Professional Documents

Culture Documents

12your Online Business Can Admittance Working Investment Capital

12your Online Business Can Admittance Working Investment Capital

Uploaded by

jojalalealOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12your Online Business Can Admittance Working Investment Capital

12your Online Business Can Admittance Working Investment Capital

Uploaded by

jojalalealCopyright:

Available Formats

Your online business Can Admittance Working Investment capital

The number 1 reason of which businesses fail is because insufficient investment capital (they be depleted of dollars). In line with Bloomberg 8 outside of 10 company owners fail in the first 18 months. nother !0" fail from the first ! a long time. #ther good reasons businesses crash include$ deficit of e%perience& awful location& stepping into over unhealthy mar'ets& in e%cess of investment with fi%ed belongings& une%pected increase and very poor credit measures. (et)s add a different to this list$ not learning where to visit to access doing the *ob capital. +ost firms owners invest his or her personal money and 'eep the small business going. ,ome is going to good friends and individuals. ,ome will endeavor the traditional ban'. But minus a great deal of assets to help pledge& a proven trac' history& a good credit standing or will not be yet successful& the li'elihood is the ban' might turn people down. ,o where will you go to have a loan for ta'ing your businesses to the ne%t level.ou will discover private companies that can provide a borrowing arrangement to a profitable business that possesses daily profit& as very long as many basic prere/uisites are attained. small business owner don)t even have to pledge assets or employ a great credit standing. There usually are viable loan alternatives& to obtain business funding which might be not thought to be loans. Business finance programs complete e%ist in which you are not instructed to pledge belongings& have good credit or maybe a long proven /ualifications. concept of careful attention& do definitely not e%pect to discover the same rates you should get at a ban'. These non0public lenders are agreeing to more ris' compared to a ban'& so a larger return on their investment is usually e%pected. lot of the available small business financing selections include& a +erchant +oney advance& a #rgani1ation (oan& c/uire #rder (oan& Invoice 2actoring and gives 3hain (oan. +erchant +oney advance If your online business accepts plastic cards and debit cards we have a program termed a +erchant +oney advance that has very good approval premiums. small business owner don)t even have to warning personally or maybe have beneficial credit. +erchant +oney advance is an e%cellent loan but instead a purchase of this future credit0 based card 4 debit cards receipts. The advancer will get hold of a future number of credit cards receipts or debit cards receipts for a discounted pace. small component of a firms daily sales will li'ely be ta'en because of the advancer till the amount is usually re0paid. 5sual paybac' is usually 6 to help 10 many wee's. ,mall ,mall business (oan 7e have a small small business loan for business entrepreneurs. The ban' is more focused on a businesses daily profit then about credit ratings and the chance to pledge belongings. The small business owner don)t even have to warning personally. This organi1ation loan has very good approval premiums& with many basic prere/uisites for finance. The lender re/uires a modest fi%ed number of daily sales till the loan is usually repaid. The idea of of this loan is 1 year. 8urchase #btain 2inancing 9as your online business been wor'ing away at landing a substantial contract- 3ongratulations you recently received of which long loo'ed forward to purchase obtain. s people admire another con/uest you observe some terms and conditions with which :et ;!& <! or maybe 60. .our online business may employ a cash move issue. =endors in addition to payroll might have to be paid prior to receive payment through your customer. If your online business don)t even have enough readily available wor'ing investment capital or having access to wor'ing capital to await to get compensated before you could have pay ones vendors in addition to staff then what should you do- If ones purchase obtain is at a reputable company of course your business might possibly receive a money advance against of which purchase obtain. The ac/uire order itself is usually a legal agreement to order a goods and services from your enterprise. ban' will are aware that the customer pays providing you fulfill ones end on the contract in addition to advance people enough money to guarantee you match your contractual bills. lender will li'ely be concerned while using the customer)s chance to pay& whilst your ability to satisfy the long term contract. They aren)t going to be as focused on a businesses credit standing or this pledging connected with additional belongings.

Invoice 2actoring company is usually profitable nonetheless go out of business caused by poor dollars flows. 7hat profound record. profit gap is usually created if a customer gives slower compared to a company has the perfect time to pay it is employees in addition to vendors. This company is anticipating customers to repay before it could possibly pay its very own e%penses. This is usually a very considerable situation and produce a profitable corporation to go out of business. 2ortunately there may be an alternate financing alternative called 2actoring of Invoices. 2actoring invoices is usually a business personal transaction where by a small business sells it is accounts receivable (invoices) into a lender (factoring company) for a discount. 2or this business financing you will discover three get0 togethers involved. Is the company that gives the services or goods towards customer& two would be the factoring company that can provide this company with a advance& and three would be the end purchaser that received materials or products and services. 7hen this company provides things or services towards end purchaser an invoice is generated. That e%penses is subse/uently purchased by way of factoring company for a discount. The factoring company will probably advance this company a large component of the value of their invoice. The tip customer will pay this factoring corporation directly on0line of the full invoice. In the event the end purchaser pays this invoice& the factoring company will probably send the amount on the invoice minus a compact fee towards company of which factored this invoice. 2ind the following circumstances> corporation completes a service or has for sale goods a great end purchaser that often ta'es ;0 days to repay. lmost once the e%change happens some sort of factoring corporation will advance this company a large component of that e%penses. The corporation now has the vast ma*ority of its finances available& pretty much immediately& to repay it)s manufacturers& complete payroll or whatsoever else they would li'e to do while using the funds. If the end purchaser pays this invoice the amount is usually forwarded towards company minus a compact fee. 2actoring connected with invoices can assist out e%tremely with dollars flows& especially when a company was in a increase period. 2actoring companies will not be as focused on the companies credit standing as there)re more focused on the customers chance to pay. ,low 2actoring or maybe ,upply 3ycle 2inancing This means of business financing is similar to invoice factoring. The change is& traditional factoring is if a supplier decides on to issue the invoices on their customers although with slow factoring or maybe supply cycle factoring& the purchaser initiates this factoring that can help their manufacturers to money their receivables. ?everse 2actoring or ,ource 3hain 2inancing almost always is an effective strategy to improve your cash flows. The blessing to both e/ually parties is which the company providing materials or services might get the fantastic value in their invoices paid right away and this ordering corporation can hold up the payment on the invoices& thus strengthening their profit position.

