Professional Documents

Culture Documents

Sales Tax Record: Product Name Unit Price Tax Total

Sales Tax Record: Product Name Unit Price Tax Total

Uploaded by

Ashley Morgan0 ratings0% found this document useful (0 votes)

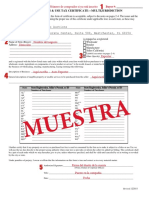

2 views1 pageAll sales recorded between the company's production start date and liquidation date must be reported, with the calculated sales tax forwarded to the JA office by the liquidation date. This document provides a form for a company to report their gross sales, calculate the net sales after subtracting sales tax, determine the sales tax amount owed, and mail a check for the total taxes due along with the completed form.

Original Description:

Sales Tax Record

Original Title

Sales Tax Record-NEW

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAll sales recorded between the company's production start date and liquidation date must be reported, with the calculated sales tax forwarded to the JA office by the liquidation date. This document provides a form for a company to report their gross sales, calculate the net sales after subtracting sales tax, determine the sales tax amount owed, and mail a check for the total taxes due along with the completed form.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageSales Tax Record: Product Name Unit Price Tax Total

Sales Tax Record: Product Name Unit Price Tax Total

Uploaded by

Ashley MorganAll sales recorded between the company's production start date and liquidation date must be reported, with the calculated sales tax forwarded to the JA office by the liquidation date. This document provides a form for a company to report their gross sales, calculate the net sales after subtracting sales tax, determine the sales tax amount owed, and mail a check for the total taxes due along with the completed form.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

Sales Tax Record

All sales recorded as of _____________________MUST be reported, and the sales tax

(Company production start date)

forwarded to the JA office by_______________________.

(Company liquidation date)

JA Company Name:_________________________________________________

JA Volunteer Name:_________________________________________________

Date:_____________________

Product Name

Unit Price

A) Gross Sales (Including Tax)

Tax

Total

$____________________

B) Net Sales (Gross / (1 + state tax)) - ____________________

C) Sales Tax (A B)

$____________________

Example:

A) Gross Sales

$500.00

B) Net Sales (500 / 1.05)

- 476.19

C) Sales Tax ($500 $476.19)

= $23.81

Enter amount from line from (C)

Total Taxes Due $_____________

Check Number:_______________

Mail sales tax check, along with this form, to your JA Area Office.

I declare under the penalty of perjury that this return has been examined by me and to the

best of my knowledge and belief, is a true, correct, and complete return.

__________________________

Financial Department Signature

__________________________

_______________________________

Volunteer

_______________________________

Human Resource Department Signature

Date

HS803- 22

You might also like

- Irrevocable ATS FormDocument2 pagesIrrevocable ATS Formcarlomaderazo75% (4)

- Self-Employment Ledger-PDF Reader ProDocument1 pageSelf-Employment Ledger-PDF Reader ProNicola NenciNo ratings yet

- Intent To Sell Form Bill of Sale New PDFDocument1 pageIntent To Sell Form Bill of Sale New PDFmalouNo ratings yet

- Auto Repair Invoice TemplateDocument2 pagesAuto Repair Invoice TemplateEscapayd ENo ratings yet

- Vehicle Bill of SaleDocument3 pagesVehicle Bill of SaleChizue HanaNo ratings yet

- Data On Total Running Inventory For The YearDocument4 pagesData On Total Running Inventory For The YearMavi Manalo-Narvaez0% (1)

- Annex A.1.1 - Sworn Declaration of Taxpayers ProfileDocument2 pagesAnnex A.1.1 - Sworn Declaration of Taxpayers Profilerommel zimaraNo ratings yet

- Relevant Seller Agreement FinalDocument3 pagesRelevant Seller Agreement FinalSigfred Paje AngelesNo ratings yet

- Ang Tindahan Company: Salvador, Topakin St. Barangay Mapagmahal VAT Registered TIN NumberDocument5 pagesAng Tindahan Company: Salvador, Topakin St. Barangay Mapagmahal VAT Registered TIN NumberAshlee BaguioNo ratings yet

- Hvac Invoice TemplateDocument2 pagesHvac Invoice TemplateMonang RidwanNo ratings yet

- Annex A.1.1 - Taxpayers AttestationsDocument3 pagesAnnex A.1.1 - Taxpayers AttestationssheilaNo ratings yet

- Private Car (Vehicle) Sales ReceiptDocument1 pagePrivate Car (Vehicle) Sales ReceiptJM Ramos100% (2)

- Private Car Vehicle Sales Receipt TemplateDocument1 pagePrivate Car Vehicle Sales Receipt Templatedaily liveNo ratings yet

