Professional Documents

Culture Documents

What Is Investment: Flow Gates Session Plan Course Coverage

What Is Investment: Flow Gates Session Plan Course Coverage

Uploaded by

micky_chhabra550 ratings0% found this document useful (0 votes)

14 views1 pageThis document summarizes key concepts and models related to investments and capital markets. It discusses fundamental and technical analysis, stock valuation methods, arbitrage theory, mutual funds, investment banking, and capital markets in India. Specific topics covered include types of mutual funds like SIP and ELSS, fundamental analysis and its components, arbitrage pricing theory, common stock valuation models, and the relationship between demographic characteristics and investment patterns in capital markets.

Original Description:

kk

Original Title

2e3f9tls for Sapmk

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes key concepts and models related to investments and capital markets. It discusses fundamental and technical analysis, stock valuation methods, arbitrage theory, mutual funds, investment banking, and capital markets in India. Specific topics covered include types of mutual funds like SIP and ELSS, fundamental analysis and its components, arbitrage pricing theory, common stock valuation models, and the relationship between demographic characteristics and investment patterns in capital markets.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 pageWhat Is Investment: Flow Gates Session Plan Course Coverage

What Is Investment: Flow Gates Session Plan Course Coverage

Uploaded by

micky_chhabra55This document summarizes key concepts and models related to investments and capital markets. It discusses fundamental and technical analysis, stock valuation methods, arbitrage theory, mutual funds, investment banking, and capital markets in India. Specific topics covered include types of mutual funds like SIP and ELSS, fundamental analysis and its components, arbitrage pricing theory, common stock valuation models, and the relationship between demographic characteristics and investment patterns in capital markets.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 1

Teaching/ Learning Strategy

What is investment

The Big Questions

How to do fundamental and technical analysis

The Big Question and key Concepts of SAPM

How stock valuation is done

What is arbitrage theory

What is mutual fund and investment banking

Capital market in India

Common stock valuation models

Fundamental analysisEconomic &industryanalysis

Fundamental analysisEconomic &industry analysis, concept of Business Cycles, Indicators of economic prosperity, Industry analysis, Company analysis,

Arbitrage pricing theory

Types of Mutual Funds-SIP/ELSS

Types of Mutual Funds-SIP/ELSS, Tax Implications. , Investment Banking, Role of Fund Manager, Portfolio management services,

Investment opportunities available to Investors, relation of demographic characteristics with investment pattern of issue in Capital market.

Malkiels's Law, Interrelationship of Bond Market and Stock market, International events and its impact on security market Risk and return in the context of Portfolio

Arbitrage pricing theory, Generating the efficient frontier, Efficient market theory, Valuation by PE ratio /Book value to price value analysis, Motivation for partitioning of risk

Flow Gates Course Coverage Session Plan

5 17%

The Key Concepts

5 33% 9 63%

6

83%

5

100%

30 Sessio

100%

You might also like

- The Lazy Fundamental Analyst: Applying quantitative techniques to fundamental stock analysisFrom EverandThe Lazy Fundamental Analyst: Applying quantitative techniques to fundamental stock analysisRating: 3 out of 5 stars3/5 (7)

- Fundamentals of Petroleum EconomicsDocument38 pagesFundamentals of Petroleum Economicsfavou5100% (2)

- Syllabus Capital MarketsDocument4 pagesSyllabus Capital MarketsAdnan MasoodNo ratings yet

- Investment & Portfolio Mgt. SyllabusDocument7 pagesInvestment & Portfolio Mgt. SyllabusEmi YunzalNo ratings yet

- Security Analysis and Portfolio - S. KevinDocument595 pagesSecurity Analysis and Portfolio - S. KevinShubham Verma100% (1)

- Investment & Risk ManagementDocument5 pagesInvestment & Risk ManagementE-sabat RizviNo ratings yet

- Market Microstructure: Confronting Many ViewpointsFrom EverandMarket Microstructure: Confronting Many ViewpointsFrédéric AbergelNo ratings yet

- Competitive Strategy: Techniques for Analyzing Industries and CompetitorsFrom EverandCompetitive Strategy: Techniques for Analyzing Industries and CompetitorsRating: 4.5 out of 5 stars4.5/5 (31)

- Investment ManagementDocument173 pagesInvestment Managementvikramthevictor100% (1)

- Active Equity Management - Compress PDFDocument435 pagesActive Equity Management - Compress PDFdnajkdfNo ratings yet

- Fundamental Analysis of PETROLEUM SectorDocument31 pagesFundamental Analysis of PETROLEUM SectorAbhay Kapkoti0% (1)

