Professional Documents

Culture Documents

Local Property Tax Legislation

Uploaded by

FFRenewalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Local Property Tax Legislation

Uploaded by

FFRenewalCopyright:

Available Formats

__________________ Finance (Local Property Tax) (Amendment) (No.

2) Bill 2013 ________________

BILL

entitled

AN ACT TO AMEND THE FINANCE (LOCAL PROPERTY TAX) ACT 2012 AND THE FINANCE (LOCAL PROPERTY TAX) (AMENDMENT) ACT 2013 IN ORDER TO ENSURE THAT NO PAYMENTS ARE DEDUCTED BY REVENUE UNTIL THE CALENDAR YEAR TO WHICH THE LOCAL PROPERTY TAX LIABILITY RELATES

BE IT ENACTED BY THE OIREACHTAS AS FOLLOWS:

1. -

In this Act Principal Act means the Finance (Local Property Tax) Act 2012 and the

Amendment Act means the Finance (Local Property Tax) (Amendment) Act 2013.

2. -

Subsection (1) of section 119 of the Principal Act, as amended by the Amending Act, is

amended by deleting the following: (1) Local property tax in relation to a liability date shall be due on that date. and substituting the following: (1) Local property tax in relation to a liability date shall be due on that date but notwithstanding the payment method chosen, payment shall not be deducted from the liable person prior to the commencement of the calendar year to which the liability relates.

You might also like

- IMF Letter To Michael McGrath TDDocument2 pagesIMF Letter To Michael McGrath TDFFRenewalNo ratings yet

- Local Government (HC) Amendment) Bill 2012Document5 pagesLocal Government (HC) Amendment) Bill 2012FFRenewalNo ratings yet

- Sequestration Transparency Act OF 2012: 2d SessionDocument17 pagesSequestration Transparency Act OF 2012: 2d SessionPeggy W SatterfieldNo ratings yet

- FINANCE ACT, No. 35 OF 2018Document24 pagesFINANCE ACT, No. 35 OF 2018janithbogahawattaNo ratings yet

- Act No. 5 of 2022 The Finance Act 2022 Act No. 5 of 2022Document48 pagesAct No. 5 of 2022 The Finance Act 2022 Act No. 5 of 2022Mathias MhinaNo ratings yet

- Islamabad Capital Territory (Tax On Services) Ordinance, 2001Document12 pagesIslamabad Capital Territory (Tax On Services) Ordinance, 2001Bilal KhanNo ratings yet

- State of New YorkDocument33 pagesState of New YorkJimmyVielkindNo ratings yet

- Kevyn Orr's Proposal To Detroit's CreditorsDocument134 pagesKevyn Orr's Proposal To Detroit's CreditorsHuffPostDetroitNo ratings yet

- Gazette 22 of 27 May 2011Document10 pagesGazette 22 of 27 May 2011Thandi85No ratings yet

- Title Vii-Additional Provisions: M R H.R. 3630, I O Ml. LLLLLLDocument23 pagesTitle Vii-Additional Provisions: M R H.R. 3630, I O Ml. LLLLLLNu WexlerNo ratings yet

- Senate - 2022 July 20 (R)Document4 pagesSenate - 2022 July 20 (R)BernewsAdminNo ratings yet

- Revenue Code of Liberia With 2011 Amendments Included 011212 PDFDocument263 pagesRevenue Code of Liberia With 2011 Amendments Included 011212 PDFHassan NewlandNo ratings yet

- Ab - 103 - Taxation - Personal Income and Corportation TaxesDocument156 pagesAb - 103 - Taxation - Personal Income and Corportation TaxesCalWonkNo ratings yet

- Motor em Rel 12Document3 pagesMotor em Rel 12FFRenewalNo ratings yet

- Service-Turnover-Tax-Repeal 2020Document3 pagesService-Turnover-Tax-Repeal 2020vaishnaviNo ratings yet

