Professional Documents

Culture Documents

Supply Chain Management

Supply Chain Management

Uploaded by

nirajmishraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Supply Chain Management

Supply Chain Management

Uploaded by

nirajmishraCopyright:

Available Formats

SUPPLY CHAIN MANAGEMENTLINKING IDEATION TO PROFITABILITY AND SECTORAL ANALYSIS OF THE PHARMACEUTICAL SECTOR

By Krishna Chaintanya Nidhi Singh

INTRODUCTION: The increasingly flattening world is constantly evolving and impacting the way, the business is being done. Supply Chains have become complex, global and dynamic. The success of a company in this global era depends on developing innovative supply chain strategies that could help improve profitability while drawing continuous improvements. Supply chain Management enables world leading organizations to re-align their supply chains to the flat world paradigm by providing standard solutions for the organizations needs in supply and demand planning and forecasting, sourcing and procurement, supply chain execution, enterprise asset management. The role of supply chain has changed considerably over the last three decades. The benefits of improving the performance of the supply chain initially included revenue growth and higher profitability through greater market share and price premium. Traditionally the focus has been on the flows within the organization or flows over which the organization has direct control. But the things have changed now. At present, the successful supply chain management requires the recognition that the firm is simply one player in the long chain that starts with suppliers and includes transporters, distributors and customers. Close relationship between suppliers, manufacturers, transporters, distributors and customers are going to be the key to success in the times to come. Now companies are recognizing that supply chain innovations can be not only the driver of cost reduction but importantly a catalyst for revenue growth by achieving greater levels of customer satisfaction. OBJECTIVE: Understanding Supply chain management and how it assists in profitability considering the pharmaceutical industry. Understanding and analyzing the transition of the global pharmaceutical sector from being an imitator to an innovator.

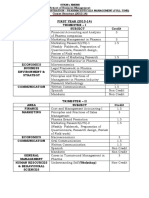

SUPPLY CHAIN STRATEGY

Demandflow strategy

collaboration strategy

Supply chain strategy framework

customer service strategy

technology integration strategy

Collaborative strategy: Opportunities for collaboration among business partners will vary depending upon the organizations perspective role in the supply chain. Collaboration enables partners to jointly gain a better understanding of future product demand and implement more realistic programs to satisfy demand. The collaborative strategy includes three major types of relationship: � Manufacturer/supplier collaboration � Manufacturer/customer collaboration � Collaboration with third party and fourth party logistics provider Demand Flow Strategy: Traditionally in supply chain management, the key focus has been in managing the flow of materials and goods from suppliers through the manufacturing and distribution chain to the customers. The key in demand management is the continuous flow of demand information from

customer and end users through distribution and manufacturing to suppliers. The shared objective of the chain is fulfilling customer demand. Customer Service Strategy Customer satisfaction level is directly proportional to the service provided by the company. The customer service can be seen as a continuum between dissatisfied and delighted customers. Organizations need to add value to customers time and trouble. Formulating a customer service strategy involves: � Customer segmentation � Cost to serve � Revenue management Information Technology Strategy A number of IT based supply chain information management tools are now available to provide intelligent decision support and execution management. They can be TPS focused on day to day operations or strategic planning tools used to redesign the supply chain infrastructure. Consequently, there is an ever increasing need for fully integrated supply chain information management solutions which incorporate all the functionality of network strategy/ supply chain configuration, demand planning, transportation management and warehouse management. LITERATURE REVIEW As per UPS supply chain solutions, 2005; in order to incorporate supply chain into pharmaceutical sector, the following three practices are mandatory: � Rationalized global production networks � Change over competence with smaller batch production. � A compliant management system. The two trends that dramatically affect the future of pharmaceutical fulfillment are Smaller batch production led by genomics and customer demand

