Professional Documents

Culture Documents

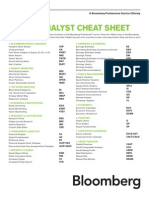

Bloomberg Cheat Sheets

Uploaded by

user121821Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bloomberg Cheat Sheets

Uploaded by

user121821Copyright:

Available Formats

John Poehling

Forty-Four Bloomberg Cheat Sheets

December 13, 2008

< S T R AT E G I E S >

October 2004

C H E AT S H E E T

Asset-Backed Securities

YT <Go> lets you analyze price and yield relationships for a specific security under various prepayment assumptions. CLP <Go> provides statistics about the collateral of a selected MBS. PDI <Go> provides monthly historical paydown information for a selected CMO. APX <Go> displays a menu of functions for analyzing to-be-announced MBS issues.

MCAL <Go> displays a menu of new issue calendars for asset-backed securities, collateralized mortgage obligations and commercial-mortgage-backed securities.

DV <Go> lets you create custom prepayment scenario vectors, which you can use to analyze MBSs.

CMOR <Go> provides a menu of functions for analyzing CMOs, ABSs and CMBSs.

RA <Go> calculates the total return from holding a selected MBS versus selling or refinancing the security and investing the proceeds.

CCR <Go> displays monthly performance reports on credit cardbacked securities.

CAMP <Go> displays outstanding balances and new issuance and pay-down

ICMO <Go> displays data on CMO issuance.

WALG <Go> graphs the weighted average life and principal payments of a selected MBS or ABS under various prepayment speed assumptions.

IABS <Go> displays data on ABS issuance.

amounts for the CMO and ABS markets in different time periods.

MYS <Go> lets you compare spreads between to-be-announced securities and U.S. Treasury benchmarks.

ICMB <Go> displays data on CMBS issuance.

SPA <Go> lets you see a bonds cash flow priority level within a selected CMO or ABS issue.

POOL <Go> lists functions that let you find information on pools of mortgagebacked securities.

BMMI <Go> provides MBS prepayment reports and performance statistics for ABS issues.

CLC <Go> displays the composition of a selected CMOs collateral at issuance.

CMO <Go> lists CMO and ABS ticker symbols alphabetically by issuer name.

Compiled by DIRK VERMEHREN and MARY K. WOOD dvermehren@bloomberg.net mwood@bloomberg.net

TBA <Go> monitors prices for to-beannounced generic agency MBS issues.

PPST <Go> provides statistics about prepayments on MBSs.

SNIP AND SAVE

For assistance in using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

CHEAT SHEET

Bankruptcy Analysis

BLAW <Go>

displays the main menu of legal, regulatory and compliance information.

BKRG <Go>

CMOV <Go>

RSKC <Go>

lets you access a guide to performing legal research on bankruptcy using the Bloomberg Professional service.

BLBK <Go>

ranks the best- and worst-performing creditdefault swaps, which are financial instruments based on bonds and loans that are used to speculate on a companys ability to repay debt.

BNKF <Go> DDIS <Go>

displays a snapshot of risk data for a selected company and a peer.

ECCG <Go>

displays bankruptcy-related corporate actions for a selected list of securities.

RATC <Go>

lets you display data on the maturity and amount of a selected companys debt.

LPRF <Go>

lets you compare credit indicators for a selected security by graphing implied volatilities, five-year CDS spreads and stock prices.

CRPR <Go>

displays a menu of functions and legal information related to corporate bankruptcy.

USBK <Go>

monitors credit rating changes and lets you filter them using various criteria.

RATD <Go>

lists current and historical legal counsel information for a selected company.

displays current and historical credit ratings for a selected company.

lets you access dockets, opinions and rules for U.S. bankruptcy courts by state.

BALR <Go>

DIS <Go>

provides credit rating scales and definitions for various rating firms.

WCDS <Go>

lists bonds that traded at least 10 percent above a benchmark in the past five days, according to the Trade Reporting and Compliance Engine.

offers a menu of bankruptcyrelated law report summaries.

BBLS <Go>

monitors current values of and changes to CDS spreads around the world.

NI BCY <Go>

lets you search for legal documents by citation, text, source and date and set alerts that can notify you of bankruptcy filings.

BLMR <Go>

lists headlines of news stories on bankruptcy.

NI CREDITDN <Go>

lists headlines of news stories on credit rating downgrades.

ANR <Go>

AGGD <Go>

NI CDRV <Go>

displays a list of the top holders of a selected com panys debt.

HDS <Go>

lists headlines of news stories on credit derivatives.

DISS <Go>

ranks legal documents by readership.

BKLB <Go>

displays analysts recommendations, price targets and a consensus rating for a selected company.

lets you search for the institutional and insider holders of a selected security.

displays a menu of distressed debt news, research and company searches.

displays a menu of bankruptcy-related blogs.

Compiled by JO BUCKLEY

PULL OUT AND SAVE JUNE 2008 Press <Help> twice to send a question to the Bloomberg Analytics help desk.

February 2002

CHEAT SHEET Bond Portfolios

Snip-and-save tips on fixed-income analytics and bond portfolio management

SRCH <Go>

is the Bond Search function. SRCH helps you find bonds based on your specified criteria. You can also type LSRC <Go> for the Loan Search function. lets you track new security issuance. NIM also lets you create custom monitors to follow fixed-income new issues by product type and geographic area. accesses the Fair Market Curves function, which lets you analyze a wide variety of sector yield curves. Type <Corp> FMC <Go> and <Muni> FMC <Go> to compare yields across sectors and rating classes. is a menu of international yield curves and curve analytics. is a customizable calendar of economic, government and industry events and reports that may affect security and portfolio values. is the World Bond Markets function. WB lists price and yield information for global benchmark bond issues. Type 93 <Go> for live yield curves. is the Ranked Returns: Bond Indices function, which ranks the performance of bond indexes over a specified time period. can be used to access live, executable pricing and to enter an electronic trade for a particular bond. BBT lists the most-active government bond issues from a selected country. Type QBBT <Go> for additional information. lets you access executable U.S. and European government bond and interest rate swap prices from Cantor Fitzgerald. shows rating revisions by rating type, rating agency, industry and issuer. lets you paper trade to see how adding or subtracting securities would affect your portfolios characteristics and potential performance. You must first create or select a portfolio before running the function. is the Portfolio Value-at-Risk Report function. PVAR measures the maximum potential loss in a portfolio for a specified time period and the probability that the maximum loss will occur. You must first create or select a portfolio before running the function. can be used to determine the fair value of a bond based on the price of similar issues. To run BFV and the rest of the functions listed below, you must first type a security ticker and press the appropriate yellow key. shows the Yield & Spread Analysis screen. YAS summarizes a bonds descriptive, price, yield, spread and hedging information on one screen. Type YASD <Go> to change the default values for the YAS screen. shows the historical performance of a bond relative to a benchmark security. is the Issuer Information function, which summarizes the financial health and operations of an issuer so you can evaluate its ability to repay its debt. displays the size and maturity distribution of a companys outstanding public debt.

NIM <Go>

FMC <Go>

IYC <Go> EVNT <Go>

WB <Go>

WBIS <Go>

BBT <Go>

CNTR <Go>

RATC <Go> PSH <Go>

PVAR <Go>

BFV <Go>

YAS <Go>

RV <Go>

C AT H A R I N E B E N N E T T

ISSD <Go>

DDIS <Go>

S N I P A N D SAV E

F o r a s s i st a n c e i n u s i n g t h e B l o o m b e r g P r ofe s s i o n a l s e r v i c e , p r e s s < H e l p > t w i c e .

CHEAT SHEET

Credit Derivatives

CHSA <Go> CDST <Go>

displays historical analysis of credit-default-swap switch strategies, which typically buy one tenor and sell another.

VCDS <Go>

lets you value a tranche of a synthetic collateralizeddebt obligation.

CINS <Go>

CDSW <Go>

RSKC <Go>

lets you value a selected bond from CDS spreads.

SWDF <Go>

lets you search for CDS indexes that include a selected constituent.

CDSL <Go>

lets you create and value single-name and index CDSs and CDSs on loans.

CDXI <Go>

displays a snapshot of risk for a selected company.

GCDS <Go>

lets you graph historical CDS spreads for a selected list of reference entities.

