Professional Documents

Culture Documents

Balance of Payment 36.

Uploaded by

prince3041Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance of Payment 36.

Uploaded by

prince3041Copyright:

Available Formats

Balance of Payments

1.

A countrys balance of payments reveals its financial position vis-vis foreign countries.

2.

The two sides of balance of payments must always balance i.e. payments to be made to outsiders must equal the receipts from outsiders.

3.

Since it furnishes key information related to an understanding of a countrys economic problems thus it is of great value in forecasting its business and economic conditions.

Balance of payments Current account Capital account

Current account shows the income and expenditure for /or purchase of goods and services .

Exports Merchandise Imports

Current Account Services

Travel

Transportation

Invisibles

Income

Insurance

Grants, Gifts

Capital account reflects the changes in the international indebtedness of the country.

Foreign Investment Capital Account Loans Banking Capital

FDI FII Invetment

As a simple accounting necessity : balance of payments data are kept according to accounting principles- so for every debit there is a credit. So it is clear that a nations balance of payments must always balance. Then why we talk about a deficit or a surplus in balance of payments?

Transactions appearing in balance of payments:

Autonomous Transactions

Transactions Induced or compensatory transactions

Adjustments of Balance of Payments: 1. A decline in foreign balances,

2. Export of gold,

3. Sale of domestically held securities in an international market, and 4. Short-term borrowings.

Balance of Payments Summary: Current Account

29.6% 31.5 %

13.8% 20 %

3.7 % 37.3%

40.1% 34 %

Source: RBI http://indiabudget.nic.in

Source: RBI http://indiabudget.nic.in

Balance of Payments Summary: Capital Account and Overall Balance

Source: RBI http://indiabudget.nic.in

100000 80000

92164

Overall Balance

All Figures are in US $ million

60000

40000 20000 0 2006-07 2007-08 2008-09 2009-10 2010-11 -20000 -40000 -20080 36606 13441 13050

Overall 7030

5719

201112#

Source: RBI http://indiabudget.nic.in

You might also like

- 10 2QDocument1 page10 2Qprince3041No ratings yet

- 10 1QDocument1 page10 1Qprince3041No ratings yet

- BRIDGE To INDIA Case Study Giriraj EnterprisesDocument11 pagesBRIDGE To INDIA Case Study Giriraj EnterprisesAmol KhadkeNo ratings yet

- AirThread G015Document6 pagesAirThread G015sahildharhakim83% (6)

- Australian Chickpea Exports: (Desi & Kabuli)Document14 pagesAustralian Chickpea Exports: (Desi & Kabuli)prince3041No ratings yet

- Canteen Rate List 2014Document3 pagesCanteen Rate List 2014prince3041No ratings yet

- 2014 15 Pulse StandardsDocument98 pages2014 15 Pulse Standardsprince3041No ratings yet

- 10 3QDocument1 page10 3Qprince3041No ratings yet

- India Solar Compass Oct 2014 PrezDocument10 pagesIndia Solar Compass Oct 2014 Prezprince3041No ratings yet

- 11Document1 page11prince3041No ratings yet

- BFSI Sector AnalysisDocument3 pagesBFSI Sector Analysisprince3041No ratings yet

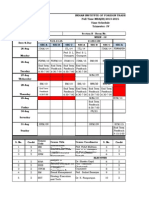

- IIFT MBA Timetable for Trimester IVDocument4 pagesIIFT MBA Timetable for Trimester IVprince3041No ratings yet

- Case Analysis of Consolidated Rail Company (Conrail) Takeover BidDocument7 pagesCase Analysis of Consolidated Rail Company (Conrail) Takeover BidRahul Garg50% (2)

- CRC)Document2 pagesCRC)prince3041No ratings yet

- Treasury Management-An Integrated ApproachDocument20 pagesTreasury Management-An Integrated Approachprince3041No ratings yet

- Mathematik, 1, 269-271Document1 pageMathematik, 1, 269-271prince3041No ratings yet

- Balance of Payment 36.Document12 pagesBalance of Payment 36.prince3041No ratings yet

- Ijptt V5P401Document4 pagesIjptt V5P401prince3041No ratings yet

- Results 14 16Document27 pagesResults 14 16prince3041No ratings yet

- Foreign Trade Policy 2009-2014Document112 pagesForeign Trade Policy 2009-2014shruti_siNo ratings yet

- Data Interpretation SolutionsDocument28 pagesData Interpretation SolutionsimdebarshiNo ratings yet

- HIERCHYDocument1 pageHIERCHYprince3041No ratings yet

- Abraham LincolnDocument10 pagesAbraham Lincolnprince3041No ratings yet

- URLListDocument3 pagesURLListmichelle_carloNo ratings yet

- Banking: Lesson 15Document12 pagesBanking: Lesson 15vkfzrNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)