Professional Documents

Culture Documents

Proj Flow

Proj Flow

Uploaded by

ssregens82Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Proj Flow

Proj Flow

Uploaded by

ssregens82Copyright:

Available Formats

AMIS 525 example:

Long-run Project Evaluation four year project

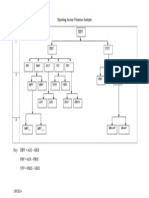

SIMPLE INVESTMENT MODEL [ANNUITY FLOWS] C = cost F = operating flow regular t annual flow 0 - C0 1 +F 2 +F 3 +F 4 +F SIMPLE INVESTMENT MODEL [NOT ANNUITY FLOWS] C = cost F = operating flow regular t annual flow 0 - C0 1 + F1 2 + F2 3 + F3 4 + F4 COMPLEX INVESTMENT MODEL [ANNUITY FLOWS] irregular one-time flows: working capital (WC), maintenance (M), and salvage value (SV) C = cost F = operating flow

regular irregular t annual flow one-time flow 0 - C0 - WC0 1 +F 2 3 4 +F +F +F + SV4 + WC4 evaluate as an annuity evaluate as single amounts - M2

all flows - C0 - WC0 +F +F - M2 +F +F + SV4 + WC4

COMPLEX INVESTMENT MODEL [NOT ANNUITY FLOWS] irregular one-time flows: working capital (WC), maintenance (M), and salvage value (SV) C = cost F = operating flow all flows combined

A0 A1

regular irregular t annual flow one-time flow 0 - C0 - WC0 1 + F1 2 3 4 + F2 + F3 + F4 + SV4 + WC4 - M2

all flows - C0 - WC0 + F1 + F2 - M2 + F3 + F4 + SV4 + WC4

A2 A3

A4

evaluate as single amounts

1/9/2014

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 1 BowersoxDocument38 pagesChapter 1 Bowersoxssregens82100% (1)

- Orchestro State Inventory Management 2015Document8 pagesOrchestro State Inventory Management 2015ssregens82No ratings yet

- Risk and Rates of Return: Learning ObjectivesDocument36 pagesRisk and Rates of Return: Learning Objectivesssregens82No ratings yet

- Judicial Power of Supreme CourtDocument2 pagesJudicial Power of Supreme Courtssregens82No ratings yet

- Building Multi-Tier Web Applications in Virtual EnvironmentsDocument30 pagesBuilding Multi-Tier Web Applications in Virtual Environmentsssregens82No ratings yet

- Vcost DemoDocument2 pagesVcost Demossregens82No ratings yet

- Lussier 3 Ech 05Document50 pagesLussier 3 Ech 05ssregens82No ratings yet

- Static Picture Effects For Powerpoint Slides: Reproductio N Instructions Printing Instructions Removing InstructionsDocument17 pagesStatic Picture Effects For Powerpoint Slides: Reproductio N Instructions Printing Instructions Removing Instructionsssregens82No ratings yet

- AMIS 525 Pop Quiz - Chapters 22 and 23Document5 pagesAMIS 525 Pop Quiz - Chapters 22 and 23ssregens82No ratings yet

- CHP 3Document2 pagesCHP 3ssregens82No ratings yet

- Week 8 AssignmentDocument5 pagesWeek 8 Assignmentssregens82100% (2)

- Problems, Problem Spaces and Search: Dr. Suthikshn KumarDocument47 pagesProblems, Problem Spaces and Search: Dr. Suthikshn Kumarssregens82No ratings yet

- Supplier General QualificationsDocument3 pagesSupplier General Qualificationsssregens82No ratings yet

- Transportation and Logistics OptimizationDocument18 pagesTransportation and Logistics Optimizationssregens82No ratings yet

- I (P Q) - (V Q) - F: The Fundamental EquationDocument1 pageI (P Q) - (V Q) - F: The Fundamental Equationssregens82No ratings yet

- Ri RoiDocument1 pageRi Roissregens82No ratings yet

- V Ac - SC V (Aa Ar) - (Sa SR) V (Aa Ar) - (Aa SR) + (Aa SR) - (Sa SR) V ( (Aa Ar) - (Aa SR) ) + ( (Aa SR) - (Sa SR) )Document1 pageV Ac - SC V (Aa Ar) - (Sa SR) V (Aa Ar) - (Aa SR) + (Aa SR) - (Sa SR) V ( (Aa Ar) - (Aa SR) ) + ( (Aa SR) - (Sa SR) )ssregens82No ratings yet

- Signs For Income VarianceDocument1 pageSigns For Income Variancessregens82No ratings yet

- Time Value PracticeDocument1 pageTime Value Practicessregens82No ratings yet

- TPRICEDocument1 pageTPRICEssregens82No ratings yet

- Regular Flow Irregular Flow Irregular Flow DepreciationDocument1 pageRegular Flow Irregular Flow Irregular Flow Depreciationssregens82No ratings yet

- Total For 5 Years Each YearDocument1 pageTotal For 5 Years Each Yearssregens82No ratings yet

- Process StepsDocument1 pageProcess Stepsssregens82No ratings yet

- Percent DoneDocument1 pagePercent Donessregens82No ratings yet

- Operating Income Variances DiagramDocument1 pageOperating Income Variances Diagramssregens82No ratings yet