Professional Documents

Culture Documents

Accounts Payable

Accounts Payable

Uploaded by

Amit MakwanaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts Payable

Accounts Payable

Uploaded by

Amit MakwanaCopyright:

Available Formats

Accounts Payable

OBJECTIVES

A basic understanding of the AP System An understanding of the AP documents and their uses Ability to run Accounts Payable Inquiries in Transaction Processing and

in Decision Support

CONTENTS

1. System Overview, p. 3 2. The Accounts Payable documents, p. 5 3. Accounts Payable Inquiries, p. 7 4. AP Decision Support Queries, p. 9 5. AppendixAccounts Payable Resources, p. 11

Rev J

D A F I S

U S E R S

G U I D E

Page 2

Rev J

A C C O U N T S

P A Y A B L E

SYSTEM OVERVIEW

What is Accounts Payable?

The DaFIS Accounts Payable (AP) module is a collection of documents used to make payments to vendors, employees, and individuals. The AP module is linked to the DaFIS Purchasing module, providing a complete Purchasing/Payable system. It is important that the information on purchasing documents is complete and correct, in order to ensure that the payments made on the AP documents can be processed efficiently and accurately. The AP process begins when an AP document is created in the department. Once an AP document has been completed and is routed through the appropriate departmental approvals, it goes to the Accounts Payable department for final approval. The initiating department must send hardcopy backup documents (i.e. invoices) to AP for each AP transaction. The AP Request for Document Action cover sheet, available at http://accounting.ucdavis.edu/Forms/, should be used when sending receipts to AP, but is not required when sending invoices. When the backup documents are received, the Accounts Payable department reviews the DaFIS document. It is checked for tax codes, remit-to vendor, and payment amount. In order to be approved, the total payment on the AP document must match the payment due on the vendors invoice. If the document is correct, AP approves it for payment. If necessary, AP personnel can make limited changes to these documents in order to ensure accuracy of payment. These changes will not cause any additional routing. If there are corrections that cannot be made by AP, the document is disapproved and a note is attached indicating what changes need to be made. If a document is disapproved by Accounts Payable, they will retain the hard copy backup. When the initiator creates the new, corrected document they should contact Accounts Payable with the new document number.

How does the AP process work?

How do I pay a vendor not listed in DaFIS?

For all AP documents, payments may only be made to an individual or vendor in the DaFIS vendor table. If you are trying to pay an individual or business with an AP document, and cannot locate them in the vendor table, complete the online New Request form at Vendor https://accounting.ucdavis.edu/dafis/vendors/vendorreq.cfm.

Rev J

Page 3

D A F I S

U S E R S

G U I D E

How and when does the check get written?

An automated process is used to generate checks. The process is run every night to produce checks from each of the payable documents that have received final approval from AP (document status A). The daily check-write process will pay against documents that:

have an open AP status; have a scheduled payment date of today or less; and do not have any indication that this payment should be made by

another type of disbursement (i.e. bank wire, foreign bank draft). At this point, a check would generally be processed. There are conditions that would prohibit a payment from being made, such as a levy against the vendor, or an outstanding credit issued by the vendor that is greater than the amount currently owed.

How do I make a correction to an AP Document?

Use the in Notes any field

document created a to make

In the event that an error is discovered in the original document, you have several options for making a correction. Depending upon the status of the document at the time the error is discovered, the following options are available:

1. After routing, but prior to final approval re-open the document and

correction. the

Cite

attach a Note, with a brief explanation, requesting that AP disapprove the document.

previous document in It the is number

note. also to note

2. After final approval, but before payment date the entire document

advisable attach to the a

original

may be reversed. This is accomplished by reentering the same information that appeared in the erred document, but with the opposite value of the amounts entered in the payment amount field of each detail line. The template function should always be used to insure accuracy. Use the Reference Document Number field to indicate the number of the original document. Note: This correction applies only to AP documents where the group code is 2, 5 or 5A.

document, citing the number

document for the

3. After the payment date the mistake must be corrected by the

correction document.

department using a Vendor Credit Memo, Distribution of Expense or Error Correction document.