The addition of retailer, provider and consumer direct to manufacturers customer base Both these aspects signify towards an in-evitable shift in pattern from distributing larger pallet quantities to wholesalers, to distributing smaller package to pallet quantities across a large customer base. The benefits associated with drug makers include access to real-time demand and to actual consumers. Most importantly, the cost management based approach in the pharmaceutical sector has laid emphasis on improvements in the supply chain management. This in-turn has led to a new concept of supply chain event management. The current sales model for many drug manufacturers is to release product data and samples to sales forces that struggle to get a two-minute window of time with medical providers. In that window, a sales representative may be introducing several new drugs and/or reinforcing current products. Current sales efforts are becoming less effective and more costly as sales forces are expected to cover more and more products. In the last five years, pharmaceutical sales forces have grown 85 percent. In fact, behind R&D, sales representative costs are the second largest category of expense for drug makers.

Just recently, the Department of Health and Human Services issued new standards to drug manufacturers sales approach, stating that drug makers could not offer incentive payments or other tangible benefits to encourage or reward the prescribing or purchase of particular drugs by doctors, health plans or companies that manage drug benefits for employers and insurers. The government has informed the industry that many of its sales and marketing practices may violate federal fraud and abuse laws.

KEY TRENDS IN THE PHARMACEUTICAL INDUSTRY Recent breakthroughs in genomics and proteomics may be mind-boggling to most. And, although news reports remind us regularly of the strides pharmaceutical companies are making in the fight against disease and pain, little is reported about the increasing struggles pharmaceutical companies face in this fight.

In fact, the pharmaceutical industry is experiencing unparalleled change and challenges. All of the usual suspects that impact business today are at play: globalization, treatment and pricing economics, government controls and technology.However, in an era of continuing consolidation, innovation abounds not only in R&D, but also in business models.

INTRODUCTION TO THE PHARMACEUTICAL INDUSTRY Pharmaceutical industry in India is playing a vital role in the healthcare area of the nation. With the implementation of product patent from the year2005, there will be a tough competition for the global market share. Pharmaceutical companies will have to focus more intensively on R&D activity to survive the competition. As we are moving towards globalization, there is a need for strategic planning to meet the challenges posed by the product patent era. In the present context with the available expertise, manpower and skill, the Indian Pharmaceutical Industry will fight successfully for the global market share .here we have reviewed the status of Indian

pharmaceutical industry vis-a-vis Global pharmaceutical industry. The strong opportunities lie within this sector to grow as the condition of Indian health sector is discouraging. Some of the factors signifying the same are: India ranks very low in the global health scenario, both in terms of status and expenditure .Over 50% of young children in the country are malnourished. Only 35% of the countrys population has access to essential drugs. Reason attributed to this is that India invests only 5.@% of its GDP on health .Various reports published by WHO and other health organizations indicated that India has the highest number of Tuberculosis and Hepatitis-B patients in the world. India also accounts for most number of blind patients globally. Mortality in India, due to Malaria, Peaks highest amount all the nations. Health indicators also show that there will be highest number of AIDS patients in the country by 2020. Inspite of sustained efforts by the Government and NGOs, Polio has not been completely eradicated and is still prevalent in certain pockets of the country .Another Startling fact reveals that almost 80%of the countrys medical workforce is employed in the private sector.

A GLIMSE OF THE GLOBAL PHARMACEUTICAL INDUSTRY The Pharmaceutical industry of the Western World is the leading manufacturers of medicines. North America, Europe, Japan and Latin American countries account for 85% of the worldwide pharmaceutical production. These countries control almost 77% of the global pharmaceutical market (Figure1). The US invest 13.7% of its GDP on health .Annual drug expenditure (per capita) for Japan amounts to $ 412, while for India it is a low $ 3(Figure 2).The US and The UK had a combined 62%(46%+16% respectively) share of global pharmaceutical exports in 2005. The US and the UK together sell 2 out of 3 pharmaceutical products in the world. According to WHO survey, US pharmaceutical industry market was$ 512 billion in 2005. Of this, $ 318 billion came from products free from patent protection, Drug prices in Europe are about 60% of the prices in US and yet European firms spend larger share of their revenues on R&D rather than their American counterparts. Data representing Pharmaceutical Drug Production Worldwide (2007): REGION %SHARE OF DRUG % SHARE OF

PRODUCTION NORTH AMERICA 30.9

POPULATION 4

EUROPE JAPAN REST OF THE WORLD

30.4 20.9 17.8

7 2 87

This clearly shows that rest of the world needs to improve on their drug production ability as they have tremendous potential for betterment of the situation. One of the step could be working on the supply chain event management.

