Professional Documents

Culture Documents

5.4 Balance Sheet Analysis of Non Financial Companies: (Listed at KSE)

5.4 Balance Sheet Analysis of Non Financial Companies: (Listed at KSE)

Uploaded by

Sania NawazOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5.4 Balance Sheet Analysis of Non Financial Companies: (Listed at KSE)

5.4 Balance Sheet Analysis of Non Financial Companies: (Listed at KSE)

Uploaded by

Sania NawazCopyright:

Available Formats

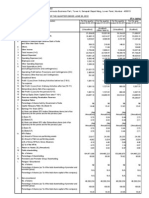

Handbook of Statistics on Pakistan Economy

5.4 Balance Sheet Analysis of Non Financial Companies

(Listed at KSE)

(Million Rupees)

ITEMS

A. CAPITAL STRUCTURE

1. Ordinary share capital

2. Surplus

3. Shareholders' equity (A1+A2)

4. Preference shares

5. Debentures

6. Other fixed liabilities

7. Total fixed liabilities (A4+A5+A6)

8. Total capital employed (A3+A7)

9. Gearing (A7 as % of A8)

10. Shareholders' equity as % of ordinary share capital (A3 as % of A1)

11. Break-up value of ordinary shares (in Rs.)

B. LIQUIDITY:

1. Liquid Assets:

(i) Cash

(ii) Investments

2. Other current assets

3. Current assets (B1+B2)

4. Current liabilities

5. Net current assets (B3-B4)

6. Current liabilities as % of current assets (B4 as % of B3)

7. Net liquid assets (B1-B4)

C. FIXED ASSETS:

1. Fixed assets at cost

2. Fixed assets after deducting accumulated depreciation

3. Depreciation for the year

4. Average annual % depreciation on written down fixed assets

D. OPERATION:

1. Sales

2. Gross profit

3. Net profit before tax provision

4. Net profit as % of Sales (D3 as % of D1)

5. Tax provision

6. Tax provision as % of net pre-tax profit (D5 as % D3)

7. Sundry debtors as % of gross sales

8. Expenses

9. Expenses as % of shareholders equity (D8 as % of A3)

E. PROFIT VIS_A_VIS CAPITAL:

1. Earning per ordinary share:(in rupees)

-before tax provision (D3/No. of ordinary shares)

-after tax provision [(D3-D5)/No. of ordinary shares]

2. Net profit as % of shareholders' equity (D3 as % of A3)

3. Total amount of dividend

4. Dividend ratio to equity (E3 as % of A3)

5. Dividend cover [(D3-D5)/E3]

6. Total value of bonus shares issued

F. SOURCES OF INCREASE IN CAPITAL EMPLOYED:

1. Increase/decrease in capital employed (A8-A8 of preceding year)

2. Retention in business (D3-D5-E3)

3. Self-financing ratio (F2 as % of F1)

4. Finance from outside the company (F1-F2)

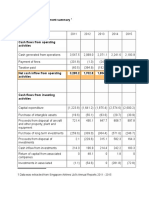

G. CASH FLOW DATA:

1. Depreciation for the year plus retention in business: cash flow (C3+F2)

2. Depreciation for the year plus changes in capital employed (C3+F1)

3. Cash flow ratio (G1 as % of G2)

H. No. OF COMPANIES

398

1966

1967

1968

1969

1970

2,050.0

1,290.0

3,340.0

50.0

30.0

1700.0

1,780.0

5,120.0

34.8

162.9

16.3

2,350.0

1,350.0

3,700.0

50.0

30.0

.2,020.0

2,100.0

5,800.0

36.2

157.4

15.8

2,550.0

1,350.0

3,900.0

50.0

80.0

2,260.0

2,390.0

6,290.0

38.0

152.9

15.3

2,980.0

1,620.0

4,600.0

60.0

180.0

2,430.0

2,670.0

7,270.0

36.7

154.4

15.4

3,410.0

1,750.0

5,160.0

80.0

280.0

2,520.0

2,880.0

8,040.0

35.8

151.3

15.1

470.0

270.0

200.0

2,600.0

3,070.0

2,110.0

960.0

68.7

-1,640.0

490.0

280.0

210.0

2,990.0

3,480.0

2,660.0

820.0

76.4

-217.0

540.0

290.0

250.0

3,090.0

3,630.0

2,880.0

750.0

79.3

-234.0

650.0

380.0

270.0

3,710.0

4,360.0

3,360.0

1,000.0

77.16

-271.0

770.0

460.0

310.0

4,570.0

5,340.0

4,170.0

1,170.0

78.1

-340.0

5,600.0

4,160.0

190.0

4.37

6,700.0

4,980.0

250.0

4.78

7,390.0

5,540.0

290.0

6.01

8,530.0

6,270.0

370.0

5.57

9,620.0

6,870.0

440.0

6.02

4,890.0

860.0

540.0

11.04

120.0

22.22

5,840.0

910.0

480.0

8,22.0

120.0

25.00

6,400.0

1,160.0

640.0

10.00

150.0

23.44

8,020.0

1,450.0

750.0

9.35

200.0

26.67

9,690.0

1,620.0

790.0

8.15

250.0

31.65

450.0

13.5

590.0

15.9

700.0

17.9

.910.0

19.8

1,080.0

20.9

2.6

2.0

16.2

160.0

4.8

2.6

10.0

2..0

1..5

13.0

190.0

5.14

1.9

40.0

2.5

1.9

16.4

230.0

5.9

2.1

60.0

2.50.0

1.8

16.3

280.0

6.1

2.0

80.0

2.3

1.6

15.3

280.0

5.4

1.9

100.0

550.0

260.0

47.3

290.0

680.0

170.0

25.0

510.0

490.0

260.0

53.1

230.0

980.0

270.0

27.6

710.0

770.0

260.0

33.8

510.0

450.0

740.0

60.8

148

420.0

930.0

45.2

173

550.0

780.0

70.5

188

640.0

1,350.0

47.4

203

700.0

1,210.0

57.8

237

Capital Market

5.4 Balance Sheet Analysis of Non Financial Companies

(Listed at KSE)

(Million Rupees)