IRSM <Go>

lets you access quotes for CDS indexes and tranches.

CMA <Go>

lets you set swap defaults.

lets you display lists of credit derivatives.

CXEV <Go>

monitors CDS spreads and stock trading for a selected list of securities.

lets you access credit derivative data from CMA DataVision.

CMOV <Go>

displays a menu of functions you can use to analyze interest-rate swaps and credit derivatives.

HGCS <Go>

lets you analyze single-name CDS curve trades.

MEMC <Go>

ranks the best- and worst-performing CDSs for a selected sector, country or currency.

FCDS <Go>

displays a list of reference names that are included in a selected CDS index.

REDL <Go>

lets you value a selected CDS future that trades on Eurex.

FWCS <Go>

BANK <Go>

CDSH <Go>

lets you analyze implied forward CDS curves for a selected security.

HG <Go>

displays reference entity data from derivatives data provider Markit Group Ltd.

ECCG <Go>

lets you monitor CDS spreads and stock prices for selected global banks and brokers.

CDOT <Go>

lets you graph historical CDS spreads for selected reference entities.

CDSO <Go>

lets you analyze various hedge strategies.

NI CDRV <Go>

lets you graph option vola tility, CDS spreads and stock prices for a selected company.

SWPM <Go>

displays quotes and correlation data for CDS index tranches.

CDSD <Go>

lets you value options on CDS indexes or single-name CDSs.

CDSI <Go>

displays lists of CDS indexes.

lets you search and display news stories, research reports and multimedia presentations on credit derivatives.

WCDS <Go>

lets you create, value and update interest-rate swaps and other derivatives.

Compiled by KHADI GODINg

lets you set price source and custom curve defaults for valuing CDSs.

monitors CDS spreads.

PULL OUT AND SAVE SEPTEMBER 2008 Press <Help> twice to send a question to the Bloomberg Analytics help desk.

CHEAT SHEET

Charting Shortcuts

You can use the following shortcuts, or tails, with charting and technical analysis functions such as BOLL, GPO, MACD, RSI and GP, as shown here.

GP D <Go> GP VOL <Go>

displays a price line chart with volume.

GP NOV <Go>

displays a price line chart without volume.

displays a daily price line chart.

GP W <Go>

GP M <Go>

GP E <Go>

displays a monthly price line chart.

GP MC <Go>

displays a price line chart with event icons.

displays a weekly price line chart.

GP WC <Go>

displays a weekly price line chart that includesdata for the current week.

HS <Go>

displays a monthly priceline chart that includesdata for the current month.

GP Y <Go>

displays a yearly price line chart.

SGE <Go> GRE <Go> YRH <Go>

displays two price series, the spread between them, a summary table and a histogram.

HSN <Go>

displays the price-earnings ratios for two instruments and the spread between them.

GR <Go>

displays price-earnings ratios for two stocks and the ratio of one P/E to the other.

VBAR <Go>

displays two price series normalized to 100, the spread between them, a summary table and a histogram.

HSE <Go>

displays two price series and the ratio of one to the other.

GRT <Go>

displays a bar chart with volume-at-price distribution along each price bar.

BETA <Go>

performs regression analysis for any instrument against another for two separate periods in yield terms and determines a hedge amount for the independent security.

IVAT <Go>

displays the price-earnings ratio for two securities, the spread between them, a summary table and a histogram.

SGP <Go>

displays two price series, the ratio of one to the other,a summary table andahistogram.

GRY <Go>

performs regression analysis for an equity and an index, measuring the sensitivity of one to a change in the other during a selected period.

PRH <Go>

displays an intraday chart with volume histogram, average volume at time and accumulated volume for the day versus its average for the same period.

IGPO VWAP <Go>

displays two yield series and the ratio of one to the other.

GRYT <Go>

displays two price series and the spread between them.

SGY <Go>

displays two yield series and the spread between them.

displays two yield series, the ratio of one to the other, a summary table and a histogram.

performs regression analysis for any instrument against another for two separate periods and determines a hedge amount for the independent security.

displays an intraday chart with volume-weighted average price overlaid on the price chart.

Compiled by TOM SCHNEIDER

PULL OUT AND SAVE MAY 2008 Press <Help> twice to send a question to the Bloomberg Analytics help desk.

< S T R AT E G I E S >

January 2007

Cheat Sheet

Commodities

NRG <Go> displays a menu of energy pricing functions as well as energy-related news, statistics and commentary. METL <Go> monitors spot and futures contract prices for metals. ETOP <Go> displays headlines of top energy-related news stories. CHME <Go> provides a menu of data for analyzing steel markets in China. LME <Go> displays the prices of base metals, including copper, nickel and zinc, that are traded on the London Metal Exchange.

AGRS <Go> displays the main menu of functions and data for analyzing agricultural commodities.

MINE <Go> displays a menu of metals price monitors and mining-related data and news.

ENST <Go> displays a menu of international energy statistics.

NRGA <Go> lists energy-related assets for a selected company.

CMDS <Go> monitors commodity futures prices for a selected region.

ESSC <Go> calculates the spark spread, which is the difference between the cost of fuel and the price of electricity

NSRC <Go> lets you create custom searches for energy assets such as power plants or refineries.

CRUD <Go> provides access to price monitors for crude oil. taking efficiency and the cost of emissions credits into account, for European power producers.

PTCH <Go> displays a menu of price monitors for petrochemicals.

BSHI <Go> displays a menu of functions related to shipping, including freight rates and fixtures, which are daily agreements to charter ships.

CTM <Go> provides a menu of futures contracts by type.

SPRK <Go> lists regional spark-spread monitors and lets you access calculator functions.

CRR <Go> ranks the returns of commodity futures contracts during a selected time period.

CCRV <Go> enables you to see commodity forward curves, which reflect expectations about future prices.

VOLT <Go> displays a menu of functions for analyzing electricity markets.

CPF <Go> displays analyst price forecasts for commodities.

NATG <Go> displays a menu of natural gas related functions.

Compiled by JON ASMUNDSSON

WEAD <Go> displays a menu of weather data.

SNIP AND SAVE

To ask q uest ions about using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

< S T R AT E G I E S >

June 2007

Cheat Sheet

Company Earnings

EE <Go> provides a menu of earnings estimates and analyticsas well as earnings projections from third-party contributorsfor a selected company. ERN <Go> displays a summary of earnings-per-share data for a selected company. WPE <Go> displays stock price ratios and dividend yields of global benchmark equity indexes.

EEO <Go> displays consensus estimates for 18 financial measures and six valuation ratios for a selected company.

SURP <Go> lets you track earnings or revenue surprises for a selected company.

SPXE <Go> enables you to track quarterly earnings for sectors in the Standard & Poors 500 Index.

EEA <Go> displays earnings and revenue consensus estimatesor estimates from a specific brokerfor a selected company.

EEB <Go> displays details of the consensus estimate for a selected financial measure, including a chart plotting

EERM <Go> lets you monitor revisions to earnings estimates for a selected company or group of companies.

GE <Go> lets you graph stock price and valuation ratios for a selected company during a specified period.

PEBD <Go> graphs a selected companys stock price against bands representing historical high and low priceearnings ratios. the consensus over time, along with a list of the broker estimates that make up the consensus.

ACDR <Go> displays actual and estimated earnings and announcement dates for companies in a selected region or country.

GRE <Go> graphs the ratio of the historical P/Es for two selected companies.

EM <Go> displays a matrix that enables you to compare actual financial data with estimates for a selected company.

NI EST <Go> lists headlines for news stories related to earnings estimates.

EEG <Go> graphs a selected companys stock price against estimates for a selected financial measure.

GUID <Go> displays earnings guidance for a selected company whose stock is included in the Russell 3000 Index.

BQ <Go> displays an overview of stock price and trade data, fundamental information and news for a selected company.

RV <Go> enables you to compare the performance of a selected company with other companies in its industry or sector.

SNIP AND SAVE

BBEA <Go> displays a menu of regional and topic categories for accessing earnings-related news.

Compiled by JOHN RUSSELL

Press <Hel p> tw ice to send a q uest ion to the Bloomberg Analyt ics hel p desk.