Page 4

Rev J

A C C O U N T S

P A Y A B L E

THE ACCOUNTS PAYABLE DOCUMENTS

AP Direct Charge

The Direct Charge (DC) document is defined as a payment request, processed through the AP system, for which a specific procurement agreement (purchase order) does not exist. Uses include:

Utility payments (telephone, electricity, garbage, etc.); Reimbursements; Memberships; and Honoraria.

For details on the DC and its uses, go to the Online Reference Manual at: http://dafis.ucdavis.edu/olrm/index.cfm?doc=DC.

AP Travel Expense Voucher

Most travel and entertainment expenses are processed in MyTravel (http://mytravel.ucdavis.edu). A DaFIS Travel Expense Voucher (TEV) is required when you have a situation that cannot be accommodated in MyTravel. The most common example is when a vendor bills the university directly (i.e., your department receives an invoice payable to the vendor). In this case, the TEV is used to process a payment directly to the vendor. For details on the TEV and its uses, go to the Online Reference Manual at: http://dafis.ucdavis.edu/olrm/index.cfm?doc=TEV. Most travel and entertainment expenses are processed in MyTravel (http://mytravel.ucdavis.edu). As with the TEV, the Entertainment Expense Voucher (EEV) document should be used to pay a vendor who directly bills the university. For details on the EEV and its uses, go to the Online Reference Manual at: http://dafis.ucdavis.edu/olrm/index.cfm?doc=EEV.

AP Entertainment Expense Voucher

Rev J

Page 5

D A F I S

U S E R S

G U I D E

AP Vendor Credit Memo

Discounts rebates handled the and not

The Vendor Credit Memo (CM) document is used to record a credit from a vendor for a returned item which was previously paid for. Departments should always secure a credit memo from a vendor when a credit is being issued to their account Departmental users can enter a new credit memo for a vendor or adjust a previously entered credit memo. Once approved, the credit memo appears in the system until it is applied against an outstanding payment to the vendor (via the Check-write), or it is manually reversed. The credit memo is manually reversed by the AP department if the vendor sends a check, or the credit is written off. For details on the CM and its uses, go to the Online Reference Manual at: http://dafis.ucdavis.edu/olrm/index.cfm?doc=CM.

are

through

Vendor Memo They

Credit

document. should be

processed through Vendor the Invoice by item using

AP Vendor Invoice

document inserting lines and

appropriate commodity codes.

The Vendor Invoice (VI) document is defined as a request to initiate a payment to a vendor based on order information already existing in DaFIS, generally in the form of a purchasing document. Information entered on a purchase order is automatically brought forward to the Vendor Invoice, reducing the amount of processing time. Multiple Vendor Invoice documents can be processed against one purchasing document. For more details on the VI and its uses, go to the Online Reference Manual at: http://dafis.ucdavis.edu/olrm/index.cfm?doc=VI.

Page 6

Rev J

A C C O U N T S

P A Y A B L E

ACCOUNTS PAYABLE INQUIRIES

The Accounts Payable Lookup allows you to query the system for information about Accounts Payable documents. You can see the status of the payable and other related information (e.g., PO Number, Check Number, etc.). Through various inquiry screens, you can view accounting and item information. You can also see the electronic document that created the payable, or the original purchasing document by double-clicking on the corresponding document numbers. The Accounts Payable Functions screen is accessed by selecting Accounts Payable from the Inquiries drop-down menu.

Only that

documents have been by AP

approved are

accessible the AP

through Query.

Clicking the Lookup.

button brings you to the Accounts Payable

Rev J

Page 7

D A F I S

U S E R S

G U I D E

Search parameters can be entered to locate a particular document(s). document is located, you have the following inquiry options:

Once a

Double-click on the PO

viewing; or

Double-click on the Document Click on the

number (in the search result field) to access the PO Inquiry screen and view the order details; Number to open the document for

The Accounts Payable Inquiry provides an overview of the payment detail for the selected document.

for the Accounts Payable Inquiry screen.

From this screen there are options for viewing further details of the AP document. Clicking on document. will return the account and distribution information for the

Clicking the button will return a list of the items paid for by the AP document. (this option only applies to VI documents). Click on the button on the Accounts Payable PO Items screen to return the Accounting Detail for a specific item.

