Professional Documents

Culture Documents

FINANCIAL INCLUSION STUDENTS

Uploaded by

Ranjan SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FINANCIAL INCLUSION STUDENTS

Uploaded by

Ranjan SinghCopyright:

Available Formats

FINANCIAL INCLUSION AND STUDENTS Social justice has been accorded top priority in the Constitution of India.

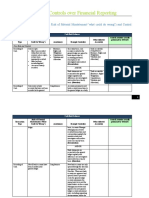

Growth with justice has been at the core of the ongoing economic and financial sector reforms. Besides, Indian banks have been given the responsibility of acting as the prime movers in the process of planned development with the objectives of economic growth and social justice. Banks have, therefore, inter alia, formulated various schemes to provide access to the common man. However, about sixty percent of Indian population is estimated to be outside the monetized sector. Financial inclusion will ensure economic growth with social justice and harmony. Financial inclusion pursued by banks since 2004 envelopes the role of education and what needs to be done with a clear cut plan and approach (blue print) is to involve student participation - as a part of co-curricular activity - to bring about dynamic and drastic positive changes in the neighborhood by improving the quality of life of the underprivileged sections of the community in accordance with the policy objectives of our welfare Government and the proposal is a feasible one and shall serve as a model at local, district, State and National level as well to meet the aspiration s of the common human. The banking system is required to ensure monetization through coverage of all the unbanked clusters with a population of 2000 by the year 2012 and according to the Financial Inclusion Plan, 3.48 lakh villages are required to be covered to reach this target. Student Participation Students in India have a constructive role to play in nation building. Therefore, it is proposed to select a few of them as pioneers on an experimental basis, guide them to engage themselves in transforming the lives of the economically poor and illiterate families in the neighborhood of Colleges to positively contribute towards this national goal. These students will ultimately become instruments of social change, in accordance with the objectives of education itself. In the process, they begin to understand the very purpose of studying banking or finance or

economics as a subject and are aware of suitable banking and insurance products to recommend and deliver, to bring about desired positive changes in real life of the weaker sections. The method is application of the theory into practice to promote social welfare. Reserve Bank of India (RBI) notified on April 24, 2008 that banks could engage individuals as Business Facilitators and a range of service providers to act as Business Correspondents and also permit banks to charge fees from customers for using them. Microfinance has generally taken one of the following three forms: i) Self-Help Group (SHG) programme that has linkages with banks, ii) cooperatives, or iii) Grameen bank branches. Organized SHGs consist of 10 to 12 people with similar socio-economic and demographic characteristics (e.g., low-income women in rural or urban slums). The purpose of the SHGs is to help the members save small amounts of money on a regular basis, to create an internal insurance fund for members to draw on in times of emergencies, to empower the members through collective decision-making, and to extend uncollateralized loans to group members. Since 1992, the National Bank for Agriculture and Rural Development (NABARD) has experimented with creating linkages between SHGs and banks. Such banks lend through Non-Governmental Organizations (NGOs) or directly to SHGs. Banks continue to encourage creation of relationships with SHGs and institutions such as Post offices and Mutual funds. Micro credit extended to the small borrowers by various commercial banks is reckoned as part of priority sector advances by the Reserve Bank of India and the Government of India. Micro credit is defined as the provision of thrift, credit and other financial services and products of very small amount to the poor in the rural, semi-urban and urban areas for enabling them to raise their income level and improve living standards. In sum, micro credit is a linkage between the underprivileged citizens who do not have any security to offer to procure even a small loan, and banks themselves.

The National Bank for Agriculture and Rural Development (NABARD) administers and regulates the prescriptions through Regional Rural Banks (RRBs) and other bank branches, including co-operative banks. Quality of life of the common man is to be touched ultimately by the banking system through the features of link SHG, a popular bank product, and a bank which has become a part and parcel of contemporary banking business. According to Prof.Muhammad Yunus who has been awarded the Nobel Peace Price in 2006, microfinance originated in India and it is not going as fast as it should. However, in Bangladesh, it has reached 115 million people in 30 years. At that rate, India should have reached 160 million. Taking a cue from Prof. Yunus, it is suggested that with student participation (he has not suggested this while addressing at the Mumbai University) we, Indians can reach the underprivileged citizens faster to enable them to get out of poverty. For instance, bancassurance has already been in vogue in India and if poor farmers are granted micro credit to spend on seeds, fertilizer or land whatsoever, and insurance is added, without any collateral farmers suicide can be avoided. In urban slums, it can transform the quality of life of the people. The proposal is a feasible one and shall serve as a model as a pioneering effort of the Mumbai University to begin at local, district, State and National level as well to meet the aspirations of the common human. The 12 digit Aadhaar (Unique Identification Authority of India) is a cost effective way in reaching out to vast group of Indians hitherto financially excluded by identifying them and to access to formal institutional finance which would benefit the poor in the rural and urban India. Viable innovative business model can thus be created in an approved manner utilizing their energy and increasing revenue for banks and also transformation.