July 2006

Cheat Sheet

Credit Analysis

ASW <Go> enables you to structure and value asset swaps so you can hedge and swap cash flows for a selected fixed-income security. CDSW <Go> lets you create, structure, value and analyze a CDS on the issuer of a selected bond or equity. RVS <Go> graphs the historical spread of a selected bonds yield against an interpolated point on the interest rate swap curve, allowing you to identify trends and better price and structure credit default swaps.

BBT <Go> monitors prices for debt issued by sovereign governments and for interest rate swaps.

CRPR <Go> displays current and historical credit ratings for a selected bond issuer.

BTMM <Go> lets you monitor key interest rates, government debt yields and economic data releases for a selected country.

CSDR <Go> displays short- and long-term credit ratings for sovereign debt issued by a country you select.

SWDF <Go> lets you set interest rate swap pricing defaults and create custom curves.

CDSD <Go> enables you to set price source and custom curve defaults for valuing credit default swaps. You can also search for CDS curves by ticker and industry.

EDSF <Go> lets you monitor effective yields for synthetic forward rate agreements made up of strips of Eurodollar futures contracts, which

SWPM <Go> enables you to create, value and update interest rate swaps and derivatives. You can also perform risk and horizon analyses for each leg of a swap and for the entire deal.

CDSI <Go> CDSO <Go> let you display lists of CDS indexes and value options on them.

USSW <Go> monitors U.S. government and agency debt yields as well as swap rates, equity index prices, London interbank offered rates and bond futures prices. reflect expectations about interest rates on U.S. dollardenominated deposits in non-U.S. banks.

CDSM <Go> lets you create and value a notional basket default swap, create new baskets and display corresponding maturity terms.

NI CDO <Go> lists headlines for news stories related to collateralized debt obligations.

WCDS <Go> displays current values of and changes to Bloomberg Generic credit default swap spreads, which are the averages of contributed prices.

CDSN <Go> enables you to create and value an nth-to-default basket swap.

NI CDRV <Go> lists headlines for news stories on credit derivatives.

WS <Go> monitors current and historical interest rate swap rates and spreads.

Compiled by JOHN RUSSELL jorussell@bloomberg.net

SNIP AND SAVE

To ask q uest ions about using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

St rat e g i es

November 2007

Cheat Sheet

Credit Analysis

BYFC <Go> displays forecasts for government bond yields. ASW <Go> lets you structure and value asset swaps so you can hedge and swap cash flows for a selected bond. HNGB <Go> shows details on a list of outstanding bridge loans. YCRV <Go> displays bond, money market and swap fair-market yield curves you can use to make relative value comparisons. CMOV <Go> displays the best- and worstperforming CDSs for a selected sector, currency and period.

WCDS <Go> lets you monitor credit default swap spreads.

AGGD <Go> lets you search for holdings information for a selected issuer of corporate or government debt.

HG <Go> lets you hedge the credit risk and the interest rate risk of a corporate

CDSW <Go> lets you create, structure, value and analyze a CDS on the issuer of a selected bond.

CBS <Go> lets you analyze a selected bonds relative value compared with other bonds with a comparable maturity and rating and similar currency and industry classifications.

bond with a CDS and an interest rate swap or other instrument.

WB <Go> monitors current and historical world bond prices and yields.

WBF <Go> monitors active world bond futures prices and yields.

ILBE <Go> ranks inflation expectations for government bonds as measured by subtracting the yield on inflationprotected bonds from the yield on similar nominal bonds.

HSA <Go> lets you analyze curve and butterfly spread strategies on benchmark government debt and swap rates. You can also choose secu rities for a custom strategy. A butterfly trade might involve selling swap spreads at short and long maturity wings and buying at a maturity in between in the expectation that spreads at that part of the curve will widen.

VCDS <Go> lets you calculate the value of a bond based on the CDS spreads.

WS <Go> monitors current and historical interest rate swap spreads.

CRVD <Go> lets you compare the value of an issuers bonds with the value of CDSs on the issuer as reference entity.

SLIQ <Go> lets you compare the costs for various borrowers of accessing the short-term U.S. dollar cash markets.

COV <Go> shows information on the pro tections a selected bond or loan provides to investors.

snip and save

MOSB <Go> shows a list of the most actively traded bonds by volume for a selected exchange.

Compiled by david Fogel

Press <Hel p> tw ice to send a q uest ion to the Bloomberg Analyt ics hel p desk.

< S T R AT E G I E S >

July 2005

C H E AT S H E E T

Credit Risk Management

CDSW <Go> lets you create and value credit default swaps. CDSI <Go> displays a menu of CDS indexes. CDSN <Go> enables you to create and value nth-to-default basket default swaps. FA <Go> provides an overview of a selected companys income statement, balance sheet, cash flow and debt-to-equity data as well as various valuation measures and financial ratios. AZS <Go> forecasts a companys probability of entering bankruptcy within the next two years based on a mathematical formula.

CRPR <Go> displays current credit ratings from major rating firms for a selected company or security.

/ALLNEW <Corp> <Go> lists all of the credit derivatives that were created by using CDSW and CDSN that you have privileges to view.

WCDS <Go> monitors Bloomberg Generic

RATC <Go> monitors current and historical credit rating changes for a variety of issuers.

CDSM <Go> lets you value loss and notional basket default swaps using a Morgan Stanley pricing model. CDS spreads for the current trading day. CDSD <Go> lets you set the defaults for the spread curves to be used when valuing your CDSs.

DDIS <Go> displays a maturity distribution chart of a selected issuers outstanding bonds and loans.

IRSM <Go> displays a menu of functions related to interest rate and credit derivatives.

CRVD <Go> lets you gauge the relative value of an issuers Trace-eligible bonds versus a reference CDS curve. Trace is the NASDs Trade Reporting and Compliance Engine.

YCRV <Go> lets you graph bond, money market, swap and fair-market yield curves for historical and relative value comparisons.

MRKT <Go> lets you access contributor pricing sources for CDSs and other derivatives.

WB <Go> shows current price and yield data for government bond markets.

ALLQ <Go> displays current prices for a selected fixed-income security from various sources.

NI CDRV <Go> lists headlines of news stories on the credit derivatives market.

SNIP AND SAVE

YAS <Go> calculates a selected fixed-income securitys price based on yield spreads and determines risk and hedge ratios to offset interest rate risk.

G <Go> lets you create custom graphs that you can use to chart historical CDS spreads.

Compiled by MARY K. WOOD mwood@bloomberg.net

For assistance in using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

< S T R AT E G I E S >

September 2004

C H E AT S H E E T

Convertible Bonds

CBMU <Go> displays a menu of functions you can use to analyze a selected convertible security. CVMN <Go> lets you search for convertible securities based on your specified criteria. ALLQ <Go> lets you monitor current pricing for a selected convertible and certain pricing providers.

OVCV <Go> determines the fair and relative values of a selected convertible bond. OVCV also measures a bonds sensitivity to price changes in the underlying common stock.

CDSW <Go> lets you create and value a credit default swap on a selected convertible issuer.

YA <Go> computes the yield of a selected convertible.

CVS <Go> compares historical prices of a selected convertible with those of its underlying equity so that you can determine whether the security is trading at, above or below its conversion value.

CNVG <Go> graphs a selected convertibles price or yield and its underlying stocks

NI EQL <Go> displays headlines of news stories related to equity-linked securities.

TNI EQL CNI <Go> displays headlines of news stories related to new convertible issues.

DES <Go> provides an overview of a selected convertible and its issuer.

price, points premium, percentage of premium or parity price.

PELS <Go> lets you create a group of equitylinked securities from the securities in a selected portfolio.

PPCR <Go> lets you create custom convertible securities for pricing and evaluation before theyre officially structured and issued.

SRCH <Go> lets you create and save as many as 20 custom searches for fixedincome securities based on parameters you select, including coupon, maturity, country of issue and currency.

HVG <Go> graphs the historical volatility and prices or yields of a selected convertible.

NIM 5 <Go> enables you to monitor new equity-linked-bond offerings.

ASW <Go> lets you structure and value asset swaps for a selected convertible.

CDSD <Go> lets you find credit default swap spreads for specific convertible issuers and set up custom curve defaults for valuing CDSs.

CSDF <Go> lets you customize the calculation settings used by default to analyze a selected convertible.

CRPR <Go> displays current and historical credit ratings from major rating agencies for a specific issuer or security.