- Investment Analysis & Portfolio ManagementDocument23 pagesInvestment Analysis & Portfolio ManagementUmair Khan Niazi67% (3)

- Investment ManagementDocument2 pagesInvestment ManagementAvinash JhaNo ratings yet

- 4ca62security Analysis & PortfolioDocument1 page4ca62security Analysis & PortfolioAkhil VijayNo ratings yet

- Security Analysis Syllabus IBSDocument2 pagesSecurity Analysis Syllabus IBSnitin2khNo ratings yet

- Iapm NotesDocument8 pagesIapm NotesRuchaNo ratings yet

- FINN 454-Portfolio Management-Salman KhanDocument5 pagesFINN 454-Portfolio Management-Salman KhanMalik AminNo ratings yet

- Security Analysis and Portfolio ManagementDocument4 pagesSecurity Analysis and Portfolio ManagementRaHul Rathod100% (1)

- Iap SyllabusDocument3 pagesIap SyllabusSUKHIL REDDYNo ratings yet

- Mail AttDocument34 pagesMail AttChristianJerryNo ratings yet

- Capital MarketsDocument4 pagesCapital MarketsMubashir KhanNo ratings yet

- Critical Appraisal of Financial Models in Investment Decisions & Security TradingDocument7 pagesCritical Appraisal of Financial Models in Investment Decisions & Security TradingAnonymous CwJeBCAXpNo ratings yet

- Saim NotesDocument120 pagesSaim NotesJagmohan Bisht0% (1)

- FinanceDocument12 pagesFinancearjun rawoolNo ratings yet

- Financial Markets and Services Syllabus PDFDocument2 pagesFinancial Markets and Services Syllabus PDFOberoi MalhOtra MeenakshiNo ratings yet

- 8581-Article Text-16817-1-10-20210523Document17 pages8581-Article Text-16817-1-10-20210523crkNo ratings yet

- Investors' Perception Towards Stock Market With Special Reference To KARVY Stock Broking Ltd. AbstractDocument10 pagesInvestors' Perception Towards Stock Market With Special Reference To KARVY Stock Broking Ltd. AbstractRajat PawanNo ratings yet

- Security Analysis and Portfolio ManagementDocument2 pagesSecurity Analysis and Portfolio Managementgarima50% (2)

- Risk and Return Analysis of Commercail BanksDocument71 pagesRisk and Return Analysis of Commercail BanksBhupendra TamangNo ratings yet

- MF0010Document308 pagesMF0010Abdul Lateef KhanNo ratings yet

- Af 602Document2 pagesAf 602Haseeb KhanNo ratings yet

- Finance and Security Analysis: Expectations Investing Course OverviewDocument2 pagesFinance and Security Analysis: Expectations Investing Course OverviewBiswajeet PattnaikNo ratings yet

- Brochure Eridays2012asiaDocument16 pagesBrochure Eridays2012asiahvenkiNo ratings yet

- Investment Analysis FIN4020 Sem1 2012-2013 Course OutlineDocument6 pagesInvestment Analysis FIN4020 Sem1 2012-2013 Course OutlineBairah KamilNo ratings yet

- Dissertation Topics On Efficient Market HypothesisDocument8 pagesDissertation Topics On Efficient Market HypothesisHelpWithWritingAPaperCanada100% (1)

- Bond and Equity Trading Strategies UZ Assignment 2Document15 pagesBond and Equity Trading Strategies UZ Assignment 2Milton ChinhoroNo ratings yet

- PAM Outlines 07012021 042154pmDocument7 pagesPAM Outlines 07012021 042154pmzainabNo ratings yet

- The Capital Asset Pricing Model A Critical LiteratureDocument17 pagesThe Capital Asset Pricing Model A Critical LiteratureMelani ValenzuelaNo ratings yet

- The Capital Asset Pricing Model A CriticDocument16 pagesThe Capital Asset Pricing Model A CriticLeon LöppertNo ratings yet

- Pim Final NewDocument2 pagesPim Final Newabhisheksingh1234jsrNo ratings yet

- Course Outline-Finance TheoryDocument5 pagesCourse Outline-Finance TheorymuzammalNo ratings yet

- 1 1 EpqDocument17 pages1 1 Epqtung ziNo ratings yet

- Course Title: Managerial Economics Course DescriptionsDocument3 pagesCourse Title: Managerial Economics Course DescriptionsIan ManabatNo ratings yet

