Professional Documents

Culture Documents

Mock Cpa Board Exams - Rfjpia R-12 - W.ans (1) FGFDGGF

Uploaded by

redearth2929Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mock Cpa Board Exams - Rfjpia R-12 - W.ans (1) FGFDGGF

Uploaded by

redearth2929Copyright:

Available Formats

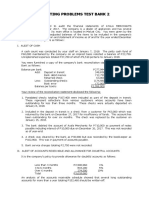

RFJPIA-R12

2

ND

Annual Regional Convention 2008 Mock CPA Board !a"ination#

THEORY OF ACCOUNTS 1. Which of the following statements is (are) true, for purposes of financial reporting in the Philippines? I. Philippine practice is to present in the balance sheet current assets before non-current assets, current liabilities before non-current liabilities; and e uit! accounts before liabilities II. "otes are normall! presented in the following order# $ignificant accounting policies; statement of compliance of P%&$s; supporting information on items presented on the face of the financial statements; and lastl!, other disclosures III. 'he I($ term )%eser*es) in present Philippine practice, ma! refer to re*aluation increment, translation ad+ustments recogni,ed in e uit!; unreali,ed gains and losses from a*ailable for sale securities recogni,ed in e uit!. a. I and II onl! b. I and III onl! c. II and III onl! d. I, II and III -. (n entit! purchases a building and the seller accepts pa!ment partl! in e uit! shares and partl! in debentures of the entit!. 'his transaction should be treated in the cash flow statement as follows# a. 'he purchase of the building should be in*esting cash outflow and the issuance of shares and the debentures financing cash outflows. b. 'he purchase of the building should be in*esting cash outflow and the issuance of debentures financing cash outflows while the issuance of shares in*esting cash outflow. c. 'his does not belong in a cash flow statement and should be disclosed onl! in the notes to the financial statements. d. Ignore the transaction totall! since it is a non-cash transaction. "o mention is re uired in either the cash flow statement or an!where else in the financial statements .. 'he scope of P($ ./ includes all of the following except a. &inancial instruments that meet the definition of a financial asset b. &inancial instrument that meet the definition of a financial liabilit! c. &inancial instruments issued b! the entit! that meet the definition of an e uit! instrument d. 0ontracts to bu! or sell non-financial items that can be settled net. 1. 2eposits in foreign countries which are sub+ect to a foreign e3change restrictions should be a. 4alued at current e3change rates and shown as current assets b. 4alued at historical e3change rates and presented as noncurrent assets c. 4alued at current e3change rates and presented as noncurrent assets 5 d. 4alued at historical e3change rates and presented as current assets 6. What is the proper accounting for credit card sales if the credit card compan! is Affiliated with a bank Not affiliated with a bank a. $ale on account 0ash sales b. $ale on account $ale on account c. 0ash sale 0ash sale d. 0ash sale $ale on account 7. 8osses which are e3pected to arise from firm and non-cancellable commitments for the future purchase of in*entor! items, if material should be a. %ecogni,ed in the accounts b! debiting loss on purchase commitments and crediting estimated liabilit! for loss on purchase commitments b. 2isclosed in the notes c. Ignored d. 0harged to retained earnings 9. 2elta 0orp. purchased 9,1:: shares of ;aiden 0ompan!<s common stoc= and classified it as a*ailable-forsale. 'he purchase price was P.7-,:::, which is e ual to 6:> of ;aiden 0ompan!<s retained earnings balance. ;aiden 0ompan!<s 17,::: shares of common stoc= are acti*el! traded. 2elta should account for this using the a. 0ost method b. ? uit! method c. 0ost method sub+ect to fair *alue *aluation in the balance sheet d. ;ar=et *alue method sub+ect to fair *alue *aluation in the balance sheet

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e ) of )%

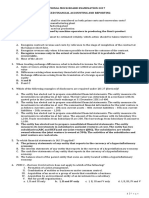

@. Which of the following statements regarding In*estment Propert! is (are) true I. (n in*estment propert! shall be measured initiall! at its cost II. 'ransaction cost shall be included in the initial measurement of in*estment propert! III. With certain e3ceptions, an entit! shall choose as its accounting polic! either the fair *alue model or the cost model and shall appl! such polic! to all its in*estment propert! a. I and II onl! b. I and III onl! c. II and III onl! d. I, II and III /. In determining the fair *alue of a biological asset for balance sheet purposes, which of the following should be considered? a. Price change b. Ph!sical change c. Aoth price change and ph!sical change d. "either price change nor ph!sical change 1:. ( compan! ac uired some of its own common shares at a price greater than both their par *alue and original issue price but less than their boo= *alue. 'he compan! uses the cost method of accounting for treasur! stoc=. What is the impact of this ac uisition on total stoc=holders< e uit! ('$?), and the net boo= *alue ("A4) per common share? a. $? B decrease ; "A4 B increase c. $? B decrease; "A4 B decrease b. $? B increase ; "A4 B decrease d. $? B increase; "A4 - increase 11. What is the measurement basis of an asset that is ac uired in non-monetar! e3change With .o//e0.ial 12b1tan.e With no .o//e0.ial 12b1tan.e a. &air *alue of asset gi*en up 0arr!ing amount of asset gi*en up b. 0arr!ing amount of asset gi*en up 0arr!ing amount of asset recei*ed c. 0arr!ing amount of asset recei*ed &air *alue of asset recei*ed d. &air *alue of asset gi*en up &air *alue of asset gi*en up 1-. Which of the following statements concerning borrowing costs is false? a. Aorrowing costs generall! include interest costs, ban= o*erdrafts, amorti,ation of discounts or premiums related to borrowings, finance charges with respect to finance leases. b. Aorrowing costs are interest and other costs incurred b! an enterprise in relation to borrowed funds. c. Per P($ -., the benchmar= treatment for borrowing costs is to capitali,e it as part of the cost of the asset to which it relates. d. Aorrowing costs include amorti,ation of ancillar! costs incurred in connection with the arrangement of borrowings, as well as e3change differences arising from foreign currenc! borrowings to the e3tent that the! are regarded as an ad+ustment to interest cost. 1.. ?as! Auilders Inc. is in the middle of a two-!ear construction contract when it recei*es a letter from the customer e3tending the contract b! a !ear and re uiring the construction compan! to increase its output in proportion of the number of !ears of the new contract to the pre*ious contract period. 'his is allowed in recogni,ing additional re*enue according to P($ 11 if a. "egotiations ha*e reached an ad*anced stage and it is probable that the customer will accept the claim b. 'he contract is sufficientl! ad*anced and it is probable that the specified performance standards will be e3ceeded or met. c. It is probable that the customer will appro*e the *ariation and the amount of re*enue arising from the *ariation, and the amount of re*enue can be reliabl! measured. d. It is probable that the customer will appro*e the *ariation and the amount of re*enue arising from the *ariation, whether the amount of re*enue can be reliabl! measured or not. 11. Cnder I($ -:, which of the following is permitted in recogni,ing an intangible asset ac uired free of charge, or for nominal consideration, b! wa! of a go*ernment grant? I. %ecogni,e both the intangible asset and the grant initiall! at fair *alue. II. %ecogni,e the asset initiall! at a nominal amount plus an! e3penditure that is directl! attributable to preparing the asset for its intended use a. I onl! b. ?ither I or II, at the option of the ac uiring enterprise c. II onl! d. "either I nor II 16. P($ -:, Do*ernment Drants pro*ide two approaches to accounting for go*ernment grants # (1) capitali,ation approach and (-) income approach. (rguments in support of the income approach include the following except: a. Do*ernment grants are considered earned through compliance with the condition and

