Professional Documents

Culture Documents

Tugasan MA

Tugasan MA

Uploaded by

rasyid_hasan0 ratings0% found this document useful (0 votes)

45 views1 pageCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views1 pageTugasan MA

Tugasan MA

Uploaded by

rasyid_hasanCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

3-5

Predetermined overhead rate = Estimated total manufacturing overhead

cost

Estimated total amount of the allocation base

Overhead applied to job = predetermined overhead Actual direct

labor hours

rate x charged to job

predetermined Overhead Rate(POR) = RM 23.40

Actual total manufacturing overhead cost =RM 249,000

Total direct labor-hours = RM10,800

Overhead total applied to job =RM23.40 x10,800

=RM252,720

3-8

1) Estimated total manufacturing Overhead =RM 218,400

Actual total manufacturing Overhead = RM215,000

POR =RM 18.20

Overhead applied to job = POR x actual direct labor –hours

= RM 18.20 X11500

= RM 209,300

Actual MOH - MOH applied

RM 215000 - RM209,000 = RM5700 is underapplied

2) RM5700 adalah underapplied ,maka kos barang dijual akan meningkat

manakala untung kasar akan menurun.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- FINAL Critique of 7 Principles of SCMDocument7 pagesFINAL Critique of 7 Principles of SCMAllana NacinoNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Audit Group Project FINALDocument74 pagesAudit Group Project FINALLatoya Johnson100% (1)

- Antigua Free Presentation Template SlideforestDocument8 pagesAntigua Free Presentation Template SlideforestAnggeri LfoNo ratings yet

- Customer Retention and Customer Winback Strategies (For ABF)Document42 pagesCustomer Retention and Customer Winback Strategies (For ABF)Burin T. SriwongNo ratings yet

- Chapter18 Creating Competitive AdvantageDocument16 pagesChapter18 Creating Competitive AdvantageRomeo De Guzman Jr.No ratings yet

- Annex F - ESCO Evaluation FlowchartDocument2 pagesAnnex F - ESCO Evaluation FlowchartEmerson MiteriaNo ratings yet

- SHRMDocument15 pagesSHRMDharti Parikh0% (1)

- A Study On Financial Performance of Esaf Microfinance & Investments (P) LTDDocument23 pagesA Study On Financial Performance of Esaf Microfinance & Investments (P) LTDneenuwilsonNo ratings yet

- 3.6 - Making Strategic Decisions - Success&FailureDocument53 pages3.6 - Making Strategic Decisions - Success&FailureGary ANo ratings yet

- Chapter 5-Accounting For Merchandising Operations - ExercisesDocument8 pagesChapter 5-Accounting For Merchandising Operations - Exercisessgjalmi23No ratings yet

- Isoquan Dan IsocostDocument20 pagesIsoquan Dan Isocostkezia aureliaNo ratings yet

- Account Payable ConfigurationDocument21 pagesAccount Payable ConfigurationSrinivasan SanthanamNo ratings yet

- References PMKDocument3 pagesReferences PMKhjNo ratings yet

- Assignment - SadatDocument25 pagesAssignment - Sadatshamim hossainNo ratings yet

- AS8908 Drawing and BOM For OAL Spyrometer LensDocument5 pagesAS8908 Drawing and BOM For OAL Spyrometer LensBruno SantosNo ratings yet

- Sales Training For ProfessionalsDocument39 pagesSales Training For ProfessionalsESLAM AHMED100% (1)

- Consumer Brand Preference Between The Shoe Brands HRX & SkechersDocument13 pagesConsumer Brand Preference Between The Shoe Brands HRX & SkechersAman BaghelNo ratings yet

- Sales Presentations Bonus1Document4 pagesSales Presentations Bonus1Awayes Steel TradersNo ratings yet

- Comparative Statements of LEDDocument10 pagesComparative Statements of LEDSurinder KumarNo ratings yet

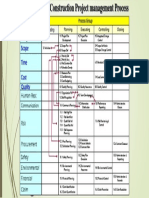

- Project Management ProcessDocument1 pageProject Management ProcessNoliet YatnoNo ratings yet

- Management Principles & DynamicsDocument38 pagesManagement Principles & DynamicsJennifer DeleonNo ratings yet

- PCM 814 Slides For StudentsDocument219 pagesPCM 814 Slides For StudentsIsaac Tetteh CharnorNo ratings yet

- Company BrochureDocument15 pagesCompany BrochurehpavleNo ratings yet

- 1000 Ways To Engage EmployeesDocument7 pages1000 Ways To Engage EmployeesNadinneNo ratings yet

- CBE Vision Mishion and ValuesDocument4 pagesCBE Vision Mishion and ValuesHiwot GebreNo ratings yet

- Test 2 IBPSES Exam PaperDocument6 pagesTest 2 IBPSES Exam PaperSushma ShresthaNo ratings yet

- Entrepreneurship: Business Model and PlanDocument31 pagesEntrepreneurship: Business Model and PlanFederico DoriaNo ratings yet

- Instructor: DONALD N. DELA CRUZ Mobile Number: 0906-952-0219 Contact ScheduleDocument8 pagesInstructor: DONALD N. DELA CRUZ Mobile Number: 0906-952-0219 Contact ScheduleJulius Orquillas PatrollaNo ratings yet

- Bhuwalka Premier Group of Companies: Client NameDocument17 pagesBhuwalka Premier Group of Companies: Client NamemahalakshmiNo ratings yet

- Business Story WritingDocument25 pagesBusiness Story WritingFasih RehmanNo ratings yet