Professional Documents

Culture Documents

Aspire March 2023 Psaf Intervention - 04-03-2023

Uploaded by

Desmond Grasie ZumankyereCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aspire March 2023 Psaf Intervention - 04-03-2023

Uploaded by

Desmond Grasie ZumankyereCopyright:

Available Formats

1 | www.aspireproconsult.

com | 0555 213 559

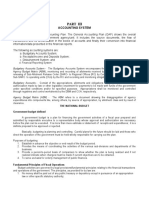

PUBLIC SECTOR ACCOUNTING AND FINANCE (PAPER 2.5)

SYLLABUS COVERAGE WEIGHT

A Public sector financial reporting in Ghana 15

B Conceptual Framework for General Purpose Financial Reporting by Public Sector Entities 15

C Public Financial Management Systems. e.g. Public Expenditure and Accountability (PEFA) 10

Framework

D Accounting policies for both cash and accrual bases in public sector 10

E Preparation of financial statements for public sector entities in line with generally 20

accepted accounting practices

F Evaluate financial position, performance and prospects of public sector entities using financial and 10

other information

G Rules and procedures in Public Procurement 10

H Public financing initiatives: public –private partnership and public-public partnership 10

TOTAL 100

The Paper 2.5 Examination Team

The examination team expects you to demonstrate a professional approach to all questions – not just presenting information

in a professional manner, but also integrating knowledge and understanding of topics from across the syllabus.

The interpretation of some of the questions has often times appeared to be problematic in the minds of the candidates.

Therefore, candidates are advised to take their time to carefully read and understand the requirements of questions before

answering.

DISCLAIMER

This document is strictly for the purpose of our revision towards the coming examination. The questions and some answers

provided or contained herein are not specific recommendations for the coming examination but must only serve as a guide.

Aspire Professional Consult is not responsible for your failure by strictly relying on this document.

2 | www.aspireproconsult.com | 0555 213 559

PART A- PUBLIC SECTOR FINANCIAL REPORTING IN GHANA

1. The current medium term strategic plan of Enkakyire Municipal Assembly (EMA) has overall objective of

improving the performance of the Assembly. One critical strategy towards attainment of this goal is adoption

of new public management strategy to increase participation of private sector in the provision of public

services without losing sight of the differences between public sector and private sector. In fact, some of these

differences are so fundamental that they cannot be washed away any time soon.

The Chief Executive suggested outsourcing as a key strategy in improving the delivery of public services at

local level through the private sector. EMA is currently bedeviled with poor revenue mobilization, lack of

proper data on the Assembly’s activities, and poor infrastructure provision. Other supporting activities like

cleaning and security are not well performed or performed at very high cost by internal staff. These issues have

been tabled at the first strategy meeting convened by the Chief Executive.

Required:

a) Describe FOUR(4) fundamental differences between public sector and private sector entities that EMA should take

cognizance of in pursuance of the new public management strategy.

b) Explain FOUR(4) objectives of public sector entities

2. Parliament of the Republic of Ghana performs several functions such as enactment of laws, securitization of law,

approval of national budget, among others. However, in reference to section 11 (1) of the Public Financial

Management Act 2016 (Act 921) provide that Parliament shall also provide oversight responsibilities in several areas.

In achieving this Parliament may assign responsibilities under this to a committee of Parliament or an Office

established by Parliament.

Required:

Explain THREE (3) responsibilities each of the Public Finance Committee and Public Account Committee of Parliament.

Public Finance Committee

1. Receiving and reviewing financial proposals (finance bill).

2. Examining and reviewing loan agreement of government.

3. Providing a general oversight over public financial management.

Public Account Committee

1. Obtain audit reports on covered as referred from parliaments.

2. Review of audit reports and investigate financial irregularities reported by the Auditor General.

3. Submit reports and recommendations to parliament for approval.

4. Conduct follow up on the extent of implementation of their recommendations.

3. A. Public officers are entrusted with resources with the responsibility to manage and safeguard public moneys, within

the public financial management legal framework. Therefore, public are entrusted with such responsibilities must be

knowledgeable in the relevant financial enactments.

Required:

a. Explain to a newly appointed officer in charge of public money, the key financial legislations he must be conversant with

in the conduct of his functions.

b. Discuss the responsibilities of the following officers under financial enactments:

i. Principal spending officer

ii. Principal account holder

3 | www.aspireproconsult.com | 0555 213 559

Solution

Principal spending officers

• Ensures the regularity and proper use of money appropriated in that covered entity.

• Authorize commitment for the covered entity within a ceiling set by the minister of finance.

• Manage the resources received held of disposed of by or on account of the covered entity.

• Establish an effective system of risk management, internal control and internal audit in respect of resources and

transaction of a covered entity.

• Remit the subvention received on behalf on another entity to that entity in accordance with approved cash flow plan

for the subvention.

Principal account holder

• Directing policies f0r the sector.

• Submitting performance report of the covered entity.

• Providing oversight over the management of the covered entity to which they relate.

4. National budgeting a well thought through and rigorous process that succeeds on the collective effort of many

stakeholders.

Required:

a) Identify FIVE (5) key stakeholders in national budgeting and their respective contribution to the process.

b) Explain the stages of the budget cycle of government, indicating the activities associated with each.

c) Explain the following budgeting approaches, indicating advantages and disadvantages

i. Activity based budgeting

ii. Programmed based budgeting

iii. Zero based budgeting

iv. Incremental budgeting

Solution

a)

Stakeholder Role

Minister of finance Responsible for

• fiscal planning

• preparation of national budget

• presentation of budget for approval by parliament

• implementation of budget.

Bank of Ghana Responsible for the formulation monetary policy aspect of economic

policy of the country.

Ghana statistical Service Provision of fiscal statistical data as the basis for the estimation of

GDP, inflation rate and employment rate.

Ghana Revenue Estimation of tax revenues of government for the preparation of the

Authority budget and collection revenues approved by parliament

Controller and Accounting for budget implementation by capturing actuals

Accountant General outcomes.

National Development Ensures the development and compliance with national

Planning Commission development plans by providing strategic direction for national

budgeting.

4 | www.aspireproconsult.com | 0555 213 559

c)

i. Activity based budgeting

It’s a variation of ZBB where resources are linked to the activities leading the attainment of set objectives (outcome). ABB

refers to the resource allocation based on relationship between activities and costs, and which provides greater detail on

overheads than the normal financial budgeting. Individual activities within the organisation are assesses in terms of their

contribution to the achievement of the organisation’s objectives success. Costs are transparent, understandable and

actionable.

ii. Programmed based budgeting

It is the process of developing budgets based on the relationship between program funding levels and expected results

from that program. Programme based budgeting placed emphasis on outcomes, service delivery and results. PBB

structures allow for the identification of necessary inputs to produce the core operations and projects required in order

to contribute to strategic objectives. It on the other hand difficult to define measurable outcome of most public sector

programmes.

iii. Zero based budgeting

This is budgeting approach which requires that all activities are re-evaluated each time budget is prepared so that each

activity can justify its inclusion in the budget. Each activity or project is treated as though it was being undertaken for the

first time and is expected to justify its inclusion in the budget in terms of benefits expected to derive from it. The

technique expects that organisations should even justify the need that they should continue to exist. It ensures that

inefficient or obsolete operations are eliminated. But Zero-based

iv. Incremental budgeting

his is budgeting approach where the previous year budget is adjusted to allow for changes in future conditions. This approach

involves the use of previous budget as a baseline and adds or subtracts amount to/from that budget in order to reflect

assumptions for the forthcoming budget year. It makes budgeting simple and ensures continuity in government programmes

and activities. On the other hand, It encourages budget slacks in putting together a budget and it leads to allocation of

resources to irrelevant item or activities.

5. Explain the concepts of Virement and its conditions under the Public Financial Management Act, 2016 (Act 921)

Solution

Virement refers to the reallocation of an appropriation from one expenditure head of sub-head to another. Sometimes

Virement is used to meet over spending in one expenditure head when there is a surplus balance on one expenditure

head. Under the PFM Act, the Minister for minister is responsible for approving virements. However, the Minister may

delegate the power to authorize virements to a head of department, indicating clearly the terms and extent of such

delegation.