Compiled by DIRK VERMEHREN and MARY K. WOOD

dvermehren@bloomberg.net mwood@bloomberg.net

SNIP AND SAVE

For assistance in using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

CHEAT SHEET

Economics Watch

ECO <Go>

lets you monitor and set alerts for economic releases.

FED <Go>

ECOW <Go>

WPU <Go>

displays a comprehensive list of economic data from the trailing 13 months for a selected country or region.

BPGC <Go> TAYL <Go>

displays global population and unemployment data.

FCW <Go>

displays data, news and information related to U.S. Federal Reserve monetary policy.

ECB <Go>

lets you access Financial Conditions Watch.

WIRP <Go>

displays results of Bloomberg Professional global economic confidence surveys.

CPFC <Go>

lets you calculate fed-fundsrate estimates according to the Taylor Rule model.

FXFC <Go>

displays data, news and information related to European Central Bank monetary policy.

BOE <Go>

lets you analyze world interest rates implied by trading in futures and options.

IRR <Go>

displays price forecasts for major commodities.

BYFC <Go>

displays foreign exchange forecasts.

ILBA <Go>

displays data, news and information related to Bank of England monetary policy.

displays global interest-rate forecasts.

lets you graph and compare measures of inflation and asset prices.

EVNT <Go>

lets you run historical return reports for indexes, securities or currencies for custom time periods.

HOIN <Go>

LEAD <Go>

lets you analyze trends in leading economic indicators for a selected group of countries.

lets you customize and manage multiple economic calendars.

ECST <Go>

displays a menu of housing and construction data from around the world.

STAT <Go>

lets you access economic statistics from around the world.

BBSE <Go> BOJ <Go> FWCM <Go>

displays a menu that lets you access economic, financial, energy and commodities data.

ECFC <Go>

displays a menu of codes for accessing economic news.

IM <Go>

displays data, news and information related to Bank of Japan monetary policy.

BLS <Go>

displays forward rates for interest-rate-swap curves.

EVTS <Go>

displays forecasts and historical values for key economic indicators.

ECMX <Go>

displays a menu of money market and bond monitors.

WEI <Go>

lets you monitor the locales with the biggest changes in employment and unemployment according to data from the U.S. Bureau of Labor Statistics.

lets you customize calendar of corporate events for a region, country, industry or list of securities.

lets you create a custom matrix of economic data for multiple countries.

Compiled by JO BUCKLEY

monitors world stock indexes.

YCRV <Go>

graphs global bond, money market and swap curves.

160

BLOOMbERG MARKETS JANUARY 2009

PULL OUT AND SAVE JANUARY 2009 Press <Help> twice to send a question to the Bloomberg Analytics help desk.

FO C U S

Economic Analysis

March 2006

C H E AT S H E E T

ECONOMIC ANALYSIS

ECST <Go> provides economic data for a selected country. ESNP <Go> provides a snapshot of economic statisticsincluding gross domestic product, consumer and producer price, unemployment and trade balance figuresfor a selected country or region. STAT <Go> displays a menu of economic, financial market, energy and commodities data as well as various tables and rankings.

AGRI <Go> monitors releases of U.S. agricultural and livestock data.

BBSE <Go> is the main menu for economicsrelated information from Bloomberg News. BBSE includes links to the top economic news stories as well as news on the economies of more than 40 countries.

CBQ <Go> displays economic and stock and bond market information for a selected country.

OECD <Go> displays a menu of economic indicators for countries belonging to the Organization for Economic Cooperation and Development.

ECMX <Go> lets you compare economic

OUTL <Go> displays a menu of Bloomberg News economic survey data, categorized by region, economic indicator and financial instrument.

EVNT <Go> lets you create a custom calendar of upcoming economic events for a specific country or region. indicators for various countries. BTMM <Go> tracks interest, foreign exchange and money market rates and monitors economic data releases for a selected country or region.

WCRS <Go> ranks the 10 best-performing and 10 worst-performing currencies versus a selected currency for a selected period.

FOMC <Go> provides information on the U.S. Federal Reserves Federal Open Market Committee.

EUST <Go> provides economic information on the euro zone.

ECO <Go> displays a calendar of economic releases for a country you select.

IBQ <Go> lets you follow news, benchmark statistics and individual and group performance analysis for companies in a selected industry.

WE <Go> provides key dataincluding annual GDP, year-over-year percentage of change in GDP, year-over-year percentage of change in the consumer price index and the jobless ratefor major global economies.

ECOR <Go> is the main menu for information on U.S. economic statistics.

SNIP AND SAVE

IECO <Go> provides economic data and the percentages of change in the data from prior periods for groups of countries and regions.

YCRV <Go> graphs government, money market, swap, municipal fair market and corporate fair market yield curves for various countries.

Compiled by JOHN RUSSELL jorussell@bloomberg.net

For assistance in using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

< S T R AT E G I E S >

February 2007

Cheat Sheet

Emerging Markets

EMKT <Go> displays a menu of topics for finding news, data and functions related to emerging markets. EMEC <Go> displays gross domestic product, inflation, budget surplus/deficit and employment statistics for emerging-market countries. TOP EM <Go> displays the headlines of the top news stories on emerging markets. WCR <Go> ranks the returns of currencies relative to a selected base currency.

EMEQ <Go> monitors daily and historical performances of emerging-market equity indexes.

IRR <Go> lets you generate historical return reports for a specific index category, date range and currency.

CSDR <Go> displays ratings for long-term and short-term sovereign debt denominated in foreign or local currencies.

IM <Go> displays a menu of major money market, foreign exchange, swap

WBIS <Go> ranks the returns of a selected group of bond indexes during a specified time period.

CBQ <Go> provides a summary of benchmark statistics, a graph of recent moves in the benchmark equity index and a list of the three most-active stocks for a selected country.

WEIS <Go> ranks the returns of equity indexes for a selected region during a specified time period.

and government bond rate monitors for individual countries.

IMF <Go> lets you search for International Monetary Fund statistics on a selected country.

ECST <Go> provides access to economic statistics for a selected country.

YCRV <Go> lets you analyze various current and historical yield curves for selected countries.

WB <Go> lists prices and yields for benchmark government bonds.

WMP <Go> displays the percentage of the population that are mobile phone subscribers for individual countries.

WEI <Go> displays intraday changes and historical returns for equity indexes.

EMMR <Go> provides money market rates for emerging-market nations.

BRSW <Go> lets you create and value Brazilian interest rate swaps.

ISLM <Go> displays a menu of functions for analyzing Islamic capital markets.

BRDY <Go> lists active Brady bonds, which are debt securities issued under a restructuring plan orchestrated by former U.S. Treasury Secretary Nicholas Brady.

EMWB <Go> displays a menu of emerging marketrelated functions and Web sites.

Compiled by JOHN RUSSELL

SNIP AND SAVE

Press <Hel p> tw ice to send a q uest ion to the Bloomberg Analyt ics hel p desk.

< S T R AT E G I E S >

September 2005

C H E AT S H E E T

Emerging-Market Analysis

EMKT <Go> displays a menu of topics you can click on to access data and functions related to emerging markets. NI EM <Go> displays headlines of news stories about emerging markets. EMEC <Go> displays economic statistics, including gross domestic product, inflation and unemployment data, for emerging-market countries. NI EMD <Go> displays headlines of news stories about emerging-market debt.

EMTO <Go> displays the top emerging-market news stories.

CBQ <Go> provides economic data and CRSK <Go> provides risk ratings for a selected country based on political, economic and liquidity factors. An economic forecast for the country also appears.

WEIS <Go> ranks equity indexes based on performance over a selected return period.

IRR <Go> lets you rank returns for various global security and currency indexes over periods you set.

BRDY <Go> provides a table of information on Brady bonds from various emerging-market countries.

a summary of market statistics for a selected country.

CSDR <Go> displays short- and long-term sovereign debt ratings for debt denominated in both foreign and local currencies.

IRSM <Go> displays a menu of functions for creating and valuing interest rate and credit derivatives.

ISLM <Go> displays a menu of functions for analyzing Islamic capital markets.

WBIS <Go> ranks bond indexes based on performance over a selected return period.

BRSW <Go> lets you create and value Brazilian interest rate swaps.

WCRS <Go> ranks the best- and worstperforming currencies against a selected currency over a selected return period.

