Professional Documents

Culture Documents

Law of Banking

Law of Banking

Uploaded by

Vivek JainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Law of Banking

Law of Banking

Uploaded by

Vivek JainCopyright:

Available Formats

Law of Banking

Banking law is based on a contractual analysis of the relationship between the bank and the customer. The definition of bank is mentioned earlier, whereas a customer is any person for whom the bank agrees to conduct an account. The law implies following rights and obligations: The bank account balance is the financial position between the bank and the customer, when the account is in credit, the bank owes the balance to the customer, when the account is overdrawn and the customer owes the balance to the bank. The bank can pay the customer's cheques up to the amount standing to the credit of the customer's account plus any agreed overdraft limit. The bank may not pay from the customer's account without a mandate from the customer, e.g. a cheque drawn by the customer. The bank engages to promptly collect the cheques deposited to the customer's account as the customer's agent and to credit the proceeds to the customer's account. The bank has a right to combine the customer's accounts, since each account is just an aspect of the same credit relationship. The bank has a lien on cheques deposited to the customer's account, to the extent that the customer is indebted to the bank. The bank must not disclose the details of the transactions going through the customer's account unless the customer consents, there is a public duty to disclose, the bank's interests require it, or under compulsion of law. The bank must not close a customer's account without reasonable notice to the customer, because cheques are outstanding in the

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Marketing Strategy of NokiaDocument25 pagesMarketing Strategy of NokiaVivek JainNo ratings yet

- PepsiDocument40 pagesPepsiVivek JainNo ratings yet

- Study On P&GDocument9 pagesStudy On P&GVivek JainNo ratings yet

- Customer Satisfaction in Reference To VodafoneDocument1 pageCustomer Satisfaction in Reference To VodafoneVivek JainNo ratings yet

- Consumer Behaviour Regarding Various Branded Shoes: A Project Report OnDocument69 pagesConsumer Behaviour Regarding Various Branded Shoes: A Project Report OnVivek JainNo ratings yet

- Human Digestive SystemDocument25 pagesHuman Digestive SystemVivek JainNo ratings yet

- Average Collection Period - Inventory Turnover - Total Assets Turn Over - Net Worth Turnover - Net Working Capital TurnoverDocument1 pageAverage Collection Period - Inventory Turnover - Total Assets Turn Over - Net Worth Turnover - Net Working Capital TurnoverVivek JainNo ratings yet

- Index: 1. 2. Objectives 3. Research Methodology 4. Findings 5. Questionnaire 6. Conclusion 7. BibiliographyDocument26 pagesIndex: 1. 2. Objectives 3. Research Methodology 4. Findings 5. Questionnaire 6. Conclusion 7. BibiliographyVivek JainNo ratings yet

- Plants, Also Called Green Plants (: ViridiplantaeDocument1 pagePlants, Also Called Green Plants (: ViridiplantaeVivek JainNo ratings yet

- 7 4ScienceSupportDocumentDocument13 pages7 4ScienceSupportDocumentVivek JainNo ratings yet

- Different Types of Operating Systems: There Are Several Architectures Which All Require A Different OSDocument13 pagesDifferent Types of Operating Systems: There Are Several Architectures Which All Require A Different OSVivek JainNo ratings yet

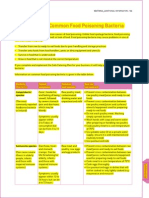

- Common Food Poisoning BacteriaDocument3 pagesCommon Food Poisoning BacteriaYani NyiikNo ratings yet

- Animals ClassificationDocument10 pagesAnimals ClassificationVivek JainNo ratings yet

- Initiative by Indian GovernmentDocument9 pagesInitiative by Indian GovernmentVivek JainNo ratings yet