Professional Documents

Culture Documents

Corporate Tax Planning

Corporate Tax Planning

Uploaded by

Niks DujaniyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Tax Planning

Corporate Tax Planning

Uploaded by

Niks DujaniyaCopyright:

Available Formats

CORPORATE TAX PLANNING

INCOME -TAX

HISTORY - System of Direct Taxation was in existence even during Hindu period, then during British period 1860 Act, amendments made in 1863,1867, 1871,1873 and 1878 continued till 1918. In 1920 it became a central subject, was overhauled in 1961 and amended from time to time, became effective from 1-4-1962; called Income-Tax Act 1961

Area/Scope Whole of India. It determines: a. Taxable Income b. Tax Liability c. Procedure of Assessment d. Appeals, Penalties and Prosecution e. Powers & Duties of various I.T. authorities Amendments are made annually in General Budget, presented by Finance Minister, through Finance Bill in which proposals for next financial year are made for various types of assessees, which contains:

a. Rates of Income-Tax for assessment year

b. Rates of TDS for current financial year c. Rates of TDS for salaried people d. Rules for calculating net agricultural income Taxable income of an assessee is taxable at two different rates: 1. Normal Rates are fixed Annual Finance Act, presented by Finance Minister every year

Special Rates on Long & Short-Term Capital Gain, Lotteries, Cross word puzzle etc. These rates are fixed under Income-Tax Act Income Tax Rules 1962 (amended up to date) These are notified in Indian Gazette (Gazette of India). It gives powers to authorities to implement the Act Role of CBDT (Sec. 119) It sends circulars and clarification for the implementation of I.T. Rule

Judicial Decisions Decision given by Supreme Court becomes a law and binding on all courts, Appellate Tribunals, Income-Tax authorities and on all assessees. In case of contradictory ruling, matter is given to a larger bench. Decisions of High Courts are also binding on all assessees as well as on the income tax authorities, but such decisions cannot overrule Supreme Court rulings Scheme of Taxation Every person, whose total income of the previous year exceeds the maximum limit (after deducting exemptions provided in Income Tax Act) for different types of assesses is chargeable for tax on his income. However total income will be determined on the basis of his residential status in India. Income tax is levied in the following manner:

a. Every person is chargeable to Income-Tax if his income exceeds the maximum exemption limit b. I-Tax is charged on Previous Years income but is taxable in the next following assessment year at the rate applicable to such year c. I-Tax is charged at two rates viz. Normal rates and Special rates, stated as above d. Tax is charged on total income, computed in accordance with the provisions of the Act e. Total income of a person is determined on the basis of his residential status in India

PERSONS For taxable purpose, it includes the following: 2(31) 1. Individual 2. H.U.F. (Linear inheritance in the family) 3. Firm 4. Company 5. Local Authority 6. Association of persons (AOP) or a body of individuals (BOI), whether incorporated or not 7. Any artificial juridical person not covered under above categories, such as Idol, Deity or a University

INDIVIDUAL means a natural person (i.e. human being), which includes a male, female, minor and a lunatic ASSOCIATON OF PERSONS (AOP) Though it is not defined under I-T Act, yet it may be construed as joining of two or more persons in an income producing legal activity for a common purpose, may be assessed as AOP, but it should not form partnership BODY OF INDIVIDUALS (BOI) It is a conglomeration of individuals engaged in an activity to earn income. Other than individuals can not become its members. I-Tax is paid by BOI, not by its individuals, on the income received by them from BOI (i.e. firms, companies, H.U.F. and individuals etc.)

Distinction between AOP and BOI:

1. AOP may consist of non-individuals, while BOI will only consist individuals 2. AOP implies a voluntary getting together for a common purpose/design, but a BOI may or may not have such common purpose or will LOCAL AUTHORITY e.g. Panchayat, Municipality, Municipal Committee, District Board and Cantonment Board etc. ARTIFICIAL JURIDICAL PERSONS W hich are not natural persons, but are separate entities in the eyes of law. Though they may not be sued directly in court of law, but can be sued through persons managing them. God, Idols, Deities and Universities are artificial persons. Their incomes such as from offerings and donations are taxable. However, exemption is provided under separate provisions of the I-T Act, if certain requirements are fulfilled.

