Professional Documents

Culture Documents

Ultimate Book of Accountancy: Brilliant Problems

Uploaded by

Pramod Vasudev0 ratings0% found this document useful (0 votes)

221 views9 pagesOriginal Title

12_accountancy_solutions_ultimate_book_of_accountancy_part_b_ch05_cash_flow_statement_07

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

221 views9 pagesUltimate Book of Accountancy: Brilliant Problems

Uploaded by

Pramod VasudevCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 9

ULTIMATE BOOK OF ACCOUNTANCY

(Author: Dr. Vinod Kumar, Publisher: Vishvas Publications)

Class - XII Accountancy (Text Book Solutions)

Chapter -05 (Part – B): Cash Flow Statement Part-7

Brilliant Problems

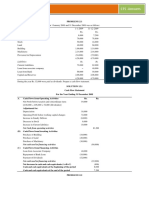

1. Cash Flow Statement

Profit during the year 10,000

Add: Transfer to General Reserve 12,500

Add: Tax provision 20,000

Add: Proposed Dividend 50,000

Add : Depreciation 31,250

Less: Profit on Sale (3,750)

Operating Profit before working capital changes 1,20,000

Add : Decrease in Trade Receivables 50,000

Less : Decrease in Trade Payable (30,000)

Less : Increase in Inventories (50,000)

90,000

Less : Tax (12,500)

Net Cash from Operating Activities 77,500

Cash Flow From Investing Activities

Proceeds from Sale of Plant & Machinery 8,750

Purchase of Land & Building (50,000)

Purchase of Plant and Machinery (86,250)

Purchase of Intangible Asset (25,000)

Net Cash Used in Investing Activities (1,52,500)

Cash Flow From Financing Activities

Issue of Share capital 50,000

Issue of Debentures 50,000

Proposed dividend (25,000)

Net Cash flow from Financing Activities 75,000

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

Working notes : Provision for Tax Account

Particulars Amount Particulars Amount

To Bank A/c (Tax paid) 12,500 By Balance b/d 17,500

To Balance c/d 25,000 By Statement of P/L 20,000

(bal. fig. provision)

37,500 37,500

Plant & Machinery Account

Particulars Amount Particulars Amount

To Balance b/d 1,25,000 By Bank A/c (sale) 8,750

To Statement of P/L 3,750 By Depreciation A/c 31,250

To Bank (bal. fig. purchase) 86,250 By balance c/d 1,75,000

2,15,000 2,15,000

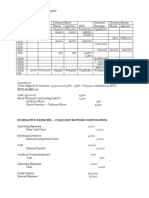

2. Cash Flow Statement

Cash Flow from Operating Activities

Loss during the year (54,000)

Add : Depreciation 28,000

Operating Loss before working capital changes (26,000)

Add : Increase in Trade payable 8,000

Add : Other Current Liabilities 2,000

Less : Increase in Inventories (10,000)

Less : Increase in Trade Receivables (14,000)

Cash used in Operating Activities (40,000)

Cash Flow From Investing Activities

Sale of Machinery 6,000

Sale of investment 12,000

Purchase of machinery (74,000)

Net Cash Used in Investing Activities (56,000)

Cash Flow From Financing Activities

Issue of Share capital 60,000

Issue of Debentures 40,000

Net Cash flow from Financing Activities 1,00,000

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

Fixed Asset Account

Particulars Amount Particulars Amount

To Balance b/d 60,000 By Bank A/c (sale) 6,000

To Bank (bal. fig. purchase) 74,000 By Depreciation A/c 28,000

By balance c/d 1,00,000

1,34,000 1,34,000

3. Cash Flow Statement

Cash Flow from Operating Activities

Profit during the year 4,400

Add : Provision for tax 1,800

Add : Dividend paid 8,000

14,200

Add : Depreciation 14,000

Less : Profit on sale of investment (100)

Less : Profit on sale of fixed assets (400)

Operating profit before working capital changes 27,700

Add : Decrease in Inventories 6,000

Less : Increase in Trade Receivables (49,000)

Less : Decrease in Trade payable (6,800)

(22,100)

Less : Tax (14,800)

Cash used in Operating Activities (36,900)

Cash Flow From Investing Activities

Sale of investment 1,700

Sale of Fixed Assets 2,400

Purchase of investment (3,600)