CRP <Go> displays equity risk premiums for various countries. The risk premium is a countrys expected equity market return minus its risk-free rate.

EMEQ <Go> lets you monitor equity indexes for emerging-market countries.

TKC <Go> provides a table of currency exchange rates by region.

WBF <Go> monitors prices and yields for active bond futures contracts.

Compiled by MARY K. WOOD mwood@bloomberg.net

EMMR <Go> provides money market rates for emerging-market countries.

SNIP AND SAVE

WFX <Go> monitors spot U.S. dollar prices versus other currencies.

For assistance in using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

FOCUS Energy

January 2006

C H E AT S H E E T

ENERGY MARKETS

NRG <Go> displays the main menu of energy-related functions. CRUD <Go> provides links to crude oil price monitors, including those for futures, swaps and crack spreads. DOE <Go> provides weekly and monthly statistics from the U.S. Department of Energys Energy Information Administration. CCRV <Go> lets you graph implied forward curves for commodity prices.

NATG <Go> displays a menu of functions for analyzing natural gas markets.

VOLT <Go> displays a menu of functions for analyzing electricity markets.

ETOP <Go> lists headlines for the top energy-related news stories.

NGHB <Go> monitors natural gas price indexes for major trading hubs in the U.S.

ENRG <Go> displays the Bloomberg News menu for energy markets.

ARB <Go> displays oil market arbitrage opportunities based on prices and costs at various refining and consumption sites.

NRGA <Go> lists a selected companys energy-related assets.

BSHI <Go> provides a menu of functions for tracking shipping rates, news and indexes as well as forward freight agreements, charter volumes and storage rates. and Canada. These hubs are locations where several natural gas pipelines converge.

OIL <Go> displays a menu of functions for analyzing oil markets.

CRCK <Go> monitors New York Mercantile Exchange month-to-month crack spreads, which measure the relationship between crude oil and oil product futures prices in terms of U.S. dollars per barrel.

LFP <Go> monitors International Petroleum Exchange and Nymex-traded energy futures contract prices.

SPSC <Go> calculates the relative profitability of a power plant based on the prices of fuel and power.

UOUT <Go> displays headlines of news stories about utility outages.

ENST <Go> displays a menu of international energy statistics.

NTBK <Go> displays a table of crude oil netback values and margins based on the refining values of major crude oils in different refining regions worldwide.

SNIP AND SAVE

SWPP <Go> provides links to crude oil, natural gas and refined-product swap price monitors.

CRR <Go> ranks the best- and worstperforming commodity futures contracts.

Compiled by MARY K. WOOD and

JOSH EASTRIGHT

mwood@bloomberg.net jeastright@bloomberg.net

For assistance in using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

< STR AT E G I E S >

December 2003

C H E AT S H E E T

Fixed-Income Derivatives

SWPM <Go> lets you create, value and save custom interest rate swaps. You can perform risk and horizon analysis on each leg of the swap and for the entire deal. FWCV <Go> enables you to project forward rates for government, fair market and interest rate swap curves. FWCV also lets you create your own benchmarks for comparison. FYH <Go> enables you to calculate the number of futures contracts required to hedge a selected bond.

WS <Go> lets you monitor worldwide interest rate swap rates for multiple maturities in various currencies. Click on the Historical Page tab for historical swap rate data.

MCA <Go> lets you compare up to four different yield curves, including government, corporate, fair market and swap curves.

USSW <Go> lets you monitor U.S. swap spreads, short-term lending rates and prices of bond futures.

TNI DRV BON <Go> displays headlines of news stories related to fixed-income derivatives.

SSRC <Go> enables you to monitor on one screen the deposit rates, swap rates, forward rate agreements, swaption volatilities and cap and floor volatilities for one of six countries or the euro zone.

CTM <Go> enables you to search for futures CDSW <Go> enables you to create and value credit default swaps based on your own assumptions.

contracts without knowing where the contract is traded. IRSM <Go> displays a menu of functions for analyzing interest rate derivatives.

CDSD <Go> lets you set up credit default swap spread curves.

BTMM <Go> lets you monitor key interest and swap rates for various countries.

WBF <Go> lets you view worldwide price and yield changes for active bond futures.

BCCF <Go> lets you create, save and value interest rate caps, floors and collars.

IYC <Go> provides a menu of functions for analyzing yield curves.

WIR <Go> lets you monitor worldwide price or yield changes for active interest rate futures.

OTM <Go> lists futures contracts for which options are available.

OV <Go> enables you to value options on a selected futures contract based on your own assumptions.

CECO <Go> enables you to create a customized calendar of upcoming economic events that might influence interest rate movements.

OVSW <Go> lets you create, save and value swaptions using different termstructure models.

Compiled by BING XIAO bxiao@bloomberg.net

S N I P A N D SAV E

F o r a s s i st a n c e i n u s i n g t h e B l o o m b e r g P r ofe s s i o n a l s e r v i c e , p r e s s < H e l p > t w i c e .

< S T R AT E G I E S >

August 2006

Cheat Sheet

Fixed-Income Electronic Trading

ALLQ <Go> displays price quotes for a selected fixed-income security. BWX <Go> enables you to create, edit and submit a list of bonds to multiple traders. MAX <Go> lets you search dealer-contributed offerings of specified pools of mortgage-backed securities. AUCS <Go> lists central banks and other issuers that participate in electronic bond auctions on the Bloomberg Professional service.

DOCP <Go> lets you purchase commercial paper offerings directly from issuers.

PICK <Go> lets you post and monitor primary and secondary municipal bond offerings.

AXES <Go> lets you search pages of axes bonds traders want to buy or sell from multiple sources. You can search by industry of the issuer, maturities or credit ratings.

ECPX <Go> lets you search through traderplaced money market offerings for euro commercial paper.

ET <Go> displays menus of security types and

RMGR <Go> displays lists of incoming runs messages used by dealers to advertise their inventory directly to clientssent via the RUNS function. You can filter messages by keyword or sort them by data item.

AXMN <Go> displays a menu of traders who contribute to AXES.

RPOQ <Go> lets you send repurchase agreement trade inquiries to dealers.

BBT <Go> monitors bid and offer prices for government bills, notes and bonds and interest rate swaps. If enabled, you can trade by clicking on prices.

firms that trade electronically on the Bloomberg service.

BOOM <Go> lets you search for commercial paper and discount note offerings you can buy electronically via the Bloomberg service.

FAXM <Go> displays a list of your fixed-income trades for automatic execution so you can follow a transaction through the entire trade process.

SRCH <Go> lets you search for government, corporate and private placement debt by coupon, maturity, country and currency. You can create and save as many as 30 custom searches.

BWRX <Go> displays lists of incoming bid and offer security prices and lets you respond to them.

BLAL <Go> lets you allocate trades executed in FAXM. You can also send allocation notifications via the Bloomberg Message system.

TW <Go> displays pricing and offering work sheets for the securities in your firms or departments inventory.

Compiled by JOHN RUSSELL jorussell@bloomberg.net

SNIP AND SAVE

To ask q uest ions about using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

FOC U S

F i xed - I n co me A na l y s i s

May 2006

Cheat Sheet

Fixed Income

ASW <Go> calculates the yield spread to the forward yield of the London interbank offered rate as a measure of the relative value of a selected bond. DDIS <Go> displays the distribution by maturity of outstanding debt and loans for a selected company. SWPM <Go> enables you to create, value and update interest rate swaps and other types of derivatives.

BBT <Go> monitors bid and offered prices for bills, notes, bonds and interest rate swaps.

HS <Go> graphs the spread between the yields of two selected securities over a specified time range.

TRAC <Go> allows you to research corporate bond trade data from NASDs Trace.

BQ <Go> lets you access a composite overview of current price, yield and spread data; track historical spreads; analyze repurchase financing; and track credit ratings for a selected corporate bond.

NABI <Go> provides data for NASD-Bloomberg indexes of the most frequently traded U.S. corporate bonds and Trace aggregate statistics from the Trade Reporting and Compliance

YA <Go> lets you analyze the relationship between price and yield along with yield spread to a benchmark for a selected corporate, government or municipal bond.

BW <Go> OW <Go> let you create and distribute bids- and offers-wanted lists. The functions can be used to combine lists for basket trading, or buying and selling a group of bonds at the same time.