ASSESSMENT YEAR [2(9)] The period of12 months, commencing on 1st. April, everyyear and ending on 31st. March next PREVIOUS YEAR [2(34) &3] Financial Year, immediately preceding the assessmentyear is called Pr. Yr. For income tax purpose it will end on 31st. March. Although the assessee can close his books of account on any other date, which may only cover either 12 months. or less than 12 months Pr. Yr. in case of newly set up business or profession orfor a new source of income shall begin from the date of setting up or coming into existence of new business or profession or new source of income and will end in the same financial year, thereby resulting uniform Pr. Yr. for all assessees and for all source of income

Cases where Income of Pr. Yr. is assessed in the same year These exceptions have been provided to safeguard the collection of taxes, so that assessees, who may not be traceable later on, are not allowed to escape the payment of the taxes, such as: 1. Income of Non-Resident from shipping business (172) 2. Income of persons leaving India (174) 3. Income of an AOP or BOI or Artificial Juridical persons formed for a particular event or purpose, if likely to be dissolved (174A) 4. Income of persons likely to transfer, sell or dispose of the property to avoid tax (175) 5. Income of discontinued business or profession (176)

MARGINAL RELIEF It is provided to ensure that the additional income tax payable, including surcharge, on the excess of taxable income over Rs. 10,00,000 is limited to the amount by which the income is more than Rs. 10,00,000 DIFFERENT HEADS OF INCOME (14): 1. Salary (15-17) 2. Income from House Property (22-27) 3. Profits and Gains of Business and Profession (28-44) 4. Capital Gain (45-55) 5. Income from Other Sources (56-59) INCIDENCE OF TAX (5) For computing income tax, first of all residential status of a person is to be decided which is defined as under. Remember only income of Pr. Yr. is taxable in the hands of an assessee

TAX INCIDENCE AT A GLANCE RESIDENTS Particulars of income derived from sources Ord- Not Non inary Ordin. Resident a. Income Received or deemed to be Received in India in the Pr. Yr., whether accrued/ earned in India or outside India Yes Yes Yes b. Income Accrues or Arises or deemed to accrue or arise in India in Pr. Yr., whether received in India or outside India Yes Yes Yes c. Income Accrued/earned and received outside India in Pr. Yr. from a business controlled in or profession set up in India Yes Yes No d. Income earned and received outside India in Pr. Yr. from a business controlled in or profession set up outside India Yes No No e. Income earned outside India in preceding years, but remitted to India during Pr. Yr. No No No

ASSESSEE [2(7)] is a person who is liable to pay tax or any other sum of money on his income under I.T.Act An assessee can either be (a) Resident or (b) NonResident in India However, for Individuals and H.U.F. a Resident of India will either be (a) Resident & Ordinarily-Resident in India or (b) Resident and Not-Ordinarily Resident in India RESIDENTIAL STATUS OF INDIVIDUALS [6(i)] some key points to be considered are as under: Residential status is always determined for the Pr. Yr. A person may be resident of more than one country for any Pr. Yr. for income tax purpose Citizenship of a country and Residential status of that country are separate concepts. It is the duty of an assessee to place all material facts before the assessing officer to enable him to determine his correct Residential status

As per Section 6(i) an Individual may be either a. Resident in India i.e. either Ordinary Resident in India or Not-Ordinary Resident in India O r, b. Non-Resident in India RESIDENT IN INDIA If any of the following two conditions is fulfilled: (i). He has been in India for a period or periods totaling 182 days or more in Pr. Yr. Or, (ii). He has been in India for 60 days or more during Pr. Yr. and has been in India for 365 days or more during 4 (four) Pr. Yr. immediately preceding the relevant Pr. Yr.