Net Cash flow from Investing Activities 500

Cash Flow From Financing Activities

Mortgage Loan 54,000

Dividend (8,000)

Net Cash flow from Financing Activities 46,000

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

Working notes : Provision for Tax Account

Particulars Amount Particulars Amount

To Bank A/c (bal. Tax paid) 14,800 By Balance b/d 15,000

To Balance c/d 2,000 By Statement of P/L 1,800

(provision made)

16,800 16,800

Fixed Asset Account

Particulars Amount Particulars Amount

To Balance b/d 80,000 By Bank A/c (sale) 2,400

To Statement of P/L 400 By Depreciation A/c 14,000

By balance c/d 64,000

80,400 80,400

Investment Account

Particulars Amount Particulars Amount

To Balance b/d 10,000 By Bank A/c (sale) 1,700

To Statement of P/L 100 By balance c/d 12,000

To Bank (bal. fig. purchase) 3,600

13,700 13,700

4. Cash Flow Statement

Cash Flow from Operating Activities

Profit during the year 1,00,000

General Reserve 12,500

Add : Loss on issue of debentures 2,500

1,15,000

Add : Dividend on Equity Shares 15,000

Add : Dividend on Pref. shares (5%) 5,000

Add : Amortisation of Intangible Assets 1,250

Add : Interest on Debentures 50,000 x 6/12 x 8/100 = 2,000

75,000 x 6/12 x 8/100 = 3,000 5,000

Add : Premium on Redemption 25,000 x 10/100 2,500

Add : Depreciation 22,500

Operating profit before working capital changes 1,66,250

Less : Increase in Trade Receivables (40,000)

Cash flow from Operating Activities 1,26,250

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

Cash Flow From Investing Activities

Purchase of investment (16,250)

Purchase of fixed assets (82,500)

Net Cash flow from Investing Activities (98,750)

Cash Flow From Financing Activities

Issue of Debentures 25,000

Redemption of Pref. Shares (25,000)

Premium on Redemption (2,500)

Dividend on Equity (15,000)

Dividend on Pref. shares (5,000)

Interest on Debentures (5,000)

Net Cash flow from Financing Activities (27,500)

Fixed Asset Account

Particulars Amount Particulars Amount

To Balance b/d 1,80,000 By Depreciation A/c 22,500

To Bank (Bal. fig. purchase) 82,500 By balance c/d 2,40,000

2,62,500 2,62,500

5. Cash Flow Statement

Cash Flow from Operating Activities

Profit during the year 1,00,000

Add : Proposed Dividend 50,000

Add : Depreciation 50,000

Less : Profit on sale (3,000

Operating profit before working capital changes 1,97,000

Less : Increase in Inventories (25,000)

Cash flow from Operating Activities 1,72,000

Cash Flow From Investing Activities

Sale of Plant & Machinery 8,000

Purchase of Plant & Machinery (3,55,000)

Net Cash use in Investing Activities (3,47,000)

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

Cash Flow From Financing Activities

Issue of Shares 3,00,000

Dividend (40,000)

Net Cash flow from Financing Activities 2,60,000

Fixed Asset Account

Particulars Amount Particulars Amount

To Balance b/d 5,00,000 By Depreciation A/c 50,000

To Statement of P/L (profit) 3,000 By Bank (sale) 8,000

To Bank (Bal. fig. purchase) 3,55,000 By balance c/d 8,00,000

8,58,000 8,58,000

6. Cash Flow Statement

Cash Flow from Operating Activities

Profit during the year 14,400

Transfer to Reserve 24,000

Add : Provision for Tax 36,000

Add : Proposed Dividend 40,000

Add : Interim Dividend 16,000

1,30,400

Add : Depreciation on Plant & Machinery 8,000

Add : Depreciation on Land & Building 16,000

Operating profit before working capital changes 1,54,400

Add : Increase in Sundry Creditors 22,400

Less : Decrease in Bills Payable (3,200)

Less : Increase in Sundry Debtors (32,000)

Less : Increase in Bills Receivable (8,000)

Less : Increase in inventories (25,600

1,08,000

Less : Tax (28,000)

Cash flow from Operating Activities 80,000

Cash Flow From Investing Activities

Sale of Land & Building 8,000

Sale of Investment 20,000

Purchase of plant & machinery (1,04,000)