You might also like

- Gender Equality and Social Inclusion Diagnostic for the Finance Sector in BangladeshFrom EverandGender Equality and Social Inclusion Diagnostic for the Finance Sector in BangladeshNo ratings yet

- Status of Microfinance and Its Delivery Models in IndiaDocument13 pagesStatus of Microfinance and Its Delivery Models in IndiaSiva Sankari100% (1)

- Women Empowerment through Self-Help GroupsDocument12 pagesWomen Empowerment through Self-Help GroupsunknownNo ratings yet

- Micro Credit in India: An Overview: Mohanan SankaranDocument10 pagesMicro Credit in India: An Overview: Mohanan SankaranAkhil Naik BanothNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Micro Credit in IndiaDocument13 pagesMicro Credit in IndiaRicha NaulaniNo ratings yet

- Script 1Document19 pagesScript 1Manasi PatilNo ratings yet

- Past and Present of The Group-Centric Microfinance Approach: A GlimpseDocument22 pagesPast and Present of The Group-Centric Microfinance Approach: A GlimpseHasyim Ali ShahabNo ratings yet

- Mfi Obj.1Document13 pagesMfi Obj.1Anjum MehtabNo ratings yet

- Microfinance in India - Growth and Present StatusDocument16 pagesMicrofinance in India - Growth and Present StatusIJOPAAR JOURNALNo ratings yet

- Self Help Groups For Inclusive GrowthDocument9 pagesSelf Help Groups For Inclusive GrowthIAEME PublicationNo ratings yet

- Self Help Groups in India - A Study on Kavach SHGDocument10 pagesSelf Help Groups in India - A Study on Kavach SHGRahul SinghNo ratings yet

- Self Help Groups (SHGS) - A Complete Understanding: Mrs. M. L. Shailaja, Dr. Venkata Subrahmanyam C. V, Dr. K. NirmalaDocument8 pagesSelf Help Groups (SHGS) - A Complete Understanding: Mrs. M. L. Shailaja, Dr. Venkata Subrahmanyam C. V, Dr. K. NirmalaAjay RohithNo ratings yet

- Finacial Inclusion and ExclusionDocument20 pagesFinacial Inclusion and Exclusionbeena antuNo ratings yet

- Social Responsibility of BanksDocument11 pagesSocial Responsibility of BanksVarun PatwalNo ratings yet

- Role of Microfinance in Financial Inclusion in Bihar-A Case StudyDocument10 pagesRole of Microfinance in Financial Inclusion in Bihar-A Case Studyfida mohammadNo ratings yet

- Micro Finance (BankingDocument35 pagesMicro Finance (BankingAsim Waghu100% (1)

- Anshu Bansal GuptaDocument32 pagesAnshu Bansal Guptasahu_krishna1995No ratings yet

- Financial Inclusion and UrbanCooperative BanksDocument7 pagesFinancial Inclusion and UrbanCooperative BanksmanojNo ratings yet

- Financial InclusiionDocument37 pagesFinancial InclusiionPehoo ThakurNo ratings yet

- 7.P Syamala DeviDocument4 pages7.P Syamala DeviSachin SahooNo ratings yet

- Financial Inclusion & Financial Literacy: SBI InitiativesDocument5 pagesFinancial Inclusion & Financial Literacy: SBI Initiativesprashaant4uNo ratings yet

- Assignment MicrofinanceDocument28 pagesAssignment MicrofinanceKamrul MozahidNo ratings yet

- Microfinance Report in MaharashtraDocument96 pagesMicrofinance Report in MaharashtraJugal Taneja100% (1)

- Micro-Finance in The India: The Changing Face of Micro-Credit SchemesDocument11 pagesMicro-Finance in The India: The Changing Face of Micro-Credit SchemesMahesh ChavanNo ratings yet

- Microfinance Scope & Future in IndiaDocument4 pagesMicrofinance Scope & Future in IndiamijjinNo ratings yet

- A Critical Analysis of Micro Finance in IndiaDocument54 pagesA Critical Analysis of Micro Finance in IndiaArchana MehraNo ratings yet

- Awareness of MicrofinanceDocument34 pagesAwareness of MicrofinanceDisha Tiwari100% (1)

- Micro Finance in IndiaDocument22 pagesMicro Finance in IndiaGeet SinghiNo ratings yet

- MicrofinanceDocument58 pagesMicrofinanceSamuel Davis100% (1)

- Sakshi Pote Tybbi ProjectDocument93 pagesSakshi Pote Tybbi ProjectAkshataNo ratings yet