Exceptions: a. If he is a citizen of India and leaves India in any Pr. Yr., as a member of crew of an Indian ship or for the purpose of employment outside India, the period of 60 days as mentioned in above condition no. (ii) shall be substituted by 182 days (i.e. an assessee will not be a Resident in India unless he stays in India at least for 182 days during Pr. Yr. in which he leaves India) b. If a person is a citizen of India or of Indian origin, he being outside India comes for a visit to India, in any Pr. Yr., the period of 60 days as mentioned in above condition no (ii) will be substituted by 182 days It is not necessary that the stay in India should be continuous at one place

RESIDENT & ORDINARY RESIDENT IN INDIA If a Resident in India fulfills following 2 (two) conditions in addition to the above one condition, will be called Ordinary- Resident in India: a. He should be Resident in India for at least 2 (two) out of 10 (Ten) Pr. Yrs. preceding the relevant Pr. Yr. and, b. He should be in India for at least 730 days during 7 (Seven) yrs. Preceding the relevant Pr. Yr. NOT- ORDINARY RESIDENT IN INDIA If both the above 2 conditions are not fulfilled, an assessee will be treated as Not Ordinary Resident in India in the relevant Pr. Yr. NON-RESIDENT IN INDIA If a person does not fulfill either of the condition laid down for becoming Resident in India, he will

RESIDENT IN INDIA H.U.F. If the management and control of its affairs is wholly or partly situated in India in the relevant Pr. Yr., then H.U.F. will be treated as Resident in India ORDINARY-RESIDENT IN INDIA H.U.F. [6(6)b] If the Karta or Head of H.U.F. fulfills all the conditions required to be fulfilled for acquiring Ordinary-Resident in India status for individual, it will be called Ordinary-Resident in India H.U.F. NOT- ORDINARY RESIDENT IN INDIA H.U.F. Same as meant for individual assessee i.e. Karta or Head as an Individual has to fulfill conditions for becoming NotOrdinary Resident in India NON-RESIDENT H.U.F. If no part of the control and management of its affairs is situated in India in the relevant Pr. Yr.

RESIDENTIAL STATUS OF A FIRM, AOP AND BOI [6(2&4) These entities are said to be Resident in India in any Pr. Yr., where during that Pr. Yr. the control and management of its affairs is partly or wholly situated in India and generally the meeting of the management is held in India Firm, AOP and BOI cannot become Ordinary and NotOrdinary Resident in India Non-Resident in India AOP, BOI and Firm These entities will be called Non-Resident in India, when the control and management of these entities is wholly situated outside India during that relevant Pr. Yr.

RESIDENTIAL STATUS OF A COMPANY [6(3)]: RESIDENT IN INDIA It is Resident in India in Pr. Yr. , if a. It is an Indian company, Or b. During the relevant Pr. Yr. control and management of its affairs is wholly situated in India NON-RESIDENT INDIAN COMPANY A company is said to be Non-Resident in India if it does not fulfill any of the above mentioned two conditions A company can not be an Ordinary and Not-Ordinary Resident in India

You might also like

- Project-Comparative Analysis of ULIPs With Traditional PlansDocument83 pagesProject-Comparative Analysis of ULIPs With Traditional Plansgauravbpit89% (9)

- Capital Budgeting Management Accounting Sem V T.y.bafDocument6 pagesCapital Budgeting Management Accounting Sem V T.y.bafShravan BaneNo ratings yet

- Management Accounting (BBA32) - Unit - II& III: Accounting For Managerial DecisionDocument30 pagesManagement Accounting (BBA32) - Unit - II& III: Accounting For Managerial DecisionT S Kumar KumarNo ratings yet

- Unit 2: Indian Accounting Standard 34: Interim Financial ReportingDocument28 pagesUnit 2: Indian Accounting Standard 34: Interim Financial ReportingvijaykumartaxNo ratings yet

- Corporate Tax Planning and ManagemantDocument11 pagesCorporate Tax Planning and ManagemantVijay KumarNo ratings yet

- Accounting For Specialized Institution Set 2 Scheme of ValuationDocument19 pagesAccounting For Specialized Institution Set 2 Scheme of ValuationTitus Clement100% (1)

- Tax Planning and Managerial DecisionDocument188 pagesTax Planning and Managerial Decisionkomal_nath2375% (4)