Page 8

Rev J

A C C O U N T S

P A Y A B L E

AP DECISION SUPPORT QUERIES

In addition to the AP inquiries in Transaction Processing, there are several useful queries in Decision Support. These include:

information on a check that has been processed, such as the date it was cashed. You can search on a date range, on a specific Check Number, or for a specific vendor.

Check Lookup (105) This query is helpful if you need to get additional

Credit Card Payment Lookup (252) If your department has a Central

Travel System (CTS) Card or a Purchasing Card, this query gives you information on specific transactions and ledger posted dates. You can search by Cardholder Name, Merchant Name, Organization Code, and Account. Note: Only CTS transactions arranged outside of Connexxus will appear on this report. Transactions and payments made on the Visa Corporate Card cannot be viewed using this query.

Purchase Order Payment History (232) This query gives a list of all

the payments posted against a specific purchase order. This can be helpful for finding out if a specific VI has been applied against a purchase order. In addition to the payment information, this query also gives commodity code and item descriptions that were used on the original purchase order.

Payment/Credit Lookup (112) This query can give you specific

information on payments and credits made by a vendor. The query allows you to search by Account or Organization Code and also allows you to specify the type(s) of documents you want to view. The Payment/Credit Lookup (112) can also tell you if credit memos have been posted to your account.

Rev J

Page 9

D A F I S

U S E R S

G U I D E

Page 10

Rev J

A C C O U N T S

P A Y A B L E

APPENDIX - ACCOUNTS PAYABLE RESOURCES

Entertainment Expense Help:

http://travel.ucdavis.edu/entertainment/ (includes definition of

entertainment, reimbursable limits, process reimbursement, entertainment policy links) of

requesting

Accounts Payable Forms: Accounts Payable staff: Travel Expense Help:

http://accounting.ucdavis.edu/Forms/#AP http://accounting.ucdavis.edu/AP/staff.cfm (staff listed by specific

topic area, including Vendor Invoices and Direct Charges)

http://travel.ucdavis.edu/ (includes travel arrangement information,

travel reimbursement limits, and information on the Corporate Card) (includes policies

Accounts Payable Policies:

http://accounting.ucdavis.edu/AP/

disbursements )

on

Accounts Payable Online Reference Manuals:

http://dafis.ucdavis.edu/help/olrm/#ap

Rev J

Page 11

D A F I S

U S E R S

G U I D E

NOTES:

Page 12

Rev J

You might also like

- Oracle AP Interview QuestionsDocument23 pagesOracle AP Interview QuestionsDinesh Kumar100% (1)

- Sales (De Leon)Document737 pagesSales (De Leon)Bj Carido100% (7)

- 13.10 Last Year The Diamond Manufacturing Company Purchased Over $10 Million Worth ofDocument7 pages13.10 Last Year The Diamond Manufacturing Company Purchased Over $10 Million Worth ofJara TakuzawaNo ratings yet

- Job Order Pure ProblemsDocument19 pagesJob Order Pure ProblemsolafedNo ratings yet

- PERPETUAL INVENTORY SYSTEM - Practice SetDocument25 pagesPERPETUAL INVENTORY SYSTEM - Practice SetJAY100% (2)

- Accounts Payable EssayDocument2 pagesAccounts Payable EssayInday MiraNo ratings yet

- Accounts Payable Interview Questions in R12Document10 pagesAccounts Payable Interview Questions in R12Pradyumna KumarNo ratings yet

- Accounts Payable NotesDocument12 pagesAccounts Payable Notesjohn_841100% (2)

- 300+ TOP Accounts Payable Interview Questions and Answers 2023Document10 pages300+ TOP Accounts Payable Interview Questions and Answers 2023Abhilash LigerNo ratings yet

- AP Interview QuestionsDocument38 pagesAP Interview QuestionsDanalakoti SuryaNo ratings yet

- Questions About Workday Financials: Spend Items: Requisitions, Ad Hoc Requests, and Receipts AnswerDocument11 pagesQuestions About Workday Financials: Spend Items: Requisitions, Ad Hoc Requests, and Receipts AnswerSkg KonNo ratings yet

- AP Interview QuestionsDocument7 pagesAP Interview Questionsbnareshnani64No ratings yet

