Professional Documents

Culture Documents

Finance & Banking Fundamentals India

Uploaded by

Mayank NandwaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance & Banking Fundamentals India

Uploaded by

Mayank NandwaniCopyright:

Available Formats

Finance & Banking Fundamentals India

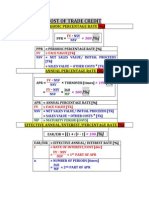

Formulae List Simple Interest (S.I) Compound Interest (C.I) CAGR FV PV NPV Inflation NAV Market capitalization (cap for short) Bond Price = P*r*t/100 = [P*(1+r/100)^t P] = [(Final Value/Initial Value)^1/n]- 1 = PV*(1+r/100)^t = FV/(1+r/100)^t = PV of all cash inflows-PV of all cash outflows e.g: NPV = -PV (C1) + PV (C2) + PV (C3). = Nominal Rate of Interest - Real Rate of Interest = (Market value of the fund investments + Income receivable - Expenses payable)/ Total no. of Outstanding units = Market Price * Number of Outstanding Shares of the Company = C / (1 + r /m )^m*t C = Coupon or Cash flows r = Yield Rate in the Market m = Number of times compounding happens in a year Time period in years = Total Purchases- Total Sales (could be in value or in quantity) = Average Lending Rate Average Deposit Rate = Interest Earned on Loans - Interest Paid on Deposits = Asset Value*Risk Weight Assigned =Capital/ Risk Weighted Assets (Term used for NBFCs) = Interest Paid on Purchase Price for the Lease Period (Hire Purchase) = [(Purchase Price Residual Value) + Finance Charges] /Lease Period = Owners Equity Losses (Term used for NBFCs) = Minimum Average Lending Rate other expenses - profit

t =

Trading Position Spread NII Risk Weighed Assets CRAR Finance Charges Lease Rental Net Owned Funds WACC

www.learnwithflip.com (page 1 of 1) (printed only on one side)

You might also like

- Corporate Finance Formula SheetDocument4 pagesCorporate Finance Formula Sheetogsunny100% (3)

- CheatSheet (Finance)Document1 pageCheatSheet (Finance)Guan Yu Lim100% (3)

- Finance Cheat SheetDocument4 pagesFinance Cheat SheetRudolf Jansen van RensburgNo ratings yet

- Corporate Finance - FormulasDocument3 pagesCorporate Finance - FormulasAbhijit Pandit100% (1)

- CFA Formula Cheat SheetDocument9 pagesCFA Formula Cheat SheetChingWa ChanNo ratings yet

- CFA Level I Formula SheetDocument27 pagesCFA Level I Formula SheetAnonymous P1xUTHstHT100% (4)

- Fnce 100 Final Cheat SheetDocument2 pagesFnce 100 Final Cheat SheetToby Arriaga100% (2)

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Calculate fair share price using dividend discount modelDocument9 pagesCalculate fair share price using dividend discount modelTannao100% (1)

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocument6 pagesFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNo ratings yet

- NoteSnack - Print Formula SheetDocument2 pagesNoteSnack - Print Formula Sheetmsg-90No ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Financial Management Formula SheetDocument2 pagesFinancial Management Formula SheetSantosh Kumar100% (2)

- Engineering formulas guide for financial analysisDocument4 pagesEngineering formulas guide for financial analysisJeff JabeNo ratings yet

- Management Advisory Services PDFDocument50 pagesManagement Advisory Services PDFDea Lyn Bacula100% (6)

- List of Formulae: Finance & Banking FundamentalsDocument1 pageList of Formulae: Finance & Banking FundamentalsLekshmi PsNo ratings yet

- Finance & Banking Fundamentals India Formulae SheetDocument1 pageFinance & Banking Fundamentals India Formulae Sheetshweta mandiliaNo ratings yet

- Wealth Management: (Page 1 of 2) (Printed Only On One Side)Document2 pagesWealth Management: (Page 1 of 2) (Printed Only On One Side)mohakbhutaNo ratings yet

- Important financial formulasDocument5 pagesImportant financial formulasKhalil AkramNo ratings yet

- FM II Midterm Formula SheetDocument1 pageFM II Midterm Formula SheetSalman J. SyedNo ratings yet

- R) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVDocument9 pagesR) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVAgnes LoNo ratings yet

- Formula SheetDocument1 pageFormula SheetZhi Cheng OngNo ratings yet

- Corporate FinanceDocument10 pagesCorporate Financeandrea figueroaNo ratings yet

- Session One FormulasDocument1 pageSession One FormulasSalarAliMemonNo ratings yet

- Calculating Present and Future Values of Cash FlowsDocument3 pagesCalculating Present and Future Values of Cash FlowsjainswapnilNo ratings yet

- Capital Structure and Cost of CapitalDocument3 pagesCapital Structure and Cost of CapitalAbhijit PanditNo ratings yet

- FORMULA SHEET GUIDEDocument3 pagesFORMULA SHEET GUIDEnatlyhNo ratings yet

- Treasury and Capital Markets Formulae GuideDocument2 pagesTreasury and Capital Markets Formulae GuideAnurag GuptaNo ratings yet