INFORMATION TECHNOLOGY IN SUPPLY CHAIN MANAGEMENT-TO REDUCE COST AND SAVE TIME Globally, innovation has been the key factor for the growth of the pharmaceutical industry. There has been a strong support for biotechnology and medical research worldwide and this is being augmented by research and development expenditure of the pharmaceutical industry. This has been one of the reasons for the growth of the pharmaceutical industry in India, as the Indian pharmaceutical industry started more as an imitator taking up outsourced research jobs rather than an innovator. Globally, there is tremendous pressure on pharmaceutical companies to develop new drugs. Carrying out R&D activities on a new drug can cost more than a billion dollars and can take as long as 12-14 years. Hence the pharmaceutical companies worldwide have been putting up efforts to reduce the rising cost in drug discovery. Hence application of Information technology (IT) in the supply chain and the research process of pharmaceutical drug making has become a key to success. IT solutions such as electronic data capture and clinical trials management are likely to streamline the drug development process.

Drugdiscovery

Drug development

Manufacturing

Distribution

Salesand marketing

Supply chain management

ERPproduction planningand control Salesforce automation CRM

Insilico research

Electronicdata capture

Warehous management

Business Intelligence/data warehousing/Knowledge management integration/ Data mining Fig: Application of IT (information technology) to speed up the drug research and production process.

ENSURING SECURITY IN THE SUPPLY CHAIN- ESSENTIAL FOR PROFOUND PROFITABILITY The responsibility of the security in the supply chain has to be a collaborative effort from all the players in the pharmaceutical industry. Organizational design and the nature of the relationships among the trading partners are crucial. Three driving forces: globalization, developments in medicine and the growth in the economy of the developing nations like India and china have resulted in the profound changes in the pharmaceutical industry. Also in the other industries globalization, technology and the growth of the developing nations does play a vital role in the bringing about changes in the supply chain system. With the growth in demand and profound development, doing business the traditional way, in the pharmaceutical industry is a disaster. Waste will not be tolerated, and failing to stem the tide of counterfeits is wasteful. The pharmaceutical supply chain system must be more focused on the customer experience: Think Wal-Mart, Procter & Gamble. Three viable solutions can be taken up via the improvements in the supply chain to make a difference in the competitive environment: � Close off diversion entry points by minimizing excess inventory at the wholesaler and by requiring wholesalers to source directly from drug manufacturers. � Reduce the cost of cheating by implementing new security technologies and by strict licensing and record-keeping requirements. � Monitor the supply chain carefully using advanced technologies like track and trace technology and also by having a better grip on the distribution channel. Pharmaceutical wholesalers and manufacturers jointly are beginning to realize that their approach to the supply chain must resemble that of the other FMCG production companies. Three reasons: � Inventory levels are too high � Asset utilization at the plant level is not good

� Stock outs are still common even though pharmaceutical manufacturers have inventory levels. FUTURE PROSPECTIVE The interconnected world we live in offers unprecedented opportunities to grow

high

for todays

organization. But these opportunities come with a whole host of challenges for those businesses supply chains through the constant change in internal and external environment. Some of these are: rapid wage inflation, spikes in commodity prices, unpredictable currency rates. Transportation costs alone can fluctuate by as much as 250% per year. it gets very important for companies to manage cost volatility by building flexibility directly into supply chains, using advanced business analytics and automation technologyinterconnecting everything from customers to suppliers to IT systems. Allowing businesses to shift workloads around the globe ,adjust inventory based on changing customer demand and respond to currency fluctuations by realigning global partnerships. Some of these changes have already been adopted by several firms to attain that flexibility which is helping companies in industries as diverse as healthcare, retail and electronics adapt to market changes and cut costs. In fact, last year, 17 out of 25 well known global supply chain companies adopted this. It is rightly quoted SMARTER BUSINESS NEEDS SMARTER THINKING. This is what supply chain is giving to all businesses including pharmaceutical sector.