5 | www.aspireproconsult.com | 0555 213 559

Conditions of Virement

a. A virement of funds allocated for wages and salaries in an expenditure vote shall not be made unless the virement is in

respect of wages and salaries within that expenditure vote

b. A virement that involves a change in the spending plans approved by the Minister for the current financial year

shall require the prior written approval from the Minister

c. A virement may be made from a recurrent expenditure to capital expenditure as well as from one capital

expenditure to another capital expenditure but shall not be made from a capital expenditure to a recurrent expenditure

d. A virement shall not be made in respect of appropriated amounts between covered entities without the approval

of Parliament in a supplementary estimate.

e. Virement shall not result in a future liability for that covered entity or the Government.

6. Government through Public Financial Management Act, 2016, (Act 921) established the Treasury Single Account

(TSA) as part of the measures for regulating the Financial Management systems of Public Sector Entities. The

primary objective of the TSA is to ensure effective aggregate control over government cash balances.

Required:

a. Explain the TWO (2) models of the TSA system.

b. Explain THREE (3) general principles of operating the systems

c. Describe THREE (3) challenges of the TSA systems.

Solution

(a) Models of TSA

i. Where the main TSA and associated ledger accounts are to be maintained in a single financial institution.

ii. Where the main TSA is maintained in a single banking institution and associated zero balance ledger sub accounts are

maintained in other institutions from where balances are swept daily to the main treasury in central bank or any

appointed main TSA hosting financial institution.

(b) General principles

i No bank account shall be operated in any guise under the purview and oversight of the Treasury

ii Consolidation of government cash resources should be comprehensive and encompass all government cash

resources. That is all public monies irrespective of whether the corresponding cash flow are subject to

budgetary control or not, should be brought under the control of government.

iii Banking arrangement should be unified to enable the relevant government stakeholders such as MoF and

the CAG have full oversight government cash flow across banks accounts.

(c ) Challenges of TSA

i. Change over from multiple bank accounts arrangements to treasury single accounts may bring

management obstacles. For example, resistance, misunderstanding and other implications on

business operation.

ii. introduce bureaucracy into the payment process at covered entity level. Speed and flexibility

associated with IGFs may be negatively affected by the TSA.

iii. less efficient banking and systems will adversely affect the operation of the treasury single accounts

systems.

6 | www.aspireproconsult.com | 0555 213 559

(B) a. Explain charts of accounts and discuss FIVE (5) objectives of GFS Chart of accounts.

Solution

The COA is a set of coding elements used to classify, record, budget and report all financial transactions in the most suitable

form for making informed and good financial decisions. A chart accounts (COA) is a critical element of the PFM framework

for classifying, recording and reporting information in a systematic and consistent way.

It is used to organize the finances of the entity and to segregate expenditures, revenue, assets and liabilities in order to give

interested parties a better understanding of the financial health of the entity.

Objectives of Charts of Accounts

i To control public spending

ii To ensure accountability of public resources

iii To strength budget management (e.g. facilitation of virement)

iv To improve financial planning and management

v To facilitate the use of management information systems to generate reliable and ensure timely dissemination of

information for decision making.

vi To enhancing general purpose financial reporting

vii To support statistical reporting

7. The rationale of Ghana Integrated Financial Management Information Systems (GIFMIS) platform is establish an

integrated ICT-based PFM information system in Ghana in all MDAs and MMDAs at national, regional and district

levels to improve efficiency in public financial management.

Required:

a. Discuss FOUR (4) specific problems in public financial management the GIFMIS seeks to address.

b. Identify the GIFMIS modules.

c. Explain FOUR (4) benefits and FOUR (4) challenges of GIFMIS implementation in Ghana.

8. Briefly describe the expenditure cycle in the public sector indicating the controls exercised at each stage.

9. Fiscal policy relates to government revenue(taxation), spending and borrowing, how these variables are used to

achieve economic stability.it is usually used to describe the effect on the aggregate economy of the overall levels

spending, taxation and more particularly the financing gap between them.

Required:

a) State the fiscal policy objective as contained in section 14 of the PFM Act 2016, (Act 921).

b) Explain five roles played by fical policies in ensuring economic development and stability.

10. Explain Public Expenditure Survey (PES) highlighting the key objectives of undertaking that exercise

as part of the budgeting processes in the public sector.

7 | www.aspireproconsult.com | 0555 213 559

PART B- CONCEPTUAL FRAMEWORK FOR GENERAL PURPOSE FINANCIAL REPORTING BY PUBLIC SECTOR ENTITIES

11. Financial reporting of public sector entities are crucial for accountability and decision making purposes and there

must be in accordance with certain frameworks. The Conceptual framework is part of the framework used in financial

reporting in the public sector. Conceptual framework of General-Purpose Financial Reports is also part of the

pronouncement of the International Public Sector Accounting Standard Board.

Required:

Explain the roles and authority of the framework of financial reporting in the public sector.

Role of the Conceptual Framework

The Conceptual Framework for General Purpose Financial Reporting by Public Sector Entities (the Conceptual

Framework) establishes the concepts that underpin general purpose financial reporting (financial reporting) by

public sector entities that adopt the accrual basis of accounting. The International Public Sector Accounting

Standards Board (IPSASB) will apply these concepts in developing International Public Sector Accounting Standards

(IPSASs) and Recommended Practice Guidelines (RPGs) applicable to the preparation and presentation of general

purpose financial reports (GPFRs) of public sector entities.

Authority of the Conceptual Framework

The Conceptual Framework does not establish authoritative requirements for financial reporting by public sector

entities that adopt IPSASs, nor does it override the requirements of IPSASs or RPGs. Authoritative requirements

relating to the recognition, measurement and presentation of transactions and other events and activities that are

reported in GPFRs are specified in IPSASs. The Conceptual Framework can provide guidance in dealing with

financial reporting issues not dealt with by IPSASs. In these circumstances, preparers and others can refer to and

consider the applicability of the definitions, recognition criteria, measurement principles, and other concepts

identified in the Conceptual Framework.

12. In line with the Conceptual Framework for General Purpose Financial Reporting by Public Sector Entities issued by

International Public Sector Accounting Standards Board (IPSASB) explain the difference, if any, between a General-Purpose

Financial Report and a Special Purpose Financial Report.

13. According to the Conceptual Framework for General Purpose Financial Reporting (GPFR) for Public Sector Entities

issued by IPSASB, GPFR of public sector entities are developed primarily to respond to the information needs of the primary

users who do not possess the authority to require a public sector entity to disclose the information they need for

accountability and decision-making purposes. It adds that the objectives of financial reporting are therefore determined by

reference to the users of GPFRs, and their information needs.

Required:

Explain the information provided by General-Purpose Financial Reports for users.

Solution

✓ Financial Position, Financial Performance, and Cash Flows

✓ Budget Information and Compliance with Legislation or Other Authority Governing the Raising and Use of Resources

✓ Service Delivery Achievements

✓ Prospective Financial and Non-Financial Information

✓ Explanatory Information

8 | www.aspireproconsult.com | 0555 213 559

14. Discuss the recognition of the elements in the financial statements in accordance with Conceptual

Framework for General Purpose Financial Reporting by Public Sector Entities issued by International Public Sector

Accounting Standards Board (IPSASB).

15. Implementation of the International Public Sector Accounting Standards (IPSAS) is a priority of Government

in 2021, and the Controller and Accountant General is doing everything possible to ensure effective

implementation. One major concern of the implementors is a measurement of public assets, as these assets are

numerous, varied and acquired in different ways. Nevertheless, assets need to be measured and recognised in

accordance with IPSAS.

Required:

i. Explain the objectives of Measurement in Financial Reporting under IPSAS.

ii. Explain FOUR (4) Measurement Bases for assets in line with the Conceptual Framework of General-

Purpose Financial Report.

16. The objective of IPSAS 1-Presenataion of Financial Statements is to set out the manner in which general

purpose financial statements shall be prepared under accrual basis of accounting including guidance for their

structure and the minimum requirement for contents. The standard is however not applicable to Government

Business Enterprises as they are required to present the financial reports using IFRS due to their peculiar

characteristics that separate them from other public sector entities.

Required:

Identify FOUR (4) characteristics of Government Business Enterprises according to IPSAS 1: Presentation of Financial

Statements.

Features of GBEs According to IPSAS 1

✓ It is an entity with the power to contract in its own name.

✓ Has been assigned the financial and operational authority to carry on a business.

✓ Sells goods and services, in the normal course of its business, to other entities at a profit or full cost recovery.

✓ Is not reliant on continuing government funding to be a going concern (other than purchases of outputs at arm’s length),

and

✓ Is controlled by a public sector entity.