ITEMS

A. CAPITAL STRUCTURE

1. Ordinary share capital

1971

1972

1973

1974

1975

3,860.0

4,120.0

3,614.6

3,767.6

1,400.8

2. Surplus

1,670.0

1,620.0

1,622.3

1,982.3

2,098.2

3. Shareholders' equity (A1+A2)

5,530.0

5,740.0

5,237.0

5,749.9

6,199.0

80.0

80.0

46.8

46.7

92.1

350.0

380.0

347.9

303.0

441.8

6. Other fixed liabilities

2,910.0

4,900.0

3,990.4

4,323.4

4,326.8

7. Total fixed liabilities (A4+A5+A6)

3,340.0

5,360.0

4,385.1

4,673.1

4,860.5

8. Total capital employed (A3+A7)

8,870.0

11,100.0

9,622.0

10,422.9

11,059.8

4. Preference shares

5. Debentures

9. Gearing (A7 as % of A8)

10. Shareholders' equity as % of ordinary share capital (A3 as % of A1)

11. Break-up value of ordinary shares (in Rs.)

B. LIQUIDITY:

1. Liquid Assets:

(i) Cash

(ii) Investments

2. Other current assets

3. Current assets (B1+B2)

4. Current liabilities

5. Net current assets (B3-B4)

6. Current liabilities as % of current assets (B4 as % of B3)

7. Net liquid assets (B1-B4)

C. FIXED ASSETS:

1. Fixed assets at cost

2. Fixed assets after deducting accumulated depreciation

3. Depreciation for the year

4. Average annual % depreciation on written down fixed assets

37.7

48.3

45.6

44.8

43.9

143.3

139.3

1,44.9

1,52.6

1,51.2

14.3

13.93

14.5

15.5

15.1

850.0

470.0

380.0

4,920.0

5,770.0

4,710.0

1,060.0

81.6

-3,860.0

930.0

580.0

350.0

5,760.0

6,690.0

6,210.0

480.0

92.8

-5,280.0

973.5

684.6

288.9

6,119.8

7,093.3

6,892.6

200.6

97.2

-5,919.1

953.3

604.3

349.0

8,380.4

9,333.7

9,115.5

218.2

97.7

-8,162.4

1,363.4

1,016.9

346.5

9,675.7

11,039.2

11,046.6

7.5

100.1

-9,682.9

11,210.0

14,500.0

13,397.7

15,105.5

16,643.6

7,810.0

10,620.0

9,421.4

10,204.7

11,067.1

510.0

670.0

723.4

754.9

907.6

6.1

5.9

7.1

6.9

8.2

16,340.0

11,900.0

14,437.2

20,881.0

25,422.8

1,450.0

1,430.0

2,020.3

2,671.4

2,943.4

620.0

290.0

861.7

853.3

1,058.4

3.8

2.4

6.0

4.1

4.2

240.0

170.0

337.3

471.1

523.5

38.7

58.6

39.1

55.2

49.5

1,060.0

1,360.0

1,,366.1

2,269.1

2,461.3

19.2

23.7

26.1

39.5

39.7

1.6

1.

11.2

290.0

5.2

1.3

80.0

0.7

0.3

5.1

240.0

4.2

0.5

40.0

2.4

1.4

16.4

446.1

8.5

1.2

36.2

2.3

1.0

14.8

372.3

7.5

0.9

47.2

2.6

1.3

17.1

457.0

7.4

1.2

95.9

830.0

90.0

10.8

740.0

2,140.0

-120.0

-5.6

2,260.0

-158.0

78.3

-49.5

-236.3

800.9

9.9

1.2

791.0

636.9

77.9

12.2

559.0

D. OPERATION:

1. Sales

2. Gross profit

3. Net profit before tax provision

4. Net profit as % of Sales (D3 as % of D1)

5. Tax provision

6. Tax provision as % of net pre-tax profit (D5 as % D3)

7. Sundry debtors as % of gross sales

8. Expenses

9. Expenses as % of shareholders equity (D8 as % of A3)

E. PROFIT VIS_A_VIS CAPITAL:

1. Earning per ordinary share:(in rupees)

-before tax provision (D3/No. of ordinary shares)

-after tax provision [(D3-D5)/No. of ordinary shares]

2. Net profit as % of shareholders' equity (D3 as % of A3)

3. Total amount of dividend

4. Dividend ratio to equity (E3 as % of A3)

5. Dividend cover [(D3-D5)/E3]

6. Total value of bonus shares issued

F. SOURCES OF INCREASE IN CAPITAL EMPLOYED:

1. Increase/decrease in capital employed (A8-A8 of preceding year)

2. Retention in business (D3-D5-E3)

3. Self-financing ratio (F2 as % of F1)

4. Finance from outside the company (F1-F2)

G. CASH FLOW DATA:

1. Depreciation for the year plus retention in business: cash flow (C3+F2)

2. Depreciation for the year plus changes in capital employed (C3+F1)

3. Cash flow ratio (G1 as % of G2)

H. No. OF COMPANIES

399

600.0

550.0

801.7

764.8

985.5

1,340.0

2,810.0

565.4

1,555.8

1,544.5

44.8

19.6

141.8

49.2

63.8

269

274

287

242

248

Handbook of Statistics on Pakistan Economy

5.4 Balance Sheet Analysis of Non Financial Companies

(Listed at KSE)

(Million Rupees)

ITEMS

1976

1977

1978

1979

1980

4,523.2

2,270.4

6,793.6

190.0

293.3

4,653.7

5,136.7

11,930.6

43.1

150.2

15.0

4,818.8

2,267.3

7,086.3

287.8

439.9

4,712.1

5,439.7

12,526.0

43.4

147.1

14.7

5,312.7

3,079.8

8,392.5

287.7

436.1

5,503.8

6,227.7

14,620.0

42.6

158.0

15.8

6,122.2

3,637.3

9,759.5

280.2

441.8

6,359.3

7,081.3

16,840.7

42.1

159.4

15.9

7,083.4

5,376.2

12,459.6

313.9

464.8

9,055.8

9,834.5

22,294.1

44.1

175.9

17.6

1,449.9

1,118.4

331.5

10,998.1

12,448.0

12,830.9

-382.9

103.1

-11,381.1

1,674.7

1,328.4

346.4

12,945.3

14,612.9

16,114.2

-1,494.3

110.2

-14,439.5

2,304.7

1,899.3

405.4

14,006.7

16,311.5

17,031.6

-720.2

104.4

-14,726.9

2,653.8

2,164.7

489.0

16,665.4

19,319.2

20,552.7

-1,233.5

106.4

-17,898.9

2,727.1

2,172.2

554.9

19,447.2

22,174.3

23,517.8

-1,343.5

106.1

-20,790.6

1. Fixed assets at cost

18,421.4

21,979.9

23,204.7

27,462.3

34,768.6

2. Fixed assets after deducting accumulated depreciation

12,313.3

14,020.1

15,340.4

18,074.2

23,637.5

958.5

1,044.1

1,179.5

1,285.2

1,650.9

7.2

6.9

4.1

8.1

9.4

28,417.9

3,387.8

933.0

3.3

453.9

48.6

33,106.4

4,368.9

920.3

2.8

473.2

51.42

36,922.1

4,340.8

1,289.4

3.5

567.2

44.0

2,776.4

40.9

3,678.7

51.9

3,324.0

39.6

439,84.0

5,744.1

1,513.2

3.4

693.0

45.8

8.2

4,736.6

48.5

61,343.9

7,330.1

2,339.4

3.8

987.1

40.1

6.6

5,791.3

46.5

-before tax provision (D3/No. of ordinary shares)

2.1

1.9

2.4

2.5

3.3

-after tax provision

[(D3-D5)/No. of ordinary shares]

