Professional Documents

Culture Documents

International Accounting Chapter 7

Uploaded by

Avinash MalladhiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Accounting Chapter 7

Uploaded by

Avinash MalladhiCopyright:

Available Formats

On September 1, Year 1, Keefer Company received an order to sell a machine to a customer in Canada at a price of 100,000 Canadian dol received

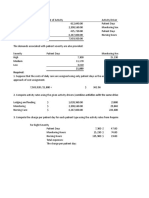

on March 1, Year 2. On September 1, Year 1, Keefer Company purchased a put option giving it the right to sell 100,000 Canadian Keefer Company properly designates the option as a fair value hedge of the Canadian-dollar firm com- mitment. The option cost $1,700 a 1. The fair value of the firm commitment is measured through refer- ence to changes in the spot rate. The following spot exchange rates Date U.S. Dollar per Canadian Dollar September 1, Year 1 . . . . . . .$0.75 December 31, Year 1 . . . . . .0.73 March 1, Year 2 . . . . . . . . . .0.71 Keefer Companys incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 pe Solution: US Dollar Value Sept 1, Year 1 0.75 75000 Dec 31, Year 1 0.73 73000 -2000 Mar 1, Year 2 0.71 71000 -2000 What was the net impact on Keefer Companys Year 2 income as a result of this fair value hedge of a firm commitment? c. A $74,160.60 increase in income

8. What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to forei d. A $2,300 increase in cash flow. Exchange Rate loss Less: Option cost Increase in cash flow 4,000 (1,700) 2,300

tomer in Canada at a price of 100,000 Canadian dollars. The machine was shipped and payment was ut option giving it the right to sell 100,000 Canadian dollars on March 1, Year 2, at a price of $75,000. -dollar firm com- mitment. The option cost $1,700 and had a fair value of $2,800 on December 31, Year in the spot rate. The following spot exchange rates apply:

r for two months at an annual interest rate of 12 percent (1 percent per month) is 0.9803

alue hedge of a firm commitment?

eign currency option to hedge this exposure to foreign exchange risk?

You might also like

- What Was The Net Impact On Keefer Company S Year 1Document1 pageWhat Was The Net Impact On Keefer Company S Year 1Let's Talk With HassanNo ratings yet

- Working 3Document6 pagesWorking 3Hà Lê DuyNo ratings yet

- Quick Company Acquired A Piece of Equipment in Year 1Document1 pageQuick Company Acquired A Piece of Equipment in Year 1Taimour HassanNo ratings yet

- CH16Document80 pagesCH16mahinNo ratings yet

- ch13 PDFDocument5 pagesch13 PDFNoSepasi FebriyaniNo ratings yet

- ACY4001 Individual Assignment 2 SolutionsDocument7 pagesACY4001 Individual Assignment 2 SolutionsMorris LoNo ratings yet

- Current Liabilities, Provisions, and Contingencies: Learning ObjectivesDocument91 pagesCurrent Liabilities, Provisions, and Contingencies: Learning ObjectivesElaine LingxNo ratings yet

- The Statement of Financial Position of Stancia Sa at DecemberDocument1 pageThe Statement of Financial Position of Stancia Sa at DecemberCharlotte100% (1)

- Audit of Other Income Statement ComponentsDocument7 pagesAudit of Other Income Statement ComponentsIbratama Sukses PratamaNo ratings yet

- The Controller of The Ijiri Company Wants You To Estimate A Cost Function From The Following Two Observations in A General Ledger Account Called MaintenanceDocument3 pagesThe Controller of The Ijiri Company Wants You To Estimate A Cost Function From The Following Two Observations in A General Ledger Account Called MaintenanceElliot RichardNo ratings yet

- تابع فصل ادارة المخزونDocument1 pageتابع فصل ادارة المخزونAhmed El KhateebNo ratings yet

- CHAPTER 17 INVESTMENTS ExercisesDocument14 pagesCHAPTER 17 INVESTMENTS ExercisesAila Marie MovillaNo ratings yet

- Comprehensive ProblemDocument3 pagesComprehensive ProblemRahul100% (1)

- Session 08: Tactical Decision MakingDocument18 pagesSession 08: Tactical Decision MakingFrancisco Pedro SantosNo ratings yet