10

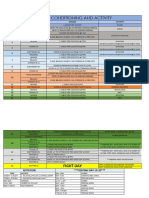

SALES AND MARKETING

SALESANDMARKETING Formularies Therapeuticinterchange Stepcaretherapy CHANNELMANAGEMENT PBMs DiseaseManagementprogram Wholesaler/distributor disintermediation Increasedgenericscompetition Shorterexclusivityperiod NEWPRODUCTDEVELOPMENT ANDROLLOUT RisingR&Dcosts Niche/specialistcompanies Outsourcingpricepressure Shorterexclusivityperiods Increasedgenericscompetition

The increased use of formularies, therapeutic interchange and step-care therapy by managed care has ignited efforts to be put up in sales and marketing in order to cater to the root of these programs: cost management in treatment programs. Moreover the time available to the marketing and sales team in order to generate and influence demand is shrinking due to increased generics competition and shortening exclusivity periods.

These shrinking timeframes and price pressures require that new product marketing and sales methods continuously address evolving sales channels. Pharmaceutical companies and their partners must also be able to quickly build differentiating capability in marketing to such sales channels.

11

Lastly, the information needs of the consumer are dramatically different from those of managed care and provider organizations. CRM and consumer support expansion is required in-order to cater to the new growing needs.

CHANNEL MANAGEMENT

Distribution channels have fast assumed a role of strategic importance for most sectors including pharmaceuticals. As the current market is witnessing deflated margins and intense competitions like never before, the efficient utilization of these channels become very crucial. In the case of the pharmaceutical sector, issue of channel conflicts is very frequent. In pharmaceuticals the nature of mixture of goods being delivered by various companies and varied nature of market segments lead to conflicts in distribution channel. Change in trends should be incorporated by using parallel channels where the modification in each channel are specific to the customers segment served and the product mix on offer. Besides, explicit and latent channels lead to an inefficient deployment of resources, but also have the ability to dilute brand image and corporate positioning. In order to cope up with these problems, pharmaceuticals should build up transparent strategic planning process. It should remove market delineation ambiguities and steps to enhance supplier power vis-a-viz channel members should be made. Effective implementation of supply chain management in pharmaceuticals should also include a more cohesive functioning with the channel than a structure based on rigid control and conventional incentives. The pharmaceutical channels needs to be re-evaluated as the new channels are emerging in the world market. Pharmaceutical companies can investigate the value of alternative distribution for samples and literature. For example, distributing direct to disease management programs or leveraging the role of retail pharmacies may provide opportunities to strengthen retail relationships and gather more accurate demand information. On the revenue side, shifting to cost- and performance-based channel management can lead to cost savings, more reliable distribution and improved demand visibility. Drug makers can now sell direct to retailers and providers through e-marketplaces such as the Worldwide Retail Exchange and Global Healthcare Exchange.

12

NEW PRODUCT DEVELOPMENT

In new product development, highly specialized niche companies are demonstrating that they can bring innovation faster. With escalating R&D costs, we believe drug manufacturers that leverage the intellectual property of such companies, as well as facilitate collaborative efforts through alliances and partnerships, can better manage risk and portfolio profitability. As more parties participate in the race for innovation, integrating research, development and design efforts will become a source for competitive advantage. Technology, information sharing and process integration will become paramount to lowering costs and optimizing intellectual property. Additionally, once a new product has been developed, the cycle for commercializing that product and rolling it out must become tighter. With exclusivity periods shortening and generics gaining higher market share, the time it takes to get product commercialized and demand generated will directly affect the profitability and life of that product.