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e # of )%

meeting en*isaged obligations b. Do*ernment grants are receipts from a source other than shareholders or capital pro*iders c. Do*ernment grants represent an incenti*e pro*ided b! the go*ernment without related costs. d. Do*ernment grants are considered as e3tension of fiscal policies similar to income and other ta3es 3USINESS LAW 4 TA5ATION 17. Eolder E altered the amount of a negotiable note from P1:,::: to P1::,::: then negotiated the note to I. (s a result# a. If I is a holder in due course, he can re uire the ma=er to pa! P1::,::: b. If I is not a holder in due course, he can re uire the ma=er to pa! the sum of P1::,::: c. I cannot re uire the ma=er to pa! because of the forger! whether or not he is a holder in due course d. I is entitled to P1:,::: if he is a holder in due course 19. 'o call a meeting for the purpose of remo*ing a director of a corporation the re uired *otes of the stoc=holders is# a. ma+orit! of the stoc=holders present b. F of the outstanding capital stoc= c. -5. of the outstanding capital stoc= d. ma+orit! of the outstanding capital stoc= 1@. Which of the following instruments is negotiable? a. GPa! to Aearer 0 P1:,:::.::) b. GPa! to 0 P1:,:::.:: or his order out of the rental of m! house in ;anila). c. GPa! to 0 P1:,:::.:: and reimburse !ourself out of the rental of m! house in ;anila). d. GPa! to the order of 0 P1:,:::.::). 1/. Paolo contributed P6:,:::; %onald contributed P96,:::; and Paul contributed P-6,:::. Ha! is the industrial partner. 'here is no stipulation regarding profits and losses. 'he partnership suffered a P.::,::: loss. 'he loss shall be shared b! the partners as follows# a. P1::,:::; P1::,:::; P1::,:::; and P: b. P96,:::; P96,:::; P96,:::; and P96,::: c. P1::,:::; P16:,:::; P6:,:::; and P: d. P1::,:::; P1::,:::; P1::,:::; and P1::,::: -:. 0ase "o. 1 B Pedro, the manager of IJK 0orporation, was promised of an increase in salar!. 'o facilitate the pa!ment of the promised increase, he prepared a board resolution and had it signed indi*iduall! b! a ma+orit! of the members of the Aoard of 2irectors. 'he treasurer of the corporation refused to pa! the increase in salar! stating that the resolution is not *alid. Is the contention of the treasurer correct? 0ase "o. - B Hose agreed to sell for a 1:> commission the land of ;aria worth P6::,:::. (ccordingl!, Hose loo=ed for a bu!er and found Pedro whom he introduced to ;aria. ;aria howe*er told Hose and Pedro that she is no longer selling her land. $ubse uentl!, ;aria sold the land to Pedro for P6::,:::, without the =nowledge of Hose. Hose upon learning of the sale, as=ed ;aria for his commission. Is Hose entitled to the commission? a. J?$; J?$ d. "L; J?$ b. J?$; "L c. "L; "L -1. 1st $tatement B ;elod! bound herself to pa! 8ucas her indebtedness. 'his is e*idenced b! a promissor! note stating therein the words GI promise to pa! 8ucas or order the amount of Php1::,:::). $gd. ;elod!. 'he instrument is non-negotiable. -nd $tatement B ;ila ga*e ;alou a chec= wherein the onl! item not filled up is the space for the amount. ;ila instructed the pa!ee to place the amount Php1,::: in the chec=. Eowe*er, ;alou placed therein Php1::,:::. ;alou negotiated the chec= to ;arissa who is a holder in due course. ;arissa can hold ;ila liable for P1::,:::. a. 1st statement is wrong, -nd statement is correct b. 1st statement is correct, -nd statement is wrong. c. Aoth statements are correct d. Aoth statements are wrong. --. ;aggie ma=es a promissor! note for P1:,::: pa!able to the order of Eomer. Eomer negotiates the note to ;argie who indorses it to Eenr!. Eenr! indorsed the instrument to ;elissa who with the consent of Eenr! raises the amount to P1::,::: and thereafter indorses it to Eilar!, Eilar! to ;enandro, and ;enandro to Eelen, who is a holder in due course. In this case a. Eelen can reco*er P1:,::: as against ;aggie. b. Eelen can reco*er P1::,::: from ;aggie. c. ;enandro and ;elissa are liable to Eelen for P1:,::: d. ;aggie and Eomer are not liable to Eelen.

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e " of )%

-.. I-cited 8imited partnership has I, as general partner, J, as limited partner, and K, as industrial partner contributing P16:,:::; P6::,:::; and ser*ices respecti*el!. 'he partnership failed and after disposing all its assets to pa! partnership debts there still remains an outstanding obligation in the sum of P1-:,:::. 'he liabilit! of the partners to the creditor will be as follows# a. I M P1-:,::: b. I and K M solidaril! liable for P1-:,::: c. I M P1:,:: JM P1:,::: KM P1:,::: d. I M P7:,:: JM P: KM P7:,::: -1. Which among the following statements is not correct? a. 'he Aureau of Internal %e*enue is part of the administrati*e machiner! for the assessment and collection of internal re*enue ta3es. b. 'he Aureau of 0ustoms is also charged with the collection of internal re*enue ta3es. c. 'he local go*ernment units, such as the municipalities, cities and pro*inces, form part of the national ta3 s!stem. d. Pri*ate ban=s ma! be authori,ed to collect internal re*enue ta3es. -6. Properties ac uired b! gratuitous title during the marriage are generall! classified as# I. $eparate properties under con+ugal partnership of gains. II. 0ommunit! properties under absolute communit! of properties. a. Lnl! I is correct c. Aoth I and II are correct b. Lnl! II is correct d. Aoth I and II are incorrect -7. ( resident decedent, head of famil!, left the following# Personal properties %eal properties (including famil! home *alued at P1,6::,:::) 2eductions claimed (including actual funeral e3penses of P-::,:::, and medical e3penses of P7::,:::) Eow much was the ta3able net estate? a. P-6:,::: b. P1,1::,::: c. P1,-6:,::: -9. ;ar,an sold his residential house under the following terms# 0ash recei*ed, Hanuar! 1:, -::@ (mount recei*ed, Hune 1:, -::@ Installment due, Hune 1:, -::/ (dditional information# 0ost of residential house ;ortgage assumed b! the bu!er ;ortgage on the residential house e3ecuted b! the bu!er in fa*or of the seller to guarantee pa!ment &air mar=et *alue of residential house Eow much was the capital gains ta3 due in -::@? a. P16,@@b. P19,719 c. P61,::: P1,:::,::: -,:::,::: /::,::: d. P-,1::,::: P1::,::: 1::,::: 7::,::: 16:,::: -::,::: 7::,::: /::,::: d. P7:,:::

-@. Which of the following go*ernment-owned or controlled corporations shall be sub+ect to the corporate income ta3? I. Philippine (musement and Daming 0orporation (P(D0L%). II. "ational 2e*elopment 0orporation ("20). III. Philippine 0harit! $weepsta=es Lffice (P0$L). I4. $ocial $ecurit! $!stem ($$$). -/. 'he following fringe benefits were gi*en b! an emplo!er to its emplo!ees for the uarter ending ;arch .1, -::@# Eousing benefits to super*isors and managers (representing total rents) P.1:,::: %eimbursed e3penses of ran= and file emplo!ees -::,::: 2e minimis benefits (not e3ceeding the ma3imum) 1::,::: Eow much was the fringe benefit ta3 pa!able for the uarter? a. P@:,::: b. P1:@,@:: c. P17:,::: d. P19-,@:: .:. 'he AI% ma! compromise pa!ment of internal re*enue ta3es when# &irst ground# ( reasonable doubt as to the *alidit! of the claim against the ta3pa!er e3ists. $econd ground# When collection costs do not +ustif! the collection of the ta3. a. Aoth grounds are correct c. Lnl! first ground is correct b. Aoth grounds are incorrect d. Lnl! second ground is correct AU6ITIN7 THEORY .1. 'he need for assurance ser*ices arises because# a. 'here is a consonance of interests of the preparer and the user of the financial statements.