Net Cash flow from Investing Activities (76,000)

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

Cash Flow From Financing Activities

Equity Share Capital issued 80,000

Dividend paid (16,000)

Pref. Shares redeemed (40,000)

Proposed dividend (33,600)

Net Cash flow from Financing Activities (9,600)

Working notes : Provision for Tax Account

Particulars Amount Particulars Amount

To Bank A/c (Tax paid) 28,000 By Balance b/d 32,000

To Balance c/d 40,000 By Statement of P/L 36,000

(bal. fig. provision made)

68,000 68,000

Plant & Machinery Account

Particulars Amount Particulars Amount

To Balance b/d 64,000 By Depreciation A/c 8,000

To Bank (bal.fig.purchase) 1,04,000 By balance c/d 1,60,000

1,68,000 1,68,000

Land and Building Account

Particulars Amount Particulars Amount

To Balance b/d 1,60,000 By Depreciation A/c 16,000

By Bank (sale bal. fig) 8,000

By balance c/d 1,36,000

1,60,000 1,60,000

7. Working notes

Plant & Machinery Account

Particulars Amount Particulars Amount

To Balance b/d 2,30,000 By Bank (sale) 8,000

(2,00,000 + 30,000) By Statement of P/L 2,000

To Bank (bal.fig.purchase) 1,25,000 By Accumulated Dep 5,000

By Balance c/d 3,40,000

(2,90,000 + 50,000)

3,55,000 3,55,000

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

Provision for Depreciation Account

Particulars Amount Particulars Amount

To Plant & Machinery A/c 5,000 By Balance b/d 30,000

To balance c/d 50,000 By Statement of P/L 25,000

(Dep. bal. fig)

55,000 55,000

8. Cash Flow Statement

Cash Flow from Operating Activities

Profit during the year 2,00,000

Add : Transfer to Reserve 28,000

Add : Provision for tax 3,20,000

5,48,000

Add : Preliminary expenses written off 20,000

Add : Depreciation 40,000

Add : Loss on Sale of furniture 2,000

Less : Profit on sale of machinery (12,000)

Operating profit before working capital changes 5,98,000

Add : Decrease in Bills Receivable 6,000

Less : Increase in Debtors (12,000)

Less : Increase in Prepaid Expenses (400)

Add : Increase in creditors 20,000

Less : Decrease in Bills payable (8,000)

6,03,600

Less : Tax 3,20,000

Cash used in Operating Activities 2,83,600

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

Complete solutions of the very popular book

“ULTIMATE BOOK OF ACCOUNTANCY” class 12th

CBSE. This book is written by a renowned author

‘Dr.Vinod Kumar’ and strongly recommended by

the experts, teachers and Chartered Accountants

for class 12th cbse.

Best Book in India for CBSE Board

For this book please Contact:

Vishvas Publications 09216629576, E-mail :

authorcbse@gmail.com

http://bestaccountancybook.in/

Buy online

http://vishvasbooks.com/

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

You might also like

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Cash Flow Statement ProblemsDocument4 pagesCash Flow Statement ProblemsPramod VasudevNo ratings yet

- UntitledDocument13 pagesUntitledTejasree SaiNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-2Document5 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-2Pramod VasudevNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Document7 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Pramod VasudevNo ratings yet

- Ma AssigmentDocument32 pagesMa AssigmentAashayNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-4Document11 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-4Pramod VasudevNo ratings yet

- Financial Reporting AnalysisDocument3 pagesFinancial Reporting AnalysisDishant TibrewalNo ratings yet

- Cash Flow Statement SolutionsDocument8 pagesCash Flow Statement SolutionsPramod VasudevNo ratings yet

- ACT320 Assignment ProjectDocument11 pagesACT320 Assignment ProjectMd. Shakil Ahmed 1620890630No ratings yet

- Quiz 2. MIDTERM (Cash Flow Statement)Document3 pagesQuiz 2. MIDTERM (Cash Flow Statement)Gila AbrazaldoNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- CF Statement Solutions 1Document4 pagesCF Statement Solutions 1Joy MukhiNo ratings yet

- Midterm Cash Flow Statement QuizDocument4 pagesMidterm Cash Flow Statement QuizGila AbrazaldoNo ratings yet