- Udah Bener'Document4 pagesUdah Bener'Shafa AzahraNo ratings yet

- Problems Chapter 7Document9 pagesProblems Chapter 7Trang Le0% (1)

- Chapter 2-Bonds Payable Students RevDocument45 pagesChapter 2-Bonds Payable Students RevPriscillia SakuraNo ratings yet

- CH 08Document10 pagesCH 08Antonios FahedNo ratings yet

- E18-16 (LO3) Sales With Returns: InstructionsDocument15 pagesE18-16 (LO3) Sales With Returns: InstructionsHappy MichaelNo ratings yet

- Exercises Chapter1Document4 pagesExercises Chapter1Huyen Siu NhưnNo ratings yet

- Acc TestDocument1 pageAcc TestWie Liana0% (2)

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDocument1 pageBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaNo ratings yet

- Accounting Changes and Error Corrections Tutorial (3753)Document3 pagesAccounting Changes and Error Corrections Tutorial (3753)Rawan YasserNo ratings yet

- BMGT 321 Chapter 11 HomeworkDocument9 pagesBMGT 321 Chapter 11 HomeworkarnitaetsittyNo ratings yet

- Tutorial Laporan Arus KasDocument17 pagesTutorial Laporan Arus KasRatna DwiNo ratings yet

- Bab 3 Chapter 12 PDFDocument4 pagesBab 3 Chapter 12 PDFGrifyn IfyNo ratings yet

- SOAL LATIHAN MK - AKL - FC TransactionsDocument4 pagesSOAL LATIHAN MK - AKL - FC Transactionscaca natalia100% (1)

- Specimen For Qiuz & Assignment .........................................Document3 pagesSpecimen For Qiuz & Assignment .........................................Umair AmirNo ratings yet

- CH08SOLSDocument23 pagesCH08SOLSMiki TiendaNo ratings yet

- 13 Factory Overhead - DepartmentaliationDocument25 pages13 Factory Overhead - DepartmentaliationGab Gab Malgapo100% (1)

- Question SamplesDocument10 pagesQuestion SamplesJinu JosephNo ratings yet

- Session 3Document17 pagesSession 3SylvesterNo ratings yet

- Syukur Tugas Akl IiDocument3 pagesSyukur Tugas Akl IiMuhammad SyukurNo ratings yet

- Group Assigment CA MATCHA CREATIONSDocument8 pagesGroup Assigment CA MATCHA CREATIONSHoàng Hải Quyên100% (1)

- Chapter 3 ExercisesDocument11 pagesChapter 3 ExercisesNguyen VyNo ratings yet

- Ujian Akhir Semester Genap Tahun Akademik 2020-2021: .Ekonomi Dan Bisnis Akuntansi S1Document2 pagesUjian Akhir Semester Genap Tahun Akademik 2020-2021: .Ekonomi Dan Bisnis Akuntansi S1mzulfikar3031No ratings yet

- Chapter 19, Modern Advanced Accounting-Review Q & ExrDocument17 pagesChapter 19, Modern Advanced Accounting-Review Q & Exrrlg4814100% (2)

- PFM CHAP 22 All SolutionsDocument22 pagesPFM CHAP 22 All Solutionsjanay martin100% (1)

- Chapter 13 Quiz: The Following Data Apply To Questions 6 and 7Document41 pagesChapter 13 Quiz: The Following Data Apply To Questions 6 and 7Dellya PutriNo ratings yet

- Tugas Personal Ke - (1) Minggu 2Document6 pagesTugas Personal Ke - (1) Minggu 2Olim BariziNo ratings yet

- Pertemuan 8 Chapter 17Document29 pagesPertemuan 8 Chapter 17Jordan Siahaan100% (1)

- By - Product Problem Solving - AsifDocument4 pagesBy - Product Problem Solving - AsifJafa AbnNo ratings yet

- Preview of Chapter 17: ACCT2110 Intermediate Accounting II Weeks 8 & 9Document91 pagesPreview of Chapter 17: ACCT2110 Intermediate Accounting II Weeks 8 & 9Chi IuvianamoNo ratings yet

- Latihan 3Document3 pagesLatihan 3Radit Ramdan NopriantoNo ratings yet

- Soal Job Costing 14 Maret 2021Document5 pagesSoal Job Costing 14 Maret 2021Sugata SNo ratings yet