9 | www.aspireproconsult.com | 0555 213 559

PART C- PUBLIC FINANCIAL MANAGEMENT SYSTEMS PUBLIC EXPENDITURE AND ACCOUNTABILITY (PEFA) FRAMEWORK

AND VALUE FOR MONEY

17.The Public Expenditure and Financial Accountability (PEFA) program provides a framework for assessing and reporting on

the strengths and weaknesses of public financial management (PFM) using quantitative indicators to measure performance.

Public Expenditure and Financial Accountability (PEFA) framework is a tool for assessing the status of a country’s public

financial management (PFM) system management at central and local government levels of governance. The PEFA

framework provides the foundation for evidence-based measurement of PFM performance at a specific point in time. The

methodology can be reapplied in successive assessments to track changes over time.

PEFA is a methodology for assessing public financial management performance. It identifies 94 characteristics (dimensions)

across 31 key components of public financial management (indicators) in 7 broad areas of activity(pillars).

Also, the purpose of a good PFM system is to ensure that the policies of governments are implemented as intended and

achieve their objectives. An open and orderly PFM system is one of the enabling elements needed for desirable fiscal and

budgetary outcomes.

Required:

a) Explain the key pillars of an open and orderly public financial management system under the PEFA framework.

b) Explain three key outcomes of an open and orderly public financial management systems.

18. PEFA reports on countries PFM performance has gained prominence in Ghana in recent times. This largely attributed

to the robustness of its scoring methodology, the wide coverage of their measurements and factors considered in drawing

conclusions of the status of a PFM system.

a. Discuss briefly the structure of the PEFA Reports.

b. Explain the scoring methodology of the PEFA in measuring PFM performance.

Solution.

The procedures for measuring PFM performance is as follow:

✓ The Pillars of the PFM is reflective of some indicators or elements of PFM. Therefore, the Pillars are measured

based on the indicators of the Pillars.

✓ The indicators of each Pillar are scored based on certain dimensions.

✓ The dimensions of each indicator are assessed based on scoring criterion ranking from ‘A’ to ‘D’.

Most indicators have a number of separate dimensions each of which must be assessed separately. Each dimension is scored

separately on a four-point ordinal scale: A, B C or D according to precise criteria established for each dimension. In order to

justify a particular score, dimension every specified in the scoring requirement must be fulfilled. If the requirements are only

partly met the criteria are not satisfied and a lower score should be given that coincides with achievement of all requirement

for the lower performance rating. A score of C reflect the basic level of performance for each indicator and dimension,

consistent with good international practice. A score D means that feature being measured is present at less that the basic

level of performance or it is absent altogether, or three is insufficient information to score the dimension. The overall score

for an indicator is based on the scores for the individual dimensions. The scores for multiple dimensions are combined into

the overall score for the indicator using either the Weakest Link Method (WL) or the Averaging Method (AV). Each indicator

specifies the method to be used.

10 | www.aspireproconsult.com | 0555 213 559

19. The core PEFA methodology was initially focused on central government, including related oversight and

accountability institutions, such as the legislature and supreme audit institutions. However, PEFA has increasingly

been used to cover the assessment of PFM performance.

Required:

a. Discuss the institutional coverage of the PEFA framework.

b. Explain the scope limitation inherent in conducting PEFA assessment and issuing reports of such

assessments based on the PEFA framework.

Solution

a. The core PEFA methodology was initially focused on central government, including related oversight and

accountability institutions, such as the legislature and supreme audit institutions. The scope of the category of

“central government”, as used in PEFA, is based on the classification structure developed by the International

Monetary Fund (IMF) for Government Finance Statistics (GFS). However, PEFA has increasingly been used to cover

the assessment of PFM performance in the following:

✓ Subnational government (state government and local government)

✓ Extra budgetary units (activities of central governments implemented outside the budget

✓ Public corporations

20. Government of Ghana’s performance of PFM dimensions for the 2018 PEFA assessment report are as

follows:

a.

Indicator/ Method Description Score Overall

dimension of for score(

scoring Dimensi To be

on determ

ined)

PI-3 Revenue outturn

M2 Aggregate revenue A

Revenue composition D

outturn

PI-24 Procurement

M2 Procurement monitoring A

Procurement methods D

Public access to D

procurement information

Procurement complaints D

management

PI-30 External audit

M1 Audit coverage and A

standard

Submission of audit reports A

to the legislature

External audit follow-up A

Supreme Audit Institution D

(SAI) Independence

11 | www.aspireproconsult.com | 0555 213 559

Required

Compute the score of each of the three indicators of Ghana and interpret the results.

Solution

a. Using the Average Method, the Ghana whose scores are C, D and B has an overall score of C on that

indicator, which is considered as the average performance under the PEFA Framework. This depicts the basic level

of performance and requires improvement in that regard.

21. The National Health Insurance Scheme (NHIS) is a social intervention program introduced by the

government to provide financial access to quality health care for residents in Ghana.

Required

Discuss the procedures that should be undertaken to ensure value for money in the implementation of National

Health Insurance Scheme.

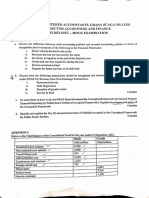

22. (a)The transaction and event of a public sector entity fall into these three groups

• Rendering of services

• Sale of goods

• Use of other assets yielding interest, royalties and dividend.

Required:

ln line with IPSAS 9: Revenue from Exchange Transactions, explain how each of the above categories of

transaction s!1ould be measured and recognized in the financial statements. {10 marks)

(b) Discuss how the following transactions should be recognized and measured in the financial statement

under IPSAS Revenue from Non- Exchange Transactions:

(i)Revenues from tax (ii)Debt forgiveness (iii) Donation of goods in kind

12 | www.aspireproconsult.com | 0555 213 559

PART D- ACCOUNTING POLICIES FOR BOTH CASH AND ACCRUAL BASES IN PUBLIC SECTOR

23. In the public Sector, there are number of approaches or technique applied in keeping or processing financial

statements. These techniques include vote accounting, commitment accounting and fund accounting.

Required:

Explain each of the above stated approached to accounting as used in the public sector.

24. In preparing general purpose financial reports for public sector entities, the choice of basis of accounting to apply is a

crucial matter. The decision has to be made on whether to prepare the accounts on cash basis, modified cash basis, modified

accrual or accrual basis. Also, the choice has an implication for the disclosure in the financial statements.

Required

As a newly appointed Deputy Head of Public Accounts Division of the Controller and Accountant General’s Department, you

are required to write a report to your Head:

a. Explaining each of the FOUR (4) bases of accounting indicated above.

b. In reference to a specific financial enactment, explain the responsibility for making accounting policy in the public sector.

c. Discuss the factors to consider in making accounting policy choice in terms of basis accounting.

d. Explain why the disclosure of accounting policy in terms of basis accounting is important in the public sector.

Solution

a. Cash bases, Accrual bases, Modified Cash and Modified Accrual.

b. The Public Financial Management Act, 2016(Act 921) entrusted the responsibility of formulating accounting standards

to the Controller and Accountant General.

The Section 8 provides that the Controller and Accountant General shall in consultation with the Auditor-General, specify

for a covered entity, the accounting standards, policies and the classification system to be applied in public accounting to

ensure that a proper system of accounting operates.

It subsequently provides in Section 82 that the Controller and Accountant-General may introduce changes to the

accounting or classification system but shall provide a justification in respect of the change; and how the accounting or

classification system introduced shall ensure that public funds are properly accounted for.

b.

✓ Requirement of financial legislation

✓ Requirement of accounting standards

✓ Transparency and accountability. ie the basis of accounting will determine the level of disclosure made in financial reports.

✓ Cost consideration

✓ Availability of expertise

✓ Users information need

c. The disclosure of accounting policy in terms of basis of accounting is important due to the following reasons:

✓ The basis of accounting affects the recognition and measurement in the financial statements and providing information

about it will make it possible for the user to understand the financial information better.

✓ The accounting policy regarding the basis of accounting affects the reported financial performance, financial position, and

cash flows condition of the entity and therefore disclosure will enhance the accountability and decision usefulness of the

information.

25. Cash accounting policies and accrual accounting policies when applied respectively to the same transaction or

events of the same entity will produce different pictures of the financial performance, position and cash flow

information of the entity. Thus, the choice of alternative policies needs to be given much consideration. The

International Public Sector Accounting Standards Board (IPSASB) permits the use of cash accounting policies whilst

encouraging the application of accrual accounting policies in the preparation of financial reports for public sector.

13 | www.aspireproconsult.com | 0555 213 559

Required:

Discuss the difference between cash accounting policies and accrual accounting policies in terms of recognition and or

treatment of the following in the Financial Statements.