- Cash Flow 8 AprilDocument17 pagesCash Flow 8 AprilMayank MalhotraNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Cash flow statement for year ended 31 March 20X2Document3 pagesCash flow statement for year ended 31 March 20X2Amit GodaraNo ratings yet

- IAS 7 Cash Flow StatementDocument5 pagesIAS 7 Cash Flow Statementchalah DeriNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Cash Flow Statement-ExampleDocument18 pagesCash Flow Statement-ExampleAnakha RadhakrishnanNo ratings yet

- Accounts Project (Solution 1)Document3 pagesAccounts Project (Solution 1)sejanahmad48No ratings yet

- Chapter 7: Cash Flow AnalysisDocument2 pagesChapter 7: Cash Flow Analysistrisasmita bisnisNo ratings yet

- Tutorial 17.5Document4 pagesTutorial 17.5نور عفيفهNo ratings yet

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- CashFlowStatement AssignmentDocument15 pagesCashFlowStatement AssignmentAnanta Vishain0% (1)

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Chegg SolutionsDocument4 pagesChegg SolutionsZenika PetersNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- Cash Flow Pr. 16-1ADocument1 pageCash Flow Pr. 16-1AKearrion BryantNo ratings yet

- Balance Sheet and Cash Flow Statement AnalysisDocument3 pagesBalance Sheet and Cash Flow Statement AnalysisAmit GodaraNo ratings yet

- Tugas PAKDocument4 pagesTugas PAKTedo Arsa NanditamaNo ratings yet

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav180% (30)

- Nica Company Income Statement As of February 17, 2018 RevenuesDocument10 pagesNica Company Income Statement As of February 17, 2018 RevenuesRoselyn JavierNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Bharat Chemicals Ltd. CPHi46l2eHDocument2 pagesBharat Chemicals Ltd. CPHi46l2eHChickooNo ratings yet

- The Statement of Cash Flows Problems 5-1. (Currency Company)Document7 pagesThe Statement of Cash Flows Problems 5-1. (Currency Company)Marcos DmitriNo ratings yet

- Ce Quiz II (A+b+c)Document3 pagesCe Quiz II (A+b+c)Mohaiminur ArponNo ratings yet

- Cash Flow Statements IIDocument7 pagesCash Flow Statements IIGood VibesNo ratings yet

- Assign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020Document6 pagesAssign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020mhikeedelantar50% (2)

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- Cash Flow Statement Cash AnalysisDocument21 pagesCash Flow Statement Cash Analysisshrestha.aryxnNo ratings yet

- Chapter 9 - Shareholders' Equity AnalysisDocument4 pagesChapter 9 - Shareholders' Equity AnalysisJudy Ann Acruz100% (1)

- Activity For Chapter 3 (Financial Statements, Cash Flow and Taxes)Document2 pagesActivity For Chapter 3 (Financial Statements, Cash Flow and Taxes)pamela dequillamorteNo ratings yet

- Cash Flow Statement QuestionDocument5 pagesCash Flow Statement QuestionsatyaNo ratings yet

- Valix Vol. 3 2014 edition problem analysisDocument10 pagesValix Vol. 3 2014 edition problem analysisJenyl Mae NobleNo ratings yet

- CASH FLOW AND INCOME STATEMENT PROBLEMSDocument17 pagesCASH FLOW AND INCOME STATEMENT PROBLEMSIris MnemosyneNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- Joyk-Excel 2 3 1Document4 pagesJoyk-Excel 2 3 1api-664350584No ratings yet

- Perfect Practice SolutionDocument41 pagesPerfect Practice Solutionnarutevarsha5No ratings yet

- Model Paper AnswersDocument12 pagesModel Paper AnswersShenali NupehewaNo ratings yet

- Zinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Document3 pagesZinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Amit GodaraNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Assignment 03Document7 pagesAssignment 03Nadeera GalagedarageNo ratings yet

- Teacher Man: Activity WorksheetsDocument3 pagesTeacher Man: Activity WorksheetsPramod VasudevNo ratings yet

- Excel Topics Seminar 1Document11 pagesExcel Topics Seminar 1Pramod VasudevNo ratings yet

- Restaurant Duty RosterDocument5 pagesRestaurant Duty RosterPramod VasudevNo ratings yet