- L-1 Basic ConceptsDocument4 pagesL-1 Basic Conceptskyunki143No ratings yet

- House PropertyDocument33 pagesHouse PropertypriyaNo ratings yet

- CG Notes PDFDocument49 pagesCG Notes PDFT S NarasimhanNo ratings yet

- Valuation of Shares Need and MethodsDocument7 pagesValuation of Shares Need and Methodsnishuppt100% (1)

- Special Provision Related To FTZDocument46 pagesSpecial Provision Related To FTZAkhilesh Kumar0% (3)

- Final Accounts of Banking Company - Lecture 01 - 21-08-2020Document8 pagesFinal Accounts of Banking Company - Lecture 01 - 21-08-2020akash gautamNo ratings yet

- Xii Mcqs CH - 9 Issue of SharesDocument7 pagesXii Mcqs CH - 9 Issue of SharesJoanna Garcia100% (1)

- Unit 2 Structure of of Options MarketsDocument36 pagesUnit 2 Structure of of Options MarketsTorreus AdhikariNo ratings yet

- Amalgamation and Absorption of CompaniesDocument89 pagesAmalgamation and Absorption of CompaniesHarshit Kumar GuptaNo ratings yet

- Divisible ProfitDocument14 pagesDivisible ProfitVeeresh SharmaNo ratings yet

- Chapter 10 Set Off and Carry Forward of Losses PMDocument12 pagesChapter 10 Set Off and Carry Forward of Losses PMMohammad Yusuf NabeelNo ratings yet

- Notes Toredemption of Preference SharesDocument40 pagesNotes Toredemption of Preference Sharesaparna bingiNo ratings yet

- Relation Between Roi and Eva-1Document11 pagesRelation Between Roi and Eva-1Jasleen KaurNo ratings yet

- Study Note 4.2, Page 169-197Document29 pagesStudy Note 4.2, Page 169-197s4sahith0% (1)

- Accounting Aspects For Mergers and AcquisitionsDocument19 pagesAccounting Aspects For Mergers and AcquisitionsHiral PatelNo ratings yet

- Financial Management in Psu'sDocument14 pagesFinancial Management in Psu'sAkshaya Mali100% (1)

- Amalgmation of CompanyDocument83 pagesAmalgmation of CompanySuryaNo ratings yet

- Company Accounts Issue of Shares Par Premium DiscountDocument20 pagesCompany Accounts Issue of Shares Par Premium DiscountDilwar Hussain100% (1)

- FINANCIAL MANAGEMENT Assignment 2Document14 pagesFINANCIAL MANAGEMENT Assignment 2dangerous saifNo ratings yet

- Tax Management With Reference To - Repair, Replace, Renewal or RenovationDocument4 pagesTax Management With Reference To - Repair, Replace, Renewal or RenovationAkhil1101No ratings yet

- Functions of IfciDocument4 pagesFunctions of IfciKŕiśhñą Śińgh100% (1)

- Key Terminology in Clearing and Sattelment Process NSEDocument9 pagesKey Terminology in Clearing and Sattelment Process NSETushali TrivediNo ratings yet

- Corporate TaxDocument17 pagesCorporate TaxVishnupriya RameshNo ratings yet

- Topic 8 - AS 20Document10 pagesTopic 8 - AS 20love chawlaNo ratings yet

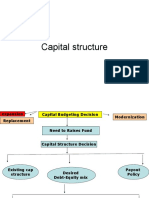

- Capital StructureDocument41 pagesCapital StructuremobinsaiNo ratings yet

- Note On Public IssueDocument9 pagesNote On Public IssueKrish KalraNo ratings yet

- Law PPT (Director Companies Act)Document24 pagesLaw PPT (Director Companies Act)rohit vermaNo ratings yet

- Leverage PPTDocument13 pagesLeverage PPTamdNo ratings yet

- SEBI Guidelines For MBDocument34 pagesSEBI Guidelines For MB9958331534100% (1)

- Mat and Amt: Objective of Levying MATDocument17 pagesMat and Amt: Objective of Levying MATNitin ChoudharyNo ratings yet