(a) Non-current asset acquired during the year

(b) Salary advance paid to an employee during the year

(c) Inventory of supplies at the end of the financial year

(d) Goods and services unpaid for during the year

(e) Service received in kind

(f) Deposits for future services to be delivered

(g) Investment income due but not received

26. Explain the usefulness of accrual basis of accounting over cash basis of accounting applied in the public sector

accounting.

27. The public sector applies the cash basis, modified cash basis, modified accrual or accrual basis in their financial

reporting. Of all the basis of accounting, which will you recommend to the government of Ghana and why?

14 | www.aspireproconsult.com | 0555 213 559

PART E - PREPARATION OF FINANCIAL STATEMENTS FOR PUBLIC SECTOR ENTITIES IN LINE WITH GENERALLY ACCEPTED

ACCOUNTING PRACTICES

28.

A. CENTRAL GOVERMEMNT

QUESTION ONE

The following transactions were extracted from the books of Controller and Accountant General for the

consolidated fund for the year ended 31st December 2020.

GH₵ 000

Accumulated Fund (01/01/2020) - Debit 1,480,000

Donation in Kind 990,000

Taxes paid by individuals 2,760,000

Taxes paid by corporation 3,670,000

Other direct taxes 760,000

General taxes on goods and services 3,560,000

Excise 1,250,000

Customs and other import duties 4,780,000

Other indirect taxes 565,000

Grants from Multilateral partners 1,040,000

Grants from bilateral partners 800,000

Property Incomes 800,000

Sales of goods and services 650,000

Penalties and Fines 960,000

Established position 5,640,000

Non-established position 1,440,000

Allowances 500,000

Contract appointment 150,000

Foreign travel Per-Diem 120,000

National pension contribution 650,000

Materials and office consumables 250,000

Utilities 150,000

General cleaning 102,000

Rent 50,000

Travel and transport 120,000

Repair and maintenance 100,000

Training,Seminar and conference 200,000

Consultancy 300,000

Purchase of property,plant and equipment 4,650,000

Construction of infrastructure 2,250,000

Other non-financial assets 750,000

Transfer to DACF 600,000

Debt forgiveness 1,200,000

Public debt Interest 5,650,000

15 | www.aspireproconsult.com | 0555 213 559

Grant to other governments 950,000

Transfer to Road Fund 100,000

Transfer to GetFund 330,000

Oil Subsidy 240,000

Utility Subsidy 150,000

Schools Subsidy (BECE and SHS) 50,000

Social benefits 420,000

Loans and advances 860,000

Equity investment 1,250,000

Sale of equity investment 450,000

Auction of unserviceable assets 240,000

Recovery of loans and advances 70,000

Domestic debt 3,770,000

External debt 4,550,000

Repayment of domestic debt 2,120,000

Repayment of external debt 2,560,000

Cash and cash equivalent at start (debit balance) 45,000

Cash and cash equivalent at start (Credit balance) 2,650,000

Additional Notes:

i. The Government of Ghana applies the full accrual basis International Public Sector Accounting Standards

(IPSAS) as the basis for preparing its financial statements.

ii. During the year, Parliament of Ghana approved a transfer of 7.5% of total tax revenue to the District

Assemblies Common Fund (DACF).

iii. It is the policy of the government to provide for consumption of fixed assets based on the rates of the assets:

property, plant and equipment-10%, Infrastructure - 5% and other depreciable assets- 20%.

iv. The property, plant and equipment has included motor vehicle donated to the government by the Netherland

Government. The fair value of the motor vehicle is GH₵ 950,000,000.

v. Inventory included in use of goods and services available at the end of the year was as follows:

Inventory for use Inventory for sale

GH₵’000 GH₵’000

Historical Cost 350,000 525,000

Replacement Cost 300,000 400,000

Net Realizable value 250,000 205,000

vi. The exchanged rate losses on external debt at the reporting date was GH₵ 200,000,000.

vii. Car and bicycle Maintenance allowance of GH₵ 900,000,000 were outstanding during the year. In addition,

National Health Insurance amounting to GH₵ 700,000,000 and Staff Welfare and Medical refund expenses of GH₵

500,000,00 remained unpaid at year end.

viii. During the year, the government incurred GH₵ 1,100,000,000 for the purpose national awards, scholarships and

bursaries to students. In addition, professional fees of GH₵ 850,000,000 was also incurred. No records were made

in respect of that.

ix. During the year 2019, a non-financial asset received as donation GH₵700,000,000 was completely

omitted from the books. This error was not identified and corrected.

16 | www.aspireproconsult.com | 0555 213 559

Required:

In accordance with the Public Financial Management Act,2016 (Act 921), Public Financial Management

Regulation,2019 (L.I.2378) and the International Public Sector Accounting Standards (IPSAS), prepare:

a) Statement of financial Performance of the consolidated fund for the year ended 31 December 2020.

b) Statement of Cash flow of the consolidated fund for the year 31st December 2020 in compliance with IPSAS

2: Cash Flow Statement.

c) Statements of changes in Net Assets.

d) Notes to the financial statements

17 | www.aspireproconsult.com | 0555 213 559

Solution

Republic of Ghana

a. Statement of Financial Performance of the Consolidated Fund for the year 31st December, 2020

Notes GH₵’000 GH₵’000

Revenue

Direct taxes 2 7,190,000

Indirect taxes 3 10,155,000

Non-tax 4 2,410,000

Grants 5b 5,330,000

Total revenue 25,085,000

Expenditure

Compensation for employees 6b 8,830,000

Goods and services 7b 1,040,000

Interest 5,650,000

Social benefit 8b 1,620,000

Subsidies 9 440,000

Exchange difference 200,000

Grants 10 2,680,875

Consumption of fixed assets 12 867,500

Other expenditure 11 1,950,000

Total Expenditure 23,278,375

Surplus 1,806,625

18 | www.aspireproconsult.com | 0555 213 559

b. Statements of cashflow for the year ended 31 December 2020

Cash flow from operating activities GH₵’000 GH₵’000

Direct taxes 2 7,190,000

Indirect taxes 3 10,155,000

Non-tax 4 2,410,000

Grants 5a 1,840,000

Compensation for employees 6a (7,930,000)

Goods and services 7a (1,542,000)

Interest (5,650,000)

Social benefit 8a (420,000)

Subsidies 9 (440,000)

Grants 10a (1,980,000)

Other expenditure 11 (1,950,000)

Net cash flow from operating activities 1,683,000

Cash flow from investing activities

Acquisition of PPE (4,650k – 950k) (3,700,000)

Construction of infrastructure (2,250,000)

Other non-financial assets (750,000)

Loans and advance granted (860,000)

Loans and advance recovery 70,000

Equity Investment (1,250,000)

Sales of Equity Investment 450,000

Auction Of Unserviceable Asset 240,000

Net cash flow from investing activities (8,050,000)

Cash flow from financing activities

Domestic borrowings 3,770,000

External borrowings 4,550,000

Repayment of external borrowings (2,120,000)

Repayment of Domestic borrowings (2,560,000)

Net cash flow from financing activities 3,640,000

Net cash flow (2,727,000)

Add cash at start 77,000

(2,650,000)

Closing cash balance

19 | www.aspireproconsult.com | 0555 213 559

c. Statement of Changes in Net Asset

Accumulated Fund

GH₵’000

Balance b/f (1,480,000)

Prior year adjustments- Cost (non-financial asset) 700,000

-depreciation (140,000)

Restated balance (920,000)

Surplus 1,806,625

Balance 886,625

d. Notes to the financial statements

1. Accounting policies

The following accounting policies and compliances have been applied in the preparation and presentation of the

financial statements.

(a) Statement of compliance

The financial statements are prepared and presented in accordance with International Public Sector Accounting

Standards (IPSASs), Public Financial Management Act, 2016 (Act 921) and Financial Management Regulation,2016

(L.I 2378).

(b) Basis of accounting

The financial statements have been prepared on accrual basis of accounting in line with IPSAS where financial

transactions are recognized when they occur.

(c) Consumption of fixed asset policy

Consumption charge for non-current asset is on straight line basis. The rates of consumption are as follows

Assets Rate

Property, plant and equipment 10%

Infrastructure asset completed 5%

Other depreciable assets 20%

(d) Borrowing costs

Borrowing cost incurred during the year are expensed.

(e) Valuation of inventories

Inventories for use are valued on the lower of historical cost and replacement costs while inventories for sale are

valued on lower of historical cost and net realizable value.

