy pdm.

D3gcd wu Lew’ % Ahora tn

meray Taw ne MO

wet phet

DS cree

QA wv.

Depttcrwer- we : a S)

ake

Bereta dey, 120i

ae

Diseut Ue Sc pres PMU Coveran F

seth, gety, Sef S

2 ‘ Rake:

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cashflow QuestionDocument5 pagesCashflow QuestionDesmond Grasie ZumankyereNo ratings yet

- Part F - Additional QuestionsDocument9 pagesPart F - Additional QuestionsDesmond Grasie ZumankyereNo ratings yet

- CR March 23Document10 pagesCR March 23Desmond Grasie ZumankyereNo ratings yet

- Part A Public Sector Financial Reporting in Ghana (Complete) 15 20marks 2Document47 pagesPart A Public Sector Financial Reporting in Ghana (Complete) 15 20marks 2Desmond Grasie ZumankyereNo ratings yet

- Part F - Evaluation of Financial Statements (Financial Statements Discussion and Analysis)Document11 pagesPart F - Evaluation of Financial Statements (Financial Statements Discussion and Analysis)Desmond Grasie ZumankyereNo ratings yet

- Aspire March 2023 Psaf Intervention - 04-03-2023Document46 pagesAspire March 2023 Psaf Intervention - 04-03-2023Desmond Grasie ZumankyereNo ratings yet

- Pefa (Scoring) PDFDocument3 pagesPefa (Scoring) PDFDesmond Grasie ZumankyereNo ratings yet

- Thesis Draft DesmondDocument78 pagesThesis Draft DesmondDesmond Grasie ZumankyereNo ratings yet

- Aspire April 2022 Psaf Intervention Final 26 03 22-FinalDocument40 pagesAspire April 2022 Psaf Intervention Final 26 03 22-FinalDesmond Grasie ZumankyereNo ratings yet

- Jane Final Dissertation TestDocument107 pagesJane Final Dissertation TestDesmond Grasie ZumankyereNo ratings yet

- Sunday School HandbookDocument33 pagesSunday School HandbookDesmond Grasie ZumankyereNo ratings yet

- Research MethodsDocument6 pagesResearch MethodsDesmond Grasie ZumankyereNo ratings yet