YT <Go> calculates the yield to maturity and yield spread to a benchmark at various prepayment rates for a selected mortgage-backed security. Engine, NASDs system for reporting prices of over-the-counter secondary corporate bond trades.

WBF <Go> monitors active bond futures prices or yields.

CDSI <Go> CDSO <Go> allow you to display lists of credit default swap indexes and value options on them.

OAS1 <Go> calculates an option-adjusted spread for a selected security with an early redemption feature so you can make a relative value judgment based only on credit risk.

WBIS <Go> ranks bond index returns over a time period you select.

CSDR <Go> shows credit ratings of debt issued by sovereign governments.

SRCH <Go> allows you to create as many as 30 custom searches for government, corporate and private-placement fixed-income securities.

YCRV <Go> displays government bond, money market, swap, municipal debt fair market or corporate bond fair market yield curves you can use for relative value comparisons.

Compiled by JOHN RUSSELL jorussell@bloomberg.net

SNIP AND SAVE

To ask q uest ions about using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

FO C U S

Fu ndamental Analysis

February 2006

C H E AT S H E E T

Fundamental Analysis

ANR <Go> provides analysts recommendations and price targets as well as a consensus rating for a selected companys stock and a ranking of analysts based on their accuracy. CNAV <Go> displays headlines of multimedia presentations for a company that you select. EE <Go> displays earnings projections for a selected company. ERN <Go> provides earnings-per-share data for a company you select.

BBEA <Go> displays headlines of news stories related to earnings analysis for a country or region you select.

TOP <Go> displays headlines of the top Bloomberg News stories on various topics and for various locations.

BBSA <Go> displays headlines of news stories related to equity analyst ratings, categorized by action, region and type.

FA <Go> lets you perform various types of financial analysis on a selected

PHDC <Go> enables you to search for institutional and insider holders whose trading activity may influence the stock price of a selected company.

GPTR <Go> graphs the stock price and dates of stock purchases and sales by insiders of a selected company.

BPO <Go> provides summaries of the most-important news stories, categorized by region, country and topic.

company, including ratio analysis and balance sheet analysis.

BR <Go> displays a menu of contributed research divided by category.

DVD <Go> provides information about a selected companys dividends and stock splits.

RV <Go> lets you compare the performance of a selected company with other companies in its industry by using various measures.

CN <Go> displays headlines of news stories, research reports and multimedia presentations for a selected company.

G <Go> enables you to create and maintain customized graphs of a selected companys financial data.

WPE <Go> monitors the price-earnings ratio and dividend yield of major stock indexes and lets you graph historical index P/Es.

EM <Go> lets you compare estimated and actual financial data for a selected company.

ECO <Go> displays a customizable calendar you can use to access historical, current and expected economic data releases for a selected country.

WEI <Go> enables you to monitor intraday changes in and display historical returns for major stock indexes.

Compiled by JOHN RUSSELL jorussell@bloomberg.net

SNIP AND SAVE

For assistance in using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

St rat e g i es

December 2007

Cheat Sheet

Futures

WEIF <Go> lets you monitor trading in active equity index futures contracts from around the world. CT <Go> monitors a series of futures contracts with different expirations. DLV <Go> lets you analyze a list of bonds that can be delivered to satisfy a selected futures contract. CTM <Go> displays a menu of futures contracts by type of underlying commodity, security or index.

WBF <Go> lets you monitor trading in active bond futures contracts.

FMQ <Go> lets you monitor and trade a selected futures contract, if youre enabled to do so.

WIR <Go> lets you monitor trading in active interest rate futures contracts.

CEM <Go> displays a menu of futures contracts by exchange.

CTG <Go> graphs prices and volume, open interest or change in price for a selected series of futures contracts.

WF <Go> lets you monitor popular futures contracts from around the world.

FFRC <Go> calculates futures-implied currency forward rates using

CCRV <Go> lets you display and compare forward curves for futures contracts.

FEPS <Go> lets you set futures and options session defaults for exchanges that have multiple trading sessions.

SFUT <Go> lists the tickers and exchange codes for the underlying securities of all single-stock futures contracts.

Eurofutures prices and compares them with actual exchange rates.

FRSK <Go> calculates the Bloomberg risk a measurement of price sensitivity to shifts in interest ratesfor a selected interest rate futures contract.

NRGF <Go> displays a menu of energy futures monitors.

METL <Go> lets you monitor the most-active metals futures contract prices.

FHG <Go> graphs historical data for a selected futures contract.

FCDS <Go> lets you analyze a selected credit default swap index futures contract that trades on Eurex.

FH <Go> calculates the short position in interest rate futures contracts needed to hedge a long position in interest rate futures.

GFUT <Go> lets you set the defaults used when rolling over generic futures.

snip and save

FSM <Go> displays a matrix of spreads between contracts that expire in different months for a selected future.

TKA <Go> displays tickers and current market information for 20 active futures contracts.

Compiled by Daryl Donelin

Press <Hel p> tw ice to send a q uest ion to the Bloomberg Analyt ics hel p desk.

< S T R AT E G I E S >

April 2007

Cheat Sheet

Rankings

LEAG <Go> lets you access league table rankings of underwriters of bonds, stocks and equity-linked instruments as well as arrangers of syndicated loans. WHF <Go> lets you access rankings of hedge funds by assets and performance, grouped by strategy. NI LEAG <Go> lists headlines for news stories related to league tables and rankings. NI LEAG CRL <Go> lists headlines for all league tables published by Bloomberg.

WFA <Go> ranks financial advisers on yearto-date announced mergers and acquisitions.

WMF <Go> lets you access rankings of mutual funds in the Americas, Asia and Europe, grouped by strategy.

UNDW <Go> lets you create and save criteria for custom league table rankings of underwriters of stocks, bonds and equity-linked instruments as well as arrangers of syndicated loans.

MOSO <Go> displays the days most-active options by volume and the contracts that have gained and lost the most.

FPC <Go> lets you create fund performance rankings according to criteria such as country and fund type.

WEIS <Go> ranks the returns of equity indexes during a selected period.

LMX <Go> lets you compare underwriter rankings in different markets and create custom league tables.

WBIS <Go> ranks the returns of bond indexes during a selected period. Options are contracts that grant the right, but not the obligation, to buy or sell an asset at a set price.

LTOP <Go> displays a snapshot of top underwriters and arrangers in major debt and equity markets.

IRR <Go> lets you create ranked return reports for custom date ranges.

MOST <Go> displays the days most-active stocks by volume or value and the stocks that have gained or lost the most.

LALT <Go> lets you access league table rankings of legal advisers on offerings of bonds, stocks and equity-linked instruments.

MRR <Go> ranks the returns of the members of an index or list of stocks during a selected period.

FRR <Go> ranks the returns of major bond futures contracts. Futures are agreements to buy or sell assets at a set price and date.

WLA <Go> ranks legal advisers on yearto-date announced mergers and acquisitions.

SNIP AND SAVE

CRR <Go> ranks the returns of the components of major commodity indexes during a selected period.

MA <Go> lets you access tools for analyzing mergers and acquisitions, including rankings of top announced deals.

Compiled by JOHN RUSSELL

Press <Hel p> tw ice to send a q uest ion to the Bloomberg Analyt ics hel p desk.

FOC U S

Foreign Exchange

June 2006

Cheat Sheet

Analyzing Currencies

FXIP <Go> displays the main menu for accessing foreign exchange functions, data and news. OVDV <Go> lets you specify foreign exchange volatility surfaces for varying maturities, strike prices and deltas to be used in OVML to graph the volatility curve for currencies. EFPH <Go> lets you compare prices of exchange-traded currency futures contracts with the implied forward rates for maturities matching the futures contracts expiration dates.

WVOL <Go> displays a snapshot of volatilities for currencies around the world taken from New York composite prices of currency options with a range of maturities and deltas, which measure sensitivity to changes in the price of the underlying currency.

FFRC <Go> monitors futures-implied currency forward rates using Eurofutures prices and compares them with actual exchange rates.

TOP FRX <Go> lists headlines for the top foreign exchangerelated news stories.

FXCT <Go> lets you analyze currency carry trades, which involve borrowing in

WFX <Go> displays composite London bid and ask spot prices for the U.S. dollar against major world currencies and currencies from other countries in Europe, Africa, the Americas and the Pacific Rim.