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e 8 of )%

b. 'here is a potential bias in pro*iding information. c. ?conomic transactions are less comple3 than the! were a decade ago. d. ;ost users toda! ha*e access to the s!stem that generates the financial statements the! use. .-. Which of the following is e3plicitl! included in the (uditor<s responsibilit! section of the auditorNs report? a. %eason for modification of opinion b. GPhilippine &inancial %eporting $tandardsG c. GPhilippines $tandards on (uditing) d. 2i*ision of responsibilit! with another auditor ... 'he term Opresent fairl!, in all material respectO, means a. 'he financial statements conform to D((P. b. 'he auditor considers onl! those matters that are significant to the users of the financial statements. c. 'he financial statements ma! still be materiall! misstated because the auditors ma! not ha*e disco*ered the errors. d. 'he financial statements are accuratel! prepared. .1. Aased on %.(. /-/@, how man! !ears can a partner who sur*i*ed the death or withdrawal of other partner(s) continue to practice under the partnership name after becoming a sole practitioner? a. 1 !ear b. - !ears c. . !ears d. Indefinite period of time .6. (n auditor who disco*ers that client emplo!ees ha*e committed an illegal act that has a material effect on the clientNs financial statements most li=el! would withdraw from the engagement if a. 'he illegal act is *iolation of generall! accepted accounting principles. b. 'he client does not ta=e the remedial action that the auditor considers necessar!. c. 'he illegal act was committed during a prior !ear that was not audited. d. 'he auditor has alread! assessed control ris= at the minimum le*el. .7. Which of the following statements would least li=el! appear in an auditorNs engagement letter? a. &ees for our ser*ices are based on our regular per diem rates, plus tra*el and other out-of-poc=et e3penses. b. 2uring the course of our audit we ma! obser*e opportunities for econom! in, or impro*ed controls o*er, !our operations. c. Lur engagement is sub+ect to the ris= that material errors or fraud, including defalcations, if the! e3ist, will not be detected d. (fter performing our preliminar! anal!tical procedures we will discuss with !ou the other procedures we consider necessar! to complete the engagement. .9. 'he audit wor= paper that reflects the ma+or components of an amount reported in the financial statements is the a. Inter-ban= transfer schedule b. 0arr! forward schedule c. $upporting schedule d. 8ead schedule .@. Which of the following best describes the primary purpose of audit procedures? a. 'o detect errors or fraud b. 'o compl! with generall! accounting principles c. 'o gather sufficient, appropriate e*idence d. 'o *erif! the accurac! of account balances ./. (nal!tical procedures used in planning an audit should focus on identif!ing a. ;aterial wea=ness in the internal control s!stem. b. 'he predictabilit! of financial data from indi*idual transactions. c. 'he *arious assertions that are embodied in the financial statements d. (reas that ma! represent specific ris=s rele*ant to the audit. 1:. (s the acceptable le*el of detection ris= decreases, an auditor ma! change theP a. 'iming of substanti*e tests; perform them at an interim date rather than at !ear-end b. "ature of substanti*e tests; select from less effecti*e to a more effecti*e procedure. c. 'iming of tests of controls; perform them at se*eral dates rather than at one time d. (ssessment of inherent ris=; assume a higher le*el. 11. 'he audit wor= performed b! each assistant should be re*iewed to determine whether it was ade uatel! performed and to e*aluate whether the a.(udit has been performed b! persons ha*ing ade uate technical training and proficienc! as auditors. b.(uditorNs s!stem of ualit! control has been maintained at a high le*el. c. %esults are consistent with the conclusions to be presented in the auditorNs report.

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e & of )%

d.(udit procedures performed are those prescribed in the technical standards. 1-. Which of the following acts are considered a fraud? I. Alteration of records or documents. II. Misinterpretation of facts. III. Misappropriation of assets. IV. Recording of transactions without substance. V. Clerical mistakes. a. III b. I and III onl! c. I, III, and I4 onl! d. (ll of them 1.. When the auditor has to determine the need to use the wor= of an e3pert, he would consider the following except# a. 'he cost of using the ser*ices of an e3pert. b. 'he uantit! and ualit! of other audit e*idence a*ailable. c. 'he materialit! of the financial statement item being considered d. 'he ris= of misstatement based on the nature and comple3it! of the matter being considered. 11. Which of the following does not re uire the ser*ices of an e3pert? a. 4aluations of certain t!pes of assets li=e land and buildings. b. 8egal opinions concerning interpretations of engagements, rules and regulations. c. 2etermination of amounts using speciali,ed techni ues. d. (pplication of accounting methods in computing in*entor! balances. 16. (n auditor should design a written audit program so that# a. (ll material transactions will be selected for substanti*e testing. b. $ubstanti*e tests prior to the balance sheet date will be minimi,ed. c. 'he audit procedures selected will achie*e specific audit ob+ecti*es. d. ach account balance will be tested under either tests of controls or tests of transactions.

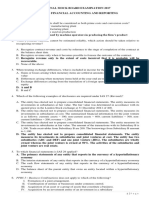

9ANA7E9ENT A6VISORY SERVICES 17. &rom the gi*en data !ou are to compute the unit sales price !ad"usted to the nearest full centa#o$ at which the $ta. (na ;anufacturing Inc. must sell its onl! product in -::6 in order to earn a budgeted operating profit (before ta3es of .6>) of P7:,:::. $ta. (na ;anufacturing Inc.<s condensed income statement for -::1 follows# $ales (.:,::: units) P 16:,::: %eturns, allowances and discounts 1.,6:: "et sales P 1.7,6:: 0ost of goods sold .:7,::: Dross profit P 1.:,6:: $elling e3penses 7:,::: (dministrati*e e3penses .:,::: Lperating profit P 1:,6:: 'he budget committee has estimated the following changes in income and costs for -::6# o .:> increase in number of units sales. o -:> increase in material unit cost. o 1.> increase in direct labor cost per unit. o 1:> increase in production o*erhead cost per unit. o 11> increase in selling e3penses, arising from increased *olume as well as from a higher price le*el, o 9> increase in administrati*e e3penses, reflecting anticipated higher wage and suppl! price le*els. (n! changes in administrati*e e3penses caused solel! b! increased sales *olume are considered immaterial for the purpose of this budget. (s in*entor! uantities remain fairl! constant, the committee considered that, for budget purposes, an! change in in*entor! *aluation can be ignored. 'he composition of the cost of a unit of finished product during -::1 for materials, direct labor, and production o*erhead, respecti*el!, was in the ratio of . to - to "o changes in production methods or credit policies were contemplated for -::6. a.P17.:1 b.P16.6. c. P 17.11 d.P 11./19. 2uring !our e3amination of the financial statements of $an Pablo Industries, the president re uested !our assistance in the e*aluation of the following financial management problem in his home appliances di*ision which he summari,es for !ou as follows# (. 'he di*ision<s current margin ratio is 6> of annual sales of P1, -::,:::. (n in*estment of P1::, ::: is needed to finance these sales. 'he 0ompan!<s basis for measuring di*isional success is %eturn on In*estment

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e + of )%

(%LI). A. ;anagement is considering the following two alternati*e plans submitted b! emplo!ees for impro*ing operations in the home appliances di*ision# o o (ntonio belie*es that sales *olume can be doubled b! greater promotional effort, but his method would lower the margin rate to 1> of sales and re uire an additional in*estment of P1::,:::. Duadalupe fa*ors eliminating some unprofitable appliances and impro*ing efficienc! b! adding P-::,::: in capital e uipment, his method would decrease sales *olume b! 1:> but impro*e the margin ratio to 9>. 'he pro+ected sales price for a new product, $antto, (which is still in the de*elopment stage of the product life c!cle) is P6:. 'he compan! has estimated the life-c!cle cost to be P.: and the first-!ear cost to be P7:. Ln this t!pe of product, the compan! re uires a P1- per unit profit. What is the target cost of $antto? a. P7: b. P.: c. P.@ d. P11@. Jahweh Inc. has a return on assets of 16> and a 1:> profit margin. 'he compan! has sales e ual to P6 million. What are Jahweh<s total assets (in millions)? a. ..:: b. .... c. ..9. d. 1.19 1/. $t. Hude ;anufacturing has assembled the data appearing below pertaining to two popular products. Past e3perience has shown that the fi3ed manufacturing o*erhead component included in the cost per machine hour a*erages P1:. $t. Hude has a polic! of filling all sales orders, e*en if it means purchasing units from outside suppliers. 2irect materials 2irect labor &actor! o*erhead at P17 per hour 0ost if purchased from an outside supplier (nnual demand (units) Huicer P7 1 17 -: -:,::: $licer P11 / ..@ -@,:::

If 6:,::: machine hours are a*ailable, and $t. Hude ;anufacturing desires to follow an optimal strateg!, it should a. Produce -6,::: $licers and purchase all other units as needed. b. Produce -:,::: Huicers and 16,::: $licers and purchase all other units as needed. c. Produce -:,::: Huicers and purchase all other units as needed. d. Purchase all units as needed. 6:. $t. 0hristopher<s ;otors, Inc. is considering a new product for the coming !ear, an electric motor which it can purchase from a reliable *endor for P-1.:: per unit. 'he alternati*e is to manufacture the motor internall!. $t. 0hristopher<s ;otors, Inc. has e3cess capacit! to manufacture the .:,::: motors needed in the coming !ear e3cept for manufacturing space and special machiner!. 'he machiner! can be leased for P16,::: annuall!. &inished goods warehouse space ad+oining the main manufacturing facilit!, leased for P./,::: annuall!, ma! be con*erted and used to manufacture the motors. (dditional off-site space can be leased at an annual cost of P61,::: to replace the finished goods warehouse. 'he estimated unit costs for manufacturing the motors internall!, e3clusi*e of the leasing costs itemi,ed abo*e, are# 2irect material P @.:: 2irect labor 1.:: 4ariable manufacturing o*erhead ..:: (llocated fi3ed manufacturing o*erhead 6.:: 'otal manufacturing cost per unit P-:.:: ( cost-benefit anal!sis would show that $t. 0hristopher<s ;otors, Inc. would sa*e a. P61,::: b! purchasing the motors from the outside *endor. b. P7/,::: b! purchasing the motors from the outside *endor. c. P@1,::: b! ma=ing the motors internall!. d. P/7,::: b! ma=ing the motors internall!. 61. Di*en the following information about $t. 4incent, compute for its economic *alue added# ?arnings before interest and ta3es P-:,::: 'a3 rate 1:> Interest-bearing liabilities P6:,::: 0ost of e uit! capital 11> 2ebt to e uit! 1#1 (dditional information# o $t. 4incent pa!s 1:> annual interest to its creditors. o 'here are no current liabilities held significant b! $t. 4incent. a. P @,:::.:: b. P -,:::.:: c. P 67::.:: d. P :