(f) Functional and presentation currency

These financial statements are presented in Ghana Cedis (GH¢), which is the Country’s functional currency.

20 | www.aspireproconsult.com | 0555 213 559

2. Direct taxes GH₵’000

Taxes paid by individuals 2,760,000

Taxes paid by corporation 3,670,000

Other direct taxes 760,000

Total 7,190,000

3. Indirect taxes GH₵’000

General taxes on goods and services 3,560,000

Excise 1,250,000

Customs and other import duties 4,780,000

Other indirect taxes 565,000

Total 10,155,000

4. Non-tax revenue GH₵’000

Property Incomes 800,000

Sales of goods and services 650,000

Penalties and Fines 960,000

2,410,000

5. Grants GH₵’000

Grants from Multilateral partners 1,040,000

Grants from bilateral partners 800,000

Total a 1,840,000

Debt Forgiveness 1,200,000

Donation in Kind 990,000

Motor Vehicle 1,300,000

Total b 5,330,000

6. Compensation for employees GH₵’000

Established position 5,640,000

Non-established position 1,440,000

Allowances 500,000

National pension contribution 650,000

Total a 7,930,000

Car and bicycle Maintenance 900,000

Total b 8,830,000

21 | www.aspireproconsult.com | 0555 213 559

7 Goods and services GH₵’000

Contract appointment 150,000

Foreign travel Per-Diem 120,000

Materials and office consumables 250,000

Utilities 150,000

General cleaning 102,000

Rent 50,000

Travel and transport 120,000

Repair and maintenance 100,000

Training, Seminar and conference 200,000

Consultancy 300,000

Total a 1,542,000

Closing Stock (use and sales- 300k + 205K) (502,000)

Total b 1,040,000

8. Social Benefit

Per TB 420,000

Total a 420,000

NHIS 700,000

Staff Welfare and Medical refund expenses 500,000

Total b 1,620,000

9. Subsidies

Oil Subsidy 240,000

Utility Subsidy 150,000

Schools Subsidy (BECE and SHS) 50,000

440,000

10. Grants GH₵’000

Transfer to DACF 600,000

Grant to other governments 950,000

Transfer to Road Fund 100,000

Transfer to GetFund 330,000

Total a 1,980,000

DACF{ (7.5% * 17,345k)-600k} 700,875

Total b 2,680,875

22 | www.aspireproconsult.com | 0555 213 559

11 Other Expenses GH₵’000

National awards, scholarships and bursaries 1,100,000

Professional fees 850,000

1,950,000

12 Non-financial (PPE) asset schedule

Construction of Other non-financial

PPE Total

infrastructure assets

Rate 10% 5% 20%

Costs GH₵’000 GH₵’000 GH₵’000 GH₵’000

Cost 4,650,000 2,250,000 750,000 7,650,000

- 700,000 700,000

4,650,000 2,250,000 1,450,000 8,350,000

Consumption of fixed

Balance b/f - - 140,000 140,000

Charge for the year 465,000 112,500 290,000 867,500

465,000 112,5000 430,000 1,007,500

Carrying amount 4,185,000 2,137,500 1,020,000 7,342,500

23 | www.aspireproconsult.com | 0555 213 559

29.

B. MINISTRIES, DEPARTMENTS AND AGENCIES (OTHER COVERED ENTITIES)

Below is the trail balance of the Information Service Department under the Ministry of Information.

Trial Balance as at 31st December 2020

GH₵’000 GH₵’000

Compensation for employees - 50,000

Goods and services - 40,000

Non- Financial assets - 25,000

Bank and Cash 5,000 -

Advances and loans 20,110 -

Fixed deposit Investment 15,280 -

Receivables 630 -

Sundry Payables - 23,350

Capital work in progress 3,500 -

Established post 37,250 -

Casual Labour 6,000 -

Contract appointments 4,000 -

Secondment 1,150 -

Insurance 2,500 -

Travel and Transport 5,000 -

General Cleaning 8,350 -

Seminar and workshops 2,750 -

Local Consultancy 5,800 -

Rent 1,900 -

Printing and Publication 1,990 -

Repairs and Maintenance 1,435 -

Office consumables 1,080 -

Foreign Travels 5,490 -

Property Plant and Equipment 19,350 -

Accumulated depreciation - 8,350

Internally generated revenues - 14,000

Donor supports - 3,500

Other expenditures 10,500 -

Accumulated fund 5,135 -

164,202 164,200

24 | www.aspireproconsult.com | 0555 213 559

Additional Information

(i) Inventories of office consumables at the end of the year with a historical cost of GH₵300,000 was valued at

replacement cost GH₵ 280,000. The estimated net realizable value is GH₵ 335,000.

(ii) Utility expenses outstanding at 31st December 2020 amounted to GH₵ 615,000 and consultancy fees paid in advance

amounted to GH₵ 1,500,000. In addition, casual labour arrears on compensation for newly recruited employees during

the year was GH₵ 2500,000.

(iii) Consumption of fixed capital is charged on straight line basis for the year as follows:

Cost Accumulated Consumption Useful life estimated

GH₵’000 c GH₵’000

Motor vehicles 10,000 4,500 5 years

Furniture, Fixtures and fittings 5,000 2,500 10 years

Equipment 4,350 1,350 4 years

(iv) During the year, the Aneka Media Association have given free air to the Information Service Department to promoting

civic education on election 2024. The estimated cost of the airtime was GH₵ 6,000,000.

(v) The Ministry of Information has also transferred some communication equipment worth GH₵ 225,000 to the

department. No recognition was made in the financial records in respect of this transaction.

(vi) Internally generated revenues earned but not received during the year amounts to GH₵ 400,000. It is the policy of

the Department to make allowance of 5% for uncollectible revenues.

(vii) Other expenses included equipment installation cost of GH₵ 20,000 paid during the year.

(viii) Budget extract of the Department is given below:

Annual Budget Revised Budget

GH₵’000 GH₵’000

Compensation for employees 60,000 70,000

Goods and Servies 50,000 57,000

GoG Subvention 100,000 105,000

Internally generated Fund 20,000 15,000

Donations and grants 12,000 13,000

Other expenditures 9,000 8,500

Required:

Prepare in accordance with the Public Financial Management Act, 2016 (Act 921) and the International Public Sector

Accounting Standards:

a. Statement of financial performance for the year ended 31st December 2020.

b. Statement of changes in net asset and equity; and

c. Statement of financial position as at 31st December,2020.

d. Statements of Budget Information in comparison with Actual performance.

e. Notes to the accounts

25 | www.aspireproconsult.com | 0555 213 559

SOLUTION

a. Statement of financial performance for the year ended 31st December 2020.

Revenue Notes Actual Revised budget

GH₵’000 GH₵’000

Government subvention 2 115,000 105,000

Internally generated funds 3 14,400 15,000

Donations and other Revenues 4 9,725 13,000

Total revenue 139,125 123,000

-

Expenses -

Compensation of employees 5 44,650 70,000

Goods and services 6 45,130 57,000

Consumption of fixed assets 7 3,649 -

Other Expenses 8 10,500 8,500

Total expenses 103,929 135,550

Surplus/Deficit 35,196 (12,550)

b. Statement of changes in net asset and equity

GH₵’000

Balance b/f (5,135)

Surplus 35,196

Balance 30,061

26 | www.aspireproconsult.com | 0555 213 559

c. Statement of financial position as at 31st December,2020.

Current Assets Notes GH₵’000

Cash and cash equivalent 5,000

Advances and Loans 20,110

Prepayment 1,500

Fixed deposit investment 15,280

Receivables 9 1,010

Inventory 280

43,180

Non-current assets -

Property plant and equipment 7,596

Capital work in progress 3,500

11,096

Total Assets 54,276

Liabilities -

Payable 10 24,215

Accumulated Fund 11 30,061

54,276

d. Statements of Budget Information in comparison with Actual performance.