- Excel Topics Seminar 3Document17 pagesExcel Topics Seminar 3Pramod VasudevNo ratings yet

- DSR Report Chennai 2018: Date Total Bills Food Sale Beverage SaleDocument2 pagesDSR Report Chennai 2018: Date Total Bills Food Sale Beverage SalePramod VasudevNo ratings yet

- HOPaperI PDFDocument154 pagesHOPaperI PDFBambi Bambi BambiNo ratings yet

- Monthly Review Report - April 2016Document2 pagesMonthly Review Report - April 2016Pramod VasudevNo ratings yet

- Restaurant Sales ReportDocument9 pagesRestaurant Sales ReportPramod VasudevNo ratings yet

- Party MenuDocument1 pageParty MenuPramod VasudevNo ratings yet

- HACC PsopDocument58 pagesHACC PsopHoscoFoodsNo ratings yet

- 11 Accountancy Notes ch05 Depreciation Provision and Reserves 02 PDFDocument18 pages11 Accountancy Notes ch05 Depreciation Provision and Reserves 02 PDFVigneshNo ratings yet

- UNIT:10 Accounts For Incomplete RecordsDocument7 pagesUNIT:10 Accounts For Incomplete RecordsPramod VasudevNo ratings yet

- Computers & Accounting Information Systems: Components, Advantages, and Role in AccountingDocument4 pagesComputers & Accounting Information Systems: Components, Advantages, and Role in AccountingPramod VasudevNo ratings yet

- 11 Accountancy Keynotes Ch02 Theory Base of Accounting VKDocument9 pages11 Accountancy Keynotes Ch02 Theory Base of Accounting VKAnonymous 1Zepq14UarNo ratings yet

- 11 Accountancy Keynotes Ch03 Recording of Transactions VKDocument5 pages11 Accountancy Keynotes Ch03 Recording of Transactions VKAnonymous 1Zepq14UarNo ratings yet

- 11 Accountancy Keynotes Ch01 Introduction To Accounting VKDocument6 pages11 Accountancy Keynotes Ch01 Introduction To Accounting VKganeshram2305No ratings yet

- Fulltext01 PDFDocument41 pagesFulltext01 PDFpriyaNo ratings yet

- Pre Int-5 Advertising - NegotiatingDocument18 pagesPre Int-5 Advertising - NegotiatingKrasimira IvanovaNo ratings yet

- WarehouseDocument8 pagesWarehousesamukriNo ratings yet

- Risk & ReturnDocument31 pagesRisk & ReturnPramod VasudevNo ratings yet

- A Sense of Adventure: Good ContactsDocument11 pagesA Sense of Adventure: Good ContactsPramod VasudevNo ratings yet

- Investment Decision MethodDocument44 pagesInvestment Decision MethodashwathNo ratings yet

- Presentation The Business Organization Unit 6 EDocument12 pagesPresentation The Business Organization Unit 6 EPramod VasudevNo ratings yet

- A Sense of Adventure: Good ContactsDocument11 pagesA Sense of Adventure: Good ContactsPramod VasudevNo ratings yet

- Pre Int-5 Advertising - NegotiatingDocument18 pagesPre Int-5 Advertising - NegotiatingKrasimira IvanovaNo ratings yet

- Presentation The Business Organization Unit 6 EDocument12 pagesPresentation The Business Organization Unit 6 EPramod VasudevNo ratings yet

- Lessons From Capital Market History: Return & RiskDocument46 pagesLessons From Capital Market History: Return & RiskBlue DemonNo ratings yet

- What Do You Know About Changes in The Aviation Industry?: Are Things Improving ForDocument16 pagesWhat Do You Know About Changes in The Aviation Industry?: Are Things Improving ForPramod VasudevNo ratings yet

- Where in The World Are You?Document9 pagesWhere in The World Are You?Pramod VasudevNo ratings yet

- Business Class English 11slidesDocument10 pagesBusiness Class English 11slidesToh Choon HongNo ratings yet

- Financial DerivativesDocument24 pagesFinancial DerivativesResmi NidhinNo ratings yet

- Fixed IncomeDocument112 pagesFixed IncomeNGOC NHINo ratings yet

- Lawn Landscaping Business PlanDocument30 pagesLawn Landscaping Business Plannaveen vmaNo ratings yet