- EBIT EPS AnalysisDocument17 pagesEBIT EPS AnalysisAditya GuptaNo ratings yet

- Tax Planning With Reference To Managerial RemunerationDocument3 pagesTax Planning With Reference To Managerial RemunerationashurebelNo ratings yet

- Income Tax AY 18-19 Vol I PDFDocument224 pagesIncome Tax AY 18-19 Vol I PDFAashish Kumar SinghNo ratings yet

- Responsibility Accounting1Document14 pagesResponsibility Accounting1Sujeet GuptaNo ratings yet

- Funds Flow and Cash Flow NotesDocument12 pagesFunds Flow and Cash Flow NotesSoumendra RoyNo ratings yet

- Meetings and ProceedingsDocument11 pagesMeetings and ProceedingssreeNo ratings yet

- BCom 6th Sem - AuditingDocument46 pagesBCom 6th Sem - AuditingJibin SamuelNo ratings yet

- Notes On Corporate Tax PlanningDocument198 pagesNotes On Corporate Tax PlanningShainaNo ratings yet

- GST Assignments For B.com 6TH Sem PDFDocument4 pagesGST Assignments For B.com 6TH Sem PDFAnujyadav Monuyadav100% (1)

- Impact of CSR On Financial Performance of Top 10 Performing CSR Companies in IndiaDocument7 pagesImpact of CSR On Financial Performance of Top 10 Performing CSR Companies in IndiaSoorajKrishnanNo ratings yet

- SebiDocument13 pagesSebiNishat ShaikhNo ratings yet

- Tax PlanDocument2 pagesTax PlanMrigendra MishraNo ratings yet

- Presentaion On The Payment of Bonus Act, 1965Document14 pagesPresentaion On The Payment of Bonus Act, 1965Deepakgupta0001No ratings yet

- Meaning Scope of Tax ManagementDocument5 pagesMeaning Scope of Tax ManagementAnish yadavNo ratings yet

- Corporate Finance Question PaperDocument1 pageCorporate Finance Question PaperGanesh KumarNo ratings yet

- Ifrs vs. Indian GaapDocument4 pagesIfrs vs. Indian GaapPankaj100% (1)

- Taxman CAFM ScannerDocument491 pagesTaxman CAFM Scannerdroom8521No ratings yet

- Advanced Corporate Accounting On13april2016 PDFDocument198 pagesAdvanced Corporate Accounting On13april2016 PDFDidier NkonoNo ratings yet

- Unit - 4 Study Material ACGDocument21 pagesUnit - 4 Study Material ACGAbhijeet UpadhyayNo ratings yet

- 11 Business Studies Notes Ch07 Sources of Business Finance 02Document10 pages11 Business Studies Notes Ch07 Sources of Business Finance 02vichmega100% (1)

- Regulations of Mutual FundDocument11 pagesRegulations of Mutual FundKishan KavaiyaNo ratings yet

- Taxation: Residential Status (Part I)Document10 pagesTaxation: Residential Status (Part I)Vineet RajNo ratings yet

- Income Tax Short Notes For C S C A C M A Exam 2014Document43 pagesIncome Tax Short Notes For C S C A C M A Exam 2014Jolly SinghalNo ratings yet

- SeemaDocument61 pagesSeemaAkash ShewadeNo ratings yet

- ATT00088Document2 pagesATT00088gauravbpitNo ratings yet

- Types of EntrepreneursDocument17 pagesTypes of Entrepreneursgauravbpit50% (2)

- Talent Management StrategiesDocument16 pagesTalent Management Strategiesgauravbpit100% (13)

- OD119978131985722000Document1 pageOD119978131985722000pankaj hitlarNo ratings yet

- Tax Administration in NigeriaDocument3 pagesTax Administration in Nigeriawhit.ehouseboyquantiumNo ratings yet

- Assignment-1: BY: NIKHIL KUMAR (05814901718)Document5 pagesAssignment-1: BY: NIKHIL KUMAR (05814901718)nikhilNo ratings yet