- Approved: February 24, 2001Document1 pageApproved: February 24, 2001Allen OlayvarNo ratings yet

- Finance Bill, 16 June 2022Document73 pagesFinance Bill, 16 June 2022grayson moshiNo ratings yet

- Finance Act, 2021Document31 pagesFinance Act, 2021NnanyerugoNo ratings yet

- 2021 Official Revenue EstimateDocument3 pages2021 Official Revenue EstimateWSYX/WTTENo ratings yet

- Consolidated Red TIF Plan - Mod 1 (Approved 7-1-11) PDFDocument12 pagesConsolidated Red TIF Plan - Mod 1 (Approved 7-1-11) PDFMatthew HendricksNo ratings yet

- F6zwe FinbillDocument22 pagesF6zwe FinbillZvikomborero Tavonga MuchandibayaNo ratings yet

- County Governments Public Finance Management Transition: SectionDocument13 pagesCounty Governments Public Finance Management Transition: SectionEng. Nthuku MutisoNo ratings yet

- Amnesty Ordinance 1 of 2020 15 Dec 2020Document16 pagesAmnesty Ordinance 1 of 2020 15 Dec 2020Shaikh Abdulsaboor SapruNo ratings yet

- 2004-3 Area 2 MR Construction Agreement. 10.16.2006pdfDocument34 pages2004-3 Area 2 MR Construction Agreement. 10.16.2006pdfBrian DaviesNo ratings yet

- Arkansas Amendment SS To Bill SB111Document2 pagesArkansas Amendment SS To Bill SB111capsearchNo ratings yet

- Arkansas Amendment SS To Bill SB131Document2 pagesArkansas Amendment SS To Bill SB131capsearchNo ratings yet

- Public Finance Management Amendment Bill 2021 1Document7 pagesPublic Finance Management Amendment Bill 2021 1drysnactylsNo ratings yet

- BSA Inc Tax Amendment 2Document2 pagesBSA Inc Tax Amendment 2CMMichaelABrownNo ratings yet

- 11 of 2011Document7 pages11 of 2011FelicianFernandopulleNo ratings yet

- Amendments To The Revised Implementing Rules and Regulations of Republic Act No. 9184Document6 pagesAmendments To The Revised Implementing Rules and Regulations of Republic Act No. 9184TabanginSnsNo ratings yet

- Finance Act 2020 Gazette1Document34 pagesFinance Act 2020 Gazette1Anaemesiobi DukeNo ratings yet

- Dumont 2011 Municipal Data SheetDocument57 pagesDumont 2011 Municipal Data SheetA Better Dumont (NJ, USA)No ratings yet

- Description: Tags: s152Document3 pagesDescription: Tags: s152anon-109600No ratings yet

- Rodolfo G Navarro Vs Executive Secretary Eduardo Ermita RESOLUTIONDocument4 pagesRodolfo G Navarro Vs Executive Secretary Eduardo Ermita RESOLUTIONKael MarmaladeNo ratings yet

- In The Senate of The United States-111Th Cong., 2D Sess.: MCG10428 S.L.CDocument13 pagesIn The Senate of The United States-111Th Cong., 2D Sess.: MCG10428 S.L.Cruss willisNo ratings yet

- Compiled CTDocument284 pagesCompiled CTWaqas AtharNo ratings yet

- ValueAddedTaxAmendmentAct2022 PDFDocument17 pagesValueAddedTaxAmendmentAct2022 PDFDesmar WhitfieldNo ratings yet

- Goa Victim Compensation Amendment Scheme, 2015Document2 pagesGoa Victim Compensation Amendment Scheme, 2015Khushi AgarwalNo ratings yet

- CW Loan Amendment 3 Fully ExecutedDocument5 pagesCW Loan Amendment 3 Fully Executeds88831139No ratings yet