FXFC <Go> lets you access foreign exchange analysts forecasts for currency values. a low-yielding currency and investing in a higher-yielding currency.

VOLC <Go> compares implied and realized volatilities, spot and forward rates, implied and realized skewness and implied and realized kurtosis for a given currency pair over a specified period of time. Skewness and kurtosis are measures of statistical distribution.

BBC <Go> displays a menu of currency market monitors, including those for spot and forward rates, deposit rates and spot precious metal prices.

FXFA <Go> calculates the currency forward rates implied by the current interest rate cash market.

FRD <Go> displays spot and forward exchange rates for a selected currency pair.

NDF <Go> calculates nondeliverable forward rates and implied interest rates.

CORR <Go> lets you create, save and retrieve as many as 20 unique correlation analysis tables. CORR estimates the strength of the historical relationship between values of currencies, securities, interest rates or indexes.

OVML <Go> enables you to structure and value multileg options for a selected currency pair.

SNIP AND SAVE

XOPT <Go> displays a menu of functions for analyzing currency options.

Compiled by JOHN RUSSELL jorussell@bloomberg.net

NI FX <Go> lists headlines of news stories related to foreign exchange.

To ask q uest ions about using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

CHEAT SHEET

Foreign Exchange

FXIP <Go>

WIRP <Go> FXFB <Go>

displays the main page for accessing foreign exchange functions, data, news and research as well as information on related markets.

displays futures- and optionsimplied probabilities for selected world interest rates.

NDF <Go>

lets you analyze a forward rate bias strategy, which is a variation on a carry trade.

BFIX <Go>

calculates nondeliverable forward rates and implied interest rates.

FXFA <Go> FRD <Go> FXFC <Go>

displays Bloomberg daily spot or forward currency fixing rates.

NI ANAFX <Go>

displays spot and forward rates for a selected currency pair and calculates forward rates for broken dates and forward forwards.

WCRS <Go>

displays composite and contributor foreign exchange rate forecasts.

OVRA <Go>

calculates implied currency forward rates and identifies arbitrage opportunities between those forward rates and current interest rates.

OVDV <Go>

lists headlines of news stories on analysts forecasts for currencies.

VOLC <Go>

ranks the best- and worstperforming currencies according to criteria you select, such as spot return or forecast total return.

XOPT <Go>

lets you analyze and manage risk in a portfolio of foreign exchange options.

CBRT <Go>

lets you specify custom, contributor or synthetic volatility surfaces used to analyze and price foreign exchange options.

FXGN <Go>

lets you graph and compare implied and realized foreign exchange volatilities and rates.

TOPI <Go>

displays a menu of central bank rate information.

FFIP <Go>

displays a menu of functions and reference information for analyzing and trading foreign exchange options.

OVML <Go>

displays futures- and optionsimplied probabilities for federal funds rate changes.

monitors Bloomberg Generic bid and ask prices for currencies.

FXCT <Go>

displays headlines for the top foreign exchangerelated news stories.

WVOL <Go>

XDF <Go>

lets you structure and price multileg foreign exchange options for a selected currency pair.

FXTP/FXSP <Go>

lets you set defaults for currency and crosscurrency functions.

FXTF <Go>

lets you analyze foreign exchange carry trades, which involve borrowing in a lowyielding currency and investing the borrowed funds in a high-yielding currency.

FX <Go>

displays a snapshot of volatilities for currencies around the world implied by the New York composite prices of currency options with a range of maturities.

NI TECHFX <Go>

lets you analyze the monthly total return performance of foreign exchange traders and various investment styles.

lets you search for tickers or rates for specific currencies or currency-related instruments.

displays a menu of electronic trading contributors that participate in foreign exchange trading on the Bloomberg Professional service.

lists headlines of news stories on technical analysis of exchange rates.

Compiled by SUZY OVERTON

PULL OUT AND SAVE FEBRUARY 2008 Press <Help> twice to send a question to the Bloomberg Analytics help desk.

hELp DESK

Portfolio Analysis

How can I use the metrics I care about to analyze my portfolio?

The Portfolio Slice and Dice (PSD) function lets you dig into the characteristics of your holdings in a variety of ways. Type PSD <Go>, click on the arrow to the right of Portfolio and select a portfo lio. To compare it against a benchmark, click on the arrow to the right of Benchmark, select an index or custom benchmark and press <Go>. Next, click on the Templates button on the red tool bar and select Fundamentals Summary if its not already selected. The Portfolio Summary sec tion of the screen displays aggregate values for fun damental metrics such as dividend yield for your portfolio and for your benchmark. You can graph a breakdown by industrial classification of an indica tor by clicking on it. To create a custom template that uses metrics you select, click on the Templates button and select New Template. In the Customize PSD window that appears, tab in to the Name field and enter a name. Fields you can use to build your analysis are organ ized into category trees on the left side of the screen. To add a field that tracks growth in earnings before interest, taxes, depreciation and amortiza tion, for example, first click on the plus sign to the left of Growth Rates to expand the tree. Next, click on EBITDA Growth to select it. To display Ebitda growth data for your benchmark, click on the box in the Benchmark Field column so that a check mark appears. When youve made your selections, click on the Update button to display the data in PSD. You can create reports that show the analysis youve created in PSD. Click on the Reports button and select Export to PDF, for example, to create a report in PDF format.

CLASSIFICATION Type PCLS <Go> to create custom classication systems you can use for attribution analysis of a portfolio.

How can I customize industry classifications for my portfolio?

The Classifications (PCLS) function lets you create or assign custom industrial classifications for ana lyzing your portfolios. This ability can be useful if you invest in securities that dont fall within a stand ard classification system. In the Global Industry Classification Standard, for example, an exchangetraded fund such as the iShares Dow Jones US Oil & Gas Exploration & Production Index Fund isnt a member of the industry it tracks. To create a custom version of GICS that classi fies the ETF as exposure to the oil and gas explora tion and production subindustry, first type PCLS <Go>. Click on the Create button and enter a name, such as MY GICS, in the Classification Name field. Click on the circle to the left of Link to Standard & Customize to select it. Click on the arrow to the right, select GICS and click on the Create button. In the classification tree that appears, click on the plus sign to the left of Energy. Click on the plus sign to the left of the next Energy node that appears in the expanded tree and then on the plus sign to the left of Oil Gas & Consumable Fuels. Finally, click on Oil & Gas Exploration & Production. In the field that appears on the right side of the screen, enter IEO US <Equity>the ticker for the ETFand press <Go>. Then click on the Save button. You can now use your new classification system in PSD or in the Bloomberg Attribution (BBAT) function. Type PSD <Go> and click on the Options button. Click on the arrow to the right of 1, for example, and select MY GICS-GICS Sub-Industries.

JULIE WARING and JESSICA WHITELEY

SLICE AND DICE Type PSD <Go> to analyze fundamental metrics for a portfolio.

Press <Help> twice to send a question to the Bloomberg Analytics help desk.

161

JANUARY 2009 BLOOMbERG MARKETS

< S T R AT E G I E S >

August 2005

C H E AT S H E E T

Managing Hedge Funds

FPC <Go> lets you compare the returns of hedge funds across different periods. BETA <Go> tracks the historical volatility of a selected fund against a benchmark. CBMU <Go> displays a menu of functions for finding and analyzing convertible debt securities. COMP <Go> lets you graph the return of a selected fund or security against an index or other benchmark. HRH <Go> plots a selected funds historical return distribution against a theoretical normal distribution.

CDSW <Go> lets you create and value credit default swaps.

FSRC <Go> lets you create custom searches for hedge and mutual funds based on criteria you select.

HVG <Go> graphs the historical price volatility of a selected fund.

OVML <Go> lets you structure and price multileg foreign exchange options.

DES <Go> provides descriptive information on a selected fund, including its objective, fees and manager.

HFND <Go> displays a menu of functions for

HGFD <Go> displays a menu of Web pages related to hedge funds.

TFUN <Go> displays headlines of the top fundrelated news stories.

QSRC <Go> lets you create custom searches for stocks based on criteria you select. analyzing hedge fund data. IRSM <Go> displays a menu of interest rate and credit derivative functions.

NI HEDGE <Go> displays headlines of news stories about hedge funds.

WHF <Go> ranks the largest and best-performing hedge funds.

