Professional Documents

Culture Documents

PF Calculations

Uploaded by

Prashu DeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PF Calculations

Uploaded by

Prashu DeeCopyright:

Available Formats

Pf is calculated on only basic of salary, not DA 2. Employee contibution is 12% 3. Employer contribution is devided in two parts A) 3.

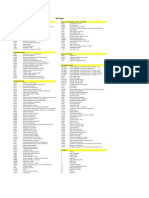

67%- which goes directly in the pf account of an emplyee. B) 8.33%- Which goes to family Pension Scheme. Including above, employer has to pay Administrative Charges = 1.10% on the total ammount of basic ie (6500 & above also). Then Employer has to pay contribution for EDLI Scheme = 0.5% & Administrative charges =0.01% of the Ammount of total basic cosider for Family pension scheme which does not include total basic amount above 6500 So this total is= 12%( 3.67+8.33)+1.10+0.5+0.01=13.61% paid by employer. 6000 basic = Pf contribution by Emplyer=720+66+30+0.6=816.6 voluntary Ceiling was 3500/- upto 01.10.94, then revised to 5000/-. Then it revaised to 6500/- from 01.04.1995. and remains same, further there is no amendment. if the employee basic wages exceeding Rs.6500/-, there is no liability on the part of employer to pay PF contribution. If employee joined with less than above basic, continuing service with more than the basic of Rs.6500/- , employer bound to pay PF contribution on the Rs.6500/- only (.i.e.Rs.780/-),eventhough his basic salary more than that. attribution http://www.citehr.com/427526-employeer-contribution-epf-excel-software.html#ixzz2jD56VbWn

Please find the below details for PF calculation on basic salary: A/C NO.1 :- From Employee 12% + Employer 3.67% A/C No.2 :- 1.1 % (it's called PF admin charges) A/C No.10 :- 8.33 % (pension) A/C No. 21 :- 0.5% (E.D. L.I) A/C No.22 :- 0.01 % (EDLI admin charges) Note:- The PF Ceiling amount is Rs.6500 /- if the Basic salary is >= 6500 /- the pension salary will be paid Rs.541 and remaining goes to PF i.e A/C NO.1

attribution http://www.citehr.com/427526-employeer-contribution-epf-excel-software.html#ixzz2jD5SfWCT

You might also like

- T CodesDocument13 pagesT CodesPrashu DeeNo ratings yet

- FICO Roles - Authorization - Matrix - and Assignments V12Document4,013 pagesFICO Roles - Authorization - Matrix - and Assignments V12Prashu DeeNo ratings yet

- Sap TablesDocument82 pagesSap TablesPrashu DeeNo ratings yet

- FI-PP, MM, SD IntegrationDocument6 pagesFI-PP, MM, SD IntegrationPrashu DeeNo ratings yet

- Sap Ps Configuration GuideDocument85 pagesSap Ps Configuration GuidePrashu Dee90% (10)

- Probationary Officers ExaminationDocument610 pagesProbationary Officers ExaminationPrashu DeeNo ratings yet

- Idli and Dosa VarietiesDocument4 pagesIdli and Dosa VarietiesPrashu DeeNo ratings yet

- Sap TableDocument82 pagesSap TableGooyong Byeon0% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)