Revenue Notes Actual Revised budget

Outturn Outturn Percent

GH₵’000 GH₵’000 GH₵’000 %

Government subvention 2 115,000 105,000 10,000.00 10%

Internally generated funds 3 14,400 15,000 (600.00) (4%)

Donations and other Revenues 4 9,725 13,000 (3,275.00) (25%)

Total revenue 139,125 123,000 16,125.00 13%

-

Expenses -

Compensation of employees 5 44,650 70,000 25,350.00 36%

Goods and services 6 45,130 57,000 11,870.00 21%

Consumption of fixed assets 7 3,649 - - -

Other Expenses 8 10,500 8,500 (2,000.00) (24%)

Total expenses 103,929 135,550 31,621.00 23%

Surplus/Deficit 35,196 (12,550)

27 | www.aspireproconsult.com | 0555 213 559

e. Notes to the account

1. Accounting policies

Refer to discussion above

2. GOG Receipts GH₵’000

Compensation for Employees 50,000

Use of goods and services 40,000

Non-financial assets 25,000

115,000

-

3. Internally generated funds GH₵’000

Per trail balance 14,000

Receivables 400

14,400

4. Donations and grants GH₵’000

Per trail balance 3,500

Free air time donation 6,000

Transfer of asset 225

9,725

5. Compensation for Employees GH₵’000

Established position 37,250

Casual Labour 6,000

Secondment 1,150

44,400

Casual labour arrears 250

44,650

-

6. Goods and services GH₵’000

Contract appointment 4,000

Travel and transport 5,000

General cleaning 8,350

Seminar and workshop 2,750

Local consultancy 5,800

Rent 1,900

Printing and publication 1,990

Repairs and maintenance 1,435

Office consumable 1,080

28 | www.aspireproconsult.com | 0555 213 559

Foreign travel 5,490

Insurance 2,500

40,295

Closing inventory (280)

Utilities accrued 615

Consultancy prepaid (1,500)

Civic education services 6,000

45,130

7. Non-current asset schedule

Furniture, fixturtes and

Motor vehicles fittings Equipment Total

GH₵’000 GH₵’000 GH₵’000 GH₵’000

Cost b/f 10,000 5,000 4,350 19,350

Additions - - 245 245

10,000 5,000 4,595 19,595

Accumulated Depreciation b/f 4,500 2,500 1,350 8,350

Depreciation 2,000 500 1,149 3,649

6,500 3,000 2,499 11,999

Carrying amount 3,500 2,000 2,096 7,596

8. Other expenses GH₵’000

Per trial balance 10,500

Provision for doubtful receivable 20

Equipment installation (20)

10,500

-

9. Receivables GH₵’000

Per trial balance 630

Revenue receivable 400

Provision for doubtful receivable (20)

1,010

-

10. Payables -

Per trial balance 23,350

Electricity 615

Casual labour 250

24,215

29 | www.aspireproconsult.com | 0555 213 559

30.

C. METROPOLITAN, MUNICIPAL AND DISTRICT ASSEMBLIES

Below is the most recent Trial Balance as at 31st December, 2020 for Gushegu Metropolitan Assembly (GMA) is the

Northern Region.

GH₵’000 GH₵’000

GOG Subvention-salary 50,000

Basic rates 11,500

Ceded revenue 14,125

Share of district assembly common fund 33,303

Hawkers licenses 724

Training workshop 995

Fixed deposit 7,000

Contract retention 16,075

Tax withholdings 1,173

Advances to staff 52,995

Contract mobilization 29,173

Bank and Cash 10,555

Special sanitation grants 10,000

Loans 617

Established Post 25,620

Assemblymen allowances 525

Printing and publications 100

Rent 67

Repairs and maintenance 459

Rehabilitation of facilities 1,784

Construction works completed 109,550

Construction works in progress 59,950

Purchase of furniture and fittings 15,550

Purchase of computer and accessories 620

Consultancy 112

Conference and seminar 280

Finance charges 49

Allowances to staff 16,600

Casual labour 2,123

Other donor support 25,385

Market toll 44,450

Lorry parks 22,330

Court fines and penalties 5,130

30 | www.aspireproconsult.com | 0555 213 559

Share of stool land revenue 7,800

Property rate 43,910

Hiring of equipment and facilities 790

Market store rent 930

Rent of residential accommodation 1,060

Utilities and office consumables 610

Accumulated fund 17,242

Foreign travels cost and per diem 325

Other expenditure 118

Interest on fixed deposits 3,350

NIB Loan 6,500

HIPC grant 20,000

335,777 335,777

Additional information

i) During the year, court, slaughter and lorry park fines amounting to GH₵ 250,000 have not been accounted

for.

ii) The assembly acquired a computer software costing GH₵ 300,000 on credit with an estimated useful life of

10 years. No records were made in relation with this acquisition.

iii) During the year newly constructed market stores were let out to traders who paid two years rent in advance

on July 1st 2020 and this rent will expire on June 30th, 2022.

iv) The fixed deposit amounting to GH₵ 5,000,000 was made with GCB Bank on July 1st, 2020 at the rate of 20%

per annum. Interest is receivable every three months. The last quarter interest is yet to be received.

v) Inventory of consumables at 31 December,2020 amounted to 100,000 at historical costs and had a net selling price of

150,000 but a replacement cost of 120,000.

vi) Consumption of fixed capital on all assets as follows on cost: Computer and accessories 30%, Furniture and fitting at

20%, Construction works completed 10%.

vii) Electricity and water of GH₵ 200,000 was outstanding at the year end.

viii) The budget performance report at the year revealed that Assembly exceeded its internally generated fund and

donation targets by GH₵ 1,000,000 and GH₵ 100,000 respectively. Further, expected government support for the

year dropped by GH₵ 500,000. However, it has overspent its compensation of employee budget by GH₵ 250 whilst

underspent goods and services by GH₵ 400,000. Other expenses out turn was exactly what was expected for the

year.

ix) In the year 2019, property rate, basic rate and ground rent amounting to GH₵ 325,000 were assessed by the assembly

but no records in respect of that were made.

Required:

Prepare suitable for external use in accordance with the Public Financial Management Act 2016, Local Governance

Act 2016 and the International Public Sector Accounting Standards:

i) Statement of Financial Performance for the year ended 31st December 2020.

ii) Statement of Financial Position as at 31st December 2020.

iii) Statement of Budget Information in Comparison with actual performance in accordance with IPSAS 24.

iv) Notes to the accounts.

31 | www.aspireproconsult.com | 0555 213 559

Solution

Gushegu Metropolitan Assembly (GMA)

Statement of Financial Performance for the year ended 31st December 2020

Notes Actual Budget

Revenue GH₵’000 GH₵’000

Decentralized transfer 2 115,228

Internally Generated Fund(IGF) 3 133,976

Donation and Grants 4 45,385

Total revenue 294,589

Expenditure

Compensation for employees 5 44,668

Goods and services 6 34,205

Interest 49

Consumption of fixed assets 7 14,281

Other expenditure 118

Total expenditure 93,321

Surplus 201,268

iii. Statement of Financial Position as at 31st December 2020.

Non-current assets Notes GH₵’000

Property, plant& equipment 7 12,874

Construction completed 7 98,595

Construction WIP 7 59,950

Intangible 7 270

171,689

Current assets

Bank and Cash 10,555

Receivables 825

Inventory 100

Loans and advances 9 53,612

Fixed deposit 7,000

72,092

Total assets 243,781

Current liabilities

Payables 8 17,748

Deferred market store income 698

Bank loan 6,500

Total current liabilities 24,946

Accumulate fund 10 218,835

218,835

Total assets and liabilities 218,781

32 | www.aspireproconsult.com | 0555 213 559

iv. Statement of Budget Information in Comparison with actual performance in accordance with IPSAS 24

Refer to discussion under CF.

v. Notes to the accounts.

1. Accounting policies

Refer to discussion under CF.

2. Decentralized transfer

GOG Subvention-salary 50,000

Ceded revenue 14,125

Share of district assembly common fund 33,303

Special sanitation grants 10,000

Share of stool land revenue 7,800

115,228

3.Internally Generated Fund

Basic rates 11,500

Hawkers licenses 724

Market toll 44,450

Lorry parks 22,330

Court fines and penalties 5,130

Property rate 43,910

Hiring of equipment and facilities 790

Market store rent 930

Rent of residential accommodation 1,060

Interest on fixed deposits 3,350

Prepayment(rent)-3/4*930 (698)

court, slaughter and lorry park fines 250

Investment income arrears 250

133,976

4. Donation and grants

Other donor support 25,385

HIPC grant 20,000

45,385

5. Compensation for employees

Established Post 25,620

Casual labour 2,123

Allowances to staff 16,600

Foreign travels cost and per diem 325

44,668

33 | www.aspireproconsult.com | 0555 213 559

6. Goods and services

Training workshop 995

Contract mobilization 29,173

Assemblymen allowances 525

Printing and publications 100

Rent 67

Repairs and maintenance 459

Rehabilitation of facilities 1784

Consultancy 112

Conference and seminar 280

Utilities and office consumables 610

Electricity and water arrears 200

Inventory (100)

34,205

7. Non-financial assets schedule

Computer and Furniture and Construction

Constructin WIP Software Total

accessories fittings completed

Bal b/f - - - - -

Additions 620 15,550 109,550 59,950 300 185,970

620 15,550 109,550 59,950 300 185,970

Consumption

Bal b/f - - - - - -

Charge for the

year 186 3,110 10,955 30 14,281

186 3,110 10,955 - 30 14,281

Carrying amount 434 12,440 98,595 59,950 270 171,689

8. Payables

Contract retention 16,075

Tax withholdings 1,173

Software payable 300

Electricity and water 200

17,748

9. Loans and advances

Advances to staff 52,995

Loans 617

53,612

34 | www.aspireproconsult.com | 0555 213 559

10. Accumulated fund

Bal b/f 17,242

Prior year adjustment 325

Surplus 201,0268

218,835

11. Receivables

Investment 250

property rate, basic rate and ground rent 325

court, slaughter and lorry park fines 250

825

31.Given below are the revenues of government for the second half of year 2020.