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e % of )%

6-. 'he following data ha*e been e3tracted from the budget wor=ing papers of W% 8imited# (cti*it! L*erhead cost (In machine hours) (In pesos)

In ;arch -::-, the actual acti*it! was 1.,9@: machine hours and the actual o*erhead cost incurred was P11,6-1. 'he total o*erhead e3penditure *ariance is nearest to a. P1,96: (&) b. P-6: (&) c. P-6: (() d. P1,6-: (()

6.. In the conte3t of budget preparation the term Ggoal congruenceG isP a 'he alignment of budgets with ob+ecti*es using feed-forward control b 'he setting of a budget which does not include budget bias c 'he alignment of corporate ob+ecti*es with the personal ob+ecti*es of a manager d 'he use of aspiration le*els to set efficienc! targets. 61. ;"P plc produces three products from a single raw material that is limited in suppl!. Product details for period 7 are as follows# Products ; " P ;a3imum demand 1,::: -,1:: -,@:: Lptimum planned production 9-: -,@:: Cnit 0ontribution (Pesos) %aw materials cost per unit (P:.6: per =g) 1.6: 1.-6 1.@: 1.6: -./6 :.96

'he planned production optimi,es the use of the 7,::: =gs of raw material that is a*ailable from ;"P plc<s normal supplier at the price of P:Q6: per =g. Eowe*er, a new supplier has been found that is prepared to suppl! a further 1,::: =gs of the material. What is the ma3imum price that ;"P plc should be prepared to pa! for the additional 1,::: =gs of the material? ( P-,1:: A P-,-1: 0 P-,.:: 2 P-,176 66. ' plc has de*eloped a new product, the '&@. 'he time ta=en to produce the first unit was 1@ minutes. (ssuming that an @:> learning cur*e applies, the time allowed for the fifth unit (to - decimal places) should be a. 6Q9/ minutes b. 9Q6. minutes c. 1:Q9- minutes d. 11Q6- minutes %ote: &or an @:> learning cur*e ! M a3 -:Q.-1/ 67. Which of the following are re uired to determine the brea=e*en sales *alue in a multi product manufacturing en*ironment? (i) indi*idual product gross contribution to sales ratios; (ii) the general fi3ed cost; (iii) the product-specific fi3ed cost; (i*) the product mi3 ratio; (*) the method of apportionment of general fi3ed costs. a. (i), (ii), (iii) and (i*) onl!. b. (i), (iii) and (i*) onl!. c. (i), (ii) and (i*) onl!. d. (ll of them. 69. 'he cost of purchasing a machine is P1::,::: pa!able immediatel!. Its disposal *alue is e3pected to be P1:,::: in fi*e !earsN time. 'he same asset can be leased for a period of fi*e !ears with rentals of P-6,::: pa!able annuall! in ad*ance. 'he asset is returned to the lessor at the end of the lease period. What is the net present *alue (to the nearest P1:) to the lessor compan! if it purchases the machine then leases it to the user on the abo*e terms if it applies an annual discount rate of 1:>? (Ignore ta3.)

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e ' of )%

a. P//:

b. P1:,17:

c. minus P1,/7:

d. minus P11,11:.

6@. ( compan! retains 9:> of its earnings and distributes the remaining .:>. 0apital in*estment pro+ects generate an annual post-ta3 return on in*estment of 16> and a pre-ta3 return of -:>. Csing the Dordon Drowth ;odel, what is the annual rate of growth? a 1.6> b 7.:> c 1:.6> d 11.:> 6/. ( compan! uses the Aaumol cash management model. 0ash disbursements are constant at P-:,::: each month. ;one! on deposit earns 6> a !ear, while mone! in the current account earns a ,ero return. $witching costs (that is, for each purchase or sale of securities) are P.: for each transaction. What is the optimal amount (to the nearest P1::) to be transferred in each transaction?

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e ( of )%

a b. c d

P6:: P1,9:: P1,/:: P19,:::

7:. Csing the capital asset pricing model (0(P;), the beta of compan! INs shares is 1Q7, the ris= free rate is 6> and the re uired return on compan! INs shares is 17Q->. 0ompan! J is uoted in the same stoc= mar=et, but has a beta of 1.1. What is the re uired rate of return on compan! JNs shares? a 1-Q:> b 1.Q:> c 1.Q-> d 11Q@> AU6ITIN7 ,RO3LE9S Jou were engaged to e3amine the accounts of Power Pla! 0orp. as of 2ecember .1, -::9 and !our audit disclosed the following# 71. 'he cash counted on 2ecember .1, -::9 included two customers< chec=s amounting to P6,::: both dated in Hanuar! -::@. 'hese chec=s were recorded in the boo=s in 2ecember and were accepted for deposit b! the ban= on due dates. 'he ad+usting entr! is# a. b. c. d. 2ebit 0ash in ban= (ccounts recei*able 0ash (ccounts recei*able 6,::: 6,::: 6,::: 6,::: 0redit 0ash on hand 0ash (ccounts recei*able $ales 6,::: 6,::: 6,::: 6,:::

7-. Jour audit disclosed that chec=s with a total of P1:,::: as pa!ment to suppliers were prepared and ta=en up as debits to accounts pa!able. Lne of these chec=s in the amount of P-,::: was cancelled on Hanuar! 6, -::@ and replaced with another for the correct amount of P-,6::. "o entr! was made for the cancellation. 'he ad+usting entr! is# a. b. c. d. 2ebit 0ash 0ash 0ash "o ad+ustment necessar! -,6:: -,::: 6:: 0redit (ccounts pa!able (ccounts pa!able (ccounts pa!able -,6:: -,::: 6::

7.. 0ustomers< chec=s amounting to P1,6:: were returned during 2ecember -::9 b! the ban= with the notation G"$&). Lf these chec=s P.,::: had been redeposited and cleared b! the ban= during the month. "o entries were made for the return or redeposit. 'he ad+usting entr! is# a. b. c. d. 2ebit 0ash (ccounts recei*able 0ash (ccounts recei*able .,::: 1,6:: 1,6:: 1,6:: 0redit (ccounts recei*able 0ash (ccounts recei*able 0ash .,::: 1,6:: 1,6:: 1,6::

71. Doods costing P-:,::: were e3cluded from the ending in*entor!. 'he selling price of these goods was P.:,:::. 'he goods were shipped b! !our client on 2ecember -/, -::9. &LA shipping point. 'he transaction was not recorded in -::9. 'he ad+usting entr! is# a. b. c. d. 2ebit 0ost of sales In*entor! (ccounts recei*able $ales -:,::: -:,::: .:,::: .:,::: 0redit In*entor! 0ost of sales $ales (ccounts recei*able -:,::: -:,::: .:,::: .:,:::

76. ;erchandise costing P16,::: were still included in ending in*entor! although these were alread! in*oiced and recorded as sales to customers on 2ecember .1. 'he sales in*oices totaling P-6,::: were no longer recorded when the goods were deli*ered on Hanuar! 6, -::@.