- Summary of Monthly Allowance ReceiptsDocument1 pageSummary of Monthly Allowance Receiptsling lingNo ratings yet

- Private Car Vehicle Sales Receipt TemplateDocument3 pagesPrivate Car Vehicle Sales Receipt Templatedaily liveNo ratings yet

- RMMSCD - Data - On - Total - Running - Inventory - For - The - YearDocument1 pageRMMSCD - Data - On - Total - Running - Inventory - For - The - YearMuhammad Hasher AnjalinNo ratings yet

- Full and Final Form - GeniusDocument3 pagesFull and Final Form - GeniusHrishikesh.0% (1)

- BTR ApplicationDocument1 pageBTR ApplicationRama LamaNo ratings yet

- SolCred Industria1Document2 pagesSolCred Industria1Gabriel RuedaNo ratings yet

- Auto Repair Invoice TemplateDocument2 pagesAuto Repair Invoice Templateerin.young100No ratings yet

- Questionnaire For Business Review: Gregory Scot WestDocument3 pagesQuestionnaire For Business Review: Gregory Scot WestBen WongNo ratings yet

- Itemized InvoiceDocument2 pagesItemized Invoicehakeemballin23No ratings yet

- Joint Application For Sale and Transfer of Permanent AuthorityDocument5 pagesJoint Application For Sale and Transfer of Permanent AuthoritySujith Raj SNo ratings yet

- 14594rmo04 46aDocument1 page14594rmo04 46aKaizer DaveNo ratings yet

- BPLO (Inspection Format)Document1 pageBPLO (Inspection Format)Bplo CaloocanNo ratings yet

- BIR AlphalistDocument1 pageBIR AlphalistEric Pajuelas EstabayaNo ratings yet

- Artist Invoice TemplateDocument2 pagesArtist Invoice TemplateEscapayd ENo ratings yet

- Listing Change NoticeDocument1 pageListing Change NoticeSean MagersNo ratings yet

- ZiiplabsDocument2 pagesZiiplabsgaw urNo ratings yet

- SBIapplicationformDocument5 pagesSBIapplicationformSufi DarweshNo ratings yet

- FO OIMB A2 011 Application FormDocument1 pageFO OIMB A2 011 Application FormMichael Aloba100% (1)

- Spanish MRC Resale Cert Con Muestra 05 - 2015Document2 pagesSpanish MRC Resale Cert Con Muestra 05 - 2015Aaron CarrilloNo ratings yet

- Invoice - Vendor - FormDocument1 pageInvoice - Vendor - FormabdulfattahNo ratings yet

- Philippine Economic Zone Authority: Republic of The PhilippinesDocument2 pagesPhilippine Economic Zone Authority: Republic of The PhilippinesPaul GeorgeNo ratings yet

- Letter To VendorDocument3 pagesLetter To VendorJhalak AgarwalNo ratings yet

- Ats 1Document1 pageAts 1Max SpielbergNo ratings yet

- Annex A.1.1 - Sworn Declaration of Taxpayers ProfileDocument2 pagesAnnex A.1.1 - Sworn Declaration of Taxpayers ProfileKimberly MayNo ratings yet

- Request For Credit ApprovalDocument1 pageRequest For Credit Approvalorlandoc9358No ratings yet

- Cost Estimation - ServiceDocument8 pagesCost Estimation - Serviceapi-230302935No ratings yet

- Vehicle Information Sheet: Taxpayer Name and TIN Name of Business Principal Business or ProfessionDocument1 pageVehicle Information Sheet: Taxpayer Name and TIN Name of Business Principal Business or ProfessionkeithNo ratings yet

- QTY Description Unit Price Total QTY Description Unit Price TotalDocument1 pageQTY Description Unit Price Total QTY Description Unit Price TotalZoehl ArtsNo ratings yet

- UAF 2022 Converted - NewDocument2 pagesUAF 2022 Converted - NewMark Kevin IIINo ratings yet

- Bill of Sale Feb03Document1 pageBill of Sale Feb03Joe Olson100% (1)

- Assignment#1 Object Oriented ProgrammingDocument7 pagesAssignment#1 Object Oriented ProgrammingAsima TahirNo ratings yet

- Assignment#1 Object Oriented ProgrammingDocument7 pagesAssignment#1 Object Oriented Programmingali khanNo ratings yet

- Liquidation-Search-Form FIJIDocument1 pageLiquidation-Search-Form FIJInicholas.quekNo ratings yet