1.1

0.9

1.4

1.3

1.9

2. Net profit as % of shareholders' equity (D3 as % of A3)

13.7

13.0

15.4

15.5

18.8

A. CAPITAL STRUCTURE

1. Ordinary share capital

2. Surplus

3. Shareholders' equity (A1+A2)

4. Preference shares

5. Debentures

6. Other fixed liabilities

7. Total fixed liabilities (A4+A5+A6)

8. Total capital employed (A3+A7)

9. Gearing (A7 as % of A8)

10. Shareholders' equity as % of ordinary share capital (A3 as % of A1)

11. Break-up value of ordinary shares (in Rs.)

B. LIQUIDITY:

1. Liquid Assets:

(i) Cash

(ii) Investments

2. Other current assets

3. Current assets (B1+B2)

4. Current liabilities

5. Net current assets (B3-B4)

6. Current liabilities as % of current assets (B4 as % of B3)

7. Net liquid assets (B1-B4)

C. FIXED ASSETS:

3. Depreciation for the year

4. Average annual % depreciation on written down fixed assets

D. OPERATION:

1. Sales

2. Gross profit

3. Net profit before tax provision

4. Net profit as % of Sales (D3 as % of D1)

5. Tax provision

6. Tax provision as % of net pre-tax profit (D5 as % D3)

7. Sundry debtors as % of gross sales

8. Expenses

9. Expenses as % of shareholders equity (D8 as % of A3)

E. PROFIT VIS_A_VIS CAPITAL:

1. Earning per ordinary share:(in rupees)

3. Total amount of dividend

468.3

443.1

547.1

644.7

805.2

4. Dividend ratio to equity (E3 as % of A3)

6.9

6.2

6.5

6.6

6.5

5. Dividend cover [(D3-D5)/E3]

1.0

1.0

1.3

1.3

1.7

49.3

20.4

54.4

12.0

159.4

6. Total value of bonus shares issued

F. SOURCES OF INCREASE IN CAPITAL EMPLOYED:

1. Increase/decrease in capital employed (A8-A8 of preceding year)

870.8

595.4

2,094.2

2,220.5

5,453.4

2. Retention in business (D3-D5-E3)

10.8

4.0

175.1

175.4

597.0

3. Self-financing ratio (F2 as % of F1)

1.24

0.7

8.4

7.9

11.0

860.0

591.4

1,919.1

2,045.1

4,856.4

4. Finance from outside the company (F1-F2)

G. CASH FLOW DATA:

1. Depreciation for the year plus retention in business: cash flow (C3+F2)

2. Depreciation for the year plus changes in capital employed (C3+F1)

3. Cash flow ratio (G1 as % of G2)

H. No. OF COMPANIES

400

969.3

1,048.3

1,354.6

1,460.6

2,247.9

1,829.3

1,639.7

3,273.7

3,505.7

7,104.3

53.0

63.9

41.4

41.7

31.6

247

244

253

254

256

Capital Market

5.4 Balance Sheet Analysis of Non Financial Companies

(Listed at KSE)

(Million Rupees)

ITEMS

A. CAPITAL STRUCTURE

1. Ordinary share capital

2. Surplus

3. Shareholders' equity (A1+A2)

4. Preference shares

5. Debentures

6. Other fixed liabilities

7. Total fixed liabilities (A4+A5+A6)

8. Total capital employed (A3+A7)

9. Gearing (A7 as % of A8)

10. Shareholders' equity as % of ordinary share capital (A3 as % of A1)

11. Break-up value of ordinary shares (in Rs.)

B. LIQUIDITY:

1. Liquid Assets:

(i) Cash

(ii) Investments

2. Other current assets

3. Current assets (B1+B2)

4. Current liabilities

5. Net current assets (B3-B4)

6. Current liabilities as % of current assets (B4 as % of B3)

7. Net liquid assets (B1-B4)

C. FIXED ASSETS:

1. Fixed assets at cost

2. Fixed assets after deducting accumulated depreciation

3. Depreciation for the year

4. Average annual % depreciation on written down fixed assets

D. OPERATION:

1. Sales

2. Gross profit

3. Net profit before tax provision

4. Net profit as % of Sales (D3 as % of D1)

5. Tax provision

6. Tax provision as % of net pre-tax profit (D5 as % D3)

7. Sundry debtors as % of gross sales

8. Expenses

9. Expenses as % of shareholders equity (D8 as % of A3)

E. PROFIT VIS_A_VIS CAPITAL:

1. Earning per ordinary share:(in rupees)

-before tax provision (D3/No. of ordinary shares)

-after tax provision

[(D3-D5)/No. of ordinary shares]

2. Net profit as % of shareholders' equity (D3 as % of A3)

3. Total amount of dividend

4. Dividend ratio to equity (E3 as % of A3)

5. Dividend cover [(D3-D5)/E3]

6. Total value of bonus shares issued

F. SOURCES OF INCREASE IN CAPITAL EMPLOYED:

1. Increase/decrease in capital employed (A8-A8 of preceding year)

2. Retention in business (D3-D5-E3)

3. Self-financing ratio (F2 as % of F1)

4. Finance from outside the company (F1-F2)

G. CASH FLOW DATA:

1. Depreciation for the year plus retention in business: cash flow (C3+F2)

2. Depreciation for the year plus changes in capital employed (C3+F1)

3. Cash flow ratio (G1 as % of G2)

H. No. OF COMPANIES

401

1981

1982

1983

1984

1985

7,614.2

6,505.2

14,119.4

310.2

715.2

10,968.3

11,993.7

26,113.1

45.9

185.4

18.5

8,551.8

7,759.5

16,311.3

345.2

834.7

14,165.7

15,345.5

31,656.8

48.5

190.7

19.1

9,185.4

9,037.8

18,223.2

340.2

890.3

17,093.2

18,323.6

36,546.8

50.1

198.4

19.8

10,662.5

10,856.4

21,518.9

371.4

918.9

20,886.4

22,176.8

43,695.7

50.8

201.8

20.2

12,157.9

13,212.9

25,370.8

312.5

1,189.2

24,091.2

25,592.9

50,963.6

50.2

208.7

20.9

2,689.7

2,112.4

577.3

23,026.5

25,716.1

25,736.0

-19.9

100.1

-23,046.3

3,113.5

2,442.5

672.0

26,878.3

29,991.8

28,267.5

1,724.3

94.2

-25,154.0

4,202.0

3,462.7

739.3

28,625.9

32,827.8

30,866.3

1,961.6

94.0

-26,664.3

4,275.5

3,399.5

876.0

32,185.6

36,461.1

34,811.7

1,649.4

95.5

-30,536.1

5,530.0

4,627.4

902.6

35,815.9

41,345.9

40,267.2

1,078.7

97.4

-34,737.2

38,955.0

26,133.0

1,864.0

7.8

45,186.0

29,932.5

2,500.6

9.6

52,155.0

34,585.3

3,319.9

11.2

64,948.2

42,046.2

3,323.9

9.2

75,741.5

49,884.9

4,025.6

9.3

74,674.9

8,550.7

2,878.9

3.86

1,164.2

40.4

6.5

6,850.1

48.52

89,669.4

10,658.8

3,221.3

3.6

1,321.3

41.0

6.8

8,267.7

50.7

104,481.4

11,863.6

3,375.8

3.2

1,198.3

35.5

6.2

9,438.6

51.8

117,189.3

12,771.3

3,333.2

2.8

1,412.7

42.4

6.2

10,741.0

49.9

134,146.1

15,706.1

4,137.0

3.08

1,520.2

36.75

6.4

13,225.2

52.1

3.8

2.2

20.4

942.4

6.7

1.8

172.7

3.8

2.2

19.8

1,050.5

6.4

1.8

285.7

3.7

2.4

18.5

1,134.2

6.2

1.9

252.4

3.1

1.8

15.5

1,230.1

5.7

1.5

459.1

3.40

2.2

16.3

1,586.2

6.2

1.6

290.7

3,819.0

772.3

20.2

3,046.7

5,543.7

849.5

15.3

4,694.2

4,890.0

1,043.2

21.2

3,846.8

7,148.9

690.4

9.7

6,458.5

7,267.9

1,030.6

14.2

6,237.3

2,636.3

5,683.0

46.4

260

3,350.2

8,044.3

41.6

266

4,363.1

8,209.9

53.1

270

4,014.3

10,472.9

38.3

288

5,056.2

11,293.5

44.8

302

Handbook of Statistics on Pakistan Economy

5.4 Balance Sheet Analysis of Non Financial Companies

(Listed at KSE)

(Million Rupees)