HEDG <Go> calculates the number of futures contracts or securities needed to hedge a selected equity investment.

TRA <Go> lets you analyze the total return of a selected fund or security.

NIM <Go> monitors new issues of stocks and bonds by type of security and geographical area.

SRCH <Go> lets you create custom searches for fixed-income securities based on criteria you select.

BFLY <Go> helps you determine the amount of a security needed to hedge investments in corporate, government or agency debt.

INSD <Go> lists stocks with high levels of insider trading activity.

Compiled by MARY K. WOOD mwood@bloomberg.net

SNIP AND SAVE

For assistance in using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

CHEAT SHEET

Legal Research

CITA <Go>

LAWB <Go> BLMA <Go>

lets you search for legal documents by citation, case name or party.

displays a menu of law related blogs by topic.

BLSL <Go>

displays a menu of mergers and acquisitions lawrelated information, analysis and news.

BLBF <Go>

displays a menu of securities lawrelated information, analysis and news.

BLEL <Go>

displays a menu of energy lawrelated information, research and news.

BLAW <Go> DCKT <Go>

displays a menu of banking and finance lawrelated information, analysis and news.

BLAT <Go>

displays the main menu of legal research functions, data and analysis.

LAW <Go>

lets you create summary litigation reports that can be viewed graphically or in tabular format.

BLCM <Go>

BLBK <Go>

displays a menu of bankruptcy lawrelated information, research, news and functions.

BLIT <Go>

displays a menu of antitrust and trade lawrelated information, analysis and news.

BBLR <Go>

displays a menu that lets you access current legal analysis, documents, news and information.

BBLD <Go>

lets you create time sheets for billing clients for research done on the Bloomberg Professional service.

BLGL <Go>

displays a menu of litigation analysis, research and news.

BLCR <Go>

lets you perform research using the analysis and primary content in the Bloomberg LawDigest.

BCIT <Go>

displays a menu of laws and regulations by region or country.

LITI <Go>

displays a menu of corporate lawrelated information, analysis and news.

CARM <Go>

lets you access current and previous issues of Bloomberg Law Reports.

BLLE <Go>

lets you research state andfederal cases with citation analysis.

LCOM <Go>

displays a snapshot of U.S. federal litigation involving a selected company.

lets you compare the likelihood of a securities class action for a selected company relative to its peers.

BLIL <Go>

displays a menu of employment and labor lawrelated information, research and news.

BLHE <Go>

BBLS <Go>

displays a menu of health lawrelated information, analysis and news.

Compiled by RICHARD ALBUQUERQUE

offers a menu of risk and compliance information, analysis, tools and news.

LLRT <Go>

lets you search for legal documents from a broad range of sources.

displays a menu of insurance lawrelated information, analysis and news.

BIPL <Go>

lets you manage your Bloomberg law alerts.

displays a menu of intellectual property lawrelated information, analysis and news.

PULL OUT AND SAVE NOVEMBER 2008 Press <Help> twice to send a question to the Bloomberg Analytics help desk.

< S T R AT E G I E S >

May 2005

C H E AT S H E E T

Loans and High-Yield Debt

LOAN <Go> displays a menu of functions for finding and analyzing syndicated loans, including links to credit rating monitors, loan news, league tables and loan pricing. LSRC <Go> enables you to list syndicated loans chronologically by issue date or alphabetically by issuer name or to search for specific issues using criteria you select. RATD <Go> provides rating scales and definitions for different credit rating firms.

HYM <Go> displays the main menu for highyield-debt-related functions, including those for news, custom security searches, new issue monitors and ratings information.

SRCH <Go> lets you create and store custom searches for high-yield bonds and other debt securities based on coupon, maturity, currency or other criteria.

YA <Go> lets you calculate the price or yield of a selected debt security as well as sensitivity measures such as duration and convexity, cash due at settlement and future cash flows.

LEAG <Go> displays underwriter rankings for a selected market, including high-yield-debt underwriters and syndicated-loan arrangers. LEAG lets you create and save custom searches so that you can find the top underwriters based on region, industry, issue size, time period or other criteria you select.

RATC <Go> displays a monitor of current and prior company debt ratings. RATC

YCRV <Go> displays current and historical yield curves for various regions and types of debt.

NIM <Go> enables you to monitor new fixedincome offerings and to create custom new issue monitors.

also lets you create and save custom rating searches. LMX <Go> lets you create and save custom tables of rankings for multiple markets, including high-yielddebt underwriters and syndicatedloan arrangers.

DDIS <Go> shows the distribution by maturity of a selected companys debt outstanding.

CSDR <Go> lists short- and long-term ratings for debt issued or backed by various countries. CSDR also lets you search for recent rating actions.

ISSD <Go> provides an overview of a selected companys capital structure and operating data.

HYLN <Go> lists headlines for news stories related to high-yield bonds.

EMKT <Go> lets you access functions related to emerging-market debt.

CRAN <Go> lists headlines for news stories on company and country debt ratings.

SNIP AND SAVE

TRAC <Go> lets you research trade data for high yield debt and other corporate bond issues.

Compiled by MARY K. WOOD mwood@bloomberg.net

HYI <Go> lists indexes for tracking various types of high-yield debt.

For assistance in using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

< STR AT E G I E S >

March 2004

C H E AT S H E E T

Syndicated Loans/High-Yield Debt

HYM <Go> displays a menu of functions related to the high-yield-bond market. LSRC <Go> enables you to search for syndicated loans either alphabetically or chronologically or via custom searches that you create. ISSD <Go> provides a summary of a selected issuers capital structure and cash flow data to help you gauge the issuers ability to pay back debt. NI HYL <Go> lists headlines of high-yield-bondmarket news stories.

NI SYNLOANS <Go> lists headlines of news stories on syndicated loans.

PPCR <Go> lets you create custom securities you can price and analyze before they get officially structured and issued.

DLIS <Go> provides the maturity distribution of a selected issuers outstanding loans in both graph and table forms.

NIM <Go> lets you monitor new fixed-income offerings.

RATD <Go> provides rating scales and definitions for various rating firms as well

CRPR <Go> provides current and historical ratings from various credit rating firms for a selected issuer. as Bloomberg Composite ratings. LOAN <Go> displays a menu of functions related to the syndicated-loan market.

CACT <Go> displays a calendar of corporate actions, including debt offerings, debt redemptions and bankruptcy filings. You can search for corporate actions by date range, type of action, country and company.

HYI <Go> displays a list of high-yield-bond indexes.

SRCH <Go> lets you create and save up to 20 custom searches for bonds based on criteria such as coupon, maturity and currency.

LMX <Go> lets you create custom matrixes of rankings to compare underwriters across multiple markets.

RATC <Go> displays a monitor of credit ratings for various issuers to help you evaluate their credit risk. RATC lists current and previous ratings as well as date, agency, rating type and industry type.

YA <Go> calculates the price or yield of and sensitivity measures for a selected security. YA also helps you determine the cash due at settlement and future cash flows.

LEAG <Go> lets you create ranking tables for underwriters of fixed-income securities and arrangers of syndicated loans.

CSDR <Go> lets you access short- and long-term debt ratings for debt issued or guaranteed by sovereign governments.

YTC <Go> calculates the yield to call for a selected security. YTC lets you view different yield scenarios at various redemption dates.

Compiled by MARY K. WOOD mwood@bloomberg.net

SNIP AND SAVE

For assistance in using the Bloomberg Professional ser v ice, press <Hel p> tw ice.

< STR AT E G I E S >

February 2003

C H E AT S H E E T

Syndicated Loans

LOAN <Go> provides a menu of syndicated bank loan functions, including links to credit rating monitors and loan news. NI SYNLOANS <Go> lists the latest news headlines on the syndicated loan market. Tab in to the Search field, enter a keyword or key phrase and press <Go> to find stories that mention it. flow data to help you evaluate the issuers ability to pay back debt. DDIS <Go> shows in graphic and tabular forms the maturity distribution by year of a selected issuers outstanding public debt.

TKL <Go> lets you search for the ticker symbols of syndicated loans for a specific borrower.

NI LRA <Go> provides loan ratings news.

DES <Go> displays important details, such as issuer and credit ratings, for a selected syndicated loan. For loan facilities, DES lists all of the tranches that make up the facility and enables you to click on any of the tranches listed to display the DES page for that specific tranche.