- Taxation Law - Question PapersDocument2 pagesTaxation Law - Question Papers18651 SYEDA AFSHANNo ratings yet

- Tax Law Lecture NotesDocument6 pagesTax Law Lecture NotesZulu MasukuNo ratings yet

- Income Tax Theory by T.S. Reddy From Margham Publication 2022-23Document1 pageIncome Tax Theory by T.S. Reddy From Margham Publication 2022-23Riya M0% (1)

- Week 8Document3 pagesWeek 8yogeshgharpureNo ratings yet

- New Microsoft Word DocumentDocument8 pagesNew Microsoft Word DocumentMuhammad WaqarNo ratings yet

- Yellow - Not Sure, Green - CorrectDocument7 pagesYellow - Not Sure, Green - CorrectIsaiah John Domenic M. CantaneroNo ratings yet

- 3 - CIR Vs Shell PetroleumDocument4 pages3 - CIR Vs Shell PetroleumAnneNo ratings yet

- Tax TermsDocument3 pagesTax TermsRAJINIKNTH REDDYNo ratings yet

- What Is Gross Income (Or Taxable Gross Income) ?Document24 pagesWhat Is Gross Income (Or Taxable Gross Income) ?Joe P PokaranNo ratings yet

- G.R. No. 179115 AIA Vs CIRDocument5 pagesG.R. No. 179115 AIA Vs CIRRene ValentosNo ratings yet

- Payroll: PayslipDocument2 pagesPayroll: PayslipSergio PAREDES VERANo ratings yet

- Special Income Tax Treatment of Gains and Losses From Dealings in PropertyDocument52 pagesSpecial Income Tax Treatment of Gains and Losses From Dealings in PropertyAngeliqueGiselleCNo ratings yet

- 1625 Interpretation of Statutes CA 2Document6 pages1625 Interpretation of Statutes CA 2Naman JainNo ratings yet

- Compagnie Financiere Sucres Et Deneres Vs CIR - Documentary Stamp TaxDocument3 pagesCompagnie Financiere Sucres Et Deneres Vs CIR - Documentary Stamp TaxKC ToraynoNo ratings yet

- Hadee Lutful & Co.: Presented byDocument19 pagesHadee Lutful & Co.: Presented byColors of LifeNo ratings yet

- RPH Taxation ReportDocument38 pagesRPH Taxation ReportLois SabadoNo ratings yet

- G - R - No - L - 12710, - 12721 - Collector - of - Internal - Revenue - V - McGrathDocument6 pagesG - R - No - L - 12710, - 12721 - Collector - of - Internal - Revenue - V - McGrathJade ClementeNo ratings yet

- Taxation TIAS 1591Document76 pagesTaxation TIAS 1591pablomartinezdiezNo ratings yet

- Non-Tax Filer Student 2021 Certification 23-24Document1 pageNon-Tax Filer Student 2021 Certification 23-24Kamal GroverNo ratings yet

- 3402.4190 Tariff & SROsDocument2 pages3402.4190 Tariff & SROsONLINE COMPUTER COURSESNo ratings yet

- Sravani Medical Syndicate-Tenali (12x6) GST - PsDocument1 pageSravani Medical Syndicate-Tenali (12x6) GST - PsmytreyiNo ratings yet

- CIR v. St. Luke's Medical CenterDocument3 pagesCIR v. St. Luke's Medical CenterZandra LeighNo ratings yet

- 08 JSSH (S) - 0752-2018Document12 pages08 JSSH (S) - 0752-2018yuliaarya sastiNo ratings yet

- Topic 2-Residence Status For IndividualDocument19 pagesTopic 2-Residence Status For IndividualAgnesNo ratings yet

- Interpretation of Taxation StatuteDocument3 pagesInterpretation of Taxation StatuteAdv. Abhinav JainNo ratings yet

- On Income From Salary - 20210202100403Document14 pagesOn Income From Salary - 20210202100403AJ WalkerNo ratings yet

- 2200-AN Jan 2018 ENCS Annex ADocument2 pages2200-AN Jan 2018 ENCS Annex AMaureen PascualNo ratings yet