Professional Documents

Culture Documents

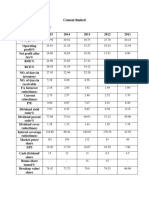

Particulars Mar 2013 Mar 2012 Mar 2011 Mar 2010 Mar 2009: Operational & Financial Ratios

Uploaded by

khushma8Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Particulars Mar 2013 Mar 2012 Mar 2011 Mar 2010 Mar 2009: Operational & Financial Ratios

Uploaded by

khushma8Copyright:

Available Formats

Particulars

Mar 2013

Mar 2012

Earnings Per Share (Rs)

0.98

-8.12

CEPS(Rs)

3.75

DPS(Rs)

Mar 2011

Mar 2010

Mar 2009

4.70

3.23

9.74

-5.62

6.99

5.13

3.29

0.00

0.00

0.32

0.30

1.50

26.06

25.08

33.20

28.87

129.81

-38.98

23.75

31.13

32.04

31.99

Core EBITDA Margin(%)

1.30

-0.37

3.41

3.44

3.31

EBIT Margin(%)

3.42

0.14

3.65

3.63

3.28

Pre Tax Margin(%)

0.16

-2.16

1.98

2.22

1.38

PAT Margin (%)

0.22

-1.65

1.36

1.51

0.94

Cash Profit Margin (%)

0.84

-1.14

2.03

2.40

1.59

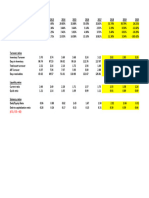

ROA(%)

0.43

-4.29

4.45

3.96

3.07

ROE(%)

3.83

-27.87

15.14

11.77

9.60

11.52

0.60

19.29

16.35

17.85

1.97

2.61

3.26

2.63

3.27

11.94

14.16

10.75

8.92

12.63

-384.84

-579.89

24.10

7.47

9.96

0.08

0.07

0.09

0.11

0.08

Receivable days

21.22

22.19

22.48

17.56

11.67

Inventory Days

33.42

29.66

41.85

56.83

47.67

Payable days

73.15

50.34

24.46

15.82

14.97

PER(x)

19.75

0.00

21.39

20.13

4.18

PCE(x)

5.16

-13.85

14.38

12.67

12.37

Price/Book(x)

0.74

3.11

3.03

2.25

1.57

Yield(%)

0.00

0.00

0.32

0.46

0.74

EV/Net Sales(x)

0.09

0.18

0.40

0.41

0.24

Operational & Financial Ratios

Book NAV/Share(Rs)

Tax Rate(%)

Margin Ratios

Performance Ratios

ROCE(%)

Asset Turnover(x)

Sales/Fixed Asset(x)

Working Capital/Sales(x)

Efficiency Ratios

Fixed Capital/Sales(x)

Valuation Parameters

EV/Core EBITDA(x)

2.14

28.27

9.29

9.17

6.21

EV/EBIT(x)

2.53

129.52

10.99

11.42

7.45

EV/CE(x)

0.20

0.34

1.19

0.93

0.75

M Cap / Sales

0.04

0.16

0.29

0.30

0.20

-9.19

43.01

61.07

3.10

33.20

467.40

-78.53

53.81

18.59

-23.60

2101.87

-94.46

62.02

14.10

-30.16

PAT Growth(%)

112.07

-272.77

45.66

65.70

-53.27

EPS Growth(%)

112.07

-272.78

45.66

-66.86

-65.95

Total Debt/Equity(x)

3.27

5.18

1.33

0.84

0.61

Current Ratio(x)

0.99

1.00

1.19

1.71

1.86

Quick Ratio(x)

0.76

0.81

0.70

0.65

0.88

Interest Cover(x)

1.05

0.06

2.19

2.58

1.73

Total Debt/Mcap(x)

4.40

1.67

0.44

0.37

1.95

Growth Ratio

Net Sales Growth(%)

Core EBITDA Growth(%)

EBIT Growth(%)

Financial Stability Ratios

You might also like

- Larsen & Toubro: Deepak KhandelwalDocument19 pagesLarsen & Toubro: Deepak KhandelwaldeepakashwaniNo ratings yet

- Ratios: Mar ' 12 Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08Document5 pagesRatios: Mar ' 12 Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08Prajapati HiteshNo ratings yet