Regulations and compliance also affect the transition from development to rollout. The FDA allows new drugs to be marketed in the United States immediately following approval, but Europe often experiences delays of up to 12 months between drug approval and market availability.2 Tighter and more intelligent synchronization between production, fulfillment, marketing and channel networks will enable faster rollouts.

13

CONCLUSION:

The winning pharmaceutical companies will be those organizations that can: 1. Maintain profitability despite falling margins 2. Generate and conserve cash flow for future acquisitions and licensing arrangements 3. Resiliently merge and integrate supply chains to enable M&A, licensing and collaborative R&D strategies

What does it take to become a winner? Pharmaceutical companies that want to be well positioned for the future, despite the growing hardships and complexity of the industry, should achieve excellence by focusing on these five supply chain areas: Production Fulfillment Customer Management Forecasting & Planning Procurement

14

REFERENCES: � Larry Koester-United Parcel Service of America � House Of commons Health committee-the influence of the pharmaceutical industry, fourth report, session 2004-05 � The Link between Gross Profitability and Pharmaceutical R&D Spending, Health Affairs, vol. 20, no. 5 (September/October 2001), pp. 216-220. � The Pharmaceutical IndustryPrices and Progress, New England Journal of Medicine, vol. 351, no. 9 (August 26, 2004), pp. 927-932. � Purchasing And supply, John.A.Woods � Supply Chain Management in the 21st century, B.S.Saha

15

You might also like

- Accenture Pharmaceuticals Supply Chain AnalyticsDocument5 pagesAccenture Pharmaceuticals Supply Chain AnalyticsChetan MehtaNo ratings yet

- Benchmarking Supply Chain Practices in FMCG IndustryDocument4 pagesBenchmarking Supply Chain Practices in FMCG IndustryParth ShahNo ratings yet

- Decide To Live Second Edition SoftcoverDocument263 pagesDecide To Live Second Edition SoftcoverRod CzlonkaNo ratings yet

- Checklist of Daily ActivitiesDocument3 pagesChecklist of Daily ActivitiesGrace Ann ZacariasNo ratings yet

- SCM Group 12Document17 pagesSCM Group 12Shouvik DuttaNo ratings yet

- BCI Industry ReportDocument20 pagesBCI Industry ReportVivek Prakash100% (1)

- A Project Report On Impact in The Effectiveness of The Supply Chain Integration at HUL LTDDocument90 pagesA Project Report On Impact in The Effectiveness of The Supply Chain Integration at HUL LTDBabasab Patil (Karrisatte)No ratings yet

- Serialization - Traceability and Big Data in The Pharmaceutical Industry PDFDocument19 pagesSerialization - Traceability and Big Data in The Pharmaceutical Industry PDFBúp CassieNo ratings yet

- Balancing MarqueringDocument11 pagesBalancing Marqueringlucia zegarraNo ratings yet

- Transformation in The Pharmaceutical Industry - Developing Customer Orientation at Pharma CorpDocument17 pagesTransformation in The Pharmaceutical Industry - Developing Customer Orientation at Pharma CorpMegavarman GopalanNo ratings yet

- Assignment On Supply Chain Management in Healthcare: Done By, Hiren D AsraniDocument8 pagesAssignment On Supply Chain Management in Healthcare: Done By, Hiren D AsraniHiren AsraniNo ratings yet

- Research Methods - Mitigating Supply Chain Disruptions Through Resilience Strategies - "A Case Study of The Pharmaceutical Industry."Document10 pagesResearch Methods - Mitigating Supply Chain Disruptions Through Resilience Strategies - "A Case Study of The Pharmaceutical Industry."wsndichaonaNo ratings yet

- Pharma MarketingDocument55 pagesPharma MarketingArpan KoradiyaNo ratings yet

- Supply Chain Coordination and Collaboration For Enhanced Efficiency and Customer Satisfaction.Document56 pagesSupply Chain Coordination and Collaboration For Enhanced Efficiency and Customer Satisfaction.jamessabraham2No ratings yet