- Treasury Capital Markets FormulasDocument2 pagesTreasury Capital Markets FormulasRohit ShawNo ratings yet

- Finance 3000 Midterm2 Formula Sheet: October 28, 2015Document2 pagesFinance 3000 Midterm2 Formula Sheet: October 28, 2015Jack JacintoNo ratings yet

- 63 Useful Exam Formulas for ACCA Paper F9Document4 pages63 Useful Exam Formulas for ACCA Paper F9Muhammad Imran UmerNo ratings yet

- AFM. Resources. Useful FormulasDocument4 pagesAFM. Resources. Useful FormulasAnonymous MeNo ratings yet

- FINANCIAL FORMULA SHEETDocument4 pagesFINANCIAL FORMULA SHEETSameer SharmaNo ratings yet

- 1 Rec Formula ResearchDocument20 pages1 Rec Formula Researchbhobot riveraNo ratings yet

- Formulas To LearnDocument3 pagesFormulas To LearnHuệ LêNo ratings yet

- Formula Sheet FIN 300Document3 pagesFormula Sheet FIN 300Stephanie NaamaniNo ratings yet

- Fin 3101Document5 pagesFin 3101Park JiyeonNo ratings yet

- 08-b. Current Liabilities Management - Commercial Paper Formula, CommerceDocument2 pages08-b. Current Liabilities Management - Commercial Paper Formula, CommerceShohojShorolNo ratings yet

- FRL 300 Formula Sheet Common FinalDocument3 pagesFRL 300 Formula Sheet Common FinalAnonymous WimU99ilUNo ratings yet

- BMS SSF 2009-10Document46 pagesBMS SSF 2009-10Nitin GoriNo ratings yet

- External Capital Rationing Internal Capital RationingDocument10 pagesExternal Capital Rationing Internal Capital RationingSiva SubramaniamNo ratings yet

- FM FormulasDocument10 pagesFM Formulasyesha-parikh-4523No ratings yet

- MGT201 Financial Management Formulas Lect 1 To 22Document13 pagesMGT201 Financial Management Formulas Lect 1 To 22Farhan UL HaqNo ratings yet

- Financial Management FormulasDocument5 pagesFinancial Management Formulasrera zeoNo ratings yet

- Calculating WACC and Valuing Projects with Different Costs of CapitalDocument7 pagesCalculating WACC and Valuing Projects with Different Costs of CapitalkasimgenelNo ratings yet

- Time LineDocument2 pagesTime LineM Mansoor HussainNo ratings yet

- 25th Aug 2014 Lect: Current Time InvestDocument3 pages25th Aug 2014 Lect: Current Time InvestGaurav SomaniNo ratings yet

- FM Formula Sheet 02Document2 pagesFM Formula Sheet 02Aninda DuttaNo ratings yet

- Abm FormulasDocument39 pagesAbm FormulasYogambica Pilladi0% (1)

- Financial Management: (Formulas From Chapter 1-22)Document12 pagesFinancial Management: (Formulas From Chapter 1-22)Li Hui FooNo ratings yet

- Strategic Financial Management Formula and Concept KitDocument84 pagesStrategic Financial Management Formula and Concept KitNirmal ShresthaNo ratings yet

- Formula SheetDocument4 pagesFormula SheetAdil AliNo ratings yet

- Financial Statement Analysis RatiosDocument4 pagesFinancial Statement Analysis RatiosSumeet DekateNo ratings yet

- Formula Sheet 1Document1 pageFormula Sheet 1Ashley WintersNo ratings yet

- 12 & 13. Cost of CapitalDocument5 pages12 & 13. Cost of CapitalSatyam RahateNo ratings yet

- Cost of Capital Mahindra - Sohanji - FinalDocument21 pagesCost of Capital Mahindra - Sohanji - FinalJaiprakash PandeyNo ratings yet

- How Ancient Athens' Direct Democracy Can Inspire Modern CompaniesDocument7 pagesHow Ancient Athens' Direct Democracy Can Inspire Modern CompaniesMayank NandwaniNo ratings yet

- OLSDocument1 pageOLSoggyvukovichNo ratings yet

- Embedded SystemsDocument19 pagesEmbedded SystemsMayank NandwaniNo ratings yet

- OLSDocument1 pageOLSoggyvukovichNo ratings yet

- Speed Control of DC Motor Using Fuzzy Logic TechniquesDocument10 pagesSpeed Control of DC Motor Using Fuzzy Logic TechniquesMayank NandwaniNo ratings yet

- Speed Control of DC Motor Using Fuzzy Logic TechniquesDocument10 pagesSpeed Control of DC Motor Using Fuzzy Logic TechniquesMayank NandwaniNo ratings yet

- DTU Times (May Edition)Document16 pagesDTU Times (May Edition)Mayank NandwaniNo ratings yet

- Short Report TransformersDocument14 pagesShort Report TransformersMayank NandwaniNo ratings yet

- Collapse of The Soviet UnionDocument6 pagesCollapse of The Soviet UnionMayank NandwaniNo ratings yet