- Particulars Operational & Financial Ratios Mar 2014 Mar 2013 Jun 2012Document4 pagesParticulars Operational & Financial Ratios Mar 2014 Mar 2013 Jun 2012saboorakheeNo ratings yet

- HCN Total Hedge Fund Index 1109Document1 pageHCN Total Hedge Fund Index 1109nicco7No ratings yet

- Valuation Ratio: Mar 2009 Mar 2008 Mar 2007 MarDocument4 pagesValuation Ratio: Mar 2009 Mar 2008 Mar 2007 MarDeepak RehalNo ratings yet

- Attock Cement LimitedDocument9 pagesAttock Cement Limitedmuhammad farhanNo ratings yet

- MarutiDocument2 pagesMarutiVishal BhanushaliNo ratings yet

- All RatiosDocument6 pagesAll RatiosAkshat JainNo ratings yet

- Simple ScreeningDocument2 pagesSimple ScreeningJeffry KurniadiNo ratings yet

- Ratio Analysis of Suzlon EnergyDocument3 pagesRatio Analysis of Suzlon EnergyBharat RajputNo ratings yet

- My Research - Hindustan Tin WorksDocument17 pagesMy Research - Hindustan Tin Worksranjan.duttaNo ratings yet

- Sawmi Vivekananda Life and WorkDocument6 pagesSawmi Vivekananda Life and WorkChetan NagarNo ratings yet

- BNL Stores - Solution - RatiosDocument1 pageBNL Stores - Solution - RatiosShareceNo ratings yet

- Consolidated Key Financial Ratios of Hindalco IndustriesDocument3 pagesConsolidated Key Financial Ratios of Hindalco IndustriesManav JhaveriNo ratings yet

- Adlabs InfoDocument3 pagesAdlabs InfovineetjogalekarNo ratings yet

- Suven Life ScieDocument12 pagesSuven Life Sciejitendrasutar1975No ratings yet

- RatiosDocument2 pagesRatiosKishan KeshavNo ratings yet

- Tvs MotorDocument6 pagesTvs MotortusharbwNo ratings yet

- Accounts - ComparisonDocument24 pagesAccounts - ComparisonNirav HariaNo ratings yet

- Per Share RatiosDocument3 pagesPer Share RatiosRuchy SinghNo ratings yet

- FedEx (FDX) Financial Ratios and Metrics - Stock AnalysisDocument2 pagesFedEx (FDX) Financial Ratios and Metrics - Stock AnalysisPilly PhamNo ratings yet

- Berger Paints RatiosDocument1 pageBerger Paints RatiosDeepNo ratings yet

- Covid DataDocument4 pagesCovid DataBangur Palash KamalkishorNo ratings yet

- Industry: Finance - Small: Print CloseDocument1 pageIndustry: Finance - Small: Print Closeaaron chenNo ratings yet

- ProjectDocument14 pagesProjectSameer BhattaraiNo ratings yet

- Acen VDocument1 pageAcen Vjerik960No ratings yet

- Investalk SharingDocument10 pagesInvestalk SharingLee Kwen YauNo ratings yet

- Gujarat Industries Power CompanyDocument17 pagesGujarat Industries Power CompanySunmeet HalkaiNo ratings yet

- SAPMDocument10 pagesSAPMNikhilNo ratings yet

- Narration Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Trailing Best Case Worst Casemukeshkumar91No ratings yet

- RatiosDocument2 pagesRatiosnishantNo ratings yet

- Technidex: Stock Futures IndexDocument3 pagesTechnidex: Stock Futures IndexRaya DuraiNo ratings yet

- Main YearDocument3 pagesMain YearKe ShuNo ratings yet

- Particulars Mar 2016 Mar 2015 Mar 2014 Mar 2013 Mar 2012: Operational & Financial RatiosDocument7 pagesParticulars Mar 2016 Mar 2015 Mar 2014 Mar 2013 Mar 2012: Operational & Financial RatiosHardik PatelNo ratings yet

- Key Financial Ratios of Tata Consultancy ServicesDocument13 pagesKey Financial Ratios of Tata Consultancy ServicesSanket KhairnarNo ratings yet