- Supply Chain Management in The Healthcare IndustryDocument23 pagesSupply Chain Management in The Healthcare IndustryMohammed Al Ayoubi67% (3)

- Accenture Pharmaceutical DistributionDocument4 pagesAccenture Pharmaceutical DistributionMichael HendarmanNo ratings yet

- Synopsis SampleDocument7 pagesSynopsis SamplesjajidNo ratings yet

- Supply Chain Management in Food IndustriesDocument3 pagesSupply Chain Management in Food IndustriesArjun PatelNo ratings yet

- SM Value Chain Group 2 Assignment ReportDocument10 pagesSM Value Chain Group 2 Assignment ReportSashivNo ratings yet

- Supply Chain Management in Healthcare Industry - Chirag Shetty - NMIMS MumbaiDocument4 pagesSupply Chain Management in Healthcare Industry - Chirag Shetty - NMIMS MumbaiCHIRAG SHETTY0% (1)

- Imprortance, Research Methdology, Objectives and Hypothesis: Chapter - IiDocument23 pagesImprortance, Research Methdology, Objectives and Hypothesis: Chapter - Iisacred54No ratings yet

- Case StduyDocument3 pagesCase StduyridzuttNo ratings yet

- McKinsey White Paper - Building New Strenghts in Healthcare Supply Chain VFDocument13 pagesMcKinsey White Paper - Building New Strenghts in Healthcare Supply Chain VFsinghmk100% (1)

- Supply Study TvsDocument20 pagesSupply Study TvsSiva RatheeshNo ratings yet

- Aligning Supply Chain Strategy With Business StrategiesDocument5 pagesAligning Supply Chain Strategy With Business StrategiesEddy MusyokaNo ratings yet

- Winning in Emerging Markets To Drive GrowthDocument28 pagesWinning in Emerging Markets To Drive GrowthsybabaNo ratings yet

- Procurement Strategy DCHFT 2021 24Document20 pagesProcurement Strategy DCHFT 2021 242022hb21031No ratings yet

- Supply-Chain and Logistics Management FOR Creating A Competitive Edge Part OneDocument21 pagesSupply-Chain and Logistics Management FOR Creating A Competitive Edge Part OneNixon PatelNo ratings yet

- Market Led Extesion-Agribusiness and Supply Chain ManagementDocument19 pagesMarket Led Extesion-Agribusiness and Supply Chain Managementsathya priyaNo ratings yet

- Analytics in Pharma and Life SciencesDocument13 pagesAnalytics in Pharma and Life SciencesPratik BhagatNo ratings yet

- Healthcare Supply Chain PlaybookDocument40 pagesHealthcare Supply Chain PlaybookKen MoughaluNo ratings yet

- NHS Procurement Review Call For Evidence: 27 July 2012Document10 pagesNHS Procurement Review Call For Evidence: 27 July 2012api-124184243No ratings yet

- ANU AStudyonMarketingofHospitalServicesDocument46 pagesANU AStudyonMarketingofHospitalServiceskeralahockeyNo ratings yet

- Building Supply Chain Capabilities in The Pharmaceutical IndustryDocument7 pagesBuilding Supply Chain Capabilities in The Pharmaceutical Industrysarin15juneNo ratings yet

- Supply Chain Management Compendium 2014 Edition FinalDocument7 pagesSupply Chain Management Compendium 2014 Edition FinalVicky Ze SeVenNo ratings yet

- Global Supply-Chain Strategy and Global CompetitivenessDocument14 pagesGlobal Supply-Chain Strategy and Global CompetitivenessgiovanniNo ratings yet

- Westminster Company: A System Design Assessment Company ProfileDocument7 pagesWestminster Company: A System Design Assessment Company ProfileKaneki KenNo ratings yet

- Forecasting CaseDocument28 pagesForecasting CaseRichard Sinchongco Aguilar Jr.No ratings yet

- Abstract - Jaipuria2 - Re-Engineering The Revenue CycleDocument2 pagesAbstract - Jaipuria2 - Re-Engineering The Revenue Cyclemunish_tiwari2007No ratings yet