- If A Firm Raises Capital by Selling New BondsDocument24 pagesIf A Firm Raises Capital by Selling New BondsMary Justine PaquibotNo ratings yet

- Task AccountingDocument13 pagesTask AccountingYordan LawijayaNo ratings yet

- Tugas Materi KewajibanDocument1 pageTugas Materi KewajibanandNo ratings yet

- DocDocument13 pagesDocIbnu Bang BangNo ratings yet

- Final Exam - Inter 1 (Batch 2022) - RevDocument14 pagesFinal Exam - Inter 1 (Batch 2022) - RevVanessa vnssNo ratings yet

- Latihan Soal KelompokDocument3 pagesLatihan Soal KelompokPutri RahmawatiNo ratings yet

- Investments: Learning ObjectivesDocument52 pagesInvestments: Learning ObjectivesElaine LingxNo ratings yet

- Exercises On Employee BenefitsDocument2 pagesExercises On Employee BenefitsPeachyNo ratings yet

- InstructionsDocument2 pagesInstructionsGabriel SNo ratings yet

- ABC, Resource Drivers, Service Industry Glencoe Medical Clinic Operates A Cardiology Care Unit and A Maternity Care UnitDocument3 pagesABC, Resource Drivers, Service Industry Glencoe Medical Clinic Operates A Cardiology Care Unit and A Maternity Care UnitKailash KumarNo ratings yet

- Variance Analysi1Document2 pagesVariance Analysi1Elliot RichardNo ratings yet

- What Was The Net Increase or Decrease in Cash FlowDocument1 pageWhat Was The Net Increase or Decrease in Cash FlowLet's Talk With HassanNo ratings yet

- Bonds ProblemDocument9 pagesBonds ProblemLouie De La TorreNo ratings yet

- Bond ProblemsDocument27 pagesBond ProblemsCharity Laurente Bureros83% (6)

- Adjusting and Corporation Quiz 1Document13 pagesAdjusting and Corporation Quiz 1JEFFERSON CUTENo ratings yet

- Vendor Recognition White PaperDocument9 pagesVendor Recognition White PaperAvinash MalladhiNo ratings yet

- Savings CardDocument1 pageSavings CardAvinash MalladhiNo ratings yet

- Email ChannelDocument34 pagesEmail ChannelAvinash MalladhiNo ratings yet

- Macy's ONLINE Rebate Form - November 2018Document3 pagesMacy's ONLINE Rebate Form - November 2018Avinash MalladhiNo ratings yet

- GL Coding Upload Using SpreadsheetDocument11 pagesGL Coding Upload Using SpreadsheetAvinash MalladhiNo ratings yet

- VIM OverviewDocument32 pagesVIM OverviewAvinash Malladhi0% (4)

- SidharthaDocument5 pagesSidharthaAvinash MalladhiNo ratings yet

- FSCM-01 Credit ManagementDocument23 pagesFSCM-01 Credit ManagementAvinash Malladhi67% (6)

- Head Office and Branch Concept Demostrated For Both Vendors CustomersDocument13 pagesHead Office and Branch Concept Demostrated For Both Vendors CustomersAvinash Malladhi0% (1)

- MR11Document2 pagesMR11Avinash MalladhiNo ratings yet

- AP Premium ChecklistsDocument26 pagesAP Premium ChecklistsAvinash MalladhiNo ratings yet

- FDD Customer Account StatementDocument14 pagesFDD Customer Account StatementAvinash Malladhi0% (1)

- SAP AR ConfigDocument29 pagesSAP AR ConfigAvinash Malladhi100% (1)

- SAP Credit ManagementDocument6 pagesSAP Credit ManagementAvinash MalladhiNo ratings yet

- Aditya HrudayamDocument2 pagesAditya HrudayamraghuarjunNo ratings yet

- AR AP GL Process Flow ChartDocument1 pageAR AP GL Process Flow ChartAvinash MalladhiNo ratings yet

- 3 - IM - F - 004 - Customer Shipping Label FormDocument8 pages3 - IM - F - 004 - Customer Shipping Label FormAvinash MalladhiNo ratings yet

- May 2014 Chrysler PresentationDocument10 pagesMay 2014 Chrysler PresentationAvinash MalladhiNo ratings yet

- Brown-Forman Corporation Business Transformation StudyDocument2 pagesBrown-Forman Corporation Business Transformation StudyAvinash MalladhiNo ratings yet