ITEMS

A. CAPITAL STRUCTURE

1. Ordinary share capital

2. Surplus

3. Shareholders' equity (A1+A2)

4. Preference shares

5. Debentures

6. Other fixed liabilities

7. Total fixed liabilities (A4+A5+A6)

8. Total capital employed (A3+A7)

9. Gearing (A7 as % of A8)

10. Shareholders' equity as % of ordinary share capital (A3 as % of A1)

11. Break-up value of ordinary shares (in Rs.)

B. LIQUIDITY:

1. Liquid Assets:

(i) Cash

(ii) Investments

2. Other current assets

3. Current assets

4. Current liabilities

5. Net current assets (B3-B4)

6. Current liabilities as % of current assets (B4 as % of B3)

7. Net liquid assets (B1-B4)

C. FIXED ASSETS:

1. Fixed assets at cost

2. Fixed assets after deducting accumulated depreciation

3. Depreciation for the year

4. Average annual % depreciation on written down fixed assets

D. OPERATION:

1. Sales

2. Gross profit

3. Net profit before tax provision

4. Net profit as % of Sales (D3 as % of D1)

5. Tax provision

6. Tax provision as % of net pre-tax profit (D5 as % D3)

7. Sundry debtors as % of gross sales

8. Expenses

9. Expenses as % of shareholders equity (D8 as % of A3)

E. PROFIT VIS_A_VIS CAPITAL:

1. Earning per ordinary share:(in rupees)

-before tax provision

(D3/No. of ordinary shares)

-after tax provision

[(D3-D5)/No. of ordinary shares]

2. Net profit as % of shareholders' equity (D3 as % of A3)

3. Total amount of dividend

4. Dividend ratio to equity (E3 as % of A3)

5. Dividend cover [(D3-D5)/E3]

6. Total value of bonus shares issued

F. SOURCES OF INCREASE IN CAPITAL EMPLOYED:

1. Increase/decrease in capital employed (A8-A8 of preceding year)

2. Retention in business (D3-D5-E3)

3. Self-financing ratio (F2 as % of F1)

4. Finance from outside the company (F1-F2)

G. CASH FLOW DATA:

1. Depreciation for the year plus retention in business: cash flow (C3+F2)

2. Depreciation for the year plus changes in capital employed (C3+F1)

3. Cash flow ratio (G1 as % of G2)

H. No. OF COMPANIES

402

1986

1987

1988

1989

1990

13,091.9

17,887.9

30,979.8

299.6

415.9

25,924.4

26,639.9

57,619.7

46.2

236.6

23.7

14,385.2

18,704.5

33,089.7

379.8

301.3

28,699.9

29,381.0

62,470.6

47.03

230.03

23.0

16,359.1

20,685.8

37,044.9

372.4

333.5

31,856.8

32,562.7

69,607.7

46.8

226.5

22.6

19,183.3

25,196.7

44,380.0

360.1

248.4

39,811.0

40,419.5

84,799.5

47.7

231.4

23.1

24,420.1

35,268.1

59,688.2

437.6

373.7

48,558.7

49,370.0

109,058.2

45.3

244.4

24.4

6,269.0

5,370.9

898.1

39,606.5

45,875.5

43,580.5

2,295.0

95.0

-37,311.6

5,826.9

4,786.7

1,040.2

43,422.9

49,249.7

46,171.2

3,078.5

93.7

-40,344.4

7,614.6

6,343.9

1,270.7

49,125.8

56,740.4

54,732.1

2,008.3

96.5

-47,117.5

10,597.0

8,887.7

1,709.3

57,784.9

68,381.9

65,488.9

2,893.0

95.8

-54,891.9

15,766.7

12,439.7

3,327.0

70,107.6

85,874.3

81,459.6

4,414.7

94.9

-65,692.9

84,618.6

55,324.6

4,765.4

9.6

92,105.2

59,392.4

5,522.5

9.8

106,048.2

67,599.4

5,895.0

9.6

133,818.5

81,906.5

7,143.1

10.1

162,248.7

104,643.4

8,793.7

9.0

145,223.3

20,558.3

5,196.6

3.6

1,456.8

28.0

7.0

17,835.8

57.6

156,125.7

21,379.3

4,881.7

3.13

1,591.8

32.6

7.1

18,703.3

56.5

185,521.8

23,313.6

7,117.5

3.8

2,245.1

31.5

6.5

18,216.1

49.2

209,772.5

27,008.6

8,441.2

4.0

2,562.3

30.4

6.7

20,621.8

46.5

252,162.4

28,662.4

9,831.6

3.9

3,147.8

32.0

7.1

21,162.1

35.5

3.9

2.9

16.8

1,824.4

5.9

2.1

544.7

3.4

2.3

14.8

1,948.0

5.9

1.7

735.1

4.4

3.0

19.2

2,311.7

6.2

2.1

592.5

4.4

3.1

19.0

2,892.4

6.5

2.0

640.3

4.0

2.7

16.5

2,967.5

5.0

2.3

824.7

6,656.1

1,915.4

28.8

4,740.6

4,850.9

1,341.9

27.7

3,509.0

7,137.1

2,560.7

35.9

4,576.4

15,191.9

2,986.5

19.7

1,2205.4

24,258.6

3,716.3

15.3

20,542.3

6,680.8

11,421.5

58.5

300

6,864.4

10,373.4

66.2

307

8,455.7

13,032.1

64.9

332

10,129.6

22,335.0

45.4

356

12,510.0

33,052.3

37.9

398

Capital Market

5.4 Balance Sheet Analysis of Non Financial Companies

(Listed at KSE)

(Million Rupees)

ITEMS

A. CAPITAL STRUCTURE

1. Ordinary share capital

2. Surplus

3. Shareholders' equity (A1+A2)

4. Preference shares

5. Debentures

6. Other fixed liabilities

7. Total fixed liabilities (A4+A5+A6)

8. Total capital employed (A3+A7)

9. Gearing (A7 as % of A8)

10. Shareholders' equity as % of ordinary share capital (A3 as % of A1)

11. Break-up value of ordinary shares (in Rs.)

B. LIQUIDITY:

1. Liquid Assets:

(i) Cash

(ii) Investments

2. Other current assets

3. Current assets

4. Current liabilities

5. Net current assets (B3-B4)

6. Current liabilities as % of current assets (B4 as % of B3)

7. Net liquid assets (B1-B4)

C. FIXED ASSETS:

1. Fixed assets at cost

2. Fixed assets after deducting accumulated depreciation

3. Depreciation for the year

4. Average annual % depreciation on written down fixed assets

D. OPERATION:

1. Sales

2. Gross profit

3. Net profit before tax provision

4. Net profit as % of Sales (D3 as % of D1)

5. Tax provision

6. Tax provision as % of net pre-tax profit (D5 as % D3)

7. Sundry debtors as % of gross sales

8. Expenses

9. Expenses as % of shareholders equity (D8 as % of A3)

E. PROFIT VIS_A_VIS CAPITAL:

1. Earning per ordinary share:(in rupees)

-before tax provision (D3/No. of ordinary shares)

-after tax provision [(D3-D5)/No. of ordinary shares]