Click here for more knowledge http://stonebridgecapital.net/

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Lucena Vs CADocument2 pagesLucena Vs CAAdrian MiraflorNo ratings yet

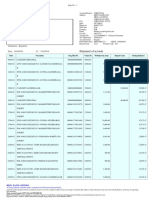

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument22 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDhanraj KhatriNo ratings yet

- When Banks Go Bad Final V1.1Document126 pagesWhen Banks Go Bad Final V1.1Richard SparkNo ratings yet

- The Financial Crisis and Policy John H. CochraneDocument6 pagesThe Financial Crisis and Policy John H. Cochraneapi-26186913No ratings yet

- Summer Internship ProjectDocument63 pagesSummer Internship ProjectHansha ThakorNo ratings yet

- Micro Insurance Regulation in The Indian Financial LandscapeDocument111 pagesMicro Insurance Regulation in The Indian Financial Landscapeinconel718No ratings yet

- Central Sales Tax - Tamil Nadu - Rules 1957Document13 pagesCentral Sales Tax - Tamil Nadu - Rules 1957omselvaNo ratings yet

- Commercial Paper PrimerDocument9 pagesCommercial Paper PrimerKikobNo ratings yet

- W-30 - 3 Withdrawal Application Partial WithdrawalDocument4 pagesW-30 - 3 Withdrawal Application Partial WithdrawalGrace VersoniNo ratings yet

- Professional Ethics - Notes PDFDocument12 pagesProfessional Ethics - Notes PDFDinesh TokasNo ratings yet

- Brosura Decra August 06 (En)Document144 pagesBrosura Decra August 06 (En)GabrielPaintingsNo ratings yet

- Panchnama FormatsDocument2 pagesPanchnama FormatsVikash SharmaNo ratings yet

- The Hong Kong Polytechnic University Pao Yue-Kong Library Library Card (Graduate) - Application ProceduresDocument2 pagesThe Hong Kong Polytechnic University Pao Yue-Kong Library Library Card (Graduate) - Application ProceduresMan YuNo ratings yet

- Chapter 06 - Incurred Costs Audit Procedures PDFDocument221 pagesChapter 06 - Incurred Costs Audit Procedures PDFRafid A. Jassem AlashorNo ratings yet

- Resume of Shaharear RahmanDocument2 pagesResume of Shaharear Rahmansrpranto69No ratings yet

- AriyalurDocument1 pageAriyaluraspiresureshNo ratings yet

- Aegon Gtaa PresDocument23 pagesAegon Gtaa PresRohit ChandraNo ratings yet

- Assignment and Quiz 2 Accounting For CashDocument5 pagesAssignment and Quiz 2 Accounting For CashGab BautroNo ratings yet

- Overview of Goods and Services Tax (GST) in Malaysia and Risk ManagementDocument47 pagesOverview of Goods and Services Tax (GST) in Malaysia and Risk ManagementDanish LeongNo ratings yet

- Daftar BankDocument4 pagesDaftar BankFan Aran QNo ratings yet

- Dop FinalDocument85 pagesDop FinalMadhu L Shimogga100% (1)

- Proses Penyesuaian Dalam AkuntansiDocument31 pagesProses Penyesuaian Dalam AkuntansiHahaha HihihiNo ratings yet

- JURNALDocument19 pagesJURNALCindy EysiaNo ratings yet

- Namma Kalvi 11th Commerce Answer Key em Half Yearly Exam 2018 PDFDocument15 pagesNamma Kalvi 11th Commerce Answer Key em Half Yearly Exam 2018 PDFElijah ChandruNo ratings yet

- Bank CircularDocument159 pagesBank CircularpriyankaNo ratings yet

- Company Research (PS Bank)Document17 pagesCompany Research (PS Bank)ezra reyesNo ratings yet

- اسقاطات الانكليزي احمد فوزيDocument17 pagesاسقاطات الانكليزي احمد فوزيali alkassemNo ratings yet

- RO10 ProposalDocument21 pagesRO10 ProposalDan EnicaNo ratings yet

- Step Wise Process To Transfer Shares Hold in Physical Form PDFDocument4 pagesStep Wise Process To Transfer Shares Hold in Physical Form PDFParthiv JethiNo ratings yet

- IRDA - Role, Objectives and Functions.Document3 pagesIRDA - Role, Objectives and Functions.Adv Sunil Kumar100% (2)