- FY12 Supplemental Emergency BRA ANS (Revenue Estimate Revised) (4 17 12)Document3 pagesFY12 Supplemental Emergency BRA ANS (Revenue Estimate Revised) (4 17 12)dcfpisilvermanNo ratings yet

- GPPB Resolution No. 02-2020Document6 pagesGPPB Resolution No. 02-2020Myron CunananNo ratings yet

- Claims and Payments Regulations 2013Document56 pagesClaims and Payments Regulations 2013Stuart MackayNo ratings yet

- TAXATION 1 Smith V CommissionerDocument79 pagesTAXATION 1 Smith V CommissionerJoan Margaret GasatanNo ratings yet

- The Budget Control Act of 2011: The Effects On Spending and The Budget Deficit When The Automatic Spending Cuts Are ImplementedDocument19 pagesThe Budget Control Act of 2011: The Effects On Spending and The Budget Deficit When The Automatic Spending Cuts Are ImplementedcaseywootenNo ratings yet

- Amendments in Wealth Tax 07.10.14 PDFDocument12 pagesAmendments in Wealth Tax 07.10.14 PDFvenkatesh reddyNo ratings yet

- 2013 P T D 1420Document6 pages2013 P T D 1420haseeb AhsanNo ratings yet

- Amending Section 23.1 (A) (Iii) of The Revised Implementing Rules and Regulations of Republic Act No. 9184 WDocument3 pagesAmending Section 23.1 (A) (Iii) of The Revised Implementing Rules and Regulations of Republic Act No. 9184 WMae L AlmonteNo ratings yet

- Indirect TaxDocument4 pagesIndirect TaxAtharva SamantNo ratings yet

- Arkansas Amendment HH To Bill HB1035Document1 pageArkansas Amendment HH To Bill HB1035capsearchNo ratings yet

- AFF's Memorandum On Federal & Provincial Finance Acts, 2022Document61 pagesAFF's Memorandum On Federal & Provincial Finance Acts, 2022ABODE PVT LIMITEDNo ratings yet

- New York City Preliminary Expense Revenue Contract Budget FY2011Document487 pagesNew York City Preliminary Expense Revenue Contract Budget FY2011Aaron MonkNo ratings yet

- List of Expiring Federal Tax Provisions 2010-2020: Prepared by The Staff of The Joint Committee On TaxationDocument39 pagesList of Expiring Federal Tax Provisions 2010-2020: Prepared by The Staff of The Joint Committee On TaxationtpselfNo ratings yet

- Finance Act (No. 2) (No. 10 of 2020)Document40 pagesFinance Act (No. 2) (No. 10 of 2020)Christina TambalaNo ratings yet

- A Bill: 112 Congress 1 SDocument12 pagesA Bill: 112 Congress 1 SaedemersNo ratings yet

- Budgetbill2812c032911 1Document530 pagesBudgetbill2812c032911 1Casey SeilerNo ratings yet

- Wealth Transfer Tax Planning 2013Document52 pagesWealth Transfer Tax Planning 2013ExactCPA100% (1)

- Fy10 Unified Economic Development ReportDocument38 pagesFy10 Unified Economic Development ReportVeronica DavisNo ratings yet

- The Law of Allotments and Allotment Gardens (England and Wales)From EverandThe Law of Allotments and Allotment Gardens (England and Wales)No ratings yet

- Act on Special Measures for the Deregulation of Corporate ActivitiesFrom EverandAct on Special Measures for the Deregulation of Corporate ActivitiesNo ratings yet

- Moore Street Area Renewal and Development Bill 2015Document20 pagesMoore Street Area Renewal and Development Bill 2015FFRenewalNo ratings yet

- Fianna Fáil Foreign Affairs Policy PaperDocument20 pagesFianna Fáil Foreign Affairs Policy PaperFFRenewalNo ratings yet

- Health Policy V7Document49 pagesHealth Policy V7FFRenewalNo ratings yet

- Fiscal Responsibility (Amendment) Bill 2015Document5 pagesFiscal Responsibility (Amendment) Bill 2015FFRenewalNo ratings yet