2. Net profit as % of shareholders' equity (D3 as % of A3)

3. Total amount of dividend

4. Dividend ratio to equity (E3 as % of A3)

5. Dividend cover [(D3-D5)/E3]

6. Total value of bonus shares issued

F. SOURCES OF INCREASE IN CAPITAL EMPLOYED:

1. Increase/decrease in capital employed (A8-A8 of preceding year)

2. Retention in business (D3-D5-E3)

3. Self-financing ratio (F2 as % of F1)

4. Finance from outside the company (F1-F2)

G. CASH FLOW DATA:

1. Depreciation for the year plus retention in business: cash flow (C3+F2)

2. Depreciation for the year plus changes in capital employed (C3+F1)

3. Cash flow ratio (G1 as % of G2)

H. No. OF COMPANIES

403

1991

1992

1993

1994

1995

28,740.0

38,140.9

66,880.9

278.2

563.2

60,747.4

61,588.8

128,469.7

47.9

232.7

23.3

43,185.5

43,133.6

86,319.1

369.1

432.6

82,511.8

83,313.5

169,632.6

49.1

199.9

20.0

48,852.6

51,208.2

100,060.8

329.0

292.7

91,846.4

92,468.1

192,528.9

48.0

204.8

20.5

63,179.6

60,456.7

123,636.3

216.1

122.8

119,186.4

119,525.3

243,161.6

49.2

195.7

19.6

85,223.9

70,945.9

156,169.8

325.9

14,790.9

119,002.3

134,119.1

290,288.9

46.2

183.2

18.3

20,398.0

15,712.7

4685.3

86,478.1

106,876.1

102,664.6

4,211.5

96.1

-82,266.6

21,552.6

14,909.4

6,643.2

102,315.5

123,868.1

118,982.5

4,885.6

96.1

-97,429.9

27,815.2

20,064.1

7,751.1

122,143.4

149,958.6

149,478.6

480.0

99.7

-121,663.4

36,243.7

24,547.0

11,696.7

139,111.0

175,354.0

176,944.4

-1,589.7

100.9

-140,700.7

46,349.6

27,043.2

19,306.5

162,274.6

208,624.2

207,262.4

1,361.8

99.3

-160,912.8

192,532.7

124,258.1

10,576.7

9.9

242,023.3

164,746.9

13,629.8

9.8

296,090.0

192,049.0

16,225.8

9.7

356,437.1

243,139.0

18,170.7

9.5

415,162.1

288,927.6

19,934.9

8.2

312,773.3

34,369.8

9,837.8

3.2

3,344.7

34.0

7.2

27,588.4

41.3

358,687.7

42,953.7

11,438.5

3.2

4,212.2

36.8

6.5

34,817.4

40.3

405,099.5

48,778.3

14,444.9

3.6

5,466.6

37.8

7.0

39,677.0

39.7

467,866.6

57,098.7

15,948.6

3.4

5,713.7

35.8

6.9

46,452.1

37.6

486,189.1

63,057.8

11,650.4

2.4

6,641.0

57.0

8.0

57,540.7

36.8

3.4

2.3

14.7

2,980.4

4.5

2.2

661.2

2.7

1.7

13.3

4,755.7

5.5

1.5

-1,202.2

3.0

1.8

14.4

4,804.7

4.8

1.9

1,208.2

2.5

1.6

12.9

5,385.3

4.4

1.9

2,281.7

1.4

0.6

7.5

4,672.3

3.0

1.1

3,336.0

19,411.4

3,512.7

18.1

15,898.7

41,162.9

2,470.6

6.0

38,692.3

22,896.5

4,173.6

18.2

18,722.9

50,632.6

4,849.6

9.6

45,783.0

47,127.3

337.1

0.7

46,645.6

14,089.4

29,988.1

47.0

422

16,100.4

54,792.7

29.4

477

20,399.4

39,122.3

52.1

486

23,020.3

68,803.9

33.5

537

20,272.0

67,062.2

30.2

532

Handbook of Statistics on Pakistan Economy

5.4 Balance Sheet Analysis of Non Financial Companies

(Listed at KSE)

(Million Rupees)

ITEMS

1996

A. Capital Structure

1. Ordinary share capital

2. Surplus

3. Shareholders' equity (A1+A2)

4. Preference shares

5. Debentures

6. Other fixed liabilities

7. Total fixed liabilities (A4+A5+A6)

8. Total capital employed (A3+A7)

9. Gearing (A7 as % of A8)

10. Shareholders' equity as % of ordinary share capital (A3 as % of A1)

11. Break-up value of ordinary shares (in Rs.)

B. Liquidity:

1. Liquid Assets:

(i) Cash

(ii) Investments

2. Other current assets

3. Current assets

4. Current liabilities

5. Net current assets (B3-B4)

6. Current liabilities as % of current assets (B4 as % of B3)

7. Net liquid assets (B1-B4)

C. FIXED ASSETS:

1. Fixed assets at cost

2. Fixed assets after deducting accumulated depreciation

3. Depreciation for the year

4. Average annual % depreciation on written down fixed assets

D. OPERATION:

1. Sales

2. Gross profit

3. Net profit before tax provision

4. Net profit as % of Sales (D3 as % of D1)

5. Tax provision

6. Tax provision as % of net pre-tax profit (D5 as % D3)

7. Sundry debtors as % of gross sales

8. Expenses

9. Expenses as % of shareholders equity (D8 as % of A3)

E. PROFIT VIS_A_VIS CAPITAL:

1. Earning per ordinary share:(in rupees)

-before tax provision (D3/No. of ordinary shares)

-after tax provision [(D3-D5)/No. of ordinary shares]