- 2014-VII-1&2 NilimaDocument13 pages2014-VII-1&2 NilimaAPOORVA GUPTANo ratings yet

- Edited MicrofinanceDocument59 pagesEdited Microfinancedarthvader005No ratings yet

- Complete ProjectDocument72 pagesComplete ProjectKevin JacobNo ratings yet

- 1.format - Man-An Study of Microfinance Schemes and Its Awareness in PDFDocument9 pages1.format - Man-An Study of Microfinance Schemes and Its Awareness in PDFImpact JournalsNo ratings yet

- Financial InclusionDocument3 pagesFinancial Inclusionputul6No ratings yet

- Rajni Sinha PDFDocument23 pagesRajni Sinha PDFshivani mishraNo ratings yet

- Socio-Economic Empowerment of Women Through Micro-FinancingDocument24 pagesSocio-Economic Empowerment of Women Through Micro-FinancingPriyanka SharmaNo ratings yet

- Comparative Analysis of Important Insurance Schemes of Public and Private Life InsurersDocument8 pagesComparative Analysis of Important Insurance Schemes of Public and Private Life Insurersshashikumarb2277No ratings yet

- 100 % Financial Inclusion: A Challenging Task Ahead: Dr. Reena AgrawalDocument16 pages100 % Financial Inclusion: A Challenging Task Ahead: Dr. Reena AgrawalAashi Sharma100% (1)

- Financial Inclusion Study of SBI & ICICI BanksDocument128 pagesFinancial Inclusion Study of SBI & ICICI BanksDinesh Nayak100% (1)

- 07 Chapter 1Document18 pages07 Chapter 1SakshiNo ratings yet

- What Is Financial Inclusion?: Providing Formal Credit AvenuesDocument5 pagesWhat Is Financial Inclusion?: Providing Formal Credit AvenuesRahul WaniNo ratings yet

- Role of Self Help Groups in Microfinance in IndiaDocument13 pagesRole of Self Help Groups in Microfinance in IndiaKhaki AudilNo ratings yet

- IJCRT23A4170Document9 pagesIJCRT23A4170raghav.samaniNo ratings yet

- Research Paper On Microfinance in India PDFDocument8 pagesResearch Paper On Microfinance in India PDFegya6qzc100% (1)

- Financial Inclusion for Rural GrowthDocument14 pagesFinancial Inclusion for Rural GrowthDeepu T MathewNo ratings yet

- Lack CollateralDocument4 pagesLack CollateralMudassir AliNo ratings yet

- CapstoneDocument29 pagesCapstonelajjo1230% (1)

- Current Market Size of Rs27 BillionDocument5 pagesCurrent Market Size of Rs27 BillionSiddhartha BothraNo ratings yet

- Impact of Micro Finance On Living Standard With Reference To Microfinance Holders in Kurunegala DistrictDocument8 pagesImpact of Micro Finance On Living Standard With Reference To Microfinance Holders in Kurunegala DistrictInternational Journal of Business Marketing and ManagementNo ratings yet

- Micro-Finance Builds Rural India's Social and Economic StatusDocument9 pagesMicro-Finance Builds Rural India's Social and Economic StatusChauhan NeelamNo ratings yet

- A Brief On Microfinance: Patni InternalDocument4 pagesA Brief On Microfinance: Patni InternalshiprathereNo ratings yet

- Impact of Micro Finance On Living Standard With Reference To Microfinance Holders in Kurunegala DistrictDocument9 pagesImpact of Micro Finance On Living Standard With Reference To Microfinance Holders in Kurunegala DistrictShah WazirNo ratings yet

- Role of NGOs in Eradicating Poverty in BangladeshDocument9 pagesRole of NGOs in Eradicating Poverty in Bangladeshabir al ahsanNo ratings yet

- A Study On Awareness Towards Financial Inclusion Among Rural Areas With Special Reference To CoimbatoreDocument27 pagesA Study On Awareness Towards Financial Inclusion Among Rural Areas With Special Reference To CoimbatoreprathikshaNo ratings yet

- Chapter 4 Rural Banking and Micro Financing 1Document16 pagesChapter 4 Rural Banking and Micro Financing 1saloniNo ratings yet

- Ujjivan's Commitment To Help India's Urban Poor: Parinaam FoundationDocument3 pagesUjjivan's Commitment To Help India's Urban Poor: Parinaam Foundationrecoil25No ratings yet

- Project Mangementment Basics ChapterDocument13 pagesProject Mangementment Basics ChapterRanjan SinghNo ratings yet

- Construction EquipmentsDocument163 pagesConstruction EquipmentsAlly Mghamba100% (2)

- India Vs South KoreaDocument9 pagesIndia Vs South KoreaRanjan SinghNo ratings yet