- Deloite Pharma and Connected PatientDocument40 pagesDeloite Pharma and Connected PatientBobAdlerNo ratings yet

- A Study On Supply Chain Management of PepsicoDocument20 pagesA Study On Supply Chain Management of PepsicoUpadhayayAnkurNo ratings yet

- PWC - SCM - NEXT GENDocument19 pagesPWC - SCM - NEXT GENPartha Patim GiriNo ratings yet

- Supply Chain Management in Retail & Performance ReveiwDocument4 pagesSupply Chain Management in Retail & Performance ReveiwMarya BhuttoNo ratings yet

- Assignment 6.1. Submission of Reflection Paper 1 DUE Mar 11Document2 pagesAssignment 6.1. Submission of Reflection Paper 1 DUE Mar 11Khatlane Joy Nolasco SecopitoNo ratings yet

- EquaTerra Perspective Pharma Outsourcing Future Jun2009 3129Document8 pagesEquaTerra Perspective Pharma Outsourcing Future Jun2009 3129StinkyNo ratings yet

- Challenges PDFDocument4 pagesChallenges PDFRupal RawatNo ratings yet

- Pharmacoeconomics Driving Brand Success in The Pharmaceutical IndustryDocument16 pagesPharmacoeconomics Driving Brand Success in The Pharmaceutical IndustrysanaayamehtaNo ratings yet

- PWC Global Supply Chain Survey 2013Document19 pagesPWC Global Supply Chain Survey 2013mushtaque61No ratings yet

- The Role of Customer Relationship Management in Enhancing Customer Loyalty (Body) With Capters 1,2,3Document28 pagesThe Role of Customer Relationship Management in Enhancing Customer Loyalty (Body) With Capters 1,2,3Akash MajjiNo ratings yet

- Value Creating PurchasingDocument13 pagesValue Creating Purchasingmanish.cdmaNo ratings yet

- Introduction To SCMDocument14 pagesIntroduction To SCMmridulchandraNo ratings yet

- Small and Medium Enterprises: Presented To: Prof.I.SiddiqueDocument24 pagesSmall and Medium Enterprises: Presented To: Prof.I.Siddiquemanahil_7863129No ratings yet

- The Role of Customer Relationship Management in Enhancing Customer Loyalty (Body)Document63 pagesThe Role of Customer Relationship Management in Enhancing Customer Loyalty (Body)Akash MajjiNo ratings yet

- The Role of Customer Relationship Management in Enhancing Customer Loyalty (Body)Document67 pagesThe Role of Customer Relationship Management in Enhancing Customer Loyalty (Body)Akash MajjiNo ratings yet

- The Role of Customer Relationship Management in Enhancing Customer Loyalty (Body) Without Data InterpretationDocument30 pagesThe Role of Customer Relationship Management in Enhancing Customer Loyalty (Body) Without Data InterpretationAkash MajjiNo ratings yet

- SālsLetterV3 3 PDFDocument8 pagesSālsLetterV3 3 PDFMuhammad Tariq KhanNo ratings yet

- Global Competitiveness: Role of Supply Chain Management: Prof. Shailendrakumar Uttamrao KaleDocument9 pagesGlobal Competitiveness: Role of Supply Chain Management: Prof. Shailendrakumar Uttamrao KaleSriyogi KottalaNo ratings yet

- Business Plan: Pharmaceutical Repackaging Plant FounderDocument19 pagesBusiness Plan: Pharmaceutical Repackaging Plant FounderSheroze Masood100% (1)

- Pharmaceutical Supply Chain and Inventory Management Strategies PDFDocument13 pagesPharmaceutical Supply Chain and Inventory Management Strategies PDFRizky AzizahNo ratings yet

- Supply Chain Business Startup Guide: Step-by-Step Tips for SuccessFrom EverandSupply Chain Business Startup Guide: Step-by-Step Tips for SuccessNo ratings yet

