Professional Documents

Culture Documents

Lesson 7 Assignment 4

Uploaded by

marcied357Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson 7 Assignment 4

Uploaded by

marcied357Copyright:

Available Formats

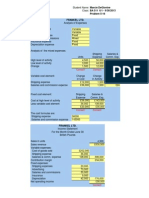

Student Name: Marcie DeGiovine Class: BA511 6/1 - 9/30/2013 Problem 11-22 ROWE COMPANY Flexible Budget-Finishing Department

Budgeted direct labor-hours Cost Formula Item per DLH Variable overhead costs: Indirect labor $0.60 Utilities 1.00 Maintenance 0.40 Total variable $2.00 Fixed overhead costs: Supervisory salaries Insurance Depreciation Equipment rental Total fixed Total overhead costs 50,000

Direct Labor-Hours 40,000 50,000 $24,000 40,000 16,000 80,000 $30,000 50,000 20,000 100,000

60,000 $36,000 60,000 24,000 120,000

60,000 5,000 190,000 45,000 300,000 $380,000 Correct! ROWE COMPANY Overhead Rates

60,000 5,000 190,000 45,000 300,000 $400,000 Correct!

60,000 5,000 190,000 45,000 300,000 $420,000 Correct!

Total overhead rate: Total overhead costs Budgeted DLH Total overhead rate Variable overhead rate: Variable overhead costs Budgeted DLH Variable overhead rate Fixed overhead rate: Fixed overhead costs Budgeted DLH Fixed overhead rate

$400,000 50,000 $8.00 Correct! 100,000 50,000 $2.00 Correct! $300,000 50,000 $6.00 Correct!

Student Name: Marcie DeGiovine Class: BA511 6/1 - 9/30/2013 Problem 11-22 ROWE COMPANY Variable Overhead Spending and Efficiency Variances Manufacturing Overhead 385,700 25,700

Actual costs Underapplied overhead

360,000 Applied costs

Analysis of under- or overapplied overhead: Variable overhead variances: Actual hours 46,000 Actual rate $1.95 Standard hours 45,000 Spending Variance Efficiency Variance Fixed overhead variances: Budgeted Fixed OH Cost $300,000 Fixed OH Cost Applied to Work in Process $270,000 $4,000 Favorable $30,000 Unfavorable Standard rate $2.00 Actual hours Actual hours Standard of input of input for output @ actual rate @ std. rate @ std. rate $89,700 $92,000 $90,000 $2,300 Favorable $2,000 Unfavorable

Actual Fixed OH Cost $296,000 Budget Variance Volume Variance

Overhead variances summary: Variable overhead: Spending variance Efficiency variance Fixed overhead: Budget variance Volume variance Underapplied overhead

$2,300 Favorable 2,000 Unfavorable 4,000 Favorable 30,000 Unfavorable $25,700 Correct!

Given Data P11-22: ROWE COMPANY Budget costs for Finishing Department: Variable costs: Direct materials Direct labor Indirect labor Utilities Maintenance Total variable costs Fixed costs: Supervisory salaries Insurance Depreciation Equipment rental Total fixed costs Total budgeted costs Budgeted direct labor-hours Part 3: Actual activities and costs: Actual direct labor-hours worked Standard direct labor-hours allowed Actual variable manufacturing overhead cost incurred Actual fixed manufacturing overhead cost incurred Check figures: (3a) Applied overhead (3b) Volume variance (unfavorable)

$600,000 450,000 30,000 50,000 20,000 1,150,000

60,000 5,000 190,000 45,000 300,000 $1,450,000 50,000

46,000 45,000 $89,700 296,000

$360,000 30,000

You might also like

- Lesson 10 Assignment 4Document4 pagesLesson 10 Assignment 4marcied357No ratings yet

- Lesson 10 Assignment 2Document3 pagesLesson 10 Assignment 2marcied357No ratings yet

- Lesson 8 Assignment 2Document2 pagesLesson 8 Assignment 2marcied357No ratings yet

- Lesson 9 Assignment 4Document2 pagesLesson 9 Assignment 4marcied357No ratings yet

- Lesson 9 Assignment 2Document2 pagesLesson 9 Assignment 2marcied357No ratings yet

- Lesson 6 Assignment 2Document5 pagesLesson 6 Assignment 2marcied357No ratings yet

- Lesson 5 Assignment 2Document3 pagesLesson 5 Assignment 2marcied357No ratings yet

- Lesson 4 Assignment 2Document3 pagesLesson 4 Assignment 2marcied357No ratings yet

- Lesson 3 Assignment 2Document2 pagesLesson 3 Assignment 2marcied357No ratings yet

- Lesson 4 Assignment 4Document2 pagesLesson 4 Assignment 4marcied357No ratings yet

- Lesson 1 Assignment 4Document2 pagesLesson 1 Assignment 4marcied357No ratings yet

- Lesson 2 Assignment 2Document3 pagesLesson 2 Assignment 2marcied357No ratings yet

- Lesson 2 Assignment 4Document2 pagesLesson 2 Assignment 4marcied357No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)