2. Net profit as % of shareholders' equity (D3 as % of A3)

3. Total amount of dividend

4. Dividend ratio to equity (E3 as % of A3)

5. Dividend cover [(D3-D5)/E3]

6. Total value of bonus shares issued

F. SOURCES OF INCREASE IN CAPITAL EMPLOYED:

1. Increase/decrease in capital employed (A8-A8 of preceding year)

2. Retention in business (D3-D5-E3)

3. Self-financing ratio (F2 as % of F1)

4. Finance from outside the company (F1-F2)

G. CASH FLOW DATA:

1. Depreciation for the year plus retention in business: cash flow (C3+F2)

2. Depreciation for the year plus changes in capital employed (C3+F1)

3. Cash flow ratio (G1 as % of G2)

H. No. OF COMPANIES

404

1997

1998

1999

160,027.6

98,189.2

258,216.8

208.0

21,223.8

180,432.9

201,864.8

460,081.6

43.9

161.4

16.1

172,509.7

106,577.9

279,087.6

195.3

24,764.3

203,990.5

228,950.0

508,037.6

45.1

161.8

16.2

175,476.8

108,419.4

283,896.2

204.1

25,225.9

209,950.7

235,380.8

519,276.9

45.3

161.8

16.2

184,691.2

124,072.1

308,763.3

187.2

38,816.0

212,910.0

251,913.3

560,676.6

44.9

167.2

16.7

60,071.7

35,598.5

24,473.2

214,283.9

274,355.6

271,848.4

2,507.1

99.1

-211,776.7

61,136.8

37,488.6

23,648.2

258,300.1

319,436.9

340,694.3

-21,257.4

106.7

-279,557.5

73,788.2

50,842.0

22,946.2

299,599.7

373,387.9

409,126.3

-35,738.4

109.6

-335,338.1

80,253.7

55,763.0

24,490.7

303,019.9

383,273.5

389,788.2

-6,514.7

101.7

-309,534.6

633,626.9

457,574.4

26,461.4

9.2

736,006.9

529,295.1

33,108.4

7.2

796,311.6

555,015.3

39,849.4

7.5

843,925.6

567,191.3

45,253.4

8.2

638,972.7

88,262.9

24,483.3

3.8

8,117.3

33.2

9.7

70,651.1

27.4

766,196.1

108,564.5

26,706.5

3.5

8,450.2

31.6

11.2

90,952.6

32.6

867,600.5

127,618.7

33,952.5

3.9

8,527.9

25.1

13.6

107,213.1

37.8

861,391.7

132,619.3

36,377.8

4.2

10,128.9

27.8

12.1

111,727.5

36.2

1.5

1.0

9.5

11,016.9

4.3

1.5

2,565.9

1.5

1.1

9.6

17,566.6

6.3

1.0

2,348.6

1.9

1.4

12.0

27,036.0

9.5

0.9

2,393.2

2.0

1.4

11.8

22,125.6

7.2

1.2

2,137.5

169,792.7

5,349.1

3.2

164,443.6

47,956.0

689.6

1.4

47,266.4

11,239.3

-1,611.5

-14.3

12,850.8

41,399.7

4,123.3

10.0

37,276.4

31,810.5

196,254.1

16.2

553

33,798.0

81,064.4

41.7

549

38,237.9

51,088.7

74.8

547

49,376.7

86,653.0

57.0

530

Capital Market

5.4 Balance Sheet Analysis of Non Financial Companies

(Listed at KSE)

ITEMS

A. CAPITAL STRUCTURE

1. Ordinary share capital

2. Surplus

3. Shareholders' equity (A1+A2)

4. Preference shares

5. Debentures

6. Other fixed liabilities

7. Total fixed liabilities (A4+A5+A6)

8. Total capital employed (A3+A7)

9. Gearing (A7 as % of A8)

10. Shareholders' equity as % of ordinary share capital (A3 as % of A1)

11. Break-up value of ordinary shares (in Rs.)

B. LIQUIDITY:

1. Liquid Assets:

(i) Cash

(ii) Investments

2. Other current assets

3. Current assets

4. Current liabilities

5. Total liabilities

6. Net current assets (B3-B4)

7. Contractual Liabilities

8. Current liabilities as % of current assets (B4 as % of B3)

9. Net liquid assets (B1-B4)

C. FIXED ASSETS:

1. Fixed assets at cost

2. Fixed assets after deducting accumulated depreciation

3. Depreciation for the year

4. Average annual % depreciation on written down fixed assets

5. Total assets (B3-+C2)

D. OPERATION:

1. Sales

2. Gross profit

3. Overhead and other expenses

4. Operating profit

5. Overhead and other expenses as % of gross sales (D3 as % of D1)

6. Financial expenses

7. Financial expenses as % of operating profit (D6 as % of D4)

8. Financial expenses as % of gross sales(D6 as % of D1)

9. Financial expenses as % of contractual liabilities (D6 as % of B7)

10. Net profit before tax provision

11. Net profit as % of Sales (D3 as % of D1)

12. Tax provision

13. Tax provision as % of net pre-tax profit (D5 as % D3)

14. Sundry debtors as % of gross sales

E. PROFIT VIS_A_VIS CAPITAL:

1. Earning per ordinary share:(in rupees)

-before tax provision

(D3/No. of ordinary shares)

-after tax provision

[(D3-D5)/No. of ordinary shares]

2. Net profit as % of shareholders' equity (D3 as % of A3)

3. Total amount of dividend

4. Dividend ratio to equity (E3 as % of A3)

5. Dividend cover [(D30-D5)/E3]

6. Total value of bonus shares issued

F. SOURCES OF INCREASE IN CAPITAL EMPLOYED:

1. Increase/decrease in capital employed (A8-A8 of preceding year)

2. Retention in business (D3-D5-E3)

3. Self-financing ratio (F2 as % of F1)

4. Finance from outside the company (F1-F2)

G. CASH FLOW DATA:

1. Depreciation for the year plus retention in business: cash flow (C3+F2)

2. Depreciation for the year plus changes in capital employed (C3+F1)

3. Cash flow ratio (G1 as % of G2)

H. No. OF COMPANIES

405

(Million Rupees)

2000

2001

2002

2003

191,623

126,645

318,268

194

41,441

194,033

235,668

553,936

43

166

17

189,761

128,977

318,738

187

53,364

172,799

226,350

545,088

42

168

17

228,070

204,867

432,937

890

43,882

138,313

183,085

616,021

30

190

19

246,857

200,607

447,464

1,083

40,128

154,612

195,824

643,287

30

181

18

93,649

60,934

32,715

309,237

402,886

432,862

668,530

-29,976

0

93

-339,213

107,564

70,642

36,921

344,592

452,155

498,536

724,886

-46,380

419,627

91

-390,972

119,968

74,347

45,621

344,221

464,189

453,948

637,033

10,240

331,725

102

-333,981

162,465

97,228

65,237

234,268

509,330

485,825

681,649

23,505

341,082

105

-323,360

897,625

583,912

44,452

8

986,798

955,846

591,469

50,578

9

1,043,624

1,018,106

605,781

58,697

10

1,069,970

1,070,185

619,782

54,992

9

1,129,113

1,003,217.3

149,919

0

0

1,177,502.6

151,819

1,091,767

108,926

0

0

0

0

0

37,660

4

21,015

56

11

93

54,377

50

5

13

54,549

5

23,956

44

10

1,222,526.1

186,783

1,124,121

117,714

92

47,999

41

4

15

69,714

6

25,405

36

9

1,380,310.7

210,041

1,277,734

130,931

92

32,030

24

2

9

98,901

7

36,046

36

8

2

1

12

28,784

9

1

3,792

2

3

2

17

35,970

11

1

3,258

3

3

2

16

44,537

10

1

1,879

3

4

3

22

52,182

12

1

1,240

4

-6,740

-12,139

180

5,398

-8,848

-5,377

61

-3,472

70,933

-228

0

71,161

27,266

10,674

39

16,592

32,313

37,711

86

45,201

41,730

108

520

506

58,469

129,630

45

481

65,666

82,258

80

463

Handbook of Statistics on Pakistan Economy

5.4 Balance Sheet Analysis of Non Financial Companies

(Listed at KSE)

ITEMS

(Million Rupees)

2004

A. CAPITAL STRUCTURE

1. Ordinary share capital

2. Surplus

3. Shareholders' equity (A1+A2)

4. Preference shares

5. Debentures

6. Other fixed liabilities

7. Total fixed liabilities (A4+A5+A6)

8. Total capital employed (A3+A7)

9. Gearing (A7 as % of A8)

10. Shareholders' equity as % of ordinary share capital (A3 as % of A1)

11. Break-up value of ordinary shares (in Rs.)

B. LIQUIDITY:

1. Liquid Assets:

(i) Cash

(ii) Investments

2. Other current assets

3. Current assets (B1+B2)

4. Current liabilities

5. Total liabilities

6. Net current assets (B3-B4)

7. Contractual Liabilities

8. Current liabilities as % of current assets (B4 as % of B3)

9. Net liquid assets (B1-B4)

C. FIXED ASSETS:

1. Fixed assets at cost

2. Fixed assets after deducting accumulated depreciation

3. Depreciation for the year

4. Average annual % depreciation on written down fixed assets

5. Total assets (B3-+C2)

D. OPERATION:

1. Sales

2. Gross profit

3. Overhead and other expenses

4. Operating profit

5. Overhead and other expenses as % of gross sales (D3 as % of D1)

6. Financial expenses

7. Financial expenses as % of operating profit (D6 as % of D4)

8. Financial expenses as % of gross sales(D6 as % of D1)

9. Financial expenses as % of contractual liabilities (D6 as % of B7)

10. Net profit before tax provision

11. Net profit as % of Sales (D3 as % of D1)

12. Tax provision

13. Tax provision as % of net pre-tax profit (D5 as % D3)

14. Sundry debtors as % of gross sales

E. PROFIT VIS_A_VIS CAPITAL:

1. Earning per ordinary share:(in rupees)

-before tax provision

(D3/No. of ordinary shares)