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e )! of )%

'he ad+usting entr! is# a. b. c. d. 2ebit 0ost of sales (ccounts recei*able $ales "one of the abo*e 16,::: -6,::: -6,::: 0redit In*entor! $ales (ccounts recei*able 16,::: -6,::: -6,:::

'he $toc= In*estment account showed the following details# Han 1 audited balance, -,::: shares ;ar .1 bought shares 'he following transactions occurred# 77. ( cash di*idend of P:.6: per share was recei*ed on &eb. -@ 'he ad+usting entr! is# 2ebit 0redit a. $toc= in*estment 1,::: 2i*idend income b. %etained earnings 1,::: 2i*idend income c. 2i*idend income 1,::: $toc= in*estment d. 0ash 1,::: 2i*idend income $toc= In*estment in Platinum &eb -@ cash di*idend 1:,::: (pril 1 sale of rights 1,6:: Hune .: sale of shares 1,::: .,::: 6,:::

1,::: 1,::: 1,::: 1,:::

79. Ln ;arch 16, stoc= rights were recei*ed entitling shareholders to purchase one share for e*er! fi*e held at P16 per share. ;ar=et *alues on this date were shares, P-:; rights P6. 'he ad+usting entr! to recogni,e the cost allocated to the right is# 2ebit 0redit a. $toc= rights @,::: $toc= in*estment b. $toc= rights 1:,::: $toc= in*estment c. $toc= rights 6,::: $toc= in*estment d. "o entr! 7@. Ln ;arch .1, .:: shares were purchased with the partial e3ercise of these right. 'he ad+usting entr!, after the ad+ustment in "o. .6 abo*e has been effected, is 2ebit 0redit a. $toc= in*estment /,::: $toc= rights b. $toc= in*estment 7,::: $toc= rights c. $toc= rights 7,::: $toc= in*estment d. $toc= in*estment 7,::: 0ash 7/. Ln (pril 1, the remaining rights were sold for P.,:::. 'he ad+usting entr! is# 2ebit 0redit a. $toc= in*estment .,::: Dain on sale of rights b. $toc= in*estment .,::: $toc= rights gain on sale of rights c. $toc= in*estment -,::: $toc= rights 8oss on sale of rights 1,::: d. 0ash .,::: $toc= rights

@,::: 1:,::: 6,:::

/,::: 7,::: 7,::: 7,:::

.,::: -,::: 1,::: .,::: .,:::

9:. Power Pla! 0orp. decided that the allowance for bad debts should be ad+usted to e ual the estimated amount re uired based on aging the accounts as of 2ecember .1. &ollowing date were gathered# (llowance for bade debts, Hanuar! 1, -::9 P1-:,::: Pro*ision for bad debts during -::9 (-> of P.,:::,::: sales) 7:,::: Aad debts written off in -::9 96,::: ?stimated bad debts per aging of accounts on 2ecember .1, -::9 @:,::: 'he bad debts pro*ision should be ad+usted b! 2ebit 0redit a. Aad debts e3pense 16,::: (llowance for bad debts 16,::: b. (llowance for bad debts 16,::: (ccounts recei*able 16,::: c. (llowance for bad debts -6,::: Aad debts e3pense -6,:::

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e )) of )%

d. Aad debts e3pense @:,::: (llowance for bad debt @:,::: 91. 'he land account was debited for P.::,::: on ;arch .1, -::9 for an ad+oining piece of land which was ac uired in e3change for 16,::: shares of Power Pla! 0orp.<s own stoc= with a par *alue of P1:. (t the time of the e3change, the shares were selling at P-1. 'ransfer and legal fees of P-:,::: were paid and charged to Professional &ees. 'he ad+usting entr! is 2ebit a. b. c. d. 8and 8and 8and 8and 11:,::: 17:,::: @:,::: -:,::: 0redit Premium on capital stoc= 0apital stoc= 0ash Professional fees Premium on capital stoc= Professional fees 11:,::: 16:,::: 1:,::: -:,::: 7:,::: -:,:::

9-. Jou completed !our filed wor= for -::9 on (pril 1:, -::@. Aefore issuance of !our audit report on (pril -6, -::@, !ou were ad*ised that on (pril 16, -::@ a large recei*able from a customer who is facing ban=ruptc! was written off as uncollectible. What should !ou do about this fact? a. disclose the loss in the -::9 statements b. ad+ust the -::9 financial statements c. date !our report (pril 1:, -::@ d. ta=e up the loss in the -::@ statements ,RACTICAL ACCOUNTIN7 ) 9.. In -::@, Paul E!permar=et awards lo!alt! points to customers who use Paul E!permar=et<s own credit card to pa! for purchases. 'he award is at the rate of one point for e*er! P-6: charged to the card and each point entitles the customer to a certain credit against future purchases, without time limit. Paul E!permar=et estimates the fair *alue of each point at P1 and in -::@, P-6:,:::,::: is charged to the Paul E!permar=et<s credit card. "one of the customers ha*e claimed their corresponding credit points during -::@. 'he amount to be reported as re*enue for -::@ b! Paul E!permar=et is a. P-6:,:::,::: b. P-1/,:::,::: c. P-17,:::,::: d. P-16,:::,::: Cse the following information for numbers 91 and 96 Ln Hanuar! 1, -::7 8u=e 0ompan!, a financial ser*ices entit! which is also in*ol*ed in real estate de*elopment, has purchased a plot of land in ;a=ati 0it! for P-,:::,::: which it intends to de*elop and e*entuall! sell. Ln Hul! 1, -::7, 8u=e 0ompan! purchased 1: passenger *ehicles for a total consideration of P-,6::,:::. 8u=e 0ompan!<s intention was to use the passenger *ehicles to transport 8u=e 0ompan!<s emplo!ees. 8u=e 0ompan! uses the straight-line depreciation method for the passenger *ehicles with no e3pected sal*age *alue and an estimated useful life of @ !ears. Ln 2ecember .1, -::9, 8u=e 0ompan! entered in a lease agreement with Hohn 0ompan! for its land in ;a=ati 0it! and its passenger *ehicles. 2e*elopment cost incurred until 2ecember .1, -::9 was P9::,:::. 'he fair *alues of the land in ;a=ati 0it! and the 1: passenger *ehicles were P-,/6:,::: and P-,1@1,-6: respecti*el!. (ssets classified b! 8u=e 0ompan! as in*estment properties are presented at fair *alue. (t the end of -::@, the fair *alues of land and 1: passenger *ehicles were .,1::,::: and P-,-:1,-6: respecti*el!. 91. 'he gain (loss) to be reported in -::9 in relation to the reclassification to in*estment propert! is a. : b. 16:,::: c. -6:,::: d. 1::,::: 96. 'he re*aluation surplus balance at 2ecember .1, -::@ is a. : b. 16:,:: c. .66,69 d. 1@-,6: : 9 : 97. Aefore !ear-end ad+usting entries, Aass 0ompan!Ns account balances at 2ecember .1, -::1, for accounts recei*able and the related allowance for uncollectible accounts were P6::,::: and P16,:::, respecti*el!. (n aging of accounts recei*able indicated that P7-,6:: of the 2ecember .1 recei*ables are e3pected to be uncollectible. 'he net reali,able *alue of accounts recei*able after ad+ustment is a.P1@-,6::. b. P1.9,6::. c. P./-,6::. d. P166,:::. 99. Isaac 0o. assigned P6::,::: of accounts recei*able to 2i3on &inance 0o. as securit! for a loan of P1-:,:::. 2i3on charged a -> commission on the amount of the loan; the interest rate on the note was 1:>. 2uring the first month, Isaac collected P11:,::: on assigned accounts after deducting P.@: of discounts. Isaac accepted returns worth P1,.6: and wrote off assigned accounts totaling P.,9::. 'he amount of cash Isaac recei*ed from 2i3on at the time of the transfer was

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e )# of )%

a. P.9@,:::.

b. P11:,:::.

c. P111,7::.

d. P1-:,:::.