Import Fees& Total

duties Company charges

Dividend Gift tax GHS000 P.A.Y.E tax Loans GHS000 Revenue

Month GHS000 GHS000 GHS000 GHS000 GHS000 GHS000

July 2,000 450 8,550 12,000 16,000 100,000 3,000 142,000

August 1,200 0 7,000 10,400 17,000 0 7,000 42,600

September 1,800 0 6,000 11,000 12,500 20,000 6,000 57,300

October 2,200 850 4,000 8,000 18,000 320,000 5,000 358,050

November 3,200 600 9,500 7,800 10,000 0 6,800 37,900

December 2,000 500 10,000 26,000 14,500 0 4,600 57,600

TOTAL 12,400 2,400 45,050 75,200 88,000 440,000 32,400 695,450

The Controller and Accountant General (CAG) is mandated to transfer at least 5% (currently 5%) of the total revenue to the

District Assembly Common Fund on quarterly basis for onward distribution to all the Metropolitan, Municipal and District

Assemblies (MMDAs). The District Assembly Common Fund Administrator upon the receipt of the transfers from the CAG,

disburses 80% of the fund to the

35 | www.aspireproconsult.com | 0555 213 559

MMDAs based on a formula approved as follows:

Factor Weight (%)

Needs 40

Responsiveness 10

Service presure 20

equalization 30

100

Assuming that there are only three assemblies in Ghana; Mfantsiman Metropolitan Assembly (JMA), Ejura Sekyredumasi

Municipal Assembly (ESMA) and Shai-Osudoku District Assembly (SDA). Below is the factor analysis result of the three

assemblies.

Factor MMA ESMA SDA Total

Need 2 3 5 10

Responsiveness 3 4 3 10

Service presure 5 3 2 10

Equalization 1 1 1 3

Required:

a) Compute the amount to be transferred to the District Assembly Common Fund for the third quarter and fourth

quarter respectively in accordance with the provisions of the District Assembly Common Fund Act 1993 (Act 455),

using the current rate of 5%.

b) Prepare a statement of distribution of the District Assembly Common Fund to the three assemblies (MMA, ESMA

and SDA) for the fourth quarter based on the approved sharing formula.

32. The following information were produced by the Ministry of Finance for the 2021 fiscal year:

GH¢ million

Grants 1,130.70

Non Tax Revenue 4,358.70

Taxes on income and Property 9,238.30

Taxes on Domestic Goods and Services 7,061.70

International Trade Taxes 4,051.10

Other taxes 161.40

Required:

The 1992 Constitution and the District Assemblies Common Fund Act 455 requires Parliament to annually allocate

portions of national revenue into the District Assemblies Common Fund (DACF) for distribution to local

governments. From the above:

i) Calculate the statutory total amount to be transferred into DACF required by law and grant policy for the 2021 fiscal

year.

ii) Assuming that Parliament approves for an equal distribution of the DACF for 2021 to all local governments, how

much would one typical local government in Ghana receive as its share of the DACF for the 2021 fiscal year for

development.

36 | www.aspireproconsult.com | 0555 213 559

PART F- EVALUATE FINANCIAL POSITION, PERFORMANCE AND PROSPECTS OF PUBLIC SECTOR ENTITIES USING FINANCIAL

REPORTS AND OTHER INFORMATION

33. The financial information below relates to the Consolidated Fund of Ghana.

Consolidated Fund Statement of Financial Performance forThe Year Ended 31st December 2022.

2022 2021

Actual Actual

GH¢ million GH¢ million

Revenue

Direct Tax 38,000 41,000

Indirect Tax 53,000 60,000

Non-Tax Revenue 15,000 20,000

Grants 16,000 15,000

Total revenue 122,000 136,000

Expenditure

Compensation for employee 59,100 47,400

Use of Goods and Service 53,500 35,000

Public Debt Interest 42,000 28,700

Subsidies 24,500 24,000

Social Benefit 31,500 25,000

Grants 29,000 26,000

Consumption of Fixed Asset 5,000 4,300

Other Expense 2,000 1,800

Total expenditure 246,600 192,200

Surplus/Deficit (124,600) (56,200)

Statement of Financial Position as at 31st December 2022.

Assets 2022 2021

Non-Current Asset GH¢ million GH¢ million

Property, Plant and Equipment 23,000 21,200

Infrastructure 29,000 20,800

Equity investment 20,000 10,000

Total non-current asset 72,000 52,000

Current Asset

Cash and Cash Equivalent 60,000 100,000

Loans and advances 25,000 22,000

Receivables 5,000 8,500

90,000 135,000

Total Assets 162,000 187,000

37 | www.aspireproconsult.com | 0555 213 559

LIABILITIES AND FUND

Current liabilities

Payables 70,000 60,000

Deposits and Trust Monies 12,000 15,000

Total current liabilities 82,000 65,000

Non-Current Liabilities

Domestic Debt 120,000 90,000

External Debt 162,600 110,000

Total non-current liabilities 282,600 200,000

Accumulated Fund (202,600) (78,000)

162,000 187,000

Additional Information:

i) The statistical data indicates that the population of the country is estimated as 26,000,000 in 2022 and

25,000,000 in 2021.

ii) The total capital asset acquired in 2021 and 20202 are GH¢ 6,165,000,000 and GH¢6,880,000,000

respectively.

iii) The total market value of all final goods and services produced domestically in Ghana for 2021 and 2020 fiscal

year amounted to GH¢376,800,000,000 and GH¢350,000,000,000 respectively.

iv) The non-tax revenue included an Annual Budget Funding Amount of GH¢1,800,000,000 in GH¢1,700,000,000

in 2022 and 2021 respectively. Additionally, non-tax revenue reported include dividend received from the

State Owned Enterprises of the governments in the respective years. Dividend income constitutes 30% of

the non- tax revenues in the year 2022 and 20% of the non-tax revenues in the year 2021.

Required:

a) Compute the following ratios

i) Debt to GDP

ii) Non-oil primary fiscal balance

iii) Non-oil fiscal balance

iv) Capital spending to total expenditure

v) Interest to tax revenue ratio

vi) Wage bill to tax revenue ratio

vii) Tax per capita

viii)Return on equity

b) Based on your computations in question (a), write a report to the Joint Financial Management Committee analysing

and discussing the financial performance and financial position over the two-year period indicating clearly the

strength and weaknesses of each year. The report should however also highlight, among others key assumptions

that underpin your analysis and conclusion and limitations of your analysis.