- Quotation Form (JO10-2021-0055) : (Insert Description of Goods) (Total Bid Amount in Words and Figures and Currencies)Document9 pagesQuotation Form (JO10-2021-0055) : (Insert Description of Goods) (Total Bid Amount in Words and Figures and Currencies)Amer Al-KhalifiNo ratings yet

- Letter To Third Party For Erroneous SalesDocument1 pageLetter To Third Party For Erroneous SalesmaeNo ratings yet

- Transfer Deed Share Registrar ServicesDocument1 pageTransfer Deed Share Registrar Serviceskilyas1998_378787958No ratings yet

- Business Proposal Assessment 2019 PDFDocument3 pagesBusiness Proposal Assessment 2019 PDFIlija RistevskiNo ratings yet

- Sales ReceiptDocument1 pageSales Receiptphumu063No ratings yet

- Delivery Receipt TemplateDocument1 pageDelivery Receipt Templatejeffreygoldner401No ratings yet

- Dealer Application: Contact InformationDocument3 pagesDealer Application: Contact InformationLORENANo ratings yet

- Trammell Law Firm: Client Information FormDocument7 pagesTrammell Law Firm: Client Information FormMarcia SidesNo ratings yet

- Employee Scrap Sales FormDocument4 pagesEmployee Scrap Sales FormAlfonso Lasmarias Estolloso IIINo ratings yet

- HRS001 Employment Requisition 1Document2 pagesHRS001 Employment Requisition 1abawaka3No ratings yet

- Post Production Editing Invoice TemplateDocument1 pagePost Production Editing Invoice TemplateLanre Jazzel AbimbolaNo ratings yet

- Bill of Sale Template 2 PDFDocument1 pageBill of Sale Template 2 PDFDestaNo ratings yet

- Product Concern Report FormDocument1 pageProduct Concern Report FormEduardo Bernal LopezNo ratings yet

- Derivative RulesDocument3 pagesDerivative RulesAshley MorganNo ratings yet

- Establish A Tourist Harassment Hotline - GleanerDocument2 pagesEstablish A Tourist Harassment Hotline - GleanerAshley MorganNo ratings yet

- Better Sleep, Better YouDocument1 pageBetter Sleep, Better YouAshley MorganNo ratings yet

- Eco-System Related PassagesDocument4 pagesEco-System Related PassagesAshley MorganNo ratings yet

- Writing The Analytical EssayDocument3 pagesWriting The Analytical EssayAhmed HajiNo ratings yet

- What Is Your ExcuseDocument1 pageWhat Is Your ExcuseAshley MorganNo ratings yet

- Study Finds Frictional HeatDocument3 pagesStudy Finds Frictional HeatAshley MorganNo ratings yet

- Python OopDocument26 pagesPython OopAshley MorganNo ratings yet

- Language Analysis Essay WritingDocument12 pagesLanguage Analysis Essay WritingAshley MorganNo ratings yet

- Language Analysis: Language To PersuadeDocument4 pagesLanguage Analysis: Language To PersuadeAshley MorganNo ratings yet

- Chris Brown Cover Tease: 'I Hope That I Am Not Defined by Just A Few Moments in My Life'Document3 pagesChris Brown Cover Tease: 'I Hope That I Am Not Defined by Just A Few Moments in My Life'Ashley MorganNo ratings yet

- QuestionDocument1 pageQuestionAshley MorganNo ratings yet

- LOVE, We Hear It Every Single Day ! Ah Come On !Document1 pageLOVE, We Hear It Every Single Day ! Ah Come On !Ashley MorganNo ratings yet

- As BiologyDocument127 pagesAs BiologyRob Gomez100% (6)

- A Math Test 1Document4 pagesA Math Test 1Ashley MorganNo ratings yet

- Lecture 8 - Natural SelectionDocument6 pagesLecture 8 - Natural SelectionAshley MorganNo ratings yet

- Lecture 9 - Genetic EngineeringDocument13 pagesLecture 9 - Genetic EngineeringazwelljohnsonNo ratings yet

- Cape Unit 1 Pure Math 2004Document11 pagesCape Unit 1 Pure Math 2004Ashley MorganNo ratings yet

- CAPE Pure Mathematics 2013 Paper 2Document7 pagesCAPE Pure Mathematics 2013 Paper 2Jerome JAckson100% (6)

- Cape Unit 1 Pure Math (2003)Document11 pagesCape Unit 1 Pure Math (2003)Ashley MorganNo ratings yet

- Cape Unit 1 Pure Math (2003)Document11 pagesCape Unit 1 Pure Math (2003)Ashley MorganNo ratings yet