- AP PrepareDocument51 pagesAP Preparebujjipandu7100% (1)

- Accounts Payable OverviewDocument6 pagesAccounts Payable OverviewbharatNo ratings yet

- Self Billing 1Document10 pagesSelf Billing 1Oumayma Ben FrajNo ratings yet

- UntitledDocument19 pagesUntitledchef JamesNo ratings yet

- Oracle R12 Payables Interview QuestionsDocument13 pagesOracle R12 Payables Interview QuestionsPrashanth KatikaneniNo ratings yet

- Chapter 5Document6 pagesChapter 5Jane LubangNo ratings yet

- P2P Interview Questions and AnswersDocument13 pagesP2P Interview Questions and Answersanu100% (1)

- 1-Procure To Pay OverviewDocument6 pages1-Procure To Pay Overviewskjayasree_6No ratings yet

- Literature Review On Payment VoucherDocument8 pagesLiterature Review On Payment Voucherc5nqw54q100% (1)

- Case 2Document6 pagesCase 2kiminza ndonyeNo ratings yet

- Aeb SM CH14 1Document28 pagesAeb SM CH14 1fitriNo ratings yet

- DocumentDocument6 pagesDocumentDivyansh SinghNo ratings yet

- Script COMACDocument3 pagesScript COMACRany Meldrenz FloresNo ratings yet

- APDocument4 pagesAPnagkkkkkNo ratings yet

- Chapter 5 (Cando & Lascona)Document51 pagesChapter 5 (Cando & Lascona)brennaNo ratings yet

- Ebs P2PDocument57 pagesEbs P2PSreehari ReddyNo ratings yet

- P2P Interview - 2Document12 pagesP2P Interview - 2nahlaNo ratings yet

- Receipt Lo1Document11 pagesReceipt Lo1Nigus AyeleNo ratings yet

- Credit NoteDocument7 pagesCredit Notesubhani.nwNo ratings yet

- Proses of Account ReceivableDocument5 pagesProses of Account ReceivableNishanthini 2998No ratings yet

- Account Payable InterviewDocument5 pagesAccount Payable InterviewhanharinNo ratings yet

- CashDisbursementCycle ReDocument5 pagesCashDisbursementCycle ReKenneth Joshua Cinco NaritNo ratings yet

- Unit-4 ComputerDocument8 pagesUnit-4 Computer29.Kritika SinghNo ratings yet

- Evaluate and Authorize Payment RequestsDocument3 pagesEvaluate and Authorize Payment Requestsabebe kumelaNo ratings yet

- How To Authorize ACHDocument12 pagesHow To Authorize ACHPete Ng100% (2)

- Case Study On Letter of CreditDocument4 pagesCase Study On Letter of Creditfarhanahmed01No ratings yet

- Procurement DetailDocument3 pagesProcurement DetailNauman ZiaNo ratings yet

- Evaluate and Authorize Payment Requests ModuleDocument28 pagesEvaluate and Authorize Payment Requests ModuleTegene Tesfaye100% (1)

- The Cash Disbursements Systems: Operating Expenses - AnDocument7 pagesThe Cash Disbursements Systems: Operating Expenses - AnCathlene TitoNo ratings yet

- Forum 6 MRGDocument4 pagesForum 6 MRGadhi anoragaNo ratings yet

- Chapter 10 SummaryDocument12 pagesChapter 10 SummaryWendelyn TutorNo ratings yet

- The Revenue Cycle Is A Recurring Set of Business Activities and RelatedDocument6 pagesThe Revenue Cycle Is A Recurring Set of Business Activities and RelatedJna AlyssaNo ratings yet

- Types of Source DocumentsDocument10 pagesTypes of Source DocumentsNippun Abhi Attrey90% (10)

- Credit Memo RequestDocument8 pagesCredit Memo Requestvishnu0072009No ratings yet

- VouchersDocument9 pagesVouchersRaviSankar100% (2)

- AP Accounts Payable 1Document3 pagesAP Accounts Payable 1Imran HassanNo ratings yet

- Chapter 13 Ed.12 SolutionsDocument6 pagesChapter 13 Ed.12 SolutionsCaroline ShawNo ratings yet