38 | www.aspireproconsult.com | 0555 213 559

Solution

Ratio analysis

2021 2020

GH¢ million GH¢ million

𝑇𝑜𝑡𝑎𝑙 𝐷𝑒𝑏𝑡 282,600 200,000

i) Debt to GDP= 𝐺𝐷𝑃

× 100 × 100= 75% × 100= 57.14%

376,800 350,000

ii) Non-oil Primary fiscal balance to GDP = (124,600)+42,000−1,800 (56,200)+28,700−1,700

𝐹𝑖𝑠𝑐𝑎𝑙 𝑏𝑎𝑙𝑎𝑛𝑐𝑒+𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡−𝑜𝑖𝑙 𝑟𝑒𝑣𝑒𝑛𝑢𝑒

× 100 × 100

376,800 350,000

×100

𝐺𝐷𝑃 = (22.39%) = (8.34%)

iii) Non-oil fiscal balance to GDP = (124,600)−1,800 (56,200)−1,700

𝐹𝑖𝑠𝑐𝑎𝑙 𝑏𝑎𝑙𝑎𝑛𝑐𝑒−𝑜𝑖𝑙 𝑟𝑒𝑣𝑒𝑛𝑢𝑒

× 100 × 100

376,800 350,000

×100

𝐺𝐷𝑃 = (33.55%) =(16.54%)

iv) Capital spending to total expenditure= 6,165 6,880

× 100 × 100

𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝑒𝑥𝑝𝑒𝑛𝑑𝑖𝑡𝑢𝑟𝑒 246,600 192,200

× 100

𝑇𝑜𝑡𝑎𝑙 𝑒𝑥𝑝𝑒𝑛𝑑𝑖𝑡𝑢𝑟𝑒 = 2.5% = 3.58%

42,000 28,700

v) Interest to total tax = × 100= 46.15% × 100=28.42%

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 91,000 101,000

× 100

𝑇𝑜𝑡𝑎𝑙 𝑡𝑎𝑥 𝑟𝑒𝑣𝑒𝑛𝑢𝑒

59,100 47,000

vi) Wage bill to tax × 100= 64.95% 101,000

× 100=46.53%

𝐶𝑜𝑚𝑝𝑒𝑛𝑠𝑎𝑡𝑖𝑜𝑛 𝑜𝑓 𝑒𝑚𝑝𝑙𝑜𝑦𝑒𝑒𝑠 91,000

revenue= 𝑇𝑜𝑡𝑎𝑙 𝑡𝑎𝑥 𝑟𝑒𝑣𝑒𝑛𝑢𝑒

× 100

vii) Tax per capita 91,000 101,000

𝑝𝑒𝑟 𝑐𝑖𝑡𝑖𝑧𝑒𝑛 = 𝑝𝑒𝑟 𝑐𝑖𝑡𝑖𝑧𝑒𝑛 =

𝑇𝑜𝑡𝑎𝑙 𝑡𝑎𝑥 𝑟𝑒𝑣𝑒𝑛𝑢𝑒 26 25

= (𝑖𝑛 𝐺𝐻𝐶 𝑝𝑒𝑟 𝑐𝑖𝑡𝑖𝑧𝑒𝑛) GH¢3,500 𝑝𝑒𝑟 𝑐𝑖𝑡𝑖𝑧𝑒𝑛 GH¢4,040𝑝𝑒𝑟 𝑐𝑖𝑡𝑖𝑧𝑒𝑛

𝑃𝑜𝑝𝑢𝑙𝑎𝑡𝑖𝑜𝑛

𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 4,500 4,000

viii) Return on equity =

𝐸𝑞𝑢𝑡𝑦 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡

× 100 × 100 =22.50% × 100 =40.00%

20,000 10,000

39 | www.aspireproconsult.com | 0555 213 559

QUESTION TWO

Below is the Statement of financial Position of the Ogundipe College of Education as at 31 December 2022 prepared in

accordance with International Public Sector Accounting Standards.

NON-CURRENT ASSETS: Note GH¢’000 GH¢’000

Property, Plant and Equipment 11,976,100

Investment Property 1,312,250

Software 806,355

14,094,705

CURRENT ASSETS:

Cash and Cash Equivalent 264,810

Inventory 159,500

Receivables 563,101 987,411

Total Assets 15,082,116

LIABILITIES AND FUND:

Current Liabilities:

Payable 382,550

Non-Current Liabilities:

Bank Loans 685,000

Total Liabilities 1,067,550

Accumulated Fund 14,014,566

15,082,116

Required:

Based on a Common Size Statement of Financial Position, write a report discussing and analysing the financial

position of the Ogundipe College of Education in line with the Recommended Practice Guide 2, Financial Statement

Discussion and Analysis.

40 | www.aspireproconsult.com | 0555 213 559

34. Recommended Practice Guideline (RPG) provides guidance for preparing and presenting financial

statement discussion and analysis.

Required:

a) In reference with Recommended Practice Guide 2, explain financial statements discussion and analysis

and discuss its usefulness.

b) Explain the general considerations in providing financial statements discussion and analysis.

c) Explain THREE (3) common tools used in analysis of financial statement of public sector entities.

Solution

a) Financial statement discussion and analysis is an explanation of the significant items, transactions and events

presented in an entity’s financial statements and the factors that influenced them

Usefulness of Financial statement discussion and analysis

✓ It assists users in understanding the financial position, financial performance, and cash flows presented in the financial

statements.

✓ It provides useful information to the users for accountability and decision-making purposes by enabling the user gain

insight into the operation from the perspective of the entity itself.

✓ It allows the entity to reflect its perspective on key items, transactions and events that affect the financial position,

financial performance and cash flows of the entity within the reporting period.

✓ It provides users with better understanding of the trends the entity’s operations.

✓ Financial statements discussion and analysis completes the information in the financial statements.

✓ It helps to discuss the financial statements of the entity to the understanding of users that are distant from the

organisation.

✓ It is a narrative reporting providing preparers interpretation of the results that will be valuable to the users in assessing

accountability and decision making.

b) General Considerations of Financial statement discussion and analysis

✓ information provided in financial statement discussion and analysis should meet the qualitative characteristics of

financial reporting taking into account the constraints on information included in general purpose financial

reports.

✓ It should not be a mere repetition of information already provided in the financial statements but to analyse and

explain the significant items, transactions and events in the financial statement.

✓ Financial statement discussion and analysis should be presented at least annually and should use the same

reporting period as that covered by the financial statements.

✓ The reporting boundary for financial statement discussion and analysis should be the same as that used for the

financial statements.

✓ Financial statement discussion and analysis should be issued with the financial statements.

✓ It should be clearly identified and distinguished from the financial statements and other information

✓ Financial statement discussion and analysis should not be described as complying with this RPG unless it complies

with all the requirements of this RPG.

41 | www.aspireproconsult.com | 0555 213 559

PART G - RULES AND PROCEDURES IN PUBLIC PROCUREMENT

35. The Section 14 of Public Procurement Act 2003, Act (663) as amended by the Public Procurement Act,2016(Act 914)

provides for the scope and application of the Act.

Required:

According to Section 14(1) (2) of the Public Procurement (Amendment) Act 2016, discuss the scope and application of the Act.

36. Generally, public procurement is built on certain key and universal principles and these are what must

guide the public procurement processes. These principles flow through every aspect of the procurement

process and is meant to ensure that government get the best value in their use of public funds and that the

whole country benefits from.

Required:

Explain any FIVE(5) general principles of public procurement.

37. The University of Cape Coast advertised a national tender to build a water harvesting system for the

School of Agriculture in the University. There was a lot of interest from contractors because it was a big

project worth a lot millions of Ghana Cedis. The Vice Chancellor asked the Senior Works Officer to provide

one particular contractor information about the estimated price for the contract to help him prepare his bid.

The Vice Chancellor said that the said contractor was based in the Cape Coast, so he deserved to get more

assistance than other contractors. The Senior Works Officer argued that, this is unfair and that all contractors

should receive same information about the contract or the procurement processes.

Required:

a) In accordance with the Public Procurement Act 2003, Act (663) as amended, which of the two officers (Vice

Chancellor and Senior Works Officer) is right. Explain the bases of your position?

b) In accordance with the Public Procurement Act 2003, Act (663) as amended, explain offences relating to the

public procurement.

38. Section 14 of the Public Procurement Act 2003, as amended stipulates the scope and application of

the Act therefore covers disposal of public stores, vehicle and equipment.

Required

a. Discuss the procedures involved in the disposing off unserviceable, obsolete and surplus stores, vehicles,

plants and equipment.

b. Explain the methods of disposal under the Act.

39. The public procurement Act 2003, as amended has provided clear rules to follow in the public procurement

to eliminate the use of discretion capriciously.

Required:

Explain the procurement rules in the following matters

i. Rejection of tenders, proposals and quotations

ii. Suspension of suppliers, contractors and consultants

42 | www.aspireproconsult.com | 0555 213 559

Solution

i. Rejection of tenders, proposals and quotations

Section 29 provides that a procurement entity may reject tenders, proposals and quotations at any time prior to acceptance

if the grounds for the rejection are specified in the tender documents. The ground for rejection shall be communicated to the

tenderer but justification for rejection is not required. No liability arises to the procurement entity upon rejection.Notice of

rejection must be given to participating tenderers within two days from the date the procurement entity decides to

discontinue with the tender process. If the decision to reject tenders is taken before the closing date, tenders received shall

be returned unopened to the tenderers submitting them