Professional Documents

Culture Documents

Birchmarketupdate 121013

Uploaded by

api-245069443Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Birchmarketupdate 121013

Uploaded by

api-245069443Copyright:

Available Formats

Avg Ratio; Sales Price/Tax Value

Cnty Avg Zebulon WF Wendell Wake Cnty Ro'ville Raleigh M'ville K'dale H'Springs Garner FV Cary Apex Angier 78% 80% 82% 84% 89% 86% 88% 92% 90% 87% 91% 97% 97% 88% 90% 92% 94% 96% 98% 100% 94% 96% 95% 93% 91%

85% 86%

Avg Sales Price

Cnty Avg Zebulon WF Wendell Wake Cnty Ro'ville Raleigh M'ville K'dale H'Springs Garner FV Cary Apex Angier

$0 $50,000 $259,872 $141,858 $263,772 $127,252 $296,193 $293,880 $240,241 $268,981 $181,417 $277,263 $167,437 $209,484 $313,672 $262,725 $210,556 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000

The above graphs were developed after analysis of data provided by the Wake County Revenue Department for residential closed sales between 1/1/13 and 12/5/13. The top graph illustrates the average relationship between sales price and assessed value and the bottom graph illustrates the average sales price by ETJ within the county. Let us know if we can provide assistance for any of your valuation needs.

Stacey Peter Anfindsen stacey@staceypeter.com Robert M. Birch rmbirch@birchappraisal.com I. Douglas Deaton dougdeaton@msn.com

2013 Stacey P. Anfindsen/S.M.A Publications, Inc.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 944 Spring Meadow Drive Floor PlanDocument1 page944 Spring Meadow Drive Floor Planapi-245069443No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Sample Offer To Purchase ContractDocument12 pagesSample Offer To Purchase Contractapi-245069443No ratings yet

- Floor PlanDocument1 pageFloor Planapi-245069443No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Floor Plan WatereeDocument2 pagesFloor Plan Watereeapi-245069443No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- 2529 Diamondhitch Trail Floor PlanDocument2 pages2529 Diamondhitch Trail Floor Planapi-245069443No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- 103 Kurtner Court Floor PlanDocument2 pages103 Kurtner Court Floor Planapi-245069443No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Working With Re AgentsDocument4 pagesWorking With Re Agentsapi-245069443No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

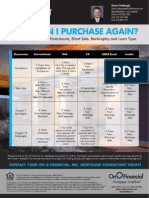

- On Q Borrower Waiting Period 3-25Document1 pageOn Q Borrower Waiting Period 3-25api-245069443No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 203 Spencor Mill Road Floor PlanDocument2 pages203 Spencor Mill Road Floor Planapi-245069443No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Q Dos and Donts - 3-25Document1 pageOn Q Dos and Donts - 3-25api-245069443No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- 500 Dogwood Creek Place Floor PlanDocument2 pages500 Dogwood Creek Place Floor Planapi-245069443No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- NewsletterDocument2 pagesNewsletterapi-245069443No ratings yet

- 1827 Milan Street Floor PlanDocument1 page1827 Milan Street Floor Planapi-245069443No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- NewsletterDocument2 pagesNewsletterapi-245069443No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Miwd Customer Assurance Warranty - 6-4-13Document2 pagesMiwd Customer Assurance Warranty - 6-4-13api-245069443No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)