-after tax provision

[(D3-D5)/No. of ordinary shares]

2. Net profit as % of shareholders' equity (D3 as % of A3)

3. Total amount of dividend

4. Dividend ratio to equity (E3 as % of A3)

5. Dividend cover [(D30-D5)/E3]

6. Total value of bonus shares issued

F. SOURCES OF INCREASE IN CAPITAL EMPLOYED:

1. Increase/decrease in capital employed (A8-A8 of preceding year)

2. Retention in business (D3-D5-E3)

3. Self-financing ratio (F2 as % of F1)

4. Finance from outside the company (F1-F2)

G. CASH FLOW DATA:

1. Depreciation for the year plus retention in business: cash flow (C3+F2)

2. Depreciation for the year plus changes in capital employed (C3+F1)

3. Cash flow ratio (G1 as % of G2)

H. No. OF COMPANIES

2005

2006

2007

2008

305,608

289,230

594,838

1,083

23,474

196,727

221,284

354,204

430,746

784,950

3,628

30,905

198,831

233,364

372,336

501,329

873,665

3,519

31,265

251,933

286,717

394,510

558,499

953,009

10,168

45,095

306,986

362,249

419,424

560,270

979,694

9,446

49,586

374,483

433,515

816,122

27

195

20

1,018,314

23

222

22

1,160,382

25

235

24

1,315,258

28

242

24

1,413,209

31

234

23

241,185

160,857

80,328

267,963

692,687

596,893

818,177

95,794

373,562

116

-355,708

300,873

188,306

112,567

337,303

844,851

681,142

914,506

163,709

445,336

124

-380,269

376,658

184,142

192,516

414,622

1,031,848

888,036

1,174,753

143,812

556,212

116

-511,378

409,161

169,690

239,471

515,562

1,196,256

1,041,343

1,403,592

154,913

646,345

115

-632,182

409,911

167,180

242,731

704,003

1,488,310

1,411,856

1,845,371

76,454

851,132

105

-1,001,945

1,150,211

720,328

60,445

9

1,413,015

1,458,664

858,605

69,186

9

1,703,456

1,671,977

1,016,570

75,870

9

2,048,418

1,863,050

1,160,345

86,255

9

2,356,601

2,087,349

1,336,755

96,852

8

2,825,065

1,632,834

272,673

1,471,056

199,205

90

23,752

12

1

6

175,453

11

49,604

28

7

2,031,217

358,493

1,814,613

254,458

89

29,473

12

1

7

224,985

11

62,678

28

8

2,570,950

404,602

2,328,819

305,994

91

49,294

16

2

9

256,700

10

73,133

28

8

2,837,923

406,796

2,616,505

296,426

92

67,127

23

2

10

229,299

8

60,628

26

9

3,471,233

506,629

3,239,172

301,974

93

96,973

32

3

11

205,001

6

95,000

46

11

6

4

29

73,715

12

2

2,263

6

5

29

70,028

9

2

3,399

7

5

29

105,526

12

2

5,764

6

4

24

97,590

10

2

2,996

5

3

21

105,520

11

1

4,731

172,835

52,134

30

120,701

202,192

92,279

46

109,913

142,068

78,041

55

64,027

154,876

71,081

46

83,795

97,951

4,481

5

93,470

112,579

233,280

48

451

161,465

271,378

59

443

153,911

217,938

71

436

157,336

241,131

65

437

101,333

194,803

52

436

Source: Statistics & DWH Department, SBP

Source: Statistics & DWH Department, SBP

406

You might also like

- Burton Sensors SheetDocument128 pagesBurton Sensors Sheetchirag shah17% (6)

- Toy World - ExhibitsDocument9 pagesToy World - Exhibitsakhilkrishnan007No ratings yet

- Me Mums Brownies Business PlanDocument8 pagesMe Mums Brownies Business Planapi-24995312150% (4)

- Diversity Activities Resource GuideDocument106 pagesDiversity Activities Resource GuideVinay NaiduNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Ge Sign A Profile BrochureDocument15 pagesGe Sign A Profile BrochurePaul PichardoNo ratings yet

- Appriasal Letter Format-OriginalDocument1 pageAppriasal Letter Format-Originalvenustaffing100% (1)

- Linking Construction Fatalities To The Design For Construction Safety ConceptDocument23 pagesLinking Construction Fatalities To The Design For Construction Safety ConceptJacob TanNo ratings yet

- Umair Bilal MBA 4 (A) Morning 13367Document56 pagesUmair Bilal MBA 4 (A) Morning 13367Hohaho YohahaNo ratings yet

- GulahmedDocument8 pagesGulahmedOmer KhanNo ratings yet

- Pakistan Petroleum Overall: A.Non-Current Assets (A1+A3+A5+A6+A7)Document16 pagesPakistan Petroleum Overall: A.Non-Current Assets (A1+A3+A5+A6+A7)0300MalikamirNo ratings yet

- IBF QuestionDocument13 pagesIBF QuestionSaqib JawedNo ratings yet

- MSSL Results Quarter Ended 31st December 2011Document4 pagesMSSL Results Quarter Ended 31st December 2011kpatil.kp3750No ratings yet

- Financial Statement Analysis of Non Financial SectorDocument6 pagesFinancial Statement Analysis of Non Financial SectorTayyaub khalidNo ratings yet

- Bluedart AnalysisDocument14 pagesBluedart AnalysisVenkat Sai Kumar KothalaNo ratings yet

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43No ratings yet

- Key RatiosDocument2 pagesKey RatiosKhalid MahmoodNo ratings yet

- Burton ExcelDocument128 pagesBurton ExcelJaydeep SheteNo ratings yet

- Petroleum BSA 06 10Document44 pagesPetroleum BSA 06 10Haji Suleman AliNo ratings yet

- BVADocument15 pagesBVAJasonNo ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- JK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDocument4 pagesJK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDeepa GuptaNo ratings yet

- Financial Projection TemplateDocument88 pagesFinancial Projection TemplateChuks NwaGodNo ratings yet

- Peak Sport Products (1968 HK) : Solid AchievementsDocument9 pagesPeak Sport Products (1968 HK) : Solid AchievementsSai Kei LeeNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- 17 Financial HighlightsDocument2 pages17 Financial HighlightsTahir HussainNo ratings yet

- Axis Bank ValuvationDocument26 pagesAxis Bank ValuvationGermiya K JoseNo ratings yet

- HelloDocument1 pageHellosonikonicaNo ratings yet

- Financial Analysis of Pakistan Cables: Submitted To: Sir Shahbaz 9/10/2014Document25 pagesFinancial Analysis of Pakistan Cables: Submitted To: Sir Shahbaz 9/10/2014Ali RazaNo ratings yet

- Biocon - Ratio Calc & Analysis FULLDocument13 pagesBiocon - Ratio Calc & Analysis FULLPankaj GulatiNo ratings yet

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadNo ratings yet

- 5 Year Cash FlowDocument5 pages5 Year Cash FlowRith TryNo ratings yet

- 2013 Mar 13 - Pernod Ricard SADocument21 pages2013 Mar 13 - Pernod Ricard SAalan_s1No ratings yet

