Professional Documents

Culture Documents

Payback

Payback

Uploaded by

ssregens82Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payback

Payback

Uploaded by

ssregens82Copyright:

Available Formats

AMIS 525

Payback Evaluation of Operating Investments

EVALUATION OF PAYBACK METHOD

4.00%

interest rate

0

1

2

3

4

5

6

7

8

9

10

payback (P)

sum of flows (SF)

PV

NPV

A

($6,000)

$1,000

$1,000

$1,000

$1,000

$1,000

$1,000

$1,000

$1,000

$1,000

$1,000

6.00

$4,000.00

$8,110.90

$2,110.90

Note: change to 15% and notice NPV

B

($6,000)

$5,000

$200

$200

$200

$200

$200

$1,000

$1,000

$1,000

$1,000

6.00

$4,000.00

$8,532.57

$2,532.57

C

($6,000)

$200

$200

$200

$200

$200

$5,000

$1,000

$1,000

$1,000

$1,000

6.00

$4,000.00

$7,710.70

$1,710.70

D

($6,000)

$200

$200

$200

$200

$200

$5,000

$2,000

$2,000

$2,000

$2,000

E

($4,000)

$1,000

$1,000

$1,000

$1,000

$2,000

$2,000

$2,000

6.00

$8,000.00

$10,579.45

$4,579.45

4.00

$6,000.00

$8,374.21

$4,374.21

F

($4,000)

$1,600

$1,600

$1,600

$1,600

2.50

$2,400.00

$5,807.83

$1,807.83

notice that SFB = SFC but NPVB always > NPVC

notice that SFD > SFB but NPVD not always > NPVB

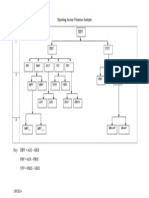

PAIRWISE COMPARISONS AND DOMINANCE

0

1

2

3

4

5

payback

sum of flows

PV

NPV

W

($1,000)

$1,000

$1,000

$1,000

$1,000

$1,000

1.00

$4,000.00

$4,451.82

$3,451.82

X

($1,000)

$1,000

$500

$1,000

$1,000

$1,500

1.00

$4,000.00

$4,400.51

$3,400.51

W-X

$0

$0

$500

$0

$0

($500)

$0.00

$51.31

$51.31

Y

($500)

$200

$200

$400

$200

$300

Z

($500)

$400

$200

$200

$200

$200

4.00

4.00

$800.00

$700.00

$1,150.36 $1,082.67

$650.36

$582.67

Y-Z

$0

($200)

$0

$200

$0

$100

$100.00

$67.68

$67.68

note: NPVW > NPVX for any ir > 0

but NPVY may be > or < NPVZ depending on the ir

1/9/2014

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 1 BowersoxDocument38 pagesChapter 1 Bowersoxssregens82100% (1)

- Orchestro State Inventory Management 2015Document8 pagesOrchestro State Inventory Management 2015ssregens82No ratings yet

- Building Multi-Tier Web Applications in Virtual EnvironmentsDocument30 pagesBuilding Multi-Tier Web Applications in Virtual Environmentsssregens82No ratings yet

- Risk and Rates of Return: Learning ObjectivesDocument36 pagesRisk and Rates of Return: Learning Objectivesssregens82No ratings yet

- CHP 3Document2 pagesCHP 3ssregens82No ratings yet

- Judicial Power of Supreme CourtDocument2 pagesJudicial Power of Supreme Courtssregens82No ratings yet

- Supplier General QualificationsDocument3 pagesSupplier General Qualificationsssregens82No ratings yet

- Lussier 3 Ech 05Document50 pagesLussier 3 Ech 05ssregens82No ratings yet

- Transportation and Logistics OptimizationDocument18 pagesTransportation and Logistics Optimizationssregens82No ratings yet

- Static Picture Effects For Powerpoint Slides: Reproductio N Instructions Printing Instructions Removing InstructionsDocument17 pagesStatic Picture Effects For Powerpoint Slides: Reproductio N Instructions Printing Instructions Removing Instructionsssregens82No ratings yet

- AMIS 525 Pop Quiz - Chapters 22 and 23Document5 pagesAMIS 525 Pop Quiz - Chapters 22 and 23ssregens82No ratings yet

- Problems, Problem Spaces and Search: Dr. Suthikshn KumarDocument47 pagesProblems, Problem Spaces and Search: Dr. Suthikshn Kumarssregens82No ratings yet

- Time Value PracticeDocument1 pageTime Value Practicessregens82No ratings yet

- Week 8 AssignmentDocument5 pagesWeek 8 Assignmentssregens82100% (2)

- V Ac - SC V (Aa Ar) - (Sa SR) V (Aa Ar) - (Aa SR) + (Aa SR) - (Sa SR) V ( (Aa Ar) - (Aa SR) ) + ( (Aa SR) - (Sa SR) )Document1 pageV Ac - SC V (Aa Ar) - (Sa SR) V (Aa Ar) - (Aa SR) + (Aa SR) - (Sa SR) V ( (Aa Ar) - (Aa SR) ) + ( (Aa SR) - (Sa SR) )ssregens82No ratings yet

- Vcost DemoDocument2 pagesVcost Demossregens82No ratings yet

- Ri RoiDocument1 pageRi Roissregens82No ratings yet

- TPRICEDocument1 pageTPRICEssregens82No ratings yet

- I (P Q) - (V Q) - F: The Fundamental EquationDocument1 pageI (P Q) - (V Q) - F: The Fundamental Equationssregens82No ratings yet

- Regular Flow Irregular Flow Irregular Flow DepreciationDocument1 pageRegular Flow Irregular Flow Irregular Flow Depreciationssregens82No ratings yet

- Signs For Income VarianceDocument1 pageSigns For Income Variancessregens82No ratings yet

- Process StepsDocument1 pageProcess Stepsssregens82No ratings yet

- Total For 5 Years Each YearDocument1 pageTotal For 5 Years Each Yearssregens82No ratings yet

- Operating Income Variances DiagramDocument1 pageOperating Income Variances Diagramssregens82No ratings yet

- Percent DoneDocument1 pagePercent Donessregens82No ratings yet