Professional Documents

Culture Documents

Uniform RMD WKSHT

Uniform RMD WKSHT

Uploaded by

DannyBreenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Uniform RMD WKSHT

Uniform RMD WKSHT

Uploaded by

DannyBreenCopyright:

Available Formats

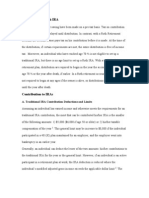

IRA Required Minimum Distribution Worksheet

Use this worksheet to figure this years RMD for your traditional IRA UNLESS your spouse1 is the sole beneficiary of your IRA and he or she is more than 10 years younger than you. Deadline for receiving RMDs: Year you turn age 70 - by April 1 of the following year All subsequent years - by December 31 of that year

1. IRA balance2 on December 31 of the previous year 2. Distribution period from the table below for your age on your birthday this year 3. Line 1 divided by number entered on line 2 = your RMD for this year from this IRA 4. REPEAT STEPS 1 THROUGH 3 FOR EACH OF YOUR IRAs. (Once you determine a separate RMD from each of your traditional IRAs, you can total these minimum amounts and take them from any one or more of your traditional IRAs.) ________ ________ ________

Age 70 71 72 73 74 75 76 77 78 79 80 81

Distribution Period 27.4 26.5 25.6 24.7 23.8 22.9 22.0 21.2 20.3 19.5 18.7 17.9

Age 82 83 84 85 86 87 88 89 90 91 92 93

Distribution Age Period 17.1 16.3 15.5 14.8 14.1 13.4 12.7 12.0 11.4 10.8 10.2 9.6 94 95 96 97 98 99 100 101 102 103 104 105

Distribution Period 9.1 8.6 8.1 7.6 7.1 6.7 6.3 5.9 5.5 5.2 4.9 4.5

Age 106 107 108 109 110 111 112 113 114 115 and over

Distribution Period 4.2 3.9 3.7 3.4 3.1 2.9 2.6 2.4 2.1 1.9

For additional information, please refer to Publication 590, Individual Retirement Arrangements (IRAs).

1

Generally, your marital status is determined as of January 1 of each year. If your spouse is the beneficiary of your IRA on January 1, he or she remains a beneficiary only for purposes of calculating the RMD for that IRA even if you get divorced or your spouse dies during the year.

2

You must increase your IRA balance by any outstanding rollover and recharacterized Roth IRA conversions that were not in any traditional IRA on December 31 of the previous year.

You might also like

- FM 2012 WorksheetDocument9 pagesFM 2012 WorksheetBeing ShonuNo ratings yet

- Review+Materials+Ch03 Managerial FinanceDocument32 pagesReview+Materials+Ch03 Managerial FinanceYee Sook YingNo ratings yet

- International FInanceDocument3 pagesInternational FInanceJemma JadeNo ratings yet

- Active Trader Magazine - The TUT SpreadDocument4 pagesActive Trader Magazine - The TUT Spreadgneyman100% (1)

- Bootstrapping Spot RateDocument37 pagesBootstrapping Spot Ratevirgoss8100% (1)

- Individual Retirement Accounts - Required Minimum Distributions RMDs 2021Document2 pagesIndividual Retirement Accounts - Required Minimum Distributions RMDs 2021Finn KevinNo ratings yet

- These Are The Dates (And Deadlines) Too Often Forgotten.: Presented by Fred Leamnson, CFP®, AIF®Document3 pagesThese Are The Dates (And Deadlines) Too Often Forgotten.: Presented by Fred Leamnson, CFP®, AIF®api-118535366No ratings yet

- IRA Required Minimum Distribution WorksheetDocument1 pageIRA Required Minimum Distribution Worksheetoana_avramNo ratings yet

- Interest Rates On NRI DepositsDocument2 pagesInterest Rates On NRI DepositsrahulpriyanNo ratings yet

- Service-Disabled Veterans Insurance RH Information and Premium RatesDocument20 pagesService-Disabled Veterans Insurance RH Information and Premium RatesOmer ErgeanNo ratings yet

- SF Instructions and Form Combined 8.13.18 ENGDocument4 pagesSF Instructions and Form Combined 8.13.18 ENGbabyduckiezNo ratings yet

- ICF - Lecture 2 - Time Value of MoneyDocument46 pagesICF - Lecture 2 - Time Value of Moneyioana_doncaNo ratings yet

- Taxes: On Pera BenefitsDocument15 pagesTaxes: On Pera BenefitsMinmin WaganNo ratings yet

- Chapter 10 (Calculation If Premium)Document34 pagesChapter 10 (Calculation If Premium)Khan AbdullahNo ratings yet

- Calculation of The Retirement Pension: General RulesDocument2 pagesCalculation of The Retirement Pension: General RulesakteruzzamanNo ratings yet

- Smart Humsafar Brochure - BRDocument14 pagesSmart Humsafar Brochure - BRVishal Vijay SoniNo ratings yet

- US Internal Revenue Service: Not98-2Document10 pagesUS Internal Revenue Service: Not98-2IRSNo ratings yet

- National Retirement Risk IndexDocument7 pagesNational Retirement Risk IndexWBURNo ratings yet

- Your Annual Gwinnett Retirement System Benefits StatementDocument3 pagesYour Annual Gwinnett Retirement System Benefits StatementMirela SzathmariNo ratings yet