- B. LiabilitiesDocument1 pageB. LiabilitiesSamuel OnyumaNo ratings yet

- BGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEDocument5 pagesBGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEmittleNo ratings yet

- FS Final March31 2009Document29 pagesFS Final March31 2009beehajiNo ratings yet

- 06 Financial HighlightsDocument1 page06 Financial HighlightsKhaira UmmatienNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhNo ratings yet

- Consolidated Financial StatementsDocument78 pagesConsolidated Financial StatementsAbid HussainNo ratings yet

- Excel FSADocument20 pagesExcel FSAJeremy PascuaNo ratings yet

- Selected Financial Summary (U.S. GAAP) : For The YearDocument82 pagesSelected Financial Summary (U.S. GAAP) : For The YearshanzarapunzleNo ratings yet

- Growth Rates (%) % To Net Sales % To Net SalesDocument21 pagesGrowth Rates (%) % To Net Sales % To Net Salesavinashtiwari201745No ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- 2007-08 Annual ReoprtDocument116 pages2007-08 Annual ReoprtParas PalNo ratings yet

- Supreme Infrastructure: Poised For Growth BuyDocument7 pagesSupreme Infrastructure: Poised For Growth BuySUKHSAGAR1969No ratings yet

- Maruti Suzuki, 1Q FY 2014Document16 pagesMaruti Suzuki, 1Q FY 2014Angel BrokingNo ratings yet

- UST SpreadsheetDocument21 pagesUST SpreadsheetTUNo ratings yet

- Unaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)Document2 pagesUnaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)nayanghimireNo ratings yet

- BudgetBrief2012 PDFDocument90 pagesBudgetBrief2012 PDFIdara Tehqiqat Imam Ahmad RazaNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Additional Information Adidas Ar22Document15 pagesAdditional Information Adidas Ar22TADIWANo ratings yet

- DCF Valuation Pre Merger Southern Union CompanyDocument20 pagesDCF Valuation Pre Merger Southern Union CompanyIvan AlimirzoevNo ratings yet

- In RM Million Unless Otherwise Stated: 2018 MfrsDocument4 pagesIn RM Million Unless Otherwise Stated: 2018 MfrsTikah ZaiNo ratings yet

- Cisco - Balance Sheeet Vertical AnalysisDocument8 pagesCisco - Balance Sheeet Vertical AnalysisSameh Ahmed Hassan0% (1)

- Atul Auto (ATUAUT) : Market Rewards PerformanceDocument5 pagesAtul Auto (ATUAUT) : Market Rewards PerformanceGaurav JainNo ratings yet

- Vertical Analysis FS Shell PHDocument5 pagesVertical Analysis FS Shell PHArjeune Victoria BulaonNo ratings yet

- Bharti Airtel: Concerns Due To Currency VolatilityDocument7 pagesBharti Airtel: Concerns Due To Currency VolatilityAngel BrokingNo ratings yet

- Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Document1 pageStandalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Santosh VaishyaNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- KPMG Budget BriefDocument52 pagesKPMG Budget BriefAsad HasnainNo ratings yet

- India Fdi July 2007Document10 pagesIndia Fdi July 2007manishsood224867No ratings yet

- Fsa 2012 16Document190 pagesFsa 2012 16Muhammad Shahzad IjazNo ratings yet

- BIL IN - Table 132Document10 pagesBIL IN - Table 132Zikuz SarNo ratings yet

- Consolidated Statements of Income and Other Comprehensive Income (In Million Rupiah) Description 2021 2020 2019 2018 2017Document4 pagesConsolidated Statements of Income and Other Comprehensive Income (In Million Rupiah) Description 2021 2020 2019 2018 2017Ferial FerniawanNo ratings yet

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlNo ratings yet

- The Development of Econometrics and Empirical Methods in EconomicsDocument12 pagesThe Development of Econometrics and Empirical Methods in EconomicsIrsyad Khir100% (2)

- Articulo de Pernos Metalicos PrefabricadosDocument14 pagesArticulo de Pernos Metalicos PrefabricadosYvelisse LoraNo ratings yet

- Leon County Booking Report: Feb. 21, 2021Document3 pagesLeon County Booking Report: Feb. 21, 2021WCTV Digital Team0% (1)

- Introduction To Human Resource Development: Emergence of HRD, Critical HRD Roles, Challenges For HRDDocument63 pagesIntroduction To Human Resource Development: Emergence of HRD, Critical HRD Roles, Challenges For HRDRaj KuttyNo ratings yet

- People v. SaleyDocument47 pagesPeople v. SaleyDLNo ratings yet

- Test OgenDocument65 pagesTest OgenMichael PogodaNo ratings yet

- OTQM 111 Lecnote#1 What Is Operations Management?Document2 pagesOTQM 111 Lecnote#1 What Is Operations Management?Angela Marie HipeNo ratings yet

- Recent Ielts QuestionsDocument44 pagesRecent Ielts QuestionsprajwalsNo ratings yet

- Admission, Transfer, and DischargeDocument28 pagesAdmission, Transfer, and DischargeydtrgnNo ratings yet

- Memorandum No. 002.sy2019 2020 PDFDocument2 pagesMemorandum No. 002.sy2019 2020 PDFJopher NazarioNo ratings yet

- Short Term Decision Making: Question No. 1Document2 pagesShort Term Decision Making: Question No. 1AbdulAzeemNo ratings yet

- Product Presentation PPT NeerajDocument8 pagesProduct Presentation PPT NeerajNeeraj UdiniyaNo ratings yet

- Round & Webbing Slings WLL ChartDocument1 pageRound & Webbing Slings WLL ChartNhien ManNo ratings yet

- Evaluating of Security Information Resources and Services in Selected Polytechnic Libraries in Ogun StateDocument18 pagesEvaluating of Security Information Resources and Services in Selected Polytechnic Libraries in Ogun StatepeterNo ratings yet

- Reflection PDFDocument3 pagesReflection PDFRizette PaloganNo ratings yet

- BHIKHU PAREKH - Some Reflections On Hindu Tradition of Political ThoughtDocument15 pagesBHIKHU PAREKH - Some Reflections On Hindu Tradition of Political ThoughtPooja PandeyNo ratings yet

- Department of English and American Studies English Language and LiteratureDocument43 pagesDepartment of English and American Studies English Language and LiteratureSorica DianaNo ratings yet

- Present Simple: I - Put The Sentences Into Present Simple. Don't Forget The "S" If It's NecessaryDocument3 pagesPresent Simple: I - Put The Sentences Into Present Simple. Don't Forget The "S" If It's NecessaryAlmeria JubranNo ratings yet

- Kureeethadam, Joshtrom IsaacDocument30 pagesKureeethadam, Joshtrom IsaacFattihi EkhmalNo ratings yet

- Internal Workings of Essbase-ASO & BSO Secrets RevealedDocument62 pagesInternal Workings of Essbase-ASO & BSO Secrets RevealedparmitchoudhuryNo ratings yet

- AUTHORSDocument15 pagesAUTHORSMarian Althea FumeraNo ratings yet

- SRF Faruqi On Faruqi 2013Document23 pagesSRF Faruqi On Faruqi 2013tvphile1314100% (1)

- CMA April - 14 Exam Question SolutionDocument55 pagesCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- LP PERMUTATIONDocument2 pagesLP PERMUTATIONCarter MangahasNo ratings yet

- Manual WFNDocument385 pagesManual WFNFerzz MontejoNo ratings yet