9@. Ln Hune 1, -::@, Lslo 0orp. sold merchandise with a list price of P16,::: to ;ead on account. Lslo allowed trade discounts of .:> and -:>. 0redit terms were -516, n51: and the sale was made f.o.b. shipping point. Lslo prepaid P.:: of deli*er! costs for ;ead as an accommodation. Ln Hune 1-, -::@, Lslo recei*ed from ;ead a remittance in full pa!ment amounting to a. P@,-.b. P@,6-7. c. P@,6.-. d P@,./9. 9/. In Hanuar! -::@, Hen=s ;ining 0orporation purchased a mineral mine for P1,-::,::: with remo*able ore estimated b! geological sur*e!s at .,:::,::: tons. 'he propert! has an estimated *alue of P1::,::: after the ore has been e3tracted. Hen=s incurred P1,16:,::: of de*elopment costs preparing the propert! for the e3traction of ore. 2uring -::@, .1:,::: tons were remo*ed and .::,::: tons were sold. &or the !ear ended 2ecember .1, -::@, Hen=s should include what amount of depletion in its cost of goods sold? a. P1.:,779 b. P.@:,::: c. P1/6,::: d. P671,::: @:. 2own 0o. bought a trademar= from 0ater 0orp. on Hanuar! 1, -::@, for P11-,:::. (n independent consultant retained b! 2own estimated that the remaining useful life is 6: !ears. Its unamorti,ed cost on 0aterNs accounting records was P67,:::. 2own decided to write off the trademar= o*er the ma3imum period allowed. Eow much should be amorti,ed for the !ear ended 2ecember .1, -::@? a. P1,1-:. b. P1,1::. c. P-,-1:. d. P-,@::. Cse the following information for uestions @: and @1 Ln Hanuar! -, -::@, Eernande,, Inc. signed a ten-!ear non-cancelable lease for a hea*! dut! drill press. 'he lease stipulated annual pa!ments of P9:,::: starting at the end of the first !ear, with title passing to Eernande, at the e3piration of the lease. Eernande, treated this transaction as a capital lease. 'he drill press has an estimated useful life of 16 !ears, with no sal*age *alue. Eernande, uses straight-line depreciation for all of its plant assets. (ggregate lease pa!ments were determined to ha*e a present *alue of P1-:,:::, based on implicit interest of 1:>. @1. In its -::@ income statement, what amount of interest e3pense should Eernande, report from this lease transaction? a. P:. b. P-7,-6: c. P.6,:::. d. P1-,:::. @-. In its -::@ income statement, what amount of depreciation e3pense should Eernande, report from this lease transaction? a. P9:,:::. b. P17,779. c. P1-,:::. d. P-@,:::. @.. Ln Lctober .1, -::@, Aeta 0ompan! engaged in the following transactions# Lbtained a P6::,:::, si3-month loan from 0it! Aan=, discounted at 1->. 'he compan! pledged P6::,::: of accounts recei*able as securit! for the loan. &actored P1,:::,::: of accounts recei*able without recourse on a non notification basis with E!pe 0ompan!. E!pe charged a factoring fee of -> of the amount of recei*ables factored and withheld 1:> of the amount factored. What is the total cash recei*ed from the financing of recei*ables? a. P1,.-:,::: b. P1,.6:,::: c. P1,.@:,::: d. P1,19:,::: @1. 'he closing in*entor! of Dandhi 0ompan! amounted to P-@1,::: at 2ecember .1, -::@. 'his total includes two in*entor! lines about which the in*entor! ta=er is uncertain. Item 1 - 6:: items which had cost P16 each and which were included at P9,6::. 'hese items were found to ha*e been defecti*e at the balance sheet date. %emedial wor= after the balance sheet date cost P1,@:: and the! were then sold for P-: each. $elling e3penses were P1::. Item - - 1:: items that had cost P1: each but after the balance sheet date, these were sold for P@ each with selling e3penses of P16:. What figure should appear in Dandhi<s balance sheet for in*entor!? a. P-@.,76: b. P-@.,/6: c. P-@1,::: d. P-@1,.:: @6. In reconciling the 0ash in ban= of Jna 0ompan! with the ban= statement balance for the month of "o*ember -::@, the following data are summari,ed# Aoo= debits for "o*ember, including Lctober 0; for note collected, P7:,::: P @::,::: Aoo= credits for "o*ember, including "$& of P-:,::: and ser*ice charge of P@:: for Lctober 7-:,::: Aan= credits for "o*ember including 0; for "o*ember for ban= loan of P1::,::: and Lctober deposit in transit for P@:,::: 9::,::: Aan= debits for "o*ember including Lctober outstanding chec=s of P19:,@:: and "o*ember ser*ice charge of P-:: 7::,::: What is the amount of outstanding chec=s for "o*ember ? a. P -:,::: b. P19:,-:: c. P191,::: d. P1/1,:::

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e )" of )%

,RACTICAL ACCOUNTIN7 # @7. %oel, He=ell and ;i=e, 0P(s, decide to form a partnership and agree to distribute profits in the ratio 6#.#-. It is agreed, howe*er, that %oel and He=ell shall guarantee fees from their own clients of P7::,::: and P6::,::: respecti*el!, that an! deficienc! is to be charged directl! against the account of the partner failing to meet the guarantee, and that an! e3cess is to be credited directl! to the account of the partner with fees e3ceeding the guarantee. &ees earned during -:31 are classified as follows# &rom clients of %oel P1,:::,::: &rom clients of He=ell 1::,::: &rom clients of ;i=e 1::,::: Lperating e3penses for -:31 are P-::,:::. 2etermine the share of %oel on the operating results for the !ear -:31. a. P/::,::: b. P6::,::: c. P-::,::: d. P.::,::: @9. 0aine, Lsman, and %oberts formed a partnership on Hanuar! 1, -:31, agreeing to distribute profits and losses in the ratio of original capitals. Lriginal in*estments were P7-6,:::, P-6:,::: and P1-6,::: respecti*el!. ?arnings of the firm and drawings b! each partner for the period -:31--:37 follows# 60awin-1 : Net in.o/e lo11$ CaineO1/an Robe0t1 -:31 P11:,::: P16:,::: P9@,::: P6-,::: -:36 1@6,::: 16:,::: 9@,::: 6-,::: -:37 ( 1:6,:::) 1::,::: 6-,::: 6-,::: (t the beginning of -:39, 0aine and Lsman agreed to permit %oberts to withdraw from the firm. $ince the boo=s for the firm had ne*er been audited, the partners agreed to an audit in arri*ing at the settlement amount. In withdrawing, %oberts was allowed to ta=e certain furniture and was charged P16,:::, although the boo= *alue was P16,:::; the balance of %oberts< interest was paid in cash. 'he following items were re*ealed in the course of the audit. End of #!;8 End of #!;& End of #!;+ Cnderstatement of accrued e3penses P 1,::: P 6,::: P 7,6:: Cnderstatement of accrued re*enue -,6:: 1,::: 1,6:: L*erstatement of in*entories 16,::: -:,::: -:,::: Cnderstatement of depreciation e3pense Ln assets still held 1,6:: .,6:: -,::: Eow much must %oberts recei*ed from the partnership? a. P611,-6: b. P167,6:: c. P16,-6: d. P11,-6: @@. (t the beginning of -::@, $ 4ideo established a R0 Aranch and a ;0 Aranch in order to pro*ide wider distribution of its merchandise. ;erchandise is transferred to the branches at a pricd .:> abo*e cost. (ll branch merchandise is ac uired from the home office. (t the end of -::@, the R0 Aranch and the ;0 Aranch reported net income and ending in*entor! balances as follows# Net in.o/e Endin- in<ento0= R0 Aranch P16,6:: P76,::: ;0 Aranch 6-,::: 9@,::: 'he !ear-end balances in the home office account<s allowance for unreali,ed gross margin in branch in*entor! are P 1@,96: for the R0 Aranch and P6@,6:: for the ;0 branch. 'he income from Aranch, home office should record is# a. P191,96: b. P/9,6:: c. P1.:,6:: d. P91,-6: @/. Ln Hanuar! 1, -::@, (shle! 0orp. purchased 96> of the common stoc= of %ac=s 0orp. $eparate balance sheet data for the companies at the combination date are gi*en below# (shle! %ac=s 0ash P @1,::: P 9-1,::: 'rade %ecei*able 6:1,::: /1,::: ;erchandise In*entor! 17-,::: 1..,::: 8and -9.,::: 11-,::: Plant (ssets -,16:,::: 1,:6:,::: (ccumulated 2epreciation (@1:,:::) (-1:,:::) In*estment in %ac=s 1,.9-,::: 'otal (ssets P1,.:6,::: P1,@/9,::: (ccounts Pa!able 0apital $toc= %etained ?arnings P 9-1,::: -,@::,::: 9@1,::: P 1/9,::: 1,:6:,::: .6:,:::

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e )8 of )%

'otal ? uities P1,.:6,::: P 1,@/9,::: (t the date of combination the boo= *alues of %ac=s net assets was e ual to the fair *alue of the net assets e3cept for %ac=<s in*entor! which has a fair *alue of P-1:,:::. Ln the date of ac uisition in the consolidated balance sheet# Eow much is the total assets? a. P .,6..,-6: b. P1,/@1,::: c. P 7,61.,-6:

d.