- Expenditure Cycle: For Each Document Listed: 1. Highlight The Important Information 2. Describe Why It Is SignificantDocument14 pagesExpenditure Cycle: For Each Document Listed: 1. Highlight The Important Information 2. Describe Why It Is SignificantRizza L. MacarandanNo ratings yet

- White Paper On Prepare and Record PaymentsDocument22 pagesWhite Paper On Prepare and Record PaymentsObaid Ul AleemNo ratings yet

- Grup 9Document8 pagesGrup 9Ssempijja Joshua BuyinzaNo ratings yet

- Chapter 9.handling Finacial ProceduresDocument35 pagesChapter 9.handling Finacial ProceduresAngelica SamaniegoNo ratings yet

- SD Credit MemoDocument13 pagesSD Credit MemoAnil KumarNo ratings yet

- Cash AppsDocument10 pagesCash AppsShameera BegamNo ratings yet

- P To P CycleDocument5 pagesP To P CycleJaved AhmadNo ratings yet

- Unit 7: Finance Cycle ApplicationsDocument14 pagesUnit 7: Finance Cycle Applicationsyadelew likinaNo ratings yet

- b15t2 Oap LoansDocument12 pagesb15t2 Oap LoansabhishekNo ratings yet

- POS CheckDocument18 pagesPOS CheckGiriprasad GunalanNo ratings yet

- Debit Memo and Credit MemoDocument2 pagesDebit Memo and Credit MemoRakesh RaiNo ratings yet

- Textbook of Urgent Care Management: Chapter 13, Financial ManagementFrom EverandTextbook of Urgent Care Management: Chapter 13, Financial ManagementNo ratings yet

- Report. Introduction To Legal Research ProcessDocument36 pagesReport. Introduction To Legal Research ProcessBj CaridoNo ratings yet

- Nfjpia Mockboard-2011 BLTDocument6 pagesNfjpia Mockboard-2011 BLTBj CaridoNo ratings yet

- PRTC Final Pre-Board - Prac1Document14 pagesPRTC Final Pre-Board - Prac1einsteinspyNo ratings yet

- Prudente Vs DayritDocument7 pagesPrudente Vs DayritBj CaridoNo ratings yet

- Lopez vs. Commissioner of Customs 68 SCRA 320 (1975)Document6 pagesLopez vs. Commissioner of Customs 68 SCRA 320 (1975)Bj CaridoNo ratings yet

- Legal Writing Is Not As It Should BeDocument24 pagesLegal Writing Is Not As It Should BeBj CaridoNo ratings yet

- Commissioner of Public Highways Vs HonDocument1 pageCommissioner of Public Highways Vs HonBj CaridoNo ratings yet

- PERS Family Code 01Document56 pagesPERS Family Code 01Bj CaridoNo ratings yet

- 9 - Aisporna v. CA (GR L-39419, 12 April 1982)Document6 pages9 - Aisporna v. CA (GR L-39419, 12 April 1982)Bj CaridoNo ratings yet

- Powell Vs PNBDocument1 pagePowell Vs PNBBj CaridoNo ratings yet

- 7 - Floresca v. Philex Mining (GR L-30642, 30 April 1985)Document30 pages7 - Floresca v. Philex Mining (GR L-30642, 30 April 1985)Bj CaridoNo ratings yet

- Common Interview Questions For Law SchoolDocument2 pagesCommon Interview Questions For Law SchoolBj CaridoNo ratings yet

- 10 - China Bank v. Ortega (GR L-34964, 31 January 1973)Document4 pages10 - China Bank v. Ortega (GR L-34964, 31 January 1973)Bj CaridoNo ratings yet

- Aparri vs. CADocument5 pagesAparri vs. CAAna Margarita Guinacaran About-OlivarNo ratings yet

- Obligation and ContractsDocument2 pagesObligation and ContractsBj CaridoNo ratings yet

- Garcia Vs Exec Secretary Dec 2 1991Document5 pagesGarcia Vs Exec Secretary Dec 2 1991Bj CaridoNo ratings yet

- Vat and Completion of Acc Cycle For MerchandisingDocument7 pagesVat and Completion of Acc Cycle For MerchandisingLouie De La TorreNo ratings yet