- Clar 2015 - An Ireland For AllDocument80 pagesClar 2015 - An Ireland For AllFFRenewalNo ratings yet

- Low Pay Commission SubmissionDocument8 pagesLow Pay Commission SubmissionFFRenewalNo ratings yet

- FF National Drugs Action PlanDocument16 pagesFF National Drugs Action PlanFFRenewalNo ratings yet

- Assaults On Elderly Persons Bill 2015Document8 pagesAssaults On Elderly Persons Bill 2015FFRenewalNo ratings yet

- Migrant Earned Regularisation Bill 2015Document16 pagesMigrant Earned Regularisation Bill 2015FFRenewalNo ratings yet

- Fianna Fáil Policy Paper: Michael Moynihan TDDocument10 pagesFianna Fáil Policy Paper: Michael Moynihan TDFFRenewalNo ratings yet

- Central Bank and Financial Services Authority of Ireland Bill 2013Document2 pagesCentral Bank and Financial Services Authority of Ireland Bill 2013FFRenewalNo ratings yet

- The Family Home Mortgage Settlement Arrangement Bill 2014Document13 pagesThe Family Home Mortgage Settlement Arrangement Bill 2014FFRenewalNo ratings yet

- Streets Ahead Policy PaperDocument32 pagesStreets Ahead Policy PaperFFRenewalNo ratings yet

- Central Bank Letter Re Mortgage Arrears StatsDocument3 pagesCentral Bank Letter Re Mortgage Arrears StatsFFRenewalNo ratings yet

- Freedom of Information MaterialDocument2 pagesFreedom of Information MaterialFFRenewalNo ratings yet

- Fianna Fail Pre Budget Submission Final DraftDocument40 pagesFianna Fail Pre Budget Submission Final DraftFFRenewalNo ratings yet

- Markiewicz ReportDocument28 pagesMarkiewicz ReportFFRenewalNo ratings yet

- State Boards Appointments Bill 2014Document12 pagesState Boards Appointments Bill 2014FFRenewalNo ratings yet

- Appraisal Report 19112014 FinalDocument111 pagesAppraisal Report 19112014 FinalFFRenewalNo ratings yet

- Fianna Fáil Submission To The Central Bank On Mortgage Lending RulesDocument1 pageFianna Fáil Submission To The Central Bank On Mortgage Lending RulesFFRenewalNo ratings yet

- Mario Draghi Letter To Michael McGrathDocument2 pagesMario Draghi Letter To Michael McGrathFFRenewalNo ratings yet

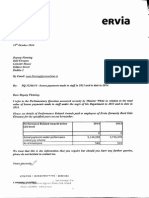

- Ervia BonusesDocument1 pageErvia BonusesFFRenewalNo ratings yet

- Ógra Fianna Fáil Pre-Budget Submission 2015Document22 pagesÓgra Fianna Fáil Pre-Budget Submission 2015OgraFiannaFailNo ratings yet

- Water Services (Exempt Charges) Bill 2014Document2 pagesWater Services (Exempt Charges) Bill 2014FFRenewalNo ratings yet

- Submission by Michael McGrath TD On Behalf of Fianna FáilDocument4 pagesSubmission by Michael McGrath TD On Behalf of Fianna FáilFFRenewalNo ratings yet

- Water Services (Exempt Charges) Bill 2014Document2 pagesWater Services (Exempt Charges) Bill 2014FFRenewalNo ratings yet

- Local Government Bill 2014Document20 pagesLocal Government Bill 2014FFRenewalNo ratings yet

- Refundable Tax Credits Discussion PaperDocument4 pagesRefundable Tax Credits Discussion PaperFFRenewalNo ratings yet

- Planning and Development (Amendment) Bill 2014Document2 pagesPlanning and Development (Amendment) Bill 2014FFRenewalNo ratings yet