- Saleha 1Document31 pagesSaleha 1Mamoona SamadNo ratings yet

- Akpm 06 Return Saham Value at Risk Dan Aktivitas Trading Pada Kelompok Harga Terendah Low Tick Size Di Bursa Efek IndonesiaDocument22 pagesAkpm 06 Return Saham Value at Risk Dan Aktivitas Trading Pada Kelompok Harga Terendah Low Tick Size Di Bursa Efek IndonesiaMalim Muhammad SiregarNo ratings yet

- 1-Behavioural Finance - Template For Course Syllabus FramingDocument3 pages1-Behavioural Finance - Template For Course Syllabus FramingMurugan MNo ratings yet

- Literature Review of Modern Portfolio TheoryDocument6 pagesLiterature Review of Modern Portfolio Theoryjhnljzbnd100% (1)

- The Importance of Basic Education About Stock Investment and Trading For Undergraduate StudentsDocument29 pagesThe Importance of Basic Education About Stock Investment and Trading For Undergraduate StudentsAdelio BalmezNo ratings yet

- Art 2Document17 pagesArt 2raja.elasriNo ratings yet

- Mba-Iii-Investment Management Notes PDFDocument121 pagesMba-Iii-Investment Management Notes PDFNaveen KumarNo ratings yet

- Security Analysis and Portfolio ManagementDocument3 pagesSecurity Analysis and Portfolio ManagementAniket HireNo ratings yet

- Introduction To Investments: Course 2 Financial Market AnalysisDocument23 pagesIntroduction To Investments: Course 2 Financial Market Analysishuat huatNo ratings yet

- Equity ResearchDocument2 pagesEquity ResearchSmit NareshNo ratings yet

- Bba 6 (2017)Document3 pagesBba 6 (2017)ali.amarmaqboolNo ratings yet

- 20880-Article Text-66052-1-10-20180826Document9 pages20880-Article Text-66052-1-10-20180826shubham moonNo ratings yet

- International Journal of Management (Ijm) : ©iaemeDocument6 pagesInternational Journal of Management (Ijm) : ©iaemeIAEME PublicationNo ratings yet

- Dissertation Stock Market EfficiencyDocument7 pagesDissertation Stock Market EfficiencyWebsiteThatWritesPapersForYouSiouxFalls100% (1)

- Hiral Thakkar (107350592100) Mitali Wadhwani (107350592074)Document31 pagesHiral Thakkar (107350592100) Mitali Wadhwani (107350592074)Hiral ThakkarNo ratings yet

- TIOB - Asset & Liability Management For Banks in Africa 2021Document7 pagesTIOB - Asset & Liability Management For Banks in Africa 2021Alex KimboiNo ratings yet

- 00 Syllabus 2024 Investments MS+readingsDocument5 pages00 Syllabus 2024 Investments MS+readingsxinluli1225No ratings yet

- 9a498final Placement - IreossDocument2 pages9a498final Placement - Ireossmicky_chhabra55No ratings yet

- 877c8orient Electricals Revised Final Placement NoticexxDocument6 pages877c8orient Electricals Revised Final Placement Noticexxmicky_chhabra55No ratings yet

- Khoj Reg (Edited)Document16 pagesKhoj Reg (Edited)micky_chhabra55No ratings yet

- Name Contact No Duty Assigned AssignedDocument1 pageName Contact No Duty Assigned Assignedmicky_chhabra55No ratings yet

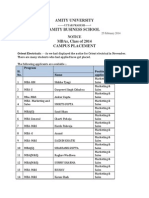

- Amity Business SchoolDocument3 pagesAmity Business Schoolmicky_chhabra55No ratings yet

- Treasure Hunt InvitationDocument1 pageTreasure Hunt Invitationmicky_chhabra55100% (1)

- 7c37afinal Placement Nommtice - CRISILDocument3 pages7c37afinal Placement Nommtice - CRISILmicky_chhabra55No ratings yet

- Amity Business School: Heartiest Congratulations!Document1 pageAmity Business School: Heartiest Congratulations!micky_chhabra55No ratings yet

- Event ReportDocument2 pagesEvent Reportmicky_chhabra55No ratings yet

- MBA's Class of 2014 (MBA, MBA-E, MBA-HR, MBA-M&S, MBA-Retail)Document2 pagesMBA's Class of 2014 (MBA, MBA-E, MBA-HR, MBA-M&S, MBA-Retail)micky_chhabra55No ratings yet

- GM InternationalDocument11 pagesGM Internationalmicky_chhabra55No ratings yet

- Blackbook Project On Rural Marketing of ITCDocument62 pagesBlackbook Project On Rural Marketing of ITCmicky_chhabra55No ratings yet