- Compute The Correct Amount of Inventory:: Problem 10-1 Amiable CompanyDocument83 pagesCompute The Correct Amount of Inventory:: Problem 10-1 Amiable CompanyIrish SungcangNo ratings yet

- Marketing LogisticsDocument211 pagesMarketing Logisticsv123t456100% (1)

- At 1Document7 pagesAt 1jessicavaleoNo ratings yet

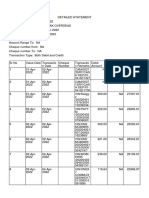

- Detailstatement - 15 2 2023@16 2 31Document20 pagesDetailstatement - 15 2 2023@16 2 31Siddhivinayak OverseasNo ratings yet

- Answer Sheet 1 Final Barreto PDFDocument18 pagesAnswer Sheet 1 Final Barreto PDFdoths gorg0% (1)

- Chapter 3 NotesDocument51 pagesChapter 3 NotesDonald YumNo ratings yet

- Managerial AccountingDocument38 pagesManagerial AccountingLEA100% (1)

- FAR Freight ChargesDocument2 pagesFAR Freight ChargesJaybie John Palco Eralino100% (1)

- CH 7 7 7 TBDocument40 pagesCH 7 7 7 TBRabie HarounNo ratings yet

- Difference Between Third Party Sales & Inter Company Sales in SAPDocument2 pagesDifference Between Third Party Sales & Inter Company Sales in SAPBalaji_SAPNo ratings yet

- Dwi Harmoyo BMT Syariah Sejahtera Boyolali: Volume 3 Nomor 2, Desember 2012Document19 pagesDwi Harmoyo BMT Syariah Sejahtera Boyolali: Volume 3 Nomor 2, Desember 2012Caesar Romero DixiNo ratings yet

- Homework Chapter 2: BE 3-4 Larned Corporation Recorded The Following Transactions For The Past MonthDocument3 pagesHomework Chapter 2: BE 3-4 Larned Corporation Recorded The Following Transactions For The Past MonthLee Xing100% (1)

- Supply Chain Planning Manager or Planning Manager or Supply ChaiDocument3 pagesSupply Chain Planning Manager or Planning Manager or Supply Chaiapi-121371382No ratings yet

- SAP MM - Procurement ScenarioDocument6 pagesSAP MM - Procurement Scenariosyamsu866764100% (1)

- Ch1 Week 1Document101 pagesCh1 Week 1harshmaroo100% (2)

- Mad City Money CorrectDocument10 pagesMad City Money Correctapi-238434564No ratings yet

- Hansa World Manual 13-05-2013Document89 pagesHansa World Manual 13-05-2013Helio Antonio Soares MeragyNo ratings yet

- King Emanuel AnilDocument16 pagesKing Emanuel AnilSeoonnho KimNo ratings yet

- Annotated 3.1 Q3 PPT Adjusting Entries Accruals and DeferralsDocument36 pagesAnnotated 3.1 Q3 PPT Adjusting Entries Accruals and DeferralsenzobarnaoNo ratings yet

- Bank Statement Exela MoversDocument2 pagesBank Statement Exela MoversCain HabilNo ratings yet

- IC Accounts Receivable Template Updated 8552Document3 pagesIC Accounts Receivable Template Updated 8552Kevzz EspirituNo ratings yet

- Chapter 3 PDFDocument31 pagesChapter 3 PDFkacem_hzNo ratings yet

- Sample ExcelDocument9 pagesSample Excelhmmmmn75% (4)

- Chapter # 17: Valuation of Accounts ReceivableDocument24 pagesChapter # 17: Valuation of Accounts ReceivableHakim JanNo ratings yet

- Accounting Chapter 2 - Analyzing and Recording TransactionsDocument72 pagesAccounting Chapter 2 - Analyzing and Recording Transactionsnicat100% (4)

- CEP Course On Supply Chain ManagementDocument5 pagesCEP Course On Supply Chain ManagementdebkinkarNo ratings yet

- Laporan Keuangan WIKA Per 31 Maret 2019-DikonversiDocument170 pagesLaporan Keuangan WIKA Per 31 Maret 2019-DikonversiRatna ShafaNo ratings yet