- Correlation and RegressionDocument6 pagesCorrelation and RegressionRanjan SinghNo ratings yet

- Financial StrructureDocument20 pagesFinancial StrructureRanjan SinghNo ratings yet

- Senior Living Sector in IndiaDocument30 pagesSenior Living Sector in IndiaRanjan SinghNo ratings yet

- Poisson Distribution ExamplesDocument2 pagesPoisson Distribution ExamplesEdward KahwaiNo ratings yet

- Session 1 - 4 Banking System & Structure PDFDocument27 pagesSession 1 - 4 Banking System & Structure PDFrizzzNo ratings yet

- Deutsche Bank Outlines New Payment System Going Around The US DollarDocument28 pagesDeutsche Bank Outlines New Payment System Going Around The US DollarAnthony Allen Anderson100% (4)

- The Decline in Access To Correspondent Banking Services in Emerging Markets: Trends, Impacts, and SolutionsDocument56 pagesThe Decline in Access To Correspondent Banking Services in Emerging Markets: Trends, Impacts, and SolutionsforcetenNo ratings yet

- Guidelines for setting up local area banks in private sectorDocument2 pagesGuidelines for setting up local area banks in private sectorSuresh ShNo ratings yet

- Nets Terminal Requirement Specification 1.2.1Document70 pagesNets Terminal Requirement Specification 1.2.1alejandro sanchezNo ratings yet

- April 21st To 29thDocument1,061 pagesApril 21st To 29thNdokwaNo ratings yet

- Quiz 3Document5 pagesQuiz 3natashaNo ratings yet

- Calculate Simple InterestDocument12 pagesCalculate Simple InterestyonesNo ratings yet

- Bank Reconciliation: Reconcile AccountsDocument19 pagesBank Reconciliation: Reconcile AccountsJaneth Bootan ProtacioNo ratings yet

- List PDFDocument2 pagesList PDFLana AmerieNo ratings yet

- MCQ (New Topics-Special Laws) - PartDocument2 pagesMCQ (New Topics-Special Laws) - PartJEP WalwalNo ratings yet

- Primer 2015Document18 pagesPrimer 2015pierrefrancNo ratings yet

- Bonds Payable Issued at A DiscountDocument10 pagesBonds Payable Issued at A DiscountCris Ann Marie ESPAnOLANo ratings yet

- International Parity Relationships and Forecasting Exchange RatesDocument23 pagesInternational Parity Relationships and Forecasting Exchange Rateshui yiNo ratings yet

- Case MatrixDocument10 pagesCase MatrixAly ConcepcionNo ratings yet

- Deloitte Model Aptitude Paper - XIDocument4 pagesDeloitte Model Aptitude Paper - XIAnonymous ZVbwfcNo ratings yet

- Ecurrency eSDR White Paper 052019Document7 pagesEcurrency eSDR White Paper 052019Joseph ParkNo ratings yet

- DOP Finacle - Module Wise Menu List - SA POSTDocument8 pagesDOP Finacle - Module Wise Menu List - SA POSTJavedNo ratings yet

- Top Investment Banks ListDocument48 pagesTop Investment Banks ListVikrant ChaturvediNo ratings yet

- 2023 02 16 17 54 04nov 22 - 600053Document6 pages2023 02 16 17 54 04nov 22 - 600053narendran kNo ratings yet

- Banks and Financial Systems: An OverviewDocument6 pagesBanks and Financial Systems: An Overviewshanthala mNo ratings yet

- Currency During The American OccupationDocument2 pagesCurrency During The American OccupationElai TrinidadNo ratings yet

- Casa ManualDocument425 pagesCasa ManualAnton TarasovNo ratings yet

- SBIDocument11 pagesSBIsourav khandelwalNo ratings yet

- Appendix - 1 - Illustrative List of RoMMs and Control ActivitiesDocument190 pagesAppendix - 1 - Illustrative List of RoMMs and Control ActivitiesspandanNo ratings yet

- Gas BillDocument1 pageGas BillMuhammad AkramNo ratings yet

- General Banking Act PDFDocument69 pagesGeneral Banking Act PDFJerwin TiamsonNo ratings yet

- T-5 Banking TechnologyDocument18 pagesT-5 Banking TechnologyNamanNo ratings yet

- Infographic - Effect of Access To Finance On Financial Performance of Small and Medium Enterprises in Batangas CityDocument1 pageInfographic - Effect of Access To Finance On Financial Performance of Small and Medium Enterprises in Batangas CityBen TorejaNo ratings yet

- Advanced Financial Accounting & Reporting Icwai - Final: CompendiumDocument192 pagesAdvanced Financial Accounting & Reporting Icwai - Final: Compendiumteodora100% (1)