P 6,191,-6:

/:. 'he following data pertained to Pogi 0ompan!<s construction +obs, which commenced during -::@# P%LH?0' 1 P%LH?0' 0ontract Price P1-:,::: P.::,::: 0ost incurred during -::@ -1:,::: -@:,::: ?stimated cost to complete 1-:,::: 1:,::: Ailled to customers during -::@ 16:,::: -9:,::: %ecei*ed from customers during -::@ /:,::: -6:,::: If Pogi compan! used the percentage of completion method, what amount of profit (loss) would Pogi 0ompan! report in its -::@ income statement? a. P(-:,:::) c. P--,6:: b. P-:,::: d. P1:,::: /1. Ln (pril 1, -::@, %ingo 0orp. entered into franchise agreement with Ruart 0orp. to sell their products. 'he agreement pro*ides for an initial franchise fee of P1,-1@,96: pa!able as follows# P1,1@1,-6: cash to be paid upon signing of the contract and the balance in fi*e e ual annual pa!ment e*er! 2ecember .1, starting at the end of -::@. %ingo signs 1-> interest learning note for the balance. 'he agreement further pro*ides that the franchise must pa! a continuing franchise fee e ual to 6> of its monthl! gross sales. Ln (ugust .: the franchisor completed the initial ser*ices re uired n the contract at a cost of P1,.6:,::: and incurred indirect costs of P-.-,6::. 'he franchise commenced business operations on $eptember ., -::@. 'he gross sales reported to the franchisor are $eptember sales, P11:,:::; Lctober sales, P1-6,:::; "o*ember sales P1.@,:::; and 2ecember sales, P16/,:::. 'he first installment pa!ment was made on due date. (ssume the collecti*it! of the note is reasonabl! assured. In its income statement for the !ear ended 2ecember .1, -::@ how much is the reali,ed gross profit? a. P-,@7@,96: b. P-,/.7,--6 c. P-,@/6,.6: d. P.,17@,9-6 /-. 'he trustee for Hohn 0orp. prepares a statement of affairs which shows that unsecured creditors whose claims total P 61:,::: ma! e3pect to recei*e appro3imatel! P 1:6,::: if assets are sold for the benefit of creditors. a. 2anielle 0orp. holds a note for P--,6:: on which interest of P1,.6: is accrued, propert! with a boo= *alue of P1@,::: and a reali,able amount of P -9,::: is pledged on the note. b. %andolph, an emplo!ee is owed P7,96: for his salar!. c. Aaltimore 0orp. holds a note of P61,::: on which interest of P-,9:: is accrued, securities with a boo= *alue of P 6@,6:: and a reali,able amount of P16,::: is pledged on the note. d. "ic= 0orp. holds a note for P/,::: on which interest of P6:: is accrued, nothing has been pledged for the note. Eow much ma! each of the following creditors recei*e? 2anielle 0orp; %andolph 0orp; Aaltimore 0orp.; "ic= 0orp., respecti*el!. a. P -9,::: ; P6,:7.; P6.,996 ; P : c. P-9,::: ; P7,96:; P67,9:: ; P : b. P -.,@6:; P 7,96:; P67,9::; P9,1-6 d, P-.,@6:; P7,96:; P6.,996 ; P 9,1-6 /.. 'he following information was ta=en from E 0ompan!<s accounting records for the !ear 2ecember .1, -::@# Increase in raw materials in*entor! P 16,::: 2ecrease in finished goods in*entor! .6,::: %aw materials purchased 1.:,::: 2irect labor cost -::,::: &actor! o*erhead control -7:,::: &reight-in 16,::: 'here was no wor= in process in*entor! at the beginning or end of the !ear. E<s -::@ cost of goods sold is if &LE is applied at 11:> of labor costs# a. P/6:,::: b. P/76,::: c. P/96,::: d. P//6,:::

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e )& of )%

/1. 0 0ompan! has underapplied factor! o*erhead of P16,::: for the !ear ended 2ecember .1, -::@. Aefore disposition of the underapplied o*erhead, selected 2ecember .1, -::@, balances from 0<s accounting records are as follows# $ales P1,-::,::: 0ost of goods sold 9-:,::: In*entories# 2irect materials .7,::: Wor= in process 61,::: &inished goods /:,::: Cnder 0<s cost accounting s!stem, o*er B or underapplied o*erhead is allocated to appropriate in*entories and cost of goods sold based on !ear B end balances. In its -::@ income statement, 0 should report cost of goods sold of a. P7@-,6:: b. P7@1,::: c. P967,::: d. P969,6:: /6. 4ioleta compan! adds materials at the beginning of the process in 2epartment (. Information concerning the materials used in (pril -::@ is as follows# Cnits Wor= in process (pril PPPPPPPPPPPPPPPPPP............... P1:,::: $tarted during (prilPPPPPPPPPPPPPPPPPPPPPPPP.. 6:,::: 0ompleted S 'ransferred to the ne3t department during (prilPPPP. .7,::: "ormal spoilage incurredPPPPPPPPPPPPPPPPPPPPPP .,::: (bnormal spoilage incurredPPPPPPPPPPPPPPPPPPPPP 6,::: Wor= in process at (pril .:PPPPPPPPPPPPPPPPPPPPP. 17,::: Cnder 4ioleta<s accounting s!stem, the cost of normal spoilage are treated as part of the cost of good units produced. Eowe*er, the cost of abnormal spoilage is charged to factor! o*erhead. Csing weighted a*erage method, what are the e ui*alent units for the materials unit cost calculation for the month of (pril? a. 19,::: b. 6-,::: c. 66,::: d. 69,::: /7. (genc! ;a=aba!an recei*ed "otice of 0ash (llocation ("0() B P16,:::,::: for the !ear -::@, the entr! would be# a. "o entr! b. ;emorandum entr! in %egistr! of (llotments c. "ational 0learing (ccount 16,:::,::: (ppropriation (lloted 16,:::,::: d. 0ash-"ational 'reasur!, ;2$ 16,:::,::: $ubsid! Income from "ational go*ernment 16,:::,::: /9. $a*e the Planet, a pri*ate nonprofit research organi,ation, recei*ed a T6::,::: contribution from ;s. $usan 0lar=. ;s. 0lar= stipulated that her donation be used to purchase new computer e uipment for $a*e the Planet<s research staff. 'he contribution was recei*ed in (ugust of -::1, and the computers were ac uired in Hanuar! of -::-. &or the !ear ended 2ecember .1, -::1, the T6::,::: contribution should be reported b! $a*e the Planet on its a. $tatement of acti*ities as unrestricted re*enue. b. $tatement of acti*ities as deferred re*enue. c. $tatement of acti*ities as temporaril! restricted re*enue. d. $tatement of financial position as deferred re*enue. /@. Ln Hanuar! 1, -:3., Pi=e 0ompan! purchased @:> of the outstanding *oting shares of $word compan! for P@::,:::. Ln that date, $word had P.::,::: of capital stoc= and P7::,::: of retained earnings. (ll assets and liabilities of $word had boo= *alues appro3imatel! e ual to their fair mar=et *alues. Doodwill, if an!, is not amorti,ed. Pi=e uses the complete e uit! method to account for its in*estment in $word. Ln (pril 1, -:3., Pi=e sold e uipment with a boo= *alue of P1:,::: to $word for P7:,:::. 'he e uipment is e3pected to ha*e a useful life of fi*e !ears from the date of the sale and no sal*age *alue. $word will use straight-line depreciation. &or !ear -:3., $word reported net income of P-::,::: and paid di*idends of P1:,:::. 2etermine the income from in*estment under the complete e uit! method. a. P11.,::: b. P111,::: c. P17.,::: d. P111,::: //. P 0ompan! owns controlling interests in $ and ' 0orporations, ha*ing ac uired an @: percent interest in $ in -:31 and a /: percent interest in ' on Hanuar! 1, -:3-. P<s in*estments in $ and ' were at boo= *alue e ual to fair *alue. In*entories of the affiliated companies at 2ecember .1, -:3- and 2ecember .1, -:3. were as follows# 6e.e/be0 ")> #!;# 6e.e/be0 ")> #!;"