- Ace AnalyserDocument4 pagesAce AnalyserRahul MalhotraNo ratings yet

- Modern Trade Calculator + PCPM TGT Vs Ach 21-22 - West Zone Oct 21-1Document74 pagesModern Trade Calculator + PCPM TGT Vs Ach 21-22 - West Zone Oct 21-1Tejas HankareNo ratings yet

- Tata RatiosDocument1 pageTata RatiosSaurabh ChipadeNo ratings yet

- DameDocument22 pagesDameAgus SetionoNo ratings yet

- Income Statement Balance Sheet Cash Flow Ratios FCFF Eva & Roic News Analysis 1 News Analysis 2Document9 pagesIncome Statement Balance Sheet Cash Flow Ratios FCFF Eva & Roic News Analysis 1 News Analysis 2ramarao1981No ratings yet

- CBRMDocument14 pagesCBRMSurajSinghalNo ratings yet

- IdfcDocument6 pagesIdfcSonal BansalNo ratings yet

- Christ University Christ UniversityDocument3 pagesChrist University Christ Universityvijaya senthilNo ratings yet

- EXHIBITDocument5 pagesEXHIBITmelisaNo ratings yet

- RatiosDocument10 pagesRatiossakthiNo ratings yet

- Particulars Mar-11 Mar-10 Mar-09 Mar-08 Mar-07 Mar-06: Dabur IndiaDocument3 pagesParticulars Mar-11 Mar-10 Mar-09 Mar-08 Mar-07 Mar-06: Dabur IndiaPurnima PandeyNo ratings yet

- MSR IndiaDocument10 pagesMSR IndiaREYANSH ASTHANANo ratings yet

- MSR IndiaDocument10 pagesMSR IndiaREYANSH ASTHANANo ratings yet

- Finance Departrment 1Document5 pagesFinance Departrment 1Vansh RanaNo ratings yet

- Fortis HealthcareDocument3 pagesFortis HealthcareAnant ChhajedNo ratings yet

- Key Indicators 2006 2007 OperatingDocument2 pagesKey Indicators 2006 2007 OperatingUsman NasirNo ratings yet

- Balance Sheet and Ratio Analysis of ItcDocument3 pagesBalance Sheet and Ratio Analysis of ItcNiraj VishwakarmaNo ratings yet

- Goodyear Indonesia TBK.: Balance SheetDocument20 pagesGoodyear Indonesia TBK.: Balance SheetsariNo ratings yet

- Chapter Four 2 7Document12 pagesChapter Four 2 7Olasunmade Rukayat olamideNo ratings yet

- Operational & Financial Ratios 2006 2007 2008 2009 2010 2011Document6 pagesOperational & Financial Ratios 2006 2007 2008 2009 2010 2011Anant chaudhary Investing mentorNo ratings yet

- Narration Sep-08 Sep-09 Mar-08 Mar-09 Mar-10 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseDocument12 pagesNarration Sep-08 Sep-09 Mar-08 Mar-09 Mar-10 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CasegamesaalertsNo ratings yet

- Narration Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst Caseraj chopdaNo ratings yet

- Industry Median 2018 2017 2016 2015 2014 2013 2012Document10 pagesIndustry Median 2018 2017 2016 2015 2014 2013 2012AnuragNo ratings yet

- Particulars: Mar. 12 Amt. (RS.) Mar. 13 Amt. (RS.)Document4 pagesParticulars: Mar. 12 Amt. (RS.) Mar. 13 Amt. (RS.)reena MahadikNo ratings yet

- Balance SheetDocument3 pagesBalance Sheetkhushma8No ratings yet

- Session 6 PPDocument27 pagesSession 6 PPkhushma8No ratings yet

- CCCDocument1 pageCCCkhushma8No ratings yet

- Presentation 1Document5 pagesPresentation 1khushma8No ratings yet

- TrenttDocument1 pageTrenttkhushma8No ratings yet

- Qwwewthghnxsvmmayur Jhifheronmgkmdspvoierjbimemayur Harpal Arvind Nishit Sagar HemangDocument1 pageQwwewthghnxsvmmayur Jhifheronmgkmdspvoierjbimemayur Harpal Arvind Nishit Sagar Hemangkhushma8No ratings yet

- TrenttDocument1 pageTrenttkhushma8No ratings yet