- IFRS Vs US GAAPDocument5 pagesIFRS Vs US GAAPtibebu5420No ratings yet

- Subjects Chapters DOC: I) Ethical and Professional Standards 1.ethics and Trust in The Investment ProfessionDocument2 pagesSubjects Chapters DOC: I) Ethical and Professional Standards 1.ethics and Trust in The Investment ProfessionHanako ChinatsuNo ratings yet

- Inputs For Synthetic Rating Estimation Please Read The Special Cases Worksheet (See Below) Before You Use This SpreadsheetDocument4 pagesInputs For Synthetic Rating Estimation Please Read The Special Cases Worksheet (See Below) Before You Use This SpreadsheetHicham NassitNo ratings yet

- Deposit Mobilization of Commercial Bank in Nepal Case Study of Nabil Bank LTDDocument9 pagesDeposit Mobilization of Commercial Bank in Nepal Case Study of Nabil Bank LTDKrishanKhadkaNo ratings yet

- 500 Practice Questions For BRBL PaperDocument89 pages500 Practice Questions For BRBL PaperJyoti LahaneNo ratings yet

- Risk Management in Banks 2Document56 pagesRisk Management in Banks 2Aquib KhanNo ratings yet

- Corporate Strategy NotesDocument40 pagesCorporate Strategy NotesLinh Chi Trịnh T.No ratings yet

- POA Exercise 28.11, 28.12A, 28.13Document6 pagesPOA Exercise 28.11, 28.12A, 28.13Ain FatihahNo ratings yet

- About Hantec MarketsDocument12 pagesAbout Hantec MarketsSrini VasanNo ratings yet

- Momentum Picks New RecommendationsDocument25 pagesMomentum Picks New RecommendationstanmaygoonNo ratings yet

- Mapping Matrik PenelitianDocument2 pagesMapping Matrik PenelitianKatarina BernardaNo ratings yet

- Multiple Choice Questions: Answer: B. Wealth MaximisationDocument20 pagesMultiple Choice Questions: Answer: B. Wealth MaximisationArchana Neppolian100% (1)

- DR Reddy's LabDocument10 pagesDR Reddy's LabTarun GuptaNo ratings yet

- Sample - Thermax Financial Statement AnalysisDocument25 pagesSample - Thermax Financial Statement Analysispavan79No ratings yet

- ISSB Cross-Industry Metrics (SASB) - DSDocument121 pagesISSB Cross-Industry Metrics (SASB) - DSAmishNo ratings yet

- Black-Scholes Option Pricing Formulas GuideDocument11 pagesBlack-Scholes Option Pricing Formulas Guidebodong408No ratings yet

- 1.2 BIWS Equity Value, Enterprise Value, and PDFDocument121 pages1.2 BIWS Equity Value, Enterprise Value, and PDFalbroNo ratings yet

- Costco - Relentless Focus On The One ThingDocument10 pagesCostco - Relentless Focus On The One ThingLuís LeiteNo ratings yet

- Financial Planning & Forecasting GuideDocument15 pagesFinancial Planning & Forecasting GuideChanet SetiadiNo ratings yet

- Financial Statement Analysis: K.R. SubramanyamDocument50 pagesFinancial Statement Analysis: K.R. SubramanyamDaveli NatanaelNo ratings yet

- Proj ListDocument5 pagesProj ListY KarthikNo ratings yet

- September 08 - Chapter 6-Capital Gains Taxation (Assignment)Document3 pagesSeptember 08 - Chapter 6-Capital Gains Taxation (Assignment)anitaNo ratings yet

- Strategic Financial Management Chapter IIDocument14 pagesStrategic Financial Management Chapter IIAnish MittalNo ratings yet

- Basic Consolidation Question 71Document5 pagesBasic Consolidation Question 71IbraheemsadeekNo ratings yet

- Roadmap FASB 123R Share-Based Pymt - DeloitteDocument280 pagesRoadmap FASB 123R Share-Based Pymt - DeloitteAlycia SkousenNo ratings yet

- IFM AssignmentDocument3 pagesIFM AssignmentUsmanNo ratings yet

- SEFL AnnexureDocument1 pageSEFL AnnexureBalakrishna AnkayyaNo ratings yet