- Publication 590 Appendix C, Individual Retirement Arrangements (IRAs)Document10 pagesPublication 590 Appendix C, Individual Retirement Arrangements (IRAs)Michael TaylorNo ratings yet

- A Monthly PensionDocument5 pagesA Monthly Pensionnotapernota101No ratings yet

- Looking For A Way To Supplement Your Income?Document2 pagesLooking For A Way To Supplement Your Income?Putnam InvestmentsNo ratings yet

- Distribution From IRAsDocument18 pagesDistribution From IRAsbhuang1No ratings yet

- Income Splitting Strategies enDocument6 pagesIncome Splitting Strategies eneriklicanadaNo ratings yet

- NSSA Threshold April To June 2022Document2 pagesNSSA Threshold April To June 2022Daniel FerreiraNo ratings yet

- RevisionInterestRates CircularDocument5 pagesRevisionInterestRates CircularK NkNo ratings yet

- Kotak Surakshit JeevanDocument12 pagesKotak Surakshit JeevanHiten VajariyaNo ratings yet

- Int001 2211Document7 pagesInt001 2211Justin EllingsenNo ratings yet

- Finance Project-2Document4 pagesFinance Project-2api-242736484No ratings yet

- En 05 10069Document10 pagesEn 05 10069Ioan CercetasulNo ratings yet

- 114 008 1 ct5Document8 pages114 008 1 ct5Wei SeongNo ratings yet

- Odd Periods Questions No 2Document3 pagesOdd Periods Questions No 2lren.lawrenceNo ratings yet

- Finance ProjectDocument5 pagesFinance Projectapi-436951596No ratings yet

- Financial Professional Factsheet Jan 14Document4 pagesFinancial Professional Factsheet Jan 14peakdotieNo ratings yet

- Aviva MyRetirementDocument16 pagesAviva MyRetirementAkbar AkhtarNo ratings yet

- 2023.05.03 - The 3 Ira Beneficiary Categories - Again and Again and AgainDocument2 pages2023.05.03 - The 3 Ira Beneficiary Categories - Again and Again and AgainJay AnnNo ratings yet

- Zakat CalculatorDocument10 pagesZakat CalculatorAsim DarNo ratings yet

- Accounting For Wealth in The Measurement of Household IncomeDocument24 pagesAccounting For Wealth in The Measurement of Household IncomeYaronBabaNo ratings yet

- Annuity Plus Brochure - BR - New SizeDocument10 pagesAnnuity Plus Brochure - BR - New SizeBharat VyasNo ratings yet

- RevisionInterestRates CircularDocument5 pagesRevisionInterestRates CircularPrashantGuptaNo ratings yet

- Finance Project Final 1Document5 pagesFinance Project Final 1api-332608130No ratings yet

- Retirement Nestegg Calculator: You May Need A Nestegg of $3,287,327 To Retire at Age 67Document4 pagesRetirement Nestegg Calculator: You May Need A Nestegg of $3,287,327 To Retire at Age 67fishtaco96No ratings yet

- Buying A House: Math 1030Document5 pagesBuying A House: Math 1030api-382630770No ratings yet

- 2023 08 International Payroll GuideDocument46 pages2023 08 International Payroll Guidesgideon681No ratings yet

- Sample Employment Contract: Day(s) /week(s) / Month(s) / Year(s), Ending On Day(s) / Week(s) / Month(s)Document5 pagesSample Employment Contract: Day(s) /week(s) / Month(s) / Year(s), Ending On Day(s) / Week(s) / Month(s)Fredrick FernandezNo ratings yet

- How About A For A Lifetime?: Second IncomeDocument5 pagesHow About A For A Lifetime?: Second Incomebhanupratapsngh055No ratings yet

- Accounting Period: AssignmentDocument15 pagesAccounting Period: Assignmentankitb9No ratings yet

- EN 05 10072 CreditDocument8 pagesEN 05 10072 Credittreb trebNo ratings yet

- Esteem Eternity ENDocument6 pagesEsteem Eternity ENHihiNo ratings yet

- Bond ValuationDocument12 pagesBond ValuationvarunjajooNo ratings yet

- Revision of Interest Rates On Domestic Term DepositsDocument2 pagesRevision of Interest Rates On Domestic Term DepositsLipsa DhalNo ratings yet

- Where's My Money?: Secrets to Getting the Most out of Your Social SecurityFrom EverandWhere's My Money?: Secrets to Getting the Most out of Your Social SecurityNo ratings yet

- RBL Bank Latest Interest RatesDocument3 pagesRBL Bank Latest Interest RatesAdrak Wali ChaiNo ratings yet

- Finance Project FinalDocument5 pagesFinance Project Finalapi-356639260No ratings yet

- MopDocument56 pagesMopSaptorshi BagchiNo ratings yet

- Math 1030Document5 pagesMath 1030api-442263040No ratings yet

- Meeting Your Obligations and Finding Some Opportunities.: RMD Precautions and OptionsDocument2 pagesMeeting Your Obligations and Finding Some Opportunities.: RMD Precautions and Optionsapi-118535366No ratings yet

- Vedic Numerology Day 3 English Summary NotesDocument10 pagesVedic Numerology Day 3 English Summary Notesoccultist95No ratings yet