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e )+ of )%

P in*entories P7:,::: P61,::: $ in*entories .@,96: .1,-6: ' in*entories -1,::: .7,::: P sells to $ at a -6 percent mar=up based on cost, and ' sells to P at a mar=up of -: percent. P<s beginning and ending in*entories for -:3. consisted of 1:> and 6:>, respecti*el!, of goods ac uired from '. (ll of $ in*entories consisted of merchandise ac uired from P. 'he in*entor! that should appear in the 2ecember .1, -:3. consolidated balance sheet should amount to# a. P1:/,7:: b. P1:7,::: c. P11:,6:: d. P1-1,-6: 1::. In !ear -:3@, a /: percent-owned subsidiar! sold land to its parent at a gain. 'he parent still owns the land. In the consolidated balance sheet at 2ecember .1, -:3/, the minorit! interest in the subsidiar! should be shown at# a. 1: percent of the subsidiar!<s total e uit!. b. 1: percent of the subsidiar!<s total e uit! less 1: percent of the gain on the land sale. c. 1: percent of the subsidiar!<s total e uit! plus 1: percent of the gain on the land sale. d. 1: percent of the subsidiar!<s total e uit! less 1:: percent of the gain on the land sale. EN6 OF E5A9INATIONS 7OO6LUC?@@@

CRC-ACE REVIEW SCHOOL !"#$ %"&'(!) * %"&(!") * !(## '+)!)() ,a-e )% of )%

You might also like

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Free Cpa Review Materials Philippines PDFDocument3 pagesFree Cpa Review Materials Philippines PDFAdrian JamesNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Far Reviewer QualiDocument124 pagesFar Reviewer Qualijestoni alvezNo ratings yet

- Auditing Problems Test Bank 2Document15 pagesAuditing Problems Test Bank 2Mark Jonah Bachao80% (5)

- NFJPIA Mock Board 2016 - AuditingDocument8 pagesNFJPIA Mock Board 2016 - AuditingClareng Anne100% (1)

- Qualifying Exam Review Qs Final & Answers2Document30 pagesQualifying Exam Review Qs Final & Answers2hy050796x82% (11)

- CPA Review Notes 2019 - Audit (AUD)From EverandCPA Review Notes 2019 - Audit (AUD)Rating: 3.5 out of 5 stars3.5/5 (10)

- Audit in CIS EnvironmentDocument49 pagesAudit in CIS Environmentlongix100% (3)

- AfarDocument11 pagesAfarWilsonNo ratings yet

- Mock Sqe 2nd YearDocument15 pagesMock Sqe 2nd YearAANo ratings yet

- Quiz in Fin Man AssetsDocument7 pagesQuiz in Fin Man AssetsCherseaLizetteRoyPicaNo ratings yet

- Business Law and TaxationDocument15 pagesBusiness Law and TaxationKhim Dagangon100% (1)

- Financial Acctg 1 ReviewerDocument9 pagesFinancial Acctg 1 ReviewerAllyza May GasparNo ratings yet

- Intermediate Accounting 1 Final ExaminationDocument9 pagesIntermediate Accounting 1 Final ExaminationPearlyn Villarin100% (1)

- Toa PreboardDocument9 pagesToa PreboardLeisleiRagoNo ratings yet

- Afar-Theories: Milyonaryo TestbankDocument21 pagesAfar-Theories: Milyonaryo TestbankVanessa Anne Acuña DavisNo ratings yet

- 1 PMDocument8 pages1 PMHanbin Kim100% (1)

- Investments: Pas 32 Financial Instruments - PresentationDocument11 pagesInvestments: Pas 32 Financial Instruments - PresentationBromanine100% (1)

- Cost Accounting ReviewerDocument10 pagesCost Accounting RevieweraiswiftNo ratings yet

- Afar Mixauthors PDFDocument78 pagesAfar Mixauthors PDFGamers HubNo ratings yet

- Financial Accounting and ReportingDocument3 pagesFinancial Accounting and ReportingEmma Mariz GarciaNo ratings yet

- Afar ToaDocument19 pagesAfar ToaRicamae Mendiola100% (1)

- Test Bank - Financial Accounting and Reporting Theory (Volume 1, 2 and 3)Document17 pagesTest Bank - Financial Accounting and Reporting Theory (Volume 1, 2 and 3)Kimberly Etulle Celona100% (1)

- Management Advisory Services PDFDocument50 pagesManagement Advisory Services PDFDea Lyn Bacula100% (6)

- Government Accounting Final Examination With Answer and SolutionDocument13 pagesGovernment Accounting Final Examination With Answer and SolutionRheu Reyes100% (6)

- AT 3rdbatch 1stPBDocument12 pagesAT 3rdbatch 1stPBvangieolalia100% (2)

- Far Volume 1, 2 and 3 TheoryDocument17 pagesFar Volume 1, 2 and 3 TheoryKimberly Etulle CelonaNo ratings yet

- Quiz 2 AnswersDocument7 pagesQuiz 2 AnswersLayla MainNo ratings yet

- All Subjects - CCDocument11 pagesAll Subjects - CCMJ YaconNo ratings yet

- Past CPA Board On MASDocument22 pagesPast CPA Board On MASJaime Gomez Sto TomasNo ratings yet

- Far Theory Test BankDocument15 pagesFar Theory Test BankKimberly Etulle Celona100% (1)

- List of Reviewers For Cpa Board ExamDocument1 pageList of Reviewers For Cpa Board Examdarwindan100% (4)

- Operation Arising From Its Effective PortionDocument14 pagesOperation Arising From Its Effective PortionShey INFTNo ratings yet

- Test Bank For RFBTDocument15 pagesTest Bank For RFBTErjohn PapaNo ratings yet

- Case 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Document14 pagesCase 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Santiago BuladacoNo ratings yet

- MAS Compilation of QuestionsDocument21 pagesMAS Compilation of QuestionsInocencio Tiburcio67% (3)

- Business CombinationsDocument17 pagesBusiness CombinationsBlairEmrallaf0% (1)

- AFAR Theories Reviewer For CPALEDocument25 pagesAFAR Theories Reviewer For CPALEColeen CunananNo ratings yet

- Actual Cpa Board ExaminationsDocument32 pagesActual Cpa Board Examinationscamillebacale82% (22)

- Act-6j03 Comp1 1stsem05-06Document14 pagesAct-6j03 Comp1 1stsem05-06RegenLudeveseNo ratings yet

- Govacc Chapters 1 3Document2 pagesGovacc Chapters 1 3Bianca CarandangNo ratings yet

- International School of Asia and The Pacific: Alimannao Hills, Peñablanca, Cagayan 3502Document16 pagesInternational School of Asia and The Pacific: Alimannao Hills, Peñablanca, Cagayan 3502lalala010899No ratings yet

- You Have Been Engaged To Examine The Financial Statements of NashockDocument1 pageYou Have Been Engaged To Examine The Financial Statements of NashockSherlock Holmes0% (1)

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobNo ratings yet

- Select The Best Answer From The Choices Given.: TheoryDocument14 pagesSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGANo ratings yet

- Polytechnic University of The PhilippinesDocument12 pagesPolytechnic University of The PhilippinesKyla Dane P. Prado0% (1)

- Advance AccountingDocument18 pagesAdvance AccountingMarvin AquinoNo ratings yet

- Theory of AccountsDocument2 pagesTheory of AccountsrayNo ratings yet

- Nfjpia Nmbe Afar 2017 AnsDocument12 pagesNfjpia Nmbe Afar 2017 AnsSamiee0% (1)

- National Mock Board Examination 2017 Advanced Financial Accounting and ReportingDocument11 pagesNational Mock Board Examination 2017 Advanced Financial Accounting and ReportingTzaddi Ann DeluteNo ratings yet

- Nfjpia Nmbe Afar 2017 AnsDocument10 pagesNfjpia Nmbe Afar 2017 AnshyosungloverNo ratings yet

- Final Exam CDocument12 pagesFinal Exam Cnhorelajne03No ratings yet

- AcctgDocument14 pagesAcctgLara Lewis AchillesNo ratings yet

- ACCTGDocument13 pagesACCTGCabardo Maria RegilynNo ratings yet

- TOA MockBoardDocument16 pagesTOA MockBoardHansard Labisig100% (1)

- 1st PreMid WITHOUT ANSWERSDocument19 pages1st PreMid WITHOUT ANSWERScasio3627No ratings yet

- D. All of The Above Statements ApplyDocument15 pagesD. All of The Above Statements ApplyXavier AresNo ratings yet

- BFJPIA Cup Level 2 Theory of AccountsDocument6 pagesBFJPIA Cup Level 2 Theory of AccountsBlessy Zedlav LacbainNo ratings yet

- Audit Theory PSADocument87 pagesAudit Theory PSAlongixNo ratings yet

- Contracts Reviewer For CPA AspirantsDocument13 pagesContracts Reviewer For CPA Aspirantsojodelaplata1486No ratings yet

- The Art of WarDocument96 pagesThe Art of WarlongixNo ratings yet

- Quality Management System Internal AuditDocument153 pagesQuality Management System Internal Auditlongix100% (1)