- DK2802 ch01Document64 pagesDK2802 ch01Reza JafariNo ratings yet

- Database Sector Wise NewDocument38 pagesDatabase Sector Wise NewTanmay VashishthaNo ratings yet

- Tata 100307Document17 pagesTata 100307api-3773208No ratings yet

- Drugs and Society: Instructor: Course Info: Class Times: Contact Info: Office HoursDocument5 pagesDrugs and Society: Instructor: Course Info: Class Times: Contact Info: Office HoursSam Sternfield100% (1)

- Equity Note - Active Fine Chemicals Ltd.Document3 pagesEquity Note - Active Fine Chemicals Ltd.Makame Mahmud DiptaNo ratings yet

- J K DistributorsDocument28 pagesJ K Distributorspoojaotwani611No ratings yet

- TesiDocument113 pagesTesiDimitris PlotasNo ratings yet

- 2 - Danh Sách Cơ Quan Qu N Lý Dư C Các Nư C Thu C Danh Sách Sra (7 - 2021)Document3 pages2 - Danh Sách Cơ Quan Qu N Lý Dư C Các Nư C Thu C Danh Sách Sra (7 - 2021)Huong PhamNo ratings yet

- 2014 4 15 Apr 2014 1057013171prefeasibilityofvasudhaDocument24 pages2014 4 15 Apr 2014 1057013171prefeasibilityofvasudhaNithin CherianNo ratings yet

- Final Assignment PDFDocument21 pagesFinal Assignment PDFsuruchi100% (1)

- Chapter 01Document21 pagesChapter 01Jan MarcusNo ratings yet

- Pharmaceutical IndustryDocument15 pagesPharmaceutical IndustrySri KanthNo ratings yet

- Exhibitor Name Alloted Booth: Anzen ExportsDocument5 pagesExhibitor Name Alloted Booth: Anzen ExportsRichard OrtizNo ratings yet

- Innovation in Pharma Packaging - An Update 2012 PDFDocument11 pagesInnovation in Pharma Packaging - An Update 2012 PDFmariela maldonado escobedoNo ratings yet

- Introduction To Genric DrugDocument60 pagesIntroduction To Genric Drugganesh_orcrdNo ratings yet

- Label ObatDocument421 pagesLabel ObatjeanetNo ratings yet

- Indian Pharmaceutical IndustryDocument63 pagesIndian Pharmaceutical Industryprashant gauravNo ratings yet

- Cro in SingaporeDocument41 pagesCro in SingaporeSan EeshNo ratings yet

- Business Mumbai Mba Pharma Curriculum PDFDocument4 pagesBusiness Mumbai Mba Pharma Curriculum PDFTech WizardNo ratings yet

- A Critical Analysis of Relationship Marketing in Indian Pharmaceutical IndustryDocument12 pagesA Critical Analysis of Relationship Marketing in Indian Pharmaceutical IndustryRajeev ChinnappaNo ratings yet

- Recognizing Misleading Pharmaceutical Marketing OnlineDocument8 pagesRecognizing Misleading Pharmaceutical Marketing OnlineWicked RubyNo ratings yet

- PHARMA Industry Overview PresentationDocument27 pagesPHARMA Industry Overview PresentationdishaNo ratings yet

- 21 Day ConditioningDocument3 pages21 Day Conditioningreymondmaestrado60No ratings yet

- Ag Listing 05oct2023Document98 pagesAg Listing 05oct2023kiranduggarajuNo ratings yet

- Hatch Waxman Act and Generic Drugs PDFDocument6 pagesHatch Waxman Act and Generic Drugs PDFGaming ViperNo ratings yet

- Dedicated To Life, Healing & Recovery: Product ListDocument4 pagesDedicated To Life, Healing & Recovery: Product ListsyedsajjadaliNo ratings yet

- Restructuring: Business Strategy Project ReportDocument34 pagesRestructuring: Business Strategy Project ReportefgkNo ratings yet

- Day 1Document9 pagesDay 1Anil SoniNo ratings yet